The safe withdrawal rate (SWR) is one of the most important numbers in retirement planning. In simple terms, it's the percentage of your savings you can spend each year without the fear of your money running out. The classic rule of thumb here is the 4% Rule, which says you can withdraw 4% of your nest egg in the first year of retirement and then adjust that amount for inflation in the following years.

In This Guide

- 1 What Is the Safe Withdrawal Rate and Why It Matters

- 2 The Surprising History of the 4 Percent Rule

- 3 Navigating the Three Big Retirement Risks

- 4 How to Calculate Your Personal Safe Withdrawal Rate

- 5 Flexible Strategies Beyond the 4 Percent Rule

- 6 Frequently Asked Questions About Safe Withdrawal Rates

- 6.1 1. Is it ever safe to use a 5% withdrawal rate?

- 6.2 2. How do taxes impact my withdrawal rate?

- 6.3 3. How does Social Security affect my SWR calculation?

- 6.4 4. What is the best asset allocation for the 4% Rule?

- 6.5 5. Should I adjust my withdrawals for inflation every year?

- 6.6 6. Does the 4% Rule work for early retirees?

- 6.7 7. What happens if my portfolio value drops sharply?

- 6.8 8. Can I include my home equity in my portfolio value?

- 6.9 9. How do international stocks affect the SWR?

- 6.10 10. Is the safe withdrawal rate guaranteed to work?

- 7 Bringing It All Together

What Is the Safe Withdrawal Rate and Why It Matters

Think of your retirement savings as a big jug of water that needs to last you for the rest of your life. The safe withdrawal rate is how much you can pour into your glass each day. You want to drink enough to be comfortable, but you can't be reckless—especially if there's a long drought (like a market crash) ahead. Drain the jug too fast, and you'll go thirsty.

This concept is the bedrock of turning a pile of savings into a reliable, lifelong paycheck. It's the answer to the one question every single retiree asks: "How much can I actually spend each year?"

The Famous 4 Percent Rule Explained

The conversation almost always starts with the 4% Rule. This isn't just a random number; it was born from a landmark study that put investment portfolios through the wringer, testing them against some of the worst economic periods in U.S. history.

The rule is elegantly simple: in your first year of retirement, you can withdraw 4% of your total portfolio value. From that point on, you adjust the dollar amount you withdraw each year for inflation, not for how your portfolio is doing.

This might sound a little confusing, so let's walk through an example.

A Practical Example: Meet Alex

Let's imagine Alex just retired with a $1,000,000 portfolio. He decides to follow the 4% Rule to figure out his first year's income.

- Year 1 Withdrawal: $1,000,000 x 4% = $40,000

Easy enough. Now, let’s say inflation for the year was 3%. For his second year, Alex won't recalculate 4% of whatever his new portfolio balance is. Instead, he simply gives himself a cost-of-living raise on his original withdrawal.

- Year 2 Withdrawal: $40,000 + (3% of $40,000) = $41,200

He'll continue this process every year. This approach is designed to give him a steady, predictable income that keeps up with the rising cost of living, no matter what the stock market is doing.

Key Takeaway: The 4% Rule isn't about taking 4% of your ever-changing portfolio balance each year. It’s about setting your income in year one and then giving yourself an annual inflation adjustment on that dollar amount.

Why the Safe Withdrawal Rate Is So Important

Getting a handle on your SWR is absolutely fundamental to achieving a secure retirement. It’s not just an academic exercise; it's a practical tool that serves several critical purposes:

- It Gives You a Target: Knowing your SWR helps you work backward to figure out exactly how much you need to save to support your desired lifestyle.

- It Creates a Stable "Paycheck": By adjusting for inflation, it helps your income maintain its purchasing power year after year.

- It Manages Risk: The whole point of the SWR is to build a buffer for bad times. It’s a strategy designed to survive market downturns without forcing you to sell your investments at the worst possible moment.

Ultimately, your safe withdrawal rate is the bridge between accumulating wealth and actually living off it. If you're serious about planning for the future, you can learn more about what financial independence really means in our detailed guide. Understanding this concept is a huge step forward on your retirement journey.

The Surprising History of the 4 Percent Rule

To really understand the safe withdrawal rate, we have to go back to 1994. A financial advisor named William Bengen was wrestling with a question that would define modern retirement planning: How much could someone actually spend from their portfolio each year without ever running out of money?

He wasn't just looking for an average number. Bengen wanted a rule that could hold up through the absolute worst financial storms in modern history.

Before Bengen's work, retirement planning was often a mix of guesswork and overly simplistic projections that completely ignored the chaos of real-world markets. Bengen decided to take a completely different path—one grounded in historical data. He set out to stress-test retirement portfolios against the most brutal economic environments imaginable.

Forged in Financial Fire

Bengen’s laboratory was American financial history. He gathered decades of stock and bond returns and created a gauntlet for his hypothetical retirees to run. His method was to simulate retirements starting in every single year since 1926, subjecting each one to the actual market returns and inflation that followed.

He experimented with different portfolio mixes and withdrawal rates, searching for the "magic number" that could survive anything the 20th century could throw at it. This meant surviving two giants of market turmoil:

- The Great Depression: A time of devastating stock market crashes and economic ruin.

- The 1970s Stagflation: A nasty cocktail of high inflation and poor market returns that hammered both stocks and bonds.

After running the numbers again and again, a clear pattern emerged. Withdrawal rates above 4% often failed spectacularly. But at 4%, something incredible happened: the portfolios survived.

Bengen found that a 4% initial withdrawal, with every following year’s withdrawal adjusted for inflation, was the highest rate that survived every single historical 30-year period he tested. Even if someone retired on the eve of the Great Depression, a 4% rate from a balanced portfolio held strong.

The Birth of a Benchmark

This was a game-changer. For the first time, retirees had a rule of thumb backed by serious research, not just a hunch. It wasn't a perfect theory, but a number that had been battle-tested against some of the worst-case scenarios ever recorded.

Think about it. Imagine you retired in 1968, right before the market went into a prolonged slump. Bengen's research showed that with a 4% withdrawal rate from a balanced portfolio, your nest egg would have lasted at least 33 years.

If you had a $1 million portfolio, that meant taking out $40,000 in your first year and then adjusting that amount upward each year with inflation. Even through the brutal bear market of 1973-74—when stocks plummeted 48% and inflation shot up to 12%—the 4% strategy held up. You can dive deeper into Bengen’s original paper on how he determined withdrawal rates using historical data.

Understanding this history is key. The 4% rule isn't a guarantee for the future, but it's a powerful benchmark born from an understanding of how markets have behaved in the past. It gives us a solid, time-tested foundation to start building a resilient retirement plan.

Having a withdrawal strategy is a fantastic start, but even the best-laid plans can run into serious trouble. To build a retirement plan that can actually go the distance, you have to get to grips with the three biggest risks that can sink it: sequence of returns, inflation, and longevity. Honestly, ignoring them is like setting sail without checking the weather.

Think about it this way. Imagine two hikers setting out on the same long trail, each carrying the exact same amount of food. One gets hit by a nasty storm on the very first day, forcing them to burn through extra rations just to stay warm and safe. The other enjoys a week of perfect, sunny weather. Even though they started with identical supplies, that first hiker is now in a much tougher spot and far more likely to run out of food.

This is the perfect way to understand sequence of returns risk.

The Danger of a Bad Start

Sequence of returns risk is simply the danger of hitting a down market right at the beginning of your retirement. When you’re pulling money out of a portfolio that’s also shrinking in value, you’re forced to sell more shares to get the cash you need. This kicks off a brutal cycle that can permanently damage your portfolio’s ability to bounce back, even when the market eventually recovers.

A retiree who gets lucky with strong returns early on builds a nice cushion. But someone who retires right into a bear market is in a far more dangerous position. It's wild, but this one factor—the timing of returns—can mean the difference between a comfortable retirement and running out of money.

To put a fine point on it, historical data shows that the worst-case scenarios for retirees—the ones that forced the lowest safe withdrawal rates—saw an average real return of just 0.86% per year over the first 15 years. These brutal starting points are exactly why the "safe" rate had to drop below 4.5% for people retiring in tough times like the Great Depression or the stagflation of the 1970s. You can get more details from Kitces's deep dive into this fascinating market history.

The Two Other Threats to Your Plan

Beyond a poor sequence of returns, two other huge risks are always lurking. Understanding how they work is absolutely critical for protecting your nest egg.

| Risk Type | How It Threatens Your Retirement | Real-Life Example |

|---|---|---|

| Inflation Risk | This is the silent killer of purchasing power. A fixed income that feels perfectly fine today can feel shockingly small in 10 or 20 years as the cost of everything, from gas to groceries, goes up. | Your $40,000 withdrawal might cover your lifestyle today. But if inflation averages 3% a year, that same $40,000 will only buy what about $22,000 buys today in 20 years. |

| Longevity Risk | This is the very real risk of outliving your money. People are living longer than ever, which means a retirement that you once planned for 20 years might need to stretch to 30 or even 40, putting a massive strain on your savings. | A healthy 65-year-old couple today has a very good chance that at least one of them will live past age 90. A plan built for a 25-year timeline would leave them in a terrible spot financially in their later years. |

The Retirement Dilemma: Your plan has to be tough enough to survive a market crash right out of the gate (sequence risk), keep up with rising costs (inflation risk), and last for a completely unknown number of years (longevity risk).

Tackling these challenges requires more than just picking a static withdrawal rate and hoping for the best. For more on this, you might want to read our guide on how to protect your wealth during market crashes. By facing these threats head-on, you can start building a more flexible and resilient plan designed to last a lifetime.

How to Calculate Your Personal Safe Withdrawal Rate

Now that we've covered the history and theory behind the 4% rule, let's get practical. Figuring out your specific safe withdrawal rate is where the real work begins. It all starts with a simple calculation that flips the script from saving to spending.

Your Initial SWR = Annual Retirement Expenses ÷ Total Retirement Savings

Let’s say you’ve figured out you’ll need $60,000 a year to live comfortably in retirement. If you’ve managed to save up a nest egg of $1.5 million, the math is straightforward: $60,000 ÷ $1,500,000 = 0.04, or 4%.

This gives you a solid starting point, but it's just that—a start. A truly reliable SWR has to be fine-tuned to your personal situation.

Adjusting Your Rate for Key Variables

The classic 4% rule was built on the assumption of a 30-year retirement. But what if you're retiring early and need your money to last 40 or even 50 years? What if your investment mix is less aggressive than the historical models? These are the kinds of questions you need to ask.

You have to adjust your rate to account for the real-world risks you'll face.

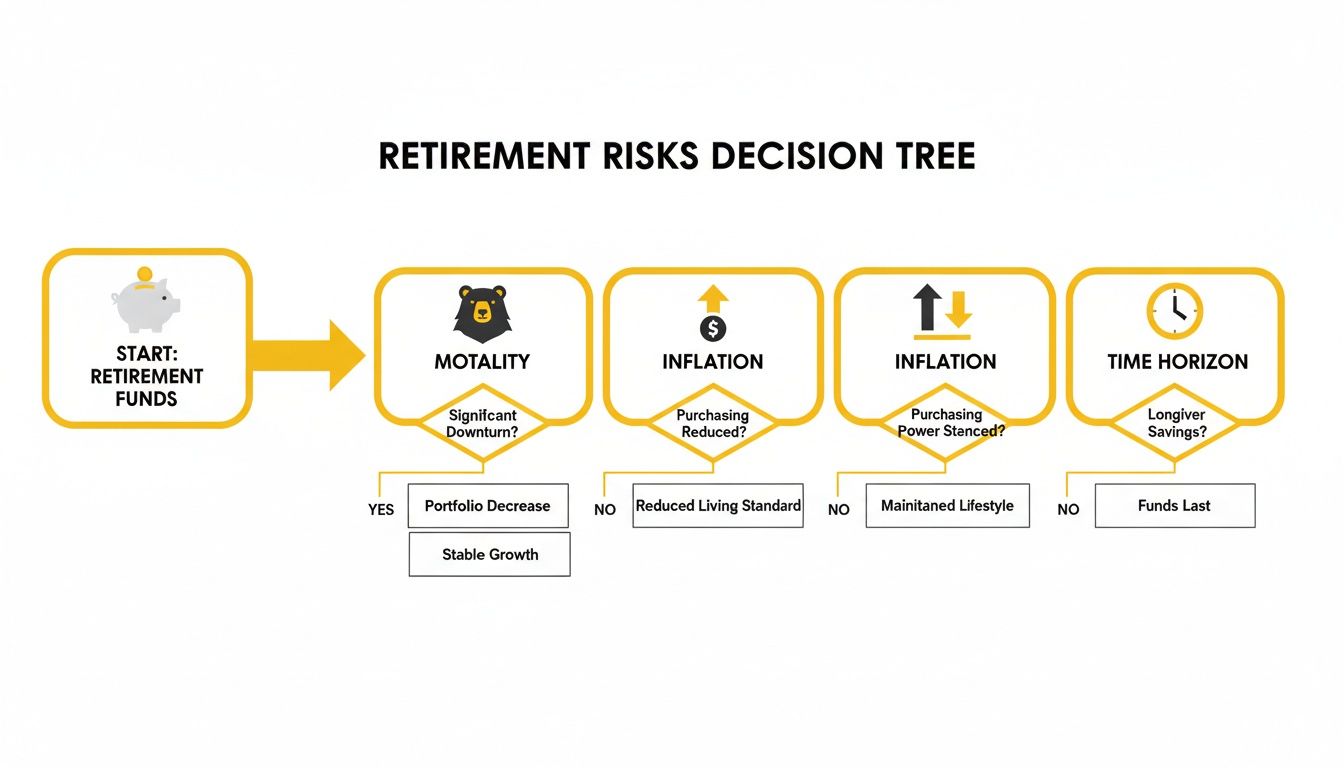

As this flowchart shows, every factor—from market downturns to your own retirement timeline—can nudge your ideal withdrawal rate lower to ensure your money lasts as long as you do.

A Real-Life Example: Maria and David

Let's walk through an example. Meet Maria, age 62, and David, age 63. They've saved $2 million for retirement and their annual expenses are $80,000. On paper, this gives them a baseline SWR of exactly 4%.

However, they’re planning for a long and active retirement that could easily stretch 30 to 35 years. They also have a moderately conservative portfolio (50% stocks, 50% bonds) and no pension to fall back on.

Given their longer time horizon and less aggressive asset mix, a static 4% rate feels a little too risky for them. They decide to adjust their SWR down to a more cautious 3.5%. This reduces their first-year withdrawal to $70,000 but builds in a crucial safety buffer against bad market timing and the risk of outliving their money.

This isn't just a gut feeling; historical data backs up their decision. The longer your retirement, the more conservative your withdrawal rate needs to be.

Adjusting Withdrawal Rates by Retirement Length

The table below shows how dramatically the ideal rate can change based on how long you need your portfolio to last. This data, synthesized from various retirement planning studies, highlights the trade-offs between withdrawal rates and portfolio longevity.

| Retirement Horizon | SWR (Portfolio Can Deplete) | PWR (Preserves Principal) |

|---|---|---|

| 30 Years | 4.0% | 3.5% |

| 40 Years | 3.25% | 2.8% |

| 50 Years | 2.8% | 2.3% |

| 60 Years | 2.5% | 2.0% |

As you can see, someone planning for a 40-year retirement might need to drop their SWR closer to 3.25%. For a 60-year horizon, it tightens all the way down to around 2.5%. These numbers illustrate why a one-size-fits-all approach just doesn't work.

Stress-Testing Your Number

Once you’ve settled on a personalized rate, it's time to put it to the test. This is where modern retirement planning tools can be incredibly helpful.

- Monte Carlo Simulations: These tools run your portfolio and withdrawal plan through thousands of different simulated market futures—good, bad, and ugly. They won't predict what will happen, but they can give you a probability of success, like an 85% chance your money will last for 35 years.

- Historical Backtesting: This approach takes your plan and runs it against actual market history, including the worst periods on record like the Great Depression or the stagflation of the 1970s. It answers a powerful question: "How would my strategy have held up if I retired at the worst possible time?"

Using these tools helps transform your SWR from a simple guess into a data-informed strategy. Ultimately, the goal is to find a number that not only works on a spreadsheet but also lets you sleep soundly at night. As you refine your plan, it’s also critical to understand how to calculate real investment returns after inflation, since that’s the silent force that erodes your purchasing power over time.

Flexible Strategies Beyond the 4 Percent Rule

Relying on a static withdrawal rate is a bit like setting your car's cruise control on a road full of steep hills and sharp curves. It’s simple, sure, but it’s not always the smartest way to navigate the terrain. This set-it-and-forget-it approach doesn’t react to market downturns or capitalize on roaring bull markets.

That's precisely why many savvy retirees are embracing dynamic strategies that adapt to what the market is actually doing.

These flexible methods have built-in rules for adjusting your spending. The goal is simple: give yourself a “raise” when your investments are performing well and tighten the belt when markets get rocky. It’s a move beyond the one-size-fits-all 4% Rule.

The Guardrail Method: A Real-Life Scenario

One of the most practical dynamic approaches is the Guardrail Method. Imagine your retirement plan as a highway. The guardrails are there to keep you safely on the road, preventing you from veering into a ditch during a market crash or getting overly exuberant during a boom. Let's revisit our couple, Maria and David, to see how this works.

They retired with $2 million and planned to withdraw $70,000 (a 3.5% rate). They set up 20% guardrails.

- Upper Guardrail: If their portfolio value climbs 20% above its starting inflation-adjusted point (to $2.4 million), they will give themselves a 10% spending increase for the next year (to $77,000).

- Lower Guardrail: If their portfolio drops 20% below its starting inflation-adjusted point (to $1.6 million), they will take a 10% spending cut (to $63,000).

These pre-planned adjustments help them enjoy the good times while automatically protecting their nest egg from sequence of returns risk during the bad ones.

The Bucket Strategy

Another tried-and-true flexible plan is the Bucket Strategy. This is more of a mental framework that helps you visualize and manage your money by separating your portfolio into different "buckets" based on when you'll need the cash. It brings a sense of order and calm to the often-chaotic world of retirement withdrawals.

Here's a popular three-bucket setup:

- Bucket 1 (Short-Term): This holds 1-3 years of your living expenses in ultra-safe places like cash, money market funds, or short-term CDs. This is your spending money, totally insulated from market swings.

- Bucket 2 (Mid-Term): Here, you’ll keep 3-10 years of expenses in a mix of high-quality bonds and conservative funds. Its job is to generate modest returns and act as the refilling station for Bucket 1.

- Bucket 3 (Long-Term): This is the growth engine of your retirement. It holds the rest of your portfolio in assets like stocks, designed to grow over the long haul and keep you ahead of inflation.

The system works by spending from Bucket 1. When it runs low, you refill it by selling some assets from Bucket 2. In turn, you refill Bucket 2 by selling appreciated assets from Bucket 3, ideally when the market is doing well.

Comparing Static vs Dynamic Withdrawal Strategies

Deciding between a rigid rule and a flexible plan really comes down to your personality. Do you crave simplicity and predictability, or do you prefer a more hands-on approach that can adapt to changing conditions? While a static rule is easier to follow, dynamic methods often lead to better long-term results. Understanding the details of smart retirement withdrawal strategies can make your money last longer.

To help you see the differences more clearly, here’s a breakdown of how these approaches stack up.

| Strategy | How It Works | Pros | Cons |

|---|---|---|---|

| Static 4% Rule | You take out a fixed percentage of your initial portfolio, adjusted for inflation each year, no matter what the market does. | Dead simple to understand and follow. Delivers a highly predictable income stream. | Can force you to sell low in bad markets or leave too much money on the table in good ones. Totally inflexible. |

| Guardrail Method | Your spending goes up or down by a set amount (e.g., 10%) if your portfolio hits a predefined performance trigger (e.g., +/- 20%). | Lets you spend more when you can afford to. Offers crucial protection during downturns. | Your annual income can fluctuate. Requires you to monitor your portfolio against the set thresholds. |

| Bucket Strategy | You segment your money into different time-based "buckets" (cash, bonds, stocks) and spend from the safest bucket first. | Creates immense peace of mind by separating short-term needs from market risk. Fosters discipline. | Takes more effort to set up and manage. Can sometimes lead to holding too much cash, dragging down overall returns. |

Ultimately, there's no single "best" strategy for everyone. The right approach is the one that fits your financial plan and, just as crucially, lets you sleep at night. Whether you opt for the simplicity of a static rule or the adaptability of a dynamic one, consistency is key. Find a system you trust and can stick with through thick and thin.

Frequently Asked Questions About Safe Withdrawal Rates

Once you move past the theory and start thinking about your own retirement, the real questions start popping up. How do taxes fit in? What about Social Security? Can I really take a bit more? Getting these practical details right is what turns a good plan into a great one, giving you the confidence to actually enjoy retirement.

Let's walk through the ten questions I hear most often from retirees trying to make this all work in the real world.

1. Is it ever safe to use a 5% withdrawal rate?

For most people planning a 30+ year retirement, a 5% rate is extremely risky and significantly increases the chance of depleting your portfolio. However, it might be feasible if you have a very short retirement horizon (e.g., 15-20 years), significant other income like a pension, or are willing to be highly flexible and cut spending drastically during market downturns. For most, sticking to 4% or lower provides a critical safety margin.

2. How do taxes impact my withdrawal rate?

Taxes are a crucial, often-overlooked factor. Your safe withdrawal rate is a pre-tax number. A 4% withdrawal from a traditional 401(k) or IRA will be reduced by income taxes, whereas a withdrawal from a Roth account is tax-free. A smart plan involves calculating your after-tax spending needs and withdrawing strategically from different account types to minimize the tax bite. You can learn more in our comparison of retirement accounts for maximum tax benefits.

3. How does Social Security affect my SWR calculation?

Social Security or a pension is a game-changer because it reduces the amount your portfolio needs to generate. The simplest way to account for it is the "subtraction method": calculate your total annual expenses, then subtract your guaranteed income. The remaining amount is what your portfolio needs to cover with your chosen withdrawal rate. For example, if you need $70,000 and receive $30,000 from Social Security, your portfolio only needs to provide $40,000.

4. What is the best asset allocation for the 4% Rule?

The original research and subsequent studies suggest a balanced portfolio gives the 4% rule the highest probability of success. This typically means an allocation of 50% to 75% in stocks and the remainder in high-quality bonds. Being too conservative (e.g., 25% stocks) starves the portfolio of growth needed to outpace inflation, while being too aggressive (e.g., 100% stocks) exposes you to severe sequence of returns risk.

5. Should I adjust my withdrawals for inflation every year?

The classic rule says yes, but forgoing an inflation adjustment after a year when your portfolio has lost value is a powerful way to improve your plan's longevity. This small sacrifice in a down year prevents you from selling more shares when prices are low, preserving your capital for the eventual recovery.

6. Does the 4% Rule work for early retirees?

No, the 4% Rule is generally considered too aggressive for those retiring in their 40s or 50s. A retirement lasting 40, 50, or even 60 years requires a more conservative approach. Most research suggests early retirees should target a safe withdrawal rate in the 3.0% to 3.5% range to ensure their portfolio can last the distance.

7. What happens if my portfolio value drops sharply?

A significant market drop, especially early in retirement, is the primary threat to any withdrawal plan. The most important action is to avoid panic-selling. Your strategy was created with the knowledge that downturns would occur. If using a dynamic strategy like the Guardrail Method, you would make a pre-planned spending cut. If using a static rule, staying the course is typically the best move.

8. Can I include my home equity in my portfolio value?

Almost always, the answer is no. Your SWR calculation should be based on liquid, income-producing assets. You cannot spend your home's equity to buy groceries unless you have a concrete plan to sell the house or take out a reverse mortgage. Until then, keep its value separate from your investment portfolio.

9. How do international stocks affect the SWR?

Adding international stocks can make your withdrawal plan more resilient. The original SWR studies were based primarily on the historically strong performance of the U.S. market. Global diversification reduces your reliance on a single country's economy and can smooth out returns, providing a buffer if the U.S. market experiences a prolonged period of underperformance.

10. Is the safe withdrawal rate guaranteed to work?

No. This is the most critical point. The SWR is a guideline based on historical data, not a guarantee of future results. It is an educated starting point. A successful retirement requires periodic reviews of your spending, portfolio, and overall plan, with a willingness to make adjustments as your life and the markets evolve.

Bringing It All Together

Figuring out how to make your money last through retirement is, without a doubt, one of the biggest financial challenges you'll ever face. The safe withdrawal rate, and specifically the famous 4% rule, gives you a fantastic framework to start the conversation. It’s a solid, time-tested concept.

But the real secret to a successful retirement isn't just about picking a number. It's about making that number work for you. Understanding where these rules came from, knowing the real-world risks like a bad market run right after you retire, and being ready to adapt is what truly builds confidence.

Think of your retirement plan less like a stone tablet and more like a living, breathing guide. It needs to be checked on, tweaked, and adjusted as your life changes and the world around you does too. That's how you build a plan that doesn't just look good on paper, but actually works for you year after year.

For more exclusive insights and proven tactics to enhance your investment portfolio, turn to Top Wealth Guide. Explore our resources at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.