Think of generational wealth as a financial game plan, but one where you’re not just playing for yourself. You're playing for your kids, and their kids, and so on. The goal is to build a foundation of assets so solid that it provides security and opens up opportunities for the generations that follow you. This isn't just about saving money; it's a deliberate strategy that combines smart investing, savvy estate planning, and, just as importantly, financial education.

In This Guide

- 1 What Is Generational Wealth and Why It Matters Now

- 2 Building the Foundation for Your Financial Legacy

- 3 Choosing Your Wealth Creation Engines

- 4 How to Protect and Preserve Your Growing Assets

- 5 Passing on More Than Just Money

- 6 Your Blueprint for Building a Lasting Legacy

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How much money do I need to start building generational wealth?

- 7.2 2. What's the biggest mistake families make when passing on wealth?

- 7.3 3. Is life insurance a good tool for generational wealth?

- 7.4 4. How can I protect my assets from taxes and lawsuits?

- 7.5 5. Should I put my house in a trust?

- 7.6 6. What is the difference between a will and a trust?

- 7.7 7. At what age should I start teaching my children about money?

- 7.8 8. Is paying off my mortgage early a good wealth-building strategy?

- 7.9 9. What is the most important non-financial asset to pass on?

- 7.10 10. What professionals should I have on my generational wealth team?

What Is Generational Wealth and Why It Matters Now

Imagine planting a financial tree—one that doesn't just grow but thrives, bearing fruit for your children, grandchildren, and even great-grandchildren to enjoy. That’s the heart of generational wealth. It's so much more than a number in a bank account. It’s a legacy of assets, knowledge, and opportunity that flows through a family line.

This kind of legacy isn't just about inheriting a windfall. It’s about building a foundation that can completely change a family's future for the better.

The True Impact of a Financial Legacy

A strong financial legacy gives future generations a powerful head start, unlocking doors that might have otherwise been bolted shut. The benefits are layered and profound, creating a cycle of prosperity that replaces a cycle of struggle.

Here's what that really looks like:

- Educational Freedom: Your descendants can pursue higher education without being shackled by mountains of student debt. This lets them choose a career they’re passionate about, not just one that pays the bills.

- Entrepreneurial Opportunity: With a financial safety net, taking a calculated risk—like starting a business—becomes a real possibility instead of a terrifying gamble that could lead to ruin.

- Enhanced Financial Security: Life throws curveballs. A medical emergency or an unexpected job loss can be devastating, but a financial cushion prevents a single setback from derailing the family's progress for years.

This kind of long-term security is more than just comfort; it's a strategic advantage. You can dive deeper into how to invest for generations and why your legacy matters more than ever in our detailed guide.

The Great Wealth Transfer Is Happening Now

Why the sudden urgency? Because we're standing at the beginning of a monumental economic shift. Experts are calling it the 'Great Wealth Transfer,' and it's happening right now.

We’re talking about an estimated $83 trillion expected to change hands between generations worldwide over the next two decades. The largest chunk of that is moving from Baby Boomers to their heirs. In the United States alone, this transfer is projected to be over $29 trillion. You can find more insights on this global shift from UBS.

This massive movement of assets makes understanding these principles absolutely critical. It’s a powerful reminder that building a legacy isn’t some exclusive club for the ultra-wealthy. It’s an achievable goal, built on a long-term vision, disciplined habits, and smart planning that anyone can start today, no matter where they're starting from.

Building the Foundation for Your Financial Legacy

Before you can build a skyscraper, you have to pour a rock-solid foundation. The same goes for building a financial legacy. All the fancy investment strategies in the world won't do you any good without getting the basics right first. And it all starts not with money, but with a fundamental shift in how you think about it.

The secret is moving from a consumer mindset to an owner mindset. Instead of seeing your income as something to spend, you start seeing every dollar as a seed. A seed you can plant to grow your own financial tree for the future. This is the real starting line.

Crafting a Purpose-Driven Financial Plan

Once you've got the owner mindset dialed in, it's time to map out a clear, purpose-driven plan. This isn't about boring spreadsheets; it's about making sure your daily financial habits are pulling you toward your biggest goals.

A truly solid plan rests on three core pillars you just can't skip:

- A Purpose-Driven Budget: Think of a budget not as a restriction, but as a tool for control. It gives every single dollar a specific job, making sure your money is working for your legacy, not just vanishing on random purchases.

- Systematic Debt Elimination: High-interest debt from things like credit cards is an anchor dragging down your wealth. Getting aggressive about paying it off frees up your cash flow so you can put it to work building assets instead.

- A Robust Emergency Fund: This is the moat around your financial castle. You need enough cash to cover 3-6 months of essential living expenses, period. This ensures that a surprise car repair or job loss doesn't force you to sell your investments at the worst possible time.

Building wealth isn't a sprint; it's a marathon. Morgan Housel, author of The Psychology of Money, points out that Warren Buffett made 99% of his legendary fortune after he turned 65. As Housel says, “His skill is investing, but his secret is time.” It’s a powerful reminder that consistency over decades—not a single lucky break—is what truly builds lasting wealth.

The Power of Paying Yourself First

One of the most powerful habits you can build is to "pay yourself first." It’s a simple rule with profound effects. Before you pay a single bill or buy a coffee, you automatically move a set portion of your income into your savings and investment accounts.

It’s a non-negotiable. This simple act transforms wealth-building from something you’ll "get to later" into your top financial priority.

Let's look at how this one habit changes the game.

| Habit | Monthly Process | Financial Outcome |

|---|---|---|

| Paying Yourself Last | Pay bills, spend on wants, and then hope to save whatever is left over. | Savings are unpredictable and often tiny. Little to no money is left for investing, so your wealth stalls out. |

| Paying Yourself First | 10-15% of income is automatically transferred to investment accounts. You handle bills and spending with what remains. | Investing becomes consistent and guaranteed. It forces you to be disciplined with your spending and turbocharges compound growth over the long haul. |

Real-Life Example: The Garcia family, earning a combined $85,000 annually, decided to implement the "pay yourself first" rule. They set up an automatic transfer of 12% of their take-home pay ($850/month) into a low-cost S&P 500 index fund. By automating the process, they removed the temptation to spend that money. After 10 years, assuming an average 10% annual return, that consistent habit grew into over $160,000, forming the cornerstone of their children's future financial security.

If you're just at the beginning and want to get a handle on the fundamentals, you can learn more about how to start investing money in our beginner’s guide. Nailing this first step is absolutely crucial for any long-term financial strategy.

Choosing Your Wealth Creation Engines

Once you've built a solid financial foundation, it's time to switch from defense to offense. Creating a real legacy means putting your money to work in powerful wealth creation engines—assets that don't just sit there, but actively grow your capital over the long haul.

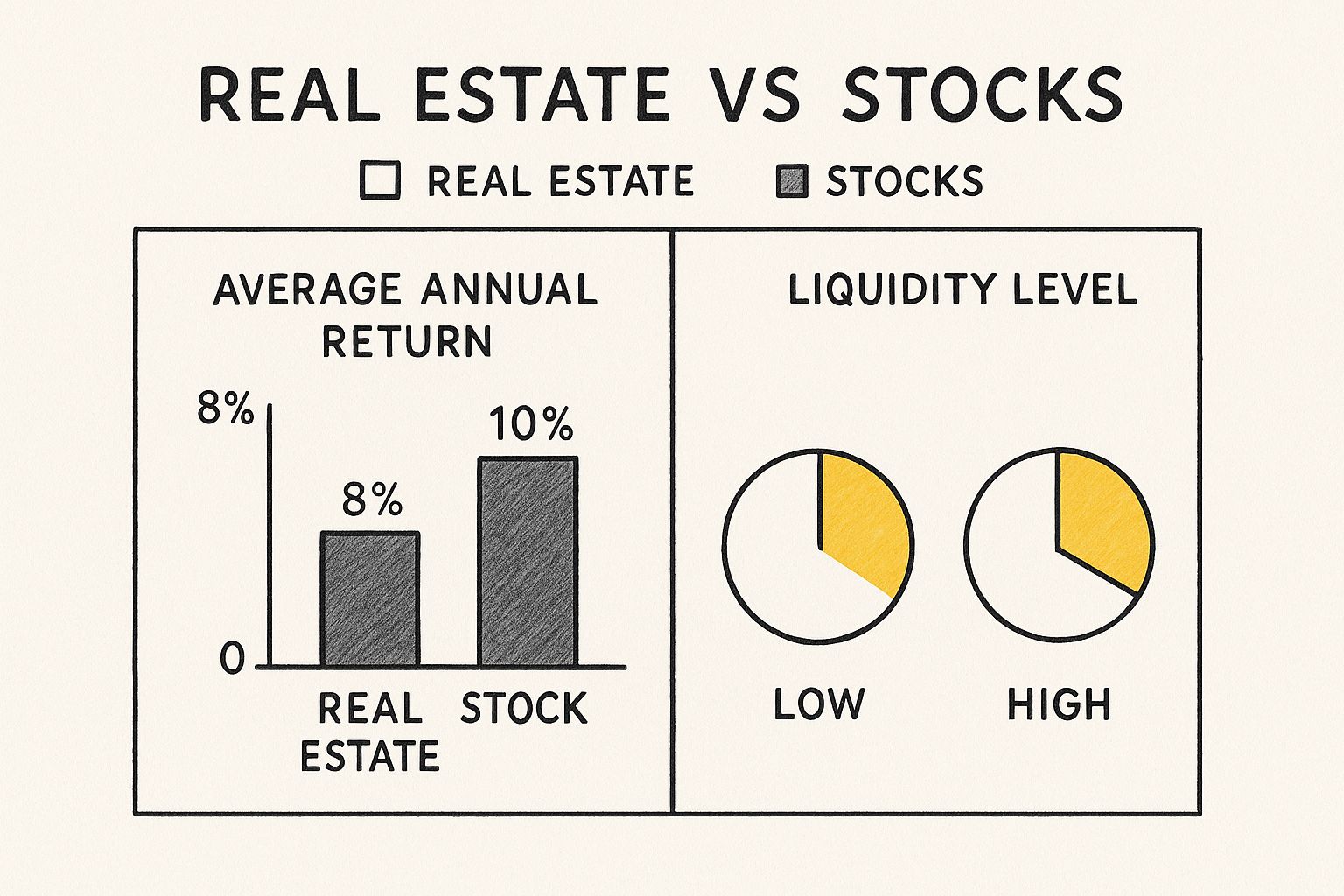

The three most proven vehicles for building this kind of wealth are stocks, real estate, and business ownership. Each one operates on a different set of rules and offers a unique mix of risk, reward, and hands-on effort. Getting a handle on these differences is the first step to picking the right strategy for your family.

The Stock Market: A Compounding Powerhouse

For most people, the stock market is the most direct and powerful path to building wealth. This isn't about the frantic, high-stakes world of day trading. It's about something much simpler: owning small pieces of the world's most successful companies and letting the magic of compound interest do the heavy lifting for decades.

The most effective way to do this is by investing in low-cost index funds and Exchange-Traded Funds (ETFs). Think of these as baskets that hold hundreds, or even thousands, of different stocks at once. This approach gives you instant diversification, which helps smooth out the bumps while still capturing the market's overall growth. Historically, that has translated to an average annual return of around 10%.

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." – Albert Einstein

This quote nails it. Small, steady investments made today can snowball into a fortune over a lifetime, all thanks to your earnings generating their own earnings.

Real Estate: A Tangible Legacy Builder

Real estate is more than just a place to call home; it can be a cornerstone of generational wealth by generating both reliable cash flow and long-term appreciation. The goal here is to own properties that put money in your pocket month after month.

Here are the two main ways to do it:

- Rental Properties: The classic approach. Owning residential or commercial properties and collecting rent provides a steady income stream while the property itself (hopefully) grows in value over time.

- REITs (Real Estate Investment Trusts): If you like the idea of real estate but not the reality of being a landlord, REITs are a fantastic alternative. These are companies that own or finance income-producing properties, and you can buy and sell their shares on the stock market just like any other stock.

Real estate also comes with some unique perks, like significant tax advantages and the ability to use leverage (a mortgage) to control a much larger asset than you could afford with cash. To explore this further, our guide on whether real estate is a good investment breaks it all down.

Business Ownership: The Ultimate Wealth Accelerator

Starting a business is easily the riskiest path, but it also offers the highest potential reward. Nothing can build wealth faster than owning a successful company. Whether it's a tech startup or a profitable side hustle, a business can generate income and build equity at a pace that traditional investments simply can't match.

Real-Life Example: Consider the Mars family, creators of Mars, Inc. (M&M's, Snickers). Frank Mars started making candy in his kitchen in 1911. By reinvesting profits and focusing on long-term growth, the family built a global empire. Today, the business remains privately owned by the family, providing immense wealth and opportunities for successive generations, a prime example of business ownership as a generational wealth strategy.

A business is a living asset that can be grown, scaled, and one day sold or passed down to your kids. You can discover more insights about wealth per person by country to see how asset ownership impacts global wealth distribution.

Comparing Your Wealth-Building Options

So, which engine should you choose? It really comes down to your personality, your goals, and how much time and capital you're willing to commit. There’s no single "best" answer, and frankly, the most successful plans usually combine a few different strategies.

To help you think it through, let's compare the primary investment vehicles for generational wealth.

Comparison of Core Wealth-Building Asset Classes

| Asset Class | Risk Level | Potential for Appreciation | Income Generation | Liquidity | Management Effort |

|---|---|---|---|---|---|

| Stocks (Index Funds) | Medium | High | Low (Dividends) | High | Low |

| Real Estate (Rentals) | Medium-High | Medium-High | High (Rent) | Low | High |

| Business Ownership | Very High | Very High | Very High | Very Low | Very High |

Ultimately, picking your wealth creation engines is a deeply personal decision. By understanding the real-world dynamics of stocks, real estate, and entrepreneurship, you can start designing a balanced strategy that’s built to last for generations.

How to Protect and Preserve Your Growing Assets

Building wealth is an incredible achievement, but it’s only half the battle. The other, equally critical part of the journey is making sure that wealth isn't chipped away by taxes, legal challenges, or just bad planning.

Think of it like building a fortress; a powerful offense is pointless without impenetrable defenses. This is where smart generational wealth strategies come into play. These are the tools that ensure the assets you’ve worked so hard to build actually make it to the next generation, ready to keep growing.

Smart Tax Planning: Your First Line of Defense

Taxes are one of the biggest threats to your wealth over the long haul. The good news? You can legally and ethically use the tax code to your advantage to soften the blow.

Two of the most powerful tools in your arsenal are tax-advantaged retirement accounts:

- 401(k)s and Traditional IRAs: These accounts let your investments grow tax-deferred. You contribute with pre-tax dollars, lowering your taxable income today. You only pay taxes when you finally withdraw the money in retirement.

- Roth IRAs: Roths are a different animal. You contribute with after-tax dollars, so there's no immediate tax break. But the magic happens down the road: your investments grow completely tax-free, and so are your qualified withdrawals. This is a huge win for passing on wealth.

Another brilliant move is tax-loss harvesting. This simply means selling investments that have lost value to cancel out the capital gains taxes you'd owe on your profitable ones. It’s a savvy way to find a silver lining when the market is down.

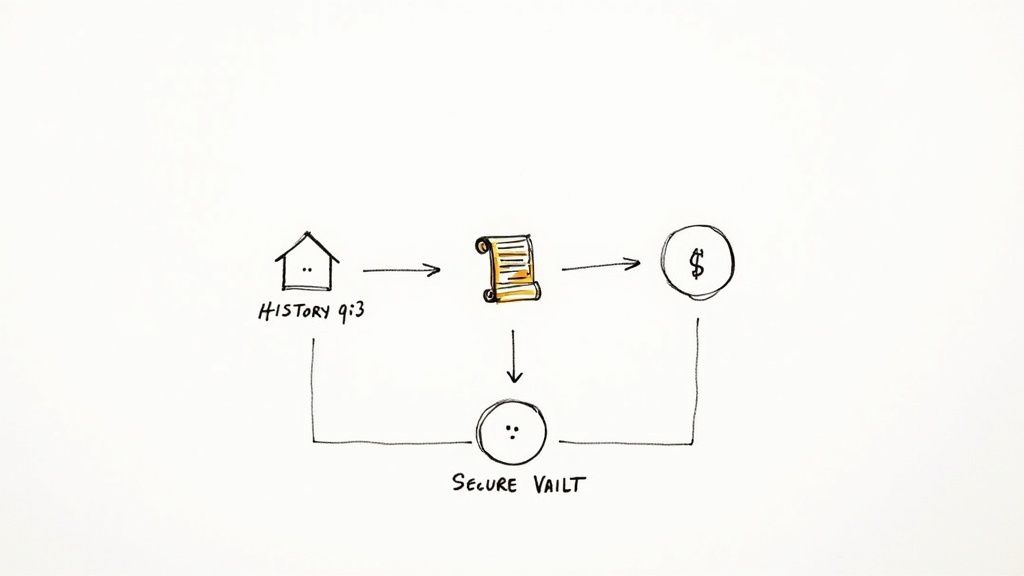

Using Legal Structures to Safeguard Your Legacy

Legal structures are the walls of your financial fortress. They create a formal framework for how your assets are managed, shielded from threats, and passed on to your family exactly as you intended.

For generational wealth, the most important legal tool is the trust. A trust is a legal entity that holds and manages assets on behalf of your chosen beneficiaries.

A will tells the world what to do with your assets after you die. A trust, on the other hand, can control and protect those assets for decades, ensuring your legacy is managed with the wisdom and care you intended, long after you're gone.

Setting up a trust gives you several key advantages that a simple will just can't match:

- Avoiding Probate: Assets held in a trust get to skip the long, expensive, and very public court process called probate. This means your family gets access to their inheritance faster and with far more privacy.

- Creditor Protection: The right kind of irrevocable trust can shield assets from lawsuits, creditors, and even a beneficiary’s future divorce settlement.

- Control and Conditions: You can lay out specific rules for how and when beneficiaries receive their inheritance. This lets you ensure the money is used for things you value, like education or a down payment on a home.

Comparing Asset Protection Tools: Wills vs. Trusts

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Probate Process | Required. Assets are tied up in a public court process. | Avoided. Assets transfer privately and efficiently. |

| Asset Control | Ends at your death. A court then oversees everything. | You can set long-term rules for how assets are managed. |

| Privacy | Becomes a public record for anyone to see. | Remains a private document, protecting your family's affairs. |

| Creditor Protection | Offers very little protection for your heirs' inheritance. | Certain trusts provide significant protection from lawsuits. |

For anyone serious about building a lasting legacy, a trust is almost always the better option. You can dig deeper by reading our guide on how to effectively manage your wealth for long-term growth, which explores these strategies in more detail. At the end of the day, protecting what you’ve built is the final, crucial step to ensure your hard work benefits your family for generations.

Passing on More Than Just Money

Building a financial legacy is one thing. Making it last is another entirely. The numbers on this are frankly staggering: research consistently shows that 70% of wealthy families lose their wealth by the second generation. By the third? A whopping 90% are back to where the first generation started.

This isn't happening because of bad stock picks or a dip in the market. The real culprit is a failure to transfer the wisdom along with the wealth. Handing over a large inheritance without preparing your heirs is like giving a teenager the keys to a Formula 1 car and just wishing them luck.

The most successful families shift their focus from simply transferring assets to building a legacy of stewardship. It’s a mindset where shared values and open communication become just as important as the money in the trust.

Cultivating a Culture of Stewardship

True generational wealth isn't just about the financial instruments you use; it’s about the family culture you build around them. The goal is to transform your heirs from passive recipients into active, responsible stewards of the family's future.

Here are a few pillars that can support this culture:

- A Family Mission Statement: This doesn't have to be some stuffy corporate document. It’s a simple, shared understanding of your family’s core values. It answers the fundamental question, "What is all this for?" The answer could be anything from funding education for generations to come, sparking new entrepreneurial ventures, or making a lasting impact through philanthropy.

- Open Communication: Make talking about money normal. Regular family meetings to discuss finances—even in broad strokes—can demystify the topic. These conversations get everyone aligned on the same goals and give the next generation a real voice in the family’s financial journey.

- Shared Values: When you instill principles like hard work, financial discipline, and a spirit of generosity, wealth is no longer seen as just a means for personal spending. It becomes a powerful tool for creating a positive impact.

There's an old saying that perfectly captures this risk: "shirtsleeves to shirtsleeves in three generations." It describes the all-too-common cycle where the first generation builds the fortune, the second enjoys it, and the third, lacking the founder's grit and know-how, loses it all.

Teaching Financial Literacy at Every Age

Financial education isn't a one-and-done lecture. It's an ongoing conversation that needs to evolve as your children grow up. The objective is to build their financial competence and confidence step-by-step, so they're fully prepared when the time comes to manage what you've built.

A progressive approach works best:

- Early Childhood (Ages 3-7): It all starts with the piggy bank. Get a clear one so they can literally see their savings grow. This simple visual is incredibly effective at teaching the foundational concept of accumulation.

- Childhood (Ages 8-12): Now's the time to introduce an allowance tied to chores, connecting the dots between work and earning. This is the perfect age to start talking about budgeting and the difference between "needs" and "wants."

- Teenage Years (Ages 13-18): Get them a checking or savings account with a debit card. Better yet, open a custodial investment account (like a Roth IRA) to give them a front-row seat to the magic of compound interest. Seeing their own money grow is a lesson they'll never forget.

The Family Bank: A Practical Training Ground

One of the most powerful ways to teach responsible financial habits is to create a "family bank." This is simply an informal system where your kids can borrow money from you for a major purchase, like their first car or a new laptop, but with real-world terms attached.

They have to pitch you on why they need the loan and present a clear plan for how they'll pay it back. By charging a modest interest rate, you give them a safe, controlled environment to learn about the real cost of borrowing. It’s a fantastic hands-on lesson in debt and financial responsibility.

Ultimately, these non-financial strategies are the glue that holds a family's legacy together. They are every bit as critical as the legal documents in your plan. To learn more about the legal structures that protect and transfer your assets, you can explore our guides on estate planning. When you combine financial wisdom with solid legal planning, you build a legacy that can truly thrive for generations.

Your Blueprint for Building a Lasting Legacy

We’ve covered the mindset, the wealth-building tools, and the legal shields you need to create a lasting financial legacy. Now, let’s pull it all together into a clear, actionable roadmap. Think of this as your personal checklist for designing a generational wealth plan, no matter where you're starting from today.

The entire process boils down to a few core principles that should guide every decision you make. These are the non-negotiables that turn good intentions into real, tangible results over the decades.

A legacy isn't built overnight. It’s etched from the decisions we make every day—a tapestry woven from threads of discipline, vision, and purpose. The most powerful generational wealth strategies are never just about money; they're about fostering a culture of stewardship that lasts.

Your Actionable Legacy Checklist

This blueprint isn't just theory. It distills all the core strategies we've discussed into a step-by-step process. Use this framework to build a plan that’s resilient, effective, and tailored to what your family truly values.

-

Solidify Your Foundation: First things first. Get a purpose-driven budget in place, crush any high-interest debt, and build an emergency fund that covers 3-6 months of essential living expenses. This is the bedrock. Don't skip it.

-

Automate Your Investments: Pick your wealth engines—whether that's low-cost index funds, real estate, or something else—and commit to the "pay yourself first" mantra. Set up automatic contributions so your wealth grows consistently in the background.

-

Construct Your Fortress: It's time to talk to an estate planning attorney. You'll need to create essential legal documents like a will and, most importantly, a trust. This is what protects your assets from the costly, public process of probate and makes sure your wishes are actually followed.

-

Educate the Next Generation: Start talking about money early and often. Open custodial investment accounts for your kids and involve them in age-appropriate financial discussions. You're not just passing down assets; you're preparing them to be wise stewards of those assets.

Don't Go It Alone: Seek Professional Guidance

While this guide gives you the map, a team of seasoned professionals can help you navigate the tricky terrain. Assembling your expert team is a critical step in turning a good plan into a great one.

Here’s who you need in your corner:

- A Certified Financial Planner (CFP) to help you craft an investment and retirement strategy.

- An Estate Planning Attorney to draft your will, trusts, and other crucial legal documents.

- A Certified Public Accountant (CPA) for smart, long-term tax planning.

These experts do more than just fill out paperwork. They'll customize every one of these strategies to your unique situation, making sure your plan is both powerful and legally sound. With this blueprint in hand, you have what you need to move forward with confidence and build a meaningful legacy that stands the test of time.

Frequently Asked Questions (FAQ)

1. How much money do I need to start building generational wealth?

You don't need a large sum to start. The most important factor is consistency. Begin by automating small, regular investments—even $50 or $100 per month—into low-cost index funds. The power of compound interest over several decades is what truly builds wealth, not the initial amount.

2. What's the biggest mistake families make when passing on wealth?

The most common and devastating mistake is a lack of communication and preparation. Many families fail to educate the next generation about financial principles, the purpose of the wealth, or the responsibilities that come with it. This leads to the "shirtsleeves to shirtsleeves in three generations" phenomenon, where wealth is lost due to poor stewardship.

3. Is life insurance a good tool for generational wealth?

Yes, particularly permanent life insurance (like whole or universal life). It can provide a tax-free death benefit to heirs, bypassing the probate process. This provides immediate liquidity to cover estate taxes, pay off debts, or fund business transitions without forcing the sale of other assets.

4. How can I protect my assets from taxes and lawsuits?

Asset protection involves a multi-layered approach. Key strategies include:

- Establishing Trusts: An irrevocable trust can legally separate assets from your personal estate.

- Utilizing Tax-Advantaged Accounts: Maximize contributions to 401(k)s, Roth IRAs, and HSAs to allow for tax-deferred or tax-free growth.

- Purchasing Umbrella Insurance: This provides extra liability coverage beyond your standard home and auto policies.

- Correctly Titling Assets: The way you own property can offer built-in legal protections.

5. Should I put my house in a trust?

For many people, placing their home in a revocable living trust is a smart move. This allows the property to pass directly to beneficiaries without going through the public, lengthy, and often expensive probate court process. It also provides a clear plan for managing the property if you become incapacitated.

6. What is the difference between a will and a trust?

A will is a document that outlines your wishes for asset distribution after death, but it must go through the court process of probate to be executed. A trust is a private legal entity that holds your assets. Since the trust owns the assets, they can be managed and transferred according to your rules without court intervention, offering more privacy and control.

7. At what age should I start teaching my children about money?

Start as early as possible. For young children (ages 3-7), use a clear jar for savings to make the concept of accumulation visual. For older children (8-12), introduce an allowance tied to chores to connect work with earning. For teens, open a custodial investment account to teach them about compound growth firsthand.

8. Is paying off my mortgage early a good wealth-building strategy?

It can be, but it depends on your financial situation and risk tolerance. Paying off a mortgage provides a guaranteed, risk-free "return" equal to your mortgage interest rate. However, if your interest rate is low (e.g., 3-4%), you could potentially earn a higher return over the long term by investing that extra money in the stock market.

9. What is the most important non-financial asset to pass on?

Financial literacy and a strong value system are the most critical non-financial assets. Passing on the knowledge of how to manage, preserve, and grow money—along with values like discipline, hard work, and generosity—is what ensures the financial assets will last for generations.

10. What professionals should I have on my generational wealth team?

A well-rounded team is crucial. At a minimum, you should have:

- A Certified Financial Planner (CFP®) to develop your overall financial strategy.

- An Estate Planning Attorney to create the legal structures like wills and trusts.

- A Certified Public Accountant (CPA) to handle tax planning and compliance.

At Top Wealth Guide, our mission is to provide you with the knowledge and tools needed to build and protect your financial legacy. To continue your journey with exclusive insights and proven strategies, explore our resources at https://topwealthguide.com.