Cryptocurrency investing can feel overwhelming when you’re starting out — a fast-moving, jargon-soaked playground where one misstep costs you real money. At Top Wealth Guide, we’ve watched too many people cannonball in without a plan (enthusiasm ≠ strategy) and leave with losses they couldn’t afford.

A well-structured crypto portfolio does two things: it protects your capital and positions you for real gains — disciplined exposure, not gambling. This guide walks you through the exact steps to build one…clear, practical, and no nonsense.

In This Guide

What You Actually Need to Know About Bitcoin and Ethereum

Bitcoin launched in 2009 as a peer-to-peer payment system – and yes, it still sits on top of the crypto mountain at roughly $1.3 trillion as of January 2026. Ethereum arrived in 2015 with a different job description: it’s a platform to run code and build apps on a decentralized network. That distinction matters – Bitcoin is mostly a store of value (digital gold, if you want the shorthand), while Ethereum is the plumbing for smart contracts and the DeFi circus. If you’re assembling a portfolio, understand the split – that’s what explains different behavior when markets sneeze.

How Bitcoin and Ethereum Move Differently

Bitcoin tends to follow macro levers – inflation expectations, central bank posture, that sort of thing – according to Morgan Stanley’s Global Investment Committee. Ethereum dances to a different beat: risk appetite and tech sentiment (innovation buzz, protocol upgrades, NFT mania). Neither pays dividends or hands you interest – you’re speculating on adoption and price appreciation. Don’t trust social-media hysteria as a strategy. Look at the real numbers on CoinGecko or CoinMarketCap – volume, market cap, price history – and watch weekly closes to see how they decouple. Do that for a few weeks and the fog clears.

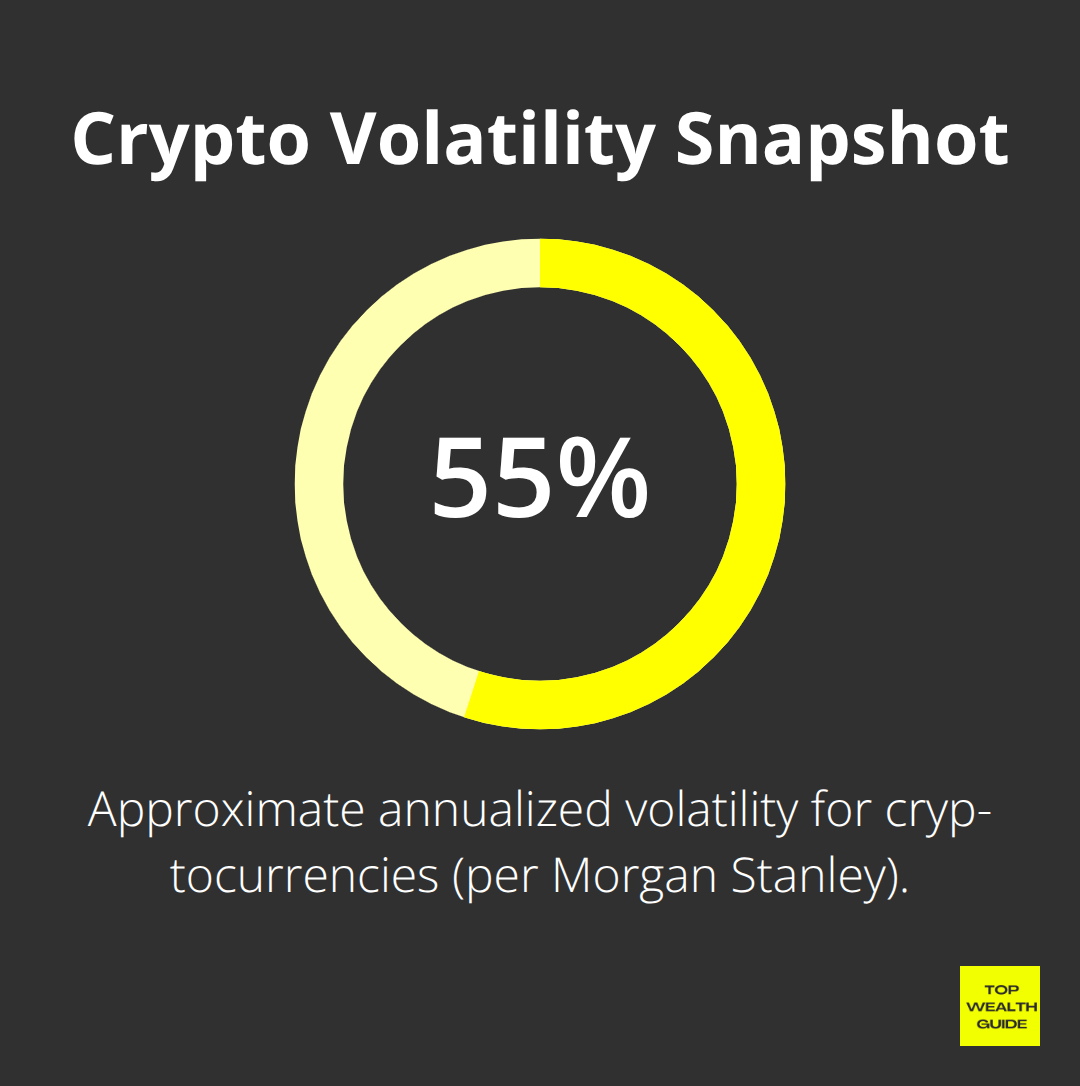

Volatility Is Your Biggest Reality Check

Cryptocurrency volatility runs roughly 55 percent annualized, according to Morgan Stanley research. Translation: a $10,000 stake can realistically swing $5,500 in a year – up or down. Drawdowns aren’t theoretical footnotes; they’re recurring headline events.

If a 50 percent hit would force you to sell (or ruin your dinner plans), you don’t have the capacity for crypto in your current portfolio size. Morgan Stanley’s rules of thumb exist for a reason: aggressive investors – cap crypto at 4%; growth-focused – 3%; balanced – 2% or less. Heck, 6% of crypto can double your portfolio’s volatility. Wanna sleep at night? Adjust the position size.

Learn From Past Market Collapses

The 2022 crypto winter – Bitcoin from $69k to $16.5k. Terra – billions erased in a blink. These aren’t anomalies; they’re repeats in a pattern. Read the playbook (and the mistakes) – Research these events – so you know what triggers big declines and how long recoveries can take. History doesn’t repeat exactly, but it rhymes… loudly.

Calculate Your Personal Loss Threshold

Before you click buy, do one practical thing: calculate the percent drop that would force you to panic-sell or compromise bills. That number – not your TED-talk optimism about decentralization – should set your maximum allocation. Use that guardrail as you work on portfolio construction and pick assets. Simple, boring, effective.

Build a Portfolio That Matches Your Risk Appetite

Size Your Position Based on Loss Tolerance

Start with a hard number – what percentage of your total investable assets can you allocate to crypto without losing sleep? Build a Portfolio That Matches Your Risk Appetite requires balance – thoughtful position sizing, disciplined rebalancing and a sober read on the risks. If you can’t live with a 50% drawdown in that slice, you’ve already sized too large. Period.

Work backwards. $100,000 of investable assets and comfortable with 2%? Fine – $2,000 max in crypto.

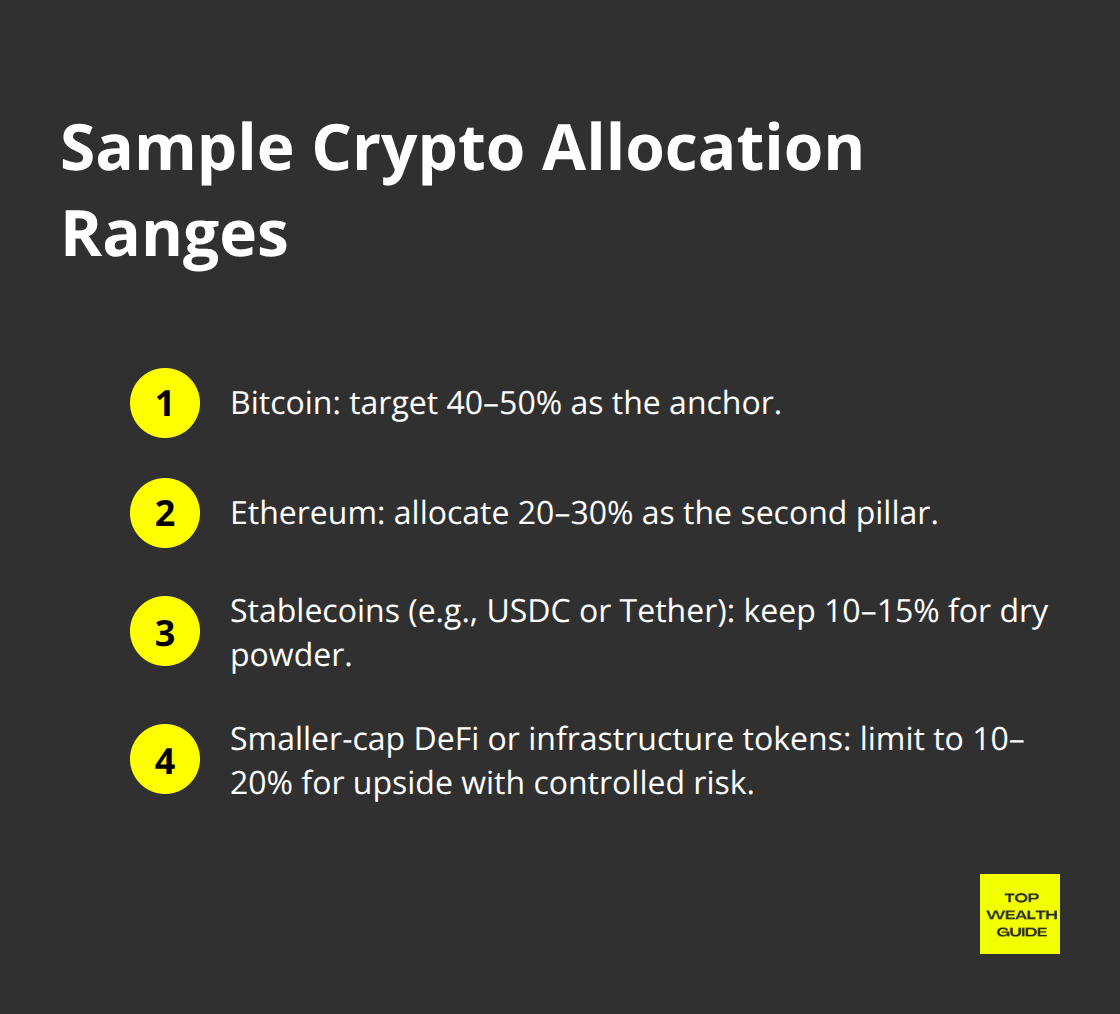

Within that $2,000, think bricks and mortar: Bitcoin (your anchor – call it 40–50% of the allocation), Ethereum (the second pillar – 20–30%), stablecoins like USDC or Tether (10–15% for dry powder to pounce on dips), and smaller-cap tokens in DeFi or infrastructure (10–20%). Not mysticism – liquidity and operating history matter. Bitcoin and Ethereum move like institutional-grade assets; stablecoins let you act fast; small bets give you upside without vaporizing the whole portfolio if one project blows up.

Choose Assets Across Risk Tiers

Check market caps on CoinGecko or CoinMarketCap before you buy anything – a $50 million market-cap token behaves nothing like a $50 billion one. Size positions accordingly: big weight in established assets, tiny in the sketchier plays.

And for the love of returns, avoid over-diversification. Holding 100 tokens doesn’t reduce risk – it creates chaos and trading-fee hemorrhage. Aim for 8–15 holdings max. Beyond that you’re not managing a portfolio, you’re babysitting a spreadsheet. The point is sector spread – payments, DeFi, infrastructure, governance – so a collapse in one corner doesn’t take the whole house with it.

Rebalance on a Schedule, Not on Emotion

Rebalance quarterly. If Bitcoin moons and suddenly makes up 60% of your crypto stash instead of 45%, trim and redeploy into the underweights. Don’t let winners run wild and twist your risk profile into something you didn’t sign up for. Discipline here keeps your portfolio aligned with the plan you actually agreed to.

Match Your Entry Strategy to Your Time Horizon

Timeline matters as much as temperament. Money you need in the next 18 months – no crypto, full stop. If you’re on a 5+ year horizon, you can weather volatility and let compounding work its slow magic.

Dollar-cost averaging – invest a fixed amount (say $200 or $500) every two weeks regardless of price – takes emotion out of entry and smooths timing risk. It’s boring, and that’s the point. For hunters of value, look for tokens trading below their historical norms relative to sector fundamentals – but that requires real research. Not for the dabblers.

Prepare for the Next Phase of Portfolio Management

The takeaway: match allocation size to your loss threshold; spread bets across risk tiers and sectors; keep stablecoins as tactical ballast; rebalance on a schedule; pick an entry strategy that fits your life. Lock those fundamentals in – then the actual work begins. Protect what you’ve built. Monitor without panic. That’s where real risk management and active oversight live – and where portfolios survive the next shock.

Manage Risk and Monitor Your Holdings

Set Stop-Loss Orders to Cap Your Losses

Stop-loss orders sound robotic until Bitcoin drops 30% in a week and you realize two things: you either had guardrails – or you didn’t. A set stop-loss orders is a standing instruction that sells automatically if an asset hits a price you decided beforehand-buy Ethereum at $2,500, set a stop at $2,000 (a 20% cushion). When price slides to that level, the position closes. No melodrama. No praying it bounces back. No waking up to find your portfolio vanished while you slept. The math is merciless: a 50% loss needs a 100% gain to get back to even.

Stop-losses won’t make losses disappear – they limit the damage to a number you chose, rather than letting the market choose for you. Put them on at purchase, not after the crowd has already stampeded. For anchors like Bitcoin and Ethereum, think 15–20% stops. For tiny, hyper-volatile tokens-bigger swings, bigger stops: 25–30%. Ignore this discipline and the cost isn’t theory – it’s catastrophic.

Rebalance Quarterly to Maintain Your Target Allocation

Rebalance quarterly keeps your portfolio from morphing into something you never agreed to. If the plan was 45% Bitcoin, 25% Ethereum, 15% stablecoins, 15% smaller caps-and Bitcoin rockets so it’s suddenly 60%-congratulations, you’ve accidentally doubled down on one bet. Trim the winners, buy the underweights. It’s mechanical. It’s uncomfortable. Which is precisely why it works.

Do it on a calendar-January 15, April 15, July 15, October 15-don’t wait for the markets to feel “right.” Quarterly hits the sweet spot: monthly is expensive (fees eat returns), annual lets drift compound into a new, riskier portfolio. Discipline beats timing. Every time.

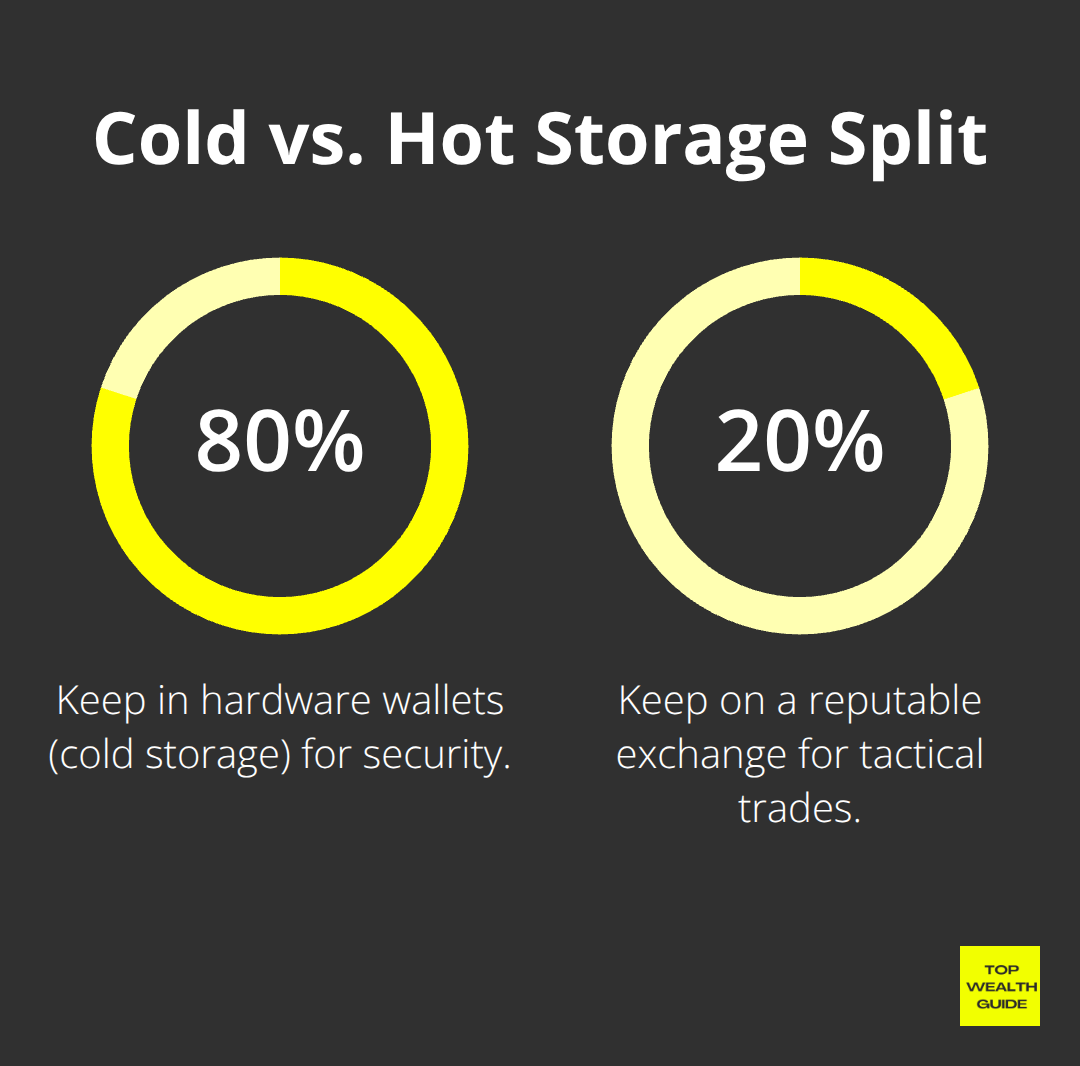

Secure Your Assets With Hardware Wallets and Offline Storage

Hardware wallets-physical devices like Ledger or Trezor that keep private keys offline-are the firewall between your life savings and the hacker economy. Park 80% of holdings in a device that never touches the internet; keep 20% on a reputable exchange for tactical trades and opportunities. Two tiers: one for cold-storage peace of mind, one for agility. If the exchange gets hit, at worst you lose the dry powder – not the whole house.

Use a passphrase beyond the default PIN, write it on paper (not in phone notes), stash it in a safe (and, if serious, one copy in a bank safety deposit box). Never share that phrase. If the hardware gets lost or smashed, the recovery seed (12 or 24 words generated during setup) restores access on another device-so store that seed separate from the device. One copy at home, one offsite. Paranoia should scale with what’s at stake.

Final Thoughts

Most people fail at crypto portfolio management not because they picked the wrong coins – they fail because they size positions like gamblers, chase volatility, or abandon the plan the moment the price chart looks ugly. The math is merciless: a 50% loss requires a 100% gain to get back to even. Discipline beats prediction… every single time. Figure your actual loss threshold – the percentage drop that forces you to sell (or compromises your bills) – and let that number dictate how large each position can be. Build around an anchor (Bitcoin), a secondary pillar (Ethereum), dry powder in stablecoins, and tiny, intentional bets in DeFi or infrastructure tokens.

The errors repeat every cycle – newcomers throw money at crypto without appreciating that Bitcoin and Ethereum are different beasts, then freak out when volatility spikes 30% in a month. They hold 50 tokens thinking diversification equals quantity (it doesn’t). They skip stop-losses and watch small losses compound into catastrophic ones. They rebalance emotionally – selling winners after they’ve already run, buying losers after they’ve already crashed. These are not moral failings; they’re predictable human behaviors you can neuter with a system.

Your next move is boring and elegant: keep ~80% in hardware wallets, set stop-losses at purchase, and rebalance on a calendar – quarterly – not when your gut tells you to act. That’s the system. It’s boring. It works. Top Wealth Guide focuses on practical strategies that align with your real financial goals and risk tolerance – crypto is a tool in a broader wealth-building toolkit, not a substitute for one.