Most folks fantasize about financial freedom… but, uh, they never get around to crafting an actual plan. The gap between dreamers and doers? It’s all about having — drumroll, please — a systematic approach that spins out multiple income streams while turbocharging those investment returns.

Here at Top Wealth Guide, we’ve cooked up a three-pillar blueprint that’ll fast-track you to financial independence. This isn’t just any framework — it’s a tried-and-true recipe that zooms in on goal-setting, income diversification, and shrewd investing tactics.

In This Guide

Understanding Financial Freedom and Setting Clear Goals

Financial freedom – it’s not the fantasy of swimming in cash like Scrooge McDuck. It’s about crafting streams of passive income that foot the bill for your lifestyle while your boss wonders where you disappeared to. Your magic number? Totally subjective – tied to your personal spending habits and desires. But fear not, there’s a trusty equation to pinpoint just what you’ll need.

Your Financial Freedom Number

Welcome to the land of the 4% rule – your ticket to calculating that evasive freedom ticket. The golden rule: you can skim off 4% of your investments each year, risk-free, without shrinking your nest egg. Fancy $60,000 a year on leisure? You’re staring down a cool $1.5 million to invest. Want to burn through $100,000? Aim for $2.5 million.

The arithmetic’s a breeze: annual expenses times 25. Historical data suggests a 3-4% withdrawal keeps the ship steady, but needle-nudging diversification could bump that to 4.9%. Zero in on your real monthly spend by tracking for three months – then pad it by 20% for those little “whoops” moments.

Create SMART Financial Milestones

Stating “I’m gonna be loaded” – yeah, that’s just wishful thinking. Craft a game plan, with goals that have clocks attached. Swap vague for vivid: not “save more bucks,” but “bank $500,000 by age 40 via $2,000 monthly stash.” Break this down – like a DJ at a wedding – into quarterly milestones: $6,000 socked away every three months.

Here’s a nugget – pen it down, those clear-cut financial objectives, and you’re 42% likelier to hit the mark than with fuzzy dreams. Sketch out three timelines: a one-year emergency stash, five-year wealth goals, and your ultimate financial cut-loose date.

Track Progress and Adjust Targets

Every six months, do a little recalibration, tweak those figures based on what’s landing in your pocket and market whims. The market’s a wild roller-coaster, portfolio ups and downs; your expenses – a moving target. Wealth ninjas adapt rather than throw in the towel when life mutates.

Stack up your assets against your goals every three months. Method turns dreams into tangible actions, setting a sturdy path for phase two-fortifying those income channels that’ll shortcut you to financial freedom.

Build Income That Works While You Sleep

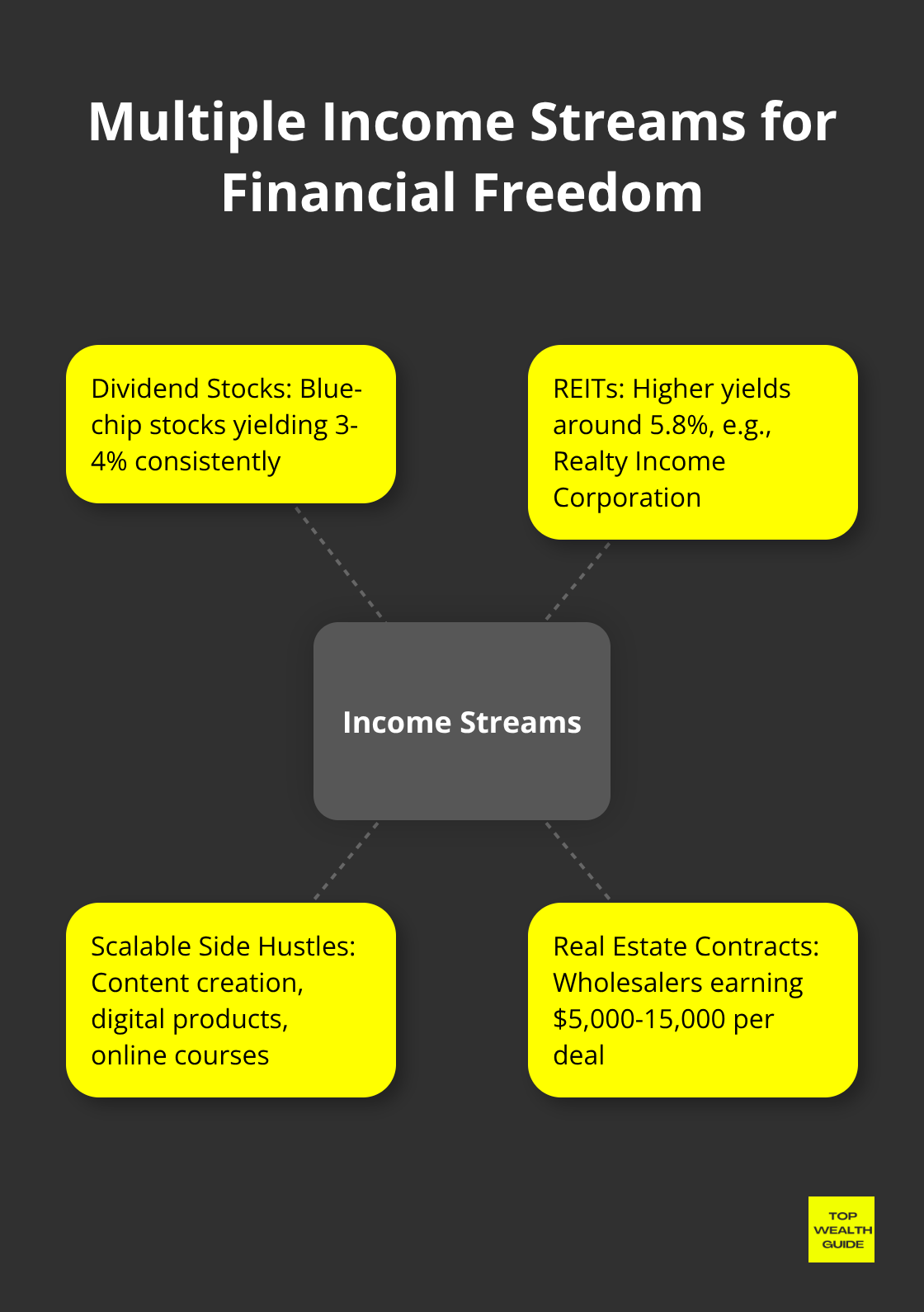

Here’s the deal – relying on a single income stream? That’s financial hara-kiri, my friend. Most people? They grind away, trading time for cash until they drop. But the savvy types? They build these income engines that churn out money non-stop. The real magic trick is flipping the script – making your money do the legwork through dividend stocks, REITs, and scalable side gigs that turbocharge your wealth without sucking up your time.

Dividend Stocks Deliver Consistent Monthly Cash

Ever heard of dividend aristocrats? These are the champions of consistency – companies boosting their payouts for over 25 years straight. We’re talking Johnson & Johnson, Coca-Cola – the big leagues. Through downturn after downturn, they’ve kept doling out the dividends. Shoot for a solid 3-4% yield from these blue-chip stocks, and reinvest those sweet, sweet payouts to watch them grow.

These dividends? They’re as reliable as a Swiss timepiece, no matter what the market’s doing. A $50,000 stash in dividend aristocrats throws off $1,500-2,000 a year in cash flow, growing each year with dividend hikes.

REITs Generate Higher Yields Than Traditional Stocks

Now, let’s talk Real Estate Investment Trusts. They take the dividend play and crank it up a notch – legally, most REITs must pay out every last dime of taxable income to shareholders. Take Realty Income Corporation – its monthly dividends yield around 5.8% and deliver steady cash flow as real estate values rise.

Dip your toes in with $10,000 split between dividend ETFs like VYM and REIT funds like VNQ. This strategy yields a cool $300-400 annually, growing all on its own (and faster than any dusty old savings account, by the way).

Scale Side Hustles Beyond Time-for-Money Trades

Here’s the Achilles’ heel of most side hustles – they still tether you to trading hours for bucks. But with content creation, digital products, and online courses? You cash in once on your know-how, then sales roll in automatically.

Imagine an online course fetching $200 a pop, raking in over $50,000 a year via automated sales funnels. Amazon sellers tell us 40% pocket $1,000 to $25,000 monthly with minimal effort once things are set up.

Real Estate Contracts Generate Deal-Based Income

Then we have real estate wholesale deals – buying properties isn’t even a thing here. Wholesalers pull in $5,000-15,000 per deal, working just 10-15 hours a week. The benchmark? Aim for over 100 bucks per hour by year-end, or shift gears to more potent options.

Put these income streams in a blender, and you get the financial momentum that day gigs just can’t touch. Smart investment strategies take this to another level with optimized portfolios and maxed-out tax-advantaged accounts.

Smart Investment Strategies to Maximize Returns

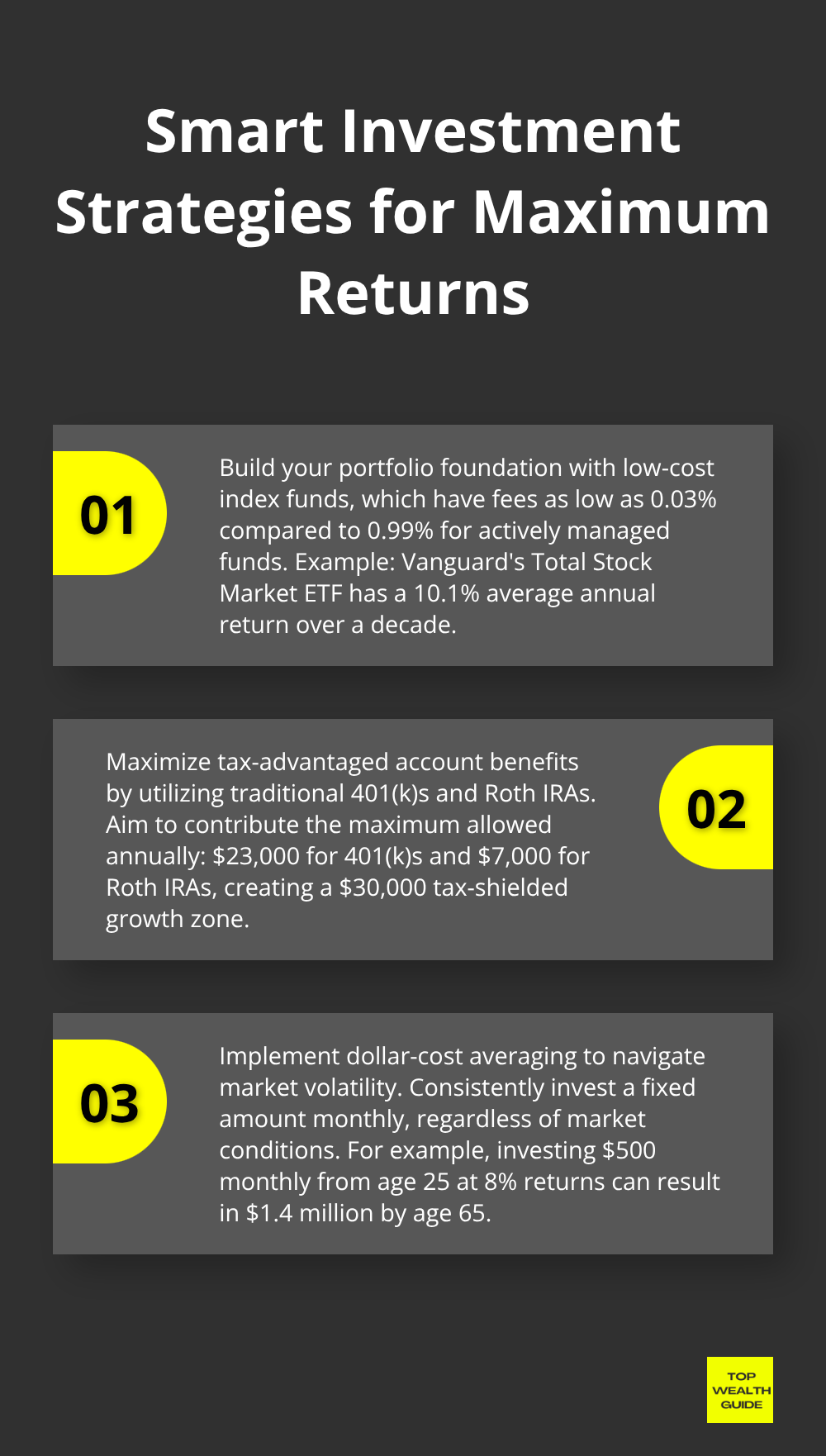

Investing-it’s all about juicing returns while keeping costs on a diet. Index funds and ETFs? They’re the rock stars with fees as skimpy as 0.03% annually, leaving actively managed funds in the dust at an average of 0.99%. Take Vanguard’s Total Stock Market ETF-it’s cranking out a mean 10.1% average annual return over a decade, with a measly 0.03% in fees. Let’s talk compounding-put $100,000 in for 30 years, and brace yourself: actively managed funds will bleed you an extra $540,000 compared to a low-cost index option.

Build Your Portfolio Foundation with Index Funds

Low-cost index funds-they’re basically the cornerstone of wealth creation. These funds don’t mess around with expensive fund managers who keep missing the mark. The S&P 500? It’s been a powerhouse, and broad market index funds latch onto this performance with minimal drain on your pocket. Start with total stock market funds for that sweet U.S. exposure-then sprinkle in international funds for a global twist (think 70% domestic, 30% international allocation).

Maximize Tax-Advantaged Account Benefits

Traditional 401ks? Pure magic for cutting down that tax bill now, while Roth IRAs are a dream come true when you pull out your nest egg tax-free. If you’re raking in the green, max out those traditional accounts first, then slide into Roth conversions for some tax variety. Do the math-it’s compelling-a $6,000 Roth IRA dump at age 25 balloons to $130,000 tax-free by retirement at a 7% return. Push your 401k to the $23,000 limit annually and your Roth IRA to $7,000-there’s your $30,000-a-year tax-shielded growth zone.

Dollar-Cost Average Through Market Volatility

Here’s the bottom line: trying to time the market? Might as well be burning cash-professional fund managers aren’t even nailing it lately. But dollar-cost averaging? That’s the champion. It sucks the emotion out of investing and levels out market chop. Plop $1,000 in monthly, come rain or shine, and compound interest will spin gold. If you start at 25, investing $500 monthly at 8% returns, you’ll be sitting on $1.4 million by 65. Push it to 35? You’re down to $679,000.

Use Health Savings Accounts as Retirement Weapons

Health Savings Accounts-they’re the triple threat no other account touches: deductible contributions, untaxed growth, and tax-free medical bucks-out. Position your HSA as a retirement powerhouse once you’re past 65-withdraw for whatever you fancy, penalty-free. Fidelity’s insights show those who rode out the 2008 storm with consistent HSA contributions bounced back 3.1 years faster than the crowd that bailed. Automate these investments through your broker, eliminating any itchy trigger fingers during market tantrums.

Final Thoughts

Financial freedom isn’t just some pipe dream for the Wall Street elite. It’s a game anyone can play – whether you’re starting with $100 or $100,000, the math doesn’t change: set clear goals with the 4% rule, create multiple income streams (we’re talkin’ dividends and REITs here), and make smart plays with low-cost index funds.

The kicker? Waiting for that “perfect moment” to dive in. Spoiler alert: Market timing? Doesn’t work. But time in the market? Oh, it does wonders. Here’s the math: a 25-year-old investing $500 every month hits $1.4 million at retirement. A 35-year-old starting the same routine? Lands at $679,000 – that’s $721,000 left on the table, folks.

Today’s income? Not your wealth destiny. What matters is action – now. Set up automatic investments, dive into that Roth IRA, geek out on dividend aristocrats, and start building those passive income streams. Check out Top Wealth Guide for all the resources you need to speed up your journey to financial independence.