In 2025, taking control of your financial destiny is more accessible than ever, moving beyond the limitations of complex spreadsheets and tedious manual calculations. Today, a powerful suite of digital tools can fundamentally transform how you manage, grow, and protect your wealth. Whether your goal is to eliminate debt, build a robust investment portfolio, or design a comfortable retirement, the right software provides the clarity and confidence required to make informed decisions.

This comprehensive guide cuts through the noise to identify the absolute best financial planning tools available right now. We move beyond marketing jargon to provide an in-depth, hands-on analysis, helping you select the platform that perfectly aligns with your unique financial journey. Our goal is to empower you to find your ideal financial co-pilot.

Inside, you will discover a curated selection of platforms designed for every specific need. We'll explore:

- All-in-one dashboards that track your net worth and investments in real-time.

- Specialized apps for disciplined, zero-based budgeting.

- Sophisticated retirement modeling and scenario-planning software.

- Advanced trackers for managing diverse assets like real estate and cryptocurrency.

Each review is structured for quick comprehension, featuring screenshots, direct links, and clear rundowns of features, pricing, and ideal user profiles. We provide honest assessments of limitations and practical insights to help you implement your chosen tool effectively. Prepare to find the perfect solution to conquer your financial goals.

In This Guide

- 1 1. Empower Personal Dashboard (formerly Personal Capital)

- 2 2. Simplifi by Quicken

- 3 3. YNAB (You Need A Budget)

- 4 Comparison: Budgeting Focus vs. Investment Focus

- 5 4. Tiller

- 6 5. Monarch Money

- 7 6. Boldin Planner (formerly NewRetirement)

- 8 Comparison: DIY Control vs. Modern Collaboration

- 9 7. Morningstar Investor

- 10 8. Kubera

- 11 9. OnTrajectory

- 12 10. EveryDollar (Ramsey Solutions)

- 13 11. Rocket Money

- 14 12. PocketSmith

- 15 Top 12 Financial Planning Tools — Feature Comparison

- 16 Your Next Step: From Planning to Action

- 17 Frequently Asked Questions (FAQ)

- 17.1 1. What is the best financial planning tool for beginners?

- 17.2 2. Are free financial planning tools safe to use?

- 17.3 3. What is the difference between a budgeting tool and a financial planning tool?

- 17.4 4. Can a financial planning tool help me get out of debt?

- 17.5 5. I use spreadsheets. Why should I switch to a dedicated tool?

- 17.6 6. What's the best tool for couples or families?

- 17.7 7. Do I need a tool that tracks my credit score?

- 17.8 8. How much should I expect to pay for a good financial planning tool?

- 17.9 9. What is the best tool for tracking cryptocurrency and other alternative assets?

- 17.10 10. Can I manage my small business finances with these tools?

1. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard has long been a heavyweight contender among the best financial planning tools, especially for those who want a holistic view of their net worth combined with powerful, free investment analysis. It excels at aggregating all your financial accounts, from checking and savings to 401(k)s, IRAs, and even mortgages, into a single, intuitive interface. This 360-degree view is its core strength, allowing you to track your complete financial picture in near real-time.

What truly sets Empower apart is its suite of sophisticated, no-cost analytical tools that rival those of paid services. The Retirement Planner is particularly robust, letting you run various "what-if" scenarios to see how different life events, saving rates, or market conditions might impact your retirement goals. Additionally, its Portfolio Fee Analyzer uncovers hidden fees in your investment accounts, showing you the long-term drag on your returns.

Real-Life Example: A user, Sarah (45), was contributing to her 401(k) but wasn't sure if she was on track for retirement. By linking her accounts to Empower, she used the Retirement Planner to see she had a 72% chance of success. She then modeled a scenario where she increased her savings by 3% annually. The tool projected this small change would boost her success probability to 95%, giving her a clear, actionable step to secure her future.

While the account aggregation can sometimes be finicky and require re-linking, the platform's value is undeniable. It's a fantastic starting point for anyone serious about tracking net worth and planning for the long term. Gaining a clear understanding of your portfolio's allocation and fees is a critical step, which is a key part of learning how to effectively manage your wealth for long-term growth.

Key Information

| Feature | Details |

|---|---|

| Best For | Investors wanting a comprehensive net worth tracker and free, in-depth retirement planning tools. |

| Key Features | Net Worth Dashboard, Retirement Planner, Investment Checkup, Fee Analyzer, Savings Planner. |

| Pricing | The dashboard and all planning tools are completely free. Optional wealth management services are available for a fee. |

| Pros | Powerful investment and retirement analysis at no cost; excellent account aggregation; clean, ad-free user interface. |

| Cons | Account syncing can occasionally require attention; advisory services are frequently offered (but not required). |

| Website | Visit Empower Personal Dashboard |

2. Simplifi by Quicken

For those who find traditional budgeting tedious, Simplifi by Quicken offers a refreshing, forward-looking approach to managing your money. As a lighter, cloud-based alternative to the classic Quicken software, it excels at providing a real-time, proactive spending plan. Instead of just tracking past expenses, Simplifi projects your upcoming bills and income to tell you exactly how much you have left to spend today, helping you make smarter daily financial decisions without complex spreadsheets.

One of its core features is the Spending Plan, which dynamically adjusts as your financial situation changes. It also includes useful tools like custom watchlists for specific spending categories, savings goal trackers, and a monitor for recurring subscriptions that can often go unnoticed. While it lacks the deep, Monte Carlo-style retirement simulations of more investment-focused platforms, it is an excellent choice for users who want an always-aware plan for their day-to-day cash flow.

Simplifi's strength lies in its intuitive design and focus on actionable insights for the here and now. It connects to your bank accounts to automate tracking, giving you a clear, consolidated view of your finances across its web and mobile apps. This makes it one of the best financial planning tools for gaining control over your spending and building consistent saving habits.

Key Information

| Feature | Details |

|---|---|

| Best For | Individuals and families wanting a simple, proactive tool for managing daily cash flow and budgeting. |

| Key Features | Dynamic Spending Plan, Savings Goals, Subscription Monitoring, Investment Tracking, Custom Spending Watchlists. |

| Pricing | Subscription-based with a monthly or annual fee. New users often benefit from a free trial and promotional discounts. |

| Pros | Intuitive and forward-looking cash-flow tools; modern, clean interface on web and mobile; a lighter, faster alternative to desktop Quicken. |

| Cons | Lacks advanced retirement modeling tools like Monte Carlo simulations; some bank connections may require periodic relinking. |

| Website | Visit Simplifi by Quicken |

3. YNAB (You Need A Budget)

YNAB, or You Need A Budget, operates on a powerful and distinct philosophy that sets it apart from many other financial planning tools: give every single dollar a job. This proactive, zero-based budgeting method forces you to become intentional with your money, transforming budgeting from a passive tracking exercise into an active plan for your spending. Instead of just looking back at where your money went, YNAB helps you decide where it will go before you even spend it, which is a game-changer for gaining control over your finances.

What makes YNAB so effective is its focus on behavior change, supported by a wealth of educational resources, workshops, and a passionate user community. The platform’s "Four Rules" create a simple framework for success, helping users break the paycheck-to-paycheck cycle and build wealth. Features like the Debt Payoff tool and goal-based "envelopes" provide a clear path to get out of debt and save for major purchases.

Real-Life Example: Mark and Jen had over $25,000 in credit card debt and felt like they were treading water. They committed to YNAB's methodology. By assigning every dollar a "job," they quickly identified hundreds of dollars each month going toward impulse buys and unused subscriptions. Using the Debt Payoff tool, they focused these reclaimed funds into a debt snowball, paying off the full balance in just 18 months.

While it lacks the investment tracking capabilities of an all-in-one platform like Empower, YNAB’s singular focus on budgeting is its greatest strength. It is an unparalleled tool for anyone who feels stuck financially and is ready to fundamentally change their relationship with money. This proactive approach is a cornerstone of a sound financial life and is a key step in budgeting for financial freedom.

Key Information

| Feature | Details |

|---|---|

| Best For | Individuals and families determined to get control of their spending, pay off debt, and build better financial habits. |

| Key Features | Zero-Based Budgeting, Goal-Based Envelopes, "Age of Money" Tracker, Debt Payoff Tool, Direct Bank Import. |

| Pricing | YNAB offers a monthly or annual subscription after a generous 34-day free trial. |

| Pros | Strong focus on behavior change; excellent educational resources and community support; proven method for gaining financial control. |

| Cons | Requires a subscription; focused purely on budgeting with no investment tracking; takes time and commitment to learn the methodology. |

| Website | Visit YNAB |

Comparison: Budgeting Focus vs. Investment Focus

| Tool | Primary Goal | Best For | Key Strength |

|---|---|---|---|

| Empower Personal Dashboard | Holistic Wealth Tracking | Long-term investors | Deep investment and retirement analysis at no cost. |

| YNAB (You Need A Budget) | Intentional Spending Control | Debt payoff & habit change | A proven methodology for changing financial behavior. |

| Simplifi by Quicken | Proactive Cash Flow Management | Daily money managers | An intuitive, forward-looking plan for today's spending. |

4. Tiller

For those who love the flexibility of a spreadsheet but hate the drudgery of manual data entry, Tiller offers a perfect solution. It stands out among financial planning tools by directly connecting your bank accounts, credit cards, and investments to Google Sheets or Microsoft Excel. This unique approach automates the transaction-gathering process, feeding all your financial data into a powerful, private spreadsheet that you own and control completely.

What makes Tiller so compelling is its ultimate customization. You start with their excellent Foundation Template, which covers budgeting, net worth, and cash flow, but you can modify it or choose from dozens of community-built templates for more specific needs like debt snowball plans or detailed investment tracking. Features like AutoCat allow you to create rules that automatically categorize your spending, saving you significant time. Tiller gives spreadsheet-savvy users an unparalleled level of transparency and control over their financial data.

While it lacks the built-in, sophisticated investment analysis tools of an all-in-one platform like Empower, its power lies in its adaptability. If you can imagine it in a spreadsheet, you can likely build it with Tiller. This makes it an ideal choice for former Mint power users or anyone who believes their finances shouldn't be locked into a proprietary app.

Key Information

| Feature | Details |

|---|---|

| Best For | Spreadsheet-savvy users who want total control, customization, and ownership of their financial data. |

| Key Features | Automated bank feeds into Google Sheets & Excel, Foundation Template, AutoCat for smart categorization, Daily email summary. |

| Pricing | A single plan at $79 per year after a 30-day free trial. A 60-day money-back guarantee is offered. |

| Pros | Ultimate customization and transparency; you own the data in your own sheet; active community with dozens of templates. |

| Cons | Requires comfort with spreadsheets; no native advanced investment analysis tools like Monte Carlo simulations. |

| Website | Visit Tiller |

5. Monarch Money

Monarch Money has quickly emerged as a top contender for households seeking a modern, collaborative approach to personal finance. It positions itself as a premium, ad-free alternative to apps like Mint, focusing on a clean user experience combined with powerful customization. The platform is built from the ground up for shared finances, allowing you to invite a partner or financial advisor to view and manage your financial picture together, with granular control over what they can see and do.

What truly differentiates Monarch is its exceptional flexibility and modern integrations. Users can create custom categories, set up powerful rules to automatically tag transactions, and connect to a vast range of institutions, including tricky ones like Apple Card and crypto exchanges like Coinbase. Its goal-setting feature is intuitive, helping you visualize progress towards major life purchases, while its investment tracking provides a clear overview of your portfolio. For those just beginning their wealth-building journey, this comprehensive view is an essential first step and a great way to understand the basics before you get started with investing your money.

The platform operates on a subscription-only model, which means there are no ads and your data isn't sold. While some may miss a free tier, the premium experience, robust feature set, and focus on collaboration make it one of the best financial planning tools for couples and families who are serious about managing their money together. The interface is polished on both web and mobile, making it a joy to use for daily tracking and long-term planning.

Key Information

| Feature | Details |

|---|---|

| Best For | Couples and households needing a shared, collaborative view of their finances with deep customization options. |

| Key Features | Shared household dashboard, unlimited account connections, custom rules and categories, investment tracking, goal setting. |

| Pricing | Subscription-based with a free trial. No free tier is available. |

| Pros | Excellent for collaborative budgeting, clean and ad-free interface, powerful transaction rules, modern integrations. |

| Cons | No free version available; retirement planning tools are not as advanced as dedicated platforms like Empower. |

| Website | Visit Monarch Money |

6. Boldin Planner (formerly NewRetirement)

Boldin Planner carves out a niche as one of the most comprehensive DIY financial planning tools available, specifically for those who want to dive deep into retirement modeling. It moves far beyond simple net worth tracking to offer a sophisticated engine for lifetime cash flow analysis. Users can input over 100 different variables to build a highly detailed financial picture, then stress-test that plan against various market conditions and life events. This level of detail makes it a powerhouse for serious planners.

What truly distinguishes Boldin Planner is its focus on granular retirement-specific scenarios that other tools often overlook. Its Roth Conversion Explorer and Social Security Optimizer allow you to model complex strategies to maximize your retirement income and minimize taxes. The platform also provides a "Chance of Success" score based on Monte Carlo simulations, giving you a probabilistic look at your plan's viability.

Real-Life Example: A couple nearing retirement, David and Maria (both 62), wanted to decide the best time to claim Social Security. Using Boldin Planner's optimizer, they discovered that if David waited until age 70 to claim, their total lifetime benefits would increase by over $120,000 compared to claiming at 62. The tool also showed them how to structure withdrawals from their IRA to cover the gap, providing a clear, tax-efficient strategy.

While the sheer number of inputs can present a steeper learning curve than simpler apps, the payoff is a highly personalized and robust plan. For those committed to understanding the intricate levers of their financial future, Boldin Planner provides the tools to map out a clear path. This detailed approach is invaluable for anyone working towards a clear definition of what is financial independence and how to achieve it.

Key Information

| Feature | Details |

|---|---|

| Best For | DIY planners seeking in-depth, customizable retirement and cash flow modeling with advanced tax and scenario analysis. |

| Key Features | Detailed Scenario Modeling, Roth Conversion Explorer, Social Security Optimizer, Monte Carlo Simulations, Federal & State Tax Projections. |

| Pricing | A basic version is free. The PlannerPlus plan with advanced features is available for an annual subscription fee. |

| Pros | Powerful, retirement-grade modeling at a consumer price point; robust "what-if" scenario tools; excellent educational content and live classes. |

| Cons | Can have a steep learning curve for beginners; some features require linking accounts, which may involve third-party aggregators. |

| Website | Visit Boldin Planner |

Comparison: DIY Control vs. Modern Collaboration

| Tool | Primary Goal | Best For | Key Strength |

|---|---|---|---|

| Tiller | Data Ownership & Customization | Spreadsheet experts | Ultimate control by linking bank data directly to your own sheets. |

| Monarch Money | Shared Financial Management | Couples & families | A polished, collaborative interface for managing money together. |

| Boldin Planner | Advanced Retirement Modeling | Serious DIY planners | Unmatched depth for scenario planning and retirement optimization. |

7. Morningstar Investor

For the do-it-yourself investor who craves institutional-grade data and unbiased analysis, Morningstar Investor is an indispensable resource. While many tools focus on budgeting or net worth tracking, Morningstar drills down into the core of portfolio construction and investment selection. It's less about your day-to-day spending and more about helping you make informed, long-term decisions on the stocks, ETFs, and mutual funds that build your wealth.

The platform’s standout feature is the Portfolio X-Ray, which analyzes your holdings to reveal potential risks you might not see, such as sector over-concentration or hidden style drift in your funds. Its robust screeners, backed by renowned analyst ratings, empower you to find high-quality investments that align with your strategy. The detailed, independent research reports provide a level of depth that goes far beyond typical brokerage firm offerings, making it a critical tool for serious investors.

While Morningstar Investor is laser-focused on investments rather than holistic personal finance, this specialization is its greatest strength. It provides the deep-dive analytics needed to build a resilient and optimized portfolio. Using its insights is a key component of many effective wealth management strategies. Although there's a learning curve, mastering its features can significantly elevate your investment planning capabilities, making it one of the best financial planning tools for portfolio optimization.

Key Information

| Feature | Details |

|---|---|

| Best For | DIY investors seeking deep-dive analysis, fund research, and professional-grade portfolio optimization tools. |

| Key Features | Portfolio X-Ray analysis, Robust screeners for funds/ETFs/stocks, Independent analyst ratings and research, Portfolio monitoring. |

| Pricing | A premium subscription is required for full access. Pricing is typically monthly or annually, with periodic free trials offered. |

| Pros | Trusted, in-depth investment data and analysis; powerful for fee awareness and portfolio construction; periodic free trials available. |

| Cons | Focused on investments rather than full personal budgeting; power features require a learning curve to master. |

| Website | Visit Morningstar Investor |

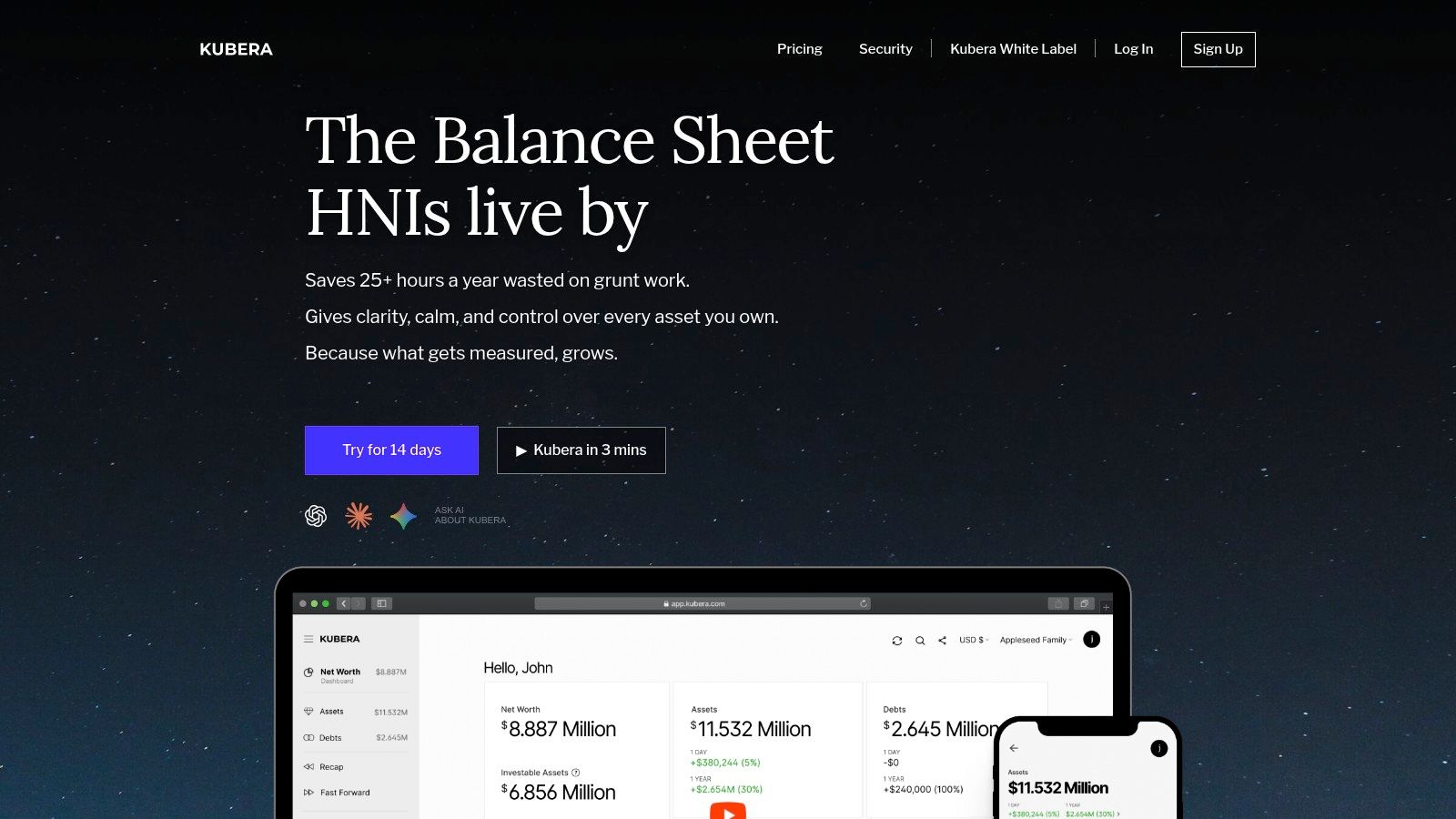

8. Kubera

For those with complex, global, or crypto-heavy portfolios, Kubera offers a premium, privacy-first alternative to mainstream financial planning tools. It positions itself as an elegant, all-in-one portfolio tracker designed to handle a diverse range of assets, from traditional stocks and bank accounts to cryptocurrencies, DeFi assets, real estate, and even collectibles like art or cars. Its clean, ad-free interface focuses purely on providing a comprehensive and accurate net worth snapshot.

What truly differentiates Kubera is its powerful organizational capabilities and respect for user privacy. The platform allows users to create nested portfolios, making it ideal for managing finances for a trust, an LLC, or different family members under one roof. Furthermore, its unique beneficiary management feature acts as an automated "dead man's switch," securely transferring vital financial information to a designated heir. This emphasis on tracking diverse assets and managing complex household finances makes it a standout choice for high-net-worth individuals and serious crypto investors.

While Kubera excels at tracking and organization, it intentionally omits the deep, forward-looking retirement planning and Monte Carlo simulations found in other tools. Its primary focus is on giving you a precise, real-time understanding of what you have today across every conceivable asset class. For those who prioritize a comprehensive, private, and versatile asset tracker over predictive financial modeling, Kubera is a top-tier solution.

Key Information

| Feature | Details |

|---|---|

| Best For | High-net-worth individuals, crypto investors, and those with complex global assets needing a privacy-focused tracker. |

| Key Features | All-in-one asset tracking (crypto, DeFi, real estate), nested portfolios, beneficiary management, multi-currency support, clean UI. |

| Pricing | Premium subscription-based service with various tiers; no free version is available after the trial. |

| Pros | Excellent for tracking complex and alternative assets; strong privacy stance with no ads or data selling; great for multi-entity households. |

| Cons | Higher cost than many competitors; lacks in-depth retirement planning and forecasting tools like Monte Carlo analysis. |

| Website | Visit Kubera |

9. OnTrajectory

OnTrajectory is a powerful, goal-based financial planning tool designed for the detail-oriented DIY investor, particularly those in the Financial Independence, Retire Early (FI/RE) community. Instead of simple budgeting, it provides a sophisticated cash-flow modeling engine that projects your financial future across your entire lifetime. Its core strength lies in its ability to run unlimited "what-if" scenarios, allowing you to visualize how different savings rates, market returns, or life events impact your long-term trajectory toward financial goals.

What truly makes OnTrajectory one of the best financial planning tools for advanced users is its deep analytical capability. It goes beyond basic retirement calculators by incorporating detailed tax implications, account-specific withdrawal rules, and debt payoff strategies into its projections. The platform uses Monte Carlo simulations and historical stress tests to provide a "chance-of-success" score, giving you a probabilistic view of your plan's viability. This data-driven approach helps you move from guessing to making informed decisions based on robust modeling.

While the user interface is less polished than some mainstream apps and requires a dedicated manual setup to be truly accurate, its affordability is remarkable for the level of power it offers. It's an ideal choice for planners who want to get under the hood of their finances and test every variable to build a resilient, long-term strategy.

Key Information

| Feature | Details |

|---|---|

| Best For | DIY investors and FI/RE enthusiasts who want powerful, lifetime cash-flow modeling and scenario analysis. |

| Key Features | Unlimited scenario modeling, Monte Carlo & historical stress tests, Tax-aware withdrawal planning, Chance-of-success scoring, Visual financial timeline. |

| Pricing | A free basic tier is available to test core features. Paid plans unlock advanced modeling capabilities. |

| Pros | Strong value pricing for robust modeling; clear visuals suitable for DIY FI/RE planners; free basic tier to try core functionality. |

| Cons | Less polished mobile experience than simpler budgeting apps; requires manual setup to achieve high accuracy. |

| Website | Visit OnTrajectory |

10. EveryDollar (Ramsey Solutions)

For those who want to take firm, hands-on control of their monthly cash flow, EveryDollar offers a refreshingly straightforward approach. Developed by Ramsey Solutions, this tool is built entirely around the principles of zero-based budgeting, where every dollar of your income is assigned a specific job. Its primary strength lies in its simplicity and laser focus on creating and sticking to a monthly spending plan, making it one of the best financial planning tools for budgeting beginners and those following the Ramsey "Baby Steps" to pay off debt.

What makes EveryDollar unique is its unwavering commitment to its budgeting philosophy. Unlike other apps that might offer more complex financial analysis, EveryDollar is designed to change your spending behavior through intentional planning. The free version requires you to manually track every transaction, which forces a high level of awareness about your spending habits. The premium version adds the convenience of bank syncing, but the core principle of giving every dollar a purpose before the month begins remains the same.

While the app's rigid structure may not appeal to everyone, its effectiveness for users committed to a structured debt-payoff plan is undeniable. It excels at helping you create a plan and see exactly where your money is going. The integration with Ramsey's educational content provides a supportive ecosystem for users who are actively working to improve their financial literacy and habits according to a proven system.

Key Information

| Feature | Details |

|---|---|

| Best For | Beginners seeking a structured, zero-based budget and individuals following the Ramsey Solutions method for debt reduction. |

| Key Features | Zero-Based Monthly Budgeting, Paycheck Planning, Debt Payoff Tools, Savings "Funds", Bank Syncing (Premium), Mobile and Web Apps. |

| Pricing | A functional manual-entry version is free. Premium, which includes bank syncing, is available via subscription. |

| Pros | Simple and focused on the zero-based method; excellent for structured debt payoff; strong integration with Ramsey educational content. |

| Cons | Must pay for the premium version to get bank syncing and transaction automation; the philosophy can feel restrictive for some users. |

| Website | Visit EveryDollar |

11. Rocket Money

While many financial planning tools focus on long-term investment growth, Rocket Money carves out a niche by delivering immediate savings and clarity on your monthly cash flow. Its primary strength lies in identifying and managing recurring expenses and subscriptions. The app automatically scans your linked accounts to find every single subscription, from streaming services to forgotten free trials, presenting them in a clean list so you can cancel unwanted ones with a single tap. This focus on "expense leakage" makes it a powerful tool for instantly freeing up cash.

Beyond subscription management, Rocket Money offers a bill negotiation service that can lower your monthly payments for things like cable, internet, and cell phone bills. The service works on your behalf and only charges a fee if they successfully save you money. This unique feature, combined with its budgeting and spending trackers, provides a practical, ground-level approach to financial management. It helps you control the money going out the door today, which is a crucial first step before you can effectively plan for tomorrow.

Though its investment tracking features are not as deep as dedicated platforms, Rocket Money excels at optimizing your spending and budget. It’s one of the best financial planning tools for anyone who suspects they are overspending on recurring costs and wants to gain quick control over their monthly budget.

Key Information

| Feature | Details |

|---|---|

| Best For | Individuals looking to quickly cut monthly expenses, cancel forgotten subscriptions, and get a clear view of their spending habits. |

| Key Features | Subscription cancellation, bill negotiation service, automated budgeting, net worth tracking, spend alerts, credit score monitoring. |

| Pricing | A free version with basic features is available. Premium tiers with advanced features have variable pricing (e.g., $4-$12/month). |

| Pros | Excellent at finding and canceling unwanted subscriptions; bill negotiation can lead to significant savings; user-friendly interface. |

| Cons | Negotiation service fee is a percentage of first-year savings; account aggregation can be less reliable than some competitors. |

| Website | Visit Rocket Money |

12. PocketSmith

Where most budgeting tools focus on tracking past spending, PocketSmith flips the script by prioritizing what’s coming next. This makes it one of the best financial planning tools for anyone who wants to forecast their future cash flow with incredible detail. Its standout feature is a calendar-based system that projects your day-to-day bank balances up to 30 years into the future, helping you visualize the real-world impact of your financial decisions and avoid cash crunches.

The platform’s strength lies in its powerful "what-if" scenario planning. You can model different financial futures, such as seeing how taking on a new mortgage or changing your income might affect your account balances months or even years down the line. It supports multiple currencies and offers highly customizable dashboards and reports, making it a robust choice for freelancers, small business owners, or anyone with fluctuating income streams who needs to manage their money proactively.

While the depth of its features can present a steeper learning curve compared to simpler apps, its forecast-first approach is unmatched for detailed forward-looking cash management. Getting started with the free plan is a great way to explore its core functionality before committing to a paid tier. The ability to see a daily projection of your finances provides a level of control and foresight that is rare in the personal finance space.

Key Information

| Feature | Details |

|---|---|

| Best For | Users who need detailed, forward-looking cash flow forecasting and scenario planning. |

| Key Features | Calendar-based cash-flow forecasting, "What-if" scenario planning, multi-currency support, custom dashboards, bank feeds. |

| Pricing | A limited free version is available. Paid plans (Foundation, Flourish, Fortune) add more features and accounts. |

| Pros | Excellent for forward-looking daily cash management; highly customizable with rich reporting; a free plan is available. |

| Cons | The powerful interface can feel dense initially; some pricing details require sign-in to view. |

| Website | Visit PocketSmith |

Top 12 Financial Planning Tools — Feature Comparison

| Product | Core features & ✨Unique Strength | Best for 👥 | Price / Value 💰 |

|---|---|---|---|

| Empower Personal Dashboard | Aggregates accounts, retirement planner, portfolio X‑ray ✨Deep investment analytics & scenario testing | 👥 Long-term investors & retirement planners | 💰 Free core; optional advisory upsell |

| Simplifi by Quicken | Spending Plan, real-time cash‑flow, goals & watchlists ✨Fast, lightweight budgeting | 👥 Everyday budgeters who want proactive cash forecasts | 💰 Subscription (annual discounts common) |

| YNAB | Zero‑based envelopes, Age of Money, goal tracking ✨Top education & community support | 👥 Behavior-focused users aiming to control spending | 💰 Subscription (34‑day trial) |

| Tiller | Automated bank feeds into Sheets/Excel, templates, AutoCat ✨Full spreadsheet ownership & customization | 👥 Spreadsheet-savvy users who want transparency & control | 💰 Subscription (owns your sheets) |

| Monarch Money | Unlimited accounts, collaborators, custom tagging ✨Polished UX for households | 👥 Households & couples needing shared access | 💰 Premium subscription (no free tier) |

| Boldin Planner | Deep retirement modeling, taxes, Roth conversions, Monte Carlo ✨100+ inputs & scenario comparisons | 👥 DIY retirement planners & advanced long-term modelers | 💰 Basic free; premium features paid |

| Morningstar Investor | Portfolio X‑Ray, screeners, analyst ratings ✨Trusted fund/ETF research | 👥 DIY investors & portfolio constructors | 💰 Subscription (trial periods occasionally) |

| Kubera | Net‑worth tracker for crypto, real estate & collectibles ✨Nested portfolios, privacy & estate tools | 👥 Complex/global/crypto-heavy households & advisors | 💰 Premium pricing (higher tiers for concierge) |

| OnTrajectory | Monte Carlo, tax-aware withdrawals, unlimited scenarios ✨Affordable FI/RE engine | 👥 DIY FI/RE planners and retirement scenario testers | 💰 Free basic; paid tiers for full features |

| EveryDollar | Zero‑based monthly budgeting, paycheck planning ✨Beginner-friendly Ramsey method | 👥 Beginners & Ramsey method followers | 💰 Free manual; Premium for bank sync |

| Rocket Money | Subscription discovery, cancel service, bill negotiation ✨Quick savings by cutting recurring costs | 👥 Users wanting fast subscription/bill savings | 💰 Free core; Premium & negotiation fees apply |

| PocketSmith | Calendar-based forecasting, multi-currency, long-term projections ✨Day-by-day 30‑year forecasting | 👥 Forward-looking cash managers and scenario planners | 💰 Free plan; paid tiers for advanced forecasting |

Your Next Step: From Planning to Action

We've journeyed through a comprehensive landscape of the best financial planning tools available today, from all-in-one dashboards like Empower Personal Dashboard to specialized budgeting systems like YNAB and powerful retirement calculators like Boldin Planner. The sheer volume of options can feel overwhelming, but this diversity is a significant advantage. It means there is almost certainly a perfect-fit solution waiting to align with your unique financial personality, goals, and current life stage.

The core takeaway is that the "best" tool isn't a universal title but a personal one. The ideal platform for a recent graduate meticulously tracking every dollar with EveryDollar will differ vastly from the needs of a pre-retiree stress-testing their portfolio with OnTrajectory or a crypto investor monitoring global assets with Kubera. Your first task isn't to find the objectively superior tool; it's to define what you need that tool to do for you right now.

How to Choose Your Financial Co-Pilot

Making a choice amidst so many great options can lead to "analysis paralysis," where the fear of picking the wrong tool prevents you from picking any at all. To break through this, let's distill the selection process into a few actionable steps based on your primary financial objective.

- If you need a 360-degree view of your net worth: Your primary goal is to see everything in one place, from your 401(k) to your mortgage and investment accounts. Start with Empower Personal Dashboard. Its free, powerful aggregation and retirement fee analyzer provide immediate, high-level clarity without a subscription commitment.

- If you need to break the paycheck-to-paycheck cycle: Your focus is on intentional spending and gaining control over your cash flow. The clear choice here is YNAB (You Need A Budget). Its proactive, zero-based budgeting methodology is specifically designed to change your relationship with money and build financial discipline.

- If you want a simple, forward-looking cash flow forecast: You're comfortable with your spending habits but want to see the future impact of your income and bills. Simplifi by Quicken or Monarch Money are excellent starting points, offering modern interfaces and powerful spending plans without the strictness of YNAB.

- If you are serious about detailed retirement and investment planning: Your priority is long-term strategy, portfolio analysis, and scenario modeling. Look no further than Boldin Planner for unparalleled retirement simulation or Morningstar Investor for deep-dive investment research.

From Selection to Implementation: Making It Stick

Once you've identified a top contender, the real work begins. A financial planning tool is only as valuable as the commitment you make to it. Merely signing up is not enough. To truly harness its power, you must move from passive observation to active engagement.

Commit to a 30-day trial period. Nearly every tool on our list offers a free trial or a free version. Use this time wisely. Link all your relevant financial accounts, even the ones you rarely check. Categorize your last 60-90 days of transactions to get a clear baseline of your spending habits. Explore the platform’s unique features, whether it's setting goals in Monarch Money, running a retirement simulation in Boldin, or building your first budget in YNAB.

This initial setup phase is the most significant hurdle. Push through it. The clarity you will gain from seeing your entire financial world organized and analyzed is a powerful motivator. You will uncover surprising spending patterns, identify high-fee investment funds, and see a clear path toward your goals. This initial momentum is crucial for building a lasting habit of financial awareness and control.

Ultimately, these platforms are not just software; they are catalysts for change. They provide the data, structure, and insights you need to transform abstract financial goals into a concrete, actionable plan. By leveraging the right technology, you are not just tracking numbers; you are actively designing the financial future you envision, one informed decision at a time. The power is now in your hands.

Navigating the world of finance is a continuous journey of learning and adaptation. While the right tools provide the data, having a trusted source for strategy and insights is just as important. Top Wealth Guide is dedicated to providing in-depth articles, expert analysis, and actionable guides to help you build and manage your wealth effectively. Explore Top Wealth Guide to deepen your financial knowledge and stay ahead of the curve.

Frequently Asked Questions (FAQ)

1. What is the best financial planning tool for beginners?

For absolute beginners focused on gaining control over spending, YNAB (You Need A Budget) or EveryDollar are excellent choices. They use a straightforward, zero-based budgeting method that forces intentionality and helps build strong financial habits from the ground up.

2. Are free financial planning tools safe to use?

Reputable free tools like Empower Personal Dashboard use bank-level security, including encryption and multi-factor authentication, to protect your data. They make money through optional advisory services, not by selling your personal information. However, always verify a tool's security protocols and privacy policy before linking accounts.

3. What is the difference between a budgeting tool and a financial planning tool?

A budgeting tool (like YNAB) primarily focuses on managing your day-to-day income and expenses to control cash flow. A comprehensive financial planning tool (like Empower or Boldin Planner) takes a broader, long-term view, incorporating investments, net worth tracking, and retirement scenario modeling. Many tools offer features of both.

4. Can a financial planning tool help me get out of debt?

Yes, absolutely. Tools like YNAB are specifically designed for this purpose. They help you find extra money in your budget to allocate toward debt repayment and often include features like a "Debt Payoff Planner" that lets you model different strategies (like the debt snowball or avalanche method) to see which one works best for you.

5. I use spreadsheets. Why should I switch to a dedicated tool?

While spreadsheets offer ultimate control, dedicated tools like Tiller (which connects to your spreadsheet) automate the tedious process of manual data entry. Other tools like Empower or Simplifi offer powerful built-in features like retirement simulators, fee analyzers, and dynamic cash flow projections that are very difficult and time-consuming to build and maintain in a spreadsheet.

6. What's the best tool for couples or families?

Monarch Money is designed from the ground up for collaboration. It allows you to invite a partner to a shared dashboard where you can manage joint accounts and goals together while keeping individual accounts private if desired. This makes it a top choice for managing household finances.

7. Do I need a tool that tracks my credit score?

While helpful, credit score tracking is a secondary feature for most of these tools. Your primary goal with a financial planning app is to manage cash flow and investments. Many banks and credit card companies offer free credit score monitoring, so it shouldn't be the deciding factor when choosing a primary planning tool.

8. How much should I expect to pay for a good financial planning tool?

Prices vary widely. You can get powerful, free tools like Empower Personal Dashboard. Subscription-based tools like YNAB or Monarch Money typically range from $80 to $100 per year. The value depends on whether the tool's specific features will save you money, help you earn more on investments, or simply provide the motivation you need to stick to your plan.

9. What is the best tool for tracking cryptocurrency and other alternative assets?

Kubera is the standout leader in this category. It's specifically built to track a wide range of assets beyond traditional stocks and bonds, including cryptocurrencies from various exchanges and wallets, DeFi assets, real estate, and even collectibles.

10. Can I manage my small business finances with these tools?

Some tools, like PocketSmith, are well-suited for freelancers or small business owners due to their powerful cash flow forecasting and custom categorization. However, for more complex business needs involving invoicing, payroll, or tax reporting, you would be better served by dedicated business accounting software like QuickBooks or Xero.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.