Oil stocks … still bringing in the bacon for investors, even when the market’s playing hopscotch. 2023 was a blockbuster year for energy firms—record profits, anyone?—and the heavyweights are tossing out dividend yields over 6% like confetti.

Over at Top Wealth Guide, we’re diving into the oil stocks that are the crème de la crème—think strong fundamentals, think juicy valuations. These energy plays are your knight in shining armor against inflation and they’re all about that sweet, steady cash flow in our current economic rollercoaster.

In This Guide

Why Oil Stocks Deliver Consistent Returns

Energy Demand Surge in Developing Markets

So, here’s the deal-energy demand in developing markets is off the charts. China’s chomping down on 16 million barrels of oil daily… and it just keeps going up! We’re talking about a 4-6% annual rise, per the International Energy Agency. It’s like someone gave these economies an energy credit card-swipe, swipe, swipe. For oil companies, it’s a revenue goldmine.

Old school oil behemoths are basically ATMs. ExxonMobil? They cranked out a cool $12.2 billion in operating cash flow in 2024. Chevron topped it with $21.4 billion. And here’s the kicker-they’re returning 60-80% of that cash to shareholders through dividends and buybacks. Cha-ching!

Dividend Power That Beats Inflation

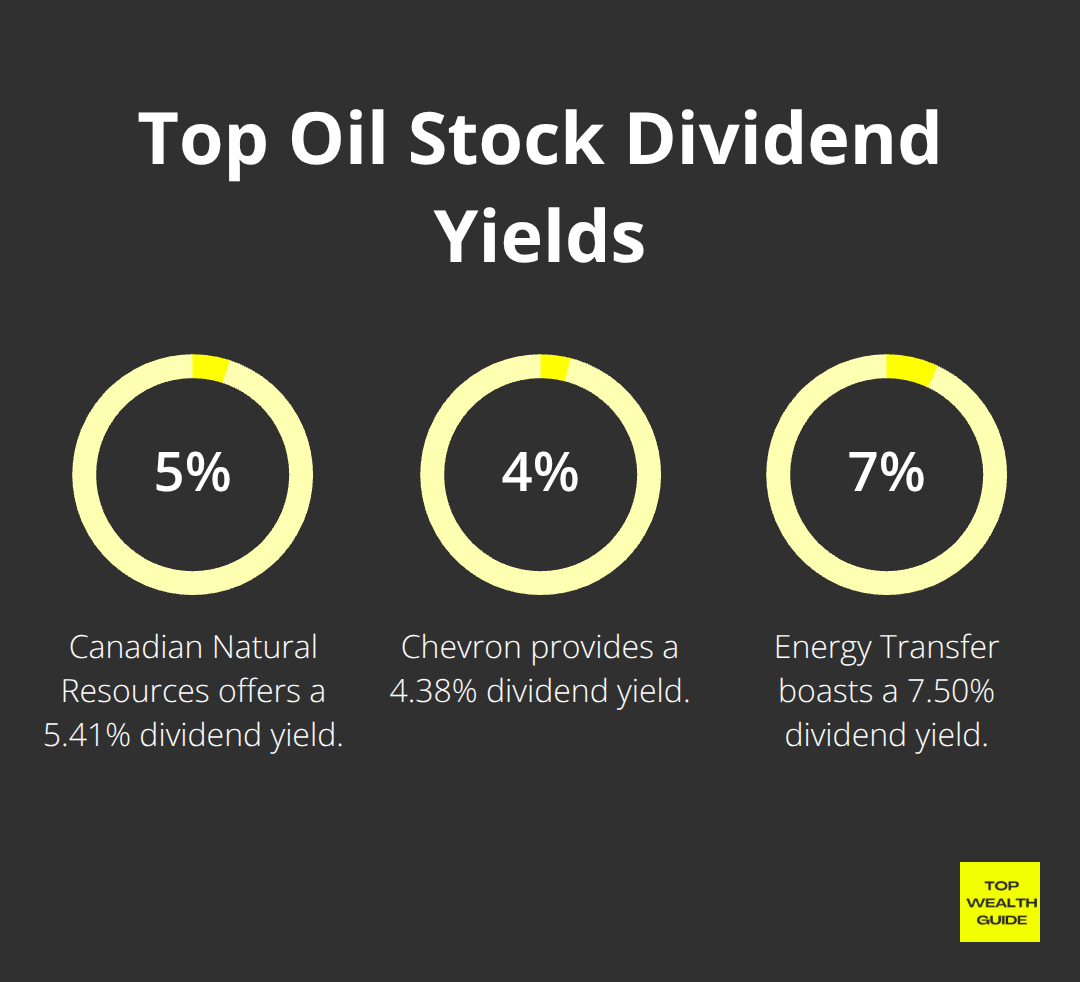

Want dividends that laugh in the face of inflation? Look no further. Oil stocks offer dividend yields that are like, “Inflation? Never heard of her.” Canadian Natural Resources? A solid 5.41% yield with 24 years of consecutive raises. Chevron rolls with a 4.38% yield and a 38-year streak of hikes. Energy Transfer’s strutting around with a 7.50% yield (that’s money in your pocket, my friend).

And these aren’t some pie-in-the-sky future profits-nope, these companies have cash-generating swagger. When inflation hovers around 3-4%, these yields are real winners-taking treasury bonds and savings accounts to the cleaners.

Portfolio Protection Through Energy Exposure

Need some protection for your portfolio? Energy stocks are your shield. They show super low correlation with tech and growth sectors, making them the ultimate portfolio chill pill. The Morningstar US Energy Index gained 4.36% from January to August 2025-breezing through wider market swings like a cool cat.

Analysts at Morningstar say energy stocks are trading at a 6.9% discount-talk about a bargain hunt! SLB’s hanging out 29% below fair value at $50 per share, Halliburton’s 27% undervalued. This sector is diversification’s best friend-cutting down risk while keeping the returns rolling in for long-term investors.

In the end, the fundamentals are rock-solid… dynamic companies leading the energy sector with top-notch performance and strategic know-how are setting the stage for success.

Which Oil Giants Lead the Pack?

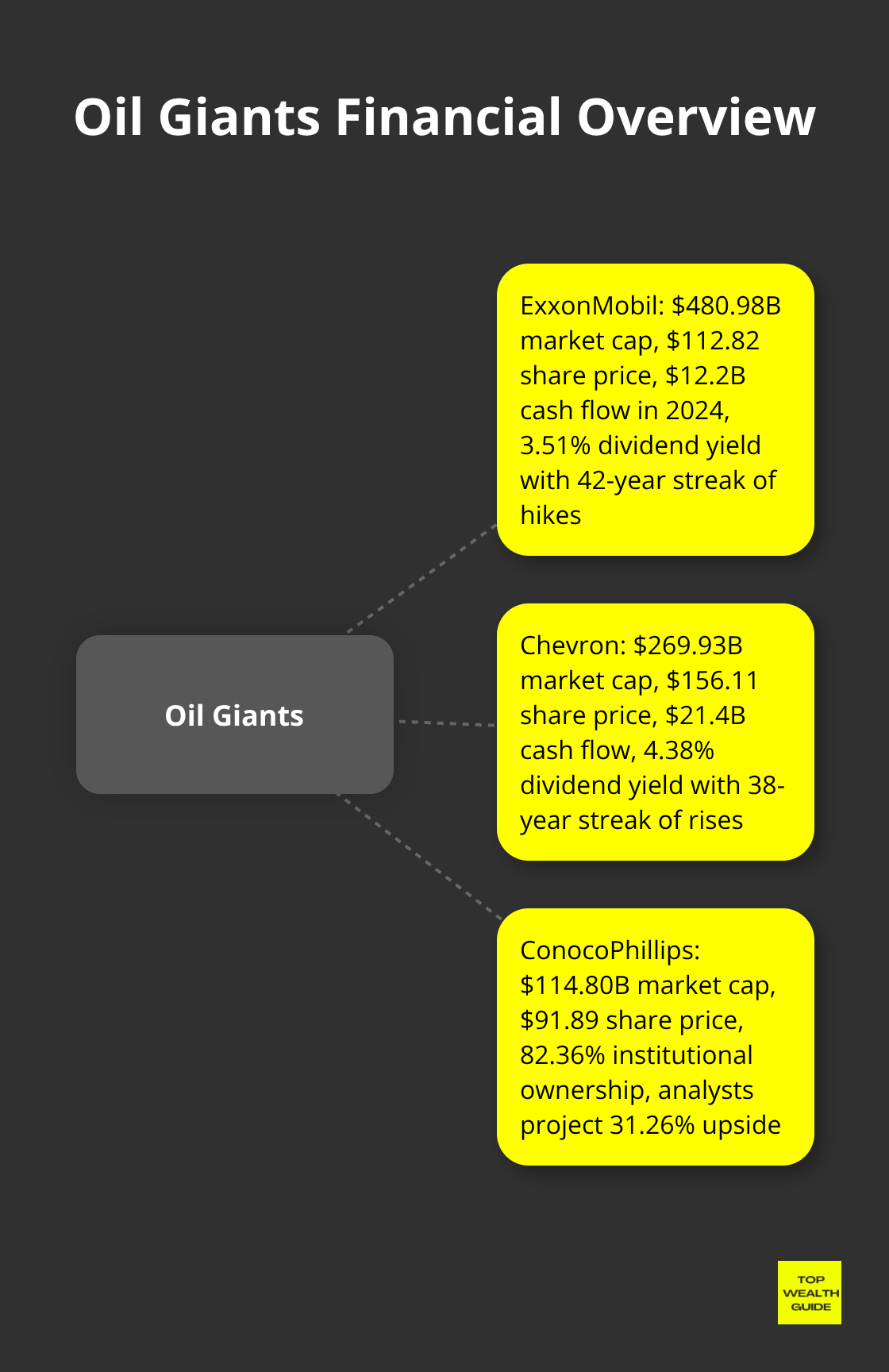

ExxonMobil’s Financial Fortress

ExxonMobil is your heavyweight champ-no contest. Sitting pretty with a market cap of $480.98 billion. Trades at $112.82 per share, and raking in a solid $12.2 billion in cash flow during 2024. That’s what I call financial muscle. Need more? Try a dividend yield of 3.51% and a jaw-dropping 42-year streak of consecutive dividend hikes. Yup, you heard it-42 years. Good luck finding another like that. They’re committed to shareholders, folks.

MarketBeat thinks big with a price target of $124.76 (that’s a 10.58% upside waiting to happen). The secret sauce? An integrated model from exploration to refining-means they’re not just riding a single wave. They’ve got a whole ocean to surf on, even when markets get shaky.

Chevron’s Dividend Dominance

Chevron steps in-watch out-its dividend, unmatched. Think operational efficiency on steroids. $21.4 billion in cash flow and a killer 4.38% dividend yield, with a 38-year streak of continuous rises. Trading at $156.11, market cap sitting at $269.93 billion. Q2 2025 earnings were $1.77 per share, leaving analyst projections of $1.58 in the dust on a cool $44.82 billion revenue.

And here’s the kicker: $202.79 billion in average annual revenue, according to MarketBeat. That’s domination, pure and simple. Their game plan? Low-cost production and a strategic hold on places like the Permian Basin and beyond. Masterstroke.

ConocoPhillips Growth Machine

ConocoPhillips-pure-play powerhouse at its finest. All eyes on high-return shale. Trading at $91.89 with a $114.80 billion market cap. Oh, and a hefty 82.36% institutional ownership. That’s confidence, folks. Analyst see a price uptick to $120.62, teasing a 31.26% upside.

Q2 2025 earnings? Crushed it with $1.42 per share-they were only supposed to hit $1.36. Revenue? $14.94 billion. Their game? Aggressive buybacks and sharp acquisitions aimed at over $1 billion in extra value through sweet operational synergy.

Three juggernauts with distinct value plays, each with a shiny advantage for the savvy investor eyeing the right fit based on risk and investment mojo.

Key Factors When Evaluating Oil Stock Investments

Production Costs and Profit Margins Analysis

Production costs are the bouncers at the door of any oil investment-letting the winners slip past velvet ropes while losers languish outside. Let’s break it down: Companies strutting their stuff in the Permian Basin get by with breakeven costs in the $35-40 per barrel range. Offshore folks? They’re talking $60-70 per barrel just to show up. ConocoPhillips, though, has this sorted-keeping things tight at $30 per barrel thanks to some savvy moves in shale operations, and they’re laughing all the way to the bank when oil hits above $65.

Now, SLB reckons it’s a solid 29% undervalued, and why? They’ve sliced operational costs by 15% year-over-year. Smart cookies-the kind you want to invest in-are keeping an eye on these low-cost production champs with profit margins that only get juicier when the market throws a fit.

Here’s the ABC of it: Lower outlay equals fatter profits when prices take off. Devon Energy bets on lower-cost shale basins and voila-strong returns on capital investments lead to its sweet 16% undervaluation compared to fair value estimates.

ESG Commitments and Sustainability Initiatives

New headline: Green is the new black! Environmental commitments-not optional anymore-they’re the backstage pass to future success. ExxonMobil dropped a cool $17 billion on carbon capture tech riding through 2027-all eyes on the regulation prize. Chevron’s been slashing methane emissions-half gone since 2016-and gunning for net-zero by 2050.

Big bucks (82.36% of ConocoPhillips’ ownership) follow companies that score high on ESG. Mess up your environmental cred? You’re facing the music with regulators and seeing investors scatter. The lesson’s clear for anyone who cares to listen: ESG mojo sways those big wallet decisions.

Do your homework, evaluate environmental histories, size up futuristic green goals. The smart money chases the eco-savvy companies, leaving the laggers in the dust.

Debt Levels and Financial Stability Assessment

Debt levels-think of them as the canary in the coal mine for financial survival in those roller-coaster commodity cycles. Occidental Petroleum’s rolling with a suave debt-to-equity ratio near 0.3, offering a safety cushion during price dips. Meanwhile, Energy Transfer’s flaunting an investment-grade credit rating despite shelling out $5 billion annually on infrastructure bling.

Cross the line into debt-to-EBITDA ratios north of 3.0, and finally, you’re staring down the barrel of refinancing risks if prices dip below $50. Solid cash flow coverage ratios above 2.5 are the tell-tale sign of dependable dividend payouts. Baker Hughes shaved down net debt by $1.2 billion last year, all set for LNG ventures zooming towards 35% capacity increases by 2028.

Those rocking solid balance sheets glide through downturns like skaters on a smooth pond, maintaining operations, keeping dividends alive. Meanwhile, the shaky ones are struggling with debt like it’s last night’s dinner.

Final Thoughts

Top-rated oil stocks-what’s the deal here? They offer up some pretty sweet investment opportunities. We’re talking multiple value drivers. You know the type: ExxonMobil, Chevron, ConocoPhillips. They’ve got these dividend yields over 3.5%, not to mention decades of payouts. That’s right, folks. Reliable cash streams that thumb their noses at inflation.

These energy behemoths are cash machines-ExxonMobil raked in $12.2 billion, and Chevron’s stacks hit $21.4 billion in 2024. Plus, they’re trading at neat valuations. Analysts are seeing dollar signs with a 10-30% upside. It’s looking good… on paper, at least.

Now, let’s talk strategy. Smart risk management begins with diversifying across energy subsectors. Keep that energy exposure in the 5-10% range of your total portfolio. Don’t go full cowboy. Zero in on firms with debt-to-equity ratios under 0.5 and production costs below 40 bucks a barrel. Those are your best bets to ride out the commodity price turbulence. ESG-focused firms? Yeah, they’re covering your back against those tightening regulations (hello, environmental crackdowns).

But don’t dive in headfirst. Energy sector exposure-it’s all about the systematic research. Drill into production costs… check that dividend sustainability… scrutinize those debt levels. Start with the tried-and-true integrated oil giants before you even think about branching into those niche midstream or oilfield services.

We’re here-at Top Wealth Guide-to lay down the groundwork for you with comprehensive analysis and practical investment strategies. Navigate the energy scene effectively. Build up that long-term wealth with a disciplined approach to portfolio construction. Let’s move the needle, people.