The cryptocurrency market is known for its exhilarating highs and gut-wrenching lows, making a well-defined plan essential for long-term success. Simply buying a popular coin and hoping for the best is a recipe for anxiety, not wealth generation. This guide moves beyond simplistic advice to detail 10 battle-tested cryptocurrency investing strategies used by both beginners and seasoned professionals.

Whether you're a long-term believer aiming to accumulate wealth steadily or an active trader looking to capitalize on market swings, understanding these distinct approaches is your first step toward making informed, confident decisions. We will dissect each strategy, complete with actionable tips, comparison tables, and practical examples to help you align your investment choices with your financial goals and risk tolerance.

This article provides the clarity needed to navigate a complex financial landscape. We'll explore everything from the disciplined approach of Dollar-Cost Averaging (DCA) and the patient art of HODLing to more active methods like Swing Trading and Technical Analysis. Our goal is to equip you with a diverse toolkit, empowering you to build a resilient and strategic crypto portfolio that works for you, rather than against you.

In This Guide

- 1 1. Dollar-Cost Averaging (DCA)

- 2 2. Buy and Hold (HODL)

- 3 3. Diversification Across Multiple Cryptocurrencies

- 4 4. Fundamental Analysis and Project Research

- 5 5. Technical Analysis and Chart Trading

- 6 6. Staking and Yield Generation

- 7 7. Value Investing and Contrarian Strategy

- 8 8. Momentum Trading and Trend Following

- 9 9. Index and ETF Investment Strategy

- 10 10. Swing Trading with Technical Triggers

- 11 10-Strategy Crypto Investing Comparison

- 12 Crafting Your Personal Crypto Investment Blueprint

- 13 Frequently Asked Questions (FAQ)

- 13.1 1. What is the best cryptocurrency investing strategy for a beginner?

- 13.2 2. How much of my portfolio should I allocate to cryptocurrencies?

- 13.3 3. Is it better to hold one cryptocurrency or diversify?

- 13.4 4. What's the difference between staking and yield farming?

- 13.5 5. Can I lose all my money in cryptocurrency?

- 13.6 6. What are the tax implications of cryptocurrency investing?

- 13.7 7. What is a "bear market" strategy for crypto?

- 13.8 8. How important is it to store my crypto in a hardware wallet?

- 13.9 9. Should I use technical analysis or fundamental analysis?

- 13.10 10. How often should I rebalance my crypto portfolio?

1. Dollar-Cost Averaging (DCA)

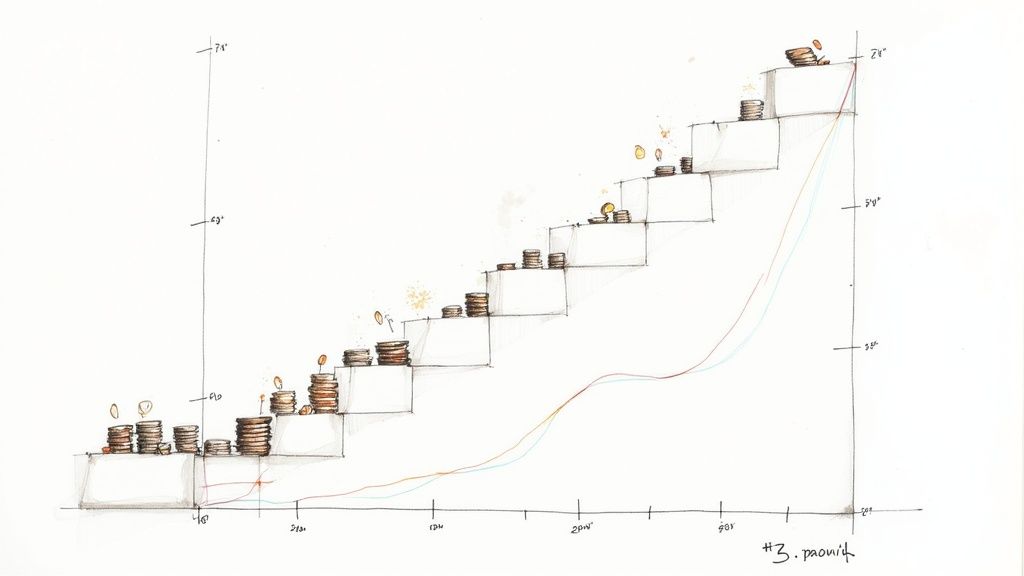

Dollar-Cost Averaging (DCA) is one of the most disciplined and effective cryptocurrency investing strategies, especially for beginners and long-term believers. Instead of investing a large lump sum at once and trying to perfectly time the market, DCA involves investing a fixed dollar amount into a specific cryptocurrency at regular intervals. This could be $100 every week or $500 every month, regardless of the asset's price.

The primary benefit is mitigating the impact of volatility. When prices are low, your fixed investment buys more of the asset; when prices are high, it buys less. Over time, this averages out your purchase price, reducing the risk of buying in at a market peak. It transforms market volatility from a source of stress into an opportunity to accumulate more assets at a lower average cost.

How to Implement DCA

Implementing DCA is straightforward, especially with modern exchanges.

- Automate Your Buys: Platforms like Coinbase and Kraken offer recurring buy features. You can set up an automatic purchase for a specific amount of Bitcoin or Ethereum to execute weekly or monthly.

- Choose Core Assets: This strategy is best suited for established, long-term holdings like Bitcoin (BTC) and Ethereum (ETH) rather than highly speculative altcoins.

- Stay Consistent: The key to DCA is consistency. Stick to your predetermined schedule and amount, removing emotional decision-making from your investment process. An investor buying $200 of Bitcoin on the 1st of every month for five years would likely have a much lower average cost than someone who tried to time the dips and peaks. To explore this strategy in more detail, you can find a comprehensive guide on Dollar-Cost Averaging (DCA) at TopWealthGuide.com.

2. Buy and Hold (HODL)

"Buy and Hold," more famously known in the crypto community as HODL (a deliberate misspelling of "hold"), is a cornerstone of long-term cryptocurrency investing strategies. This passive approach involves purchasing cryptocurrencies and holding onto them for an extended period, often several years or even decades, regardless of short-term price volatility. The core belief is that the fundamental value and adoption of well-chosen cryptocurrencies will lead to significant appreciation over time.

This strategy’s power lies in its simplicity and its ability to remove emotional, split-second decisions from the investment process. By committing to hold through market cycles, investors avoid the risks of trying to time market tops and bottoms. It’s a philosophy born from the conviction that despite dramatic price swings, the long-term trajectory for foundational assets like Bitcoin is upward. This mindset transforms market downturns from a crisis into a mere blip on a long-term chart.

How to Implement HODL

A successful HODL strategy prioritizes security and a long-term perspective.

- Secure Your Assets: For significant holdings, self-custody is paramount. Transfer your crypto from exchanges to a secure hardware wallet (like a Ledger or Trezor). This gives you full control over your private keys, protecting you from exchange hacks or failures.

- Maintain a Long-Term Vision: The essence of HODLing is to ignore short-term noise. Don't panic-sell during price drops or get overly excited during rallies. Success stories, like early Bitcoin adopters or institutional investors like MicroStrategy, are built on unwavering, long-term conviction.

- Stay Disciplined: Set realistic goals and avoid constantly checking prices, which can lead to anxiety and impulsive decisions. To properly get started with this approach, consider reviewing a foundational resource like a guide on how to invest in cryptocurrency at TopWealthGuide.com.

3. Diversification Across Multiple Cryptocurrencies

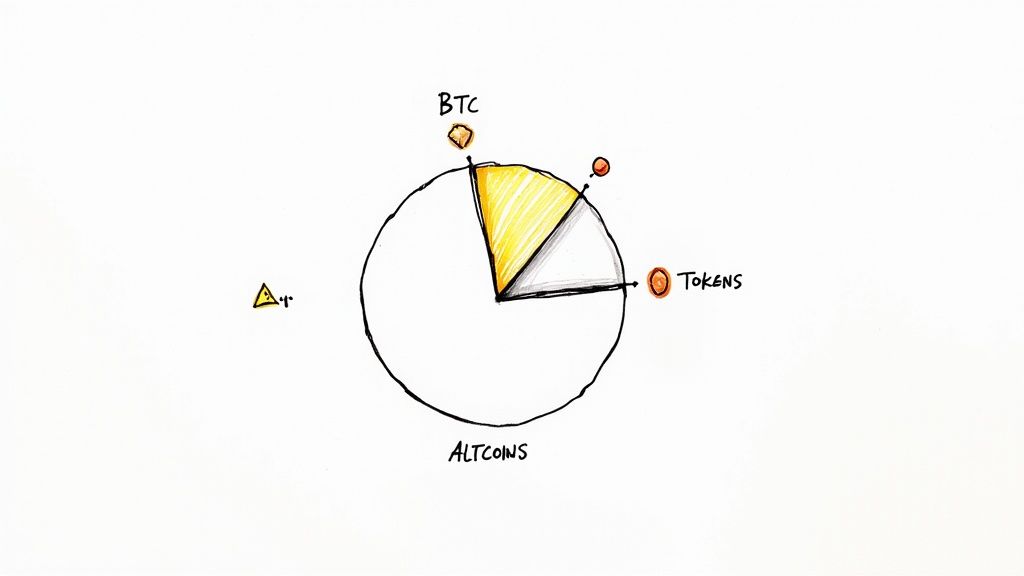

Diversification is a time-tested investment principle, famously summarized as "don't put all your eggs in one basket." This cryptocurrency investing strategy involves spreading capital across multiple digital assets with different use cases, market capitalizations, and risk profiles. Instead of concentrating funds in a single coin like Bitcoin, this approach aims to reduce unsystematic risk, the risk inherent to a specific asset, while capturing broader market growth.

The core benefit is portfolio resilience. If one asset performs poorly, the gains from others can help offset the losses, leading to a more stable investment journey. A well-diversified crypto portfolio might include a significant holding in large-cap, established projects like Bitcoin and Ethereum, complemented by positions in promising mid-cap altcoins and a smaller, speculative allocation to emerging projects. This balanced exposure smooths out returns and mitigates the impact of project-specific failures or negative news.

How to Implement Diversification

Building a diversified crypto portfolio requires research and a clear allocation plan based on your risk tolerance.

- Establish a Core-Satellite Model: Allocate the majority of your portfolio (e.g., 50-70%) to core, established assets like Bitcoin (BTC) and Ethereum (ETH) for stability. The remaining "satellite" portion can be invested in higher-risk, higher-reward altcoins across different sectors like DeFi, gaming, or infrastructure.

- Research Use Cases: Avoid owning multiple coins that do the exact same thing. Diversify across different niches. For example, your portfolio could include a store of value (BTC), a smart contract platform (ETH), a decentralized oracle network (LINK), and a gaming token (SAND).

- Rebalance Periodically: Market movements will alter your target allocations over time. Review and rebalance your portfolio quarterly or semi-annually to sell some winners and buy more of your under-allocated assets, enforcing a "buy low, sell high" discipline. To better understand how to structure your holdings, you can explore a deeper dive into optimizing your portfolio with smart asset allocation at TopWealthGuide.com.

4. Fundamental Analysis and Project Research

Fundamental Analysis and Project Research is a cryptocurrency investing strategy focused on due diligence and identifying undervalued assets with long-term potential. Instead of relying on chart patterns or market hype, this approach involves a deep dive into a project's core components: its technology, use case, development team, and tokenomics. It’s akin to how value investors like Warren Buffett analyze stocks, aiming to understand the intrinsic value of an asset before investing.

This method treats a cryptocurrency not as a speculative ticker but as a stake in a technology or a decentralized business. By thoroughly evaluating its fundamentals, investors can make informed decisions based on the project's potential for real-world adoption and growth, insulating themselves from short-term market noise. An investor using this strategy would analyze Solana's network speed and transaction costs versus competitors like Ethereum to gauge its competitive advantage.

How to Implement Fundamental Analysis

Conducting proper fundamental analysis requires a structured research process.

- Read the Whitepaper: Start with the source document. A project's whitepaper outlines its mission, technology, and roadmap. Scrutinize it for feasibility and clarity, going beyond summaries to understand the original vision.

- Investigate the Team and Development: Research the backgrounds of the core team members. Look for proven experience and past successes. Additionally, check the project's GitHub repository to confirm consistent and meaningful development activity.

- Analyze Tokenomics: Understand the token's economic model. Key factors include the total supply, distribution schedule, inflation or deflationary mechanisms, and real-world utility. Strong tokenomics align the interests of the team, investors, and users. To master this, you can explore detailed guides on how to perform investment research like a professional at TopWealthGuide.com.

5. Technical Analysis and Chart Trading

Technical Analysis (TA) is a market timing strategy that uses price charts and statistical indicators to identify potential trading opportunities. Rather than focusing on a cryptocurrency's fundamental value, TA practitioners believe that historical price action, volume, and market momentum reflect all available information and can suggest future movements. This approach is built on identifying patterns, trends, and key support or resistance levels to make informed entry and exit decisions.

The core benefit of TA is its ability to provide a structured framework for short-term to medium-term trading in the volatile crypto market. By using tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and chart patterns like the "head and shoulders," traders aim to capitalize on price swings rather than waiting for long-term growth. It's a proactive strategy favored by active traders who seek to outperform a simple buy-and-hold approach.

How to Implement Technical Analysis

Getting started with TA requires practice and a disciplined mindset, often supported by powerful charting tools.

- Master the Basics: Start by learning to identify support and resistance levels on daily or weekly charts, as these are foundational concepts. A common example is trading Bitcoin when it repeatedly fails to break a resistance level, like the $65,000 mark in a given period.

- Combine Indicators for Confirmation: Avoid relying on a single indicator. For instance, a trader might wait for a bullish crossover of the 50-day and 200-day moving averages and an RSI reading below 30 (indicating it's oversold) before entering a long position.

- Implement Strict Risk Management: This is crucial. Always use stop-loss orders to define your maximum acceptable loss on a trade. A common rule is to risk no more than 1-2% of your total trading capital on any single position. To sharpen your skills, you can explore guides on how to read stock charts at TopWealthGuide.com, as the principles are highly transferable to crypto.

6. Staking and Yield Generation

Staking and Yield Generation represents a shift from speculative trading to earning passive income directly from your crypto assets. Instead of just holding and hoping for price appreciation, this strategy involves actively participating in a network's operations or providing liquidity to decentralized finance (DeFi) protocols. By locking up qualifying cryptocurrencies, investors help secure a network (staking) or provide liquidity for trades (yield farming), receiving regular rewards in return. This approach creates a consistent revenue stream, turning your portfolio into a productive asset.

The core benefit is generating yield that can supplement or even outpace market gains, creating a buffer during downturns. For instance, staking Ethereum might offer a 3.5-4.5% annual percentage yield (APY), while providing liquidity for a trading pair on Uniswap could yield significantly more, albeit with higher risk. This powerful cryptocurrency investing strategy allows your holdings to grow through both compounding rewards and potential price increases.

How to Implement Staking and Yield Generation

Getting started with staking or yield farming can be done directly on-chain or through user-friendly platforms.

- Choose a Method: For staking, you can use liquid staking protocols like Lido or Rocket Pool for Ethereum, which provide a liquid token in return. For yield farming, platforms like Aave or Compound allow you to lend assets for variable interest.

- Understand the Risks: Be aware of impermanent loss when providing liquidity to decentralized exchanges and understand the lock-up periods associated with direct staking. Not all assets can be withdrawn instantly.

- Track and Compound: Diligently monitor your rewards and APY, as they can fluctuate with network activity. Reinvesting your earnings can significantly accelerate growth through the power of compounding. Always use validators with a proven track record of high uptime to maximize your staking rewards.

7. Value Investing and Contrarian Strategy

Value investing is a cryptocurrency investing strategy that involves buying assets when they are trading for significantly less than their intrinsic or fundamental value. This contrarian approach means you are often buying when the market is fearful, pessimistic, or outright panicking. Instead of following the herd, value investors actively seek opportunities where an asset's price has disconnected from its long-term potential, betting on an eventual recovery and market recognition.

This strategy requires immense patience, deep research, and emotional fortitude. The core idea is to purchase assets that others are selling off, capitalizing on market inefficiencies driven by fear. A prime example was buying Bitcoin when it crashed to nearly $3,000 during the March 2020 market panic, only to see it rebound to over $60,000. Similarly, investors who accumulated Ethereum during the prolonged 2018-2019 bear market were handsomely rewarded.

How to Implement a Value Investing Strategy

A successful value investing approach relies on rigorous analysis and a strong conviction in your chosen assets.

- Identify Undervalued Assets: Focus on cryptocurrencies with strong fundamentals, such as a clear use case, active development, and a robust community, that are experiencing a temporary downturn in price. Your goal is to have a clear thesis for why the asset is currently undervalued and what could cause its price to recover.

- Build a "Dry Powder" Fund: A key element is to have capital ready to deploy during market downturns. This means holding a portion of your portfolio in cash or stablecoins during bull markets so you can buy when assets go on sale.

- Be Patient and Ignore Noise: Once you've entered a position based on your value analysis, you must be prepared to hold it for the long term, potentially 2-5 years or more. Ignore the short-term negative sentiment and FUD (Fear, Uncertainty, and Doubt) that often accompanies market bottoms.

8. Momentum Trading and Trend Following

Momentum trading is a dynamic strategy centered on the idea that assets performing well will continue to do so, while underperforming assets will lag. Unlike value investing, which seeks undervalued assets, momentum traders capitalize on existing price trends, buying into strength and selling into weakness. This approach assumes that strong directional price movements, whether up or down, will persist in the short to medium term, offering opportunities for profit.

This strategy is particularly effective in the cryptocurrency market, which is known for its strong, sentiment-driven trends and distinct market cycles like "altseason." A momentum trader identifies an asset like Ethereum showing strong upward movement relative to the market and rides that trend until indicators suggest it's losing steam. The core principle is simple: "the trend is your friend." This makes it one of the most popular short-term cryptocurrency investing strategies.

How to Implement Momentum Trading

Successfully following trends requires a disciplined, rules-based approach to avoid emotional decisions.

- Identify Strong Trends: Use technical indicators like moving averages (e.g., trading above the 50-day or 200-day MA) and the Relative Strength Index (RSI) to confirm the direction and strength of a trend. A sustained price increase accompanied by high volume is a classic momentum signal.

- Set Strict Risk Parameters: This is not a "buy and hold" strategy. Use strict stop-loss orders just below key support levels or trendlines to protect capital if the trend suddenly reverses.

- Know When to Exit: Take profits at predefined resistance levels or when momentum indicators, like the MACD (Moving Average Convergence Divergence), show signs of a potential reversal. For example, a trader might sell a position in a trending altcoin once its RSI enters overbought territory (above 70) and starts to decline.

9. Index and ETF Investment Strategy

For investors seeking broad market exposure without the complexity of picking individual assets, the Index and ETF Investment Strategy is an excellent passive approach. This method involves investing in funds that track a basket of multiple cryptocurrencies, such as a crypto index fund or an Exchange-Traded Fund (ETF). It simplifies portfolio construction by offering instant diversification and removing the need for extensive research into single coins.

This strategy is one of the most accessible cryptocurrency investing strategies for beginners or those accustomed to traditional finance. It mirrors investing in an S&P 500 index fund but for the digital asset market. By buying a single share of a fund like the Purpose Bitcoin ETF (BTCC) or a trust product like the Grayscale Bitcoin Trust (GBTC), you gain exposure to the underlying asset's performance without managing private keys or a crypto wallet.

How to Implement an Index/ETF Strategy

Implementing this strategy leverages regulated financial products, making it familiar for traditional investors.

- Choose a Regulated Product: Select from a growing list of spot Bitcoin and Ethereum ETFs from major providers like BlackRock and Fidelity, or explore established products in other jurisdictions. These are available through standard brokerage accounts.

- Understand the Underlying Assets: Review the fund's methodology. Some track a single asset like Bitcoin, while others follow a diversified index of the top 10 cryptocurrencies by market cap. Ensure its composition aligns with your investment goals.

- Compare Fees: Pay close attention to the expense ratio. These management fees can vary significantly between products and will impact your long-term returns. A lower fee is generally better, assuming the fund reliably tracks its benchmark.

10. Swing Trading with Technical Triggers

Swing Trading is an intermediate-term strategy that seeks to capture gains in a cryptocurrency within a timeframe of several days to a few weeks. It sits between the high frequency of day trading and the long-term commitment of buy-and-hold investing. Swing traders rely heavily on technical analysis to identify "swings" in price, entering positions on signs of strength and exiting when momentum fades or hits a resistance level.

The core principle is to capitalize on repeatable chart patterns and technical indicators. For instance, a trader might buy Bitcoin after it breaks above a significant resistance level like $65,000 on high volume, anticipating a continued move higher. They would then set a target to sell at the next resistance, perhaps $68,000, while placing a stop-loss order just below the breakout point to manage risk. This method offers one of the most active cryptocurrency investing strategies without requiring constant market monitoring.

How to Implement Swing Trading

Successful swing trading requires a structured approach and discipline.

- Select Your Timeframe: Swing traders typically focus on 4-hour and daily charts to identify major trends and entry or exit signals. These timeframes are ideal for capturing multi-day price movements.

- Define Your Setups: Identify specific technical patterns you will trade, such as range bounces, trendline breaks, or moving average crossovers. An example is trading an altcoin that has consolidated for a week and then breaks out to the upside.

- Manage Your Risk: This is the most crucial element. Always use a stop-loss order placed immediately after entering a trade. Aim for a minimum risk/reward ratio of 1:2, meaning your potential profit is at least double your potential loss. For a deeper dive into managing risk with this strategy, you can explore resources on Swing Trading at TopWealthGuide.com.

10-Strategy Crypto Investing Comparison

| Strategy | 🔄 Implementation complexity | ⚡ Resource requirements | 📊 Expected outcomes | ⭐ Key advantages | 💡 Ideal use cases |

|---|---|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Low — set-and-forget recurring buys | Low capital consistency; exchange automation | Steady average cost reduction; moderate long-term returns | Reduces timing risk; automatable | New investors, steady savers, long-term core positions |

| Buy and Hold (HODL) | Very low — buy once, minimal active management | Low ongoing effort; requires secure custody | Long-term appreciation potential; high volatility exposure | Lowest trading fees; tax- and time-efficient | Long-term believers, passive investors, treasuries |

| Diversification Across Multiple Cryptocurrencies | Medium — allocation design and periodic rebalancing | Moderate research, portfolio tracking tools | Reduced single-asset risk; smoother risk-adjusted returns | Exposure to multiple use-cases; risk mitigation | Investors wanting balanced crypto exposure |

| Fundamental Analysis and Project Research | High — deep due diligence and ongoing monitoring | High time, technical & financial expertise | Potential to find undervalued winners; variable outcomes | Helps avoid scams; builds conviction for holds | VCs, analysts, active long-term selective investors |

| Technical Analysis and Chart Trading | High — skill development and strategy testing | High time for monitoring; charting/trading platforms | Short/medium-term profit potential; high variability | Clear entry/exit signals; works across timeframes | Day/short-term traders, algorithmic strategies |

| Staking and Yield Generation | Medium — choose protocols and manage lock-ups | Moderate capital; protocol knowledge; security practices | Passive income (variable APY); adds yield to holdings | Generates income on idle assets; compounding potential | Holders seeking passive income; DeFi participants |

| Value Investing and Contrarian Strategy | Medium–High — valuation work and timing patience | Significant capital reserves; rigorous research | High upside if thesis holds; long recovery periods | Buys assets at deep discounts; potential outsized returns | Experienced investors deploying capital in bear markets |

| Momentum Trading and Trend Following | High — fast execution and discipline required | High monitoring, execution tools, possible automation | Capture strong directional moves; elevated turnover | Profits from sustained trends; systematizable | Traders targeting clear market trends; quant teams |

| Index and ETF Investment Strategy | Low — purchase and hold fund products | Low research/time; access to ETF/index products | Market-like returns with broad diversification | Instant diversification; professional rebalancing | Passive investors, beginners, core portfolio allocation |

| Swing Trading with Technical Triggers | Medium–High — pattern-based entries and exits | Moderate time for charts; trade management tools | Capture multi-day moves; moderate-to-high risk/reward | Less time-intensive than day trading; defined R:R | Part-time traders, those preferring multi-day positions |

Crafting Your Personal Crypto Investment Blueprint

The journey through the world of cryptocurrency investing strategies reveals a powerful truth: there is no single "best" approach. The most effective path is not found in a universal formula but in a personalized blueprint, meticulously crafted to align with your unique financial goals, risk tolerance, and time commitment. We've explored a diverse toolkit, from the steady, disciplined pace of Dollar-Cost Averaging (DCA) and the long-term conviction of HODLing, to the active, analytical methods of Technical and Fundamental Analysis.

The key to success lies not in attempting to master all ten strategies at once, but in selecting and combining the ones that resonate with your personal investment philosophy. Your goal is to build a cohesive plan that you can understand, believe in, and execute with discipline, even when faced with the market's inherent volatility.

Synthesizing Your Strategy: From Theory to Action

Think of these strategies as building blocks for your portfolio. A robust and well-rounded approach might look something like this:

- The Foundation: Use DCA and HODLing for core holdings in established projects like Bitcoin and Ethereum. This builds a strong, long-term base for your portfolio, reducing the impact of short-term price swings.

- Growth and Stability: Implement diversification by investing in a basket of promising altcoins and potentially a crypto index fund. This spreads risk and captures upside potential from different sectors within the crypto ecosystem.

- Income Generation: Layer on a passive income stream through staking or yield farming. This allows your assets to work for you, generating returns that can be reinvested to compound your growth over time.

- Opportunistic Plays: Allocate a smaller, dedicated portion of your capital for more active strategies like swing trading or value investing in undervalued projects. This satisfies the desire for more hands-on involvement without jeopardizing your core portfolio.

This blended model is just one example. An investor with more time and a higher risk appetite might lean more heavily on swing and momentum trading, while a conservative investor might stick exclusively to DCA and staking. The crucial takeaway is to avoid reactive "strategy hopping" based on market noise. Instead, commit to your chosen methods, track your results, and make thoughtful adjustments as you learn and grow.

The Cornerstone of Success: Discipline and Continuous Learning

Ultimately, the most sophisticated cryptocurrency investing strategies are only as effective as the discipline behind them. Emotional decision-making, driven by fear of missing out (FOMO) or panic selling, is the primary obstacle to long-term wealth creation. Your personalized blueprint serves as your anchor, a rational guide to navigate the turbulent waters of the crypto market.

Remember that this is a dynamic field. The projects, technologies, and market conditions of today will evolve. Your commitment to continuous education is non-negotiable. Stay informed about macroeconomic trends, regulatory developments, and technological innovations. Revisit and refine your strategy annually or after significant life events to ensure it remains aligned with your objectives. By combining a well-defined plan with unwavering discipline and a thirst for knowledge, you position yourself not just to participate in the crypto market, but to thrive within it.

Ready to build your personalized investment blueprint with expert guidance? The journey to financial mastery requires the right tools and knowledge. Top Wealth Guide offers in-depth resources, analysis, and actionable insights to help you navigate complex markets, from crypto to traditional assets, and build lasting wealth. Visit Top Wealth Guide to access the strategies and expert advice you need to achieve your financial goals.

Frequently Asked Questions (FAQ)

1. What is the best cryptocurrency investing strategy for a beginner?

For most beginners, Dollar-Cost Averaging (DCA) is the most recommended strategy. It removes the pressure of timing the market, reduces the impact of volatility, and encourages a disciplined, long-term approach. Combining DCA with a Buy and Hold (HODL) mindset for established assets like Bitcoin and Ethereum provides a strong, simple foundation.

2. How much of my portfolio should I allocate to cryptocurrencies?

This depends heavily on your individual risk tolerance, age, and overall financial goals. Financial advisors often suggest a small allocation, typically between 1% and 5% of a total investment portfolio, due to crypto's high volatility. More aggressive investors might allocate a higher percentage, but it should never be more than you are willing to lose.

3. Is it better to hold one cryptocurrency or diversify?

Diversification is a proven risk management principle. While holding only Bitcoin has been a successful strategy for many, spreading your investment across multiple well-researched assets (like a mix of Bitcoin, Ethereum, and other promising altcoins) can reduce the risk of a single project failing and capture growth from different sectors of the crypto economy.

4. What's the difference between staking and yield farming?

Staking involves locking up your crypto to help secure a Proof-of-Stake network (like Ethereum) in exchange for rewards, which is generally considered lower risk. Yield farming involves providing liquidity to decentralized finance (DeFi) protocols, such as lending platforms or exchanges. It often offers higher potential returns (APY) but comes with increased risks like impermanent loss and smart contract vulnerabilities.

5. Can I lose all my money in cryptocurrency?

Yes, it is absolutely possible to lose your entire investment. The crypto market is highly volatile and speculative. Prices can crash dramatically, projects can fail, and assets can become worthless. This is why it's crucial to only invest what you can afford to lose and to employ sound risk management strategies.

6. What are the tax implications of cryptocurrency investing?

In most countries, including the United States, cryptocurrencies are treated as property for tax purposes. This means you will owe capital gains tax when you sell, trade, or use your crypto for more than you paid for it. Staking rewards and income from yield farming are typically taxed as ordinary income. Tax laws vary by jurisdiction, so consulting a tax professional is highly recommended.

7. What is a "bear market" strategy for crypto?

During a bear market (a prolonged period of falling prices), effective strategies include Dollar-Cost Averaging (to accumulate assets at lower prices), Value Investing (to buy fundamentally strong projects that are deeply discounted), and Staking (to earn passive income while waiting for a recovery). Maintaining a "dry powder" fund of stablecoins is also critical to capitalize on buying opportunities.

8. How important is it to store my crypto in a hardware wallet?

For any significant amount of cryptocurrency held for the long term (HODLing), using a hardware wallet (like a Ledger or Trezor) is highly recommended. Storing crypto on an exchange exposes you to risks like exchange hacks, freezes, or insolvency. A hardware wallet gives you full control over your private keys, making it the most secure storage method.

9. Should I use technical analysis or fundamental analysis?

The best approach often combines both. Fundamental analysis helps you identify what to invest in—projects with strong technology, teams, and long-term potential. Technical analysis helps you decide when to invest by identifying optimal entry and exit points based on price action and market sentiment. Long-term investors lean more on fundamentals, while short-term traders rely heavily on technicals.

10. How often should I rebalance my crypto portfolio?

For a diversified portfolio, rebalancing periodically is a good discipline. This involves selling some assets that have performed well and buying more of those that have underperformed to return to your target allocations. A common frequency is quarterly or semi-annually. Avoid rebalancing too often, as this can incur unnecessary transaction fees and tax events.