Passive income—money that rolls in with little effort after you’ve set it up. Sounds dreamy, right? It’s 2025, and guess what… creating these streams is easier than ever with digital platforms and investment opportunities popping up faster than you can say “financial freedom.”

So, what did we do over at Top Wealth Guide? We dove headfirst into the most effective strategies, the ones that actually put dollars in your pocket. This here’s your roadmap—practical steps to get that first income stream flowing.

In This Guide

What Makes Passive Income Different in 2025

Passive income-it’s like your bank account learned to clone itself while you’re off sipping margaritas. Active income? That’s the hamster wheel. You stop spinning, the money stops flowing. But with passive income, you set it up once (yep, just once), and it keeps sending you cold, hard cash as you sleep, travel, or chase that elusive work-life balance.

The Financial Freedom Numbers That Matter

Time for a reality check, folks: 77% of U.S. adults don’t feel totally financially secure. The math isn’t rocket science-$3,000 a month from passive gigs means you’ve swapped that office job and its $36K salary for perpetual Saturdays.

And let’s talk about compounding-it’s the secret sauce for those who want serious wealth. Check out Dividend aristocrats, like Coca-Cola, who’ve been shelling out more cash for over a quarter-century. That’s the magic of passive income stomping all over inflation.

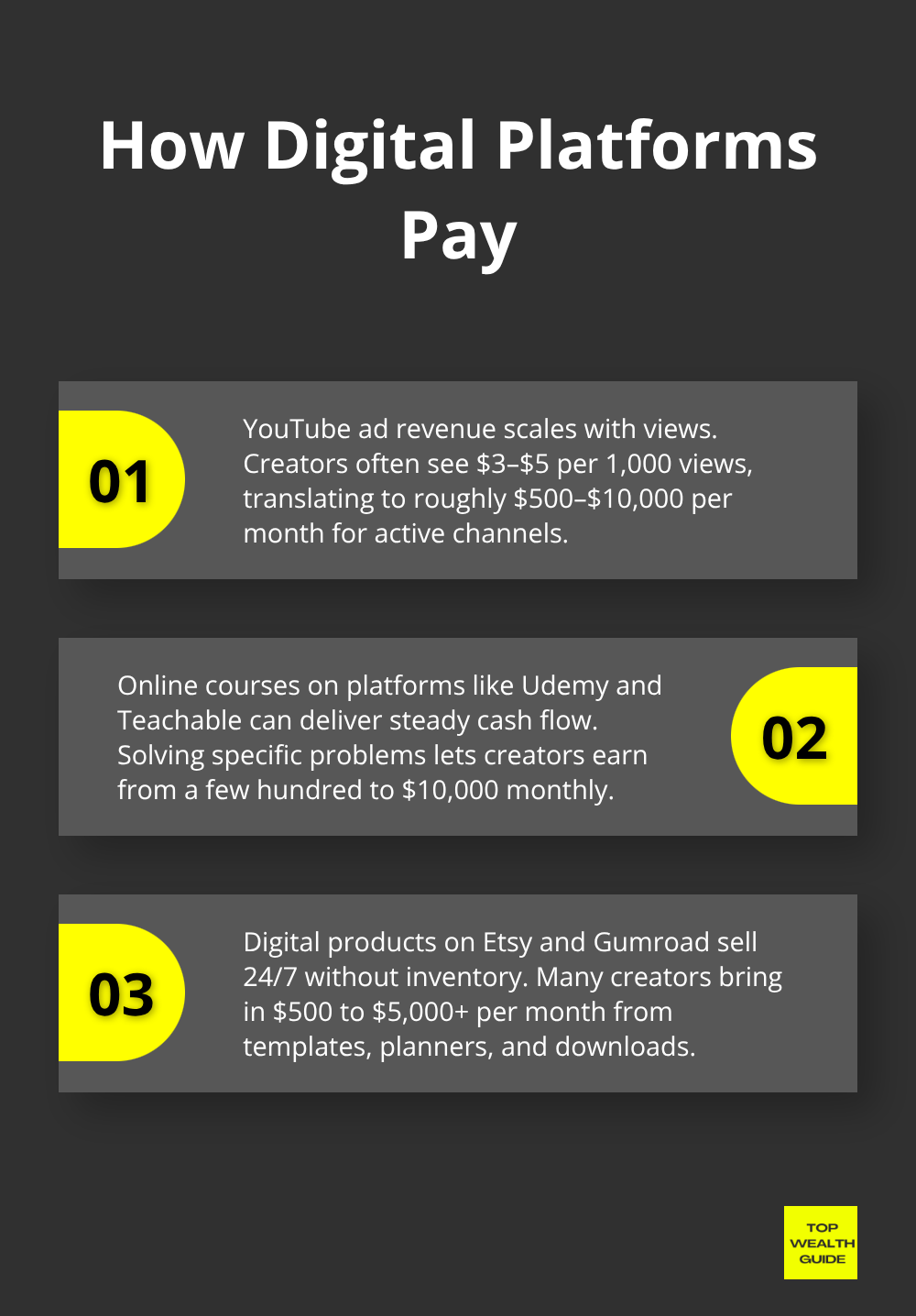

Digital Platforms Transform Income Generation

Enter the digital revolution. It’s a gold rush for passive income seekers. YouTube stars rake in $500 to $10,000 monthly just on ad clicks. That’s money right there by the thousands ($3-$5 per thousand views). Online courses on big-name platforms like Udemy and Teachable are cash cows with creators earning anywhere from a few hundred to ten grand every month.

Then there’s digital product sales on Etsy and Gumroad, which are minting creators to the tune of $500 to $5,000+ monthly. Honestly, these platforms are like Robin Hood, breaking down barriers and handing the golden keys to anyone with Wi-Fi.

Market Conditions Favor Passive Income

Real estate crowdfunding? It’s the next big thing-wave goodbye to the crazy capital you’d need for classic property investments. With inflation chilling at 2.4% by late 2024, passive income streams are the ultimate dragon slayers against those pesky rising costs-a battle your savings account can only dream of winning.

The gig economy is on fire-platforms like Upwork and Fiverr are bustling beehives with freelancers flocking in droves. It’s not just hustle culture; it’s a seismic shift, perfect for brewing multiple income streams.

So, here we are in 2025 with unique chances popping off left, right, and center. Ready to dive into strategies that deliver? Buckle up.

Which Passive Income Streams Actually Pay Off

Real Estate Investment Without Property Management Hassles

Real estate investment trusts-REITs-are your ticket to property gain without the whole landlord drama. REITs like Realty Income Corp dish out those sweet monthly dividends-yields hover around 5.62%-and you can jump in with as little as $100 via brokers like Fidelity or Charles Schwab. Sure, rental properties can bring in $200 to $2,000 per month per unit, but here’s the kicker: zero in on multi-family units in suburbs where rent-to-price ratios beat the 1% mark. Oh, and house hacking-talk about genius-it can slash your living costs by a cool 50-80% by renting out a spare room through Airbnb (yep, hosts in major metros rake in $500 to $3,000 monthly).

Dividend Stocks Crush Traditional Savings

Dividend stocks-they’re not just a game-changer, they’re a savings-crusher. While banks are hanging out at a puny 0.5%, dividend stocks are flexing with 3-7% annual yields. Take Johnson & Johnson-they’ve been shelling out dividends for 61 years, and Procter & Gamble does them four years better at 67. Toss into the mix index funds like VTSAX, offering instant diversification with a 2-4% cash crop, plus a side of capital growth. Trick is, put $500 monthly into dividend-rich ETFs, and you’ll be eyeing a cool $1,000 to $2,000 yearly in passive income in just five years. Keep those dividends rolling back in and watch as compound growth sprinkles some serious gains on your starting stack.

Digital Products Scale Without Inventory Risks

Online courses on platforms like Udemy-they’re a cash cow, churning out $1,000-$10,000 monthly for creators solving exact problems. The hack? Zone in on micro-niches like Excel tailored for real estate agents or dentist-specific social media tactics. Then there’s digital products on sites like Gumroad and Etsy-creators snag $500-$5,000 monthly peddling budget trackers, meal planners, or design templates. Print-on-demand? It tosses inventory risks out the window… while Shutterstock photographers pocket $100-$2,000 monthly from licensing stock shots. Create once, sell infinitely-digital products win hands down over traditional goods.

Affiliate Marketing Monetizes Your Audience

So, affiliate marketing-you turn content into fat commission checks (Amazon commissions range from 1% to 10% based on product category). YouTube stars rake in $500-$10,000 monthly through ads and sponsorships, with ad rates around $3-$5 per 1,000 views. Blogs too? Yep, platforms like Mediavine or AdThrive fuel blogs with steady traffic-that’s $500-$10,000 monthly. The secret sauce? It’s all about authentic product recommendations meeting actual audience needs-not sleazy pitch drills.

Now that you’ve got the lowdown on which streams pay off, it’s all about picking the right one for your budget and circumstance.

How Do You Start Your First Passive Income Stream

Let’s get a reality check on your finances. You gotta know your monthly expenses, debt load, and what cash you can throw at investments. Most folks need at least $1,000 to dive into dividends or $5,000 for a rental property down payment. But hey-digital goods? Just $50-$100 gets you rollin’. Track every dollar like it’s the last slice of pizza for 30 days with apps like Mint or YNAB-there’s always a cash leak somewhere. Aim for specific goals: $500 in monthly passive income within 12 months… way better than those vague dreams of endless wealth.

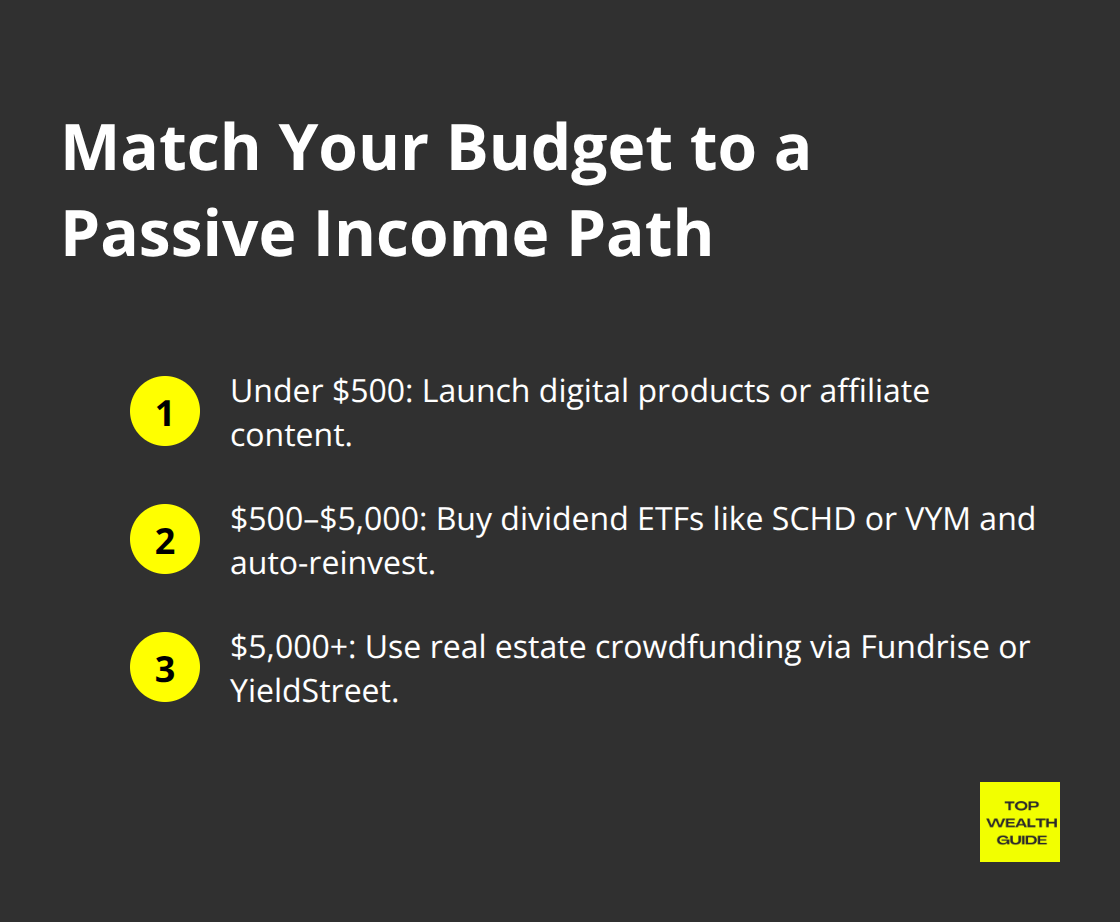

Match Your Budget to the Right Strategy

What’s your bankroll? That choice determines your path. Less than $500? Go digital-products, affiliate marketing, stock photos galore. Got $500 to $5,000? Check out dividend ETFs like SCHD or VYM and let them reinvest automatically. Pushing $5,000+? Real estate crowdfunding with Fundrise or YieldStreet puts you in real estate without the landlord nightmare.

Don’t scatter your focus-nail one stream first, then spread your wings.

Build Systems That Work Without You

Set up automatic transfers to your investments every payday. Platforms like Fidelity and Vanguard let you snag fractional shares, so even $100 gets you in on those pricey stocks. For your content, schedule posts with Buffer or Hootsuite, and let ConvertKit automate your email game for affiliate promos. Design systems where the cash flows sans daily intervention-income should roll in while you’re scaling or kicking off the next venture.

Track Progress and Adjust Quickly

Keep tabs on your streams monthly (not daily-unless you like stress and bad decisions). Use spreadsheets or go digital with apps like Personal Capital for tracking those dividend checks, rent revenue, and digital sales. Be patient; most setups take a minute to produce the big bucks, but warning signs pop up early. No views on YouTube after three months or a perpetually empty rental? Time to pivot quick. Pros spend 80% building systems, 20% keeping them in check.

Final Thoughts

Let’s talk passive income-it’s like owning a golden goose if you choose wisely. Real Estate Investment Trusts (REITs) dish out 5-7% yields and spare you the property-owner headaches, while dividend stocks-think Johnson & Johnson-are the gift that keeps on giving, year after year. Digital products? Once you set ’em up, they skyrocket without extra effort. The trick here is baby steps-begin with what you can manage, then build like a Lego master.

First step: dive into your finances and zero in on one income stream. Got a spare $100 floating around? Think dividend ETFs or go all-in on digital products. Sitting on $5,000? Real estate crowdfunding or diverse portfolios could be your playground (P.S., most streams need a solid 6-12 months to rev their engines). Automate everything you can, and keep tabs on that monthly progress-because you’re a money-making machine now.

Here’s the bottom line: $500 a month in passive income means an extra $6,000 a year without punching that clock. Ramp it up to $3,000 monthly, and boom-you’re basically replacing a full-time paycheck. At Top Wealth Guide, we’re all about handing you the playbook for these income streams. Dive into our detailed guides and tools to turbocharge your journey to financial freedom.

![The Ultimate Guide to Creating Passive Income Streams [2025] The Ultimate Guide to Creating Passive Income Streams [2025]](https://topwealthguide.com/wp-content/uploads/emplibot/passive-income-hero-1764810562-1024x585.jpeg)