Building wealth is not about finding a single, secret formula; it's about strategically combining proven methods to create a powerful, customized financial engine. Many guides offer generic advice, but true financial growth comes from understanding and implementing specific, actionable strategies tailored to your unique goals and risk tolerance. This article cuts through the noise to provide a comprehensive roadmap, detailing some of the best ways to build wealth, from traditional investments to modern entrepreneurial ventures.

You won't find vague platitudes here. Instead, you will discover a detailed breakdown of nine powerful wealth-building pillars. We will explore everything from leveraging real estate and mastering the stock market to the often-underestimated power of maximizing retirement accounts and creating multiple income streams. Each section is designed to be a mini-guide, complete with practical implementation steps, real-world examples, and comparative insights to help you make informed decisions.

Whether you're just starting your financial journey or looking to refine an existing portfolio, the principles outlined here are fundamental. We will cover how to make your money work for you through compound interest, why strategic debt management is as crucial as investing, and how continuous self-investment can yield some of the highest returns possible. This guide is your blueprint for mapping a clear and effective path toward financial freedom, equipping you with the tools necessary to not just accumulate assets, but to build lasting, generational wealth. Let's begin exploring these powerful strategies.

In This Guide

- 1 1. Real Estate Investment

- 2 2. Stock Market Investing

- 3 3. Starting and Scaling a Business

- 4 4. High-Yield Savings and Compound Interest

- 5 5. Investment in Education and Skills Development

- 6 6. Retirement Account Maximization (401k/IRA)

- 7 7. Dividend Growth Investing

- 8 8. Creating Multiple Income Streams

- 9 9. Debt Elimination and Leverage Optimization

- 10 Comparison of Wealth-Building Strategies

- 11 Your Blueprint for a Richer Future

- 12 Frequently Asked Questions About Building Wealth

- 12.1 1. What is the single best way to build wealth for a beginner?

- 12.2 2. How much money do I need to start investing?

- 12.3 3. Is it better to pay off debt or invest?

- 12.4 4. How long does it realistically take to build significant wealth?

- 12.5 5. Is real estate a better investment than stocks?

- 12.6 6. What is the biggest mistake people make when trying to build wealth?

- 12.7 7. How important is a high income for building wealth?

- 12.8 8. What are "good debt" and "bad debt"?

- 12.9 9. How can I protect my wealth once I've built it?

- 12.10 10. Can I build wealth on a low income?

1. Real Estate Investment

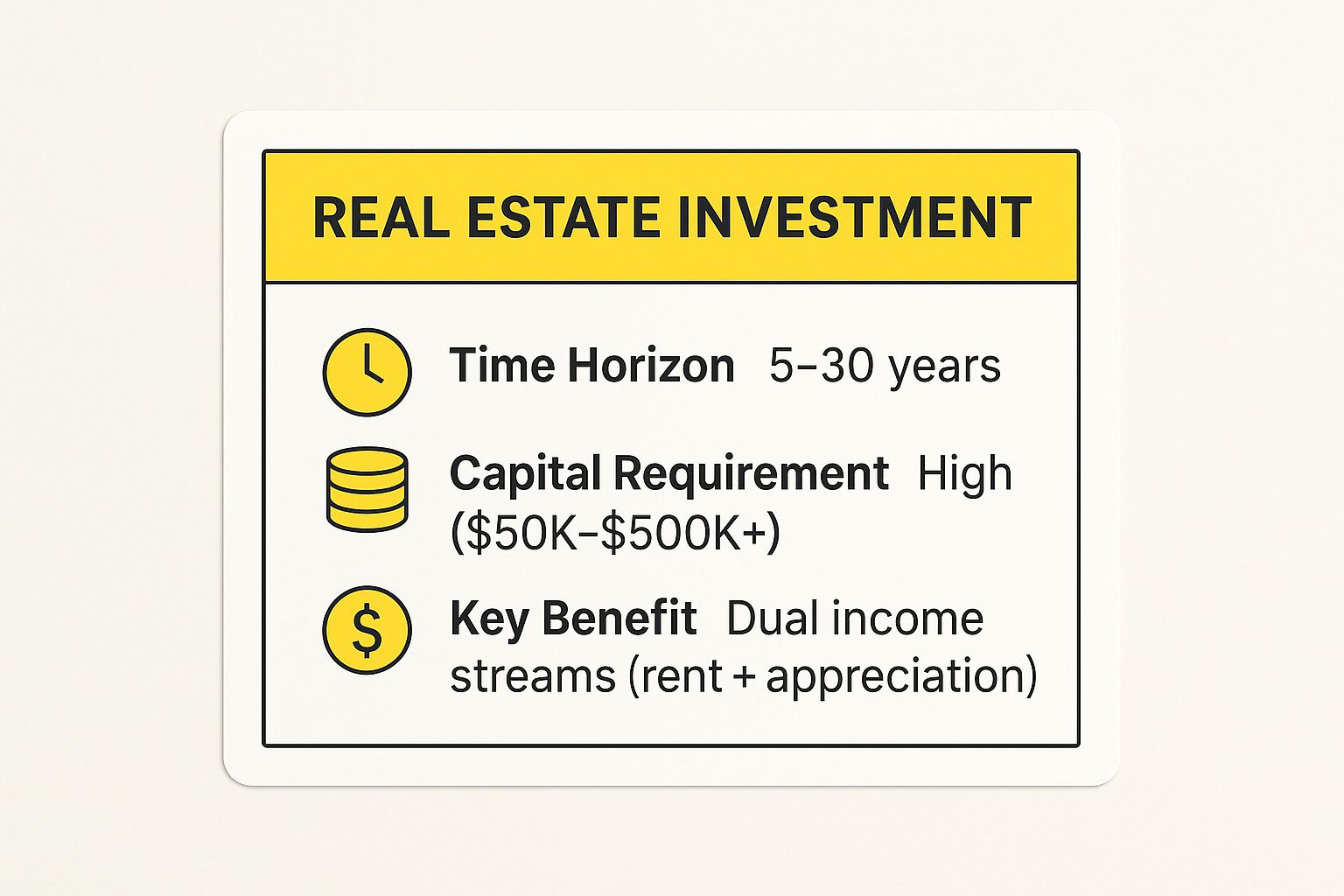

Real estate investment remains one of the most reliable and best ways to build wealth due to its tangible nature and potential for dual income streams. This strategy involves purchasing property not to live in, but to generate income through rent and to benefit from the property's appreciation in value over time. Unlike stocks, which can be volatile, real estate provides a physical asset you can see and control.

This method combines two powerful wealth-building forces: cash flow from tenants' monthly rent payments and long-term capital gains as the property's market value increases. Successful investors, from titans like Sam Zell to TV personality Barbara Corcoran, have built empires on this foundational principle. The key is leveraging other people's money (through mortgages) to control a large asset, while tenants pay down the debt and build your equity.

Actionable Strategy: House Hacking

For beginners, "house hacking" is an excellent entry point. This involves buying a multi-unit property (like a duplex or triplex), living in one unit, and renting out the others. The rental income can significantly offset or even cover your entire mortgage payment, allowing you to live for free while building equity in a valuable asset. This approach dramatically lowers the financial barrier to entry for your first investment property.

For those seeking a more passive approach or who have less capital, Real Estate Investment Trusts (REITs) offer a compelling alternative. REITs are companies that own or finance income-producing real estate. Buying shares in a REIT allows you to invest in a portfolio of properties without the complexities of direct ownership.

The infographic below summarizes the key attributes of direct real estate investment for a quick reference.

This data highlights that while real estate requires significant upfront capital and a long-term commitment, its unique ability to provide both rental income and appreciation makes it a cornerstone of many wealth-building plans. To dive deeper into the pros and cons, you can learn more about whether real estate is a good investment on topwealthguide.com.

2. Stock Market Investing

Stock market investing is a proven and powerful engine for wealth creation, allowing individuals to own a piece of publicly traded companies and share in their profits. This strategy involves purchasing stocks (shares) with the expectation that their value will grow over time, driven by the company's success and broader economic expansion. Unlike saving money in a bank account, investing in the stock market offers the potential for significantly higher returns, making it one of the best ways to build wealth for the long term.

The two primary forces driving wealth here are capital appreciation, where the stock's price increases, and dividends, which are portions of a company's profits paid out to shareholders. Legends like Warren Buffett built fortunes through meticulous stock selection, while John Bogle pioneered the index fund, allowing everyday investors to own a diversified slice of the entire market. The historical average annual return of the S&P 500, around 10% since 1957, demonstrates the incredible power of compound growth over time.

Actionable Strategy: Index Fund Investing

For most investors, especially beginners, low-cost index fund investing is the most effective and straightforward entry point. An index fund, like one that tracks the S&P 500, holds stocks from hundreds of the largest U.S. companies, providing instant diversification. This "set it and forget it" approach eliminates the need to pick individual winning stocks and consistently outperforms the majority of actively managed funds over the long run.

A powerful technique to pair with this strategy is dollar-cost averaging. This involves investing a fixed amount of money at regular intervals (e.g., $200 every month), regardless of market fluctuations. This disciplined approach helps you buy more shares when prices are low and fewer when they are high, reducing risk and building your position steadily over time. By reinvesting all dividends automatically, you accelerate the compounding effect, letting your money work even harder for you. This disciplined, long-term perspective is the key to harnessing the market's growth potential.

This data underscores that while the stock market has short-term volatility, its historical returns and accessibility make it a fundamental component of a diversified wealth-building portfolio. For those ready to explore more advanced techniques, you can learn more about how to identify top-performing stocks on topwealthguide.com.

3. Starting and Scaling a Business

Entrepreneurship stands out as one of the most powerful and best ways to build wealth because it offers uncapped potential for income and equity growth. This path involves creating a product or service, building a system around it, and scaling it to generate profits. Unlike trading your time for a salary, a successful business is an asset that can produce income independently of your direct daily involvement.

This strategy is responsible for creating some of the world's most significant fortunes. It combines two critical wealth-building engines: operating income from ongoing profits and equity value, which can be realized through a sale or public offering. Visionaries like Sara Blakely, who turned a $5,000 investment into the billion-dollar brand Spanx, and Jeff Bezos, who scaled Amazon from a garage-based bookstore into a global empire, exemplify the transformative power of a scalable business. The core principle is creating a repeatable system that solves a customer problem at a profit.

Actionable Strategy: The Lean Startup Model

For aspiring entrepreneurs, the "Lean Startup" model is a highly effective, low-risk entry point. Instead of building a complex business plan and seeking massive funding, this approach focuses on creating a "Minimum Viable Product" (MVP) to test a core business idea in the real market as quickly as possible. By gathering customer feedback early, you can iterate and improve your offering, ensuring you're building something people actually want before investing significant time and capital. This method was famously used by companies like Dropbox and Zappos to validate their concepts.

For those less inclined to start from scratch, acquiring an existing small business or a franchise can be a potent alternative. Platforms like BizBuySell or Flippa list established businesses for sale, often with existing cash flow, which drastically reduces the initial risk and ramp-up time. This allows you to leverage a proven model and focus immediately on optimization and growth. To learn more about identifying promising business opportunities, you can explore guides on how to find a business to buy on forbes.com.

4. High-Yield Savings and Compound Interest

Leveraging high-yield savings accounts and the power of compound interest is a foundational strategy for building wealth. While not as glamorous as other investments, it offers a secure, reliable, and guaranteed way to grow your money. This method involves placing your capital in savings vehicles like High-Yield Savings Accounts (HYSAs), Certificates of Deposit (CDs), or money market accounts, which offer significantly higher interest rates than traditional savings accounts, protecting your principal while it grows.

This approach is about making your money work for you, even when it's idle. The core principle is compound interest, which Albert Einstein reportedly called the "eighth wonder of the world." Your money earns interest, and then that interest earns its own interest, creating a snowball effect over time. Financial gurus like Suze Orman and Dave Ramsey champion this as the bedrock of financial security, particularly for establishing a robust emergency fund. It’s one of the best ways to build wealth from a stable base.

Actionable Strategy: Automate and Ladder

The most effective way to start is by automating your savings. Set up automatic, recurring transfers from your checking account to a high-yield savings account, like those offered by Marcus or Ally Bank, which often provide rates over 4% APY. This "pay yourself first" method ensures consistent growth without requiring constant effort. This is the perfect strategy for building an emergency fund of 6-12 months of living expenses.

For funds you won't need immediately but want to earn even higher rates on, consider a "CD ladder." This involves splitting your investment into multiple CDs with staggered maturity dates (e.g., 3-month, 6-month, 1-year). As each CD matures, you can reinvest the principal and interest into a new, longer-term CD at the current best rate. This strategy provides higher returns than a standard savings account while keeping a portion of your funds accessible on a predictable schedule, optimizing your earnings without sacrificing liquidity entirely.

5. Investment in Education and Skills Development

Often overlooked in financial discussions, investing in yourself is arguably one of the best ways to build wealth, offering potentially infinite returns. This strategy involves dedicating time and money to education, certifications, and high-income skills to dramatically increase your earning potential. Unlike market-based assets that can fluctuate, the knowledge and abilities you acquire become a permanent part of your personal capital.

This method is about transforming yourself into a more valuable professional, creating a direct impact on your primary income source: your career. Visionaries like Seth Godin and Cal Newport have championed this principle, emphasizing that specialized knowledge is the ultimate leverage in the modern economy. A medical doctor investing in years of education to earn over $300,000 annually, or a software developer whose salary jumps 50% after mastering a new programming language, are prime examples of this principle in action.

Actionable Strategy: Acquiring High-Income Skills

For those seeking to make a significant leap in income, the focus should be on acquiring high-income skills that are in constant demand. This doesn't always require a traditional four-year degree. The goal is to identify a skill gap in the market and fill it.

Start by researching rapidly growing fields like artificial intelligence, digital marketing, cybersecurity, or skilled trades like welding and electrical work. You can then pursue targeted certifications, online bootcamps, or trade school programs that offer a direct path to high-paying roles. For instance, a certification in cloud computing like AWS Certified Solutions Architect can open doors to jobs paying well over six figures, often with less than a year of focused study. The key is to continuously learn and adapt, ensuring your skills remain relevant and highly compensated.

6. Retirement Account Maximization (401k/IRA)

Maximizing contributions to tax-advantaged retirement accounts is one of the most powerful and accessible ways to build wealth. These accounts, such as a 401(k), 403(b), Traditional IRA, or Roth IRA, are designed to help you save for the future by offering significant tax benefits. Unlike a standard brokerage account, these investment vehicles allow your money to grow either tax-deferred or completely tax-free, dramatically accelerating your wealth accumulation over time.

This strategy combines the power of compound growth with a direct reduction of your tax burden. Financial experts like David Bach, Suze Orman, and John Bogle have long championed this method as a foundational step for financial independence. The key is leveraging "free money" from employer matches and allowing decades of tax-advantaged growth to multiply your initial contributions into a substantial nest egg.

Actionable Strategy: Secure the Match, Then Automate

The most critical first step is to contribute enough to your 401(k) or 403(b) to receive the full employer match. This is an immediate, guaranteed return on your investment, often ranging from 50% to 100% on the first few percent you contribute. For example, if your employer matches 100% up to 6% of your salary, contributing 6% effectively doubles your money instantly. Not taking advantage of this is like turning down a pay raise.

After securing the full match, aim to automate and gradually increase your contributions until you reach the annual maximum ($23,000 for 401(k)s in 2024). A simple tactic is to increase your contribution rate by 1% every time you get a raise, so you won't even feel the difference in your take-home pay. For those without a workplace plan or who have maxed it out, opening a Roth or Traditional IRA offers another powerful avenue for tax-advantaged savings. Choosing between Roth (post-tax) and Traditional (pre-tax) depends on whether you expect to be in a higher tax bracket now or in retirement.

Effectively managing these accounts is crucial for long-term success. To explore this topic further, you can learn more about how to effectively manage your wealth for long-term growth on topwealthguide.com.

7. Dividend Growth Investing

Dividend growth investing is a powerful strategy focused on buying shares in companies that not only pay dividends but also have a long and consistent history of increasing those payouts. This approach offers a dual benefit for wealth builders: a steadily growing stream of passive income and the potential for long-term capital appreciation. It's a method that prioritizes financial health and shareholder-friendly policies, making it one of the best ways to build wealth with a focus on stability.

This strategy combines the income-generating power of dividends with the growth potential of the underlying stock. As a company increases its dividend, it signals financial strength and confidence in future earnings, which often attracts more investors and can drive up the stock price. Legends in this space, such as Josh Peters and the late David Fish, have demonstrated how focusing on companies like the "Dividend Aristocrats" (those with 25+ years of consecutive dividend increases) can create a resilient and ever-growing income machine.

Actionable Strategy: Building a Dividend Snowball

A cornerstone of this approach is the "dividend snowball," where you consistently reinvest your dividends to buy more shares. This creates a compounding effect, as your new shares generate their own dividends, which are then used to buy even more shares. This accelerates your wealth-building journey without requiring you to invest additional capital from your pocket.

To get started, focus on these key principles:

- Prioritize Growth Rate: A high starting yield is attractive, but a high dividend growth rate is often more valuable over the long term. A company growing its dividend by 10% annually will quickly surpass a high-yield, low-growth peer.

- Monitor Payout Ratios: Ensure the company isn't paying out too much of its earnings as dividends (typically under 70%), as this leaves room for future increases and business reinvestment.

- Diversify Across Sectors: Avoid concentrating in one industry. Spread your investments across sectors like consumer staples (Coca-Cola), healthcare (Johnson & Johnson), and industrials to mitigate risk.

For those seeking instant diversification, Dividend Growth ETFs like the Vanguard Dividend Appreciation ETF (VIG) provide exposure to a broad portfolio of companies that fit this strategy, making it an accessible entry point for beginners.

8. Creating Multiple Income Streams

Relying on a single source of income, typically a primary job, creates significant financial vulnerability. Creating multiple income streams is a powerful strategy to mitigate this risk and accelerate wealth accumulation. This approach involves developing several distinct revenue channels, so that the loss of one does not derail your financial progress. It’s a core principle for building a resilient financial foundation.

This method combines active and passive income to create a diversified financial portfolio. Active income requires direct effort, like a side hustle or consulting gig, while passive income flows from assets like rental properties, dividend stocks, or royalties with minimal ongoing work. Authors like Robert Kiyosaki and entrepreneurs like Pat Flynn have built immense wealth not from one venture, but by layering multiple streams, including business profits, book royalties, and investment returns. The goal is to have money flowing in from various directions, compounding your growth potential.

Actionable Strategy: The "Stacking" Method

A practical way to begin is the "stacking" method. Start by focusing on adding just one additional income stream that leverages your existing skills. For example, a software developer could do freelance coding projects on the side. Once that stream is established and generating consistent income, reinvest a portion of those profits to start a third, more passive stream, like investing in dividend-paying ETFs or a REIT.

This methodical approach prevents burnout and allows you to build momentum. Key steps include:

- Identify Your Skills: What can you offer as a service or product?

- Start Small: Choose one manageable side hustle or investment.

- Automate and Systemize: Use tools to manage your time and money efficiently as you add more streams.

- Reinvest: Funnel profits from one stream into creating the next.

This strategy is fundamental not just for personal wealth, but also for long-term financial security. By diversifying your income, you create a safety net and open up new avenues for investment and growth. You can explore how this fits into a broader family financial plan and learn more about how to create generational wealth on topwealthguide.com.

9. Debt Elimination and Leverage Optimization

Debt management is a critical, yet often overlooked, component of a robust financial strategy. This two-pronged approach involves aggressively eliminating high-interest "bad debt" while strategically using low-interest "good debt" to acquire appreciating assets. This method isn't just about becoming debt-free; it's about optimizing your financial leverage to accelerate wealth creation.

This method transforms debt from a financial drain into a powerful tool. By systematically destroying high-cost consumer debt, you free up significant cash flow that would otherwise be lost to interest payments. Personal finance experts like Dave Ramsey and Suze Orman have popularized this foundational step, emphasizing how eliminating liabilities like credit card balances and personal loans is the first major victory in wealth building. The second phase involves using smart leverage, such as a mortgage for a rental property or a low-interest business loan, where the potential return on the asset far outweighs the cost of borrowing.

Actionable Strategy: The Debt Avalanche Method

For beginners overwhelmed by debt, the "debt avalanche" method is a mathematically sound starting point. This strategy involves making minimum payments on all debts while directing any extra money towards the debt with the highest interest rate, regardless of the balance. Once that debt is paid off, you roll its payment amount into the payment for the next-highest-interest debt, creating a snowball effect that saves the most money on interest over time.

For those already on solid ground, the focus shifts to leverage optimization. This could mean refinancing student loans to a lower interest rate, freeing up hundreds of dollars per month, or using a home equity line of credit (HELOC) to fund a value-add renovation or a business venture. The key is ensuring the borrowed capital is put to work in a way that generates a higher return than the interest rate you are paying on the loan.

This strategic management of liabilities is a key part of any comprehensive wealth plan. To learn more about how this fits into a larger financial strategy, you can explore the path to financial freedom with this guide to debt elimination on topwealthguide.com.

Comparison of Wealth-Building Strategies

To help you decide which path is right for you, this table compares the key aspects of each wealth-building method.

| Strategy | Risk Level | Capital Needed | Time Commitment | Potential Return | Passivity Level |

|---|---|---|---|---|---|

| Real Estate | Medium-High | High | Medium | Medium-High | Medium |

| Stock Market | Medium-High | Low | Low | High | High |

| Starting a Business | Very High | Variable | Very High | Very High | Low |

| High-Yield Savings | Very Low | Low | Very Low | Low | Very High |

| Skills Development | Low | Low-Medium | Medium | High | N/A (Active) |

| Retirement Accounts | Medium | Low | Low | High | High |

| Dividend Investing | Medium | Low-Medium | Low | Medium | High |

| Multiple Income Streams | Variable | Variable | High | High | Variable |

| Debt Elimination | Low | None | Medium | Guaranteed | Low |

Real-Life Examples of Wealth Building in Action

| Strategy | Real-Life Example | Outcome |

|---|---|---|

| Stock Market Investing | An investor consistently puts $500/month into an S&P 500 index fund for 30 years. | Assuming a 10% average annual return, their initial $180,000 in contributions could grow to over $1.1 million due to compound interest. |

| Real Estate (House Hacking) | A young professional buys a duplex, lives in one unit, and rents the other for $1,500/month. The mortgage is $1,800. | Their personal housing cost is reduced to just $300/month while they build equity in an appreciating asset paid down by their tenant. |

| Starting a Business | A graphic designer starts a freelance side business, earning an extra $1,000/month. | This extra income is used to pay off debt and then invested into a dividend ETF, creating a new passive income stream and accelerating wealth growth. |

| Skills Development | A marketer spends $5,000 on a digital advertising certification course. | They leverage their new skills to secure a promotion and a $20,000 annual raise, achieving a 400% return on their investment in the first year alone. |

Your Blueprint for a Richer Future

The journey to financial independence is not a sprint; it's a marathon composed of deliberate, consistent actions. We've explored a comprehensive suite of the best ways to build wealth, from the tangible assets of real estate and the dynamic power of the stock market to the entrepreneurial drive of building a business. Each strategy, whether it's harnessing the slow magic of compound interest, maximizing retirement accounts, or aggressively eliminating debt, represents a powerful tool in your financial arsenal.

The path you forge will be uniquely yours, but the underlying principles remain universal. Wealth isn't built by chance; it's constructed by design. It's the product of a well-defined plan, unwavering discipline, and a commitment to continuous learning.

Synthesizing Your Wealth-Building Strategy

Think of the strategies we've discussed not as a menu where you pick just one item, but as ingredients for your personalized financial recipe. Your optimal mix will depend on your risk tolerance, timeline, and personal passions. A young professional might focus heavily on stock market investing and skills development, while someone nearing retirement may prioritize dividend income and debt elimination.

The key is integration. Your high-yield savings account isn't just a place to park cash; it's the foundation for your next real estate down payment. The skills you acquire don't just increase your salary; they could be the catalyst for a new business venture, creating another income stream. This interconnected approach transforms individual tactics into a cohesive, powerful wealth-building machine.

Key Takeaway: True financial momentum comes from layering these strategies. Your 401(k) builds your core retirement fund, your dividend stocks provide passive income, and your side hustle accelerates your ability to invest in both.

Your Actionable Next Steps

Information without action is merely entertainment. To turn this knowledge into tangible net worth, you must move from passive reading to active implementation. Here is your immediate checklist to start building your richer future today:

- Conduct a Financial Self-Audit: Before you can build, you need a blueprint. Calculate your current net worth, track your income and expenses for one month, and identify exactly where your money is going. This clarity is non-negotiable.

- Choose Your "First-Mover" Strategy: Don't get paralyzed by choice. Select one primary strategy from this article to focus on for the next 90 days. Is it opening a Roth IRA? Automating transfers to a high-yield savings account? Outlining your business idea? Commit to that single, primary goal.

- Automate Everything Possible: The single most effective way to guarantee consistency is to remove willpower from the equation. Set up automatic transfers to your investment accounts, 401(k) contributions, and savings goals. Pay yourself first, automatically.

- Schedule a "CEO of Your Life" Meeting: Put a recurring monthly meeting on your calendar with yourself or your partner. During this one-hour session, review your progress, adjust your budget, and plan your financial moves for the upcoming month. Treat your personal finances with the same seriousness as a successful business.

Building wealth is the ultimate act of creating freedom and opportunity for yourself and your loved ones. It’s about having the resources to pursue your passions, weather any storm, and live life on your own terms. The strategies outlined in this guide are your proven roadmap. Now, it's time to start driving.

Frequently Asked Questions About Building Wealth

1. What is the single best way to build wealth for a beginner?

For most beginners, the best way to start is by consistently investing in low-cost, diversified index funds within a tax-advantaged retirement account like a Roth IRA or a 401(k), especially if there's an employer match. This strategy is simple, low-cost, and leverages the power of compound growth over the long term.

2. How much money do I need to start investing?

You can start investing with very little money. Many brokerage firms offer accounts with no minimum deposit and allow you to buy fractional shares of stocks and ETFs for as little as $1. The key is to start early and be consistent, not to start with a large sum.

3. Is it better to pay off debt or invest?

It depends on the interest rate of the debt. A common rule of thumb is to prioritize paying off any high-interest debt (typically above 7-8%, like credit cards) before investing aggressively. For low-interest debt (like a mortgage below 5%), it's often mathematically better to invest, as the potential market returns are higher than the interest you're paying.

4. How long does it realistically take to build significant wealth?

Building significant wealth is a long-term process, often taking decades. It's not a get-rich-quick scheme. For most people who build wealth through investing and saving, it's a marathon of consistent effort over 20-40 years. Starting a successful business can accelerate this timeline but comes with much higher risk.

5. Is real estate a better investment than stocks?

Neither is definitively "better"; they serve different purposes in a portfolio. Stocks offer higher liquidity and easier diversification. Real estate offers tangible assets, rental income, and significant tax advantages. Many wealthy individuals use a combination of both to build their fortunes.

6. What is the biggest mistake people make when trying to build wealth?

The biggest mistake is often inaction or "analysis paralysis." People wait for the "perfect" time to invest or spend too much time researching without taking the first step. Another major mistake is lifestyle inflation—increasing spending with every pay raise instead of increasing savings and investments.

7. How important is a high income for building wealth?

While a high income accelerates the process, your savings rate (the percentage of your income you save and invest) is more important than the absolute income figure. A person earning $60,000 and saving 25% will build wealth faster than someone earning $120,000 and saving only 5%.

8. What are "good debt" and "bad debt"?

"Good debt" is money borrowed to acquire an asset that is expected to increase in value or generate income, such as a mortgage for a rental property or a student loan for a high-earning degree. "Bad debt" is used to purchase depreciating assets or for consumption, like credit card debt or car loans.

9. How can I protect my wealth once I've built it?

Protecting wealth involves diversification across different asset classes (stocks, bonds, real estate), proper insurance coverage (health, life, liability), and sound estate planning (wills and trusts). As you accumulate wealth, shifting from a high-growth to a more conservative, capital preservation strategy becomes more important.

10. Can I build wealth on a low income?

Yes, it is absolutely possible, but it requires extreme discipline. Key strategies include maintaining a very high savings rate by living frugally, focusing on increasing your income through skills development, and starting to invest early, even with small amounts, to maximize the benefits of compound interest over time.

Ready to take your financial education to the next level? The Top Wealth Guide offers in-depth courses, personalized tools, and expert insights to accelerate your journey. We provide the detailed blueprints and advanced strategies you need to master the best ways to build wealth with confidence.

2 Comments

Pingback: Accelerate Your Wealth Accumulation with These Strategies - Top Wealth Guide - TWG

Pingback: Building Wealth with Real Estate