Using AI for stock trading isn't about finding a magic "on" switch. It’s a disciplined, step-by-step process that starts with a clear strategy and high-quality data. From there, you build and rigorously test a predictive model, and finally, you deploy it with strict risk controls.

Think of it less as a crystal ball and more as an incredibly powerful data analysis tool. Your goal is to find a statistical edge by identifying patterns and executing trades with a speed and precision that’s impossible for a human to match.

In This Guide

- 1 How AI Is Changing the Game for Stock Traders

- 2 Building Your Foundation with Strategy and Data

- 3 Choosing Your Tools and Building the AI Model

- 4 Don't Bet a Dime Until You've Put Your Model Through Hell

- 5 Deployment, Risk Management, and Continuous Monitoring

- 6 Common Questions About AI Stock Trading (FAQ)

- 6.1 1. Can I use AI for stock trading with no coding experience?

- 6.2 2. How much money do I need to start AI trading?

- 6.3 3. What is the biggest risk in using AI for stock trading?

- 6.4 4. Is AI trading better than human trading?

- 6.5 5. How often should I retrain my AI trading model?

- 6.6 6. What technical skills are most useful for building my own AI bot?

- 6.7 7. What are the ethical considerations of using AI in trading?

- 6.8 8. What's a realistic profit expectation for AI trading?

- 6.9 9. Can an AI predict a stock market crash?

- 6.10 10. Do I need a powerful computer for AI trading?

- 7 So, What's Next on Your AI Trading Journey?

How AI Is Changing the Game for Stock Traders

Welcome to the new frontier of trading. For years, AI was the exclusive domain of Wall Street quants, but that's changing fast. It's now a real, accessible tool for individual investors who are willing to put in the work. My goal here is to cut through the marketing fluff and show you what it actually takes to build an AI-powered trading approach. This guide is your roadmap.

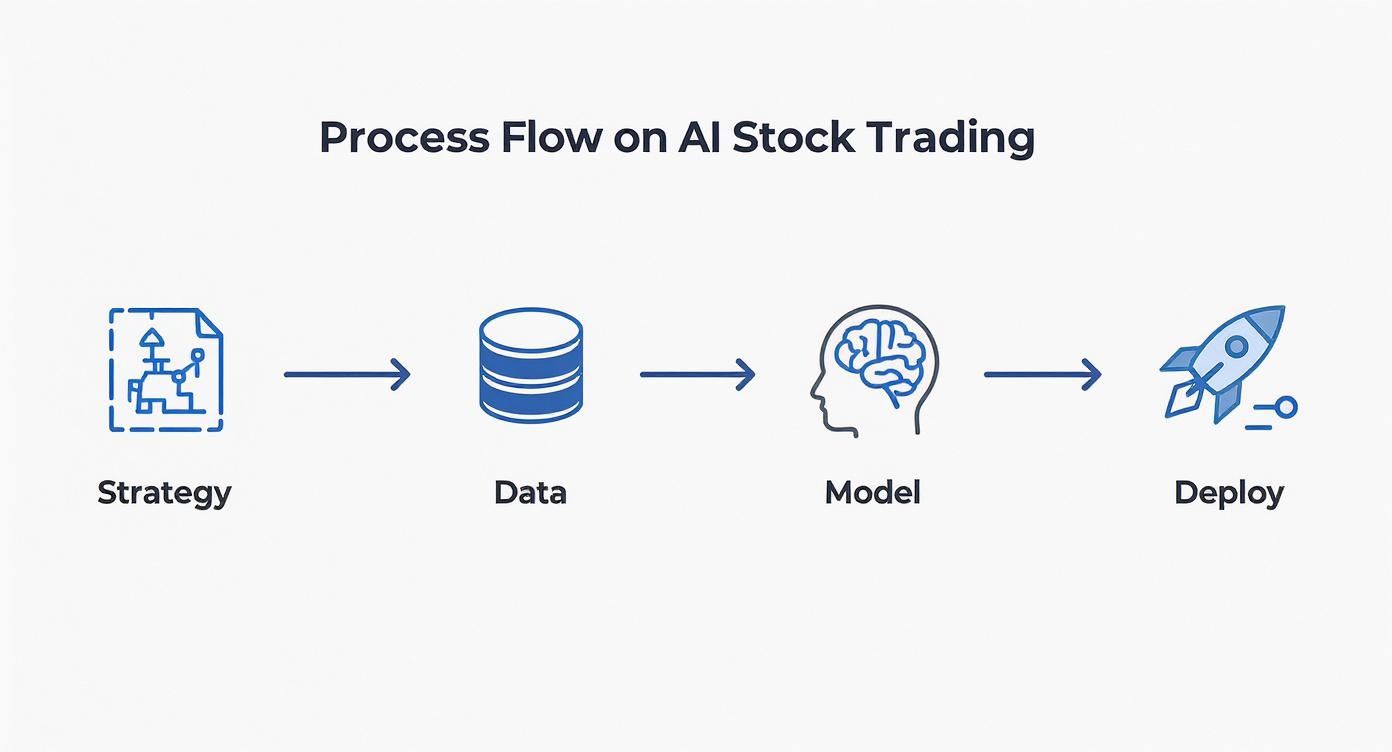

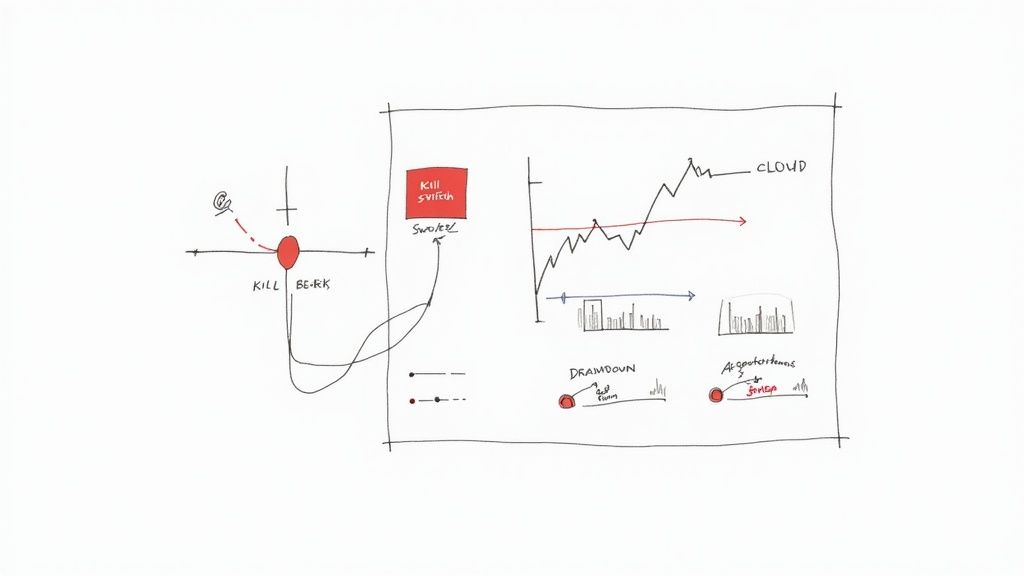

The entire process follows a logical flow, from your initial idea all the way to live execution. This chart lays out the fundamental workflow.

Each of these stages—Strategy, Data, Model, and Deployment—builds on the one before it. A successful system isn't just a clever piece of code; it’s a thoughtfully designed and tested process.

The AI Trading Landscape Today

AI-driven trading isn't new, but its growth since the early 2000s has been explosive. Algorithmic trading, often powered by AI, now accounts for an estimated 60-70% of total trading volume in major markets like the U.S. and Europe.

The money follows the trend. The global AI trading market was valued at around $11.2 billion in 2024 and is on track to hit $33.45 billion by 2030. That signals massive adoption and investment in this space. If you want to dig deeper into the mechanics, you can find more insights on how AI predicts financial markets from the team at Intellias.

This isn't just about high-frequency trading firms anymore. Retail investors now have access to powerful tools and platforms that were once reserved for massive institutions. The trick is understanding how all the pieces fit together.

The Core Components of an AI Trading System

To really understand how to use AI for stock trading, it helps to break down the system into its essential parts. Each one plays a critical role in turning raw data into an actionable trade.

This table provides a high-level overview of the pillars we'll be covering. Think of it as the blueprint for your entire system.

Core Components of an AI Trading System

| Component | Description | Key Objective |

|---|---|---|

| Strategy & Goals | The defined rules and objectives the AI will follow. | To create a clear, testable trading thesis (e.g., momentum, mean reversion). |

| Data Engine | The system for sourcing, cleaning, and preparing data. | To provide high-quality, relevant information for the model to analyze. |

| Prediction Model | The machine learning algorithm that finds patterns and makes forecasts. | To generate predictive signals (e.g., buy, sell, hold) based on data. |

| Execution & Risk | The mechanism that places trades and manages risk controls. | To translate signals into live trades while protecting capital. |

Each of these components is a link in a chain. A weakness in any single area can compromise the entire operation, which is why a holistic approach is so important.

My Two Cents: A successful AI trading system is not a single piece of software. It’s an integrated ecosystem where your strategy, data, model, and execution engine all work in harmony. If one part fails, the whole thing can fall apart.

Building Your Foundation with Strategy and Data

Every successful AI trading system is built long before you write a single line of code. Its entire potential rests on two critical pillars: a razor-sharp strategy and high-quality data. Without these, even the most sophisticated algorithm is just flying blind.

Think of this initial stage as creating the blueprint for your entire project. It’s where you translate a fuzzy idea into a specific, testable hypothesis that will guide every decision you make from here on out.

Defining Your Trading Thesis

A vague goal like "finding undervalued stocks" isn't a strategy—it's a wish. An AI needs explicit instructions and a crystal-clear objective to work with. Your first real task is to hammer out a precise trading thesis that the machine can actually execute.

Real-Life Example: Instead of a broad goal, you might develop a thesis like this: "Identify mid-cap tech stocks that show strong quarterly revenue growth but are plagued by persistent negative media sentiment. Historically, these stocks tend to rebound by 10-15% within two weeks after their earnings announcement."

Now that's a thesis an AI can sink its teeth into. It works because it is:

- Specific: It zeroes in on a particular sector (mid-cap tech) and a unique set of conditions (revenue growth vs. media sentiment).

- Measurable: It sets a clear benchmark for success (a 10-15% rebound).

- Time-Bound: It establishes an expected window for the outcome (two weeks post-earnings).

Having a concrete thesis transforms your project from a random shot in the dark into a focused scientific experiment. It also tells you exactly what kind of data you'll need to hunt down. If you're looking for more ways to generate these kinds of ideas, our guide on investment research methods the pros don't want you to know is a great place to start.

Sourcing High-Quality Data

Your AI model will only ever be as smart as the data it learns from. The old saying "garbage in, garbage out" is the absolute, unbreakable law of the land here. You'll need to find, clean, and organize data from several different categories to give your model a 360-degree view of the market.

Here’s a breakdown of the main data types you’ll be working with:

| Data Type | Description | Real-World Examples | Common Sources |

|---|---|---|---|

| Market Data | The core numbers behind price and volume. | Historical stock prices (OHLC), trading volume, bid-ask spreads, order book depth. | Polygon.io, Alpaca, IEX Cloud |

| Fundamental Data | The financial health and valuation of a company. | P/E ratios, earnings per share (EPS), revenue growth, debt-to-equity ratios. | FinancialModelingPrep, SEC filings (EDGAR) |

| Alternative Data | Unconventional data that can give you a predictive edge. | Satellite images of retail parking lots, social media sentiment, credit card transaction data. | Quandl, Thinknum |

Key Takeaway: The most powerful AI trading strategies rarely rely on just one data type. The real magic happens when you fuse them—combining market data with fundamental strength and alternative insights to give your model a much richer, more nuanced view of the world.

The All-Important Step: Data Preparation

Getting your hands on the data is just the start. Raw financial data is notoriously messy. It's often riddled with errors, gaps from trading halts, and wild outliers that can completely throw your model off track.

Before you even think about feeding data to your AI, it has to be rigorously prepped. This involves a few non-negotiable steps:

- Cleaning: This means dealing with missing values (either by filling them in intelligently or removing the data point) and correcting any obvious errors you find.

- Normalization: You have to scale different data types to a common range (like 0 to 1). This prevents one feature, like a massive trading volume number, from unfairly dominating the model's decision-making process.

- Feature Engineering: This is where the art comes in. You create new, more informative features from the data you already have. For instance, you could calculate a 50-day moving average from daily prices or engineer a sentiment score from thousands of news headlines.

This meticulous prep work ensures your model learns from genuine market signals, not just random noise. It’s time-consuming, for sure, but it’s an absolutely essential part of building a trading system you can actually trust.

Choosing Your Tools and Building the AI Model

Alright, you've defined your strategy and wrangled your data. Now comes the fun part: deciding how to actually build your trading AI. This is a major fork in the road, and the path you choose will shape your entire project.

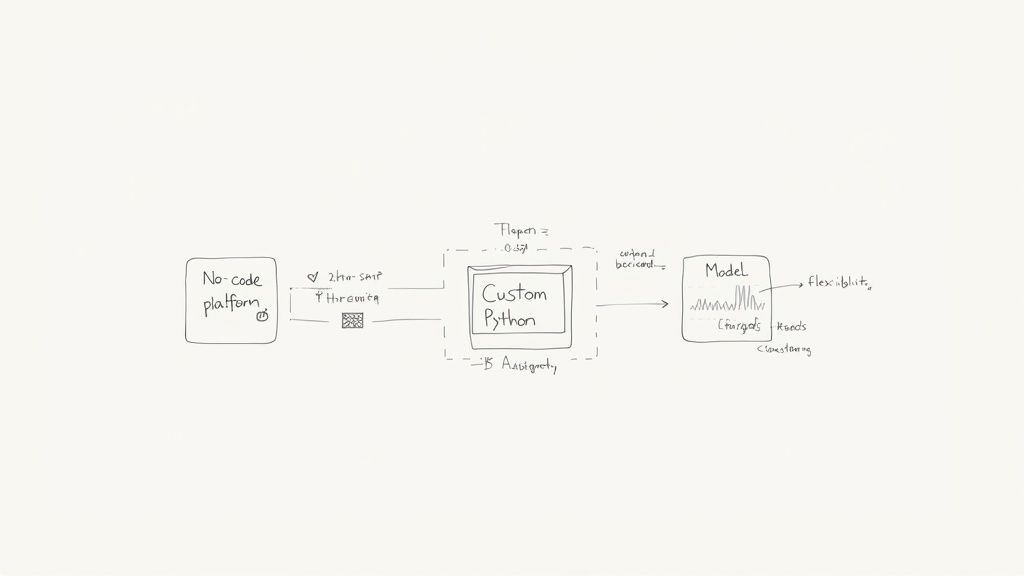

Essentially, you have two main options. You can use a ready-made platform that does a lot of the heavy lifting for you, or you can roll up your sleeves and build a completely custom model from scratch. Your decision really boils down to your coding skills, your budget, and how ambitious your trading goals are.

Platforms vs. Custom Code

Let's break down that first big technical decision. There’s no right or wrong answer here; it’s all about what makes the most sense for you.

Platforms like Tickeron or Trade-Ideas offer no-code or low-code environments. Think of them as excellent sandboxes. They let you rapidly test strategies using different indicators and pre-built AI modules without writing a single line of code. They are perfect for validating an idea quickly.

On the other hand, building a custom model with a language like Python gives you total control. You can weave in unique alternative datasets, implement niche strategies, and tweak every last parameter until it’s just right. This approach demands a solid grasp of programming and data science, but the potential for a truly unique and high-performing system is limitless.

To make it clearer, let's compare the two side-by-side.

Comparison: AI Trading Platforms vs. Custom Code

This table should help you figure out which path is a better fit for your resources and goals.

| Factor | AI Trading Platforms | Custom Python Model |

|---|---|---|

| Complexity | Low; often uses graphical interfaces and pre-built modules. | High; requires proficiency in Python, data science, and APIs. |

| Speed to Deploy | Fast; you can build and backtest a strategy in hours or days. | Slow; development, testing, and deployment can take weeks or months. |

| Flexibility | Limited to the tools and data sources offered by the platform. | Nearly infinite; you can implement any logic or data source you want. |

| Cost | Typically a monthly subscription fee (e.g., $50 – $250/month). | Low initial cost (free open-source libraries), but potential cloud computing expenses. |

| Best For | Beginners, non-coders, and traders who want to rapidly test ideas. | Experienced developers, quants, and those with a unique, complex strategy. |

As you can see, the trade-off is pretty clear: convenience versus control.

Selecting the Right AI Model for the Job

If you've decided to go the custom route, your next task is picking the right type of machine learning model. This is crucial. Using the wrong model for the job is like trying to hammer a nail with a screwdriver—it just won't work well.

Here’s a quick rundown of some common models and where they shine in the trading world:

- Linear Regression: This is your most basic model. It's great for spotting simple, straight-line relationships, like seeing if a company’s revenue growth has a direct impact on its stock price. It's a solid starting point but is often too simplistic for the messy reality of the market.

- Support Vector Machines (SVMs): These are workhorses for classification problems. You could train an SVM to look at a dozen technical indicators and classify a stock as a "Buy," "Sell," or "Hold."

- Random Forests: This model is basically a team of decision trees working together. It’s fantastic at handling complex data and is particularly good at telling you which of your features are most important in predicting price moves.

- Long Short-Term Memory (LSTM) Networks: Don't let the name scare you. LSTMs are a special kind of neural network built for time-series data—exactly what stock charts are. They have a form of "memory" that helps them spot complex patterns over time, making them a powerful choice for forecasting.

Expert Insight: It’s easy to get drawn to the most complex, cutting-edge model, but that's often a mistake. A more complicated model can easily "overfit" your historical data, meaning it learns the random noise instead of the actual market signal. I've seen well-tuned Random Forests run circles around a poorly implemented neural network many times.

When building your own model, you'll be leaning on some incredible Python libraries. Scikit-learn is the industry standard for traditional models like SVMs and Random Forests. For deep learning and LSTMs, you'll be looking at frameworks like TensorFlow or PyTorch. Understanding the different types of algorithmic trading strategies can also give you a head start in pairing the right model with your trading objective.

Ultimately, picking your tools is about aligning your capabilities with your vision. Whether you start on a platform or jump straight into code, the objective is the same: build a system that can learn from data and execute your strategy with mechanical precision.

Don't Bet a Dime Until You've Put Your Model Through Hell

An AI model can look like a financial genius on paper, spitting out incredible returns in historical simulations. But here’s a hard-earned lesson: a flawless backtest is often a massive red flag.

It usually points to a classic, costly mistake called overfitting. This is where your model gets too smart for its own good, memorizing the random noise and flukes in your historical data instead of the actual market patterns. When you unleash it on live data, it falls apart.

Before you even think about putting real money on the line, you need to rigorously test your creation. This isn’t just about running a simple backtest; it's about simulating the messy, unpredictable reality of the market to see if your model’s performance is genuine or just a historical illusion.

Go Beyond a Simple Backtest with Walk-Forward Analysis

A standard backtest has a fundamental flaw—it often lets the model cheat by "seeing the future." By training and testing on the same big block of historical data, you get inflated, misleading results.

A much more honest approach is walk-forward analysis. This method actually mimics how you would trade in the real world.

Here’s how it works:

- You train the model on an initial chunk of data (say, all of 2021).

- Then, you test it on the next slice of time it has never seen before (the first quarter of 2022).

- Finally, you slide the window forward. The test data gets added to the training set (so now you're training on 2021 + Q1 2022), and you test on the next unseen period (Q2 2022).

This iterative process ensures your model is constantly being judged on fresh, out-of-sample data. It's the only way to get a true measure of its predictive strength.

The Numbers That Actually Matter

Once the tests are done, you'll have a spreadsheet full of metrics. Don't get lost in the noise. Zoom in on the few key numbers that tell you the real story about your model’s performance and, more importantly, its risk.

| Metric | What It Tells You | Why You Should Care |

|---|---|---|

| Sharpe Ratio | The risk-adjusted return of the strategy. | Big returns are worthless if they come with gut-wrenching volatility. The Sharpe ratio (aim for a value over 1.0) tells you if the returns were actually worth the risk you took to get them. |

| Maximum Drawdown | The biggest drop your account value experienced from a peak. | This is your gut-check number. A 50% maximum drawdown means your capital was sliced in half at some point. Could you stomach that in real time without panicking? Be honest. |

| Profit Factor | Your total profits divided by your total losses. | A profit factor above 1.0 means you're making money. But a truly robust system will have a much higher number, ideally 2.0 or more, showing that your winning trades are dramatically larger than your losers. |

The Reality Check That Can Save You: Never forget to factor in real-world trading costs. Your simulations absolutely must account for commissions and slippage—the small difference between your expected trade price and the actual execution price. These tiny costs add up fast and can easily turn a "profitable" strategy into a money pit.

The Final Gauntlet: Paper Trading

After your model has survived the punishing walk-forward tests, there's one last, non-negotiable step: paper trading. This is where you let your model run in a simulated environment with live market data, but without risking a single cent.

Think of paper trading as your model's final exam. It's a confrontation with the true chaos of live markets—sudden volatility spikes, breaking news, and data feed glitches. You can learn more about this by exploring what is market volatility in our detailed guide. This step is priceless for finding bugs in your code and seeing how the model behaves before your hard-earned capital is on the line.

Deployment, Risk Management, and Continuous Monitoring

Alright, this is the moment of truth. You’ve built and tested your model, and now it's time to let it out into the wild. Going live is easily the most exciting—and nerve-wracking—part of the process. This is where all your hard work meets the unforgiving reality of the live market.

Your setup can be as simple as a script running on a dedicated PC in your office or as robust as a cloud-based server on AWS for guaranteed uptime. But no matter the hardware, your absolute top priority is safety.

Let me be clear: risk management isn't a "nice-to-have." It’s the bedrock of any trading system that has a chance of surviving long-term. A brilliant model without proper safeguards can, and will, blow up an account. It's not a matter of if, but when.

Implementing Essential Safeguards

Before your AI executes a single trade with real money, you need to hard-code several non-negotiable safeguards into its logic. Think of these as the circuit breakers for your capital.

Here are the absolute must-haves:

- Automated Stop-Losses: This is trading 101, but it’s even more critical with an AI. Every single position your bot opens must have a predefined stop-loss attached. This is your line in the sand—the maximum you're willing to lose on that trade, period.

- Strict Position Sizing: Never let your model risk more than a small fraction of your capital on any one trade. A common rule of thumb is 1-2%. This discipline ensures that a single bad call doesn't cripple your entire account. Our guide on how to determine your investment risk tolerance can help you pin down what this percentage looks like for you.

- A Manual 'Kill Switch': You need a big red button. Seriously. It’s a function that immediately cancels all orders and closes all open positions. You'll need it if the AI starts behaving erratically or a massive, unforeseen market event (like a flash crash) occurs that your model has no context for.

My Experience: The first time my own bot went haywire due to a faulty data feed, my kill switch saved me from substantial losses. It’s a feature you hope you never need, but you'll be incredibly grateful for it when you do.

Combating the Silent Killer: Model Drift

There's another, more subtle danger that trips up a lot of algorithmic traders: model drift. Markets are living, breathing things. They evolve. The conditions your model was trained on last year might not exist today, rendering its strategy less effective or even unprofitable.

Model drift happens when the live market data starts to look fundamentally different from the training data. The statistical patterns shift, and your AI's predictions get worse.

This is where continuous monitoring becomes your best friend. You have to track your model's live performance with the same intensity you used during backtesting. Set up alerts for key metrics. For instance, you could set a rule: if the win rate drops by 10% over 30 days or the profit factor sinks below 1.5, the model is automatically taken offline for retraining on fresh data.

The pace of change is only accelerating. In 2024 alone, private AI investment in the United States hit $109.1 billion. The power of these systems is ballooning, with the computing resources used for training doubling every five months and datasets growing every eight months. You can find more details in these AI index findings on hai.stanford.edu. For traders, this means market dynamics can shift faster than ever, making constant vigilance more critical than ever.

Common Questions About AI Stock Trading (FAQ)

Jumping into AI for stock trading is exciting, but it definitely brings up a lot of questions. This technology is powerful, but let's be honest, it's also complex. To help you get your bearings, I've put together some straight-to-the-point answers to the questions I hear most often from traders.

1. Can I use AI for stock trading with no coding experience?

You absolutely can. While building a custom AI model from the ground up does require some serious programming chops, there's a growing world of platforms designed specifically for traders who don't code. These tools are a fantastic way to get your feet wet. Services like Tickeron, Trade-Ideas, and TrendSpider offer slick, user-friendly interfaces that let you design, backtest, and deploy strategies using pre-made AI modules.

2. How much money do I need to start AI trading?

This might surprise you, but the starting capital can be quite low, especially if you're building your own model. In that scenario, your biggest investment is your own time. With free data tiers and commission-free brokerages, you could realistically get a simple model live with just a few hundred dollars. Platform subscriptions typically run from $50 to several hundred dollars a month. The most important rule is to start with paper trading and only risk what you are prepared to lose.

3. What is the biggest risk in using AI for stock trading?

Without a doubt, the single biggest danger is overfitting. This is a classic trap where your AI model learns the historical data a little too well—it memorizes every random quirk and piece of noise that won't happen again. An overfitted model looks like a money-printing machine in backtests but falls apart in live trading. Rigorous testing on unseen data is the best defense.

4. Is AI trading better than human trading?

It's not about being "better," it's about being different. AI shines in areas where humans are naturally weak: processing massive datasets, operating 24/7 without emotion, and executing trades with lightning speed and perfect discipline. However, humans are still superior at understanding context, nuance, and unprecedented "black swan" events. The most effective setup is often a hybrid approach where a human sets the strategy and the AI handles the execution.

5. How often should I retrain my AI trading model?

There’s no single answer; it all comes down to your strategy's timeframe. A high-frequency bot might need daily retraining, while a long-term model might only need a quarterly refresh. The key is to constantly watch for "model drift"—the gradual decline in performance as market conditions change. Set up automated alerts to signal when key performance metrics drop, indicating it's time to retrain.

6. What technical skills are most useful for building my own AI bot?

If you're going the custom route, proficiency in Python is non-negotiable. You'll need to master key libraries like Pandas for data manipulation, Scikit-learn for traditional machine learning, and TensorFlow or PyTorch for deep learning. A solid grasp of APIs, statistics, and a real-world understanding of how financial markets behave are equally crucial. Learning how to read stock charts is also a huge plus.

7. What are the ethical considerations of using AI in trading?

This is a big one. A major concern is ensuring AI isn't used for market manipulation, like "spoofing" (placing fake orders to influence prices). There's also the systemic risk of AI-fueled "flash crashes," where automated decisions can amplify volatility. As a user of these tools, you have a responsibility to trade ethically and transparently.

8. What's a realistic profit expectation for AI trading?

There is no "typical" return. Profitability depends entirely on the quality of your strategy, your risk management, and market conditions. Be extremely wary of any service promising guaranteed or high returns. The goal is to develop a statistical edge that can generate consistent returns over time, not to get rich overnight.

9. Can an AI predict a stock market crash?

No AI can predict a crash with certainty. Crashes are often caused by "black swan" events—unforeseeable circumstances that fall outside historical data patterns an AI learns from. While AI can identify rising volatility or signs of market stress that might precede a downturn, it doesn't have a crystal ball.

10. Do I need a powerful computer for AI trading?

For backtesting complex models on large datasets, a powerful computer can significantly speed things up. However, for running a live model that executes a few trades a day, you don't need a supercomputer. Many traders use cloud services like AWS, which provide scalable computing power on demand without a large upfront hardware investment.

So, What's Next on Your AI Trading Journey?

Look, diving into AI for trading isn't a weekend project; it's a marathon. You’re signing up for a constant loop of learning, building, stress-testing, and tweaking your models. If you're searching for a mythical, set-it-and-forget-it money machine, you’re going to be disappointed. That just doesn't exist. The real goal here is to methodically construct a solid system that gives you a genuine, measurable statistical edge over the long run.

My best advice? Start small. Get absolutely obsessed with managing your risk—it's the one thing that will keep you in the game. And never, ever stop questioning your model's outputs. The real magic of AI is that it opens the door to strategies that were once only available to big firms, but with that power comes a huge amount of responsibility.

The sharpest traders I've ever met treat AI with a unique mix of deep curiosity, unwavering discipline, and a big dose of healthy skepticism. That mindset is far more valuable than any single algorithm.

If you stick to those principles, you’ll be in a great position to handle the inevitable curveballs and tap into what AI can really do for your trading. The path is demanding, no doubt about it. But for those who respect the process, it can be an incredibly rewarding experience. Just remember, every expert was a beginner at some point. Focus on making steady progress and treat every single trade—win or lose—as a lesson.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.