Getting car insurance quotes online is more than just a convenient way to check a box. It’s one of the smartest financial moves you can make. From my 15 years of experience helping clients navigate the insurance world, I’ve seen firsthand how a little bit of comparison shopping can easily put hundreds of dollars back in your pocket each year—money that most people leave on the table by simply auto-renewing their old policy.

In This Guide

- 1 Why Shopping for Car Insurance Online Is a Game Changer

- 2 Gathering Your Information for the Most Accurate Quotes

- 3 Choosing Your Path: Direct Insurers vs. Comparison Sites

- 4 Decoding Your Quote to Understand What You’re Buying

- 5 Actionable Strategies to Lower Your Car Insurance Premium

- 6 Wrapping It Up: Your Path to a Better Policy

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How often should I shop for new car insurance quotes?

- 7.2 2. Will getting multiple car insurance quotes hurt my credit score?

- 7.3 3. Is the cheapest quote always the best option?

- 7.4 4. What’s the process for switching insurance companies?

- 7.5 5. Can I get an accurate quote without providing personal information?

- 7.6 6. What does “full coverage” really mean?

- 7.7 7. How can I check if an insurance company is reputable?

- 7.8 8. What are the biggest factors that influence my insurance premium?

- 7.9 9. Can I change my insurance policy in the middle of a term?

- 7.10 10. How high should my liability limits be?

Why Shopping for Car Insurance Online Is a Game Changer

This guide is designed to give you a clear, step-by-step playbook for mastering the online insurance marketplace. We’ll cut through the confusing jargon and show you exactly how to use today’s tools to protect your assets without overpaying.

Here’s something most people don’t realize: your car insurance premium is anything but static. Insurers are constantly tweaking their rates based on new data, shifting risk models, and their own internal targets. The company that gave you the best deal last year could easily be one of the most expensive this year.

The Power of Comparison

When you actively shop for quotes, you take back control. It’s a basic rule of smart money management—never assume you’re getting the best price for an essential service. The savings are real and can free up a surprising amount of cash for other financial goals.

Expert Insight: The real magic of shopping online is the transparency. You get to see multiple offers laid out right next to each other, letting you find the best value without a pushy sales agent breathing down your neck.

More Than Just Price

While everyone loves saving money, the bigger win is finding the right policy. Getting car insurance quotes online lets you play with the numbers. You can instantly see how changing your deductible or bumping up your liability limits impacts your premium.

This process forces you to understand what you’re actually buying. It ensures the coverage you choose truly fits your life and financial situation, protecting you where you need it most.

Think of it like any other part of your financial life. The same care you’d take to find the best online banks in the USA should be applied here. It’s all about making informed decisions that protect your assets and build your long-term wealth.

Gathering Your Information for the Most Accurate Quotes

Getting a truly accurate car insurance quote online all comes down to the quality of the information you plug in. If you just jump in and start guessing, you’re setting yourself up for a frustrating surprise when the final price is way higher than the initial estimate.

Think of it this way: you’re painting a picture for the insurance company of the exact risk they’re taking on. A fuzzy, incomplete picture gets you a vague, unreliable price. A sharp, detailed one gets you a quote you can actually count on. Taking five minutes to get your details in order first is the single best thing you can do to get a real, apples-to-apples comparison.

The Driver and Vehicle Checklist

Before you even open a single browser tab for car insurance quotes online, pull together this info. Every single item here is a lever that can move your premium up or down.

- Driver’s License Numbers: Grab the license for yourself and anyone else you plan to list on the policy. This is how insurers pull your official driving record (MVR).

- Dates of Birth: Age is a fundamental rating factor for every carrier out there.

- Driving History: Be prepared to be upfront about any accidents, tickets, or claims for all drivers within the last 3 to 5 years. Don’t fudge this—they will find out when they run your record, so it’s best to be honest from the start.

- Vehicle Identification Number (VIN): This is the 17-digit code on your dashboard or driver’s side door jamb. It tells them the exact make, model, trim, and safety features your specific car has, not just the general model.

- Current Insurance Policy: If you have one, have the declarations page handy. It’s the perfect cheat sheet for matching your current coverage levels so you’re comparing a real “apples-to-apples” scenario.

- Estimated Annual Mileage: Make a realistic guess of how many miles you drive in a year. Driving less usually means paying less.

Why Every Little Detail Matters

So, why all the paperwork? Because insurance is a game of risk assessment. A driver with a spotless record is a much safer bet than someone with a couple of recent speeding tickets.

It’s the same logic for your car. A vehicle loaded with modern safety features like automatic emergency braking and airbags is statistically less likely to be involved in a costly accident, which often earns you a discount.

Expert Insight: Your credit-based insurance score also plays a huge role in what you’ll pay in most states. It’s not your FICO score, but it’s derived from your credit history to predict your likelihood of filing a claim. A higher score often leads to a significantly lower premium.

Insurers see a history of financial responsibility as a sign of reliability. If you’re serious about locking in the best possible rates, it pays to understand what influences your financial standing. You can learn more about the habits that lead to top-tier scores in our guide on how to get an 800 credit score and see how it benefits more than just loans.

When you come to the table with this complete profile, you’re allowing the insurance algorithms to give you their sharpest, most accurate price right from the get-go.

Choosing Your Path: Direct Insurers vs. Comparison Sites

When you’re ready to get car insurance quotes online, you’ll immediately hit a fork in the road. Should you go straight to individual insurance company websites, or use a comparison site that pulls quotes from a bunch of carriers all at once?

There isn’t one “right” answer here. The best route really depends on what you’re looking for and how much time you have.

The Direct Approach vs. The Broad Overview

Going directly to an insurer like Progressive or State Farm is a solid move if you already have a relationship with them or if your driving history is a bit complicated. Their websites usually offer the most detailed and customizable quoting tools, letting you tweak every little detail of your potential policy.

On the flip side, comparison aggregators give you a powerful advantage: a bird’s-eye view of the market, fast. You enter your info just one time and see a list of initial quotes from a variety of companies. This is perfect for quickly figuring out who’s offering the most competitive prices in your neck of the woods.

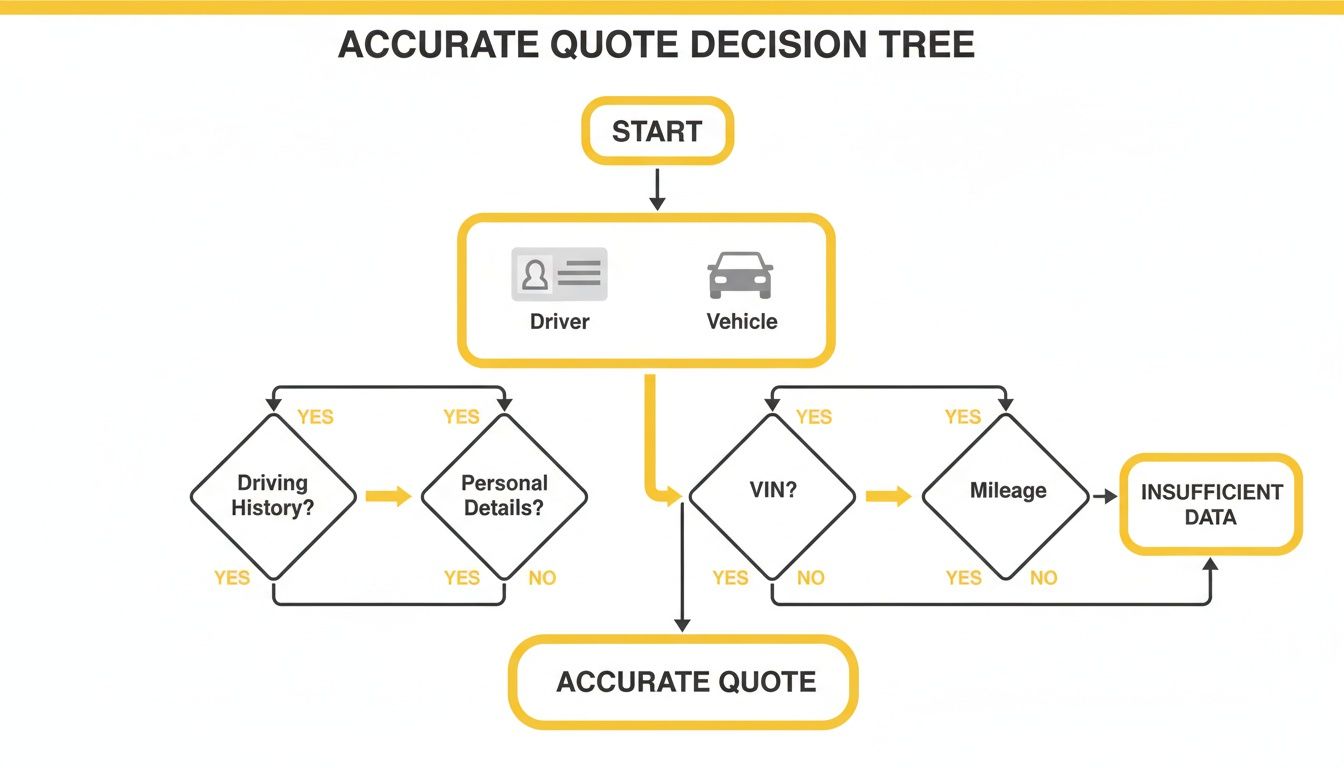

No matter which path you take, getting an accurate quote depends on having the right information handy. This flowchart breaks down exactly what you’ll need, from personal details to specifics about your vehicle.

The key takeaway? A complete profile is non-negotiable. Combining your personal history with vehicle-specific data, like the VIN, is the only way to avoid those frustrating pricing surprises down the line.

How to Decide Which Is Right for You

The switch to getting car insurance quotes online has been a game-changer. Consider this: mobile searches for “insurance near me” have shot up by over 100% in just the last two years. And a recent report found that 68% of shoppers start their search without a specific company in mind. You can dive deeper into these consumer trends in this insightful industry report.

This behavior tells us that people crave the power to compare their options easily and efficiently. To help you figure out your own strategy, this table breaks down the core differences between the two main approaches.

Direct Insurer vs. Quote Aggregator: Which Is Right for You?

This side-by-side comparison can help you decide which platform is the best starting point for your needs.

| Feature | Direct Insurer Website | Comparison Aggregator |

|---|---|---|

| Speed | Slower, since you have to visit each site individually. | Much faster, giving you multiple initial quotes at once. |

| Customization | High. You get full access to all policy options & discounts. | Lower. Often shows standard coverage options to start. |

| Quote Accuracy | Very high. The final price is usually close to the quote. | Variable. Quotes are often estimates that need verification. |

| Best For | Brand-loyal customers or those with complex coverage needs. | Shoppers wanting a quick, broad comparison of the market. |

Ultimately, neither option is inherently better—they just serve different purposes. The direct insurer gives you precision, while the aggregator gives you scope.

The Hybrid Strategy: A Pro Tip for Finding the Best Deal

For most people, the smartest move is actually a hybrid approach.

Start with a comparison site. It’s the quickest way to get a lay of the land and see which two or three insurers are offering the best rates for someone with your profile. Think of it like a preliminary screening, a crucial first step you’d take with any big financial decision, similar to using the best financial planning tools to survey your investment options.

Once you have that shortlist, go visit the websites of those top contenders directly. This is where you can dial in the details, entering your information with more precision and uncovering specific discounts—like for your profession or your car’s anti-theft system—that the aggregator might have overlooked.

First-Hand Experience: This two-step process truly gives you the best of both worlds. I used this exact method last year when my own policy was up for renewal. An aggregator pointed me to a smaller, regional company I’d never heard of. When I went to their direct site, I found a 10% discount for my alumni association that the aggregator missed, saving me an extra $150 for the year.

In the end, whether you go direct, use an aggregator, or combine the two, the goal is the same: find the best possible coverage for your needs at the most competitive price. This hands-on approach puts you squarely in the driver’s seat of a major household expense.

Decoding Your Quote to Understand What You’re Buying

Getting a list of prices from an online quote tool is just the start. The real value is buried in the details—understanding what you’re actually buying for that price. This is where you move from just hunting for the lowest number to making a smart financial choice that genuinely protects you.

Every policy is built on a few core components. Once you get a handle on what they are and how they interact, you can start to tailor coverage that fits your life perfectly.

The Three Pillars of Core Coverage

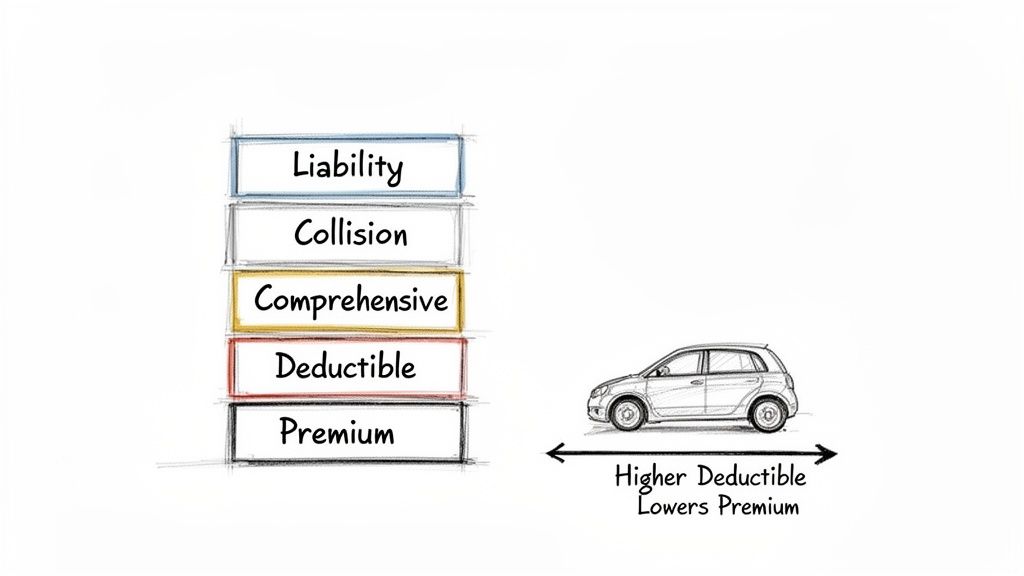

Your quote will almost always break down your protection into three main buckets. Each one covers something very different.

- Liability Coverage: This is the big one. It’s the part that’s legally required in nearly every state. Liability doesn’t fix your car or pay for your injuries; it covers the damage you cause to other people and their property when an accident is your fault.

- Collision Coverage: This is what pays to repair or replace your own vehicle after a crash, no matter who was at fault. If you back into a pole or are involved in a multi-car pileup, this is the coverage that gets your car back on the road.

- Comprehensive Coverage: Think of this as the “life happens” coverage. It handles damage from almost anything besides a collision, like theft, vandalism, fire, hail damage, or hitting a deer.

How Deductibles and Premiums Work Together

Two numbers you’ll need to balance carefully are your deductible and your premium. The deductible is what you agree to pay out-of-pocket on a claim before the insurance company steps in. The premium is simply what you pay for the policy, usually monthly or every six months.

They have an inverse relationship—a classic trade-off.

- A higher deductible means you’re taking on more financial risk yourself. In return, the insurer rewards you with a lower premium.

- A lower deductible means the insurer is on the hook for more, so they charge you a higher premium.

Nationally, the average annual cost for full coverage car insurance has hit $2,697, while state-minimum coverage is just $817. That huge gap is all about the coverage limits and deductibles people choose. Costs also swing wildly by state, from $3,254 in New Jersey down to $1,476 in Hawaii. You can dig deeper into these national car insurance cost trends to see where your state lands.

Let’s look at how this plays out with a real-world example.

Real-Life Example: Deductible vs. Premium

Imagine Sarah, a 30-year-old driver in Ohio with a clean record, gets two quotes for her 2022 Honda Civic. The only difference is the deductible she chooses for her Collision and Comprehensive coverage.

| Scenario | Deductible | 6-Month Premium | Your Out-of-Pocket Cost After an Accident |

|---|---|---|---|

| Safe & Secure Option | $500 | $610 | $500 |

| Calculated Risk Option | $1,000 | $495 | $1,000 |

By choosing the $1,000 deductible, Sarah instantly saves $115 every six months, or $230 for the year. The catch? She has to be confident she has $1,000 available in her emergency fund if she needs to file a claim. If that’s the case, the annual savings can be a smart financial move.

The right decision comes down to your personal finances and risk tolerance. Do you have $1,000 set aside in an emergency fund? If so, the annual savings might be worth it. It’s a lot like learning how to analyze a financial statement; you’re simply weighing risk against potential reward to find the healthiest option for your budget.

Actionable Strategies to Lower Your Car Insurance Premium

While hunting for the best car insurance quotes online is a fantastic start, your work isn’t done. The real magic happens when you start proactively slashing that premium. Insurance companies have a whole menu of discounts, but they rarely serve them up unless you ask.

Think of it this way: you have more control than you realize. One of the easiest and most powerful moves is bundling your auto policy with your home or renters insurance. It’s a classic for a reason—insurers love the extra business and often reward you with savings up to 25% on both policies. Have more than one car? Insuring them all with the same company is another no-brainer for significant savings.

Unlocking Common and Overlooked Discounts

Beyond the big ones, a whole world of smaller discounts exists that most people completely miss. They might not seem like much on their own, but trust me, they add up. It’s all about being your own advocate and knowing what’s on the table.

Here are a few of my favorites that I always tell people to ask about:

- Good Student Discount: Got a young driver on your policy? If they’re keeping up a “B” average or better, you should be getting a discount for it.

- Safe Driver Program: A clean driving record is gold. If you’ve gone 3-5 years without any accidents or tickets, you’ve earned a serious price break.

- Defensive Driving Course: Spending a weekend in a class might not sound fun, but completing an approved course can shave a noticeable amount off your premium for years.

- Anti-Theft Devices: That factory-installed alarm or a LoJack system isn’t just for peace of mind. It can directly lower the cost of your comprehensive coverage.

Expert Tip: Before you even start getting quotes, make a physical or digital checklist of every possible discount. As you talk to agents or fill out forms, go down the list and ask about each one. Don’t assume anything is applied automatically.

Real-World Savings Scenario

Let’s put this into perspective. Meet Alex, who received an initial 6-month premium quote of $750. By actively seeking out discounts, Alex was able to significantly lower the cost without reducing coverage.

| Action Taken | Potential Discount | 6-Month Savings | New Premium |

|---|---|---|---|

| Initial Premium | – | – | $750 |

| Bundle with Renters Insurance | 15% | $112.50 | $637.50 |

| Apply Anti-Theft Discount (Car Alarm) | 5% | $31.88 | $605.62 |

| Add Good Student Discount for Teen Driver | 10% | $60.56 | $545.06 |

Just like that, taking three simple steps saved Alex over $200 on a six-month policy, translating to over $400 in annual savings. The best part is that these discounts often stack on top of each other. If you’re looking for more ways to cut costs, check out our guide to money-saving strategies for 2025.

A more modern approach that’s gaining popularity is telematics, often called usage-based insurance. You let the insurer track your driving habits through a small plug-in device or a smartphone app. It monitors things like hard braking, sharp turns, and how many miles you drive. If you’re a genuinely safe, low-mileage driver, this program can lead to some of the biggest discounts available.

Wrapping It Up: Your Path to a Better Policy

Shopping for car insurance quotes online really comes down to taking charge of a major household expense. It might seem like a chore, but it’s one of the few areas where a little bit of homework can lead to significant savings. When you’ve got your information ready, understand the difference between talking directly to an insurer versus using a comparison site, and know what you’re actually looking at in a quote, you’re in the driver’s seat.

Think of this as an annual financial health check, not a one-and-done task. The market changes, your life changes, and rates fluctuate. The steps we’ve walked through here will help you make sure, year after year, that you’re getting the best possible price for the protection you genuinely need.

It’s easy to get fixated on finding the absolute cheapest premium. But the real win is finding a policy that lets you sleep at night, knowing you’re covered if something goes wrong. That’s the balance you’re looking for—a policy that fits your budget and your life.

Here at Top Wealth Guide, our goal is to give you the clear, practical insights you need to make smarter financial moves. For more strategies on building and protecting your wealth, head over to our main site at https://topwealthguide.com.

Frequently Asked Questions (FAQ)

1. How often should I shop for new car insurance quotes?

As a general rule, it’s wise to get new quotes at least once a year, about 30 days before your policy renewal date. However, you should also shop for quotes immediately after any major life event, such as moving, buying a new car, getting married, or a significant improvement in your credit score.

2. Will getting multiple car insurance quotes hurt my credit score?

No. Insurance companies use a “soft pull” to check your credit-based insurance score. Unlike a “hard pull” for a loan or credit card application, soft pulls do not affect your credit score at all. You can get as many quotes as you like without any negative impact.

3. Is the cheapest quote always the best option?

Not necessarily. The lowest-priced quote often reflects state-minimum liability coverage, which can leave you financially vulnerable in a serious accident. The best policy provides adequate protection for your assets at the most competitive price. Always compare quotes with identical coverage levels to find the true best value.

4. What’s the process for switching insurance companies?

Once you find a better quote, verify that the new policy matches your desired coverage levels. Then, research the new company’s reputation for customer service and claims handling. After you’ve purchased the new policy and confirmed its start date, you can contact your old insurer to cancel your previous policy. Never cancel your old policy until the new one is officially active to avoid a lapse in coverage.

5. Can I get an accurate quote without providing personal information?

You can get a rough estimate anonymously, but for a firm, buyable quote, you must provide personal details like your name, address, driver’s license number, and vehicle’s VIN. Insurers need this information to access your driving record and accurately assess risk.

6. What does “full coverage” really mean?

“Full coverage” is an informal term, not an official insurance product. It generally refers to a policy that includes three key components: Liability, Collision, and Comprehensive coverage. This combination protects you financially whether you’re at fault in an accident or your car is damaged by other means like theft or weather.

7. How can I check if an insurance company is reputable?

Look for independent ratings. Check an insurer’s financial strength on sites like A.M. Best to ensure they can pay claims. For customer satisfaction insights, consult rankings from J.D. Power and review complaint data on the National Association of Insurance Commissioners (NAIC) website.

While dozens of factors are considered, the most impactful are your driving record (accidents, tickets), your location (ZIP code), the specific type of car you drive, your age, and the coverage limits and deductibles you select.

9. Can I change my insurance policy in the middle of a term?

Yes, you are not locked into your policy for the full term. You can switch insurers at any time. If you cancel before your term is up, you are entitled to a prorated refund for any premium you’ve paid for the unused period.

10. How high should my liability limits be?

This depends on your net worth. The state minimum is rarely enough. A good starting point for many people is 100/300/100, which means $100,000 for bodily injury per person, $300,000 per accident, and $100,000 for property damage. If you have significant assets, you should consider even higher limits or an umbrella policy for extra protection.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.