The road to financial freedom isn’t some get-rich-quick fantasy. It’s a real, methodical journey toward having enough income, savings, and investments to live the life you actually want, without being chained to a traditional job. Think of it as gaining complete control over your financial destiny, one intentional decision at a time. This path is open to anyone willing to build the right habits.

In This Guide

- 1 Charting Your Path to Financial Independence

- 2 Building Your Foundation on Solid Ground

- 3 Putting Your Money to Work: The Smart Investing Phase

- 4 Expanding Your Income Beyond a Paycheck

- 5 Staying the Course in a Changing World

- 6 Frequently Asked Questions About the Freedom Financial Road

- 6.1 1. What is the first step on the freedom financial road?

- 6.2 2. How much money do I need for financial freedom?

- 6.3 3. Is it better to pay off my mortgage or invest?

- 6.4 4. What if I’m starting with a low income?

- 6.5 5. Is it ever too late to start?

- 6.6 6. How do I stay motivated when the goal feels so far away?

- 6.7 7. What’s the biggest mistake people make on this journey?

- 6.8 8. Should I use a financial advisor?

- 6.9 9. How do I handle a market crash?

- 6.10 10. Does “financial freedom” mean I have to stop working?

Charting Your Path to Financial Independence

Starting on this journey requires a fundamental mindset shift. You have to move beyond just earning a paycheck and start building a system where your money actively works for you. It’s about creating a future where your time is truly your own—freeing you up to pursue passions, travel the world, or retire on your own terms. The core concept is simple: methodically build enough assets that generate passive income to cover all your living expenses.

And no, this path isn’t just for high-earners. Success hinges on the gap between what you earn and what you spend. By consistently widening that gap, anyone can make meaningful progress.

We can break the journey down into a few key phases:

- Building a Solid Foundation: This is where you get your house in order. We’re talking about creating a detailed budget you can stick to, building a solid emergency fund, and systematically crushing any high-interest debt.

- Accelerating Your Growth: Once your foundation is secure, the focus shifts to investing. The goal is to consistently put money into assets like low-cost index funds to let the magic of compound interest do the heavy lifting.

- Expanding Your Income Streams: In the more advanced stages, you’ll start creating multiple sources of income. This could be anything from real estate and side businesses to dividend-paying stocks, all designed to build powerful financial resilience.

Different Starting Points, Same Destination

What’s great about this journey is how adaptable it is. Your starting point doesn’t dictate your potential for success—your strategy and consistency do. Two people can begin from wildly different financial situations and both reach their goals.

| Starting Profile | Initial Focus | Key Challenge |

|---|---|---|

| The Recent Graduate | Aggressively pay down student loans while starting small, automated investments. | Resisting “lifestyle creep” as income grows. |

| The Mid-Career Professional | Maximize retirement contributions and invest a significant chunk of their income. | Juggling major financial goals with family expenses like mortgages and college savings. |

For example, think about Sarah, a 25-year-old nurse with a mountain of student debt. Her first moves are all about a strict budget to attack those loans while she automatically contributes just $100 a month to a retirement account.

Then you have Mark, a 40-year-old manager. He’s maxing out his 401(k) and investing an extra $1,000 per month on top of that. Their paths look completely different, but both are making smart, intentional progress.

The ultimate destination is the same: reaching a point where your passive income outpaces your expenses. At that point, work becomes a choice, not a necessity. It’s not about never working again—it’s about having the freedom to choose.

To get started with a detailed plan, following a proven framework can give you much-needed clarity. You can learn more by checking out The Financial Freedom Blueprint: a free wealth guide that outlines these exact steps. This guide will walk you through each stage, turning the abstract idea of financial freedom into a concrete, achievable reality.

Building Your Foundation on Solid Ground

Before you even think about building real wealth, you have to make sure the ground beneath you is solid. Your journey to financial freedom doesn’t start with complicated stock picks or real estate deals. It starts with two incredibly important, non-negotiable actions: getting rid of high-interest debt and truly mastering your cash flow.

Think of it this way: these aren’t just financial chores. They’re strategic moves that unleash your single most powerful wealth-building tool—your income.

High-interest consumer debt is like an anchor dragging behind you, making it impossible to gain any real forward momentum. Every dollar you send to a credit card company is a dollar that isn’t growing for you. It’s working against you. In fact, a 2025 Economic Freedom Study found that for many people, the very definition of financial freedom is simply being free from this burden. The study, which surveyed over 6,000 adults, revealed that 27% of respondents in both the U.S. and the UK said “being debt-free” was their number one financial goal. You can dig into more of the findings from this economic freedom research on encorecapital.com.

Choosing Your Debt Takedown Strategy

Getting out of debt isn’t a one-size-fits-all game. The two most popular methods, the Debt Snowball and the Debt Avalanche, work wonders but appeal to different personality types. One is built for motivation through quick wins, while the other is all about mathematical efficiency.

Which one is right for you? Let’s break them down.

Debt Repayment Strategy Comparison

Choosing how to pay off debt often comes down to a simple question: Are you motivated more by psychology or by math? This table compares the two primary strategies to help you decide.

| Strategy | How It Works | Best For | Potential Drawback |

|---|---|---|---|

| Debt Snowball | List debts from smallest to largest balance. Pay minimums on everything, but throw every extra penny at the smallest debt. Once it’s gone, roll that entire payment onto the next smallest. | Anyone who needs to see quick progress to stay motivated. The psychological high from knocking out that first small debt can be a huge motivator. | You’ll almost certainly pay more in total interest over time since you’re ignoring the interest rates until later. |

| Debt Avalanche | List debts from the highest interest rate to the lowest. Pay minimums on everything, but attack the debt with the highest interest rate first. Once that’s paid off, move to the next highest. | People who are disciplined and driven by the numbers. This method saves you the most money in interest, period. | It might take a while to pay off that first debt, which can feel discouraging if you thrive on quick wins. |

After looking at the table, think about what keeps you going. The best plan is always the one you’ll actually stick with.

Let’s look at a real-world example. Maria and Ben were staring down $50,000 in combined credit card debt and a car loan. They knew they needed momentum, so they chose the Debt Snowball. They got serious, slashing their dining-out budget by 80%, canceling a bunch of streaming services, and Ben even picked up a weekend side hustle.

Their first target? A tiny $800 retail store card. They wiped it out in just three months, and that victory gave them the confidence and drive to keep going. That initial win was the key that powered them through the next two and a half years to become completely debt-free.

Mastering Your Cash Flow

Once you have a debt-attack plan in place, the next step is to get total control over where your money is going. This is about more than just a spreadsheet; it’s about creating an intentional spending plan that works for you.

- Zero-Based Budgeting: This is my personal favorite for getting serious. The rule is simple: income minus expenses must equal zero. Every single dollar gets a job, whether that’s paying rent, buying groceries, saving, or investing. It forces you to be incredibly deliberate with your money.

- The 50/30/20 Rule: If zero-based feels too intense, this is a great starting point. You allocate 50% of your take-home pay to Needs (housing, utilities), 30% to Wants (hobbies, fun), and a firm 20% to Savings and Debt Repayment.

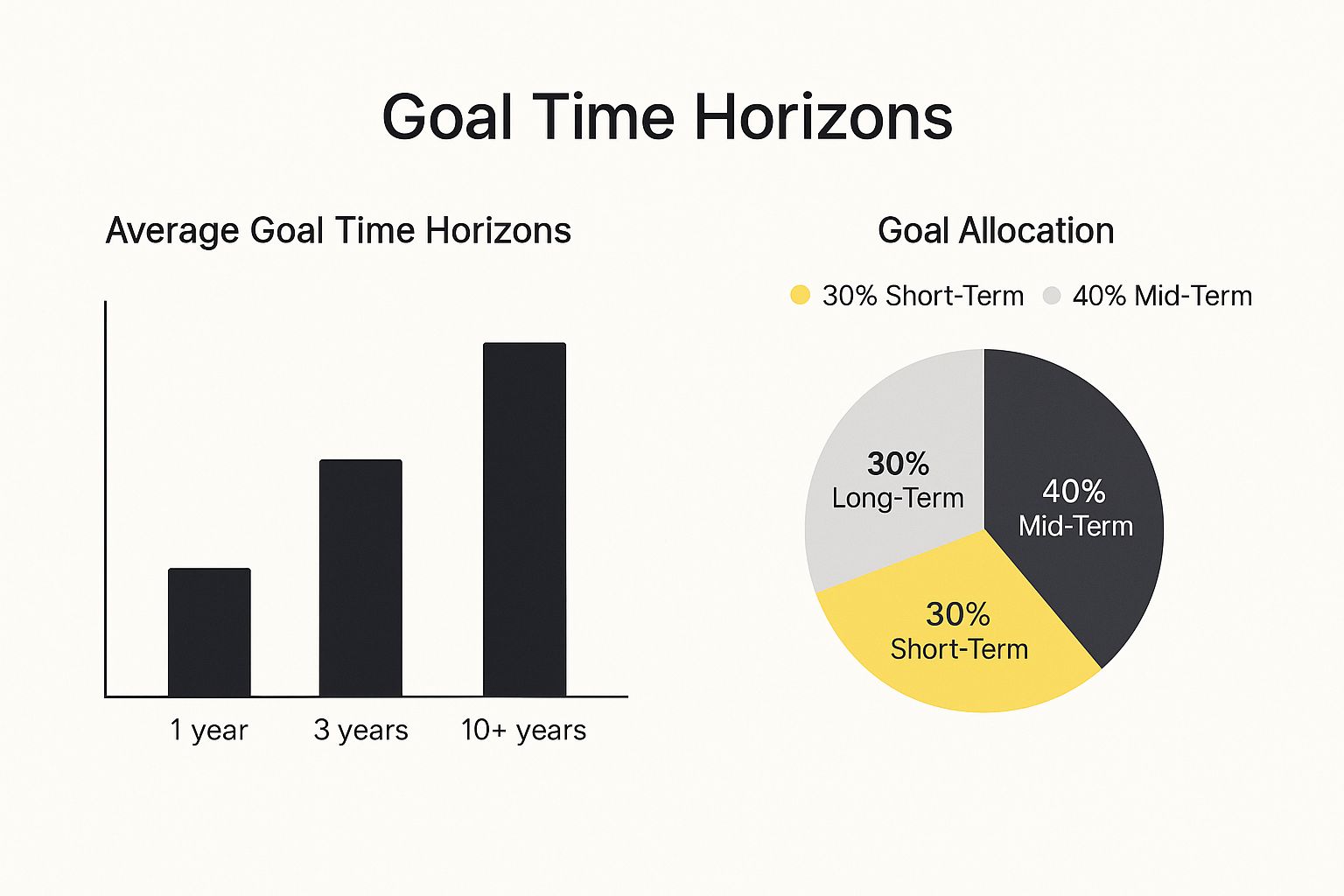

The image below gives you a sense of how people typically spread their financial goals across different timelines, which can be a useful way to think about structuring your own budget.

As you can see, there’s a strong focus on those mid-term goals, which reminds us how important it is to plan beyond just next month or far-off retirement.

The goal of a budget isn’t to restrict you—it’s to empower you. A clear budget tells you where your money is going so you can redirect it to where you want it to go.

To make these new habits stick, I highly recommend using a budgeting app that syncs with your bank accounts. This automates all the tedious tracking and gives you a real-time, honest look at your financial health.

By getting these foundational pieces right, you’re not just getting organized—you’re paving the way for serious, long-term growth. Once your foundation is secure, you’ll be ready for the next level, and you can learn more about how to effectively manage your wealth for long-term growth in our advanced guide.

Putting Your Money to Work: The Smart Investing Phase

Alright, you’ve built a solid financial foundation. Now the real fun begins. It’s time to shift from playing defense with your money—paying off debt and saving—to playing offense. This is where we start making your money work for you through smart, strategic investing.

This isn’t about gambling on hot stock tips or trying to perfectly time the market. Forget that. We’re focused on disciplined, consistent action designed for long-term growth.

The secret weapon here is compound interest. Albert Einstein supposedly called it the eighth wonder of the world, and for good reason. It’s like a tiny snowball rolling down a very long hill. Your regular investments give it a push, and it picks up more snow (your returns) along the way, growing bigger and faster all by itself.

Your Core Investment Toolkit

The investing world can feel overwhelming, but you don’t need a PhD in finance to succeed. In my experience, most people build serious wealth using a few simple, powerful tools. Let’s break down the three main players.

Understanding what each one does will help you build a portfolio that actually fits your life and your goals.

| Investment Vehicle | How It Works | Best For | Key Advantage |

|---|---|---|---|

| Index Funds | Think of it as buying a tiny slice of the entire market. An S&P 500 index fund, for example, holds stock in all 500 of those companies. | The long-term, hands-off investor. If you want broad market exposure with almost no effort, this is your go-to. | Extreme diversification and rock-bottom costs. It’s the ultimate “set it and forget it” strategy for steady growth over time. |

| ETFs (Exchange-Traded Funds) | Very similar to index funds, but they trade like individual stocks on the exchange. You can buy and sell them throughout the day. | Investors who like the diversification of an index fund but want a bit more flexibility. They often have lower initial investment requirements, too. | Flexibility and low expense ratios. Great for getting started and making adjustments on the fly. |

| Individual Stocks | This is where you buy shares of a single company, like Apple or a smaller up-and-comer, making you a part-owner. | Investors who genuinely enjoy the research and are willing to accept higher risk for the shot at much higher rewards. | Massive growth potential. Picking one big winner can deliver returns that crush the overall market average. |

For most people just starting out, a combination of low-cost index funds and ETFs is the sweet spot. It gives you diversification, keeps fees low, and is built on a historically proven strategy.

If the idea of digging into company financials gets you excited, picking individual stocks can be incredibly rewarding. But it’s a skill that takes time to develop. If you want to head down that path, our guide on how to identify top-performing stocks in the market is a great place to start.

Proof That Consistency Beats Timing

Let me tell you about someone I know, Alex. He got serious about this at age 32. He’d already built his emergency fund and wiped out his credit card debt. Then, he set up an automatic investment of $750 every single month into a simple, low-cost S&P 500 index fund.

He didn’t panic during market dips. He didn’t chase hype. For 18 years, he just let the automatic transfer do its thing. By the time he hit 50, that steady consistency had turned into a portfolio worth over $500,000. He’s now well on his way to true financial independence.

Alex’s story is the perfect example of a fundamental truth: consistency will always be more powerful than trying to time the market or find the one “perfect” investment.

Matching Your Investments to Your Life

A great portfolio isn’t just a collection of funds; it’s a reflection of your personal goals, timeline, and how much risk you’re comfortable with. This is where asset allocation comes in—it’s just a fancy term for how you divide your money between different types of investments, mainly stocks and bonds.

Here’s a simple way to think about it:

- Longer Timeline (Higher Risk Tolerance): In your 20s or 30s? You have decades for your money to grow and recover from downturns. A portfolio of 90% stocks and 10% bonds makes a lot of sense.

- Medium Timeline (Moderate Risk Tolerance): As you get into your 40s, you might want to start protecting some of your gains. Shifting to a 70% stock, 30% bond mix can smooth out the ride.

- Shorter Timeline (Lower Risk Tolerance): Nearing retirement, your focus shifts from growth to preservation. A 50/50 split between stocks and bonds helps protect your capital from major market swings.

Expanding Your Income Beyond a Paycheck

Relying on a single paycheck and a standard 401(k) is the well-traveled, slow-and-steady path. But if you want to get to financial freedom faster, you need to think differently. The real accelerator is building multiple, independent income streams.

This isn’t just about making more money. It’s about creating a safety net—a financial resilience that protects you when life happens. When a single event like a layoff can’t derail your entire plan, you’ve achieved a new level of security. Your goal is to move from depending on one source to having a whole network of them working for you.

Getting into the Real Estate Game

For generations, real estate has been a go-to for building wealth outside of the stock market. It’s tangible. It offers two powerful benefits at once: consistent cash flow from rent and the potential for the property’s value to grow over time.

But let’s be clear: “investing in real estate” isn’t a one-size-fits-all strategy. The right approach for you comes down to how much cash you have on hand, how much time you’re willing to put in, and honestly, how much risk you can stomach.

Real Estate Investing Approaches

I’ve put together this quick table to break down some of the most common ways people get into real estate. It’s a simple way to see what each path demands and what it offers in return.

| Method | Initial Capital | Time Commitment | Primary Benefit |

|---|---|---|---|

| Traditional Rentals | High (down payment, closing costs) | Medium (tenant management, maintenance) | Consistent monthly cash flow and direct control over the asset. |

| REITs (Real Estate Investment Trusts) | Low (can buy shares like a stock) | Low (completely passive) | Easy diversification across a large portfolio of properties with minimal effort. |

| House Hacking | Medium (FHA loans allow low down payments) | High (living with tenants) | Drastically reduces or eliminates your personal housing costs, freeing up significant cash. |

As you can see, each option has its trade-offs. If you want the exposure without the late-night calls about leaky faucets, REITs are a fantastic, hands-off option. On the flip side, if you’re willing to trade a little privacy for a massive financial boost, house hacking can be a game-changer. Thinking about whether real estate is a good investment for your specific situation means weighing these pros and cons carefully.

The real power of layering income isn’t just about making more money—it’s about reducing your dependence on any single source. This diversification is the bedrock of true financial security.

From Side Hustle to Thriving Business

Real estate isn’t the only game in town. Building your own business is one of the most direct ways to create an asset that pays you. And it almost always starts small, as a side hustle. The secret is to monetize a skill you already have.

Think about Maya, a graphic designer I know who was working a typical 9-to-5. She loved the creative work but hated the income ceiling. She started taking on small freelance branding projects on Upwork in her evenings.

At first, it was just a nice little bonus. But word got around. Her client list grew. Within two years, she was consistently matching her full-time salary on the side. That’s when she made the leap. She quit her job and started her own design agency. Today, she has a small team and her business brings in over $250,000 in annual revenue. That entire income stream was born from a skill she simply decided to put to work for herself.

Tapping into Digital and Dividend Income

Two other powerful ways to add layers to your income are through digital products and dividend investing. They’re very different but both incredibly effective.

- Digital Products: This is the “create once, sell forever” model. Think about writing an ebook, recording an online course, or designing a software preset. The upfront effort is significant, but once it’s done, it can generate income with very little ongoing work. It’s almost completely passive.

- Dividend Investing: This is a classic strategy for a reason. You buy shares in solid, established companies that share their profits with you in the form of dividends. It might not have the explosive growth of a hot tech stock, but a well-built dividend portfolio can become a reliable, growing stream of cash that shows up in your account like clockwork.

Ultimately, building multiple income streams is a cornerstone of achieving financial freedom. By strategically combining different approaches—like real estate, a side business, and passive investments—you build a financial foundation that isn’t just profitable, it’s incredibly durable.

Staying the Course in a Changing World

Your journey to financial freedom doesn’t happen in a bubble. It’s constantly being shaped by the world around you—government policies, market swings, and global events can either give you a helpful push or become a major roadblock.

Think of it this way: your budget and investment plan are the car, but the economy is the road you’re driving on. Things like political stability and a strong rule of law determine whether that road is a smooth highway or a bumpy, unpredictable trail. Understanding this connection is absolutely crucial for long-term success.

The Macro Factors That Shape Your Wealth

Big-picture economic forces have a very real impact on your wallet, affecting everything from your mortgage rate to the performance of your 401(k). Keeping an eye on these isn’t just for economists; it’s a practical skill for anyone serious about building wealth that lasts.

| Economic Factor | How It Directly Affects You | Real-Life Example |

|---|---|---|

| Inflation | It quietly erodes the buying power of your money. The $100 you have today will buy you less tomorrow. | If inflation is running at 3%, a savings account earning only 1% is actually losing 2% of its value every year. |

| Interest Rates | When rates go up, borrowing gets more expensive, but your savings accounts and bonds will earn more. | The Federal Reserve raising rates means your credit card balance gets costlier, but your high-yield savings account suddenly pays better. |

| Government Policy | Changes to tax laws, new regulations, or trade deals can completely shift the investment landscape. | A new tax credit for clean energy could make stocks in solar and EV companies much more attractive to investors. |

This bigger picture is exactly why diversification is so important. When your portfolio is spread across different types of assets, you’re better protected from the turbulence caused by any single economic event. You can dive deeper into picking solid companies in our guide to the best long-term stocks for sustainable growth.

Your ability to adapt your financial strategy to a changing economic climate is just as important as your ability to save and invest in the first place.

The link between a country’s political environment and an individual’s financial success isn’t just a theory—it’s backed by solid data. The Atlantic Council’s 2024 Freedom and Prosperity Indexes found a strong positive correlation (0.71) between a nation’s freedom and its prosperity.

Specifically, the report shows that a strong rule of law has the biggest impact. Countries that protect freedoms tend to see far greater economic gains over time. You can learn more about these findings on the path to prosperity.

At the end of the day, staying the course means having a disciplined personal plan while also keeping an eye on the world around you. By understanding these external forces, you can make smarter decisions and keep your financial journey on track, no matter what surprises the future holds.

Frequently Asked Questions About the Freedom Financial Road

1. What is the first step on the freedom financial road?

The absolute first step is to get a clear picture of your current financial situation. This means creating a detailed budget to understand exactly where your money is going and calculating your net worth. You can’t chart a course to your destination if you don’t know where you’re starting from.

2. How much money do I need for financial freedom?

There is no single magic number; it’s unique to you. A common rule of thumb is the “4% Rule,” which suggests you need a portfolio worth 25 times your desired annual spending. For example, if you want to live on $60,000 per year, you would aim for a portfolio of $1.5 million.

3. Is it better to pay off my mortgage or invest?

This is a classic debate. Paying off your mortgage offers a guaranteed, risk-free return equal to your interest rate and provides great peace of mind. Investing in the stock market has historically provided higher returns but comes with market risk. A balanced approach—doing a bit of both—is often a good compromise.

4. What if I’m starting with a low income?

It’s challenging but absolutely possible. The key is to focus intensely on increasing the gap between your income and expenses. This involves strict budgeting, avoiding lifestyle creep, and actively seeking ways to increase your income through new skills, job changes, or a side hustle. Start investing small amounts automatically to build the habit.

5. Is it ever too late to start?

No. While starting earlier gives you more time for compound interest to work, you can make significant progress at any age. If you’re starting later, your strategy will likely involve higher savings rates and potentially working a few more years, but the principles of budgeting, debt reduction, and investing remain the same.

6. How do I stay motivated when the goal feels so far away?

Break the journey into smaller, achievable milestones and celebrate them. Focus on paying off one credit card, saving your first $1,000, or hitting your first $10,000 invested. Track your net worth regularly to see tangible proof of your progress. This creates momentum and keeps you engaged for the long haul.

7. What’s the biggest mistake people make on this journey?

The biggest mistake is “lifestyle inflation” or “lifestyle creep.” This is when your spending increases at the same rate as your income. If you get a raise and immediately upgrade your car or apartment, you’ve erased the opportunity for that extra money to accelerate your path to freedom.

8. Should I use a financial advisor?

It depends on your confidence and knowledge. Many people successfully manage their own finances using low-cost index funds. However, a good fee-only financial advisor can provide valuable guidance, create a personalized plan, and help you avoid emotional decision-making, especially during market volatility.

9. How do I handle a market crash?

If your investment strategy is built for the long term, the best course of action during a market crash is usually to do nothing—or even invest more if you can. Market downturns are a normal part of investing. Selling in a panic locks in your losses, while staying the course allows your portfolio to recover and grow.

10. Does “financial freedom” mean I have to stop working?

Not at all. It means work becomes a choice, not a necessity. Financial freedom gives you the power to decide how you spend your time. Many people who reach it continue to work on projects they’re passionate about, start their own businesses, or dedicate their time to volunteering, free from the pressure of needing a paycheck to survive.

Here at Top Wealth Guide, our mission is to give you the strategies and insights to build real, lasting wealth. You can find more resources on stocks, real estate, and everything in between on our website. Visit Top Wealth Guide to take the next step toward securing your financial future.

2 Comments

Pingback: How to Save 100k: A Practical Guide

Pingback: How Do I Become Wealthy: A Practical Guide to Building Lasting Financial Freedom