Financial freedom. It's a term we hear all the time, but what does it actually mean? Put simply, it’s the point where you no longer have to work for money. Your assets—things like investments, real estate, or a business—are generating enough income to cover all your living expenses.

It’s not about being fabulously rich or owning a yacht. It’s about owning your time. This is the ultimate goal: the power to pursue your passions and make big life choices without being chained to a paycheck.

In This Guide

- 1 What Financial Freedom Actually Means

- 2 The Four Pillars of Your Financial Foundation

- 3 Proven Strategies to Accelerate Your Progress

- 4 How to Measure Your Journey to Financial Freedom

- 5 Navigating Obstacles on Your Path to Freedom

- 6 Using Technology to Build Wealth Smarter

- 7 Frequently Asked Questions About Financial Freedom

- 7.1 1. What's the difference between financial freedom and financial independence?

- 7.2 2. How much money do I actually need to start investing?

- 7.3 3. Should I pay off debt or invest my extra money?

- 7.4 4. What's the single best first step I can take today?

- 7.5 5. Is it possible to achieve financial freedom on a low income?

- 7.6 6. What if I'm starting late in my 40s or 50s?

- 7.7 7. What is the 4% Rule and does it still work?

- 7.8 8. What's more important: earning more or spending less?

- 7.9 9. How long does it take to reach financial freedom?

- 7.10 10. How do I stay motivated when the goal feels so far away?

What Financial Freedom Actually Means

So many people get this wrong. They chase wealth, thinking a massive bank account is the finish line. But financial freedom and being wealthy are two very different things.

Wealth is often just a number—a measure of dollars and possessions. Financial freedom, on the other hand, is measured in something far more valuable: control. It's the ability to make life-altering decisions without the crippling weight of financial stress. Imagine building a personal fortress. Its purpose isn't to hoard treasure, but to give you a safe place to weather any economic storm that comes your way.

That fortress gives you options. It means you can walk away from a toxic job, finally start that business you've been dreaming of, travel the world, or simply be more present with your family. The goal isn’t to stop working entirely (unless you want to!), but to shift from working out of necessity to working on things you genuinely love, on your own terms.

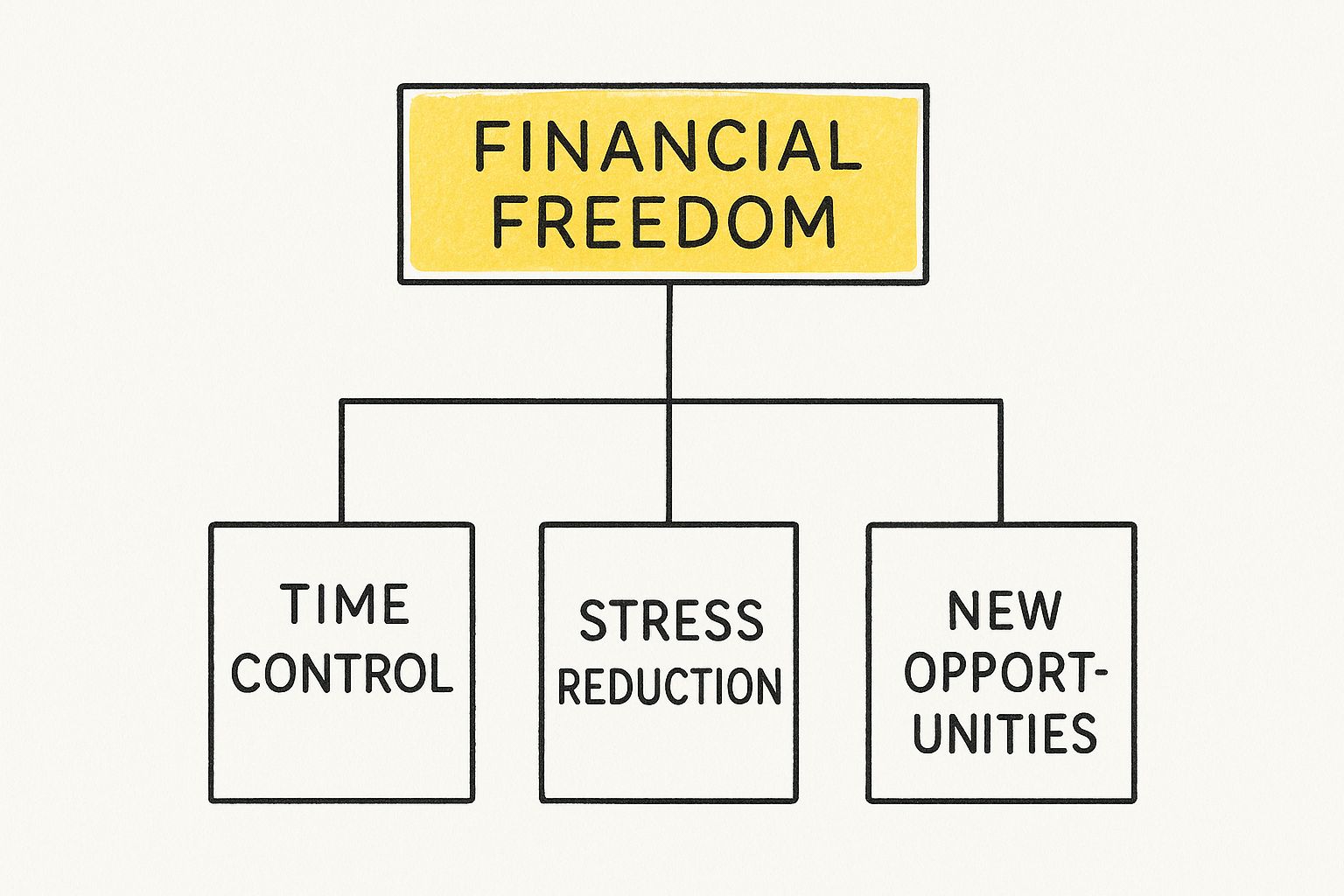

This powerful state is really built on three core pillars: complete control over your time, a massive reduction in financial stress, and the ability to say "yes" to new opportunities. This is what it looks like in practice:

As you can see, the real prize isn't a specific dollar amount; it's the incredible quality of life that money, when managed wisely, can unlock.

The Real-World Impact

This isn't just about individual well-being; the impact is staggering on a global scale. The core principles that lead to personal financial freedom—like choice, property rights, and free competition—are directly tied to better lives for entire populations.

The Fraser Institute's Economic Freedom of the World: 2025 Annual Report is a real eye-opener. It showed that in 2023, nations with the most economic freedom had an average GDP per capita of $66,434 and a life expectancy of 79 years. Now, compare that to the least free countries, which averaged a mere $10,751 in GDP per capita and a life expectancy of just 62 years. The numbers don't lie.

"Financial freedom is about having enough for your needs and a little extra for your wants. It’s the peace of mind knowing that if your car breaks down, you can fix it without going into debt, or if an opportunity arises, you have the flexibility to take it."

This distinction is what it all boils down to. It's the difference between the endless, exhausting pursuit of more and the practical, achievable goal of building a stable and deeply fulfilling life. To truly get it, it helps to understand how to define wealth beyond money and possessions.

Ultimately, the journey toward financial freedom isn’t some impossible dream reserved for the lucky few. It's a tangible path to a more meaningful life that's available to anyone willing to learn the rules and play the game.

The Four Pillars of Your Financial Foundation

Think of achieving financial freedom like building a house meant to last a lifetime. You wouldn’t just start nailing boards together without a solid foundation, right? The same is true for your wealth. Your entire financial future rests on four critical pillars that must work in harmony.

These aren't abstract theories from a textbook. They are practical, interconnected principles that, when strengthened, create a structure that not only grows your wealth but also shields it from life’s storms.

Pillar 1: Your Financial Mindset

Long before you earn, save, or invest your first dollar, the real work begins between your ears. Your mindset is the architect of your financial life. It shapes how you see money, how you react to setbacks, and ultimately, it's the most powerful predictor of your success.

Many people get stuck in a "fixed" mindset, believing their financial reality is set in stone and out of their control. This leads to fear, paralysis, and a life of watching opportunities pass by. The path to financial freedom, however, demands a "growth" mindset—one that views challenges as learning experiences and understands that financial savvy is a skill you can build.

This mental shift is everything. It changes you from a passenger in your financial life to the one firmly in the driver's seat.

Financial Mindset Comparison: Growth vs. Fixed

The way you think about money directly impacts the actions you take. Here’s a quick look at how these two mindsets stack up.

| Aspect | Growth Mindset (Path to Freedom) | Fixed Mindset (Path to Stagnation) |

|---|---|---|

| View of Money | A tool to be managed, grown, and used to create opportunities. | A limited resource that is scarce and causes stress. |

| Reaction to Setbacks | "What can I learn from this financial mistake?" | "I'm just bad with money; there's no point in trying." |

| Approach to Learning | Eagerly seeks out new financial knowledge and skills. | Avoids financial topics, believing they are too complex. |

| Handling Risk | Understands that calculated risk is necessary for growth. | Avoids all risk, often missing out on potential returns. |

| Income Potential | Believes income can be expanded through new skills or ventures. | Sees income as fixed and determined solely by an employer. |

Adopting a growth mindset isn't just positive thinking; it's about fundamentally changing your relationship with money to one of empowerment and control.

Pillar 2: Maximizing Your Income

Your income is the primary fuel for your wealth-building engine. While being frugal has its place, you can only cut so many expenses. Your earning potential, on the other hand, is virtually limitless.

This pillar is about more than just getting a raise (though that’s a good start!). It's about strategically boosting your value in the marketplace. This could mean:

- Developing high-demand skills that make you invaluable.

- Starting a side hustle to turn a hobby into a new revenue stream.

- Exploring entrepreneurship to build something you truly own.

The goal is to stop trading all of your time for money and start building systems that earn for you. A small bump in your monthly income, when invested consistently, can literally shave years off your journey to financial freedom.

Pillar 3: Strategic Saving and Investing

A six-figure salary means little if it all goes out the door each month. This third pillar is where the magic happens—it’s how you turn your income into assets that work for you. The key is being intentional.

Saving is the first step. It's about creating a gap between what you earn and what you spend. That leftover cash is your seed capital. But saving alone is a losing game thanks to inflation, which quietly eats away at your money's value over time.

Investing is putting your money to work so it can earn more money for you. It's the process of turning your savings into an army of dollar-bills that work around the clock to build your wealth, even while you sleep.

This means directing your savings into things like stocks, real estate, or businesses that can grow in value. This growth is what will eventually build the passive income you need to live life on your own terms.

Pillar 4: Eliminating Debt and Managing Risk

This final pillar is the fortress wall protecting your financial house. High-interest debt is like a fire, actively burning through your wealth and working against everything you’re trying to build.

Paying off consumer debt, especially from credit cards and personal loans, has to be a top priority. It’s like giving yourself an instant, guaranteed return on your money. Once that debt is gone, you can redirect that cash flow straight into your investments. You'll find great frameworks for setting SMART financial goals for a prosperous future that can help you map out your debt-elimination strategy.

Managing risk is the other half of the equation. This means having the right insurance, building an emergency fund to handle unexpected curveballs, and diversifying your investments so that one bad bet doesn't sink your entire portfolio.

With these four pillars standing strong, you create a foundation that is not just stable, but built for lasting growth and true financial freedom.

Proven Strategies to Accelerate Your Progress

Once you've got the basics down, it’s time to shift from planning to doing. The path to financial freedom isn’t a waiting game; it’s an active pursuit built on smart, intentional moves that create real momentum. This is where you put your money to work, turning your hard-earned savings into assets that generate wealth for you.

Ultimately, there are two powerful levers you can pull: investing your money wisely and finding ways to earn more of it. Let’s dive into some battle-tested approaches for both, using real-world examples to show you how it’s done. These aren't closely guarded secrets—they're well-worn paths available to anyone with a solid plan and the discipline to see it through.

Build Your Wealth Engine with Smart Investing

Think of investing as the engine that powers your entire journey toward financial freedom. It’s how you make your money work for you, ensuring it grows faster than inflation can eat away at its value. While there are countless ways to invest, two of the most effective and accessible strategies for most people are low-cost index funds and real estate.

Each has its own flavor, and many financially successful people use a blend of both. Getting a handle on their fundamental differences is the first step in deciding which path, or combination of paths, aligns with your goals.

Comparing Core Investment Strategies

| Feature | Low-Cost Index Funds | Real Estate Investing |

|---|---|---|

| Simplicity | High. You can get started in minutes with just a few clicks. | Low. It involves research, financing, and hands-on management. |

| Liquidity | High. You can sell your shares and get cash on any business day. | Low. Selling a property can easily take months. |

| Passivity | High. It's the classic "set it and forget it" approach. | Low to Medium. Can be hands-on or outsourced to property managers. |

| Capital Needed | Low. You can start with just a few dollars. | High. Requires a hefty down payment and good credit. |

| Leverage | Low. You're typically investing your own cash. | High. You can use loans to control a much larger asset. |

| Income Stream | Dividends (usually small and paid quarterly). | Rental income (can be significant and comes in monthly). |

Choosing between them isn't about which one is "best"—it's about which one is best for you, your risk tolerance, and how involved you want to be. For a deeper look, it's worth exploring these and other powerful wealth-building strategies to find what clicks.

Real-Life Example: The Disciplined Investor

Take Sarah, a software engineer working a standard 9-to-5. She wasn't a Wall Street whiz, but she was incredibly disciplined. From her very first paycheck, she set up an automatic transfer of 15% of her income into a low-cost S&P 500 index fund. She never tried to pick hot stocks or time the market.

Sarah's strategy was all about consistency. When the market dipped, she didn't panic—she kept right on investing, effectively buying more shares on sale. After 15 years, the magic of compound growth had turned her steady, unremarkable contributions into a six-figure portfolio, well on its way to seven figures.

Her story is a powerful reminder that you don't need a groundbreaking idea or a huge salary to win this game. All you need is a simple plan and the commitment to stick with it.

Supercharge Your Income with Multiple Streams

Relying on a single paycheck is like sitting on a one-legged stool. It might hold you up for a while, but it’s inherently unstable. One of the quickest ways to fast-track your journey is by building multiple income streams. This not only creates a financial safety net but also dramatically boosts the amount of money you can pour into your investments.

This doesn't mean you have to quit your day job. For most people, it starts with a side hustle—a small venture you build in your spare time. This could be anything from freelance writing or graphic design to opening a small e-commerce shop or even starting a local dog-walking business. In fact, a recent study showed that nearly 40% of Americans have a side hustle, proving just how mainstream this approach has become.

Real-Life Example: The Savvy Entrepreneur

Now, consider Mark. He worked as a marketing manager but loved woodworking in his spare time. He started small, selling custom-made shelves on Etsy in the evenings and on weekends. His initial profits were modest, just a few hundred dollars a month, but he funneled every penny directly into his investment accounts.

As his reputation grew, so did his orders. Within three years, his side hustle was bringing in more than his full-time salary. He took the leap, quit his job, and gained complete control over his income and his time. Mark’s journey shows how a passion project, when treated like a real business, can become an incredible engine for achieving financial freedom.

Both Sarah's patient investing and Mark's entrepreneurial spirit led them to the same place. Their stories prove the "how" is flexible. What truly matters is picking a strategy and executing it with relentless consistency.

How to Measure Your Journey to Financial Freedom

You can't hit a target you can't see. The path to financial freedom can feel incredibly long and sometimes a bit fuzzy, which is why you need real numbers to light the way. Tracking a few key metrics turns that vague dream into a concrete goal you can actually work toward.

Instead of just hoping for the best, these numbers give you a personalized roadmap. You can see exactly how your savings and investment habits are paying off in real-time. This data-driven approach takes the emotion out of it and gives you the clarity to know where you stand and what moves to make next.

Start by Calculating Your Net Worth

Your net worth is the ultimate snapshot of your financial health. It's a simple yet incredibly powerful formula: everything you own (your assets) minus everything you owe (your liabilities).

Think of it as your personal financial report card. It cuts through all the noise of your monthly income and expenses to show you what you've actually managed to build. Honestly, tracking this number every quarter or year is one of the most motivating things you can do.

Here’s a quick breakdown of what goes into the calculation:

- Assets: This is the good stuff. Tally up your cash, investment account balances, retirement funds (like your 401(k) or IRA), equity in your home, and even the value of your car.

- Liabilities: This is all your debt. Add up your mortgage balance, car loans, student loans, and any outstanding credit card balances.

Watching your net worth climb—even by small amounts at first—is tangible proof that your hard work is paying off. It's the confirmation you need that your sacrifices are moving the needle long before you hit your final destination.

Define Your Personal Freedom Number

Your "Freedom Number" is the magic number. It’s the total amount you need invested so that your money can generate enough income to cover your living expenses forever, without you ever having to work again. This is the finish line. Calculating it turns the fuzzy concept of "enough money" into a specific, actionable target.

The most common way to figure this out is the 4% Rule. It’s a well-regarded guideline suggesting you can safely withdraw 4% of your portfolio's value each year without running out of money over the long haul.

To find your Freedom Number, just multiply your desired annual expenses by 25. For example, if you figure you need $60,000 a year to live your ideal life, your Freedom Number is $1.5 million ($60,000 x 25).

Suddenly, you have a clear goal. Every dollar you save and invest is a step closer to hitting that number. It makes the whole journey feel less like an endless climb and more like a series of achievable milestones.

Your Savings Rate Determines Your Timeline

Sure, your income matters, but your savings rate is the real MVP. This is the percentage of your take-home pay that you save and invest, and it's the single biggest factor determining how quickly you reach financial independence.

A higher savings rate has a powerful two-for-one effect: you’re obviously accumulating money faster, but you’re also training yourself to live on less. This, in turn, lowers the Freedom Number you need to hit in the first place.

Of course, investment returns are a huge part of the equation too. The power of compounding can shave years, even decades, off your timeline. You can dig deeper into how this works by checking out our guide on the average rate of return for investments.

To see just how dramatically your savings rate affects your timeline, check out the table below. It shows how long it takes to reach financial independence based on different savings rates, assuming a pretty standard 7% average annual return on investments.

Timeline to Financial Freedom Based on Savings Rate

| Savings Rate (%) | Years to Financial Freedom |

|---|---|

| 10% | 51 years |

| 20% | 37 years |

| 30% | 28 years |

| 40% | 22 years |

| 50% | 17 years |

| 60% | 12.5 years |

The numbers don't lie. Even small bumps in your savings rate create a massive snowball effect. Look at the jump from a 20% savings rate to 40%. It doesn't just cut your time in half; it slashes your timeline by over 40%, from a 37-year slog to a much more manageable 22 years.

This powerful connection between your daily habits and your long-term timeline is where you find real control over your financial destiny.

Let's be honest: the path to financial freedom isn't a straight line. It’s more of a long-haul trek, complete with surprise detours and tough climbs that will test your resolve. Knowing what these roadblocks look like ahead of time is your best defense for building the resilience you'll need to stay on track.

One of the sneakiest traps is lifestyle inflation. It happens to almost everyone. You get a raise or a bonus, and suddenly, a nicer car, a bigger house, or fancier dinners feel like a necessity. While there’s nothing wrong with enjoying your hard-earned money, letting your spending grow right alongside your income can kill your progress. It’s a surefire way to stay stuck on the financial treadmill.

Then there’s the gut-wrenching reality of market volatility. It’s one thing to see your portfolio grow, but it’s another thing entirely to watch it suddenly drop by 10% or 20%. That’s when fear kicks in, and the temptation to sell everything and cut your losses becomes overwhelming. Giving in to that panic is often the single biggest mistake an investor can make, locking in losses and wiping out years of patient progress.

Staying the Course Through Volatility

The secret to weathering market storms is all about perspective. A market dip isn’t a catastrophe; it’s a discount. For anyone investing for the long term, these downturns are actually opportunities to buy great investments for cheaper than they were a month ago. It’s like your favorite store having a massive sale.

"The stock market is a device for transferring money from the impatient to the patient." – Warren Buffett

This classic line from Buffett gets to the heart of it. The most valuable tool in your investor toolkit isn't a hot stock tip; it's patience. The people who make real money are the ones who can ride out the turbulence, because historically, powerful recoveries always follow the downturns. Panic-selling is the only move that guarantees a loss.

Automating Your Defenses

So, how do you protect yourself from emotional decisions and lifestyle creep? You take your own willpower out of the equation. Putting your financial plan on autopilot is one of the most effective strategies you can use.

- Pay Yourself First: Don't wait until the end of the month to see what's left. Set up automatic transfers to your investment and savings accounts for the day you get paid. This simple move ensures your future is funded before you can even think about spending that money elsewhere.

- Automate Debt Payments: If you're tackling high-interest debt, schedule automatic extra payments. This methodically chips away at what you owe without you having to think about it.

- Increase Contributions Annually: Every time you get a raise, bump up your retirement contributions by a percentage point or two. You’ll barely feel it in your paycheck, but the long-term impact on your nest egg will be enormous.

Adapting to Life's Curveballs and Global Shifts

No plan, no matter how perfect, is immune to life. A sudden job loss, an unexpected medical bill, or a major family event can feel like a devastating blow. This is precisely why an emergency fund isn't just a nice-to-have—it's your financial shock absorber. It’s what allows you to handle a crisis without derailing your long-term goals or going into debt.

Beyond your personal life, bigger forces are always at play. Global economic conditions, shaped by policy changes and world events, have a real impact on your ability to invest and grow your wealth. For two decades, global economic freedom was on the rise, but the pandemic led to restrictive policies that wiped out nearly a decade of that progress.

In 2025, you can see huge differences between major economies like the United States (ranking 5th) and Canada (11th) and emerging ones like China (108th). On top of that, U.S. trade freedom took a sharp hit after 2018 because of new tariffs, which affected its standing. You can dive deeper into this by reading the full report on global economic freedom from the Cato Institute. These large-scale shifts just go to show how crucial it is to have a financial plan that’s not just strong, but also flexible.

Using Technology to Build Wealth Smarter

It wasn’t long ago that managing your money meant wrestling with spreadsheets or paying a small fortune for a financial advisor. Thankfully, those days are over. The most powerful tool for building wealth is probably sitting in your pocket right now.

Today's financial technology puts you in the driver's seat, removing old barriers and making it easier than ever to build solid, wealth-generating habits. These tools automate the grunt work—tracking expenses, sticking to a budget, even investing your money—so you can focus on the big picture. They take the friction out of managing your finances, which is key to staying on track.

Put Your Progress on Autopilot with FinTech

The right apps can be a game-changer. They turn your good intentions into automatic actions, creating a system that keeps you disciplined even when life gets busy.

Several types of financial tech are especially helpful on the road to financial freedom:

- Budgeting Apps: I’m a big fan of tools like YNAB (You Need A Budget). It makes you give every dollar a purpose, which brings incredible clarity to where your money is going. That awareness is the first step to saving more.

- Robo-Advisors: Platforms such as Wealthfront or Betterment take the guesswork out of investing. They build and manage a diversified portfolio for you based on your goals and comfort with risk, handling all the complex stuff like rebalancing.

- Automated Investing Platforms: If you want a bit more control, a service like M1 Finance lets you build custom investment portfolios (they call them "pies") and automatically fund them on a schedule. It’s a brilliant way to build a position over time.

These platforms aren't just about convenience; they fundamentally change the wealth-building process. If you’re just getting started, finding the right fit is crucial. You can check out some of the best investment apps for beginners to see which tools match your personal strategy.

More People Have Access Than Ever Before

This wave of technology has done more than just help individuals; it has boosted financial inclusion around the globe, which is a cornerstone of widespread financial freedom. Digital financial services have opened the doors for millions to save, invest, and protect their money for the first time.

In fact, the World Bank's Global Findex database shows a massive jump in financial account ownership since 2011, mostly thanks to mobile tech. While there’s still work to do, this progress is a huge win for personal wealth-building on a global scale.

By putting these modern tools to work, you can build wealth smarter, not harder. They give you the structure and automation needed to turn your financial plan into a reality.

Frequently Asked Questions About Financial Freedom

1. What's the difference between financial freedom and financial independence?

While often used interchangeably, financial independence (FI) is the state where your passive income covers your expenses, making work optional. Financial freedom is the broader concept of having total control over your life and finances, free from money-related stress. FI is a key milestone on the road to true freedom.

2. How much money do I actually need to start investing?

You can start with as little as $1. Modern investment platforms offer fractional shares, allowing you to buy a small piece of a stock or ETF. The key isn't the amount you start with, but the habit of consistent investing.

3. Should I pay off debt or invest my extra money?

It depends on the interest rate. A good rule is to prioritize paying off high-interest debt (like credit cards with rates over 8-10%) because the return is guaranteed. For low-interest debt (like a mortgage under 5%), you may earn more by investing in the stock market over the long term.

4. What's the single best first step I can take today?

Track your spending to create a budget. You cannot optimize what you don't measure. Understanding exactly where your money goes is the most powerful first step toward taking control and finding more money to save and invest.

5. Is it possible to achieve financial freedom on a low income?

Yes, but it requires higher discipline and a focus on increasing your income over time. It means maximizing your savings rate, living frugally, and actively looking for ways to boost your earnings through side hustles or acquiring new skills.

6. What if I'm starting late in my 40s or 50s?

It's never too late. While you have less time for compounding to work its magic, you likely have a higher income and more wisdom. The strategy becomes more aggressive: a higher savings rate and taking full advantage of catch-up contributions in retirement accounts are crucial.

7. What is the 4% Rule and does it still work?

The 4% Rule is a guideline suggesting you can safely withdraw 4% of your investment portfolio's value in your first year of retirement, and adjust for inflation thereafter, without running out of money. While it's a solid starting point, many experts now suggest a more flexible approach or a slightly lower withdrawal rate (like 3.5%) to account for longer lifespans and market volatility.

8. What's more important: earning more or spending less?

Both are critical, but in the beginning, spending less has a more immediate impact. Cutting an expense provides a 100% return, as that dollar can go directly to saving or investing. Over time, however, your ability to increase your income becomes the more powerful lever, as there's no ceiling on how much you can earn.

9. How long does it take to reach financial freedom?

This depends entirely on your savings rate. Someone saving 10% of their income might take over 50 years, while someone saving 50% could potentially reach it in under 20 years. The more you save, the faster you get there.

10. How do I stay motivated when the goal feels so far away?

Celebrate small wins and track your progress. Don't just focus on the final number. Set milestones, like your first $10,000 invested or paying off a credit card. Regularly calculating your net worth provides tangible proof that your efforts are working, which is a powerful motivator.

Ready to take the next step on your wealth-building journey? At Top Wealth Guide, we provide the strategies and insights you need to turn your financial goals into reality. Explore our resources and start building your future today.