Dreaming of retiring early? Join the club. But figuring out exactly how much you need to save? That’s the tough part. The golden ticket to financial freedom isn’t a one-size-fits-all equation—it’s a tailored calculation (think timeline, lifestyle, income goals).

The folks over at Top Wealth Guide? They’re crunching the numbers for you. This isn’t just some pie-in-the-sky theory; it’s your personal blueprint to breaking free from the 9-to-5. Let’s dig into the math and draft your very own escape plan.

In This Guide

How Much Do You Really Need to Save?

So, the math on early retirement-pretty straightforward, right? Except, lots of people mess it up. Here’s the core idea: the 25x rule is every serious FIRE enthusiast’s starting point. Multiply your annual expenses by 25, and voila, there’s your magic number. Spend $50K a year? You’re gonna need $1.25 mil invested.

And this ties right into the 4% withdrawal strategy. You can withdraw 4% of your portfolio annually, no stress about touching the principal. The good old Trinity Study from way back in the ’90s shows this holds true in all sorts of market mood swings over 30 years.

Age Changes Everything

Kick off at 25? Vs. waiting till 35? Huge difference in what you gotta stash away. Our eager 25-year-old aiming for retirement at 50? Needs to sock away about 35% of their income (assuming we’re talking 7% annual returns here). Delay till 35-yikes-and now you’re up to saving 55% for the same goal.

The magic of compound interest-it either makes you a hero or leaves you sweating bullets. Check out Vanguard: drag your heels for a decade, and bam, your monthly savings have to double.

Income Replacement Ratios Vary by Lifestyle

High roller? Whoa, it’s a wake-up call. To keep $200K annual spending rolling, you need $5 mil banked. That’s saving over 60% on a not-so-chill timeline. Middle-income folks aiming to chill on $40K a year? That’s like a $1 million target, doable with 45-50% savings over 15-20 years.

For those retirees living slim on $25K a year, just $625K does the trick. Early retirement on a 40% savings rate-totally in reach if you’re living lean. How you live determines your magic number and how big a sacrifice you gotta make.

The Reality Check Most People Avoid

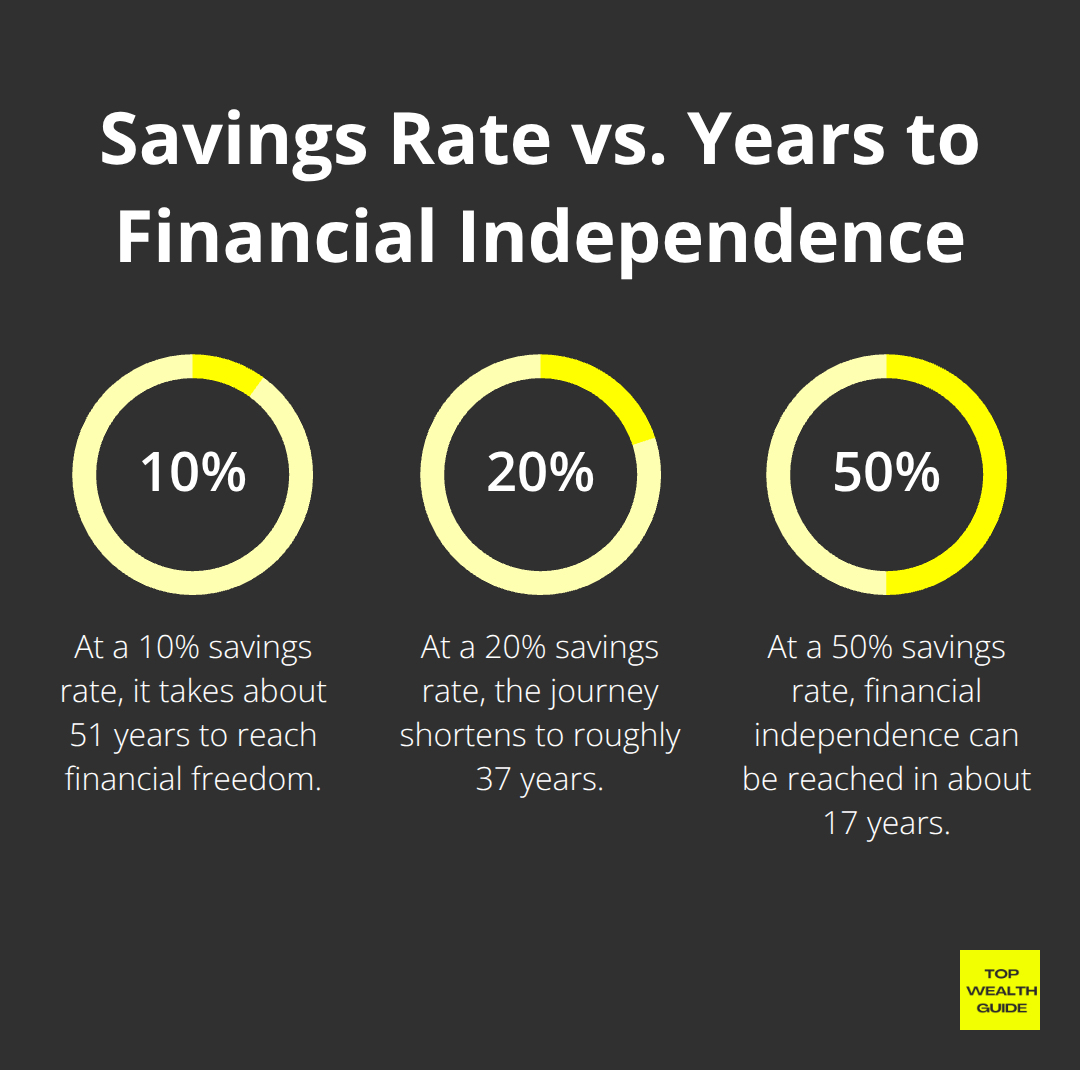

Here’s the kicker: most Americans are stowing away less than 10%. Ouch. That means working till they hit the “traditional” retirement age-maybe beyond. At 10%, you’re grinding for 51 years to hit financial freedom. Double that savings rate to 20%, and you’re looking at 37 years. Go big at 50%, and boom, just 17 years.

All these numbers? Assuming markets don’t go berserk on you, and you keep your spending on a tight leash. Market bumps can stretch your timeline, and that’s why the super-cautious folks stick to 3% withdrawal rates instead of 4%. An emergency fund? It’s your cushion against life’s curveballs.

Now that you’ve got the blueprint, let’s dive into working out your personal savings rate and timeline.

Calculating Your Personal Savings Rate for FIRE

Forget those generic calculators-they spit out averages that are basically financial white noise. Your path to FIRE? Hinges on three things that matter: your current savings rate, your dream retirement age, and your yearly spend. Start with your take-home pay and knock off your spending-what’s left? That’s your true savings rate. Making $80K post-tax and stashing away $40K? Boom, that’s a 50% savings rate, eyeing financial independence in about 17 years (that’s if the market plays nice). Drop to a 30% savings? You’re now looking at 28 years. Ouch.

Your Age Makes or Breaks the Plan

Kick things off at 25 with a 40% saving rate? You’ll hit FIRE by 45 with decent market growth at 7% per year. But hold off until 35 at the same clip, and you’re clocking out at 55. Procrastinate on retirement savings-even a little-and watch the impact surge like a tidal wave. A 35-year-old? Needs a 55% save to check out at 50, versus just 35% for a 25-year-old. That compound interest window slams shut fast, and catching up means leaving the cushy lifestyle dream in the dust.

Market Reality and Inflation Protection

S&P 500 historical returns? Average a sexy 10%-but that’s pre-inflation. Plan on 7% real gains to buffer against market nosedives. The 2008 crisis? It slapped early retirees with a harsh reminder of sequence of returns risk obliterating nest eggs. Cling to a safety net with a 20% buffer beyond your projections and mull over a 3.5% withdrawal rate instead of 4% if you check out pre-50.

Inflation? It’s averaged out at 3.2% over the last couple of decades-meaning today’s $50K spending balloons to $74K in 15 years. Weave this into your target stash or risk having your wallet audibly groan when you least want it. Now that you’ve cracked the foundational math, let’s get into some battle-tested hacks to amp up your savings and fast-track your escape plan.

How Do You Actually Hit Those Extreme Savings Rates?

Max Out Your Income Potential

The brass tacks of FIRE? It’s not about counting every penny-it’s about boosting income to hit those lofty 50%+ savings goals. Picture this: Software engineers leapfrogging from $75K to $150K with a slick job hop-cutting their financial freedom timeline in half. And let’s talk Amazon, where senior engineers in Seattle clock a median compensation of a whopping $350K. Meanwhile, nurses hustling overtime can nudge their yearly income from $65K to $85K.

Side gigs? Forget cute hobbies-they’re your financial turbo boost. Freelance writers pulling in $0.50 a word can see $3K a month just from weekend grinds. Real estate agents closing a couple deals a month? They’re looking at $8K in commissions. And get this: Full-time independent workers zoomed from 13.6 million in 2020 to 27.7 million in 2024, with ride-share drivers raking in $15-25 per hour in bustling cities.

Slash Expenses Without Living Like a Monk

Housing gobbles up 30% of the budget-so, slash away. Moving from San Francisco to Austin is like cutting rent from $3,500 to $1,800 for similar digs-that’s $20K back in your pocket. Consider house hacking with a duplex, knocking housing costs to zilch while you build some sweet equity.

Transportation ain’t cheap either, but when you kick car payments and insurance to the curb, you pocket $6K a year. Planning meals can slash grocery bills from $400 to $250 a month for families. Be ruthless with subscriptions-the average household forks over $273 monthly for barely used services.

Leverage Tax-Advantaged Accounts

Max out those 401k contributions with new limits up to $76,500 for 2024 if you toss in catch-up contributions, plus $6,500 for IRAs. HSAs? Triple tax advantages with $3,650 limits (for 2023). Take advantage of Roth conversions during low-income years to lighten future tax demons and do some tax-loss harvesting to save $3K annually on investment gains.

Every contribution to these accounts dials down your taxable income and speeds up wealth build-up. The math? Pretty sweet-especially for someone in a higher bracket, as a 401k contribution cuts taxes down significantly.

Final Thoughts

Here’s the deal: Want to retire early? You gotta save a boatload-like somewhere between 35% and 60% of your income, depending on how soon you want to peace out and what kind of life you’re dreaming about post-9-to-5. Start squirreling away 40% at 25, and you’re golden by 45. But if you drag your feet until 35, get ready to bump that up to 55%-the numbers aren’t forgiving, but they’re brutally honest.

You need to get cozy with three main factors: your age right now, when you want to kick back, and how much dough you burn through annually. Take those yearly expenses and multiply by 25-that’s your magic number, your pot of gold. Then, reverse engineer your savings rate from there. Assume a 7% return on investments, but don’t forget to pad that with a 20% cushion. Why? Because market roller coasters (sequence of returns risk, anyone?) can really throw a wrench in the gears when you’re starting out.

The roadmap’s straightforward: Hitch up your earning potential with career moves and gigs on the side. Cut the fat from housing and transportation costs. Tap into every tax-friendly account Uncle Sam offers. Max out 401(k)s, juice those HSAs, and maybe even look into geographic arbitrage to stretch your dollars. Over at Top Wealth Guide, we’ve got your back with tactics and advice to make those ambitious savings goals more than just pie-in-the-sky dreams.