Diving into cryptocurrency can feel overwhelming. With countless digital assets and hundreds of platforms, the most common starting question is, "Where do I even begin?" The answer starts with choosing the right exchange. This is the single most important decision for a newcomer, as it directly impacts your user experience, transaction fees, and the security of your assets. Making the wrong choice can lead to frustration and unnecessary costs, while the right platform provides a smooth on-ramp to your investment journey.

This guide is designed to cut through the noise and simplify that crucial first step. We’ve meticulously reviewed and tested the best cryptocurrency exchanges for beginners, focusing on the criteria that matter most when you're starting out. Our analysis prioritizes ease of use, transparent fee structures, robust security measures, and the quality of educational resources available. Instead of generic descriptions, we provide in-depth analysis based on real-world usage.

Inside, you will find detailed breakdowns of each platform, complete with comparison tables and real-life examples to help you make an informed decision. We'll explore practical use cases, highlight key features, and offer an honest assessment of each exchange's limitations. Consider this your roadmap to confidently selecting a platform that aligns with your financial goals, ensuring your entry into the world of digital assets is both secure and successful.

In This Guide

- 1 1. Coinbase: Best Overall for Ease of Use and Trust

- 2 2. Kraken: Best for Low-Fee Deposits and Security

- 3 3. Gemini: Best for Compliance and Structured Learning

- 4 4. Robinhood Crypto: The Easiest On-Ramp for Stock Investors

- 5 5. Cash App (Bitcoin only)

- 6 6. PayPal Crypto: Best for Ultimate Convenience and Familiarity

- 7 7. eToro (U.S.): Best for Social and Community-Based Learning

- 8 8. Crypto.com App: Best for an All-in-One Crypto Ecosystem

- 9 9. Binance.US: Best for Ultra-Low Trading Fees

- 10 10. Fidelity Crypto: Best for Integrated, Traditional Investing

- 11 11. Webull (Webull Pay for crypto): Best for Integrated Stock and Crypto Investing

- 12 12. Swan Bitcoin: Best for Automated Bitcoin Accumulation

- 13 Quick Comparison of Top Beginner Crypto Exchanges

- 14 Your Next Move: Start Small, Stay Secure

- 15 Frequently Asked Questions (FAQ)

- 15.1 1. What is the safest cryptocurrency exchange for a beginner?

- 15.2 2. Can I start investing in crypto with just $10?

- 15.3 3. Do I need a special "crypto wallet" to use an exchange?

- 15.4 4. Which exchange has the lowest fees for beginners?

- 15.5 5. What's the difference between Coinbase and Coinbase Pro (now Advanced Trade)?

- 15.6 6. Should I buy Bitcoin or another cryptocurrency first?

- 15.7 7. How do I cash out my cryptocurrency into dollars?

- 15.8 8. Are my crypto investments taxed?

- 15.9 9. What is the easiest way to buy only Bitcoin?

- 15.10 10. Can I lose more money than I invest in crypto?

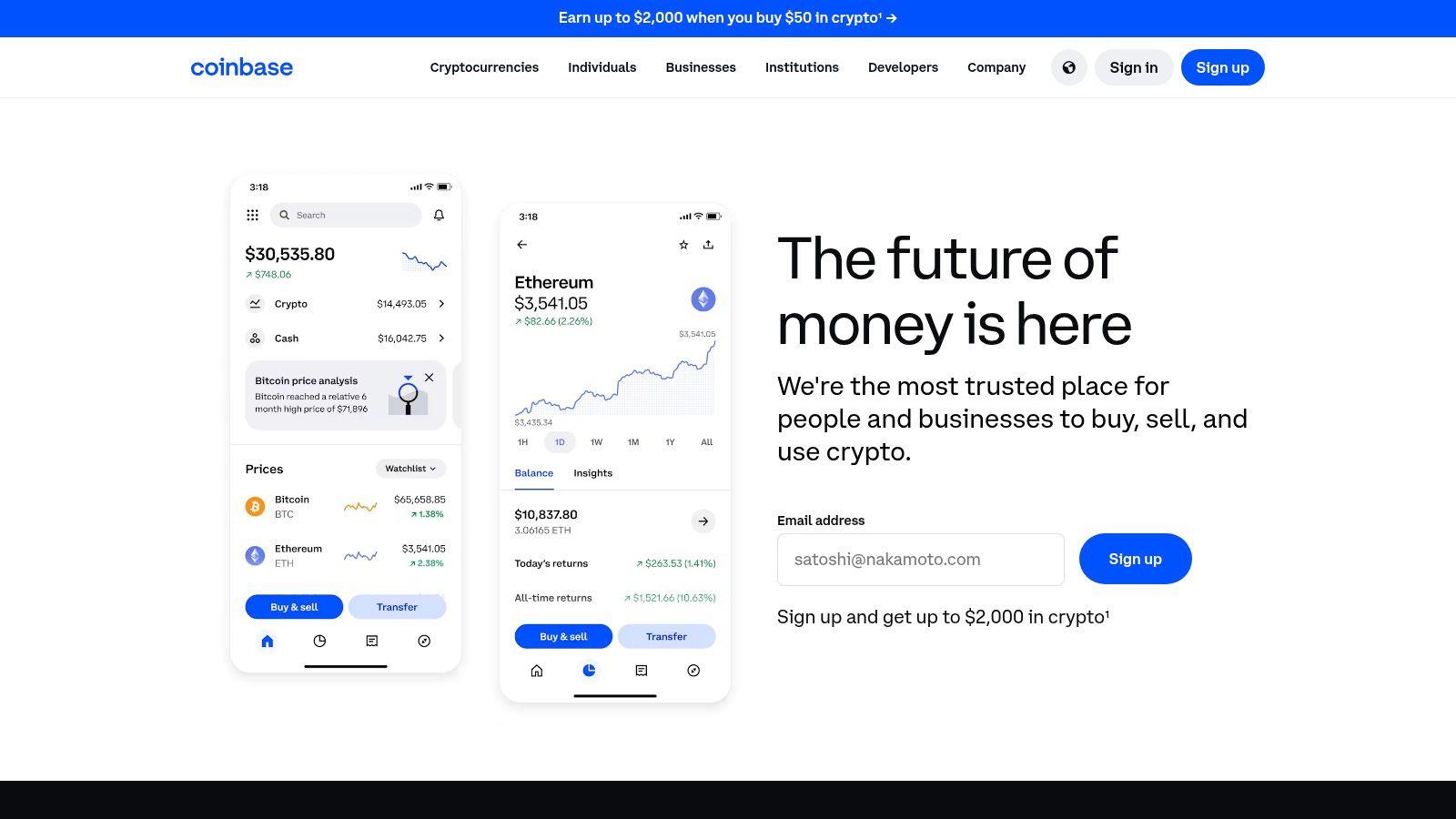

1. Coinbase: Best Overall for Ease of Use and Trust

Coinbase stands out as one of the best cryptocurrency exchanges for beginners due to its intuitive design, strong security, and U.S.-based regulatory compliance. As a publicly traded company (NASDAQ: COIN), it offers a level of transparency and trust that is reassuring for those new to crypto. Its simple interface allows users to buy, sell, and swap major cryptocurrencies like Bitcoin and Ethereum within minutes of signing up, removing much of the initial intimidation factor.

The platform is designed to grow with you. After mastering the basics, you can transition to Coinbase Advanced Trade, which provides a more sophisticated order-book interface with lower, volume-based fees. This dual-platform approach makes it an ideal long-term choice. For those just starting their journey, understanding the fundamentals is key; you can read this beginner's guide to investing in cryptocurrency to build a solid foundation.

Key Considerations for Coinbase Users

- Fee Structure: While the standard "Simple Trade" feature is easy, it comes with higher fees. Real-Life Example: Buying $100 of Bitcoin using Simple Trade might incur a fee of around $3.84. The same purchase on Advanced Trade could cost as little as $0.60, a significant saving.

- Educational Resources: Coinbase offers an extensive library of tutorials and "learn-to-earn" programs, where you can earn small amounts of crypto for completing short lessons.

- Security: It employs industry-leading security practices, including holding the vast majority of user assets in offline cold storage and offering FDIC insurance on U.S. dollar balances up to $250,000.

- Pros: Extremely user-friendly, high brand trust, and publicly regulated.

- Cons: Simple trade fees are high; frequent updates to fee structures require users to stay informed.

Website: https://coinbase.com

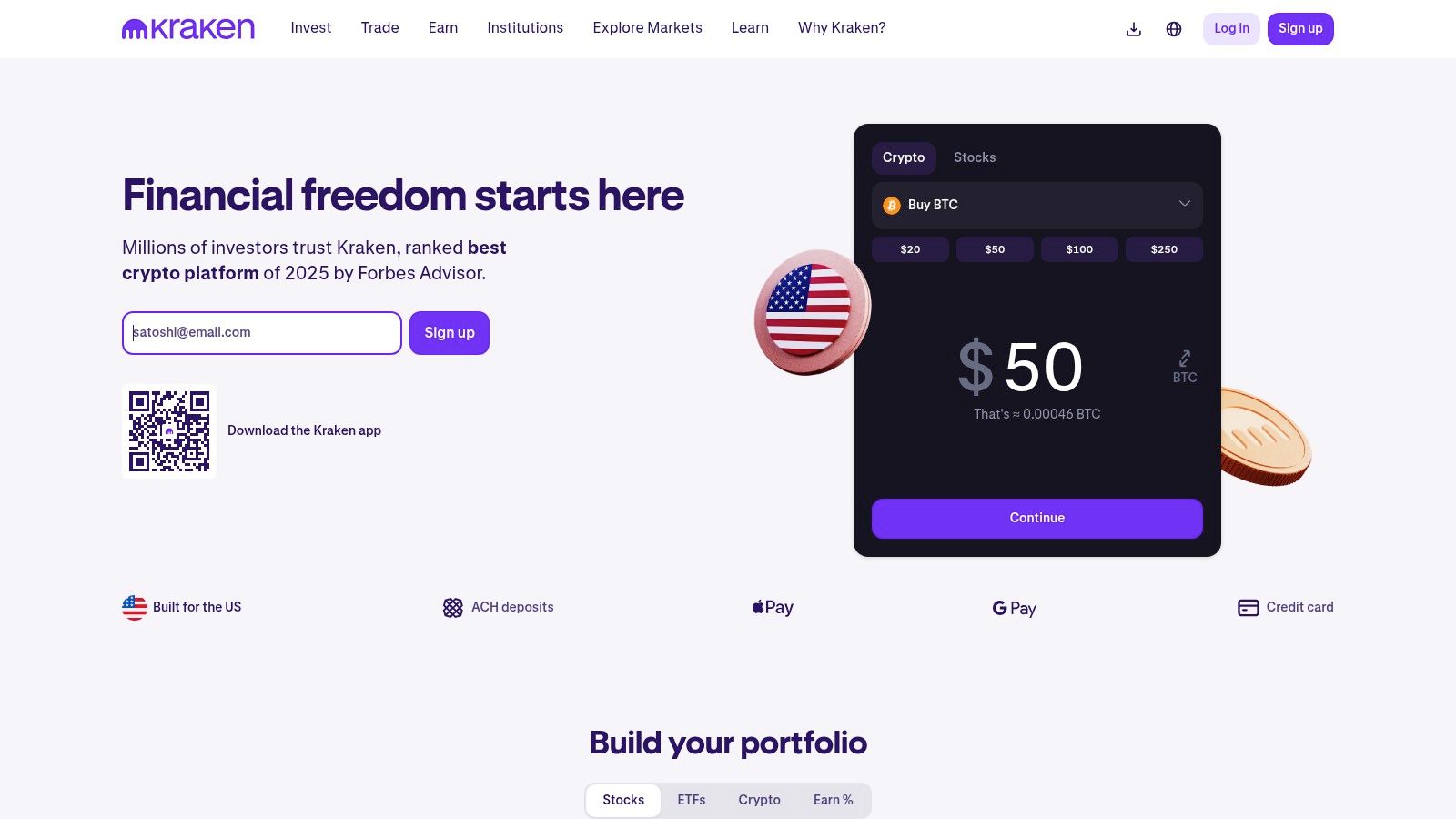

2. Kraken: Best for Low-Fee Deposits and Security

Kraken has built a strong reputation since its founding in 2011, making it one of the oldest and most trusted names in the crypto space. It stands out as one of the best cryptocurrency exchanges for beginners who prioritize transparent fees and secure, fast U.S. funding options. The platform offers a straightforward experience with near-instant ACH deposits via Plaid, allowing new users to buy assets within minutes without the friction of a traditional wire transfer.

This U.S.-based exchange is an excellent choice for those who anticipate growing their trading skills. While the initial interface is simple, users can easily graduate to Kraken Pro, which provides a professional-grade trading terminal with more advanced order types and a detailed fee schedule. This scalability ensures that you won't need to switch platforms as your knowledge and confidence expand, offering a seamless journey from novice to experienced trader.

Key Considerations for Kraken Users

- Fee Structure: Kraken uses a transparent maker-taker fee model, which is generally lower than the simplified buy/sell fees on other platforms. Real-Life Example: A beginner making a $100 market order on Kraken Pro would likely pay a "taker" fee of around 0.26% ($0.26), which is very competitive.

- Funding Options: The platform excels with its fast and free U.S. ACH deposits, which typically credit your account in minutes. However, be aware of withdrawal holds (often 72 hours) on crypto purchased with instant deposits.

- Security: Kraken is renowned for its industry-leading security, consistently ranking high in third-party audits. It offers extensive support articles and guides to help users secure their accounts with features like two-factor authentication (2FA).

- Pros: Strong security reputation, transparent and competitive fees, and very fast U.S. ACH deposits for quick trading.

- Cons: Features and funding availability can vary based on your state and verification level; withdrawal holds apply after instant deposits.

Website: https://kraken.com

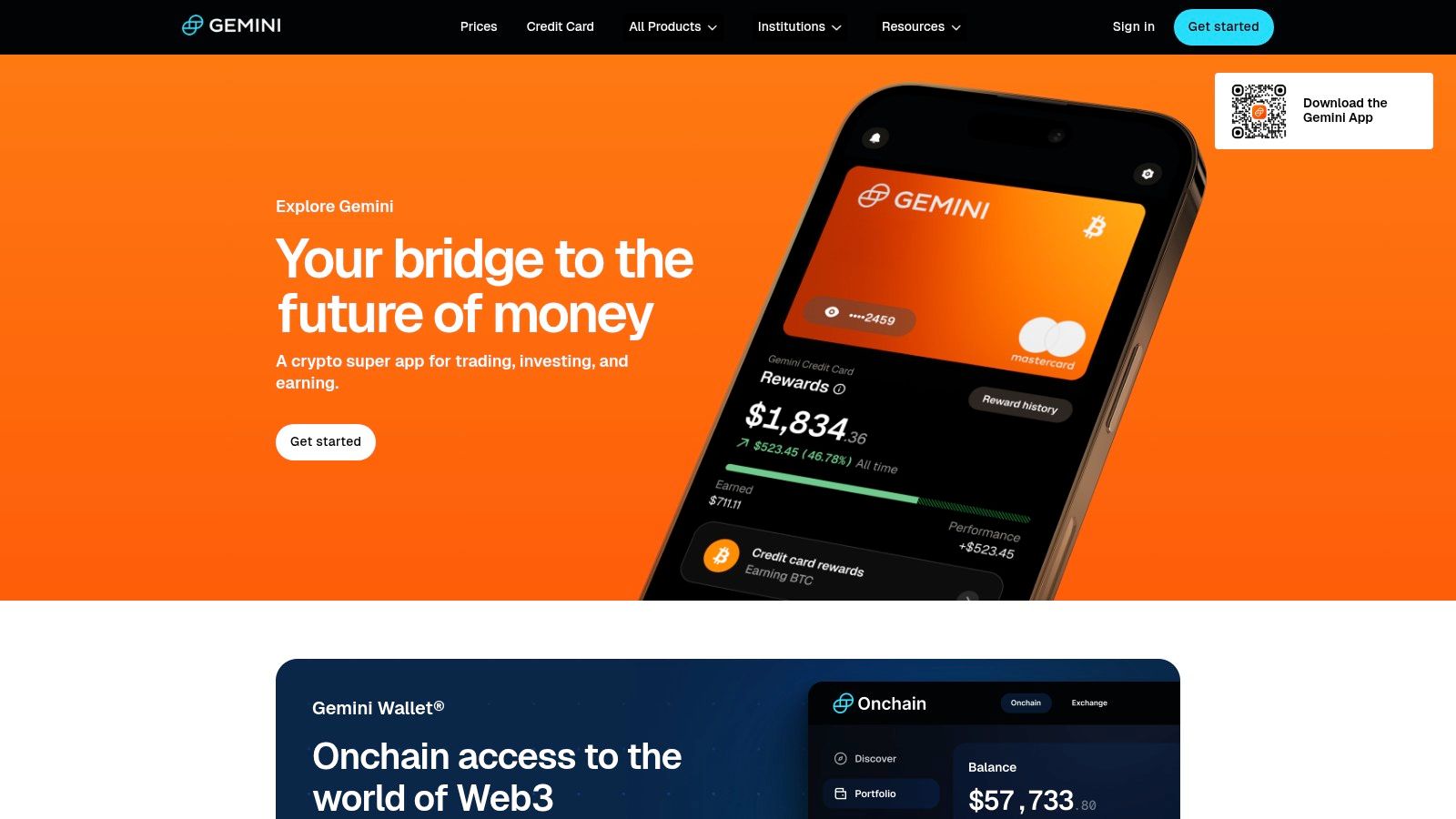

3. Gemini: Best for Compliance and Structured Learning

Gemini is one of the best cryptocurrency exchanges for beginners because it prioritizes regulatory compliance and a structured educational experience. Founded in the U.S. by the Winklevoss twins, it offers a secure and transparent environment that new investors can trust. Its standout feature is its dual-interface system, allowing users to start with a simplified "Gemini mode" for basic trades and later graduate to the more advanced "ActiveTrader" platform for lower fees and more sophisticated tools.

This scalable approach ensures that the platform remains useful as your knowledge and trading confidence grow. Gemini also provides a rich educational hub filled with articles, videos, and detailed guides that cover everything from basic concepts to complex trading strategies. This focus on user empowerment makes it an excellent choice for those who want to learn as they invest in a highly regulated setting.

Key Considerations for Gemini Users

- Fee Structure: Simple mobile or web app buys incur a transaction fee plus a convenience fee. Real-Life Example: A $100 purchase in the simple interface could cost $2.99. On ActiveTrader, the same trade might cost only $0.40, highlighting the importance of switching interfaces to save money.

- Educational Resources: The platform offers a comprehensive "Cryptopedia" section, which acts as a free encyclopedia for all things crypto, helping to build a strong foundational knowledge.

- Security: Gemini is known for its institutional-grade security, including cold storage for the majority of digital assets and insurance coverage for assets held in its online "hot wallet."

- Pros: Strong focus on security and U.S. regulation, excellent educational materials, and a dual-interface system that grows with the user.

- Cons: Fees for simple, instant buys are relatively high; the ActiveTrader interface may feel intimidating to absolute newcomers at first.

Website: https://gemini.com

4. Robinhood Crypto: The Easiest On-Ramp for Stock Investors

For those already familiar with traditional stock trading, Robinhood Crypto offers one of the most seamless transitions into the world of digital assets. Its inclusion within the well-known Robinhood brokerage app removes the need to create an account on a separate, crypto-native platform. The mobile-first interface is famously intuitive, making it one of the best cryptocurrency exchanges for beginners who value simplicity and a unified portfolio view.

Robinhood's main draw is its "commission-free" trading model, which extends to its crypto offerings. Users can set up recurring buys, earn staking rewards on eligible assets, and transfer supported cryptocurrencies to external wallets. This functionality makes it more than just a closed-loop trading app, providing essential features for those looking to engage with the broader crypto ecosystem. As you get started, it is helpful to understand the basics; you can learn more about cryptocurrency for beginners to build a strong knowledge base.

Key Considerations for Robinhood Crypto Users

- Fee Structure: While there are no explicit trading commissions, Robinhood makes money from the spread (the difference between the buy and sell price). Real-Life Example: If Bitcoin's market price is $60,000, Robinhood might offer to sell it to you at $60,150 and buy it from you at $59,850. That difference is their revenue.

- Asset Selection: The list of available cryptocurrencies is smaller and more curated compared to dedicated exchanges like Coinbase or Kraken, focusing on the most popular assets.

- Security: Robinhood provides crime insurance against certain security breaches and stores the majority of coins in offline cold storage.

- Pros: Extremely easy onboarding for existing Robinhood users, clean mobile interface, and simple recurring buy and staking features.

- Cons: Pricing transparency can be less clear than a maker/taker fee model, and it offers a limited selection of assets and no advanced order types.

Website: https://robinhood.com/about/crypto

5. Cash App (Bitcoin only)

For beginners who want to focus exclusively on Bitcoin, Cash App offers one of the simplest entry points into the world of cryptocurrency. Already a popular peer-to-peer payment service, its integration of Bitcoin buying, selling, and sending is seamless and unintimidating. Users can make one-time purchases or set up recurring buys to dollar-cost average into Bitcoin with just a few taps, making it a strong contender among beginner-friendly cryptocurrency exchanges.

The platform is designed for simplicity, abstracting away complex trading interfaces in favor of a straightforward user experience. One of its standout features is its native support for the Bitcoin Lightning Network, allowing for near-instant and low-cost transfers. This makes it ideal not just for investing but for actually using Bitcoin for payments, a feature not commonly found on other basic exchanges.

Key Considerations for Cash App Users

- Fee Structure: Cash App charges a service fee for each transaction, which can be a percentage of the total amount. Real-Life Example: A small $20 purchase of Bitcoin might incur a fee of around 2.2%, while a larger $200 purchase might have a lower fee of 1.75%. The fee structure varies with the transaction size.

- Withdrawal Options: The app provides clear options when withdrawing your Bitcoin to an external wallet, allowing you to choose between standard and priority speeds with different network fees.

- Advanced Features: Despite its simplicity, the inclusion of Lightning Network support is a sophisticated feature that gives users a taste of Bitcoin’s capabilities beyond just an investment asset.

- Pros: Extremely easy to use, especially for existing Cash App users; supports recurring buys; advanced Lightning Network capabilities.

- Cons: Limited to Bitcoin only, no other cryptocurrencies; percentage fees can be high on small purchases.

Website: https://cash.app/bitcoin

6. PayPal Crypto: Best for Ultimate Convenience and Familiarity

For beginners already comfortable with digital payments, PayPal Crypto offers one of the most accessible entry points into the cryptocurrency market. Integrated directly into the familiar PayPal app, it allows existing users in the U.S. to buy, sell, and hold a handful of major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) with just a few taps. This eliminates the need to create a new account on a dedicated exchange, making it an excellent choice for a first-time crypto purchase.

The platform has evolved beyond a simple buy/sell feature, now supporting transfers to external wallets and between PayPal and Venmo accounts. This functionality gives users more control over their digital assets, a crucial step for those wanting to explore the broader crypto ecosystem. While it's not a full-featured exchange, its simplicity is its greatest strength, making it one of the best cryptocurrency exchanges for beginners who prioritize convenience. If you are new to the space, you can learn more about what cryptocurrency is and how it works to get started.

Key Considerations for PayPal Crypto Users

- Fee Structure: PayPal charges a spread plus a transaction fee for crypto purchases. Real-Life Example: For a $50 purchase of Ethereum, you might pay a transaction fee of around $1.99 on top of the built-in price spread. The fee is always displayed clearly before you confirm the transaction.

- Coin Selection: The platform offers a very limited selection, focusing on the most popular cryptocurrencies. It is not suitable for those looking to invest in smaller, alternative coins (altcoins).

- Ease of Use: Its primary advantage is its seamless integration and familiar interface. If you've ever sent money through PayPal, you already know how to navigate the crypto section.

- Pros: Extremely easy to use for existing PayPal members, and backed by a trusted, mainstream financial brand.

- Cons: Limited selection of cryptocurrencies; fees and spreads can be higher than dedicated exchanges.

Website: https://paypal.com/crypto

7. eToro (U.S.): Best for Social and Community-Based Learning

eToro makes its mark as one of the best cryptocurrency exchanges for beginners by integrating social media-like features into its trading platform. This unique approach allows newcomers to observe and learn from more experienced traders through a community feed, providing valuable market sentiment and insights. The platform’s main appeal is its simplicity and transparent pricing, making it an excellent starting point for those who might feel overwhelmed by traditional exchanges.

The U.S. version of eToro offers a straightforward and regulated environment to buy and sell crypto. While its famous "CopyTrader" feature is not available for U.S. crypto-only accounts, the social feed remains a powerful tool for learning. The clear-cut fee structure removes the complexity of maker/taker models, which is a significant advantage for users making their first transactions.

Key Considerations for eToro (U.S.) Users

- Fee Structure: eToro charges a simple, flat 1% fee on all buy and sell transactions. Real-Life Example: If you buy $200 worth of Solana, a $2.00 fee will be added. When you sell it, another 1% fee will be applied to the sale amount. This transparency is ideal for beginners.

- Social Trading: Use the platform's social feed to follow discussions, view market analysis from other users, and gauge overall community sentiment before making a trade. This feature helps bridge the knowledge gap for new investors.

- Token Selection: The number of available cryptocurrencies for U.S. users is limited, especially following a 2024 SEC settlement. Be sure to check that the specific asset you want to trade is supported.

- Pros: Extremely simple fee structure, social features are great for learning, and a user-friendly interface.

- Cons: Higher fees compared to advanced exchanges, and a very limited selection of tradable cryptocurrencies in the U.S.

Website: https://etoro.com/en-us

8. Crypto.com App: Best for an All-in-One Crypto Ecosystem

Crypto.com has positioned itself as a major global player, offering a comprehensive app that serves as an excellent entry point into the world of digital assets. Available in most U.S. states, its mobile-first design makes buying and selling top cryptocurrencies straightforward for newcomers. The platform excels at providing an all-in-one ecosystem that goes beyond simple trading, including a popular Visa card and interest-earning features.

One of its most beginner-friendly aspects is the trade preview, which clearly displays any administrative fees before you confirm a purchase, eliminating surprises. For those looking to do more than just trade, the platform offers features like USD Cash Earn, which provides tiered APY rates. As you grow more confident, you can explore its wider range of services, making it one of the best cryptocurrency exchanges for beginners who envision expanding their activities over time. For more information, you can learn about different ways to invest in cryptocurrency.

Key Considerations for Crypto.com App Users

- Fee Structure: While convenient for instant buys, the app's spread can be higher than on dedicated exchanges. Real-Life Example: A user buying crypto with a credit card might face a fee of 2.99%, but this fee is often waived for the first 30 days for new users, offering a cost-effective start.

- Ecosystem Features: The platform's strength lies in its connected services. Users can benefit from the Crypto.com Visa Card for spending crypto, stake CRO tokens for benefits, and use the Earn feature to generate yield.

- Availability: The app is widely available but notably excludes New York residents. Users in other regions may find that some features or promotions vary.

- Pros: Extensive ecosystem with a payment card and earn products, transparent fee display on trade previews.

- Cons: Not available in New York; the full range of features and promotions can be complex for a total novice to navigate.

Website: https://crypto.com

9. Binance.US: Best for Ultra-Low Trading Fees

Binance.US serves as the U.S.-regulated counterpart to the global Binance exchange, establishing itself as one of the best cryptocurrency exchanges for beginners who prioritize minimizing costs. It is particularly known for its highly competitive fee structure, offering some of the lowest spot trading fees in the market. This makes it an attractive platform for new users looking to make frequent trades or maximize their investment capital without losing significant amounts to transaction costs.

The platform supports a broad and regularly updated selection of cryptocurrencies, allowing beginners to explore beyond just Bitcoin and Ethereum. While its interface is slightly more complex than some competitors, it provides a robust trading engine that is well-suited for those who plan to become more active traders. Its state-by-state availability is a crucial factor, so new users must first confirm it is licensed to operate in their location.

Key Considerations for Binance.US Users

- Fee Structure: Binance.US shines with its low maker/taker fees, often starting at 0.1% for takers. Real-Life Example: A $100 trade would cost just $0.10. For certain BTC and ETH trading pairs, the fee can even be 0%, making it exceptionally cheap for those assets.

- Geographic Availability: Service is not available in all U.S. states. Before signing up, verify on their website that your state is supported for full USD deposits, trading, and withdrawals.

- Coin Selection: Offers a wide variety of digital assets, with new coins and trading pairs added frequently, providing ample opportunities for portfolio diversification.

- Pros: Extremely low trading fees, large and growing selection of cryptocurrencies.

- Cons: Not available in all U.S. states; the fee structure for simple buys can be less transparent than its advanced trading fees.

Website: https://binance.us

10. Fidelity Crypto: Best for Integrated, Traditional Investing

For beginners who already trust Fidelity for their traditional investment accounts, Fidelity Crypto offers a seamless and secure entry point into the cryptocurrency market. It allows users to trade Bitcoin and Ethereum directly within the familiar Fidelity app, placing their crypto holdings alongside stocks, ETFs, and mutual funds. This integration demystifies crypto by treating it as just another asset class within a well-established and trusted financial ecosystem, making it one of the best cryptocurrency exchanges for beginners with a conservative, long-term outlook.

The platform is built on Fidelity's institutional-grade security and custody infrastructure, providing a level of confidence that is often missing from crypto-native exchanges. Its approach is ideal for investors who prioritize simplicity and security over extensive features or a vast selection of altcoins. This makes it a top choice for retirement-minded individuals, including those looking to add crypto to an IRA.

Key Considerations for Fidelity Crypto Users

- Fee Structure: Fidelity Crypto charges no commissions. Instead, it includes a transparent 1% spread on the execution price of every trade. Real-Life Example: If you place an order to buy $500 of Bitcoin, the final amount of BTC you receive will be valued at approximately $495 at the time of execution.

- Asset Selection: The platform is highly limited, offering only Bitcoin (BTC) and Ethereum (ETH). This is by design, focusing on the two most established digital assets and avoiding the volatility of smaller altcoins.

- Security: Users benefit from Fidelity's enterprise-grade security protocols and robust institutional custody solutions, providing peace of mind for those making their first crypto investment.

- Pros: Trade crypto within a trusted and familiar brokerage account, straightforward and transparent 1% spread fee.

- Cons: Extremely limited coin selection, the 1% spread is not cost-effective for frequent traders.

Website: https://fidelity.com/crypto

11. Webull (Webull Pay for crypto): Best for Integrated Stock and Crypto Investing

Webull is a popular U.S.-based brokerage known for commission-free stock and options trading, making it an excellent choice for investors who want to manage traditional assets and crypto in one app. While its direct crypto trading is being relaunched, it provides access through its Webull Pay service, which partners with established providers. This integration offers a low-friction entry point for existing Webull users curious about digital assets without needing a separate account elsewhere.

The platform is designed for individuals who appreciate a unified view of their entire investment portfolio. By adding cryptocurrencies alongside equities, ETFs, and options, Webull simplifies portfolio tracking and management. This approach makes it one of the best cryptocurrency exchanges for beginners who are already comfortable with a traditional brokerage interface and want to dip their toes into crypto with minimal hassle.

Key Considerations for Webull Users

- Fee Structure: Webull doesn't charge commissions on crypto trades but instead includes its costs in the spread. This spread is typically around 1% (100 basis points). Real-Life Example: Your buy or sell order will execute at a price that is 1% different from the current mid-market price, which is how Webull earns revenue.

- Integrated Experience: The primary draw is having your stocks and crypto under one roof. The user interface is more technical than a platform like Coinbase but is intuitive for those familiar with trading apps.

- Partnerships: Crypto services are facilitated through third-party partners like Bakkt and Coinbase, with clear disclosures on regulatory licensing. This adds a layer of reliability, although it can affect features like asset transfers.

- Pros: Seamlessly manage stocks and crypto in one account; familiar interface for existing brokerage users.

- Cons: Fees are embedded in spreads, which can be less direct than a fixed fee; feature availability has been inconsistent, so users should verify current transfer options.

Website: https://webull.com

12. Swan Bitcoin: Best for Automated Bitcoin Accumulation

Swan Bitcoin carves out a unique niche by focusing exclusively on Bitcoin, making it one of the best cryptocurrency exchanges for beginners who want a simplified, dedicated approach. Its core mission is to make dollar-cost averaging (DCA) into Bitcoin effortless. The platform is designed for users who believe in Bitcoin's long-term potential and want a "set-and-forget" system to accumulate it over time without the distractions of other cryptocurrencies.

The U.S.-based service strongly emphasizes education and self-custody, encouraging users to take control of their assets. Its clean, minimalist interface removes complexity, allowing you to set up recurring daily, weekly, or monthly buys in minutes. This focus on a single asset and a specific savings-like strategy makes Swan an excellent entry point for those who want to avoid the speculative nature of trading altcoins. To better understand how DCA fits into a portfolio, you can explore various cryptocurrency investment strategies here.

Key Considerations for Swan Bitcoin Users

- Fee Structure: Swan uses a straightforward fee model, with purchase fees around 0.99% for recurring buys. Real-Life Example: If you set up a recurring purchase of $50 per week, Swan will charge approximately $0.50 for each transaction. This is a simple and predictable cost for automated investing.

- Bitcoin-Only Focus: The platform does not support any other cryptocurrency. This is a deliberate design choice to help beginners focus on what they believe is the most established digital asset without getting overwhelmed.

- Self-Custody Emphasis: Swan actively encourages users to move their Bitcoin to their own wallets. It offers free, automated withdrawals to make the process of securing your own keys as simple as possible.

- Pros: Extremely simple to use, ideal for a set-and-forget strategy, and promotes best practices like self-custody.

- Cons: Only supports Bitcoin, and its fees are higher than what you'd find on a professional trading exchange like Kraken or Coinbase Advanced Trade.

Website: https://swanbitcoin.com

Quick Comparison of Top Beginner Crypto Exchanges

| Exchange | Best For | Fees | Key Feature | Beginner Friendliness |

|---|---|---|---|---|

| Coinbase | Overall Ease of Use | Higher on simple trades, low on Advanced | Intuitive app, Learn-to-Earn rewards | ★★★★★ |

| Kraken | Security & Low Fees | Low maker/taker fees (from 0.26%) | Industry-leading security reputation | ★★★★☆ |

| Gemini | Compliance & Learning | Higher on simple trades, low on ActiveTrader | Strong regulatory focus, Cryptopedia | ★★★★☆ |

| Robinhood | Stock Investors | Spread-based (commission-free) | Integrated stocks and crypto portfolio | ★★★★★ |

| Cash App | Bitcoin Simplicity | Percentage-based service fee | Bitcoin-only, Lightning Network support | ★★★★★ |

| Fidelity Crypto | Traditional Investors | 1% spread (commission-free) | Trusted brand, integrated with brokerage | ★★★★☆ |

| eToro | Social Learning | Flat 1% on all trades | Community feed for market insights | ★★★★☆ |

| Binance.US | Lowest Trading Fees | Very low maker/taker fees (from 0.1%) | Broad selection of altcoins | ★★★☆☆ |

Your Next Move: Start Small, Stay Secure

Navigating the world of digital assets for the first time can feel overwhelming, but selecting your first platform doesn't have to be a final decision. The detailed analysis in this guide provides a roadmap, not a destination. We've explored a dozen of the best cryptocurrency exchanges for beginners, each with distinct advantages tailored to different entry points and long-term goals.

Your key takeaway should be that the "best" exchange is deeply personal. It's the one that aligns with your specific needs for simplicity, security, and growth.

Synthesizing Your Options

Let's distill the choices down to practical scenarios to help you make a decision:

- For ultimate simplicity and familiarity, platforms like Coinbase, PayPal Crypto, and Cash App offer the most straightforward on-ramps. They integrate into financial apps you may already use, removing much of the initial friction and technical jargon.

- If your priority is a balance of user-friendliness and future growth, exchanges like Kraken and Gemini are exceptional choices. They provide simple "buy" interfaces for beginners but unlock advanced trading tools and a wider selection of assets as your knowledge and confidence expand.

- For investors focused purely on Bitcoin with a long-term strategy, specialized services like Swan Bitcoin offer a streamlined, educational approach centered on dollar-cost averaging, cutting out the noise of other cryptocurrencies.

- If you're an existing brokerage user, leveraging platforms like Robinhood, Fidelity Crypto, or Webull can centralize your investments. This approach simplifies portfolio management by keeping your stocks and crypto under one roof, though often with fewer crypto-specific features.

Your Action Plan: Three Critical First Steps

Before you transfer a single dollar, commit to a methodical start. The decisions you make now will build the foundation for a secure and successful investment journey.

- Start with a Test Amount: Your first investment should be an amount you are genuinely comfortable losing. Think of it as the cost of your education. This approach removes emotional pressure, allowing you to learn the platform's mechanics, understand market volatility, and experience the process of buying, holding, and selling without significant financial risk.

- Prioritize Security Immediately: Do not skip this step. Upon creating your account, immediately set up the strongest security features available. This includes creating a long, unique password (preferably stored in a password manager) and, most importantly, enabling two-factor authentication (2FA). Using an authenticator app like Google Authenticator or Authy is significantly more secure than SMS-based 2FA.

- Understand Your Platform's Fees: Review the fee schedule for your chosen exchange. Are you using the simple "buy/sell" feature with its higher, baked-in spread, or are you using the advanced trading interface with lower maker/taker fees? Knowing how you're being charged is fundamental to managing your investment returns over time.

Choosing from the best cryptocurrency exchanges for beginners is a pivotal first step. By starting small, prioritizing robust security measures, and understanding the platform's nuances, you are setting yourself up for a sustainable and informed journey into the world of digital assets. The landscape is ever-changing, but a solid foundation built on caution and education will serve you well no matter which direction the market moves.

Frequently Asked Questions (FAQ)

1. What is the safest cryptocurrency exchange for a beginner?

For U.S. beginners, exchanges with strong regulatory compliance and a long track record, such as Coinbase and Kraken, are often considered the safest. They employ industry-standard security measures like cold storage and offer FDIC insurance on USD balances. Ultimately, safety also depends on you using strong passwords and two-factor authentication (2FA).

2. Can I start investing in crypto with just $10?

Yes, absolutely. Most beginner-friendly exchanges like Coinbase, Cash App, and Robinhood allow you to buy fractional shares of cryptocurrencies, so you can start with as little as $1 to $10. This is a great way to learn without significant financial risk.

3. Do I need a special "crypto wallet" to use an exchange?

No, you don't need a separate wallet to start. When you buy crypto on an exchange, it is held in a custodial wallet managed by the platform. However, as you become more experienced, you may want to move your assets to a personal hardware wallet (like a Ledger or Trezor) for maximum security, a practice known as "self-custody."

4. Which exchange has the lowest fees for beginners?

Binance.US generally offers the lowest trading fees (maker/taker model). However, for absolute simplicity, a platform like eToro with a flat 1% fee or Robinhood with its spread-based model can be easier to understand, even if they aren't always the cheapest for every transaction.

5. What's the difference between Coinbase and Coinbase Pro (now Advanced Trade)?

Coinbase offers a simple, one-click interface for buying crypto, but the fees are higher. Coinbase Advanced Trade (formerly Coinbase Pro) is their advanced trading platform with lower, volume-based fees. Beginners should start on simple Coinbase but aim to switch to Advanced Trade as soon as they are comfortable to save significantly on fees.

6. Should I buy Bitcoin or another cryptocurrency first?

Most beginners start with Bitcoin (BTC) or Ethereum (ETH) because they are the largest and most established cryptocurrencies with the longest track records. It's wise to build a foundational understanding of these before exploring smaller, more volatile "altcoins."

7. How do I cash out my cryptocurrency into dollars?

On any exchange, you can sell your cryptocurrency for USD. Once the sale is complete, the cash will appear in your account balance. From there, you can initiate a withdrawal to your linked bank account via ACH transfer or wire, a process that typically takes 1-3 business days.

8. Are my crypto investments taxed?

Yes. In the United States, the IRS treats cryptocurrency as property for tax purposes. This means you will owe capital gains tax if you sell, trade, or spend your crypto for more than you bought it for. It's crucial to keep records of your transactions.

9. What is the easiest way to buy only Bitcoin?

For a beginner focused exclusively on Bitcoin, Cash App and Swan Bitcoin are two of the easiest platforms. They offer simple, recurring buy features and remove the complexity and distraction of trading thousands of other coins.

10. Can I lose more money than I invest in crypto?

No, when you are simply buying and holding cryptocurrencies (spot trading), the maximum amount you can lose is your initial investment. The value of your assets can go to zero, but you will not owe more than you put in. This is different from trading with leverage or futures, which is not recommended for beginners.

Your journey into building wealth is just beginning. At Top Wealth Guide, we provide the in-depth analysis and expert insights you need to navigate not just crypto, but the entire world of investing with confidence. Explore our comprehensive resources at Top Wealth Guide to continue your financial education and make empowered decisions for your future.