Getting started with investing really boils down to three things: figuring out what you want your money to do for you, opening the right account, and picking some straightforward, diversified investments. You don't need a fortune to begin; even small, consistent contributions are the secret sauce to building wealth over the long haul.

In This Guide

- 1 Why Investing Is More Accessible Than Ever Before

- 2 Building Your Personal Investment Foundation

- 3 Making Your First Investment Choices

- 4 Building Your First Smart Portfolio

- 5 Expanding Your Horizons with Global Investments

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. How much money do I actually need to start investing?

- 6.2 2. What's the single best investment for a total beginner?

- 6.3 3. How often should I check my investments?

- 6.4 4. Should I invest a lump sum or invest regularly?

- 6.5 5. What’s the difference between a stock and an ETF?

- 6.6 6. Are robo-advisors a good idea for beginners?

- 6.7 7. How do taxes work with investing?

- 6.8 8. What happens if my brokerage firm goes bankrupt?

- 6.9 9. Should I pay off all my debt before I start investing?

- 6.10 10. What is the biggest mistake a beginner can make?

Why Investing Is More Accessible Than Ever Before

Not too long ago, the word "investing" brought to mind images of high-powered Wall Street traders in expensive suits. That stereotype is officially dead. Technology has completely changed the game, making it possible for anyone to start building wealth, no matter how much money you have in the bank.

Forget the idea that you need a finance degree or a huge nest egg. The two most powerful tools you have on your side are time and consistency.

This guide is designed to cut through the confusing jargon and show you exactly what to do. We'll lay out the practical steps to get you from saving your money to actually making it work for you.

The Power of Starting Early

If there’s one "magic" ingredient in investing, it’s compound interest. It’s the snowball effect in action: the money your investments earn starts earning its own money. A small amount invested today has decades to grow, which is far more powerful than waiting to invest a bigger chunk of cash later on.

Real-Life Example: Imagine two friends, Alex and Ben, both aiming to retire at 65.

- Alex starts investing $200 a month at age 25 and stops at 35, investing a total of $24,000.

- Ben waits and starts investing $200 a month at age 35, continuing until he's 65, investing a total of $72,000.

Assuming an average 8% annual return, Alex, who started early but invested less, would end up with over $600,000 at retirement. Ben, who invested three times as much money but started later, would have around $540,000. That's the power of giving your money more time to grow.

This is the absolute cornerstone of building wealth. We're seeing a massive shift as younger generations get in the game much earlier than their parents did. A study from the World Economic Forum found that 30% of Gen Z starts investing in their early adult years. Compare that to just 9% of Gen X and a mere 6% of Baby Boomers. This change is all thanks to better access to information and a real desire to take control of their financial lives.

What This Guide Will Cover

Think of this as your personal roadmap, not a textbook. We're going to walk you through the entire process from start to finish so you feel confident every step of the way. Building a solid financial future starts with understanding the basics, and knowing why financial literacy is the key to building wealth is the perfect place to start.

Here’s a quick look at what’s ahead:

- Laying the Groundwork: We'll talk about setting real, achievable goals and picking a brokerage account that fits your life.

- Breaking Down the Options: We'll explain stocks, ETFs, and other investments in plain English, without the confusing jargon.

- Building Your First Portfolio: You'll learn the ropes of diversification and how to balance your investments to keep risk in check.

By the time you're done, you won't just know about investing—you'll have a clear, actionable plan to actually get started.

Building Your Personal Investment Foundation

Before you even think about picking a stock or watching market charts, you need to get your own house in order. A strong investment strategy isn't built on chasing hot tips—it's built on a crystal-clear understanding of your own goals and the right tools to get you there. This is where your journey really starts.

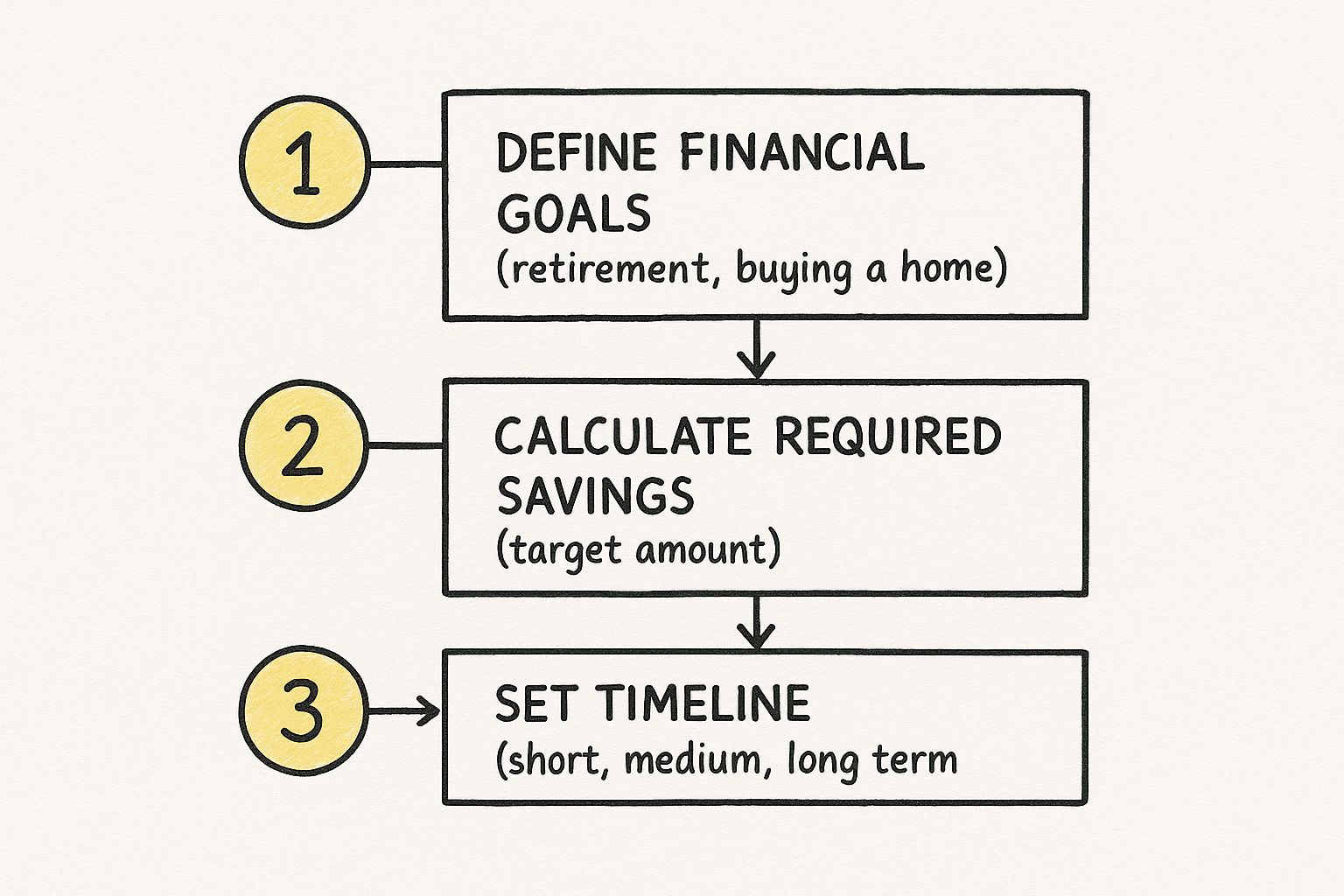

The most important question you can ask yourself is why are you investing? Seriously. Are you trying to scrape together a down payment for a house in five years? Or are you playing the long game for a retirement that's three decades away? The answer changes everything about your approach.

This simple flowchart shows how to turn a fuzzy goal into a real, actionable plan.

As you can see, a specific goal gives you a target to aim for and a timeline to work with. These are the twin pillars of any good investment plan. If you want to really nail this part down, we have a complete guide on setting SMART financial goals for a prosperous future.

Choosing Your First Brokerage Account

Once your goals are set, you need a place to actually buy and sell investments. This is called a brokerage account, and you can think of it as a bank account specifically for your stocks, funds, and other assets.

The good news is you have tons of options today, from old-school, full-service brokers to slick, easy-to-use apps. The "best" one is just the one that fits your style and doesn't intimidate you. Don't let analysis paralysis stop you; opening an account is surprisingly fast, often taking just a few minutes.

To help you get a lay of the land, here is a comparison of the main types of brokerages you'll encounter.

| Brokerage Type | Example Platforms | Best For | Key Features | Potential Fees |

|---|---|---|---|---|

| Traditional Brokers | Fidelity, Charles Schwab | Investors who want deep research tools, a huge variety of accounts, and tons of educational content. | Robust research reports, retirement calculators, excellent customer support (phone, chat, even in-person branches). | While most offer commission-free stock/ETF trades, some mutual funds or advanced services may have fees. |

| Modern App-Based Brokers | Robinhood, Webull | Beginners who love a mobile-first experience and want to start with just a few dollars. | Clean, intuitive apps, fractional shares (letting you buy a small piece of a pricey stock), and often built-in crypto trading. | Make money on "payment for order flow." You might see fees for things like transferring your account out. |

| Robo-Advisors | Betterment, Wealthfront | Hands-off investors who want a professionally managed portfolio without the guesswork of picking individual stocks. | Automated portfolio management based on your risk tolerance, automatic rebalancing, and tax-loss harvesting. | Typically charge a small annual management fee, like 0.25% of your total account balance. |

Ultimately, the goal is to find a platform that empowers you to invest confidently, not one that confuses you with clutter.

Opening and Funding Your Account

No matter which platform you go with, the sign-up process is pretty much the same and can be done from your couch. You'll need to provide some personal information, like your Social Security number and address, to verify that you are who you say you are. It's a standard and secure process.

Once your account is approved (which is often instant), the last step is to connect your bank account and transfer some money over.

And you don’t need a pile of cash to get started.

Many great platforms have $0 account minimums. You can start with $100, $50, or even just $20. The amount you start with is far less important than the act of starting itself. The moment you fund that account, you've officially made the leap from someone who thinks about investing to an actual investor.

Making Your First Investment Choices

Diving into the world of investing feels a lot like learning a new language. You're hit with a wall of jargon—equities, ETFs, REITs—and it's easy to feel overwhelmed. But here’s the secret: the core options are much simpler than they sound.

The goal isn't to become a Wall Street guru overnight. It's about understanding a few key building blocks so you can get your money working for you.

Think of your money as an employee. You need to assign it a job. Some jobs are steady and reliable, while others offer a shot at high growth but come with more uncertainty. Let’s break down the most common starting points.

Stocks: Owning a Piece of the Pie

The most classic form of investing is buying a stock, also known as a share or equity. When you buy a stock, you're purchasing a tiny sliver of ownership in a public company. If you've ever used an iPhone or grabbed a coffee from Starbucks, you're already familiar with companies whose stock you can own.

When the company does well, the value of your piece of the pie can go up. If it struggles, your share value can fall. It's that direct. The allure is the potential for big returns, but it comes with real risk. A single company's fortunes can turn on a dime, which is why putting all your eggs in one stock basket is a rookie mistake we want to avoid.

ETFs and Index Funds: The "Safety in Numbers" Approach

So, what if you don't want to bet the farm on one company's success? That's where Exchange-Traded Funds (ETFs) and Index Funds are absolute game-changers for beginners.

Imagine an investment "bundle deal." Instead of picking just one company, you buy a single fund that holds small pieces of hundreds, or even thousands, of them. It’s like buying a greatest hits album instead of a single.

Many of these funds track a market index, like the famous S&P 500. An S&P 500 index fund, for instance, gives you a stake in 500 of the biggest U.S. companies all in one shot. This approach is brilliant for a few reasons:

- Instant Diversification: Your risk is spread out. If one company has a bad year, it's balanced out by the other 499.

- Low Cost: These funds typically have incredibly low fees, so more of your money stays invested and growing.

- Simplicity: For many, this is a "set it and forget it" strategy that has historically performed very well over the long haul. No need to obsess over daily stock news.

These funds are the bedrock of most smart, long-term portfolios. If this approach sounds right for you, our guide on how index funds are the key to long-term wealth building is a great next step.

REITs: Become a Landlord, Minus the Headaches

Ever dreamed of owning property but didn't have the down payment or the desire to fix leaky faucets? Say hello to Real Estate Investment Trusts (REITs). A REIT is a company that owns and operates properties that produce income—think apartment complexes, shopping centers, or warehouses. When you buy a share of a REIT, you're essentially becoming a fractional owner of that real estate portfolio.

What makes them especially attractive is that, by law, REITs must pay out at least 90% of their taxable income to you and other shareholders as dividends. This can create a nice, steady income stream. It’s a fantastic way to dip your toes into the real estate market with the same ease as buying a stock.

Comparing Your Starting Options

To make it even clearer, here’s a quick rundown of how these choices stack up for a beginner.

| Investment Type | Best For… | Risk Level | The Gist | Real-Life Example |

|---|---|---|---|---|

| Individual Stocks | Hands-on investors who enjoy research and want to bet on specific companies they believe in. | High | You buy a direct slice of one company. Your fate is tied directly to its performance. | Buying shares of Apple (AAPL) because you believe in the future of the iPhone. |

| ETFs / Index Funds | Anyone looking for a simple, low-cost, and diversified foundation for long-term growth. The ideal starting point. | Medium | You buy a basket of stocks in one go, automatically spreading your money and risk across the market. | Buying an S&P 500 ETF (like VOO) to own a piece of the 500 largest U.S. companies. |

| REITs | People who want a piece of the real estate market without the hassle of tenants and toilets. | Medium-High | You invest in a company that owns properties. You get paid a portion of the rent collected. | Buying shares of a REIT like Prologis (PLD), which owns warehouses for companies like Amazon. |

Building Your First Smart Portfolio

Alright, now for the fun part: putting all the pieces together. Building your first portfolio isn't about picking a hot stock you heard about from a friend or trying to perfectly time the market's next move. It’s about creating a smart, balanced mix of investments that actually aligns with your life goals and can handle the market's inevitable mood swings.

This is where the concept of asset allocation becomes your secret weapon.

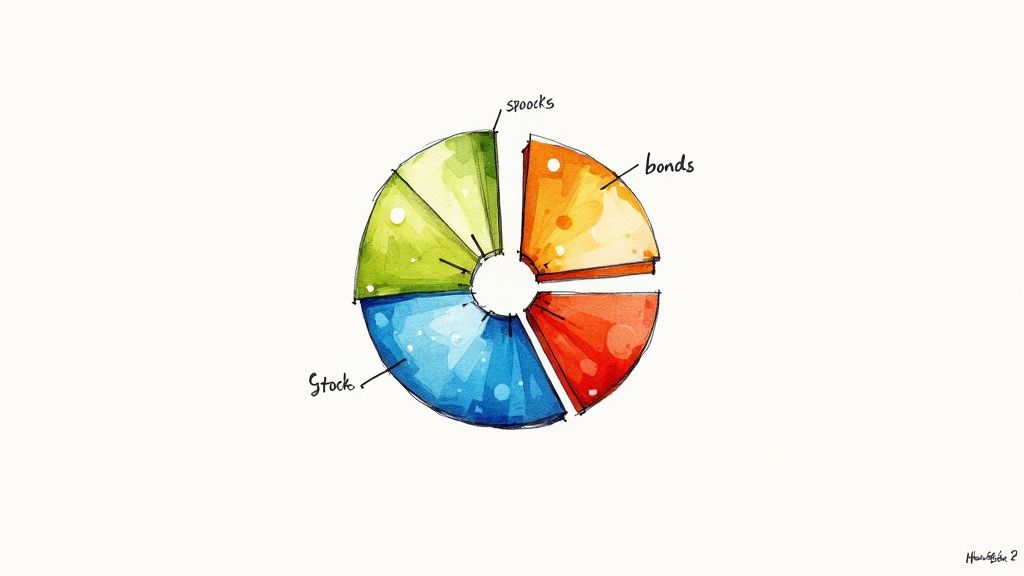

Think of it like building a championship sports team. You wouldn’t just sign 11 star quarterbacks, would you? Of course not. You need a solid defense, a reliable offense, and a few specialists to win games consistently. A strong investment portfolio works the same way, mixing different asset types—like stocks, bonds, and real estate—to create a strategy that's built to last.

The big idea driving this is diversification, which is simply your best defense against market craziness. When one asset class is having a bad year, another might be doing just fine, helping to smooth out your overall returns. It's the age-old wisdom of not putting all your eggs in one basket, applied to your money.

Aligning Your Portfolio with Your Real-Life Goals

Your investment mix should be a direct reflection of your timeline and what you're saving for. A portfolio for a 25-year-old socking money away for retirement in 40 years is going to look completely different from one for someone saving up for a house down payment in the next three.

To make this crystal clear, let's look at three practical models you can easily build yourself using just a couple of low-cost ETFs. These examples show just how simple it can be to get started.

| Portfolio Model | Risk Level | Best For | Sample ETF Allocation |

|---|---|---|---|

| The Conservative Mix | Low | Short-term goals (1-3 years), like saving for a new car or a big trip. The main goal here is to protect your money. | 40% Stocks (e.g., a total U.S. stock market ETF) 60% Bonds (e.g., a total U.S. bond market ETF) |

| The Moderate Blend | Medium | Mid-term goals (5-10 years), like a down payment or just steady, long-term growth without going overboard. | 70% Stocks (e.g., a mix of U.S. and international stock ETFs) 30% Bonds (e.g., a total bond market ETF) |

| The Aggressive Allocation | High | Long-term goals (10+ years), especially retirement. This approach is all about maximizing growth and has plenty of time to recover from dips. | 90% Stocks (e.g., a heavy allocation to U.S. and international stock ETFs) 10% Bonds (e.g., a small holding in a bond ETF) |

Think of these as starting templates, not strict rules. The key takeaway is that you can build any of these portfolios with just two or three simple, low-cost funds you can find on any major brokerage platform.

Finally, remember that your portfolio isn't something you set and forget forever. Your life will change, and so will your goals and comfort with risk. Checking in on your investments periodically and making small adjustments is key to long-term success. If you want to learn more about keeping your portfolio on track, our guide to portfolio rebalancing strategies walks you through exactly how to do it.

Expanding Your Horizons with Global Investments

If you really want to build a resilient portfolio, you can't just stop at your own country's borders. One of the smartest things you can do as a new investor is to start thinking globally from day one. Some of the most exciting companies and fastest-growing economies are outside the U.S., and you'll miss out on massive opportunities if you aren't looking.

But going abroad isn't just about chasing higher returns—it's one of the best diversification moves you can make. The truth is, international markets don't always move in the same direction as the U.S. market. That means when your domestic stocks are having a rough patch, your international holdings can act as a financial cushion, helping to smooth out the ride.

In our interconnected world, having this global perspective is no longer a "nice to have"; it's a necessity.

Why Global Diversification Really Matters

Let's be blunt: investing only in your home country is like only eating one type of food. You miss out on a whole world of flavors and nutrients. When you invest internationally, you're tapping into different economic cycles, unique consumer trends, and entire industries that might barely exist at home.

Watching where big money flows can also give you clues. In the first quarter of this year alone, global foreign direct investment (FDI) flows hit a staggering $297 billion. While the U.S. was the top dog, attracting $76 billion of that, it shows there's a ton of capital being put to work all over the world.

This is a classic example of why you can't put all your eggs in one basket. The market leader in one decade is rarely the winner in the next.

How to Easily Invest Internationally

The best part? You don't need a fancy offshore account or a deep understanding of foreign tax law to get started. For a beginner, the simplest and most effective way to invest globally is through a single, low-cost international ETF.

These funds are amazing because they give you instant diversification across thousands of companies in both developed and emerging markets, all in one shot.

Here are a couple of my go-to recommendations:

- Vanguard Total International Stock ETF (VXUS): A fantastic, widely-used fund that gives you broad exposure to pretty much every stock outside the U.S.

- iShares Core MSCI Total International Stock ETF (IXUS): Another excellent, low-cost choice that covers a massive range of international companies.

Just by adding one of these ETFs to your portfolio, you've achieved global diversification. It's a simple move, but it's a powerful one that can seriously strengthen your long-term strategy. To see how the biggest players invest on a global scale, take a look at our guide on what sovereign wealth funds are and why they matter.

Frequently Asked Questions (FAQ)

Even after mapping everything out, questions are bound to pop up. Let's tackle some of the most common ones beginners have.

1. How much money do I actually need to start investing?

You can start with as little as $1. Most modern brokers offer fractional shares, allowing you to buy a small piece of an expensive stock or ETF. The amount you start with is less important than building the habit of consistent investing.

2. What's the single best investment for a total beginner?

While there's no one-size-fits-all answer, a low-cost S&P 500 index fund or ETF is an excellent starting point. It provides instant diversification by spreading your money across 500 of the largest U.S. companies, making it a simple and historically reliable way to build wealth.

3. How often should I check my investments?

For long-term investors, checking too often can lead to emotional decisions like panic selling. A good rule is to review your portfolio quarterly or semi-annually. This is enough to ensure you're on track without getting caught up in daily market noise.

4. Should I invest a lump sum or invest regularly?

This is the "lump sum vs. dollar-cost averaging (DCA)" debate. While history shows lump-sum investing can yield slightly higher returns, DCA is often better for beginners. By investing a fixed amount regularly (e.g., $100 per month), you buy more shares when prices are low and fewer when they're high. It removes emotion and builds discipline.

5. What’s the difference between a stock and an ETF?

A stock represents ownership in a single company. An ETF (Exchange-Traded Fund) is a basket containing many different assets, often hundreds of stocks. For beginners, ETFs are ideal because they provide instant diversification and lower risk compared to betting on a single company.

6. Are robo-advisors a good idea for beginners?

Yes, they are a fantastic option. Robo-advisors use algorithms to build and manage a diversified portfolio based on your goals and risk tolerance. They are low-cost, automated, and handle complex tasks like rebalancing, making them perfect for a "set-it-and-forget-it" approach.

7. How do taxes work with investing?

When you sell an investment for a profit, you owe capital gains tax. If you hold an investment for more than a year, the profit is taxed at a lower long-term rate. If you hold it for a year or less, it's taxed at your higher, regular income rate. Investing in tax-advantaged accounts like a Roth IRA or 401(k) can significantly reduce your tax burden.

8. What happens if my brokerage firm goes bankrupt?

In the U.S., your investments are protected. Reputable brokerages are members of the Securities Investor Protection Corporation (SIPC), which insures your account up to $500,000 against the failure of the firm. Note that SIPC does not protect against market losses.

9. Should I pay off all my debt before I start investing?

It depends on the interest rate. Prioritize paying off high-interest debt (like credit cards with rates over 10%) before investing heavily. For low-interest debt (like a mortgage or federal student loan with rates under 6%), it often makes sense to pay it down on schedule while also investing simultaneously.

10. What is the biggest mistake a beginner can make?

The biggest mistake is not starting at all due to fear or analysis paralysis. The second biggest is panic selling during a market downturn. Successful investing is a long-term game; create a solid plan and stick to it through the market's ups and downs.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. Whether you're interested in stocks, real estate, or just getting started, our resources are designed to help you succeed. Explore our guides and start your journey today!