Most people track their salary like it’s the only number that matters. At Top Wealth Guide, we’ve seen high earners with six-figure incomes go broke while modest earners build serious wealth.

Your net worth tells the real story. It’s the gap between what you own and what you owe, and it’s the actual measure of your financial health. Net worth building isn’t about earning more-it’s about keeping more.

In This Guide

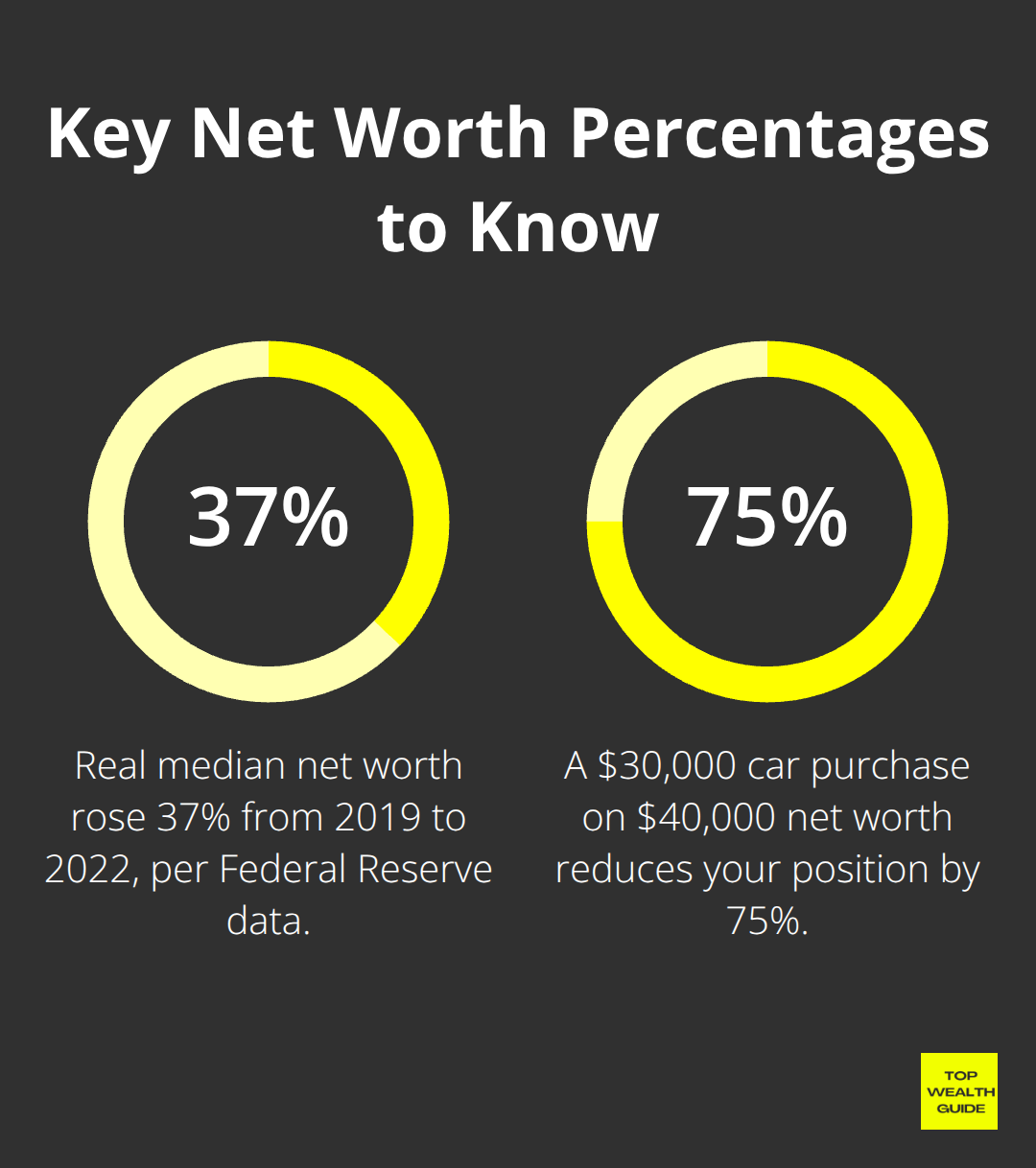

The Real Formula Behind Financial Health

The math behind net worth is straightforward: add up everything you own, subtract everything you owe, and you get your actual financial position. The Federal Reserve’s 2022 data shows real median net worth surged 37 percent between 2019 and 2022, but this masks a significant gap between earners and wealth builders. Someone pulling in $150,000 annually could have a negative net worth if they spend $160,000 each year, while a person earning $60,000 who invests $15,000 annually will accumulate substantial assets over time. Your assets include checking and savings accounts, retirement accounts like 401(k)s and IRAs, stocks, bonds, real estate equity, vehicles, and any other items you could sell or borrow against. Your liabilities are everything working against you: mortgages, car loans, credit card balances, student loans, and personal debts. The formula is simple, but most people ignore it entirely because they fixate on their paycheck instead of their balance sheet.

Why Your Salary Lies to You

Income creates the illusion of wealth. A six-figure earner feels rich until they look at their bank account and realize they own nothing. Many high earners fall far below expected wealth benchmarks because they spend everything they make on lifestyle inflation. A lawyer earning $200,000 who finances a luxury car, maintains an expensive home, and dines out constantly might have less net worth than a software developer earning $90,000 who lives modestly and invests aggressively. Net worth reveals the truth that income hides: your actual financial security depends on what you keep, not what you earn. This distinction matters because income fluctuates with job changes, recessions, and health issues, while net worth represents the safety net you’ve built through deliberate choices about spending and investing.

How High Earners End Up Broke

This pattern appears constantly. A physician earning $250,000 annually carries $180,000 in student loans, a $600,000 mortgage on a home worth $700,000, a $60,000 car loan, and $25,000 in credit card debt. Their total assets might be $750,000 while liabilities total $865,000, resulting in negative net worth despite their impressive income. The problem isn’t the salary-it’s the spending. High earners often assume their income will always be there, so they commit to large fixed expenses without building assets first. Then a job loss, medical emergency, or market downturn hits, and suddenly that six-figure income can’t cover the obligations. The wealthiest individuals, in contrast, build assets first and adjust their lifestyle to match their net worth growth, not their current paycheck.

The Path Forward: Assets Over Income

This is why tracking net worth quarterly or annually matters far more than celebrating annual raises. Your paycheck tells you what you earned this month; your net worth tells you what you’ve actually built. The gap between these two numbers determines your financial future. High earners who ignore net worth accumulate liabilities faster than assets, while modest earners who focus on net worth compounds generational wealth over decades. The choice between these two paths starts with a single decision: stop measuring success by your salary and start measuring it by your balance sheet. Understanding this shift opens the door to the specific assets and liabilities you should track to build real wealth.

What Should You Actually Count as Assets and Liabilities

Five Asset Categories That Build Your Net Worth

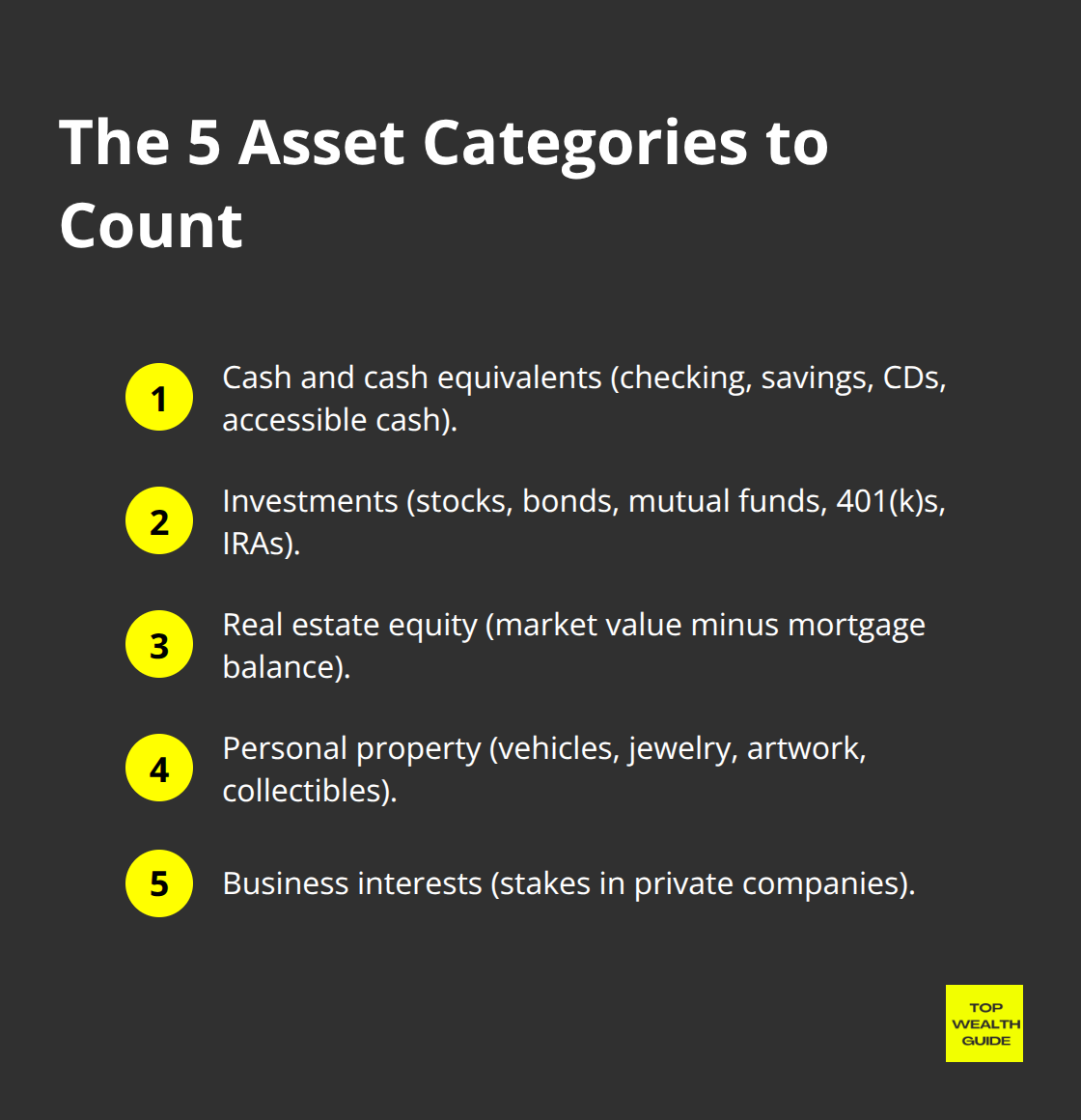

Building real net worth starts with knowing exactly what to count in your calculations. Most people guess or miss entire categories, which means their net worth snapshot stays incomplete and their financial strategy suffers. Your assets fall into five concrete categories that directly impact your financial position.

Cash and cash equivalents include your checking account, savings account, CDs, and any physical cash you hold. However, don’t inflate this number-only count money that’s actually accessible.

Investments encompass stocks, bonds, mutual funds, and retirement accounts like 401(k)s and IRAs. Pull your latest statements and use current market prices, not purchase prices. Real estate equity is your home’s current market value minus what you owe on the mortgage. Use online valuation tools like Zillow or Redfin for estimates, then verify with recent comparable sales in your neighborhood.

Personal property covers vehicles, jewelry, artwork, and collectibles. For vehicles, use Kelley Blue Book to find realistic market values-not what you think your car is worth. Business interests belong here if you own any stake in a company, though valuing private businesses requires professional help. Add all five categories together to get your total assets.

Liabilities: The Debts That Reduce Your Position

Your liabilities are straightforward but often underestimated. Mortgages represent the remaining balance, not your home’s value. Car loans, student loans, credit card balances, and personal loans all count. Pull your most recent statements for each debt to get accurate numbers. This matters because many people estimate these figures and miss thousands in outstanding debt. Add them all up for total liabilities.

Then subtract: Total Assets minus Total Liabilities equals Net Worth. This simple formula-everything you own minus everything you owe-forms the foundation of understanding your financial position. These numbers reveal that your net worth likely differs significantly from others at your income level, which means there’s opportunity to improve through better tracking and strategic decisions.

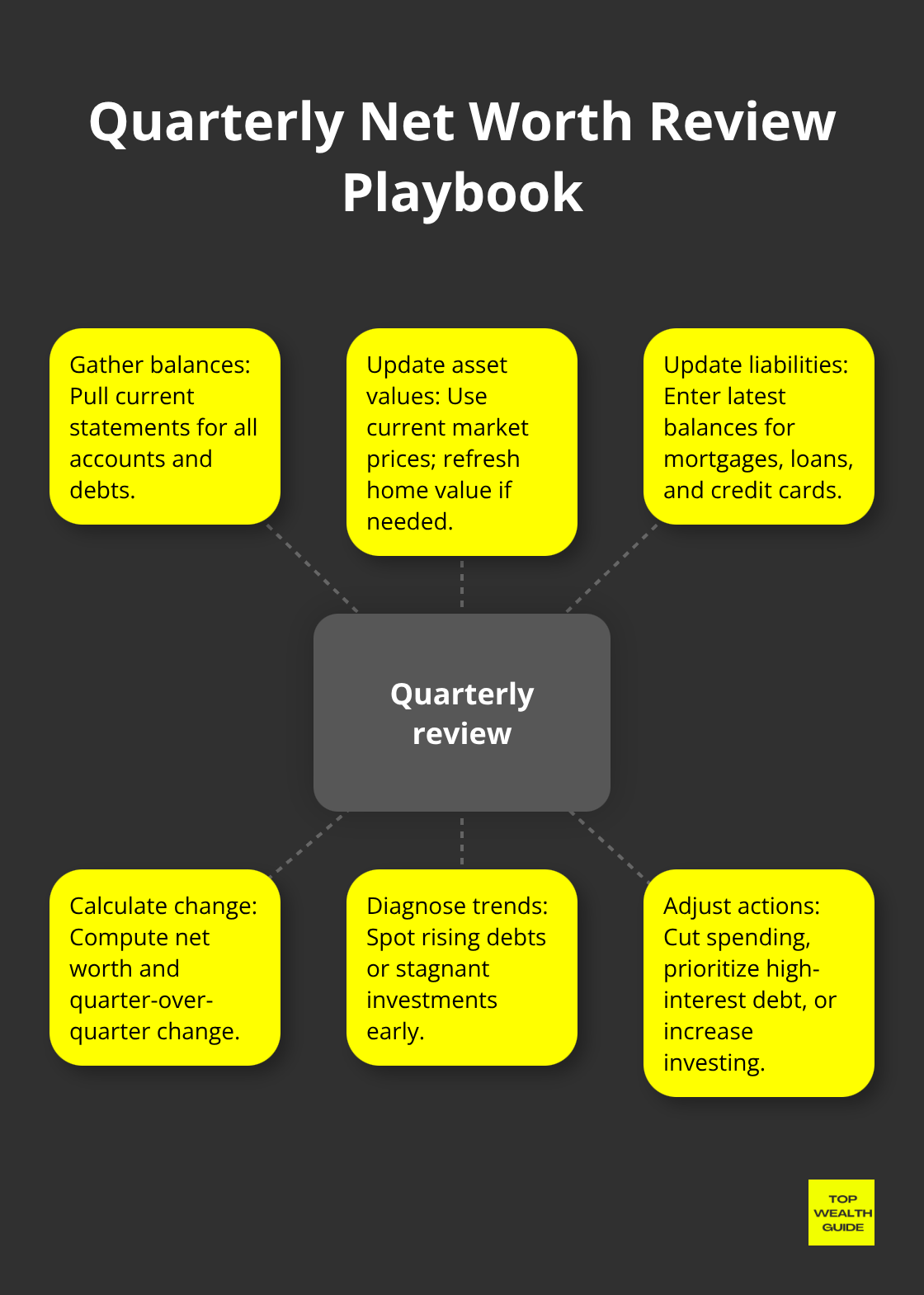

Quarterly Reviews Expose What Annual Checks Miss

The most effective approach to monitoring net worth involves quarterly or annual reviews, not constant checking. Set a specific date each quarter-say the last Sunday of March, June, September, and December-and spend 30 minutes updating your numbers.

Use a simple spreadsheet with columns for asset categories, their current values, liability balances, and the calculated net worth. This consistency reveals trends you’d otherwise miss.

Someone might think they’re building wealth steadily, but quarterly reviews often expose that credit card debt is climbing while investment accounts stagnate. Track the change in net worth each quarter, not just the absolute number. A $50,000 increase from Q1 to Q2 tells you something different than a $5,000 increase. The direction and pace matter more than the current figure because they indicate whether your spending and investment habits actually work.

Some people resist tracking this frequently because they fear discovering they’re moving backward. That fear is exactly why quarterly reviews work-they force honest confrontation with reality before small problems become catastrophic. If your net worth dropped $20,000 last quarter, you need to know that immediately so you can adjust spending or investment strategy. Waiting until year-end means you’ve wasted nine months on habits that don’t serve you.

Tools That Automate Your Net Worth Tracking

Digital tools can automate much of this work. Apps like Personal Capital or Empower connect to your bank accounts, investment accounts, and credit cards automatically, updating your net worth in real time. These platforms pull data directly from your financial institutions, eliminating manual entry errors and ensuring accuracy. If you prefer simplicity, a Google Sheet works perfectly-it costs nothing and forces you to engage with your numbers at least quarterly.

The specific tool matters less than the discipline of regular monitoring. High earners often resist this practice because they assume their income will always cover their obligations. That assumption has destroyed more financial positions than any market crash. Net worth tracking reveals whether your impressive salary actually builds wealth or simply funds an expensive lifestyle. Once you understand what you own and what you owe, you’re positioned to make decisions that accelerate your path to financial independence.

Why Your Net Worth Predicts Your Financial Future Better Than Your Paycheck

Your net worth directly determines whether you’ll retire comfortably or work until you’re seventy. This isn’t theory-it’s mathematics. The Federal Reserve’s 2022 data shows median household net worth was $192,200, but this number masks an uncomfortable truth: someone with a $150,000 salary and $50,000 net worth will face genuine financial stress in retirement, while someone earning $65,000 with $400,000 net worth can comfortably stop working. Your net worth is the only number that actually funds your future. When you retire, your paycheck disappears immediately, but your assets continue producing income through dividends, rental payments, and principal drawdowns. A person relying solely on Social Security needs substantial net worth to bridge the gap between their benefits and their actual living expenses. The average Social Security benefit in 2025 is roughly $1,907 monthly, which means you need significant assets to maintain any reasonable lifestyle. Most financial planners recommend having 25 times your annual spending saved by retirement-that’s pure net worth calculation. Someone spending $60,000 annually needs $1.5 million in net worth, not a six-figure income. This reality forces a hard choice: either you build net worth aggressively during your working years, or you work significantly longer than you want.

How Net Worth Shapes Decisions About Major Life Events

Major expenses reveal why income and net worth diverge so dramatically. A $30,000 car purchase affects a person with $40,000 net worth catastrophically-it reduces their entire financial position by 75 percent-while someone with $500,000 net worth absorbs it without disrupting their wealth trajectory. This same principle applies to home purchases, career changes, medical emergencies, and helping family members. Someone with low net worth relative to their income faces constant financial fragility. They cannot afford a job loss because they have no safety net. They cannot invest in education or side business opportunities because their cash flows toward debt payments. They cannot help their children or parents in crisis. Conversely, someone who prioritizes net worth accumulation gains optionality-the ability to make choices based on preference rather than desperation. A person with $250,000 net worth can leave a toxic job, knowing they have runway to find something better. They can negotiate higher salaries because they don’t need the paycheck immediately. They can invest in opportunities that require upfront capital. This optionality compounds over time. Better opportunities attract people with financial cushions, which means net worth builders tend to earn more and build assets faster than those trapped by lifestyle obligations.

Net Worth Forces Honest Assessment of Your Actual Progress

Most people avoid calculating net worth because it reveals uncomfortable truths. Someone earning $120,000 annually might discover they have less net worth than they did five years ago despite earning an extra $25,000 per year. That discovery is painful, but it’s also the moment everything changes. You cannot improve what you don’t measure. Someone tracking net worth quarterly quickly realizes that their annual raise barely moved the needle because increased income funded increased spending. They see clearly that their investment account grew $8,000 last year while their credit card debt grew $12,000. This honest assessment triggers behavior change far more effectively than vague goals about earning more or spending less. The numbers don’t lie or offer excuses. Quarterly net worth tracking also reveals which decisions actually work. Someone might feel productive paying extra on their mortgage while their investment account stagnates, but the net worth calculation shows this isn’t optimal-they build equity slowly in a single asset while missing compound growth opportunities. Another person might discover that their side business generates $15,000 annually but requires 25 hours monthly of their time, while investing that same $15,000 would grow at similar rates with zero effort. Net worth calculations force these comparisons into the open. This clarity matters because most people operate on financial autopilot, following habits inherited from parents or cultural expectations rather than deliberately chosen strategies.

Final Thoughts

Your net worth is the only financial metric that actually matters for your future. Income disappears the moment you stop working, but net worth funds your retirement, enables major life decisions, and creates the financial security most people chase their entire careers. The gap between high earners and actual wealth builders comes down to one fundamental choice: prioritize your paycheck or prioritize your balance sheet.

Someone earning $200,000 annually while spending $210,000 builds nothing, while someone earning $70,000 and investing $20,000 yearly accumulates substantial assets over time. Your net worth reveals this truth immediately and shows whether your impressive salary actually translates into financial progress or simply funds an expensive lifestyle that leaves you vulnerable to job loss, health crises, or market downturns. Net worth building requires discipline, but it’s not complicated-increase your assets through regular investing and debt paydown, then reduce your liabilities by tackling high-interest debt first.

Start this week by calculating your current net worth: list every asset you own, subtract every debt you owe, and write down the number. Then commit to reviewing this number quarterly on a specific date, spending 30 minutes updating your assets and liabilities to track the change in your financial position. Explore practical wealth-building strategies that align with your actual financial goals, not just your current income, because your financial future depends on the decisions you make today about what you keep, not what you earn.