Economic downturns are like a punch in the gut to your portfolio—ouch. The average investor? They’re watching a quarter of their wealth evaporate during the big bad recessions. So, what’s the smart play? Prepping before the storm hits.

At Top Wealth Guide, we’ve got the inside scoop. We’ve sifted through mountains of market data to figure out what really sticks. The right strategy? It’s your financial armor when everyone else is in panic mode—losing their shirts.

In This Guide

What Happens to Your Money During Economic Downturns

Economic downturns? Yeah, they come in three flavors-kind of like ice cream, but these don’t taste so good for your wallet. We’re talking recessions, bear markets, and financial meltdowns. Recessions? They hang around for about 10 months, courtesy of our friends at the Federal Reserve. Bear markets? They prefer the long game… dragging their feet for years. Remember 2008? $7.4 trillion evaporated off the stock market-poof, gone. The dot-com crash from 2000 to 2002 wasn’t any kinder, wiping out $5 trillion. And these numbers? They’re not just stats; they’re real dollars disappearing from your savings, poof again, just like that.

Stock Markets Take the First Hit

When the economy tanks, stocks are the first to feel the pain-like they volunteered to be the punching bag. Growth stocks and tech darlings? They get pummeled hard, while boring sectors like utilities and consumer staples do their turtle thing, hangin’ in there. Case in point-the Nasdaq took a 78% nosedive during the dot-com bust, proving that what goes up really fast can come down even faster. Real estate? It’s not immune, tagging along on the perilous plummet. Bonds, they try to keep their chin up but still feel the sting when interest rates decide to boogie upwards.

Market Crashes Follow Predictable Patterns

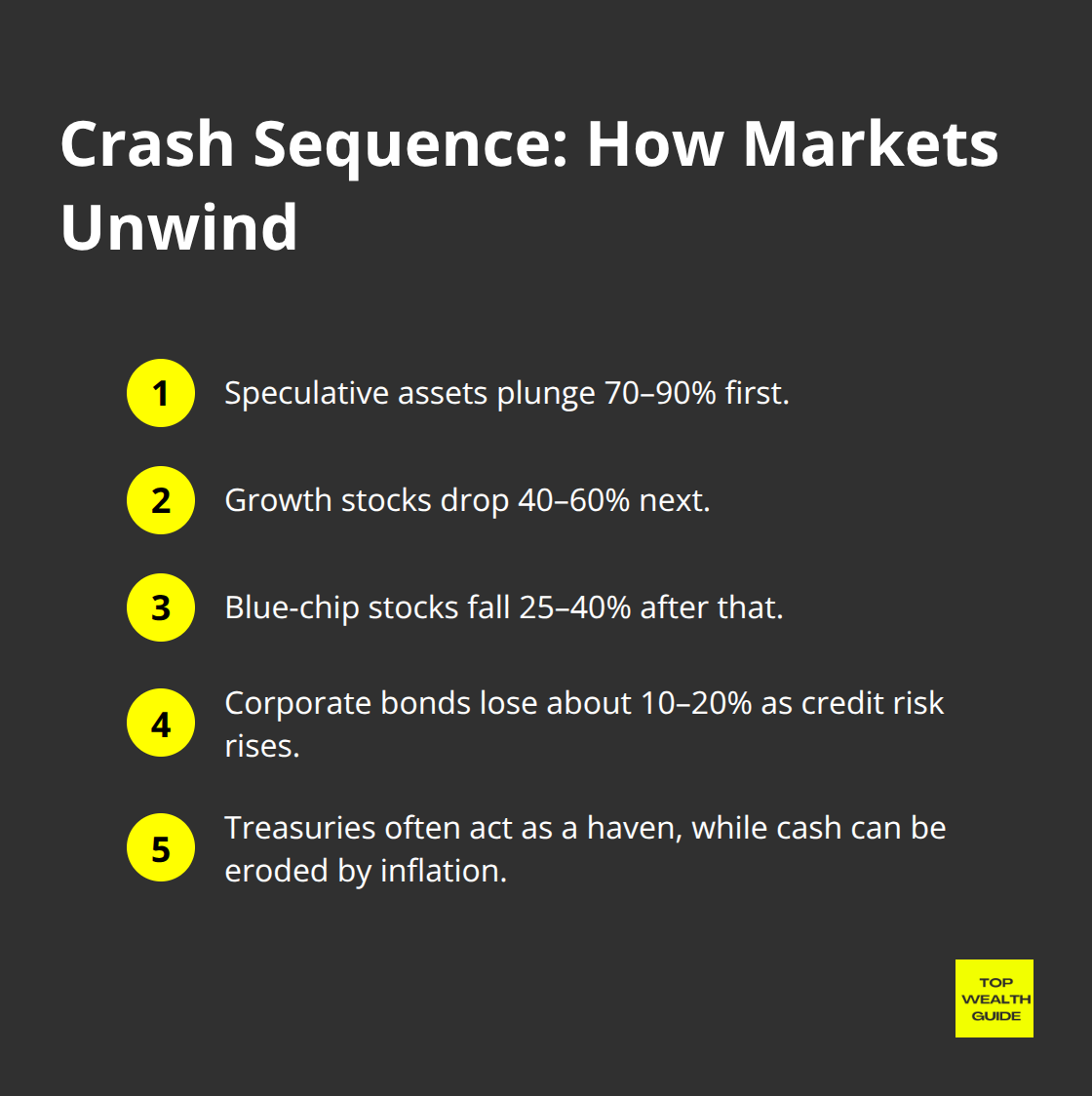

Market crashes-they love a good routine. First up, the flashy stuff-speculative assets like cryptocurrencies and meme stocks-go down 70-90%… a spectacular collapse. Then it’s growth stocks’ turn, dropping a “mere” 40-60%. Blue-chip stocks join the party, shedding 25-40%.

As for corporate bonds, they’re putting on a sad face, losing 10-20%. Treasury bonds, though, they’re the haven everyone runs to-well, most of the time. Cash is aim-for safety, though inflation can sneak up like a stealthy thief, eroding your buying power. The savvy investors? They’re the ones raking it in while everyone else panic-sells-at precisely the worst moment, of course.

Different Asset Classes React Differently

Asset classes? They’ve got personalities. Commodities like gold become the belle of the ball, outperforming during 70% of recessions since 1970-as folks scramble for a safe spot. REITs, on the other hand, go into sympathy mode with the market, dropping 40-50%. International stocks? They don’t play hero either-they crumble harder than domestic ones thanks to currency messes and our globally tangled economy. But get this: understanding these dance steps lets you build a portfolio that weathers the storm and sets you up for the sunshine on the other side.

How Do You Build a Recession-Proof Portfolio

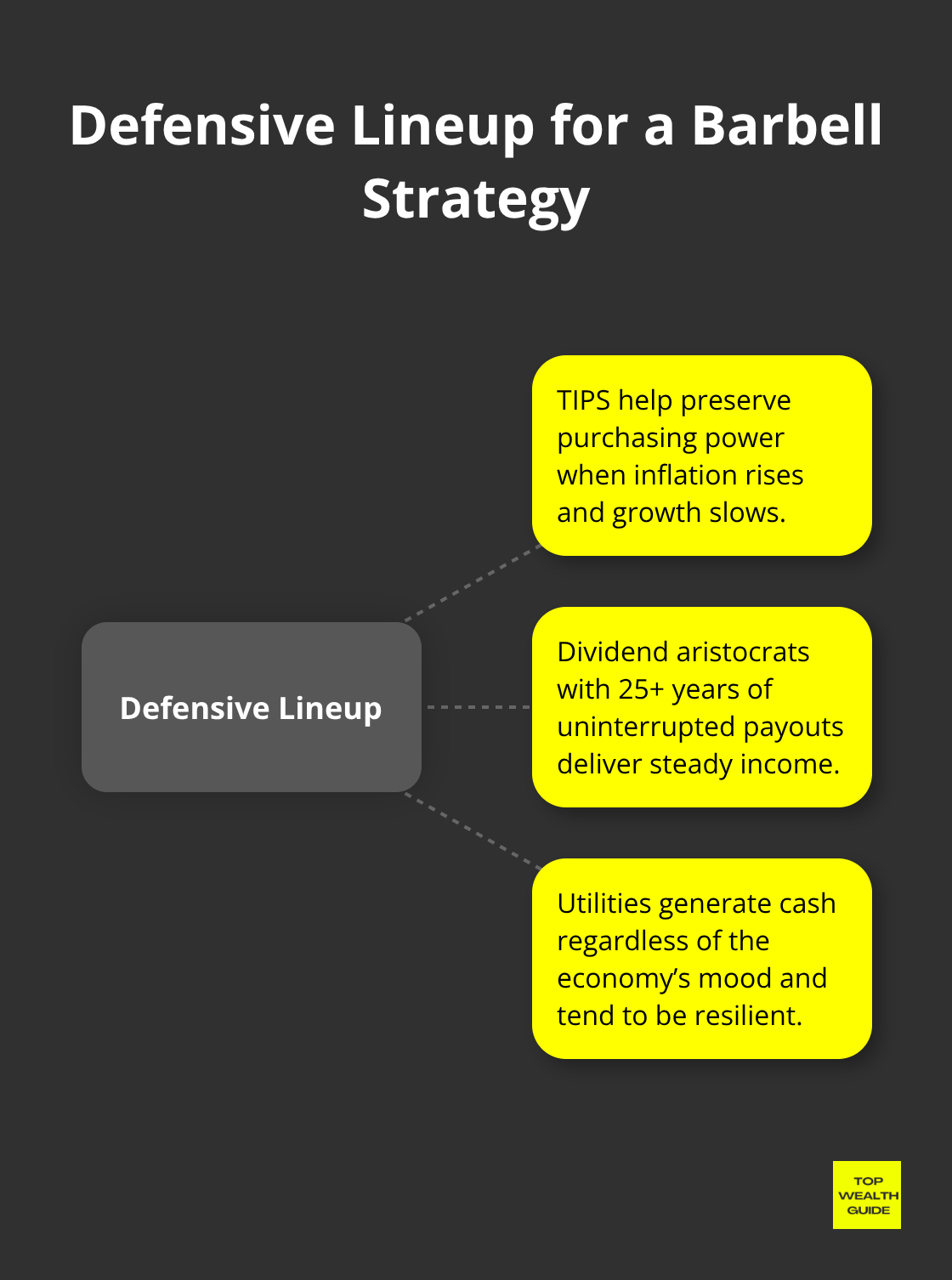

The 60/40 portfolio? Toast. Warren Buffett’s Berkshire Hathaway made that crystal-clear back in 2022-traditional balanced portfolios tanked by 16%, while Buffett’s concentrated style? It cruised through unscathed. So where’s the smart money heading? Barbell strategy-blast from the past, right? You mix the safe, secure assets with the spicy, high-risk ones. Vanguard tells us this has pulled off positive returns in 8 out of the last 10 recessions since 1950. Your defensive lineup? Treasury Inflation-Protected Securities, those solid dividend aristocrats with 25 years of uninterrupted payouts, and utility stocks-steady eddies that churn out cash regardless of the economy’s mood.

Safe Haven Assets That Actually Work

Gold – not the shiny hero you might imagine. Take the 2008 crisis: it nosedived 30% before bouncing back. Real safe havens? Treasury bills-they held onto a 1.6% return during 2008 whilst everything else was going up in smoke. Consumer staples like Procter & Gamble and Coca-Cola? Kept the dividends coming, only dipped 15% while the S&P 500 fell off a cliff at 37%. Healthcare stocks? Untouchable. Johnson & Johnson? Up 2% in 2008, while tech stocks were crashing 40%. And those defensive sectors? Outperformed 14 out of the last 16 recessions, courtesy of Federal Reserve data.

Geographic and Sector Diversification Done Right

Equal-weight global diversification-out the window. Emerging markets? They nosedive harder than their developed counterparts during downturns-lost 54% versus 22% for the developed markets in 2008. Want a winning mix? 60% in domestic defensive sectors, 25% in developed international markets, and sprinkle 15% in recession-proof sectors like utilities and healthcare across geographies. Swiss and German government bonds-they’re your anchor. Delivered positive returns in every major crisis since 1990. And tech allocation? Keep it under 15%. Remember the Nasdaq’s 78% plunge during the dot-com bust? Lesson learned.

Asset Allocation Models That Work

Step aside, traditional portfolio models-The Yale Endowment model has it covered. David Swensen’s brilliantly mixed strategy: 30% domestic equities, 15% foreign developed markets, 10% emerging markets, 20% real estate, 15% commodities, and 10% Treasury bonds. Delivered a whopping 13.1% return annually over 20 years while the S&P 500 could only muster 9.9%. Key to success? Quarterly rebalancing, not the usual annual routine. Asset class drops 20% below target? Buy more. Surge 20% above target? Sell, redistribute, rinse, repeat.

And that emergency fund of yours? Needs some TLC during portfolio setup. High-yield savings accounts-they’re dishing out 4-5% returns now (way better than that measly 0.1% from the usual banks) and cover six months of expenses before you even think about investing elsewhere.

How Much Cash Should You Actually Keep

The old three-to-six months emergency fund thing? Total nonsense in today’s economy. Look at the data-average recession lasts 11 months, not six. Savvy folks are hoarding 12-18 months of expenses in liquid assets, spread across multiple high-yield savings accounts to stay under that $250,000 FDIC cap per bank. Marcus by Goldman Sachs and Ally Bank are dishing out 4.5-5.2% at the moment, completely trouncing the 0.01% from traditional banks. That extra 5%? Over time, it piles into serious cash.

Multiple Income Streams Beat Single Paychecks

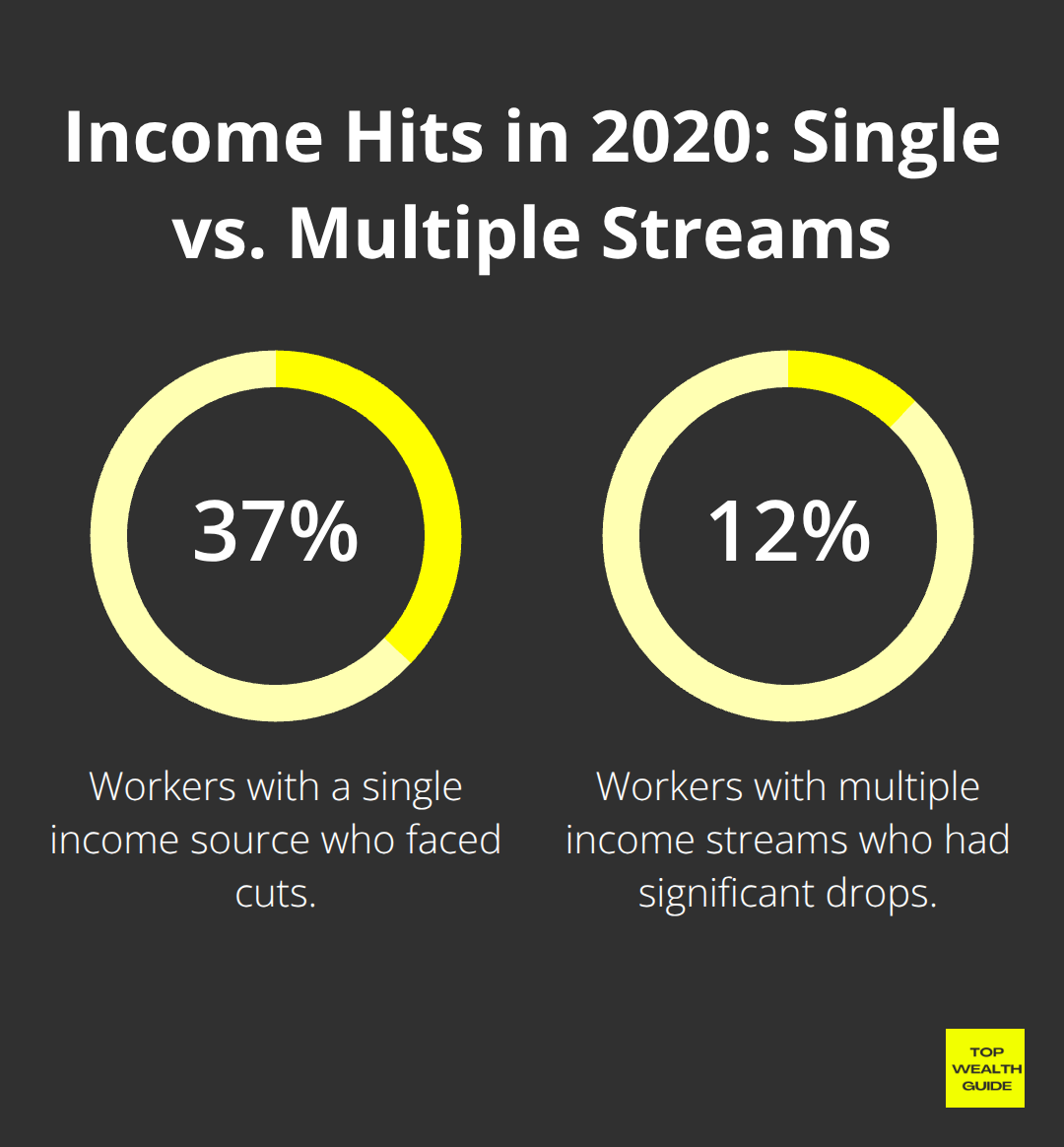

Relying on a single income source? In a downturn, that’s like signing up for financial doom. Bureau of Labor Statistics pointed out 37% of workers faced income cuts during the 2020 crisis. But those with multiple income streams? Only 12% had significant drops. Build at least three revenue pillars: your main gig, a scalable side hustle, and passive income sources like dividends or real estate.

Freelance gigs in recession-proof zones like healthcare IT or financial compliance can snag $75-150 an hour. Dividend aristocrats like Realty Income offer monthly distributions averaging 4.2% annually, which is a lifesaver when your paycheck disappears.

High-Yield Accounts Maximize Cash Returns

Sticking with traditional savings accounts? You’re basically handing your money to inflation. High-yield savings accounts from online banks like Discover and Capital One 360 are sporting 4.8-5.1% APY, compared to the measly 0.45% national average. Money market accounts offer similar returns with the bonus of check access for emergencies. Treasury bills? Another option at 5.2% for 3-month terms, though they lack FDIC safety. Split your emergency fund across 2-3 institutions to boost FDIC coverage and dodge single-bank hazard.

Debt Elimination Trumps Investment Returns

Holding onto high-interest debt in a recession? That’s financial self-harm. According to Federal Reserve data, credit card rates are still sky-high, and even bold stock investments struggle to top 12% long-term. Pay down debt hard and fast before you start building investment portfolios. The avalanche method is your best bet: knock out the highest-rate debt first, while keeping up minimums on the rest. Mortgage debt under 4%? Let it ride and invest the savings. Student loans over 6%? Wipe them out, pronto. Fixed-rate debt gets cheaper when inflation hits, but variable rates will pummel you when the Federal Reserve hikes rates during recovery phases.

Final Thoughts

Economic downturns – oh, they’re definitely coming back around. That’s not being a downer… it’s just how the world spins. The Federal Reserve’s numbers? They tell us recessions hit every 6-8 years, on average. So, your strategy to shield your wealth? It needs to be locked and loaded yesterday, not when everything is already in free fall.

Let’s kick things off with the essentials: stash away a 12-18 month emergency fund in several high-yield accounts raking in 4.5-5.2%. Forget that old-school 60/40 portfolio – it’s just not cutting it anymore. Instead, go for the barbell approach, providing positive returns 8 out of 10 times during recent recessions. Bet on defensive sectors like utilities and healthcare, keep tech under 15% (because remember the Nasdaq nose-diving 78% during the dot-com crash?), and make sure you’re spreading your risk across different geographies.

And here’s a no-brainer – multiple income streams are like a Swiss Army knife compared to a single paycheck. The 2020 crisis? It taught us that 37% of people with just one income source faced cuts, while only 12% of those with diversified earnings took a hit. At Top Wealth Guide, we champion strategies that stand tall when markets get nasty, not those flimsy theories that fold under the slightest pressure.

1 Comment

https://shorturl.fm/hYuno