Your take on money — either you’re building a fortress of financial success or, well, cycling through the hamster wheel of financial mess. Here’s the kicker: it all comes down to how you think.

At Top Wealth Guide, we’ve dissected the cognitive DNA (if you will) that sets the financially thriving folks apart from, let’s just say, those spinning their wheels. This little gem of a guide? It pinpoints the exact mental pivots you need to turn your financial ship around.

In This Guide

What Separates Rich Thinking from Poor Thinking

Let’s break it down-rich folks? They’re playing the long game. They’re looking decades ahead, not just waiting for their next paycheck. It’s this mindset that influences every single financial choice. Millionaires? They know it’s about the slow and steady climb to wealth, not the quick high, like our buddy with the 595,000 401(k) millionaires marking a milestone by mid-2025. Meanwhile, the paycheck-to-paycheck crowd is chasing the quick fix-instant gratification. No surprises then, that 78% of NFL players end up broke within two years. Roll in the dough… then roll in debt.

The Investment Gap That Changes Everything

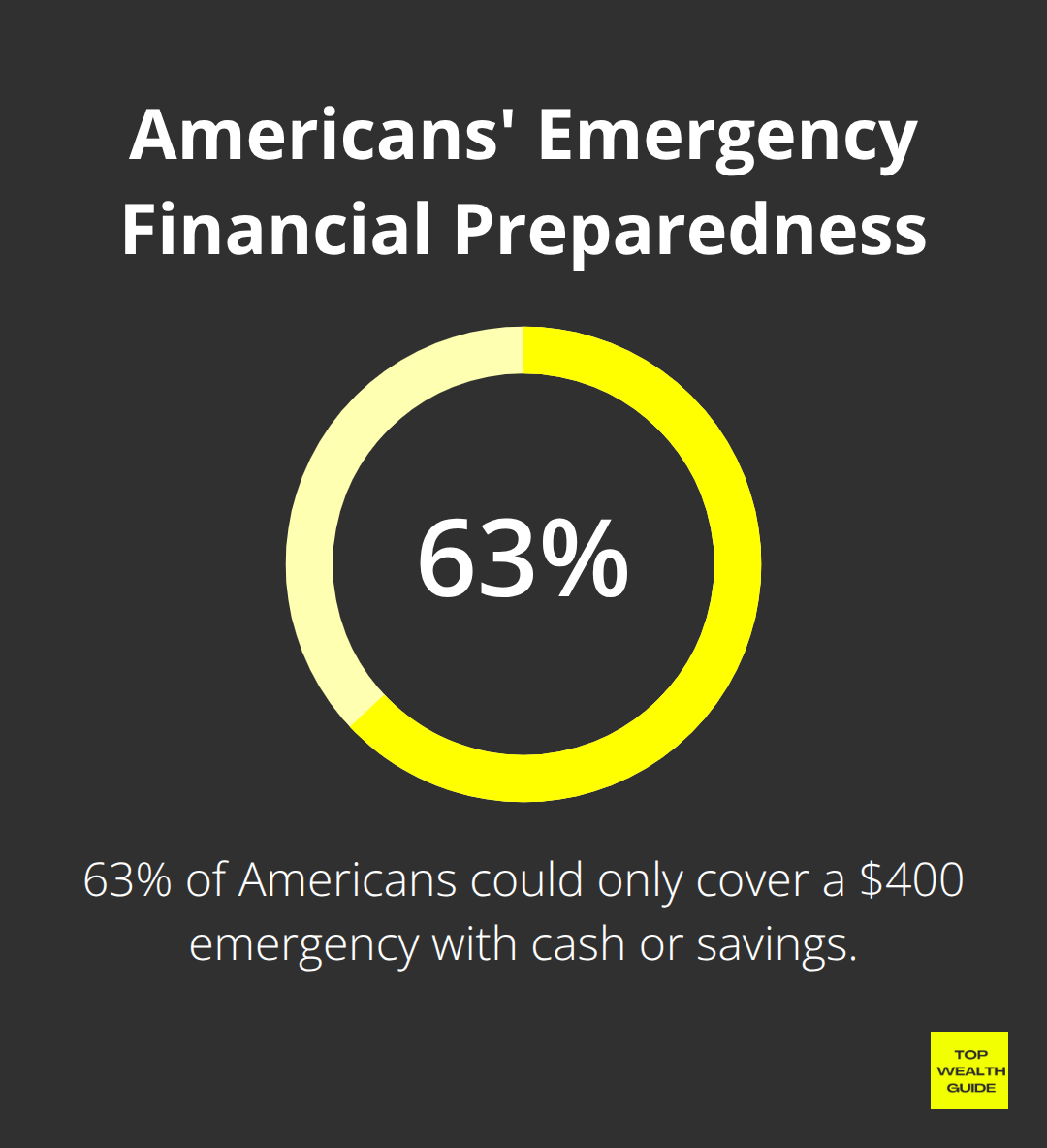

Here’s the deal-every dollar is a potential employee for the wealthy. They make it hustle. Take Warren Buffett-guy reinvests 99% of his fortune instead of blowing it on yachts. The poverty mindset? Money’s burning a hole in the pocket-gotta spend it, stat. The Federal Reserve tells us 63% of Americans could only cover a $400 emergency with cash or savings, but hey-they’ll still drop cash on lottery tickets. The rich? They’re into assets that grow; the poor? Grabbling depreciating goodies.

Risk Assessment Through Different Lenses

Now, how do we handle risk? The wealthy crunch numbers-risk is a math game. Data says 65% of wealthy individuals juggle three income streams; a good chunk even juggles four, five, or more. Market dips for them? Opportunity knocks. The poor mindset folks? They cower in fear, tucking money into accounts that inflation chews up. That hesitation costs them an average of 7% annually-money that snowballs into a wealth canyon over time.

The Scarcity vs Abundance Framework

The poor mindset is all about scarcity-a fear that there’s not enough to go around. They clutch onto cash, dodging the investment bus because the fear of loss trumps any thirst for growth. Wealthy people? They’ve got abundance on the brain-money’s a tool that multiplies when wielded wisely. Over here, you’ve got 70% of lottery winners back to broke-ville in five years-old habits die hard. The self-made millionaires, minus a few hiccups? They rebound.

These mental frameworks don’t just tweak individual choices-they paint entire financial landscapes. So, the real question? What mental blockades are keeping you from donning those wealthy glasses?

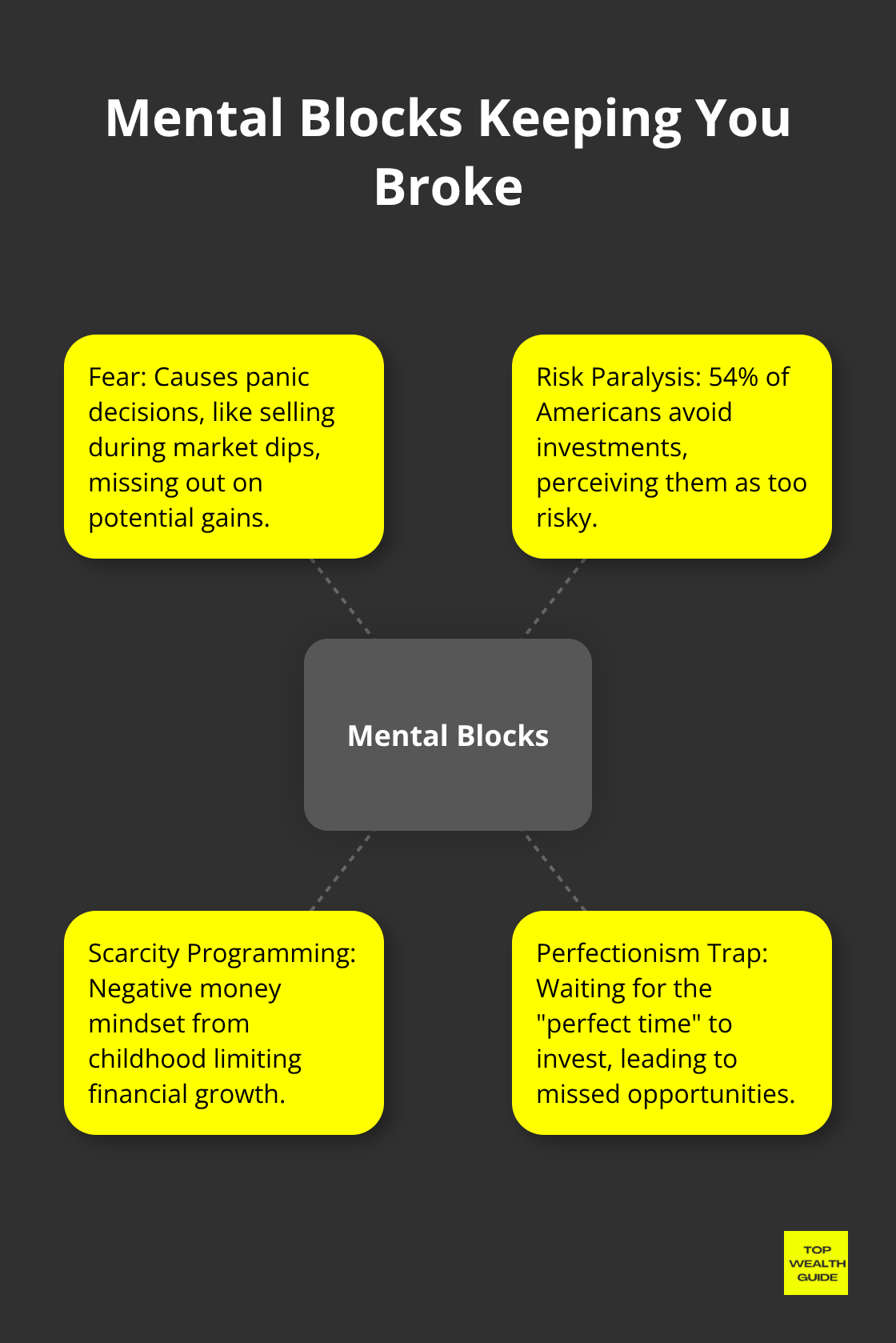

What Mental Blocks Keep You Broke

It ain’t the market crashes or fairy-tale bad luck that’s keeping you broke-it’s that fortress you’ve built around your brain with dollar bills as the mortar. Fear? Oh yeah, it’s the landlord in this mental prison. Every time you make a decision, there’s fear, turning what could be a future mogul into someone who hoards cash like it’s the end of days, watching inflation gobble it up like a ravenous beast. The Vanguard Group? They did some digging-turns out 2020’s fear-induced panic sellers missed a tidy 67% market recovery. Fear’s no knight in shining armor; it’s more like a wrecking ball for your wealth.

The Risk Paralysis That Costs Millions

Let’s get real about what divides the deep-pocketed from the constantly-broke-it’s all about risk. The wealthy? They flirt with it, size it up. The rest? They scamper away. When you hear someone saying investment is just dumb luck, know they’re waving their financial illiteracy flag high. History has shown that diversified stock portfolios actually do the job over time. But 54% of Americans? Steer clear, thinking investment is a one-way ticket to Brokeville.

And those stashing bucks in savings, thinking it’s the safe haven? They’re practically signing over a slice to inflation-at 2.9% annually with savings accounts at a measly 0.5%. So where’s the real risk here? It’s the ghost of missed opportunities to invest, haunting your bank statements.

The Scarcity Programming That Sabotages Success

Your noggin’s spinning more tales about money than a campfire storyteller. Most are stuck in this childhood narrative: money’s like rare Pokémon, rich folks are the villains, and wealth? You’re not the chosen one. Studies have found this little negative tape playing in the heads of many Americans-a destiny-dictating playlist of financial flops.

Those who rake in the big bucks? They rewrite the script. They hit repeat on daily affirmations and hang out with others who’ve cracked the code. Here’s an activity: for a week, catch every negative money thought, pen it down, then hunt for facts that prove otherwise.

The Perfectionism Trap That Prevents Action

Let’s spill the beans: there’s no knight in shining armor called “perfect time” coming to rescue you on your wealth journey (spoiler: it’s a no-show). Folks spend eons plotting the perfect investment move, yet their brokerage account is a ghost town. They’re weekend warriors with real estate articles but haven’t made an offer on a dollhouse. The analysis paralysis curse? It’s pricier than any botched decision because it keeps you as frozen as Elsa.

The wealthy? They know that doing beats dithering. They leap with what they got and tweak on the fly. It’s learning by doing, not just theory.

Now that you’ve scoped out these mental mazes, the follow-up? Dive into actions that’ll flip the script on your financial mindset.

How Do You Actually Build Wealth Habits That Stick

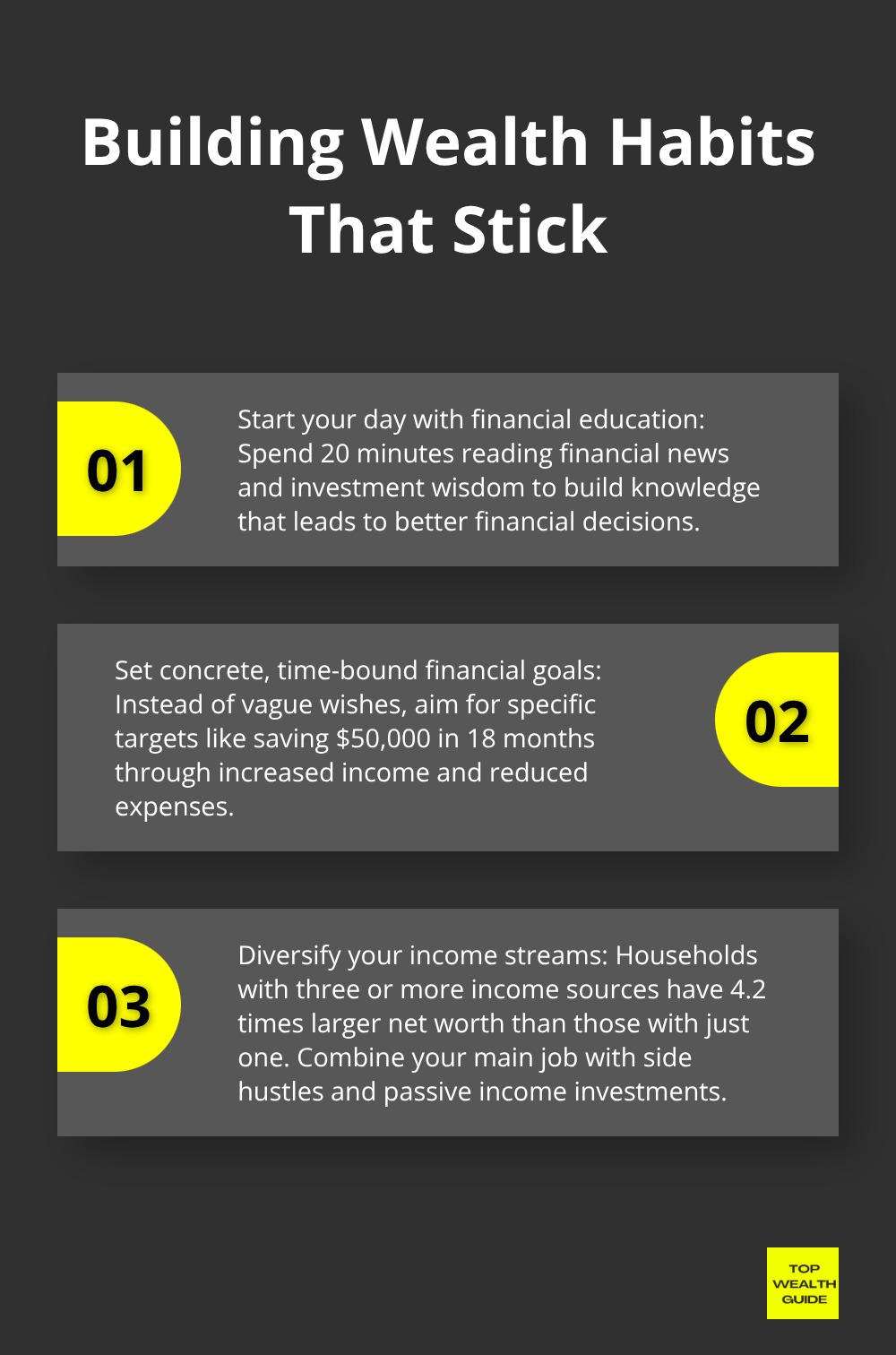

So, the wealthy-you think they just roll out of bed and stumble onto money? Not quite. These folks run on systems. It’s like turning making money into a reflex. Thomas Corley’s research digs into the big “why-some-have-why-some-don’t” questions about wealth. Spoiler: it ain’t random. Take Uncle Warren (aka Buffett)-he spends 80% of his day nose-deep in financial reports and business news. It’s the pattern, people. Consume info systematically, and watch it become dollars.

Morning Routines That Build Wealth

First things first, start your day with a quick tour of three financial news sources-before diving into the Instagram black hole. Spend a solid 20 minutes soaking up investment wisdom-podcasts, books, market deep dives-you choose. Those with the fat wallets? They’re not counting pennies but tracking every expense to spot trends and channel their cash towards wealth-building plays. This daily grind builds up a stockpile of knowledge that eventually turns into killer financial moves.

The Numbers Game That Changes Everything

Goal setting-it’s not about slapping random dreams onto a vision board. Nope. It’s math, with an alarm clock. People who jot down crystal clear financial targets? They crush it compared to the rest. Here’s the play: make those goals concrete and anchored to a timeline. Don’t just wish to swim in cash; aim to stack $50k in, say, 18 months. Do it by ramping up income by $2k each month through freelancing, shaving off $800 in expenses, and tossing the saved dough into index funds.

Reverse Engineering Your Financial Future

The well-heeled? They’ve got a secret sauce-reverse engineering their dreams. Say they crave a million in the next decade. They break it down. Do the math: $5,800 monthly with a 7% return. Then, they hustle to build income streams that hit those numbers. Flashing some Federal Reserve stats-households with three or more income sources? Their net worth is 4.2 times larger than those with just one.

Building Multiple Income Streams

Here’s the game plan: start with your main gig, toss in a side hustle leveraging your skills, and dream up passive income-real estate, investments, you name it. The wealthy-oh, they get it-diversification isn’t just for investments; it’s for cash flow too. Each income stream trims financial risk while turbocharging wealth accumulation through a buffet of growth avenues.

Final Thoughts

Here’s the deal-your journey to financial freedom kicks off with a no-nonsense truth: the chasm between thriving and just getting by isn’t some cosmic roll of the dice or about nailing perfect timing. Nope, it’s about-wait for it-rewiring your brain when it comes to the green stuff, risk, and chances. The data folks? They’re with us. Those raking it in choose different mental routes that morph into ginormous financial upsides over time.

So, hit the ground running and make these changes…now. Start tracking every penny for the next 30 days-spot those sneaky patterns. Aim for one tangible money goal, complete with timeline and price tag (think $50,000 in 18 months, no biggie). Oh, and tune into money wisdom for 20 minutes each a.m., then make your first bet on an investment this week.

Nope, you won’t walk out tomorrow with yachts and jets, but-brace yourself-the compound effect? Insane. Folks flipping from a ‘not enough’ mindset to a ‘bring it on’ mentality? Their net worth jumps like 3-5 times faster than the ‘meh, I’ll pass’ crowd. Your bank account’s fate is tied to the mental playbook you choose to run with today, and comprehensive wealth-building strategies can flip those mindset tweaks into real-deal money moves. Boom.