Debt snowball … ring any bells? This method isn’t just some mumbo jumbo — it’s actually helped millions of people kick their debt to the curb, faster than your grandma downhill on a snowboard. The secret? Focus on the little guys (the smallest debts). Knock those out first, and boom — momentum, baby.

At Top Wealth Guide (disclaimer: not a cult), we’ve seen this method turn financial paths from ‘ouch’ to ‘wow’ — all thanks to its sneaky psychological heft. We’ll help you map your plan, turbocharge that journey, and wave goodbye to debt dependency.

In This Guide

How the Debt Snowball Method Works

So, here’s the deal – the debt snowball method is all about going after your smallest debts with a vengeance, never mind the interest rates. You make those minimum payments on everything else, but that tiniest debt? Yeah, it gets all your spare cash. Once you crush that little one, you take what you were paying there and hit the next smallest debt… and it’s a cycle that gains momentum like a snowball rolling downhill.

The Snowball vs Avalanche Battle

Okay, so most calculators – those nerdy number-crunchers – will yell that the debt avalanche saves more cash by targeting high interest rates first. Numbers pan out, sure, but the heart doesn’t buy it. Harvard Business School research tells us people knocking out smaller balances are way more likely to conquer all their debts. Avalanche might save a measly $200 in interest, but snowball? Actually gets you there. With the debt snowball method, smallest debts get tackled first and you work your way up, interest rates be damned.

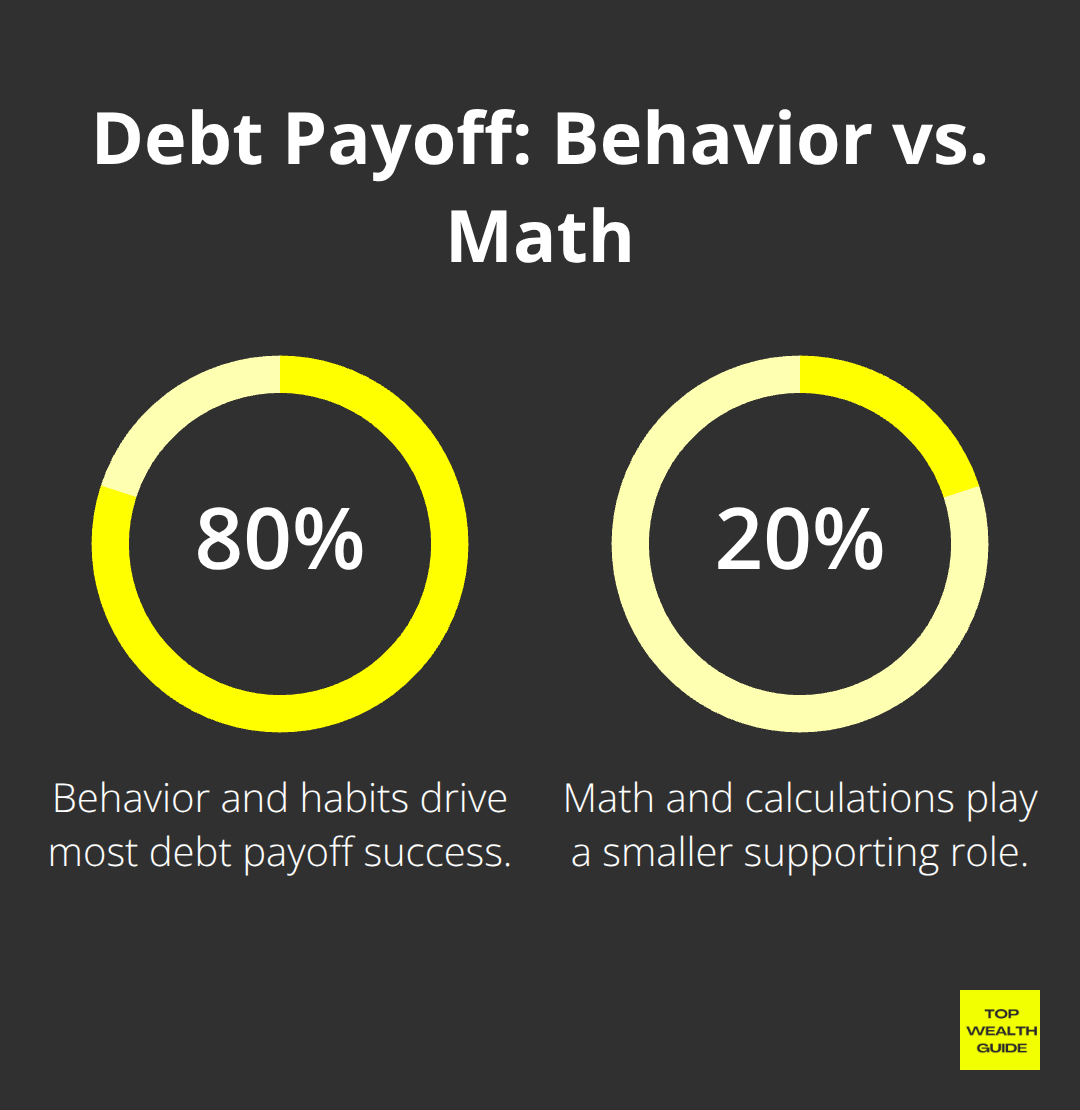

Why Your Brain Beats the Calculator

Personal finance – 80% voodoo behavior, 20% math nerd stuff. Knock out a debt, and you get this psychological “YES!” that turbocharges your motivation. The National Bureau of Economic Research saw folks who start tiny debts stay on track way better. Emotions steer your wallet more than any spreadsheet could dream.

The Psychology of Quick Wins

Quick victories are dopamine firecrackers – forming habits that keep you in the debt game, even when progress limps. Each debt you pay off? A high-five from the universe that keeps your eyes on the prize. This psychic momentum trumps the efficiency of pure math, helping avoid common financial mistakes that, honestly, can wreck debt plans.

Now that you’ve got this snowball thing down and know why it trumps math – it’s time to create a debt smackdown plan of your own and bulldoze your way to financial freedom.

Setting Up Your Debt Snowball Plan

Alright, here’s the deal. Three key steps you’ve gotta nail to make this snowball thing work – most folks trip over them. First up, gather every stinkin’ debt statement you’ve got – credit cards, personal loans, student loans, medical bills, the whole shebang (just not your mortgage). Jot down every balance to the exact penny, no “close enough” math allowed. That $1,847 in credit card debt comes before your $1,923 personal loan, even if it’s just a $76 gap. Why? The debt snowball method says it’s time to pile through debt from the smallest balance to the largest.

List All Debts from Smallest to Largest

Order is the secret sauce here – trust me, it matters more than you’d think. Toss the interest rates out the window and lock in on those balance figures. That $500 medical bill? Yeah, it wipes the floor with your $15,000 student loan, hands down. Make a no-nonsense list – three columns: creditor name, exact balance, minimum payment. This little visual becomes your GPS to financial freedom. Skip this part? Good luck staying motivated when you hit month three.

Calculate Your Attack Numbers

Time to crunch those numbers – add up all those pesky minimum payments you’re shelling out each month. We call this your baseline. Now, track every penny for a couple of weeks using apps like EveryDollar or Mint – need to find those extra bucks. The latest State of Personal Finance report digs deep into how folks are navigating their cash woes. Your smallest debt? Gets its minimum plus every scrap of extra cash you can muster.

Create Your Monthly Payment Schedule

Here’s the tactical bit – set up those minimum payments to fly out automatically the same day each month (best right after payday when your balance is looking beefy). Your target snowball debt? Oh, that gets manual attention every time you can scrounge up extra funds, not just once a month. Pay it twice monthly if you can swing it – remember, compound interest works against you here, feeding off itself. Take a $2,500 credit card debt, add $85 in minimum payments, plus slap an extra $150 on there each month – it’s gone in about 18 months.

Track Your Progress Visually

Grab a simple spreadsheet or a slick debt app with all the bells and whistles – charts and graphs that show your progress. Watch those balances shrink, month after month – this visual thrill keeps your spirits up when things start to drag. As soon as one debt vanishes, smash its payment onto the next in line. This burst of momentum flips your financial mindset on its head and speeds up every subsequent debt payoff.

So now you’ve mapped out your debt snowball strategy with precise numbers and payment plans, it’s time to jack up your progress, shaving years off your debt journey.

Strategies to Accelerate Your Debt Payoff

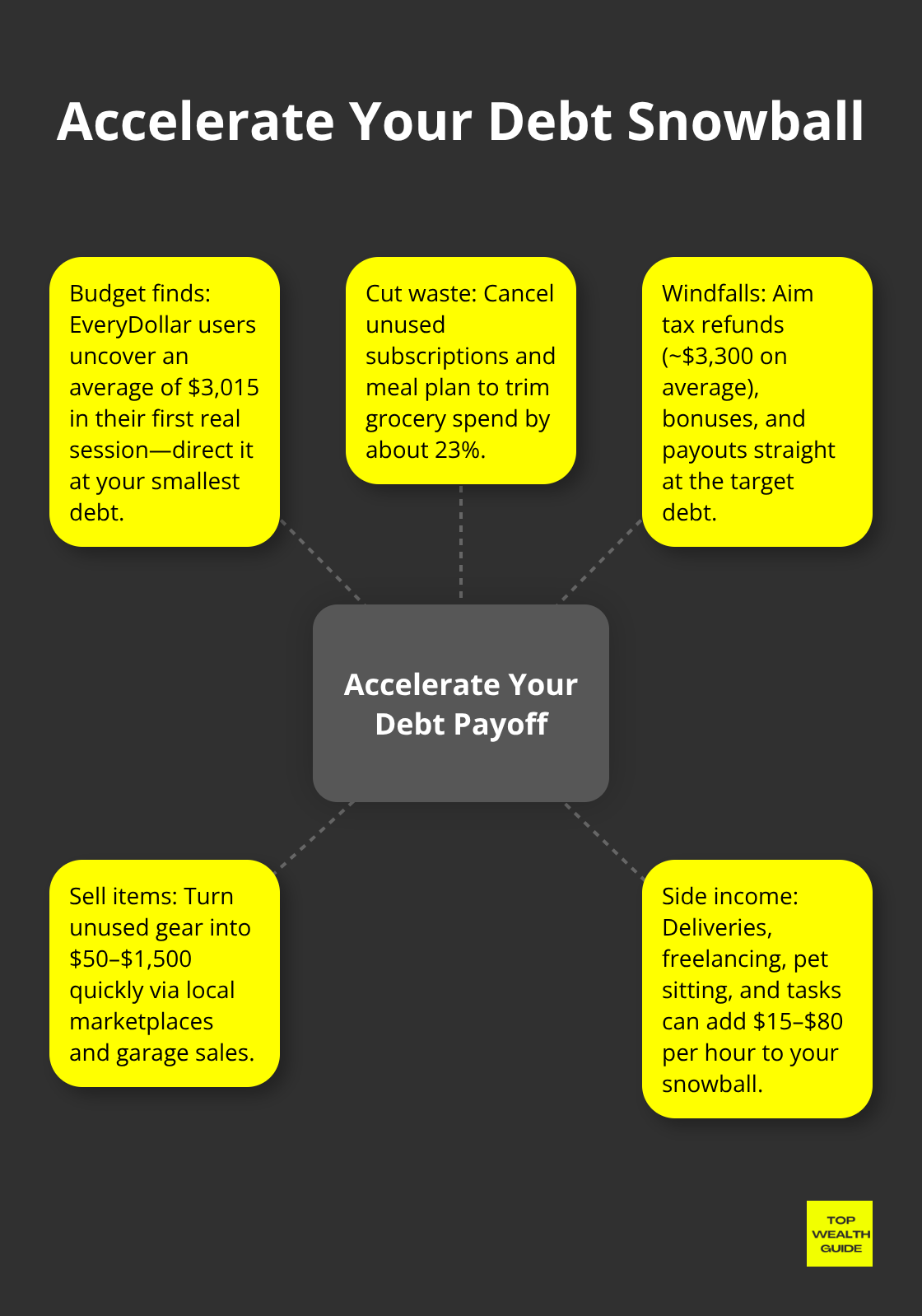

Your debt snowball plan is ready to roll, but let’s be real – most folks are barely chipping away at it because they never dig for extra dollars. Ramsey Solutions data shows people using their EveryDollar app uncover, on average, $3,015 in the first real budget session. That’s not just loose change – that’s high-octane fuel for your debt snowball.

Find Hidden Money in Your Budget

Start by doing a subscription sweep because Americans toss away $273 every month on unused stuff, per West Monroe research. Drop those streaming services you don’t even remember signing up for, let the dusty gym memberships go, and cut those outdated magazine subscriptions. Then, tackle the grocery bill – meal plans can slash food costs by 23%, as shown by University of Vermont studies. Buy generic brands for household supplies, pounce on sale cycles, and batch-cook to dodge the takeout trap.

Turn Windfalls Into Debt Destroyers

Think tax refunds, bonuses, inheritance – these windfalls are golden opportunities for debt-blasting that folks usually blow on trips or toys. The average American tax refund is about $3,300 according to IRS data, ready to knock out several small debts fast. Insurance payouts, bonuses from work, cash from relatives – every cent should laser-focus on your smallest debt, no ifs or buts.

Sell Your Stuff for Quick Cash

That dusty exercise bike? Could snag $200 on Facebook Marketplace. Old gadgets can bring $50-300 on eBay, and clothes in reasonable shape might earn $20-100 through Poshmark. One weekend of garage sales can rake in $500-1,500 in pure debt demolition force. Take another look around – you probably own thousands in items barely touched.

Generate Quick Side Income

Delivering food with DoorDash or Uber Eats can net $15-25 per hour during peak times (you choose your schedule). Freelance writing on Upwork starts at $20-50 per article for newbies, and virtual assistant gigs pay $12-18 hourly. House sitting with TrustedHousesitters or Rover pet sitting nets $25-75 daily with little hassle. TaskRabbit handyman gigs offer $30-80 per task for furniture assembly or moving jobs. The Bureau of Labor Statistics shows gig workers can earn significant extra bucks – turn that into debt-busting power and shrink your timeline from years to months with strategic application to your snowball plan.

Remember that debt elimination is just the start of your journey to lasting wealth. Once those debts are history, channel that payment might into wealth building strategies that multiply money instead of just feeding creditors’ interest.

Final Thoughts

Okay, let’s talk the debt snowball method… Most folks knock out their debts in, say, 18-36 months. The whole thing depends on how much you owe and how much extra you can throw at it. Ramsey Solutions spills the beans – committed people are zapping $20,000 of consumer debt in under two years with some elbow grease and smart budget shears. But… expect to hit those rough patches around month 6-8 when your initial high-fives and fist-bumps start to wear off.

Here’s the play: counteract those motivation dips with a little celebration every time you knock a debt off your list. Seriously, crack open a soda or something. It’s those little wins. Plus, keep your eyes on the prize with a visual tracker – charts, apps, whatever, to see those numbers tumble. And remember, the secret sauce? 80% of killing debt is behavior, not math-it’s the head game that’ll win the day over perfect number crunching.

And when you finally cross that finish line of debt freedom, do me a favor… don’t go on a spending spree just yet. Use those freed-up funds to build an emergency stash or fuel up those investment accounts. Over at Top Wealth Guide, we transition folks from stepping out of debt into wealth-building strategies – the kind that paves roads to lasting financial security.