Wealth inequality—yep, a blast from the past, roaring back like it’s the roaring ’20s—is off the charts, with the top 1% holding over 32% of all US wealth. What does that mean for you and me? Well, this concentration offers up some nifty investment plays that most folks just breeze past.

Here at Top Wealth Guide, we’re convinced savvy investors can ride these market waves to sustainable wealth shores. The secret sauce? Grasping how inequality (yes, the good ol’ divide) impacts asset prices and sends consumer habits on a wild ride through various market segments.

In This Guide

How Wealth Concentration Creates Market Opportunities

Wealth concentration – an age-old concept, yet always ripe with fresh opportunities for those with a keen eye. The richest 10% of U.S. households are sitting on the majority of US stocks, according to the Fed. This makes asset prices and market behaviors, well… pretty predictable. Meanwhile, the top 1% saw their wealth balloon during the pandemic, while the bottom 90% had to settle for crumbs. Translation? Wealth flows north with market upswings.

Premium Asset Price Acceleration

When it comes to assets that the rich cozy up to, they just seem to keep winning the race. From early 2020 to mid-2021, stock returns for the top 10% of households jumped an impressive 43%, as opposed to a mere 33% for the other 90%. Why? Because wealth doesn’t just sit; it mingles with luxury real estate, dabbles in blue-chip stocks, and dives into alternative investments. This cycle of reinvestment fuels self-sustaining price hikes – a merry-go-round of gains for those holding the golden tickets.

Market Volatility and Capital Flows

Look at historical data and you’ll see a trend – inequality’s dance with higher equity returns. The GIC notes it’s because wealthier folks shoulder more risk and think long-term, pouring capital into growth assets. In nations with glaring income gaps, investors want bigger returns for the risks. It’s a field day for those who dance the tango with volatile markets.

Consumer Demand Bifurcation

As the wealthy keep driving their Teslas and acquiring the latest tech toys, they’re also creating patterns in consumer behavior. They’re the demand engines for luxury and premium everything, whereas the rest reduce their spending on the non-essentials. This consumer split means companies that cater to the well-heeled retain their pricing power during the stormy economic weather.

In the end, these market dynamics are setting the stage. For what, you ask? For investment strategies that ride the waves of wealth concentration trends across various asset classes and sectors. It’s not just understanding the game, but playing it smartly.

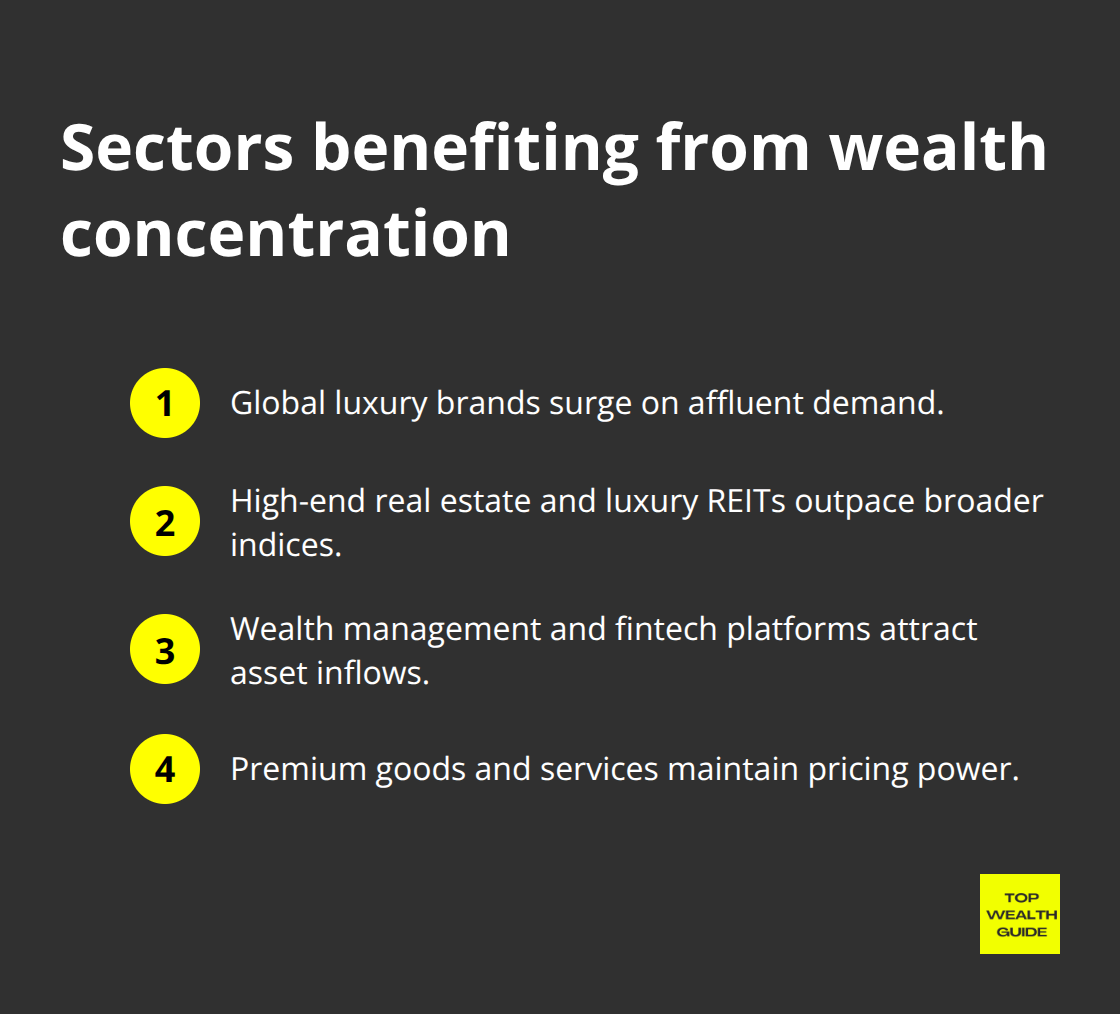

Which Sectors Profit Most from Wealth Concentration?

Alright, let’s break it down. The ultra-wealthy? They don’t just shove cash under their Tempur-Pedic mattresses – they spend it big time. And that’s a goldmine for savvy investors. Take LVMH, the luxury behemoth, which saw its stock price rocket by 300% between 2016 and 2021. Why? Because the wealthy kept snapping up Hermès bags and chugging Dom Pérignon like there’s no tomorrow. Ferrari’s laughing to the bank too, boasting record profits in 2022 with cars averaging a sweet $281,000 a pop.

It’s simple math: when the top 10% hold 89% of all stock wealth (thanks, Federal Reserve), their spending habits? They’re not just buying plush toys – they’re bolstering entire market sectors.

Premium Brand Investment Goldmine

Luxury stocks? Yeah, they’re the real winners during times of sky-high inequality. Look at Richemont, master of Cartier and Van Cleef, rolling out 15% annual returns over the past decade, while your average mall retailers are stuck in the single-digit mud. The trick? They’ve got this Jedi-level power to set prices – luxury saw a whopping 20% price growth in Q1 before taking a little April nap. Tiffany’s? Their typical transaction shot up from $230 in 2010 to $350 right before LVMH snatched it up for a cool $16.2 billion. Private equity juggernauts like Blackstone are all over premium service businesses because wealthy folks? They shell out 3-4 times more than middle-income peeps for the same old thing.

High-End Real Estate Dominance

Let’s talk Manhattan real estate – it’s a rollercoaster, folks. Prices took a nosedive, hitting 12% down in 2009 and another 4% in 2010 during the recession. But REITs with an eye on luxury markets? Like Boston Properties and Vornado? They consistently trounce the broader real estate indices. The wealth gap isn’t just some abstract concept – it’s carving out two housing markets: one defying gravity for the wealthy, another that just trudges along for everyone else.

Financial Technology Winners

Let’s shift gears to financial tech. Companies catering to the wealthy snag premium valuations. Morgan Stanley’s wealth management? A juicy 48% profit margin, compared to your mundane 15% from plain-Jane banking. Charles Schwab’s assets under management? Shot up from $1.8 trillion in 2015 to a staggering $7.9 trillion by 2022, thanks to affluent investors switching from old-school brokers to digital platforms with all the bells and whistles.

These sector dynamics showcase some pretty clear patterns, but don’t just dive in blindly, folks. They also highlight potential risks that every investor needs to wrap their head around before diving into wealth concentration strategies.

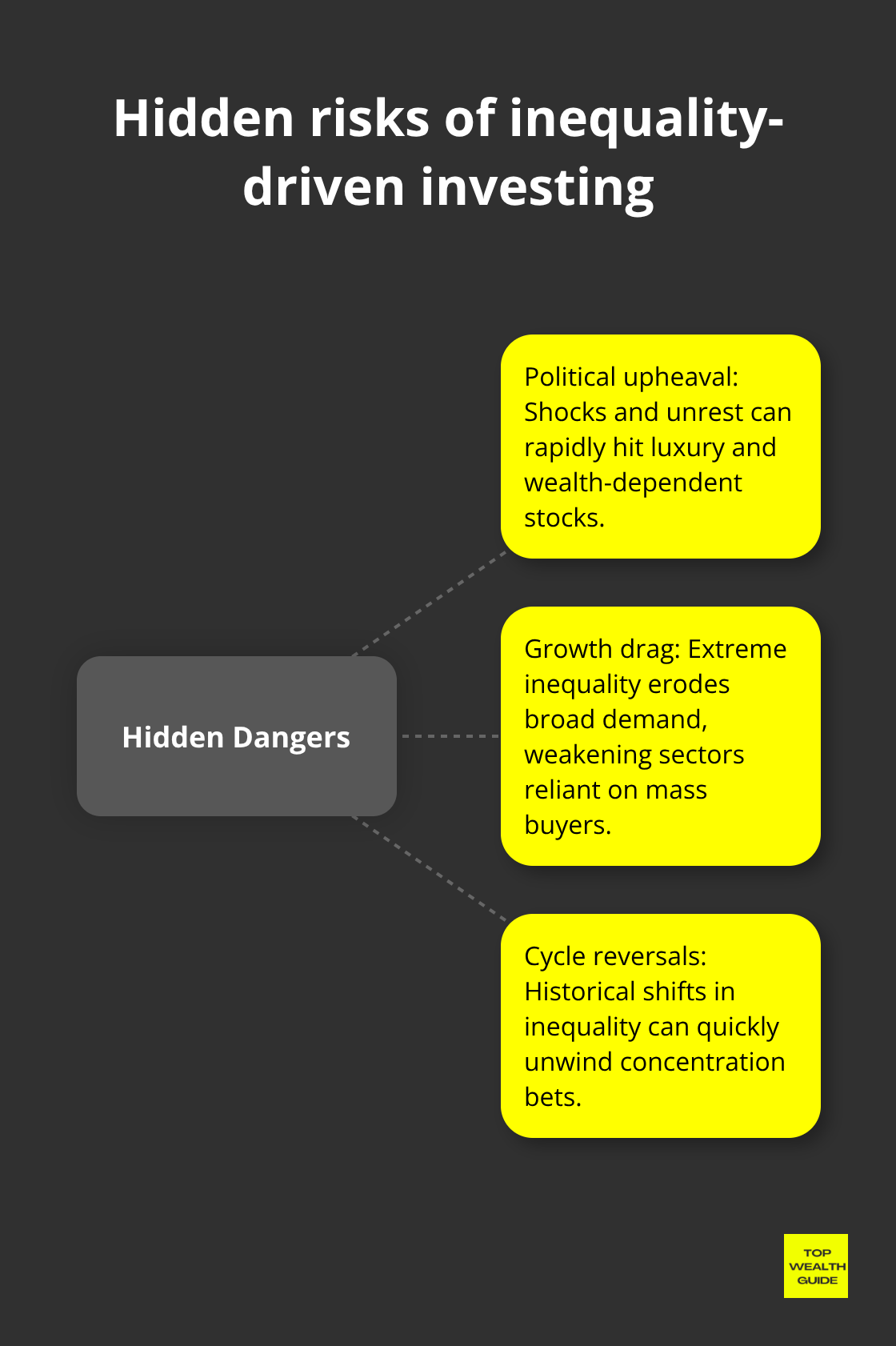

What Are The Hidden Dangers of Inequality-Driven Investments?

Political Upheaval Destroys Portfolio Value

Here’s the deal-investment strategies rooted in inequality? They’re a ticking time bomb ready to go off when social tensions hit the boiling point. January 6th Capitol chaos saw luxury stocks nosedive 8% in a day… a day. And while populist movements were throwing haymakers across Europe from 2016-2020, premium brands were taking body shots. Take France’s Yellow Vest protests-luxury retailers were directly in the crosshairs, and LVMH? Yeah, they took a €30 billion haircut during peak chaos.

And political instability? It’s not just a threat to your returns, it annihilates them in a blink. The rise of populism and higher inequality levels? Two peas in a pod, stuck in a nasty feedback loop no savvy investor can afford to ignore.

When society fractures between haves and have-nots, political blowback lands its first and hardest punches on wealth-dependent sectors.

Economic Growth Collapses Under Extreme Inequality

The brutal math-inequality’s a ball and chain on economic growth, according to research on income inequality patterns. As inequality rockets to the extreme, consumer spending power for 90% of people crumbles, making market conditions collapse under their weight.

Tesla’s share price? It took a 65% tumble in 2022 partly because middle-class buyers were left on the sidelines, priced out of the market. Companies crafting plans around wealthy customers? They’re facing a shrinking playground-Ferrari can only push so many $281,000 supercars before hitting the ceiling. The well-off can’t prop up entire market sectors indefinitely, and this truth demolishes inequality-centered investments when economic tides turn.

Historical Reversals Wipe Out Wealth-Concentration Bets

History’s got patterns, and inequality follows these shifts as shown by income trends where affluent families have seen their incomes rocket since 1980. These changes? They throw curveballs at inequality-driven investments when economic winds shift.

And these reversals? They’re stealthy like a freight train-they hit hard and fast. Betting your portfolio on endless wealth concentration, while overlooking economic cycles that have danced the same dance for eons? It’s asking for trouble. The cycle, it always circles back. And when it does, guess what? Inequality-based strategies-they’re the first dominos to fall.

Final Thoughts

Wealth inequality-it’s the double-edged sword smart investors can’t afford to overlook. The data? Oh, it paints a vivid picture: luxury sectors, posh real estate, and wealth management are like the golden geese that keep laying during times of lopsided wealth. But let’s not kid ourselves-political upheaval and economic hiccups can turn those golden eggs to dust in a heartbeat.

Here’s the winning playbook, folks: mix inequality-focused bets with good old diversification. We’re talking 20-30% of your portfolio riding the wealth wave, while the rest enjoys the soothing balm of broad market exposure. Keep an eye on political vibes-be nimble, be quick, and be ready to pivot when the social sparks start to fly.

Kick off your game plan with a close look at luxury consumer stocks, those swanky REITs, and cutting-edge fintech that’s all about pampering the well-heeled. Stop-losses? Yeah, set those at 15%-your safety net against the rollercoaster (and keep an eye on inequality markers like the Gini coefficient right alongside your usual financial readouts). The secret sauce? Surf these trends without staking your life savings on them. Sure, wealth inequality throws open doors to real investment gems, but true wealth that lasts asks for a smart, adaptable strategy. Ready to dive deeper into wealth-building strategies? Check out our full guides on crafting that all-weather portfolio and getting your risk management game on point.