Building generational wealth isn’t about some secret formula or a lucky break. It’s a deliberate process, one that hinges on three critical components: growing your assets through smart investing, protecting them with savvy estate planning, and, most importantly, teaching the next generation how to keep the legacy alive.

Think of it less as a one-time event and more like building a robust financial engine for your family’s future.

In This Guide

A Practical Blueprint for Your Family’s Legacy

Crafting a financial legacy that stands the test of time is more achievable than you might think. It’s not a privilege reserved for the ultra-wealthy. At its core, it’s about a fundamental shift in perspective—moving away from chasing short-term gains and embracing long-term stewardship.

This journey is built on a bedrock of solid financial habits, disciplined investing, and a proactive approach to protecting everything you’ve worked so hard to build. By focusing on these key areas, you’re not just saving money; you’re creating a powerful system for growth that can support your family for generations.

The Three Foundational Stages

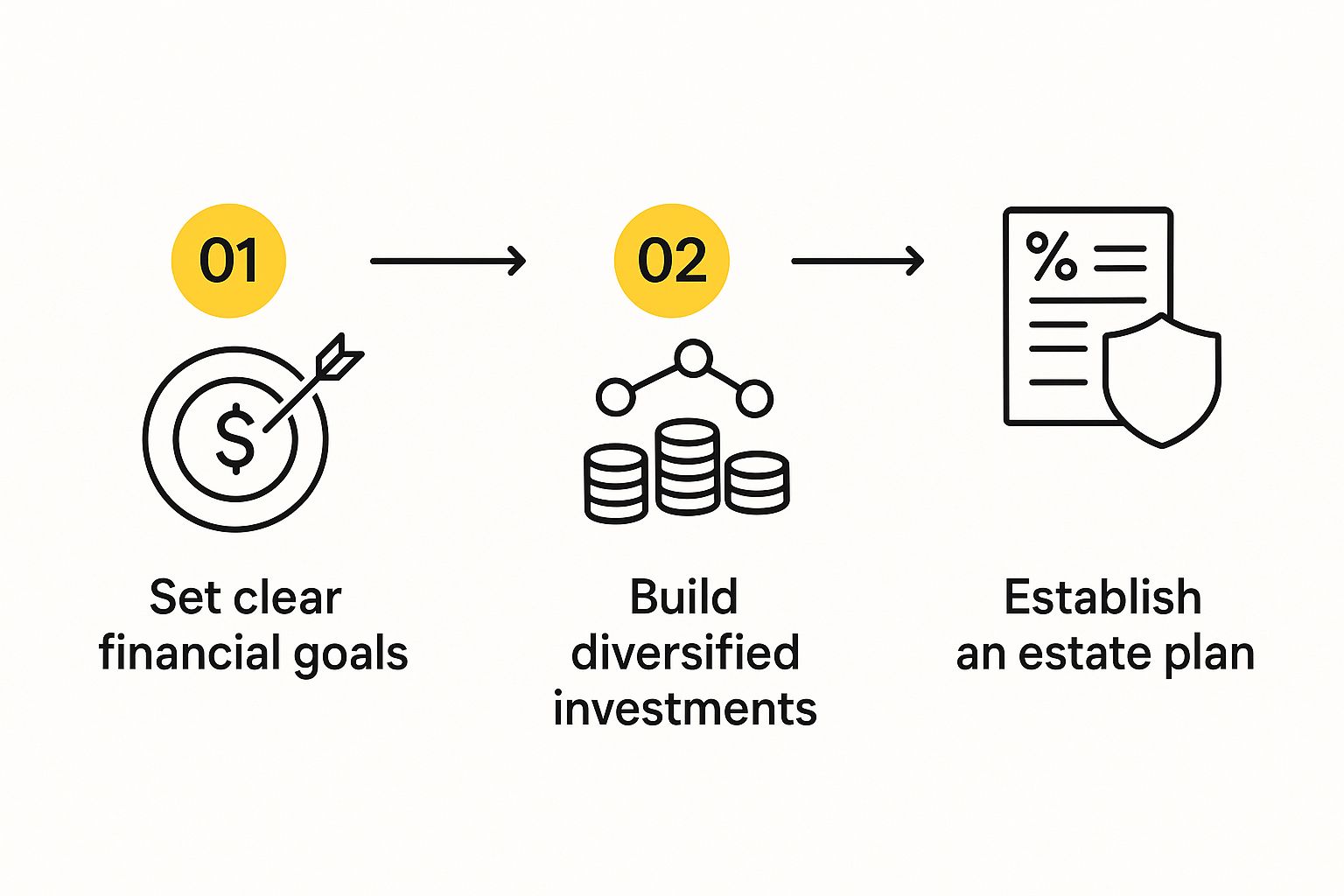

You can break down the path to generational wealth into three distinct, manageable stages. This simple flow illustrates the core steps: defining your goals, building your investments, and establishing your estate plan.

As you can see, each step builds on the one before it, creating a strategy that’s both comprehensive and sustainable. If you want to dive deeper into the overarching principles, you can check out The Financial Freedom Blueprint: Free Wealth Guide for a more detailed look.

Core Pillars of Generational Wealth Creation

To get a clearer picture of how these stages play out in the real world, it helps to break down the key actions for each pillar. The table below gives you a quick summary of the foundational components needed to not only build but also sustain wealth across generations.

| Pillar | Objective | Key Actions |

|---|---|---|

| Strategic Investing | To grow assets faster than inflation and build a substantial nest egg. | Consistently invest in a diversified portfolio of stocks, real estate, and other growth assets. Let compound interest work its magic over decades. |

| Asset Protection | To safeguard your wealth from taxes, creditors, and life’s curveballs. | Set up legal structures like trusts and wills. Get the right insurance (life, liability) to shield against potential risks. |

| Financial Education | To prepare the next generation to manage, preserve, and grow the family’s wealth wisely. | Teach the principles of budgeting, investing, and responsible stewardship. Involve heirs in financial decisions in age-appropriate ways. |

This framework provides a clear roadmap. Each pillar supports the others, creating a resilient structure designed for the long haul.

The real goal isn’t just to pass down money, but to transfer knowledge and values. Shocking statistics show that nearly 70% of wealthy families lose their fortune by the second generation, often because the heirs simply weren’t prepared to manage it.

Growing Your Wealth with Strategic Investments

If you want to build wealth that lasts for generations, strategic, consistent investing is the engine that will get you there. It’s what turns your savings from a static pile of cash into a dynamic asset that works for you around the clock.

This isn’t about trying to time the market—a game even the pros rarely win. It’s about time in the market.

At the heart of this strategy is the almost magical force of compound interest. This is where the returns your investments earn start generating their own returns. It’s a slow burn at first, but over decades, it can transform modest, regular contributions into a truly substantial fortune. The only real trick is to start as early as you can and stick with it.

The Power of a Long-Term Perspective

One of the biggest mistakes I see new investors make is reacting emotionally to the market’s daily mood swings. Watching your portfolio drop during a downturn can be gut-wrenching, but a long-term mindset completely reframes these events. Instead of moments of panic, you start to see them as potential buying opportunities.

Let’s look at a real-world scenario to see how this plays out.

Imagine Maria, a disciplined investor. At age 30, she starts putting $500 a month into a simple, low-cost S&P 500 index fund. She doesn’t stop, investing through bull markets and bear markets alike.

Fast forward 30 years. Assuming an average annual return of 8%, by the time Maria is 60, her total investment of $180,000 has snowballed into roughly $734,000. The most incredible part? Over half a million dollars of that wealth came from compound growth, not her own contributions.

Maria didn’t need a huge lump sum to get started. She just needed a plan and the discipline to follow it. This long-haul focus is the bedrock of building a real legacy. For a deeper dive into creating a durable financial plan, our guide on how to effectively manage your wealth for long-term growth is an excellent resource.

Choosing Your Investment Vehicles

A strong portfolio isn’t built on a single investment. Diversifying your money across different types of assets is crucial for managing risk and smoothing out the inevitable bumps along the road.

Choosing the right investment vehicles is a personal decision, but some are better suited for long-term wealth building than others. Understanding the trade-offs between risk and potential growth is key.

Investment Vehicle Comparison for Wealth Builders

The table below breaks down a few common options to help you see how they stack up.

| Investment Vehicle | Typical Risk Level | Growth Potential | Best For |

|---|---|---|---|

| Low-Cost Index Funds/ETFs | Low to Medium | High | Hands-off investors seeking broad market exposure and diversification at a low cost. |

| Rental Real Estate | Medium to High | High | Investors comfortable with active management who want cash flow, appreciation, and tax benefits. |

| Dividend-Paying Stocks | Medium | Medium to High | Those seeking a steady income stream in addition to capital appreciation from established companies. |

| Alternative Investments (e.g., REITs, Private Equity) | High | Very High | Sophisticated investors who understand the higher risks and longer time horizons involved. |

Ultimately, the best strategy is often a blend of these approaches, tailored to your risk tolerance, capital, and how actively you want to manage your assets.

A Practical Example of Diversification

Let’s put this all together with another real-world case. The Johnson family wants to build a financial foundation for their two children. They have a moderate risk tolerance and decide to spread their investments across a few key areas.

Here’s what their strategy looks like:

- Stock Market Foundation: They set up automatic investments of $1,000 per month into their tax-advantaged retirement accounts. They split this between a total stock market index fund (70%) and an international stock index fund (30%).

- Real Estate Anchor: After a few years of saving, they buy a duplex. By living in one unit and renting out the other, the rental income covers most of their mortgage payment, allowing them to build equity and generate cash flow.

- Future-Focused Education: They open 529 college savings plans for each child, contributing $200 per month to each. These funds will grow tax-free for future educational costs.

This multi-pronged approach doesn’t depend on any single asset class to succeed. The stock portfolio drives long-term growth, the real estate provides income and appreciation, and the 529 plans target a specific future goal. This is a classic, effective model for building wealth that can last for generations.

Protecting Your Assets with Smart Estate Planning

Growing a substantial nest egg is a monumental achievement, but honestly, it’s only half the job. The other, often-neglected half is making sure that wealth actually survives to be passed down. This is where smart estate planning stops being a “someday” task and becomes an absolute must-do.

Without a solid plan in place, the wealth you’ve worked a lifetime to build can get chewed up by taxes, legal battles, and even family squabbles. Think of your estate plan as the financial fortress you build around your assets, ensuring they get where you want them to go with as little drama as possible.

The Essential Tools for Asset Protection

At its core, estate planning is simply about creating a clear set of instructions for managing and distributing your assets. While there are many tools available, three are absolutely foundational: the will, trusts, and powers of attorney. Each one plays a distinct, critical role.

- Last Will and Testament: This is your baseline document. It outlines who gets your property and, importantly, lets you name a guardian for your kids. The big downside? A will has to go through probate, which is a public, often slow, and sometimes costly court process.

- Powers of Attorney: These documents are your lifeline while you’re still here. A durable power of attorney for finances lets a trusted person handle your money if you can’t. A healthcare power of attorney (or proxy) allows someone to make medical decisions for you. Don’t leave home without them.

- Trusts: This is where the real power lies. A trust is a legal entity that holds assets on behalf of your beneficiaries. The game-changer is that assets in a trust typically skip probate entirely, making the transfer of wealth private, fast, and seamless.

A well-structured estate plan does more than just distribute assets. It preserves family harmony by leaving clear, legally binding instructions, preventing the kind of ambiguity that can lead to devastating family conflicts.

Revocable vs. Irrevocable Trusts: A Clear Comparison

Trusts are a cornerstone of any serious wealth transfer strategy, but they aren’t one-size-fits-all. The two main types are revocable and irrevocable, and picking the right one comes down to what you’re trying to achieve.

A revocable living trust is all about flexibility. You can change it, move assets in and out, or even get rid of it completely while you’re alive. Its main purpose is to keep you in control while avoiding probate.

On the other hand, an irrevocable trust is a commitment. Once it’s set up, you generally can’t change it. So why give up control? Because it offers major advantages in asset protection, shielding wealth from creditors and often helping to reduce future estate taxes.

Here’s a simple breakdown of the key differences:

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | High—you can change it at any time. | Low—cannot be easily changed or revoked. |

| Probate Avoidance | Yes | Yes |

| Asset Protection | Limited—assets are still considered yours. | High—assets are legally owned by the trust. |

| Estate Tax Reduction | No | Yes—can remove assets from your taxable estate. |

| Best For | Maintaining control and avoiding probate. | Maximizing asset protection and tax efficiency. |

A Real-Life Scenario: How a Trust Protects a Legacy

Let’s look at a real-world example. The Miller family owned a successful small business and a few rental properties. Working with their advisor, they created an irrevocable trust and moved the ownership of the business and properties into it. A few years later, an unexpected lawsuit threatened their personal assets.

Because their most valuable assets were legally owned by the trust, they were completely shielded from the lawsuit’s claims. When the Millers passed away, the successor trustee they had named took over management seamlessly, distributing income to their children exactly as the trust dictated—no court, no delays, no public record. This single move not only protected their life’s work but also ensured the family business continued without a hitch.

Understanding how to invest for generations means recognizing that your legacy matters more than ever, and proactive planning is what makes it last.

The urgency for this kind of planning is hitting a critical point. We are on the cusp of a monumental financial shift, with a projected USD 83 trillion set to move from baby boomers to younger generations over the next two decades. For a deeper dive into this incredible transfer of wealth, you can explore the findings of the 2025 UBS Global Wealth Report.

Passing Down More Than Just Money

Building a fortune is one thing; making sure it lasts is a whole different ball game. It’s a hard pill to swallow, but an inheritance handed over without financial wisdom is often just a countdown to zero. The data is sobering: a staggering 70% of wealthy families lose their fortune by the second generation. By the third, that number jumps to 90%.

That statistic tells a story every family should hear. The greatest asset you can pass down isn’t the money in the bank—it’s the knowledge and discipline that built it. Without a real grasp of stewardship, budgeting, and smart investing, even a massive inheritance can evaporate surprisingly fast.

The mission isn’t just about transferring assets. It’s about transferring the mindset.

Start the Money Talk Sooner Than You Think

Financial education isn’t a conversation you have once your kids are adults. By then, their financial habits are mostly set in stone. The real work begins much earlier, with small, age-appropriate lessons that build a solid foundation of financial responsibility.

You can start by simply being more open about everyday family finances. I’m not talking about laying out your entire portfolio on the dinner table. It’s about involving them in discussions about the household budget, explaining the real cost of a family vacation, or talking through why you choose one brand over another at the grocery store.

Little conversations like these make money a normal, less mysterious topic. They subtly shift the family narrative from “what we own” to “how we manage what we’ve been given,” and that distinction is everything.

Get Their Hands Dirty with Real-World Practice

Talking about money is a good first step, but experience is the best teacher. You need to give the next generation a safe place to learn, practice, and even make small mistakes when the stakes are low.

Here are a few practical ways to do that:

- Open a Custodial Investment Account (UGMA/UTMA): These accounts let you invest for a minor. Sit down with them and go over the statements. It’s the perfect way to teach them firsthand about market ups and downs, the magic of dividends, and the incredible power of compounding over time.

- Match Their Roth IRA Contributions: As soon as your teen lands their first job, make them an offer they can’t refuse: match what they contribute to a Roth IRA. This drives home the importance of tax-advantaged saving and the discipline of “paying yourself first” from day one of their working life.

- Involve Them in Family Giving: Deciding together which charities to support teaches an invaluable lesson about purpose. It helps frame wealth not just as a tool for personal comfort, but as a resource for making a meaningful impact on the world.

These hands-on activities are crucial for building a sense of stewardship. They help your children see themselves as caretakers of the family’s legacy, not just as future beneficiaries waiting for a payout.

True generational wealth is more than a number in a bank account. It’s a shared set of values that guides financial decisions, ensuring the legacy endures not just for personal gain but for the family’s collective purpose and impact.

Create Your Family’s Financial North Star

One of the most powerful things you can do is sit down and create a family mission statement. This isn’t about spreadsheets and stock tickers; it’s a document that captures your family’s core values and long-term vision. For some great ideas on getting started, check out our guide on how to define wealth beyond money and possessions.

This statement should answer the big questions: What is the purpose of our wealth? What principles will we always stand by? How will we use our resources to lift up our family and our community? Putting these ideas on paper creates a north star for future generations, helping them make choices that honor the family’s enduring legacy.

Using Advanced Tax and Business Strategies

Once you’ve got your core wealth-building engine humming along, it’s time to shift gears. This is where we move into the more sophisticated strategies that do more than just grow your wealth—they build a fortress around it, shielding your assets from the corrosive effects of taxes over decades.

These tactics are especially critical for families with more complex finances, like a successful family business or a sprawling investment portfolio. Mastering these moves is the difference between simply making money and strategically keeping it for the generations that follow.

Optimizing Investment Gains with Tax-Loss Harvesting

Every single investor has losers in their portfolio. It’s unavoidable. But the smart ones know how to turn those losses into a win. That’s the whole idea behind tax-loss harvesting, a simple yet powerful technique where you sell an investment at a loss specifically to offset the taxes you owe on your winners.

Here’s how it works. Let’s say you sold some stock this year and locked in a $10,000 capital gain. Meanwhile, another one of your holdings is down $8,000. By selling that underperforming asset, you can use the $8,000 loss to wipe out most of your gain, leaving you with a taxable gain of only $2,000.

It’s a proactive maneuver that keeps more of your capital in the market and working for you. Yes, it takes some careful tracking, but the long-term tax savings can be massive, easily adding up to thousands of dollars over the years.

Tax-loss harvesting isn’t about trying to dodge market downturns. It’s about finding the silver lining when they happen, turning a temporary setback into a permanent improvement in your portfolio’s tax efficiency.

Comparing Wealth Transfer Vehicles

As your net worth climbs, how you plan to pass it on becomes just as important as how you built it. Just handing over cash or property can trigger surprisingly large tax bills for your heirs. The good news is there are specific financial tools designed to transfer wealth with minimal tax friction. The right one for you really boils down to your goals around control, tax savings, and overall simplicity.

| Transfer Vehicle | Primary Tax Benefit | Control Level for Giver | Best For |

|---|---|---|---|

| Direct Gifting (Annual Exclusion) | Tax-free up to an annual limit per recipient. | Low (once it’s gifted, it’s theirs). | Simple, smaller transfers to children or grandkids for immediate needs. |

| Permanent Life Insurance | Tax-free death benefit to heirs; tax-deferred cash value growth. | High (the policy owner is in the driver’s seat). | Providing instant cash for estate taxes and guaranteeing a tax-free inheritance. |

| Irrevocable Trust | Removes assets from the taxable estate, slashing the final estate tax bill. | Low (the trust legally owns the assets). | Protecting major assets like a business or real estate from taxes and creditors. |

Case Study: A Family Business Succession Plan

Let’s look at a real-world example. The Chen family spent 30 years building a successful manufacturing business from the ground up. Their goal was to pass it to their daughter, Sarah, but they were terrified she’d be forced to sell off pieces of it just to cover the estate tax bill. So, they put a smart, multi-layered plan in place.

First, they set up an irrevocable life insurance trust, or ILIT. This trust then bought a large life insurance policy on the parents, with the trust itself named as the beneficiary. This was a crucial move because it meant the eventual death benefit would be paid outside of their taxable estate.

At the same time, they started gifting shares of the company to Sarah each year, staying within the annual gift tax exclusion to avoid taxes. This allowed them to gradually transfer ownership while they were still around to guide her.

What was the result? When the parents eventually passed away, the tax-free insurance proceeds flowed directly into the trust, providing all the cash needed to settle the estate taxes. Sarah inherited the family business intact and debt-free, securing the Chen family legacy for another generation. It’s a perfect illustration of how proactive planning preserves generational wealth. If you want to run some numbers for your own situation, our collection of wealth tools and calculators is a great place to start.

Got Questions About Building Generational Wealth? You’re Not Alone.

Starting the journey to build a legacy that outlasts you is a big deal, and it’s natural for questions to pop up. It’s a path filled with critical decisions about money, family, and the future. Let’s tackle some of the most common things people ask, so you can move forward with confidence.

Think of this as a candid conversation where we cut through the noise and get to the heart of what really matters.

Getting Started and Sidestepping the Big Mistakes

So many people get stuck before they even start. They worry they don’t have enough capital or that they’ll make a huge mistake. But honestly, the biggest risk isn’t in the market—it’s in the planning. Or rather, the lack of it.

Success often comes down to your mindset. Are you just accumulating money, or are you building a true legacy? There’s a world of difference.

| Aspect | The Builder’s Mindset (Successful) | The Accumulator’s Mindset (Risky) |

|---|---|---|

| Primary Focus | Long-term stewardship, growth, and education. | Short-term asset accumulation and market returns. |

| Heir Preparation | Proactive financial education and involvement. | Assumes heirs will figure it out; money is kept secret. |

| Estate Planning | Integrated into the strategy from the beginning. | Seen as an afterthought or something to do “later.” |

| Legacy Definition | Values, knowledge, and purpose, supported by assets. | Primarily defined by the dollar amount passed down. |

This table hits on the single biggest mistake I see: people focus entirely on growing the pile of money, with zero plan for what happens next. Without a solid estate plan and some real-world financial education for your heirs, even a fortune can vanish in a generation.

Nailing Down Your Investment Strategy

Once you’re committed, the conversation naturally shifts to the “how.” What assets should you buy? How do you protect them? Do you need a professional?

Both real estate and the stock market are fantastic engines for wealth creation, and the smartest strategies usually blend the two. Stocks offer incredible diversification and liquidity, while real estate brings tangible assets, cash flow, and some sweet tax benefits to the table. A portfolio with a healthy mix of both is built to last.

It also helps to see where you stand. The average wealth per adult varies wildly across the globe. By 2025, Switzerland is projected to lead with USD 687,166 per adult, with the United States not far behind at USD 620,654. This isn’t about comparison; it’s about understanding the powerful economic environments we have access to. You can discover more insights about global wealth distribution on Visual Capitalist to see how different countries stack up.

A qualified financial advisor, especially a Certified Financial Planner (CFP), can be a game-changer. They’re the objective third party who can pull your investments, insurance, and estate plan into a single, cohesive strategy. That kind of perspective can save you from making incredibly expensive mistakes.

The Human Side: Family, Heirs, and Legacy

This is where things get tricky. How do you talk about wealth without breeding entitlement? It’s all about framing. Shift the conversation from luxury to responsibility and stewardship.

Get your kids involved in age-appropriate ways. Let them help budget for the family vacation or have a say in which charity receives a donation. These small lessons teach them the purpose behind the money, which is far more valuable than the money itself.

This is also where a trust becomes one of your most powerful tools. It’s a legal structure that holds assets for your beneficiaries, giving you control over how and when the money is distributed, even long after you’re gone. It’s a shield that protects the wealth from creditors, lawsuits, and frankly, a beneficiary’s own bad habits, all while keeping your family’s affairs out of the public probate courts.

Top 10 Frequently Asked Questions Answered

To wrap it up, here are some quick-fire answers to the questions I hear most often.

1. How much money do I need to start building generational wealth?

Forget about a “magic number.” It’s about habits, not a starting balance. The real key is starting early and being consistent. Thanks to the power of compound interest, even small, regular investments can balloon into a significant nest egg over time. Just focus on spending less than you earn and investing the difference.

2. What’s the biggest mistake people make?

Hands down, it’s focusing only on asset accumulation while ignoring preservation and transfer. People work their whole lives to build wealth but drop the ball on estate planning (wills, trusts) and educating their heirs. That’s how a legacy gets wiped out by taxes, legal battles, or just plain bad decisions from the next generation.

3. Real estate or the stock market? Which is better?

Why not both? A smart strategy uses a mix. The stock market gives you liquidity and easy diversification through things like ETFs. Real estate provides tangible assets, potential cash flow, and tax advantages. A portfolio that holds both is far more resilient than one leaning too heavily on either.

4. How do I talk to my kids about money without making them entitled?

Frame it as stewardship, not privilege. It’s about the responsibility that comes with resources. Involve them in financial decisions that are age-appropriate—reviewing a utility bill, planning a budget for a trip, choosing a charity. Show them the purpose of the wealth is to create opportunity, not just to buy stuff.

5. What role does life insurance play?

Permanent life insurance can be a strategic tool. Its main perks are a tax-free death benefit for your heirs—providing instant cash to cover estate taxes—and a cash value component that grows tax-deferred. It guarantees a certain amount of wealth gets transferred, no matter what the market is doing.

6. Should I hire a financial advisor?

You don’t have to, but a good one—especially a Certified Financial Planner (CFP)—is worth their weight in gold. They bring an objective eye to help you weave investments, insurance, and estate planning into one coherent plan, helping you sidestep pitfalls you might not even see coming.

7. What is a trust and why do I keep hearing about it?

A trust is a legal entity you create to hold your assets for a beneficiary. It’s a cornerstone of generational wealth because it lets you dictate exactly how and when your assets are distributed after you’re gone. It protects the inheritance from creditors, lawsuits, and divorce, all while avoiding the costly and public process of probate court.

8. How do I protect our family’s wealth from inflation?

You have to own assets that grow faster than inflation. Historically, that means stocks (equities) and real estate. The absolute worst thing you can do is hold too much cash, as its buying power gets eaten away every single year. A diversified growth portfolio is your best defense.

9. Is a family business a good way to create generational wealth?

Absolutely. A thriving business can be one of the most powerful wealth-creation engines. But—and this is a big but—it must have a rock-solid succession plan. Without one, the business and the wealth it represents often die when the founder steps away.

10. What are the first three things I should do today?

First, figure out your net worth and create a budget to see where your money is going. Second, write down your long-term goals. Third, open a tax-advantaged investment account (like a 401(k) or Roth IRA) and set up automatic contributions. Even if it’s just a small amount, taking action is what matters most.

4 Comments

Pingback: A Guide to Green Burial Coffins – Goods & Services | Cremation.Green

Pingback: 7 Smart Portfolio Rebalancing Strategies for 2025

Pingback: The Magic of Compound Interest Explained - Top Wealth Guide - TWG

Pingback: Why Wealth Gaps Keep Growing and How to Bridge Them - Top Wealth Guide - TWG