Building generational wealth—it’s the dream, but let’s face it, most people can’t even get past the first rung on that ladder. The folks over at Top Wealth Guide? They’ve peeked into the abyss and lived to tell the tale. Planning and strategy (the dynamic duo) are your tickets to a financial legacy that’ll make your great grandkids toast your portrait.

So, what do we have here? A guide that’s going to unpack the magic tricks for building and holding onto wealth like a vise…across not just your lifetime, but for generations. And let’s talk about obstacles—yeah, they’re coming, but fear not, because you’ll get the lowdown on some real-world hacks to make sure your family’s piggy bank doesn’t end up in the slaughterhouse. Secure the bag now, and your future fam will thank you later.

In This Guide

What Is Generational Wealth?

The Real Definition of Generational Wealth

Generational wealth-what is it, really? It’s all about assets or financial goodies getting passed down, hand-me-down style, from our folks to us, and then to our kiddos. Think of it as a financial baton in the intergenerational relay race, giving those who come after us a little head start. We’re talking about everything from cash and investments to real estate and family businesses. When you boil it down, generational wealth means creating a safety net and opportunities for those we leave behind.

A 2022 Federal Reserve report really drives this point home. Turns out, the wealth gap between White folks and folks of other races widened by a cool $50,000 from 2019 to 2022-yikes, right? We’re looking at gaps sitting north of $200,000. It’s a wake-up call, highlighting how crucial generational wealth is in bridging these divides.

Debunking Myths About Lasting Wealth

Let’s bust a big myth: you don’t have to roll out of the womb clutching a silver spoon to build generational wealth. Not even close. There are loads of tales of people who started from scratch and built up a nest egg worth talking about.

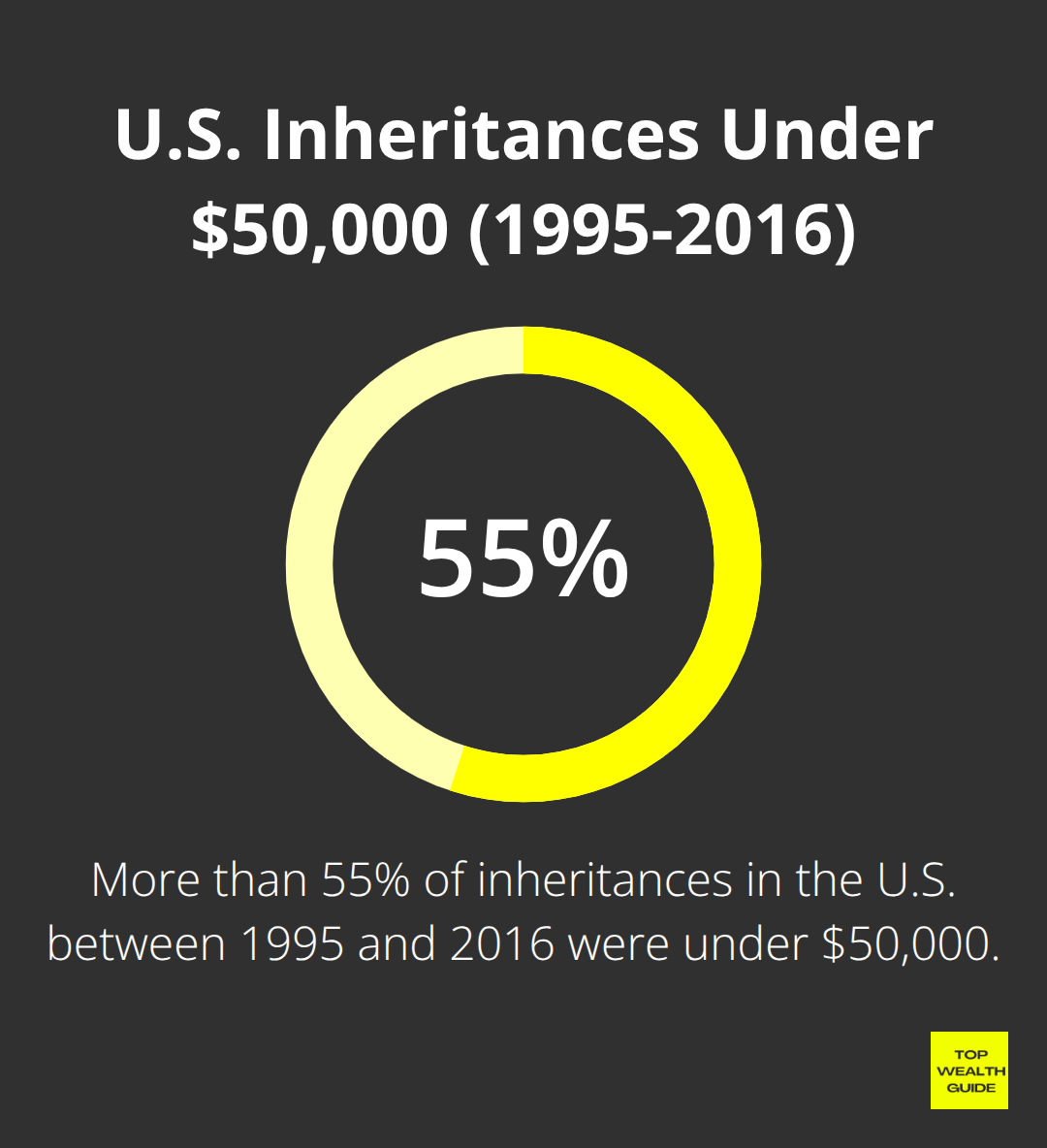

Another half-baked idea floating around is that inheritance is the only way to pass down wealth. Spoiler alert-it’s not. More than 55% of inheritances in the U.S. between 1995 and 2016 were under $50,000. The real magic? Teaching your heirs how to grow and manage their own dough, rather than just cutting them a big fat check.

Key Ingredients for Financial Success

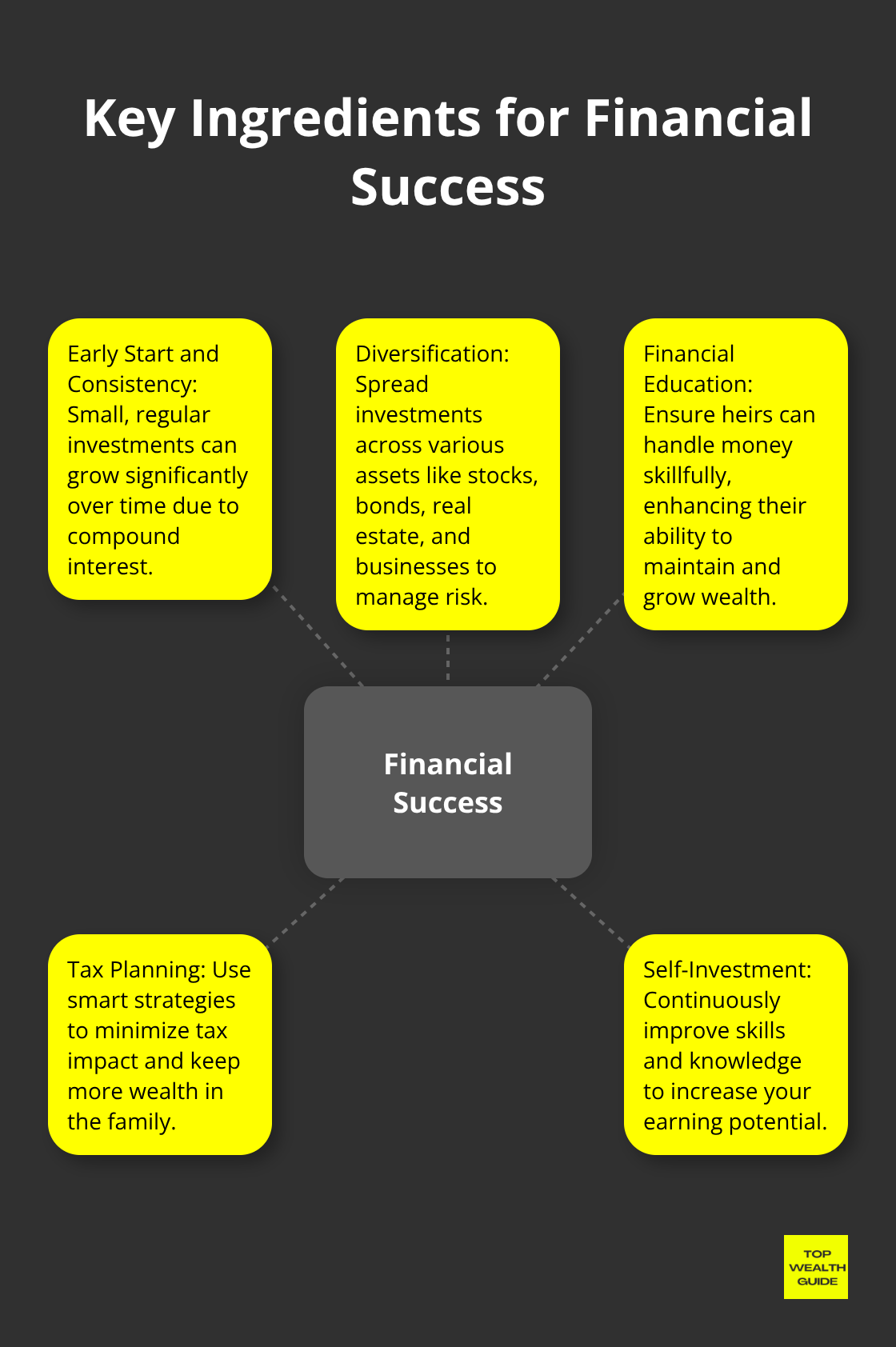

Let’s break it down-what gets you into the generational wealth club?

- Early Start and Consistency: Compound interest… it’s like letting your money have babies. Small, regular investments today can avalanche into big cash piles tomorrow.

- Diversification: Keep it interesting. Stocks, bonds, real estate, businesses-don’t bet it all on one horse.

- Financial Education: Financial literacy-it’s the gift that keeps on giving. Make sure your heirs can handle money with skill (it’s like teaching them to fish… financially, that is).

- Tax Planning: Come 2024, the federal estate tax swoops in at $13.61 million. Sounds steep, but the state might ask for its cut sooner. Smart planning? That’s what keeps the cents in the family.

- Self-Investment: The most valuable asset? You. Keep upping your skills and knowledge-think of your brain as the ultimate money-making machine.

Crafting generational wealth isn’t a sprint-it’s more like a financial marathon that rewards those with strategy, patience, and smarts. It’s about sculpting a legacy that’ll keep on giving for years to come. Now, let’s dive into the tactics to turn this wealth-building dream into a reality.

How to Build Wealth That Lasts

Diversify Your Investment Portfolio

Alright, so you want to build that fortress of generational wealth, huh? Got to play it smart with your investments. Diversification is the name of the game-spread that risk like you’re buttering toast. You don’t want eggs in one basket; we’re talking stocks, bonds, real estate, maybe even a sprinkle of something exotic if you’re feeling fancy. Start off with some low-cost index funds-why? Because Rome wasn’t built in a day, and neither is generational wealth. Once you’ve got your footing, maybe throw in some REITs or a piece of property… make that portfolio sing.

Create a Scalable Business

If you’re gunning for wealth that doesn’t check out when you do, consider building a business that’s more resilient than your morning coffee habit. Think scalable models, solid systems-why? Because you want cash coming in whether you’re in the office or sipping a margarita. Online businesses, franchises, service gigs with rockstar teams-they all fit the bill. Don’t forget, the giants we know now started as small fries, so your brainchild might just be the key to your dynasty’s golden future.

Leverage Real Estate Investments

Here’s the scoop: real estate isn’t just a roof over your head; it’s equity, it’s cash flow, it’s the whole shebang. Use other people’s money (hello, mortgages) to command some prime assets. Start small-duplex here, rental property there, ideally in places where the action’s heating up. Over time? Well, that’s how you build a portfolio that not only pays the bills but grows in value. But heads up-being a landlord comes with responsibilities, or you shell out for property management. Your call.

Safeguard Your Intellectual Property

Welcome to the digital age-where intellectual property is worth its weight in gold. We’re talking patents, trademarks, copyrights-the whole suite isn’t just for the big dogs. If you’ve got a killer product or a groundbreaking app idea, lock it down. This could be the asset that shapes your family’s financial tapestry for decades. Protect now, benefit later.

Implement Tax-Efficient Strategies

Ever hear the phrase, “death and taxes?” Well, one you can’t dodge, but taxes… you can absolutely nudge them in your favor. Deploy tax-efficient strategies to hang onto more of your fortune. Think tax-advantaged accounts like 401(k)s and Roth IRAs-tax-free or tax-deferred? Yes, please. If you’re a business owner, structure that puppy to keep Uncle Sam from taking more than his fair share. And when you’re transferring wealth, trusts are your trusty sidekick to reduce tax implications.

Building wealth that lasts isn’t a sprint; it’s a calculated marathon-smart moves, one after another. It’s about creating value, shielding your treasures, and setting up systems that pull their weight long after you’re out of the picture. In the next act, we’ll dive into conquering the typical hurdles in wealth building and transfer, ensuring your financial legacy stands the test of time. Stay tuned.

How to Overcome Wealth Building Roadblocks

Crafting generational wealth? It’s like tiptoeing through a minefield while juggling flaming torches. At Top Wealth Guide, we’ve seen it all-speed bumps that turn into mountains-and we’re here to help you outmaneuver the inevitable slip-ups.

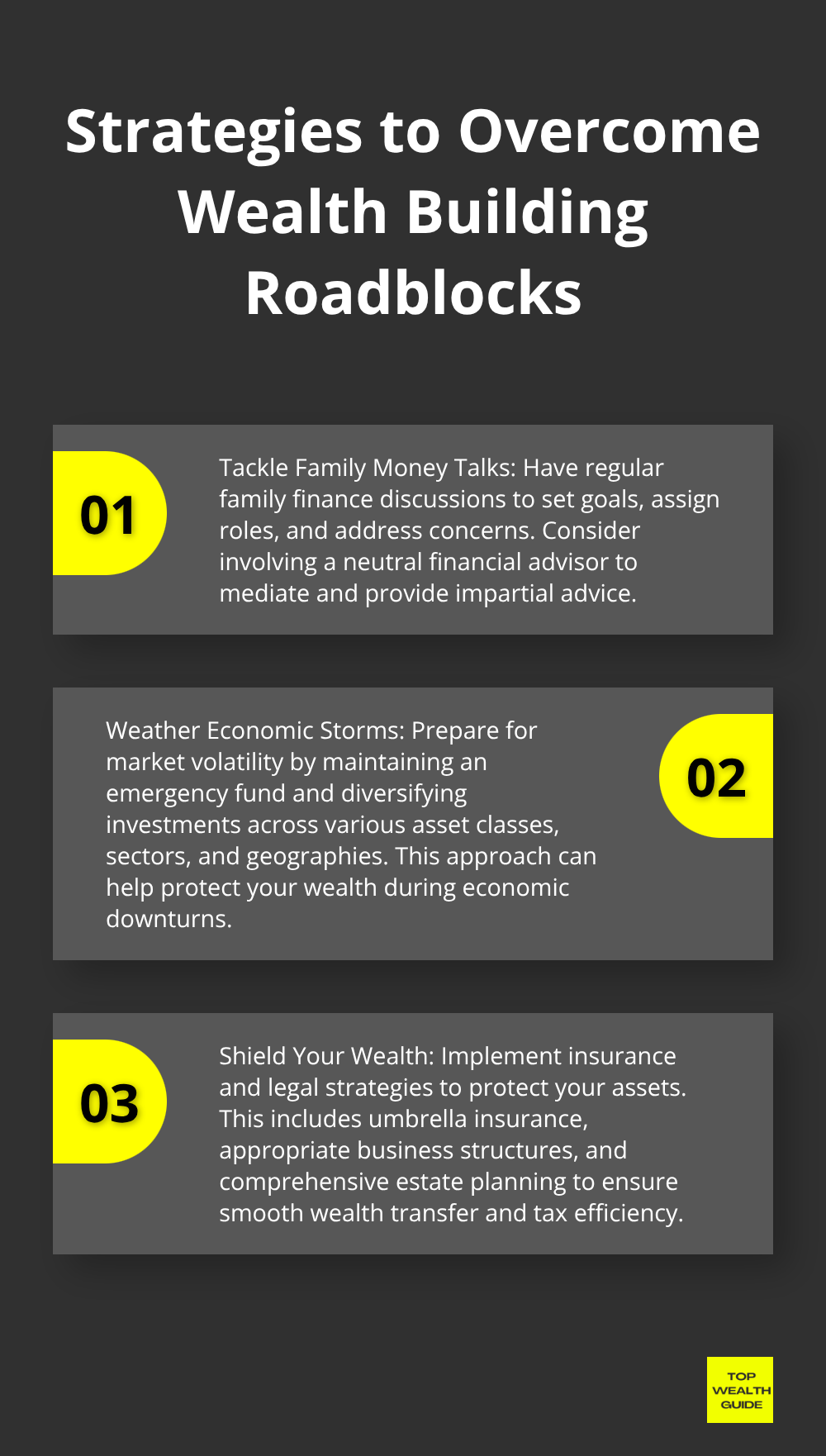

Tackle Family Money Talks

Talking money with family… yeah, about as appealing as a root canal. But sidestepping these talks is like throwing a wrench in your wealth-building machine. Make family finance powwows a regular gig-spill the beans on wealth goals, divvy up roles, hash out concerns. Laying it all bare now dodges the drama train later.

A pro tip? Bring in a neutral umpire (think financial advisor) to keep the peace. They’ll calm the emotional tides and pitch in with an impartial take on the money game plan.

Weather Economic Storms

Markets have a knack for inflicting whiplash. Yep, volatility isn’t budging from the financial terrain anytime soon. When the economic rollercoaster gets wild, consider it a chance to level up. Stash away cash for at least half a year’s expenses-your parachute for downturns so you don’t fire-sale your treasures.

Diversification, that’s your trusty lifeboat. Spread investments across asset class maps like a buffet-sectors, geographies, all of it. When one area tanks, another shines. It could land you juicy opportunities, spice up asset sleuthing, and boost those risk-adjusted returns.

Shield Your Wealth

Insurance and legal maneuvers-your wealth’s invisible bodyguards. Not the stuff of glamor, but boy, are they vital. Kick off with a solid umbrella insurance suit-it’s your asset safety trampoline. Shoot for a coverage roof that hugs your net worth.

Running a biz? Think about setting up camp as an LLC or S-Corp. These protect your personal loot from biz-related grenades. And don’t skim on pro liability insurance if your field basks in high-risk drama.

Estate planning-not just a playground for the mega-wealthy. Smart estate chess moves, trust planning, these protect family loot handovers, no matter the pile size. A sharp will and trust align asset hand-offs with your blueprints and can save heirs bucket loads on taxes and legal sticker shock. Keep those docs fresh, update after every life twist.

Raise Money-Smart Kids

Want your wealth to outlive you? Impart financial wizardry to your kiddos. Start early-even the wee ones can wrap their heads around money morsels. Use allowances as brain-ticklers, not freebies. Nudge them to slot cash into spend, save, and give silos.

As they age-and grow some financial stubble-let them eavesdrop on family funding forums. Give them a front-row seat at your financial advisor tête-à-têtes. Educate them on budgeting, investing, and compound interest’s magic show. Maybe open a custodial investment account, let them dip toes into investment waters-with your elder guidance, of course.

Financial education isn’t a one-and-done. It’s a marathon of money wisdom. Keep the chat channels open, and walk the financial walk. Your kids are eagle-eyed observers of your money antics, so make sure your actions echo your words. Start with money’s value lesson, underscore saving, open the door to investing, cheer on summer gigs, teach the credit game… you get the idea.

Final Thoughts

Building generational wealth, folks, it’s not a sprint (or a jog) – it’s a marathon. Strategy, patience, adaptability… and maybe a little luck. We dove into some tactics – from diversifying your investments to protecting that precious intellectual property – these are the pillars of a rock-solid wealth-building plan that’ll stand firm against economic storms and curveballs.

For a comprehensive guide on how to create generational wealth, check out our full article

Here’s the deal: The path to generational wealth? It’s gonna push your limits. But tackling issues head-on through good old-fashioned open dialogue and non-stop financial education – that’s how you set the stage for real, lasting prosperity. Delay even a day, and you’re missing out on potential growth and that sweet compounding effect. So, get going today (seriously, open that investment account or kick off that crucial family money convo).

We at Top Wealth Guide are here with the tools and knowledge to guide you on your wealth-building odyssey. Don’t hang around waiting for that perfect moment – the best time to plant the seeds for generational wealth is right now. Your financial legacy? It starts today.

If you’re serious about creating long-term wealth, read our step-by-step wealth building guide.

1 Comment

Pingback: Most Volatile Stocks: High Risk, High Reward? - Top Wealth Guide - TWG