At its core, the difference between stocks and bonds boils down to one simple concept: buying a stock makes you an owner, while buying a bond makes you a lender.

When you own a stock, you own a small piece of that company. Your financial fate is tied directly to its performance—you share in the profits and growth, but also the risks. As a bondholder, you're essentially loaning money to a company or government in exchange for a promise of regular interest payments and the return of your principal.

In This Guide

- 1 Ownership Versus Lending Explained

- 2 Stocks vs. Bonds: A Real-World Comparison

- 3 How to Compare Risk and Return Potential

- 4 How Each Asset Class Generates Investor Income

- 5 Choosing the Right Mix for Your Financial Goals

- 6 Frequently Asked Questions About Stocks and Bonds

- 6.1 1. Which is better for a beginner, stocks or bonds?

- 6.2 2. Can I lose all my money in both stocks and bonds?

- 6.3 3. How do interest rates affect my investments?

- 6.4 4. Are dividends from stocks and interest from bonds taxed the same?

- 6.5 5. What is a "junk bond"?

- 6.6 6. Do I have voting rights with bonds like I do with stocks?

- 6.7 7. Why would anyone buy a bond if stocks have higher historical returns?

- 6.8 8. What's the difference between a stock and an ETF?

- 6.9 9. How often do stocks and bonds pay investors?

- 6.10 10. Can a bond's price change before it matures?

Ownership Versus Lending Explained

Imagine your favorite local business wants to expand. You could buy a share of the business, hoping it grows into a huge success and your share becomes incredibly valuable. That's like buying a stock. Alternatively, you could lend them the money they need, and they'd agree to pay you back with, say, 5% interest over the next few years. That’s like buying a bond.

This choice between equity (stocks) and debt (bonds) is the first major decision every investor faces. Getting this right is foundational, a concept we dig into much deeper in our complete investing for beginners guide.

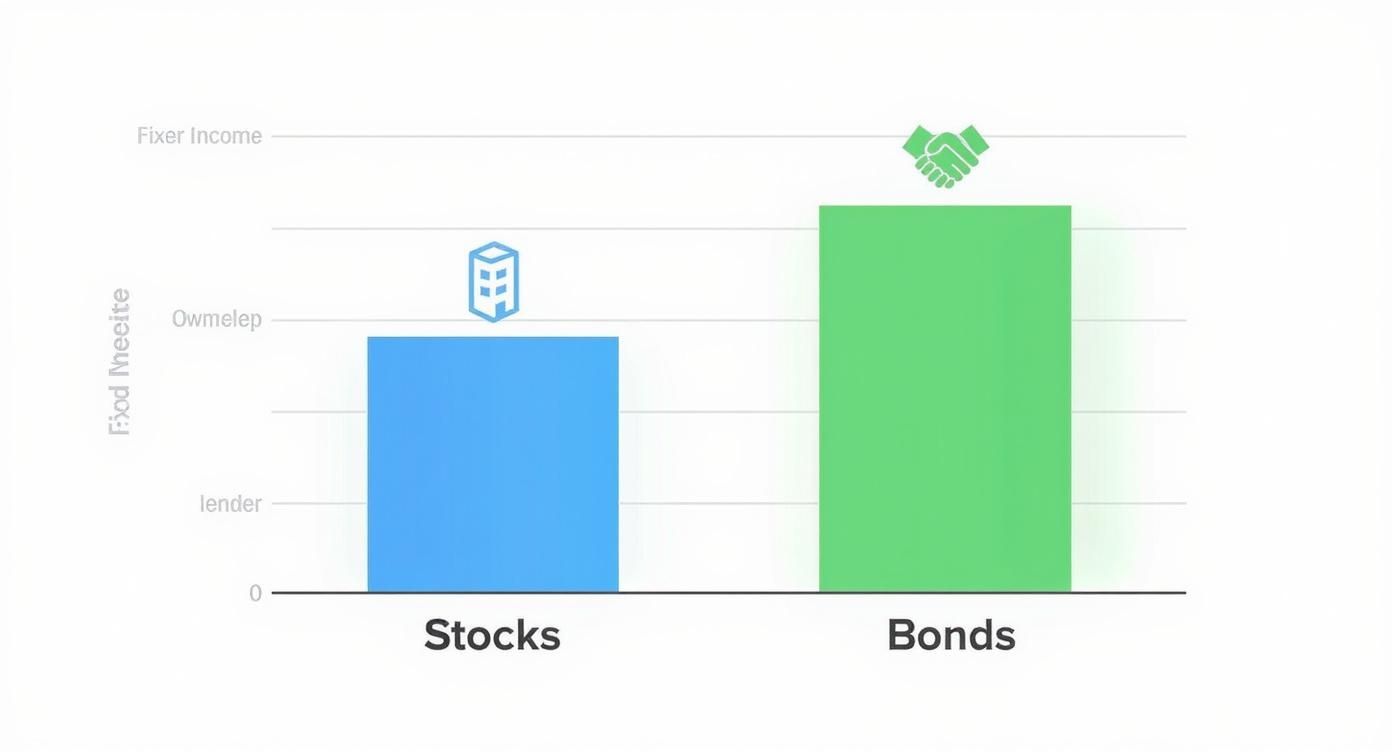

Core Differences At a Glance

Stocks and bonds play very different roles in a well-rounded portfolio because of how they behave. One is built for growth, the other for stability. To make it even clearer, this table lays out their fundamental characteristics side-by-side.

| Characteristic | Stocks (Equity) | Bonds (Debt) |

|---|---|---|

| What You Get | Ownership stake in a company | A loan to an entity (IOU) |

| Primary Goal | Capital appreciation (growth) | Fixed income and capital preservation |

| Risk Level | Higher (more volatile) | Lower (more stable) |

| Return Potential | High (theoretically unlimited) | Lower (fixed interest payments) |

| Investor Role | Shareholder/Owner | Lender/Creditor |

| Claim on Assets | Last in line in bankruptcy | Paid before stockholders |

| Income Source | Dividends (variable) | Coupon payments (fixed) |

This simple breakdown shows why investors use them for different purposes. Stockholders are betting on a company's future potential, hoping for significant growth. Bondholders, on the other hand, prioritize receiving a steady, predictable income stream with less drama.

In a worst-case scenario like bankruptcy, bondholders are first in line to get paid back from any remaining assets. Stockholders come last, which is a big part of the risk they take on for the chance at higher rewards.

Stocks vs. Bonds: A Real-World Comparison

Let's get to the heart of what it means to put your money into stocks versus bonds. It really boils down to one simple question: do you want to be an owner or a lender?

The Stock Experience: Owning a Piece of the Pie

When you buy a stock, you're buying a piece of the company. It's that simple. You become a part-owner, giving you a claim on that company's assets and, more importantly, its future profits. Your investment's success is tied directly to how well the business performs.

Real-World Example: Imagine you bought 100 shares of NVIDIA (NVDA) in early 2023 for roughly $150 per share, an investment of $15,000. Fueled by the AI boom, the company's profits soared, and by mid-2024, the stock price had rocketed past $1,200 per share. Your initial investment would have grown to over $120,000. As an owner, you directly participated in the company's explosive growth.

The Bond Experience: Being the Bank

On the other hand, buying a bond makes you a lender. You're essentially loaning your money to an entity—it could be a corporation like Apple or even the U.S. government—and they make you a promise in return.

The promise is the foundation of bond investing: you’ll receive regular, fixed interest payments over a specific period, and at the end of that term, you get your original investment (the principal) back.

Real-World Example: Suppose instead of buying stock, you bought a $15,000 U.S. Treasury Note with a 10-year maturity and a 4.5% coupon rate. Each year, you would receive $675 in interest payments ($15,000 * 4.5%), providing a predictable income stream. At the end of 10 years, the government would return your full $15,000. NVIDIA's stock performance would have no impact on your return; you receive exactly what was contractually promised.

This fundamental split between ownership and lending is why most savvy investors hold both. Stocks are your engine for growth, while bonds provide a source of stability and income.

Of course, a well-rounded strategy doesn't stop here. For investors looking to truly fortify their portfolio, it's smart to explore investment diversification beyond stocks and bonds to spread out risk even further. Understanding the distinct roles each asset plays is the first step toward building a portfolio that actually works for your financial goals.

How to Compare Risk and Return Potential

Every investment decision boils down to a classic trade-off: risk versus reward. When you buy stocks, you're accepting the ups and downs of market volatility and a company's performance in exchange for a shot at significant long-term growth. Bonds, on the other hand, are the steadier workhorses of the investment world, offering a predictable income stream for those willing to accept lower growth potential.

But it’s a mistake to think in black-and-white terms like 'stocks are risky' and 'bonds are safe'. A much better way to look at it is as a spectrum. Understanding where different investments fall on that spectrum is key to building a portfolio that actually fits your financial goals and, just as importantly, lets you sleep at night.

The Spectrum of Risk and Reward

Think about it this way: a speculative tech stock is way out on the risky end of the spectrum. Its price can soar or tank based on a new product, a competitor's move, or even just a shift in market mood. At the opposite end, you have U.S. government bonds, which are about as close to a "sure thing" as you can get in investing because they're backed by the full faith and credit of the government.

This image really drives home the fundamental difference between the two. Stocks give you a piece of the action (ownership) with variable outcomes, while bonds position you as a lender earning a fixed income.

The core idea is simple: as a stock owner, you embrace uncertainty for the possibility of higher returns. As a bondholder, you prioritize predictability and safety, which naturally comes with more modest returns.

Historical Performance as a Guide

Looking back at history gives us a clear picture of this dynamic in action. Over the long haul, stocks have consistently outperformed bonds, but it's been a much bumpier ride. If you look at the data from 1928 to 2024, the S&P 500 delivered an average annual return of roughly 11.79% (assuming dividends were reinvested).

By comparison, 10-year U.S. Treasury bonds averaged just 4.79% per year during that same stretch. This stark difference in performance is why advisors often tell younger investors to lean heavily into stocks—they have decades to ride out the market’s inevitable slumps and let compounding do its magic.

The performance gap is the crux of a common financial planning strategy: a higher stock allocation for younger investors. They have a longer time horizon to recover from market downturns and fully benefit from compounding growth.

Of course, bonds aren't without their own set of risks. The big one is interest rate risk. If you buy a bond and interest rates go up, newer bonds will be issued with more attractive yields, making your lower-yield bond less valuable if you need to sell it. Then there's default risk—the chance that the issuer (the company or government) can't make its interest payments or pay you back when the bond matures.

Before you decide on your ideal mix of stocks and bonds, it's crucial to get a handle on your personal risk tolerance and figure out your expected average rate of return.

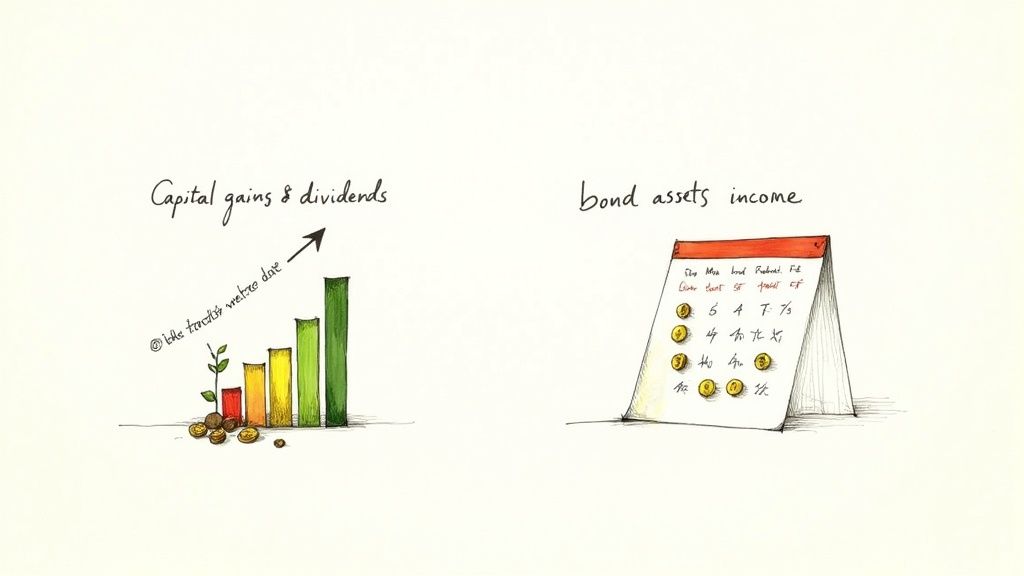

How Each Asset Class Generates Investor Income

When you invest, you're putting your money to work. But how it works to pay you back is a critical piece of the puzzle, and this is where stocks and bonds really part ways. Understanding this difference is key to aligning your portfolio with what you actually want to achieve.

For stock investors, there are two main paths to making money: capital appreciation and dividends. Capital appreciation is simply the profit you get when a stock's price goes up and you sell it for more than you bought it for. This is the primary goal for anyone investing in high-growth companies that pour every penny of profit back into expansion.

Then you have dividends. These are cash payments that more mature, established companies often pay out to their shareholders. Think of big, stable utility or consumer goods companies. These payments can create a reliable income stream, which is a huge plus for investors focused on generating regular cash flow.

Income from Stocks Versus Bonds: A Comparison

Bonds are a different story altogether, built on a foundation of predictability. When you buy a bond, you're essentially lending money, and your income comes from the fixed interest payments—known as coupons—that the issuer agrees to pay you.

These coupon payments are made like clockwork, usually twice a year, until the bond matures. At that point, you get your original investment (the principal) back. This reliable, scheduled cash flow is precisely why bonds are a go-to for investors who prioritize stability, especially those heading into retirement. For a deeper dive, our guide on income investing strategies for monthly cash flow has more on this.

Here’s a practical breakdown of how you might get paid:

| Asset Type | How You Earn Money | Example |

|---|---|---|

| Growth Stock | Capital Appreciation: The stock price increases significantly over time. | Buying Tesla stock and selling it years later for a large profit. |

| Dividend Stock | Dividends: The company pays you a share of its profits, typically quarterly. | Owning shares of Coca-Cola and receiving a regular dividend check. |

| Corporate Bond | Coupon Payments: The company pays you fixed interest on your loan, typically semi-annually. | Loaning money to Microsoft by buying their bond and receiving fixed interest payments. |

| Govt. Bond | Coupon Payments: The government pays fixed interest on your loan. | Buying a U.S. Treasury bond and receiving guaranteed interest payments. |

It's true that over the last several decades, stocks have delivered much higher returns. But that hasn't always been the case. Historical data shows that from 1792 to 1941, stocks and bonds were surprisingly neck-and-neck in terms of wealth creation. It was only after that period that stocks really took off, solidifying their reputation as the superior engine for growth. This history lesson just goes to show that both asset classes have had their moment in the sun and can play a vital role in a well-rounded portfolio.

Choosing the Right Mix for Your Financial Goals

Knowing the difference between stocks and bonds is one thing, but actually using that knowledge to build wealth is where the rubber meets the road. There’s no magic, one-size-fits-all portfolio. The right mix is deeply personal and depends entirely on your age, what you're saving for, and how much risk you can stomach.

Think about a young professional just starting out in their 20s or 30s. With retirement decades away, they have a long runway to recover from market downturns. This allows them to take on more risk in exchange for a shot at higher returns. Their portfolio might lean heavily into stocks—something like an 80% stock and 20% bond split makes a lot of sense to chase long-term growth.

Tailoring Your Strategy for Different Life Stages

Now, flip the script. Someone on the doorstep of retirement has a completely different set of priorities. Their main goal isn't aggressive growth anymore; it's about protecting the nest egg they've spent a lifetime building and creating a reliable income stream. For them, a portfolio weighted towards bonds, maybe a 40% stock and 60% bond mix, provides that crucial stability.

This is the whole point of diversification. Stocks and bonds tend to move in different cycles. When the stock market is having a rough year, high-quality bonds can act as a shock absorber for your portfolio, and the reverse is often true as well. It’s all about creating a smoother ride.

The core idea is simple: as your life and financial goals change, your investment strategy has to change with them. The stock-heavy portfolio that’s perfect for a 30-year-old would be a reckless gamble for a 65-year-old.

The historical numbers really drive this point home. Over the last 30 years, the S&P 500 has delivered an average annual return of 10.27%, while bonds have returned a more modest 2.89%. But don't let that big gap fool you. There were long stretches, like from 2000 to 2011, where bonds consistently beat stocks, proving their worth time and again as a vital part of a balanced portfolio.

Putting together the right asset mix is a critical step. It requires you to sit down and figure out how you can optimize your portfolio with smart asset allocation so it perfectly aligns with your personal journey.

Frequently Asked Questions About Stocks and Bonds

Jumping into the world of stocks and bonds can feel like learning a new language. You’ve probably got a ton of questions, and that’s a good thing. To help clear things up, here are straightforward answers to some of the most common questions investors have.

1. Which is better for a beginner, stocks or bonds?

For most beginners, the answer isn't "either/or" but "both." A diversified portfolio containing a mix of stocks and bonds, often through low-cost index funds or ETFs, is the smartest starting point. This approach balances the growth potential of stocks with the stability of bonds. A target-date fund is an excellent "all-in-one" option that automatically adjusts this mix over time.

2. Can I lose all my money in both stocks and bonds?

Yes, it's possible, but the risk differs. With a stock, your investment can go to zero if the company goes bankrupt. With a bond, the primary risk is the issuer defaulting on its payments. However, the chance of losing everything is much lower with high-quality bonds, especially U.S. government bonds, which are considered among the safest investments in the world.

3. How do interest rates affect my investments?

Generally, when interest rates rise, the value of existing bonds with lower rates goes down. For stocks, the effect is more complex. Higher rates can slow economic growth and hurt stock prices, but they can also signal a strong economy, which is good for corporate profits.

4. Are dividends from stocks and interest from bonds taxed the same?

No. In the U.S., qualified dividends from stocks are typically taxed at a lower long-term capital gains rate. Interest from most corporate and government bonds is taxed as ordinary income, which is usually a higher rate. A key exception is municipal bonds, whose interest can be exempt from federal, state, and local taxes.

5. What is a "junk bond"?

A "junk bond," more formally known as a high-yield bond, is a bond issued by a company with a low credit rating. To compensate investors for taking on the higher risk of default, these bonds offer a much higher interest rate than more creditworthy bonds. It's a classic high-risk, high-reward investment.

6. Do I have voting rights with bonds like I do with stocks?

No. As a stockholder (owner), you typically have the right to vote on corporate matters, such as electing the board of directors. As a bondholder (lender), you have no ownership stake and therefore no voting rights. Your relationship is purely contractual.

7. Why would anyone buy a bond if stocks have higher historical returns?

For stability, income, and diversification. Bonds are less volatile than stocks and provide a predictable income stream. During stock market downturns, high-quality bonds often hold their value or even increase, acting as a crucial shock absorber for a portfolio.

8. What's the difference between a stock and an ETF?

A stock represents ownership in a single company. An Exchange-Traded Fund (ETF) is a basket of securities—it can hold hundreds or thousands of stocks (like an S&P 500 ETF), bonds, or other assets. Buying one share of an ETF gives you instant diversification across all its holdings.

9. How often do stocks and bonds pay investors?

Bonds typically pay interest (coupon payments) on a fixed schedule, most commonly semi-annually. Stocks that pay dividends usually do so quarterly. However, many stocks, particularly those of fast-growing companies, pay no dividends at all, with returns coming only from an increase in the stock's price.

10. Can a bond's price change before it matures?

Absolutely. While the face value (the amount you get back at maturity) is fixed, a bond's market price fluctuates in the secondary market. Its price can rise or fall based on changes in prevailing interest rates, the issuer's creditworthiness, and overall market demand.

At Top Wealth Guide, we provide the insights you need to build a strong financial future. Our resources are designed to help you make smart investment decisions, whether you're just starting or looking to refine your strategy. Explore our guides and tools to take control of your wealth-building journey today at https://topwealthguide.com.