By: Alex Chen, Certified Financial Planner (CFP®)

Alex has over a decade of experience helping individuals optimize their cash management and savings strategies. His analysis is based on first-hand experience managing client funds across various high-yield platforms.

If your money is parked in a traditional savings account, it's almost certainly losing purchasing power to inflation. The national average annual percentage yield (APY) for savings accounts hovers at a minuscule rate, meaning your hard-earned cash is barely growing. A high-yield savings account (HYSA) is the direct solution, offering interest rates many times higher than the national average, allowing your money to grow substantially faster without the volatility of market investments.

This guide is your roadmap to finding the best high-yield savings account for your specific financial situation. We move beyond simple rate comparisons to provide a comprehensive analysis of the top contenders. You will learn how to evaluate crucial factors like APYs, monthly fees, minimum balance requirements, and digital banking features. We've done the heavy lifting to deliver a clear, in-depth look at leading platforms and banks, from comparison hubs like Bankrate to direct online banks such as Ally and Marcus by Goldman Sachs.

Each entry includes detailed breakdowns, screenshots, and direct links to help you open an account with confidence. Whether you are building an emergency fund, saving for a home, or just want to make your cash work harder, this article provides the actionable insights you need. We use real-world scenarios and side-by-side data tables to help you select an account that aligns perfectly with your goals, ensuring you make an informed decision to maximize your savings potential.

In This Guide

- 1 In-Depth Comparison of Top High-Yield Savings Accounts

- 2 1. Bankrate — High‑Yield Savings comparison hub

- 3 2. NerdWallet — Best High‑Yield Savings of the Month

- 4 3. Raisin (U.S.) — Savings marketplace

- 5 4. Ally Bank — Online Savings Account

- 6 5. Marcus by Goldman Sachs — Online Savings

- 7 6. Capital One — 360 Performance Savings

- 8 7. Discover Bank — Online Savings

- 9 Your Next Step: Taking Action to Maximize Your Savings

- 10 Frequently Asked Questions (FAQ)

In-Depth Comparison of Top High-Yield Savings Accounts

To provide a clear, at-a-glance overview, this table summarizes the key features of the direct banking options we'll review. This allows you to quickly see how they stack up against each other before diving into the detailed analysis.

| Feature | Ally Bank | Marcus by Goldman Sachs | Capital One 360 | Discover Bank |

|---|---|---|---|---|

| Typical APY Range | Highly Competitive | Highly Competitive | Competitive | Competitive |

| Monthly Fees | $0 | $0 | $0 | $0 |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Standout Feature | Smart Savings Tools | Simplicity & Brand Trust | Big Bank Convenience | 24/7 Customer Service |

| Best For | Goal-oriented savers | No-frills maximizers | Existing Capital One users | Savers who value support |

| Mobile App Rating | Excellent | Very Good | Excellent | Excellent |

1. Bankrate — High‑Yield Savings comparison hub

For savers who want to survey the entire landscape before choosing an account, Bankrate is an indispensable starting point. Instead of being a bank itself, Bankrate acts as a comprehensive financial comparison hub, providing editorially curated, constantly updated rate tables for the best high-yield savings accounts from a wide range of banks and credit unions across the nation. This makes it an ideal first stop for anyone serious about maximizing their interest earnings.

The platform's primary strength lies in its ability to consolidate key decision-making data into a single, easy-to-scan view. Users can quickly compare the most critical metrics-APY, minimum deposit requirements, and monthly fees-from dozens of institutions side-by-side. Bankrate also provides crucial context, such as current national average savings rates and expert forecasts, helping you understand if a particular offer is truly competitive.

Key Features and User Experience

Bankrate’s interface is straightforward and user-focused. The main feature is its dynamic comparison table, which is updated frequently to reflect the latest market changes. You can sort and filter offers based on your priorities.

- Daily Rate Updates: The "best rates today" feature ensures you are always looking at the most current offers available.

- Clear Insurance Information: Each listing clearly indicates whether the institution is covered by FDIC (for banks) or NCUA (for credit unions) insurance, providing peace of mind.

- Educational Content: Beyond just a list of rates, Bankrate offers in-depth explainers, reviews, and articles that help users understand the mechanics of HYSAs. This is especially useful for beginners who want to learn how to capitalize on the power of compounding; you can discover more about how compound interest works and why a high APY is so critical.

How to Use Bankrate Effectively

To get the most out of Bankrate, don't just look at the top-listed APY. Consider the entire picture: a high rate at a bank with a clunky mobile app or poor customer service might not be the right fit. Use the platform to create a shortlist of 3-4 top contenders, then click through to each bank's website to explore their full feature set, user reviews, and account opening process before making a final decision.

Real-Life Example: Sarah is starting her search for an HYSA with $10,000 to save. She uses Bankrate to instantly filter for accounts with an APY over 4.50% and a $0 minimum deposit. Within minutes, she identifies three promising online banks she hadn't heard of before and proceeds to research them further.

Website: https://www.bankrate.com/banking/savings/

2. NerdWallet — Best High‑Yield Savings of the Month

For savers seeking clear, consumer-friendly guidance, NerdWallet provides one of the most trusted and accessible resources. Rather than just listing raw data, NerdWallet curates a monthly "best of" list, presenting their top picks for the best high-yield savings accounts with short, digestible reviews. This approach is perfect for individuals who feel overwhelmed by endless options and want expert-vetted recommendations tailored to specific needs.

NerdWallet's core value lies in its editorial curation and plain-English explanations. The platform's team of finance experts, or "Nerds," analyzes dozens of accounts and presents the winners with clear summaries explaining why each one stands out. This helps users quickly match an account to their personal financial goals, whether that's finding the absolute highest APY, an account with no minimum balance, or one with a top-rated mobile app.

Key Features and User Experience

NerdWallet is designed to be approachable, especially for those new to HYSAs. The interface is clean, with key information presented upfront in a way that avoids jargon and simplifies complex terms.

- Curated Editorial Picks: Instead of an exhaustive list, you get a focused selection of top-tier accounts, each with a "Why we like it" summary.

- User-Centric Filters: The platform often categorizes accounts by user needs, such as "Best for low minimums" or "Best for ATM access," making it easy to find a suitable option.

- Transparent Methodology: NerdWallet clearly states its update frequency and evaluation criteria, giving users confidence that the information is current and objective.

- Plain-English Rate Explanations: It excels at breaking down tiered rates or accounts that require direct deposits to earn the top APY, ensuring you understand all the conditions.

How to Use NerdWallet Effectively

The best way to use NerdWallet is to trust its editorial lens as a starting point. Identify which of their "best for" categories aligns with your priorities. For example, if you are building an emergency fund from scratch, an account highlighted for its $0 minimum deposit is a great place to begin. Use their concise reviews to create a shortlist, then dive deeper into the full reviews or click through to the banks' sites. Pairing NerdWallet's recommendations with a broader view from an aggregator can give you the best of both worlds. While you're optimizing your savings, it's also a great time to evaluate your overall financial strategy; you can explore which investment accounts you should prioritize in 2025 to ensure your money is working as hard as possible.

Real-Life Example: David feels overwhelmed by the number of HYSA options. He visits NerdWallet and reads their "Best for Mobile App" category. He finds their top recommendation, reads the simple review explaining its user-friendly features, and feels confident enough to apply directly, saving him hours of research.

Website: https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

3. Raisin (U.S.) — Savings marketplace

For savers who prioritize simplicity and want to access a variety of high-rate products without juggling multiple bank logins, Raisin offers a unique and powerful solution. Instead of being a bank, Raisin is a financial marketplace that connects you with a curated network of FDIC- and NCUA-insured partner banks and credit unions. This allows you to open and manage multiple high-yield savings accounts and CDs from different institutions, all through a single, unified Raisin dashboard.

The platform’s core appeal is its incredible convenience. Once you create a Raisin account, you can fund various savings products from their partners with just a few clicks. This streamlined approach eliminates the repetitive process of filling out applications for each new bank, making it exceptionally easy to "rate chase" or build a diversified "savings ladder" across multiple institutions to maximize insurance coverage and interest earnings. Raisin itself does not charge any fees for its service.

Key Features and User Experience

Raisin's interface is clean, modern, and built around its central marketplace dashboard. The platform makes finding and funding one of the best high-yield savings account offers from its partners an effortless experience, especially for those comfortable with digital-first banking.

- Consolidated Management: View balances, manage transfers, and access tax documents for all your Raisin-powered accounts in one place, simplifying your financial overview.

- Streamlined Onboarding: A single application process gives you access to the entire network of partner institutions, saving significant time and effort.

- Low Minimums and No Fees: Many savings products on the platform require a minimum deposit of just $1, and Raisin does not charge users any account maintenance or service fees.

- FDIC/NCUA Insurance: All funds are held directly at the partner banks or credit unions, meaning your deposits are insured up to the standard $250,000 per depositor, per institution.

How to Use Raisin Effectively

To maximize Raisin’s benefits, use it as a strategic tool for diversification and yield optimization. Instead of just picking one account, consider opening several to take advantage of different promotional rates or to keep your total deposits at each institution under the $250,000 insurance limit. Remember that while Raisin provides the platform, your money is held at the partner institution, and transfers may take 1-3 business days to clear.

Real-Life Example: Maria has $500,000 in cash that she wants to keep fully FDIC-insured. Instead of opening two separate bank accounts, she uses Raisin to open HYSAs at two different partner banks. She manages both accounts through her single Raisin login, ensuring her entire balance is protected while earning a top-tier APY.

Website: https://www.raisin.com/en-us/

4. Ally Bank — Online Savings Account

For savers seeking a powerful combination of competitive interest rates and user-friendly automation, Ally Bank’s Online Savings Account is a standout choice. As one of the pioneers in online-only banking, Ally has refined its platform to deliver a seamless digital experience backed by robust features designed to make saving effortless. It consistently offers one of the best high-yield savings accounts for those who want their bank to actively help them achieve their financial goals.

The platform's core appeal lies in its suite of smart savings tools that work in the background to grow your money. With no monthly maintenance fees or minimum opening deposit requirements, it is highly accessible to everyone, from first-time savers to experienced individuals looking to optimize their cash reserves. Ally’s commitment to 24/7 customer support via phone and chat also provides a level of service that sets it apart from many digital-only competitors.

Key Features and User Experience

Ally’s interface is clean, intuitive, and built for both web and mobile, making account management simple. The standout features are its built-in automation tools that help users save consistently without manual effort.

- Savings Buckets: This tool allows you to partition your savings into different digital "envelopes" for specific goals, like an emergency fund or a down payment, all within a single HYSA.

- Automated Savings Tools: Ally offers "Round Ups," which rounds up your Ally Bank debit card purchases to the nearest dollar and transfers the change to your savings. "Surprise Savings" analyzes your linked checking accounts to find small, safe amounts of money to transfer automatically.

- No Hidden Fees: The account has a transparent fee structure with $0 monthly maintenance fees and $0 minimum deposit requirements, ensuring your interest earnings aren't eroded by costs.

How to Use Ally Bank Effectively

To maximize your savings with Ally, activate its automation features immediately. Set up recurring transfers and turn on Round Ups to build a consistent saving habit. Use the Savings Buckets to visually track your progress toward different goals; this can be a powerful motivator. For instance, creating a dedicated bucket is a great first step when you are learning how to build an emergency fund and want to keep that money separate from other savings.

Real-Life Example: The Thompson family is saving for three things at once: a new car, a vacation, and their emergency fund. Using Ally's Savings Buckets, they create a separate digital "envelope" for each goal within one HYSA. This helps them track their progress for each goal without needing to open multiple accounts.

Website: https://www.ally.com/bank/online-savings-account/

5. Marcus by Goldman Sachs — Online Savings

For savers seeking a blend of brand trust, competitive rates, and a streamlined digital experience, Marcus by Goldman Sachs is a top contender. Backed by one of the most recognizable names in finance, Marcus offers a best high-yield savings account that strips away complexity, focusing on core essentials: no fees, no minimum balance requirements, and a consistently strong APY. This makes it an excellent choice for individuals who value simplicity and reliability from a well-established institution.

The platform's strength is its focused, clutter-free approach to savings. Unlike full-service banks that may overwhelm users with a wide array of products, Marcus hones in on helping you grow your money efficiently. It is particularly well-suited for savers who want to set up an emergency fund or dedicated savings goal and let it grow with minimal friction, backed by the security of a major financial powerhouse.

Key Features and User Experience

Marcus provides a clean, intuitive interface on both its website and mobile app, making it easy to open an account, schedule transfers, and monitor your interest earnings. The user experience is designed for simplicity, ensuring you can manage your savings without navigating complex menus or unnecessary features.

- No Fees or Minimums: There are no monthly maintenance fees to worry about, and you don't need a minimum deposit to open an account or earn the advertised APY.

- Same-Day Transfers: Marcus offers same-day transfers of up to $100,000 to and from other linked banks, providing faster access to your funds when needed.

- Companion CD Products: For those looking to lock in a fixed rate for a longer term, Marcus makes it easy to open a Certificate of Deposit (CD) alongside your savings account.

- FDIC Insurance: Deposits are FDIC-insured up to the maximum amount allowed by law, offering crucial protection and peace of mind.

How to Use Marcus Effectively

To maximize your returns with Marcus, link your primary checking account and set up recurring automatic transfers. This "set it and forget it" strategy automates your savings habit, allowing your balance to grow steadily through consistent contributions and compound interest. The account is an ideal place to build a robust emergency fund; you can learn more about why a well-funded emergency account is essential and how a high-yield account accelerates that goal.

Real-Life Example: John wants a safe, reliable place to park his $50,000 emergency fund. He values simplicity and brand recognition over extra features. He chooses Marcus, opens an account in 10 minutes, and sets up a direct link to his checking account for easy access. He appreciates the clean interface that shows him exactly how much interest he's earning without any distractions.

Website: https://www.marcus.com/us/en/savings/savings1

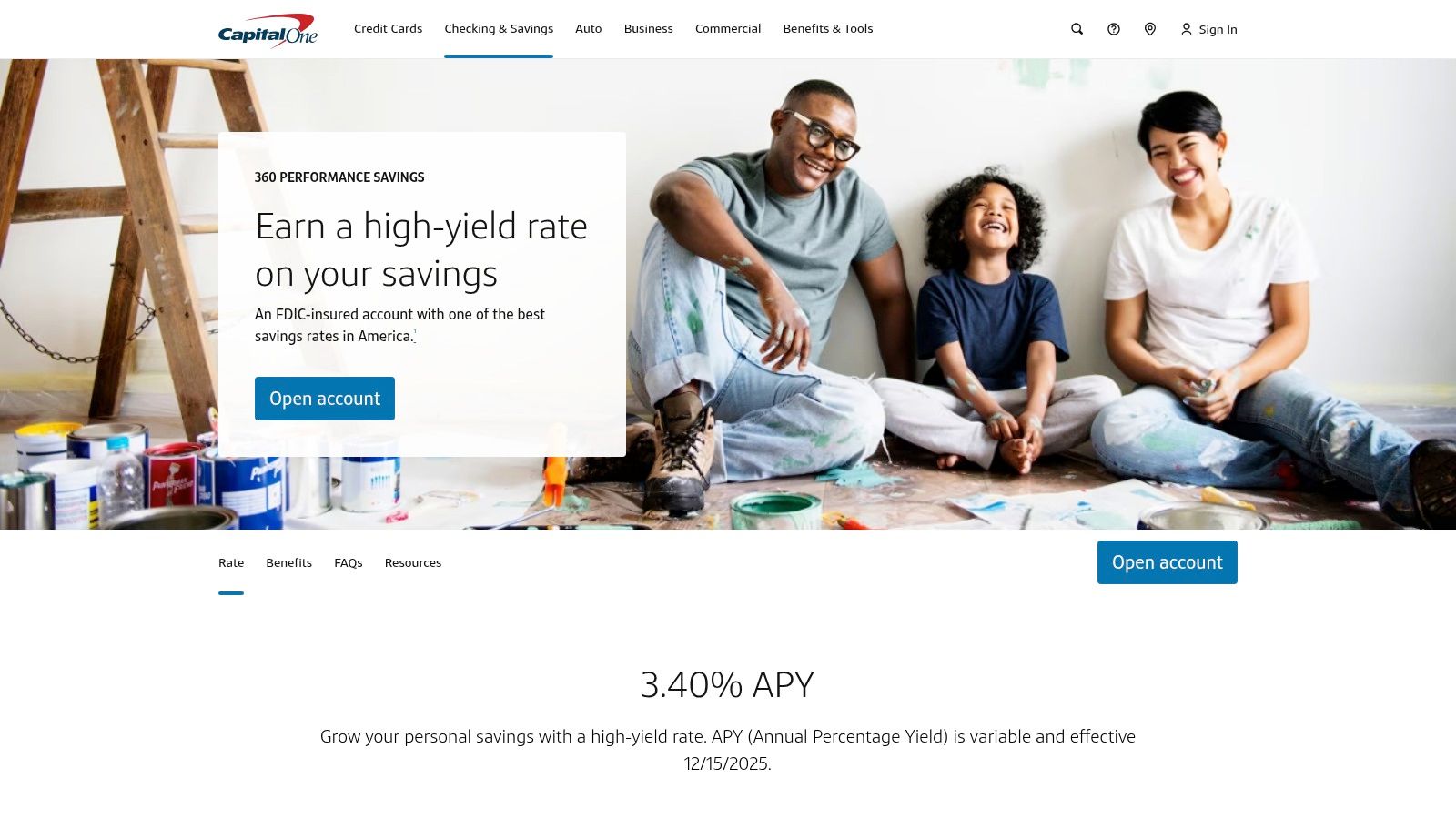

6. Capital One — 360 Performance Savings

For savers seeking the best of both worlds-a competitive APY from a major, recognizable bank-the Capital One 360 Performance Savings account is a compelling choice. It combines the fee-free, high-yield structure of an online bank with the convenience, robust technology, and brand trust of a national financial institution. This makes it an excellent option for those who want a strong return on their savings without venturing into the world of online-only fintechs.

The primary appeal of the 360 Performance Savings account lies in its simplicity and accessibility. It consistently offers an APY well above the national average while eliminating common banking hurdles like monthly service fees and minimum balance requirements. This straightforward approach makes it one of the best high-yield savings accounts for setting up an emergency fund or starting a dedicated savings goal, especially for existing Capital One customers who can manage all their finances in one place.

Key Features and User Experience

Capital One's user experience is a major differentiator, powered by one of the industry's most highly-rated mobile apps. The account opening process is digital and can be completed in minutes.

- No Fees or Minimums: There are no monthly maintenance fees to worry about and no minimum deposit required to open the account or earn the stated APY.

- Automated Savings Tools: Set up automatic, recurring transfers to build your savings effortlessly. You can also create multiple savings accounts and give them unique nicknames (e.g., "Emergency Fund," "Vacation") to better organize your financial goals.

- Top-Rated Mobile App: The Capital One mobile app allows for easy deposits, transfers, and account monitoring from anywhere, providing a seamless digital banking experience.

- FDIC Insurance: Deposits are FDIC-insured up to the maximum amount allowed by law, offering crucial security for your funds.

How to Use Capital One 360 Performance Savings Effectively

To maximize the benefits, integrate the account into your existing financial routine. Use the automated savings tools to "pay yourself first" by setting up a recurring transfer that coincides with your payday. This simple action turns saving into a consistent habit. Furthermore, leveraging these features to create and fund specific goals can significantly impact your ability to save effectively; understanding what savings rate you need for financial goals can help you set realistic and powerful targets within the app.

Real-Life Example: Emily already has a Capital One credit card and checking account. She opens a 360 Performance Savings account to keep all her finances under one login. She sets up an automatic monthly transfer of $500 from her checking to her new savings account, making her savings goal for a new home down payment effortless.

Website: https://www.capitalone.com/bank/savings-accounts/online-performance-savings-account/

7. Discover Bank — Online Savings

For savers seeking a blend of competitive interest rates and the reliability of a major, established financial institution, Discover Bank's Online Savings account is a standout choice. It effectively bridges the gap between nimble fintechs and traditional brick-and-mortar banks, offering a user-friendly digital experience backed by robust, award-winning customer support. This makes it an excellent option for those who want a strong APY without sacrificing the peace of mind that comes with a well-known brand.

Discover's primary strength lies in its simplicity and transparency. There are no monthly maintenance fees to worry about, and you can open an account with a $0 minimum deposit, making it one of the most accessible best high-yield savings accounts on the market. Interest compounds daily and is paid monthly, ensuring your money grows efficiently. This straightforward, no-fuss approach is ideal for setting up an emergency fund, saving for a down payment, or simply parking cash to earn a solid return.

Key Features and User Experience

Discover has invested heavily in its digital platform, resulting in a clean, intuitive online portal and a highly-rated mobile app. Account management is seamless, allowing users to easily set up recurring transfers, monitor their interest earnings, and manage their funds on the go.

- No Fees or Minimums: There are no monthly fees, no fees for insufficient funds, and a $0 minimum opening deposit.

- 24/7 U.S.-Based Customer Service: Unlike many online-only banks, Discover offers round-the-clock access to a live customer service team, a major advantage for users who value support.

- Daily Compounding Interest: Your balance earns interest every day, which is then credited to your account monthly, maximizing your growth potential.

- Early Pay Feature: With a qualifying direct deposit, you can get access to your paycheck up to two days early, a useful perk for managing cash flow.

How to Use Discover Bank Effectively

To maximize your savings, set up automatic, recurring transfers from your primary checking account. Even small, consistent contributions can grow significantly over time thanks to the competitive APY and daily compounding. Use the Discover mobile app to track your savings goals and make it a habit to check your progress. Since Discover is also a major credit card issuer, existing cardholders will find it convenient to manage both their credit and savings accounts within a single, integrated ecosystem.

Real-Life Example: After a bad experience with a bank's automated phone system, Mark prioritizes excellent customer service. He chooses Discover for its 24/7 U.S.-based support. When he has a question about setting up a transfer late one night, he's able to speak with a real person immediately, confirming his choice was the right one for his needs.

Website: https://www.discover.com/online-banking/savings-account/

Your Next Step: Taking Action to Maximize Your Savings

You've navigated the landscape of modern savings, from powerful comparison hubs like Bankrate to innovative marketplaces like Raisin and established digital banks such as Ally, Marcus, Capital One, and Discover. The core takeaway is clear: settling for the near-zero interest of a traditional savings account is no longer a viable option. Choosing the best high-yield savings account is a foundational step in any intelligent financial plan, transforming your static cash reserves into an active, wealth-generating asset.

The difference between a 0.01% APY and a 4.50% APY might seem small on paper, but over time, it compounds into hundreds or even thousands of dollars in effortless earnings. This isn't just about earning a few extra bucks; it's about reclaiming the purchasing power of your money from inflation and accelerating your progress toward critical financial milestones. Whether you're building an emergency fund, saving for a down payment, or setting aside cash for a major purchase, a high-yield savings account ensures your money is working as hard as you do.

From Information to Implementation: Your Action Plan

We've analyzed features, compared APYs, and explored user profiles, but the true value lies in taking decisive action. Don't fall into the trap of analysis paralysis, where the sheer number of excellent options prevents you from choosing any. Remember, opening any of the accounts detailed in this guide is a significant financial upgrade.

Here is a practical, step-by-step framework to guide your decision and get you started today:

-

Define Your Primary Savings Goal: Before you select an account, clarify its purpose. Is this your primary emergency fund that needs absolute liquidity and a reliable mobile app (like Ally or Discover)? Is it a secondary savings bucket for a specific goal where you want to chase the absolute highest rate available (making a marketplace like Raisin ideal)? Or are you a set-it-and-forget-it saver who values simplicity and a strong brand name (like Marcus or Capital One 360)?

-

Identify Your Top 2-3 Contenders: Based on your goal, revisit our comparisons. If you prioritize an all-in-one banking experience with checking and investing, Ally Bank might be your top choice. If you are purely focused on a high, competitive rate with no frills from a trusted financial name, Marcus by Goldman Sachs is a strong contender. Pick the few that resonate most with your personal financial style.

-

Perform a Final Feature Check: Spend five minutes comparing your finalists on these key criteria:

- Current APY: How does their rate stack up right now?

- Fees: Are there any monthly maintenance fees or obscure charges? (All our recommendations are fee-free).

- Mobile App & UX: Do you prefer a sleek, modern interface or a more traditional online banking portal?

- Customer Support: Check their support hours and options (phone, chat, etc.).

- FDIC Insurance: Confirm the standard $250,000 in FDIC coverage per depositor, per institution.

-

Commit and Apply: This is the most crucial step. Set aside 15 minutes, gather your personal information (Social Security number, driver's license, etc.), and complete the online application for your chosen account. The process is designed to be quick and painless.

-

Initiate Your First Transfer: An empty account earns nothing. Link your existing checking account and schedule your first deposit. To build momentum, consider setting up a recurring automatic transfer, even if it's a small amount. This automates your savings habit and ensures consistent growth.

Making the switch to a high-yield savings account is one of the highest-impact, lowest-effort financial moves available. It requires a small, one-time investment of your time to unlock a lifetime of passive growth. You've done the research; now it's time to put your money to work and build a more secure financial future.

Frequently Asked Questions (FAQ)

1. What is a high-yield savings account (HYSA)?

An HYSA is a type of savings account, typically offered by online banks, that pays a much higher interest rate (APY) than traditional savings accounts from brick-and-mortar banks. This allows your money to grow significantly faster.

2. Are high-yield savings accounts safe?

Yes. As long as the bank is insured by the Federal Deposit Insurance Corporation (FDIC) or the credit union is insured by the National Credit Union Administration (NCUA), your deposits are protected up to $250,000 per depositor, per institution. All accounts recommended in this article are FDIC-insured.

3. Why do online banks offer higher interest rates?

Online banks have lower overhead costs because they don't operate physical branches. They pass these savings on to customers in the form of higher APYs and lower fees.

4. How often do the interest rates on HYSAs change?

Interest rates on HYSAs are variable, meaning they can change at any time. They are often influenced by the Federal Reserve's federal funds rate. Banks may raise or lower their APYs based on market conditions.

5. Are there any fees associated with HYSAs?

Most of the best high-yield savings accounts have no monthly maintenance fees or minimum balance fees. This is a key advantage over many traditional savings accounts.

6. Can I use an HYSA for everyday spending?

No, HYSAs are not designed for daily transactions. They are savings vehicles. While you can transfer money to and from your checking account, they do not come with debit cards or check-writing privileges. Federal regulations may also limit the number of certain types of withdrawals per month.

7. How much money should I keep in an HYSA?

An HYSA is an ideal place for your emergency fund (typically 3-6 months' worth of living expenses), as well as short- to medium-term savings goals like a down payment on a house, a new car, or a vacation.

8. How do I deposit and withdraw money from an online-only HYSA?

You can typically deposit money via electronic transfer (ACH) from a linked checking account, mobile check deposit using the bank's app, or direct deposit. Withdrawals are usually done through electronic transfers back to your linked external account.

9. Will I be taxed on the interest I earn?

Yes, the interest you earn in a savings account is considered taxable income. Your bank will send you a Form 1099-INT at the end of the year if you earn more than $10 in interest.

10. How quickly can I open an account and start earning interest?

The online application process for most HYSAs takes only 5-15 minutes. Once your account is approved and you make your first deposit, you will start earning interest immediately. The interest typically compounds daily and is paid out monthly.

Finding the best high-yield savings account is a fantastic first step in optimizing your financial health. To take your strategy to the next level with advanced wealth-building insights and tools, explore the resources at Top Wealth Guide. We provide in-depth analysis on everything from investing to retirement planning, helping you make informed decisions to grow your net worth. Visit us at Top Wealth Guide to continue your journey.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.