Financing an investment property isn’t quite like buying your own home. Lenders play by a different set of rules because, in their eyes, it’s a riskier bet. You’ll need more than just a decent credit score; they want to see a rock-solid financial profile built on a high credit score (think 740+), a low debt-to-income ratio, and a hefty pile of cash reserves for the down payment, which is typically 20-25%.

These aren’t just suggestions—they’re the key metrics lenders use to decide if you’re a safe investment for them.

In This Guide

- 1 Laying the Groundwork to Secure Your Loan

- 2 Navigating Traditional Financing Options

- 3 Exploring Creative and Alternative Financing

- 4 Mastering the Loan Application and Approval Process

- 5 Using Existing Assets to Fund Your Next Investment

- 6 Your Top 10 Questions About Financing an Investment Property, Answered

- 6.1 1. How Much Do I Really Need for a Down Payment?

- 6.2 2. Can I Actually Use Future Rent to Help Me Qualify?

- 6.3 3. Are the Interest Rates Higher on Investment Properties?

- 6.4 4. What’s the Real Difference Between a Hard Money and a Conventional Loan?

- 6.5 5. Is There a Limit to How Many Mortgaged Properties I Can Have?

- 6.6 6. Should I Bother with an LLC for My Rental Property?

- 6.7 7. What Kind of Credit Score Do Lenders Want to See?

- 6.8 8. They Keep Talking About ‘Reserves’. What Are They and How Much Do I Need?

- 6.9 9. Is It Really Possible to Get a Loan with No Money Down?

- 6.10 10. What Is This DSCR Loan I Keep Hearing About?

Laying the Groundwork to Secure Your Loan

Before you even start scrolling through property listings, the smartest move you can make is to get your own financial house in order. Lenders are much tougher on investors because if you hit a rough patch, the investment property mortgage is usually the first one people stop paying. Your job is to prove you’re the exception—a reliable, low-risk borrower they can count on.

This is about building a financial foundation so strong that lenders are not just willing, but eager, to offer you a loan with great terms.

Get Your Credit Score in Top Shape

When it comes to investment property loans, a credit score of 740 or higher is what you should be aiming for. It’s the gold standard. Sure, you might find a lender willing to work with a score in the high 600s, but a top-tier score is your ticket to a lower interest rate. That difference can easily save you thousands—sometimes tens of thousands—over the life of the loan.

If your score needs a little work, get focused on the basics:

- Never miss a payment. Your payment history is the biggest piece of the credit score puzzle.

- Pay down your credit card balances. A good rule of thumb is to keep your credit utilization below 30%.

- Hold off on new credit. Don’t apply for new car loans or credit cards right before you apply for a mortgage. Every “hard inquiry” can ding your score.

Keep a Close Eye on Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio is a huge deal for lenders. It’s a simple calculation: your total monthly debt payments divided by your gross monthly income. For investment properties, most lenders draw a line in the sand at a DTI of 43% or lower, and that includes the new mortgage payment you’re trying to get.

A low DTI sends a clear signal to lenders: you have plenty of cash flow to manage all your current bills plus a new mortgage, even if the property sits empty for a month or two.

Let’s look at a real-world scenario. Say an investor earns $6,000 a month before taxes. Their only debts are a $500 car payment and $200 in credit card minimums. Their DTI is a healthy 11.6%. If they add a new $1,500 mortgage, their DTI climbs to 36.6%, which is still comfortably in the safe zone.

But what if they had a second car payment of $400? Suddenly, their DTI jumps to 43.3%, pushing them just over the edge and into denial territory. Sometimes, paying off one small loan is all it takes to get an approval.

Build Up Your Cash Reserves

Forget about the low down payment options you see for first-time homebuyers. For an investment property, you need to bring serious cash to the table. Plan on putting down at least 20-25% of the purchase price. For a $300,000 property, that’s a down payment of $60,000 to $75,000.

And that’s not all. Lenders will also want to see that you have cash reserves—liquid money in a checking, savings, or money market account. This is your safety net to cover mortgage payments during vacancies or for when the water heater inevitably breaks. The standard requirement is six months of PITI (principal, interest, taxes, and insurance) for every property you own.

Before you get too far down the road, it’s a great idea to run the numbers. You can use this calculator to see if you can truly afford an investment property and get a handle on all the costs involved.

For most investors, the first stop on the financing journey is a traditional lender like a bank or credit union. This is the most well-worn path, and it usually leads to what’s known as a conventional investment property loan—the true workhorse of the industry.

But here’s the first thing you need to know: lenders see investment properties as a different beast than your primary home. To them, it’s a higher risk. Their thinking is pretty straightforward: if you hit a financial rough patch, you’re far more likely to miss a payment on a rental property than on the roof over your own head.

Because of this perceived risk, you’ll find the requirements are much stricter. Expect to bring a hefty down payment to the table, typically in the range of 20-25%. That chunk of equity gives the bank a comfortable cushion and makes them feel much more secure about the deal.

Conventional Loans: The Go-To For Experienced Investors

Let’s picture a seasoned investor, Sarah, who’s ready to add her fifth rental to her portfolio. It’s a single-family home listed at $300,000. When she walks into her local bank, the underwriting team will put her entire financial life under a microscope. They’ll look at her credit score (a solid 780), her debt-to-income ratio (comfortably below 40%), and her cash reserves.

With a proven track record and a strong financial profile, Sarah is a low-risk borrower. She gets approved, puts down 25% ($75,000), and locks in a 30-year fixed-rate mortgage. This is the classic scenario for investors who have the capital and financial discipline that lenders love to see.

Government-Backed Loans: A Smart Entry For Newcomers

On the flip side, government-backed loans can be a fantastic way for new investors to get in the game, especially if they’re open to living in the property for a while.

- FHA Loans: This is the quintessential “house hacking” loan. Imagine a first-timer, Alex, who wants to buy a duplex for $400,000. With an FHA loan, he might only need 3.5% down ($14,000). The only string attached? He has to live in one of the units for at least a year. The rent he collects from the other unit can help him qualify and will cover a huge chunk of his mortgage.

- VA Loans: For eligible veterans and active-duty service members, VA loans are a game-changer. It’s one of the few ways to get into real estate investing with almost no money out of pocket. An eligible borrower could buy a property with up to four units with zero down payment, as long as they live in one of them.

The key takeaway here is that these government programs are designed for owner-occupants. You can’t use them to buy a property you intend to rent out completely from day one.

While lending standards have been notoriously tight, there’s good news on the horizon. As of June 2025, only 9% of banks reported tightening their commercial real estate lending standards. That’s a massive drop from 67.4% in April 2023, signaling that credit is slowly but surely becoming more accessible again. For a deeper dive into these market trends, the 2025 outlook from Deloitte is a great read.

Before you jump into any applications, it’s absolutely crucial to run your numbers. Our investment property loan calculator is a great tool for getting a clear picture of your potential monthly payments and total costs. Knowing your numbers inside and out is the first step toward a successful investment.

Comparing Traditional Investment Property Loans

With several paths to choose from, it’s helpful to see how the most common loan types stack up against each other. This table breaks down the key differences to help you decide which financing option best aligns with your situation and investment goals.

| Loan Type | Typical Down Payment | Best For | Key Considerations |

|---|---|---|---|

| Conventional Loan | 20-25% | Experienced investors with strong financials and significant capital. | Stricter credit and DTI requirements; non-owner-occupied. |

| FHA Loan | 3.5% | First-time investors and “house hackers” buying multi-unit properties. | Must be owner-occupied for at least one year; mortgage insurance required. |

| VA Loan | 0% | Eligible veterans and service members looking to invest with no money down. | Must be owner-occupied; can be used for up to a 4-unit property. |

Each of these loans serves a different purpose. A conventional loan offers flexibility for seasoned investors, while FHA and VA loans provide incredible low-down-payment opportunities for those willing to live in their first investment. The right choice really depends on your personal finances, your long-term strategy, and whether you’re open to the owner-occupant requirement.

Exploring Creative and Alternative Financing

Sometimes the perfect deal comes along, but it just doesn’t fit into the neat little box required for a conventional loan. Maybe the property needs more work than a bank is willing to gamble on, or you need to close in ten days, not forty-five. This is where experienced investors get, well, creative.

When a traditional lender says “no,” it’s not always the end of the road. It often just signals the start of a different kind of conversation. The strategies below are all about flexibility, speed, and finding a win-win that works outside the standard banking system. They definitely require more hustle and due diligence, but they can open doors to opportunities you’d otherwise have to pass up.

Seller Financing: Where the Owner Becomes the Bank

With seller financing, you’re not trying to win over a loan officer—you’re working directly with the property owner, who essentially acts as your bank. You make payments straight to them based on terms you both agree on. This can be a game-changer, especially for properties owned free and clear by the seller.

Picture a retiring landlord with a duplex they’ve fully paid off. They might be more interested in a steady monthly check for the next few years than a huge lump sum that comes with a big tax bill. You could propose a deal where you provide a down payment and then send them principal and interest payments each month, just like a mortgage.

When you’re hashing out the details, you’ll want to negotiate a few key points:

- Down Payment: This is often much more flexible than a bank’s rigid 20-25% requirement.

- Interest Rate: It’s all up for negotiation, but it usually lands somewhere between prime bank rates and the higher rates of hard money.

- Loan Term: These deals are often shorter, maybe with a 5-year balloon payment. This gives you time to fix up the property, get tenants in, and then refinance with a traditional lender down the line.

Hard Money Loans for Speed and Opportunity

Hard money loans are the sprinters of the real estate financing world. They are short-term, asset-based loans offered by private companies or individuals. Here’s the key difference: unlike conventional lenders who pore over every detail of your personal finances, hard money lenders focus almost entirely on the property’s potential value—specifically its After Repair Value (ARV).

This makes them a perfect fit for fix-and-flip projects. Let’s say you find a distressed property for $150,000 that needs $50,000 in work and will be worth $300,000 once it’s renovated. A traditional bank would probably run the other way. A hard money lender, on the other hand, sees the opportunity and could fund the purchase and maybe even the repairs, letting you seize the deal.

The trade-off for this speed and flexibility is the cost. You can expect much higher interest rates, often in the 8-15% range, plus points (upfront fees). Hard money is a strategic tool for a quick-in, quick-out play, not a long-term hold.

These alternative financing methods are especially potent in a changing market. In 2024, the global real estate market bounced back significantly, with an 11% increase in deal value to $707 billion, a trend largely driven by more favorable financing conditions. You can discover more insights about these global real estate trends from JLL. For many investors, using creative strategies like hard money is essential for capitalizing on these kinds of opportunities.

Leveraging Private Money Lenders in Your Network

Private money is a close cousin to hard money, but it’s sourced from individuals you know—think friends, family members, or professional colleagues. Because these arrangements are built on personal relationships and trust, they can be even more flexible than institutional hard money. You might structure the deal as a simple interest-only loan, or you could even offer your lender an equity stake in the project.

For many investors, these creative financing options are a cornerstone of growth, especially when scaling a portfolio using strategies like the BRRRR method. To see how these funding types fit into a larger investment plan, check out our detailed guide on what the BRRRR method is and how it works.

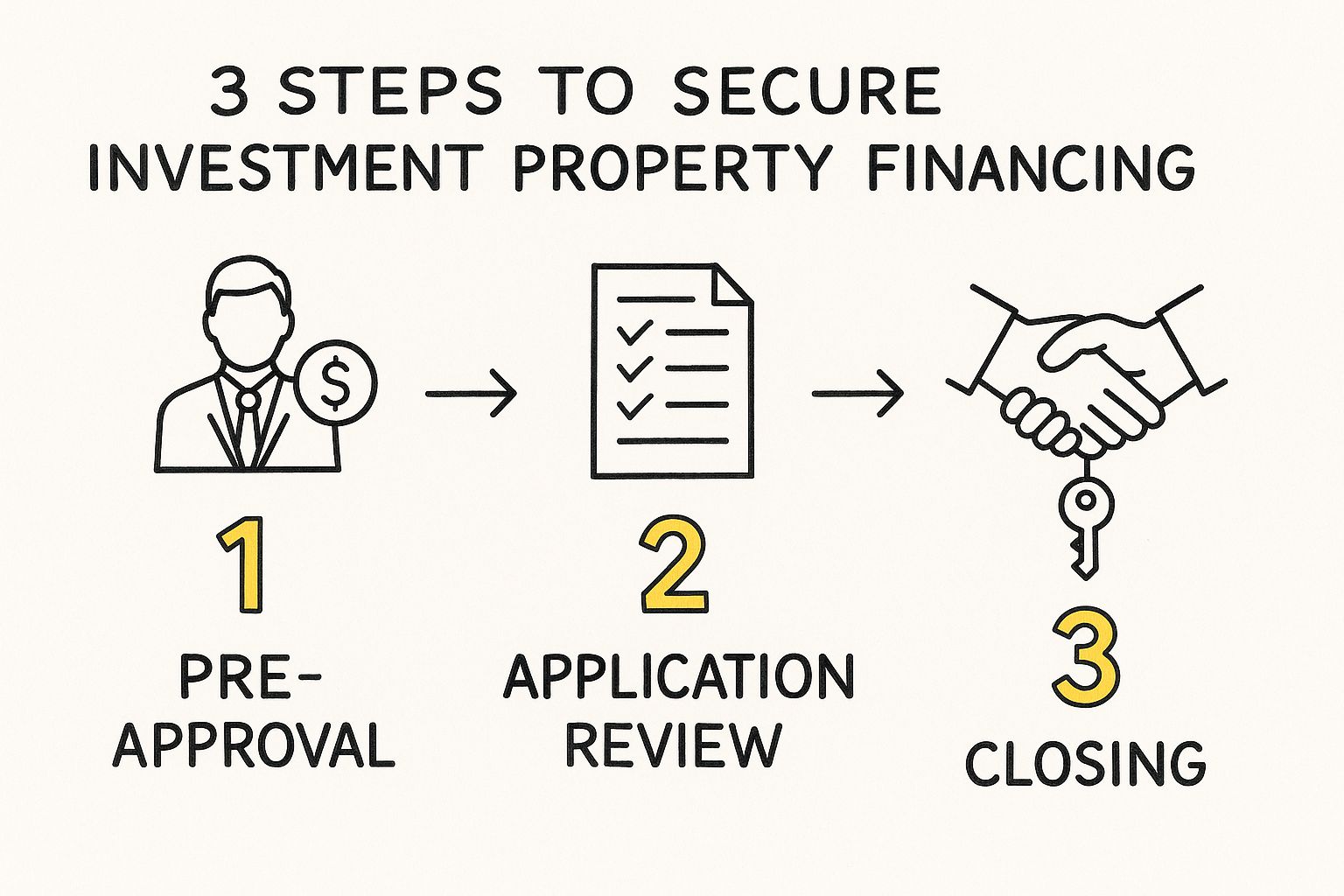

Mastering the Loan Application and Approval Process

So you’ve got your pre-approval letter in hand. That’s a great first step, but think of it as just the opening handshake. The real deep dive begins with the formal loan application and the underwriting process that follows. This is where lenders put every aspect of your financial life under a microscope to make sure both you and the property are a solid bet.

It can feel a little invasive, I know. But if you understand what they’re looking for, the whole experience becomes a lot less stressful. Lenders aren’t just ticking boxes; they’re meticulously building a risk profile. Your job is to hand them a clean, organized, and compelling file that leaves no room for doubt.

This visual breaks down the core stages you’ll go through, from that first conversation with a lender to finally closing the deal.

As you can see, it’s a logical path. You prove your financial stability, the lender reviews the deal, and then you head to the closing table. The application review is the crucial bridge that gets you from one side to the other.

Assembling Your Document Arsenal

When you officially apply for the loan, your loan officer is going to ask for a mountain of paperwork. Having everything ready to go from the start can shave days, or even weeks, off your timeline. The exact list can vary a bit between lenders, but you should count on needing these core documents:

- Proof of Income: Get ready to pull out at least two years of W-2s, your most recent pay stubs, and full federal tax returns (both personal and business, if you have one).

- Asset Statements: They’ll want to see several months of statements for every single account you have—checking, savings, investment, retirement—to verify you have the cash for the down payment and reserves.

- Existing Real Estate Portfolio: If you already own property, you’ll need a “real estate owned” or REO schedule. This is just a simple list detailing each property’s address, its estimated value, the current mortgage balance, and what it brings in for rent.

- The Purchase Agreement: A signed, finalized copy of the contract for the property you’re buying.

Walking into the process with all of this organized and ready to email over immediately shows the lender you’re a professional and serious borrower.

The Underwriter’s Perspective

Once your loan officer has all your documents, your complete file lands on an underwriter’s desk. This is the person who has the final say. Their entire job is to analyze the risk and give the green light (or the red one).

They will, of course, comb through your personal finances. But for an investment property, they’re just as interested in the asset itself. A huge piece of their analysis is the property’s income potential.

To figure this out, the appraiser will complete what’s called a Single-Family Comparable Rent Schedule, or Form 1007. This report looks at what similar properties in the area are renting for to establish a fair market rent for your new property. Here’s the key part: lenders typically only count 75% of this projected income to factor in things like vacancies and maintenance costs when they calculate your DTI. This rental income is the lifeblood of your investment, directly impacting your bottom line. You can learn more about why cash flow management is crucial for wealth building in our guide on the topic.

An appraisal that comes in below the purchase price can feel like a disaster, but it doesn’t have to kill the deal. You have options. You can challenge the appraisal by providing your own comparable sales, try to renegotiate a lower price with the seller, or, if you have the funds, simply bring more cash to closing to cover the gap.

Using Existing Assets to Fund Your Next Investment

One of the smartest moves seasoned investors make is using the properties they already own to fuel their next purchase. Your primary residence or existing rentals can be a goldmine of capital, and tapping into that equity means you can fund a down payment without draining your savings. It’s a classic strategy for scaling a portfolio.

Two of the most popular ways to do this are with a cash-out refinance or a Home Equity Line of Credit (HELOC). They both unlock your property’s value, but they work in completely different ways and are better suited for different situations.

Tapping into Equity with a Cash-Out Refinance

Think of a cash-out refinance as hitting the reset button on your mortgage, but with a bonus. You replace your current home loan with a new, bigger one and pocket the difference in cash.

Let’s walk through a real-world scenario.

An investor, Maria, has a home valued at $500,000 and she’s paid the mortgage down to $250,000. She’s found a great rental property and needs $50,000 for the down payment.

- She applies for a new mortgage of $300,000.

- The first $250,000 of that new loan immediately pays off her old mortgage.

- The extra $50,000 is wired directly to her bank account, ready to be used for her investment.

The beauty of this method is its predictability. You get a lump sum of cash at a fixed interest rate, which makes budgeting for a specific purchase straightforward.

Using a Flexible HELOC for Opportunities

A Home Equity Line of Credit (HELOC) is a totally different beast—it works a lot like a credit card. Instead of getting a one-time payout, a lender gives you a revolving credit line secured by your property that you can tap into whenever you need it.

A HELOC is an excellent tool for opportunistic buys or funding renovations. It gives you a ready-to-use source of capital, allowing you to act quickly when a great deal appears without having to re-apply for a new loan each time.

You only pay interest on the money you actually draw, and during the initial “draw period,” many HELOCs offer interest-only payments. This flexibility is why so many investors love it for having funds on standby. Once you’ve deployed the funds from a HELOC, remember to look into the tax advantages available. You can learn more about common property investment tax deductions.

Of course, using leverage isn’t free. With construction costs on the rise and debt costs in the United States not dropping as quickly as hoped at the start of 2025, it’s more important than ever to run your numbers carefully. You can discover more insights about these private market trends to stay informed.

Your Top 10 Questions About Financing an Investment Property, Answered

Jumping into real estate investing is exciting, but the financing side can feel like a maze of new terms and rules. I get these questions all the time from both new and seasoned investors. Here are straightforward answers to the ten most common things people ask, drawn from years of experience in the field.

1. How Much Do I Really Need for a Down Payment?

Let’s cut to the chase: for a conventional loan on a pure investment property, plan on putting down at least 20%. In today’s tighter lending environment, many banks are actually looking for 25%.

They see rentals as riskier than your own home, so they want you to have more skin in the game. The one popular exception is “house hacking”—if you buy a multi-unit property (2-4 units) with an FHA loan and live in one of the units, your down payment could be as low as 3.5%.

2. Can I Actually Use Future Rent to Help Me Qualify?

Yes, and it’s a critical piece of the puzzle for most investors. Lenders know the property will generate income, and they’ll let you use it to qualify.

Here’s the rule of thumb: they will typically count about 75% of the property’s gross rental income. That 25% haircut is their way of accounting for inevitable vacancies, repairs, and other hiccups. To prove the income, you’ll either need a signed lease agreement for an already-rented property or a formal rental schedule (Form 1007) from the appraiser, which projects the fair market rent.

3. Are the Interest Rates Higher on Investment Properties?

They are. Don’t be surprised when your rate comes back 0.50% to 1.00% higher than the mortgage rate on your primary home.

It’s all about perceived risk. From a lender’s perspective, if someone hits a rough financial patch, they’ll fight to keep their own home but might be quicker to let an investment property go. That statistical risk is priced directly into your interest rate.

4. What’s the Real Difference Between a Hard Money and a Conventional Loan?

Think of it as a sprint versus a marathon.

- Conventional loans are the marathon. They’re long-term (usually 15-30 years) from a traditional bank. The approval process is slow and meticulous, digging deep into your credit, income, and debt-to-income ratio.

- Hard money loans are the sprint. They’re short-term (think 6-24 months) and come from private lenders. They care less about your personal finances and almost entirely about the property itself—the “hard asset.” Approval is incredibly fast, but you’ll pay for that speed with much higher rates and fees. It’s a tool built for quick flips, not long-term holds.

5. Is There a Limit to How Many Mortgaged Properties I Can Have?

For most investors starting out, the magic number is 10. This is the limit set by the big players, Fannie Mae and Freddie Mac, who back most conventional loans.

Be aware, though, that the climb gets steeper after your fourth property. Lenders will demand higher credit scores and more cash reserves for each subsequent loan. Once you’re ready to scale past 10 properties, you’ll graduate to working with portfolio lenders or commercial banks who operate by a different set of rules.

6. Should I Bother with an LLC for My Rental Property?

This is a classic “it depends” situation, but it’s a crucial one. An LLC is fantastic for protecting your personal assets—if a tenant sues, they can go after the LLC’s assets, not your personal home or savings. That’s a huge plus.

However, getting financing can be a headache. Most conventional lenders won’t lend to an LLC; they want to lend to a person. That means you’ll likely be pushed toward a commercial loan, which often has less favorable terms. A common strategy is to buy the property in your own name first and then transfer the title to an LLC. Just be sure to check with your lender and a lawyer about the “due-on-sale” clause, which could theoretically cause problems.

Expert Insight: An LLC can be a powerful shield, but the financing hurdle is real. My advice? Don’t make this decision in a vacuum. Have a serious conversation with both a real estate attorney and your mortgage broker to weigh the pros and cons for your specific financial picture.

7. What Kind of Credit Score Do Lenders Want to See?

While it might be technically possible to get approved with a credit score in the 640s, it’s going to be a tough and expensive ride. To get the best terms and a smooth approval process, you really want to aim for a score of 740 or higher.

Lenders are simply much more cautious with investment properties. A stellar credit score is your best signal that you’re a reliable, low-risk borrower they can trust.

8. They Keep Talking About ‘Reserves’. What Are They and How Much Do I Need?

“Reserves” is just lender-speak for the cash you have left in the bank after you’ve paid your down payment and all closing costs. They need to see that you have a safety net.

What if your new property sits vacant for a few months? They want to know you can still make the mortgage payments. For a single investment property, the standard requirement is at least six months’ worth of PITI (principal, interest, taxes, and insurance) sitting in a liquid account like your checking or savings.

9. Is It Really Possible to Get a Loan with No Money Down?

With a traditional lender for a standard investment property? It’s pretty much a myth. The days of 0% down investment loans are long gone.

The most practical low-down-payment strategy is house hacking a 2-4 unit property with an FHA or VA loan. Outside of that, any “no money down” deal you hear about involves creative strategies that happen outside of a bank, like:

- Seller financing

- Partnering with someone who brings the cash

- Assuming the seller’s existing mortgage

10. What Is This DSCR Loan I Keep Hearing About?

A Debt Service Coverage Ratio (DSCR) loan is a game-changer for many self-employed investors or those scaling a large portfolio.

With these loans, the lender is less concerned with your personal pay stubs and tax returns. Instead, they focus on one simple question: does the property’s rental income cover the mortgage payment? A DSCR above 1.0 means the property pays for itself. This allows you to qualify based on the asset’s performance, not your W-2 income.

Ready to build your wealth through smart investments? At Top Wealth Guide, we provide the insights and strategies you need to succeed in real estate, stocks, and more. Explore our resources today at https://topwealthguide.com.

1 Comment

Pingback: Real Estate Investment Calculator: The Ultimate Guide to Smart Property Analysis