Owning an investment property is a powerful wealth-building tool, and understanding property investment tax deductions is key to maximizing your returns. These deductions allow you to subtract a wide range of expenses from your rental income, significantly lowering your taxable profit and boosting your cash flow.

By claiming deductions for costs like mortgage interest, property taxes, operating expenses, and depreciation, you're not just saving a few dollars—you're implementing a core financial strategy. This guide will walk you through everything from the fundamentals to advanced tactics, complete with real-life examples to make these concepts clear and actionable.

In This Guide

- 1 How Property Tax Deductions Actually Boost Your Bottom Line

- 2 Mastering Depreciation: Your Most Powerful Tax Shield

- 3 Your Complete Checklist of Deductible Operating Expenses

- 4 Advanced Strategies to Maximize Your Tax Savings

- 5 Keeping Meticulous Records to Audit-Proof Your Deductions

- 6 Staying Ahead of Tax Law Changes and Future Planning

How Property Tax Deductions Actually Boost Your Bottom Line

Think of your rental property as a business. Like any business, it has income (rent collected) and expenses (costs to maintain it). The government taxes your profit, not your total revenue. Tax deductions are the legitimate business expenses the tax code allows you to subtract from your income, directly reducing your tax bill.

Every deductible dollar you spend on your property is a dollar that lowers your taxable income. This isn't a loophole; it's a foundational principle designed to encourage real estate investment.

The Three Pillars of Property Deductions

Most of your deductions will fall into one of three major categories. Mastering these is the key to unlocking significant savings.

- Operating Expenses: These are the day-to-day costs that keep your property running. Think property management fees, insurance, routine repairs, landscaping, and advertising for new tenants.

- Financing Costs: For most investors, mortgage interest is one of the largest write-offs. You can also deduct loan origination fees (points) and other lender costs. Planning your financing is crucial, and you can model different scenarios with our investment property loan calculator.

- Depreciation: This is a game-changer. It’s a "non-cash" deduction, meaning you claim it without spending any actual money that year. The IRS recognizes that buildings and their components wear out, so they allow you to deduct a portion of your property's value each year.

Mastering these three pillars is what separates a passive property owner from a savvy, tax-efficient investor. Every deduction you claim is a dollar that stays in your pocket, ready to be reinvested or used to grow your portfolio.

A Powerful Incentive for Investors

Lawmakers often provide powerful tax incentives for real estate investors. For example, the One Big Beautiful Bill (OBBBA) brought back and made permanent 100% bonus depreciation for certain real estate assets placed in service after January 19, 2025.

This allows you to deduct the entire cost of items with a useful life of 20 years or less—things like new appliances, carpeting, or an HVAC system—all in the first year. You can read more about how the One Big Beautiful Bill impacts real estate investors to see the full scope. This single provision can massively accelerate your tax savings and transform your property's first-year cash flow.

Mastering Depreciation: Your Most Powerful Tax Shield

Of all the tax breaks available to property investors, one towers above the rest in its sheer power to slash your tax bill: depreciation. It's the ultimate "paper deduction"—a massive write-off you can claim every single year without spending a dime out of pocket.

The tax code recognizes that buildings don't last forever. Over time, roofs wear out, foundations settle, and systems become obsolete. Depreciation is the official mechanism that lets you deduct a portion of your property's value each year to account for this inevitable decline. This simple accounting move directly reduces your taxable rental income, often by thousands of dollars. It’s a beautiful paradox of real estate: you can claim a loss on paper while your property is actually gaining value in the real world.

First Things First: Separate the Building from the Land

Here’s the first golden rule you need to know: you can only depreciate the building, not the land it sits on. The IRS sees land as an indestructible asset that never gets "used up," so you can't write it off.

When you buy a property, you must allocate the purchase price between the structure and the land. Your local property tax assessment is a good starting point for this breakdown. For instance, if you buy a duplex for $400,000, the assessment might value the land at $80,000 and the building at $320,000. Your depreciation deduction is calculated only on that $320,000 building value.

A Real-World Example of Depreciation in Action

Let’s see how this plays out. Imagine you just bought a residential rental where the building value (your "cost basis") is $275,000.

In the U.S., the IRS mandates that residential rental properties be depreciated over a useful life of 27.5 years using the straight-line method. Commercial properties use a longer, 39-year schedule.

For your $275,000 residential property, the math is straightforward:

$275,000 (Building Value) / 27.5 (Years) = $10,000 per year.

That’s a $10,000 deduction you can take to lower your taxable income, and it has zero impact on your actual cash flow. This is the secret sauce that makes real estate such a powerful wealth-building machine.

Key Insight: Depreciation makes it possible to have positive cash flow hitting your bank account while reporting a paper loss to the IRS. This unique advantage is exactly why so many savvy investors flock to real estate.

Depreciation Timelines for Real Estate Assets

The depreciation schedule is set by the IRS and depends entirely on the type of asset. Getting these timelines right is critical for accurate tax planning and maximizing your deductions.

Here's a quick comparison of standard depreciation periods for common real estate assets.

| Property Type | Depreciation Period (Years) | Example Annual Deduction (on $300k Building Value) |

|---|---|---|

| Residential Rental Property (e.g., houses, apartments) | 27.5 Years | $10,909 |

| Commercial Property (e.g., offices, retail, warehouses) | 39 Years | $7,692 |

| Land Improvements (e.g., fences, paving, landscaping) | 15 Years | $20,000 |

As you can see, the shorter the depreciation period, the larger your annual deduction, which boosts your tax savings in the near term.

Advanced Strategy: Cost Segregation

For investors who want to put their deductions on steroids, there's a powerful strategy called a cost segregation study. This is a detailed engineering analysis that breaks a property down into its individual components.

Instead of lumping everything into a 27.5 or 39-year schedule, a cost segregation study identifies items with much shorter lifespans. For example, it might reclassify assets like carpeting (5-year life), appliances (5-year life), and site improvements like a parking lot (15-year life).

By accelerating the depreciation on these components, you can generate massive deductions in the early years of ownership. This front-loads your tax savings and puts a ton of cash back in your pocket right away. That extra capital can then be used for renovations or reinvested into another deal, making it a perfect fit for growth strategies like the one we cover in our guide on what the BRRRR method is and how it works.

While the study itself has a cost, the immediate tax benefits often pay for it many times over, especially on larger commercial properties or new construction.

Your Complete Checklist of Deductible Operating Expenses

Beyond the big-ticket item of depreciation, the day-to-day costs of running your rental property are where you can really start chipping away at your tax bill. Every dollar you spend to find a tenant, maintain the property, and manage your investment is a potential tax write-off. These are the ordinary and necessary costs of doing business as a landlord.

Keeping a close eye on these property investment tax deductions is fundamental. It's the difference between leaving money on the table and maximizing your net profit. A solid, organized approach to tracking expenses isn't just good bookkeeping; it’s a direct lever on your investment's financial health.

Core Property Operating Expenses

Some costs are just part of the game for nearly every rental property owner. These are the bread-and-butter deductions that form the foundation of your write-offs, so you’ll want to track them meticulously all year long.

- Mortgage Interest: For most investors, this is the single biggest operating expense. You get to deduct the interest you pay on the loan used to buy or improve your rental. Your lender will send you a Form 1098 each year detailing exactly how much you paid.

- Property Taxes: Those annual state and local property tax bills are fully deductible.

- Insurance Premiums: The cost of your landlord, flood, and liability insurance policies for the property is a straight-up business expense you can deduct.

- Utilities: If you cover any utilities for your tenants—water, gas, electricity, trash removal—those costs are on the list of deductions.

Management and Maintenance Costs

Keeping your property in great shape and occupied by paying tenants generates its own set of valuable deductions. Don't let these common expenses slip through the cracks.

- Property Management Fees: Hire a pro to handle the day-to-day? Their fees, typically 8-12% of the monthly rent, are 100% deductible.

- Advertising Costs: Any cash you spend advertising your property for rent, whether it’s a Zillow listing or a local newspaper ad, can be written off.

- HOA Fees: If your rental is a condo or in a planned community, those homeowners' association fees are deductible.

- Landscaping and Cleaning: The ongoing costs of lawn care, snow removal, and even the professional cleaning you do between tenants all count.

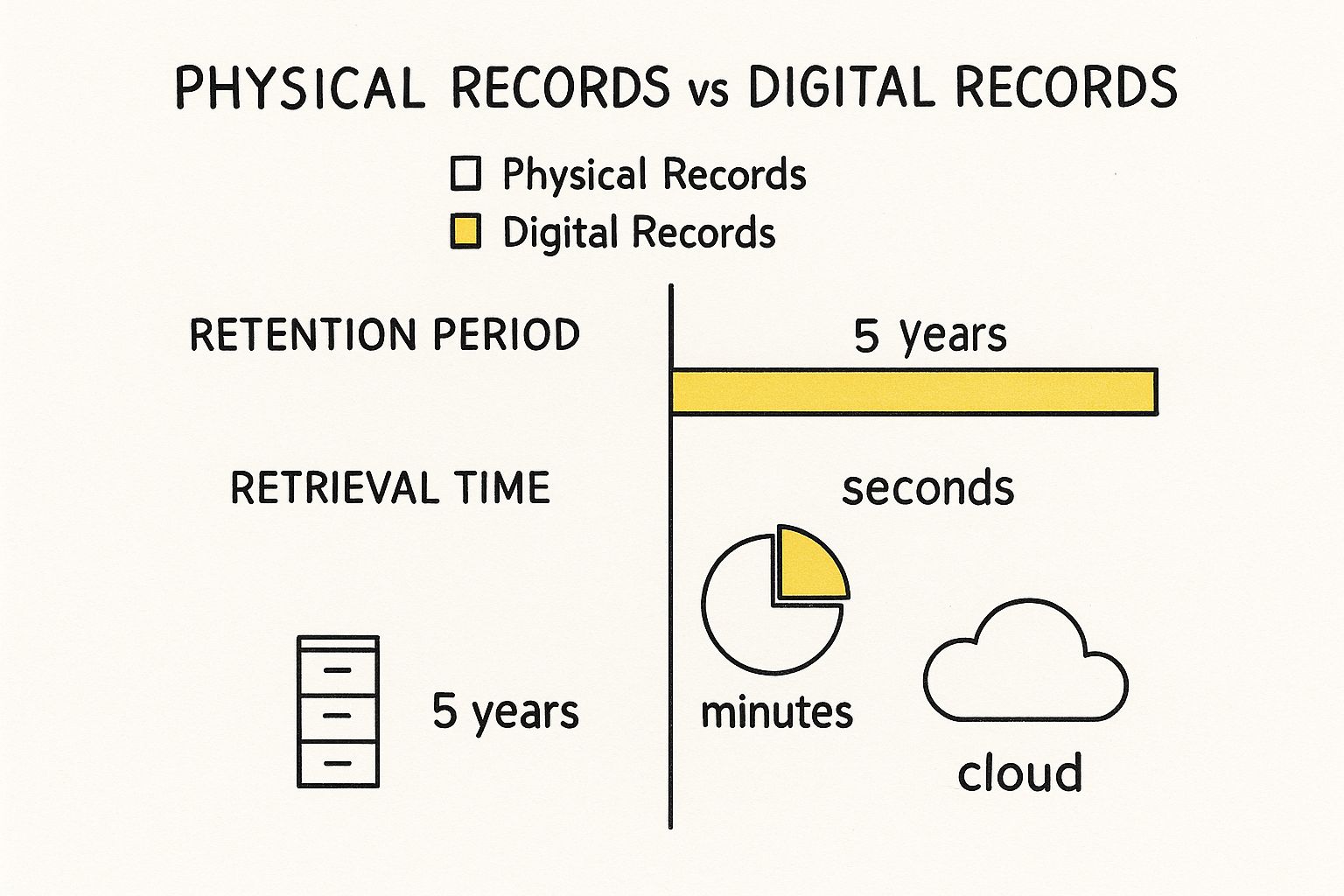

Good record-keeping is the key to making sure you can actually claim these deductions. As you can see below, whether you stick to paper or go digital, organization is what matters most.

While the IRS holds both methods to the same standard, having digital records makes finding a specific receipt during tax season—or an audit—a matter of seconds, not hours.

Repairs vs Capital Improvements: A Crucial Distinction

This is one of the most important concepts for a property investor to master. Mixing up repairs and capital improvements can attract unwanted attention from the IRS and lead to disallowed deductions.

A repair is an expense that keeps your property in good working order. It's maintenance. You're fixing something that broke or wore out, but you aren't fundamentally making the property better. The best part? You get to deduct the full cost of a repair in the year you pay for it.

A capital improvement, on the other hand, is a major upgrade. It's something that adds significant value, prolongs the property's life, or adapts it for a new use. You can't deduct these big-ticket items all at once. Instead, you must "capitalize" the cost and depreciate it over many years.

The real difference is all about timing. A repair gives you an immediate tax benefit, while an improvement gives you a smaller tax benefit spread out over a long time.

Real-Life Scenario: Repair vs. Improvement

Imagine your rental property's water heater stops working.

- Repair Scenario: You call a plumber who replaces a faulty heating element for $300. This is a repair. You deduct the full $300 on this year's taxes.

- Improvement Scenario: You decide to replace the old 40-gallon tank with a new, high-efficiency 50-gallon model for $2,000. This is a capital improvement because it's a full replacement that adds value. You can't deduct the $2,000 this year; instead, you'll depreciate it over 27.5 years.

This table helps clarify the difference across various categories:

| Expense Category | Repairs (Deductible Now) | Capital Improvements (Depreciated Over Time) |

|---|---|---|

| Plumbing | Fixing a leaky faucet or snaking a clogged drain. | Replacing all the old plumbing with brand new pipes. |

| Painting | Touching up scuff marks in a single room between tenants. | Painting the entire exterior of the building for the first time. |

| Roofing | Replacing a few shingles that blew off in a storm. | Installing a completely new roof with a 30-year warranty. |

| Flooring | Repairing a single cracked tile in the kitchen. | Tearing out old carpet and installing new hardwood floors. |

Other Important Deductible Expenses

Last but not least, a few other common costs of running your real estate business are also deductible.

- Travel Costs: You can deduct the expenses for ordinary and necessary travel to manage your properties. The easiest way is to use the standard mileage rate, which is 67 cents per mile in 2024.

- Home Office Deduction: Do you have a space in your home that you use exclusively and regularly for your rental business? You might qualify for the home office deduction.

- Professional Fees: Money paid to your lawyer for reviewing a lease or your accountant for preparing your Schedule E is a deductible professional expense.

Managing these expenses well isn't just about saving on taxes; it's a key part of your overall investment strategy. To see how these deductions fit into the bigger financial picture, check out our guide on why cash flow management is crucial for wealth building.

Advanced Strategies to Maximize Your Tax Savings

Once you’ve got a solid handle on tracking your everyday expenses and claiming depreciation, you can start thinking bigger. It’s time to shift your mindset from simply saving money on taxes each year to actively using the tax code to grow your portfolio faster.

These are the advanced strategies that savvy investors use to defer taxes, shield their income, and build serious wealth. Let's dig into three of the most powerful tools in the investor's tax kit.

Defer Taxes Indefinitely with a 1031 Exchange

Imagine selling a rental property for a huge profit and paying zero capital gains tax on the sale. That's the magic of a 1031 Exchange, named after its section in the Internal Revenue Code. It allows you to roll the entire proceeds from a sale into a new, "like-kind" property, effectively kicking your tax bill down the road.

You're not cashing out; you're swapping one investment property for another. By doing this, the IRS lets your original investment basis carry over to the new property, and your tax obligation is postponed until you finally sell for cash without another exchange.

Real-Life Example: 1031 Exchange

An investor, Sarah, bought a duplex 10 years ago for $200,000. Today, it's worth $500,000, leaving her with a $300,000 capital gain.

- Without a 1031: If she sells, she could owe around $60,000 in capital gains taxes, leaving her with $440,000 to reinvest.

- With a 1031: She sells the duplex and, within the strict IRS timelines, uses the full $500,000 to buy a small apartment building. She pays zero tax on the sale and is now able to control a larger, higher-earning asset. This is one of the cornerstone wealth-building strategies that professional investors live by.

The Qualified Business Income Deduction

Another potent tool that often flies under the radar is the Qualified Business Income (QBI) deduction. Also known as Section 199A, this allows owners of pass-through businesses—which includes many real estate investors—to deduct up to 20% of their qualified business income.

To qualify, your rental activity must rise to the level of a "trade or business." The IRS provides a safe harbor rule: if you spend at least 250 hours a year on your rental activities and keep meticulous records, you're very likely to qualify.

Key Takeaway: If your rental activities net $50,000 in income and you meet the criteria, the QBI deduction could let you slice an extra $10,000 right off your taxable income. That’s a direct, bottom-line benefit that a surprising number of landlords completely miss.

Unlocking Unlimited Losses with Real Estate Professional Status

For investors who are all-in, achieving Real Estate Professional Status (REPS) is the holy grail of tax strategy. Under normal circumstances, rental losses are considered "passive," meaning you can only use them to offset passive income (like from other rentals). Any excess loss just gets carried forward to future years.

But when you qualify as a real estate professional, your rental losses become non-passive. This means you can deduct them against your active income—including your W-2 salary—without the usual limitations.

Comparison: Passive Investor vs. Real Estate Professional

| Status | Qualification Requirements | Impact on Rental Losses |

|---|---|---|

| Passive Investor | The default for most landlords. | Losses are limited and can only offset passive income. |

| Real Estate Pro | More than 750 hours in real estate trades annually AND more than 50% of your total working time. | Losses become non-passive and can offset any type of income, including your salary. |

Qualifying for REPS is a high bar, but the payoff can be astronomical. A large "paper loss" generated by depreciation could potentially wipe out a huge chunk of your taxable income from a high-paying day job. It’s how you can transform your real estate portfolio from a simple investment into a powerful tax shelter.

Keeping Meticulous Records to Audit-Proof Your Deductions

Claiming a deduction is only half the battle. The other, more important half is being able to prove it with clear, organized documentation if the IRS ever comes knocking.

Think of meticulous record-keeping less as a chore and more as your ultimate insurance policy. It turns your tax return from a list of claims into a verifiable financial story. Without solid proof, even a perfectly legitimate expense can be disallowed, costing you significant money in back taxes and penalties.

The Foundation of Good Bookkeeping

Your goal is to create an undeniable paper trail for every single dollar spent on your rental property. This means saving more than just a line item on a credit card statement. You need detailed records that tell the full story.

The absolute essentials you need to keep are:

- Receipts and Invoices: For everything. The new water heater, the can of paint, the landscaping service—all of it.

- Bank and Credit Card Statements: Pro tip: open a separate bank account exclusively for your rental property. It makes tracking a thousand times easier.

- Lease Agreements: These are your proof of rental income and the terms you've set with your tenants.

- Closing Documents: Your settlement statement (often called a HUD-1) is critical for establishing the original cost basis of your property.

- Mileage Logs: Keep a simple but detailed log with the date, mileage, and purpose for every single trip you take for your property.

My personal rule: if you had to stand before an auditor, could you present a file of evidence so overwhelming that there's no room for doubt? That should be your standard.

Let Technology Do the Heavy Lifting

While a shoebox and a spreadsheet still work, modern software can automate this process, saving you time and reducing errors.

Tools like Stessa or QuickBooks are designed for landlords and investors. You can link your business bank accounts to automatically categorize expenses, scan and store receipts from your phone, and generate key reports like a profit and loss statement with a single click. Using one of these platforms transforms bookkeeping from a headache into a streamlined business process.

Your Year-End Prep Checklist

Organizing your documents before tax time makes everyone's life easier and can save you money on accountant fees.

| Task | Status (Check When Done) | Notes |

|---|---|---|

| Gather All Income Records | ☐ | Rent checks, late fees, pet fees, etc. |

| Categorize All Expenses | ☐ | Repairs, insurance, taxes, management fees. |

| Reconcile Bank Statements | ☐ | Make sure your books match what the bank says. |

| Compile Major Purchase Invoices | ☐ | Anything big like a new roof, HVAC, or windows. |

| Finalize Annual Mileage Log | ☐ | Tally up your total property-related miles. |

| Generate P&L and Cash Flow Reports | ☐ | Your accountant will love you for this. |

Following a process like this does more than just prepare you for tax time. It builds a powerful financial snapshot of your portfolio. This discipline is a core part of any smart financial strategy, a principle we dive into with our Wealth Plan Builder. Strong records give you the hard data you need to make smarter investment decisions, year after year.

Staying Ahead of Tax Law Changes and Future Planning

Mastering property tax deductions is not a one-time task; it’s an ongoing discipline. The tax code is a living document, constantly shifting with economic trends and new legislation. A strategy that worked last year might be obsolete next year.

This constant flux is why proactive planning is non-negotiable. The most successful investors don't just react to changes—they anticipate them. Staying informed allows you to pivot your strategy, seize new opportunities, and protect your returns from unexpected legal shifts.

Building Your Professional Advisory Team

Navigating the labyrinth of tax law alone is an unnecessary risk. One of the best investments you can make is in a team of professionals who specialize in real estate. This team isn't just a safety net; they are strategic partners in your wealth growth.

At a minimum, your core team needs two key players:

- A Real Estate CPA: This is more than just your tax filer. A great CPA offers year-round advice, helps structure deals for optimal tax benefits, and acts as your early-warning system for legislative changes that could impact your portfolio.

- A Real Estate Attorney: They are essential for legal compliance and asset protection. From reviewing contracts and setting up the right legal entity (like an LLC) to handling the complex mechanics of a 1031 exchange, a good attorney protects you from costly mistakes.

A top-tier CPA and attorney do more than just save you money on taxes. They provide the strategic insight and legal armor you need to build a resilient, long-term real estate portfolio.

Monitoring Economic and Legislative Shifts

Your tax strategy doesn't exist in a vacuum. It’s directly tied to the wider economy and government policy. Things you read about in the news—interest rate hikes, inflation, new housing regulations—all create ripples that eventually reach your investment's bottom line and tax filings.

For example, after a rebound in 2024, global real estate transaction volumes dipped by about 2% year-over-year in the first quarter of 2025. A significant factor was uncertainty around tax policies and incentives, like the reinstatement of 100% bonus depreciation. You can dig deeper into these global real estate trends and their tax implications on ubs.com.

Keeping your finger on the pulse helps you make smarter decisions. Are rising interest rates making that refi a bad idea? Is a new tax credit about to make energy-efficient upgrades a no-brainer? This kind of forward-thinking is what separates the amateur from the pro, ensuring your investment strategy stays sharp and profitable for years to come.

Frequently Asked Questions (FAQ)

Here are answers to the 10 most common questions investors have about property tax deductions.

1. Can I deduct my mortgage principal payments?

No. Principal payments build equity in your property and are not considered an expense. However, the mortgage interest portion of your payment is fully deductible.

2. What’s the real difference between a repair and an improvement?

A repair maintains the property's current condition (e.g., fixing a leak) and is deductible in the year it occurs. An improvement adds value or extends the property's life (e.g., a new roof) and must be capitalized and depreciated over time.

3. Do I need a tenant for the full year to claim deductions?

No. You can deduct expenses for the entire time the property is available for rent, even during vacant periods between tenants, as long as you are actively trying to rent it.

4. Can I deduct my own labor if I do repairs myself?

You cannot deduct the value of your own time or "sweat equity." However, you can fully deduct the cost of any materials you purchase for the repairs.

5. How does deducting travel to my rental property work?

You can deduct the costs of necessary travel to manage your rental property, such as for showing the unit or overseeing repairs. You can use the standard IRS mileage rate or track actual vehicle expenses.

6. What happens if my expenses are higher than my rental income?

This creates a net rental loss. Your ability to deduct this loss against other income (like a W-2 salary) is often limited by "passive activity loss" rules. Real Estate Professionals have more flexibility to deduct these losses.

7. Is a tenant's security deposit considered taxable income?

Not when you initially receive it. It only becomes taxable income if you keep a portion of it to cover unpaid rent or damages after the tenant moves out.

8. Can I claim a home office deduction for managing my properties?

Yes, if you have a space in your home used exclusively and regularly for your rental business, you may qualify. This allows you to deduct a portion of your home's expenses, like mortgage interest, utilities, and insurance.

9. What exactly is a Cost Segregation Study?

It's an engineering-based analysis that reclassifies parts of your property into shorter depreciation periods (e.g., 5, 7, or 15 years instead of 27.5). This accelerates your depreciation deductions, providing significant tax savings in the early years of ownership.

10. Do I really need a CPA for my rental property taxes?

While not legally required, it's highly recommended. A CPA specializing in real estate can ensure you're compliant, maximize your deductions, and provide strategic advice that often saves you far more than their fee.

At Top Wealth Guide, we're all about giving you the practical knowledge you need to grow and protect your wealth. Whether you're just starting in real estate or a seasoned pro, we have resources to help you succeed. Explore our guides and tools and take the next step on your financial journey.