Most Americans keep their money in domestic stocks and bonds, missing billions in foreign investing opportunities that could strengthen their portfolios.

At Top Wealth Guide, we’ve seen firsthand how home bias limits wealth growth. International markets offer higher returns, better diversification, and access to emerging economies growing faster than the U.S.

This guide shows you exactly where those opportunities are and how to access them.

In This Guide

Why Americans Miss Foreign Investment Opportunities

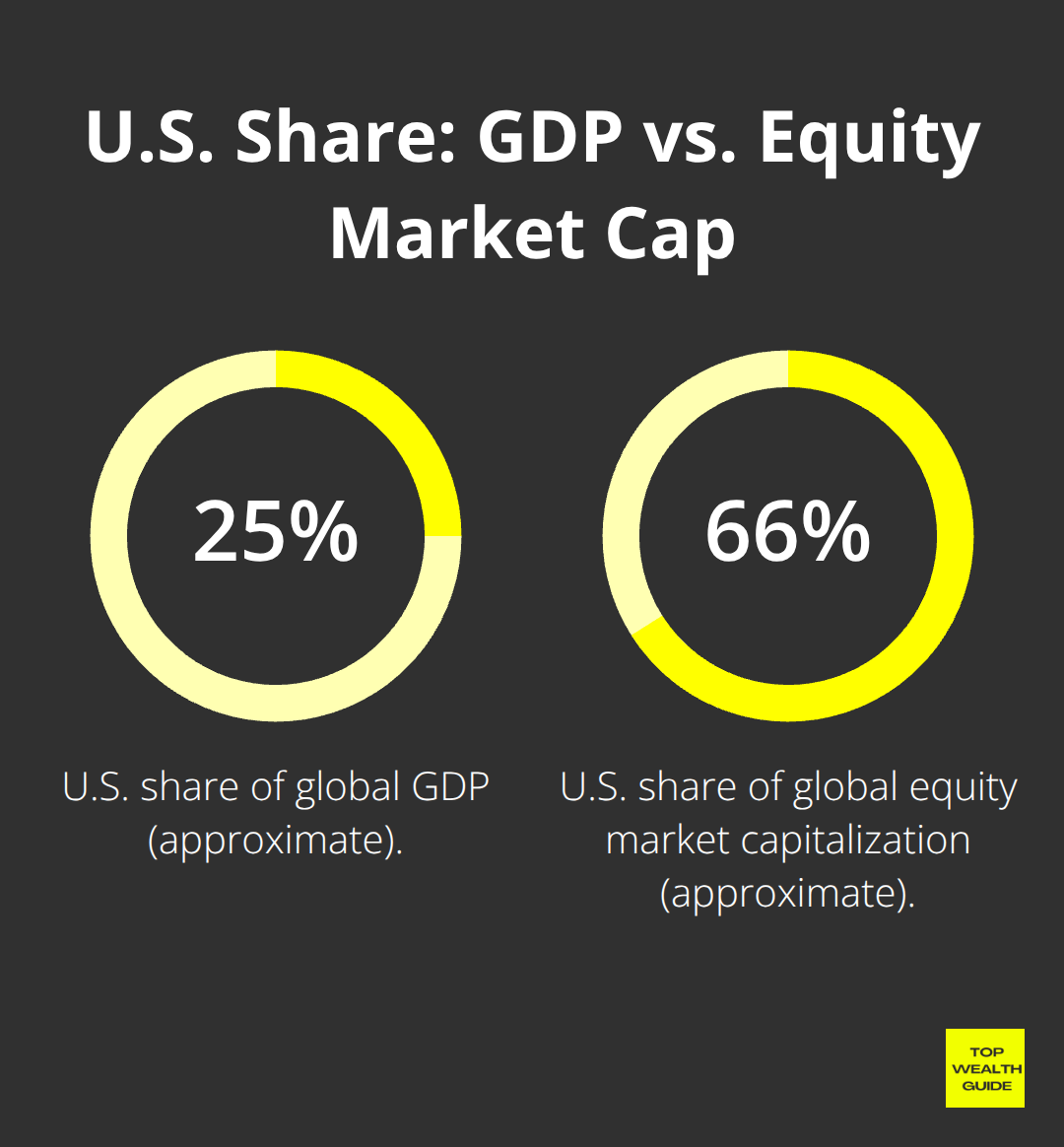

The U.S. accounts for roughly 25% of global GDP but about 66% of global equity market capitalization according to MSCI data. This massive imbalance reveals a hard truth: Americans are overweight on domestic assets and underweight on the rest of the world.

Most brokers make it easy to buy Apple or Tesla but frustrating to buy stocks in Taiwan, India, or South Korea. Fidelity, E*TRADE, Charles Schwab, and Interactive Brokers offer international access, yet many investors never explore these platforms’ foreign options. The barrier isn’t always technical-it’s psychological. You grew up watching CNBC cover the S&P 500. Your 401k defaults to U.S. index funds. Your friends talk about Apple earnings, not Alibaba’s Chinese operations. This comfort with the familiar creates a massive blind spot. International equities have traded at a valuation discount to the U.S. for roughly 15 years, with that gap widening recently according to FactSet data from May 2025. That’s not a coincidence. It’s an opportunity that sits ignored while Americans chase the same mega-cap stocks everyone else owns.

Currency Risk Gets Overstated

Currency volatility scares most individual investors away from foreign stocks. A Hong Kong stock purchase involves roughly HK$299 in broker fees plus about 0.138% in total fees per trade, according to HKEX data. Add currency conversion and suddenly the math looks complicated. But here’s the reality: currency movements cut both ways. A weaker dollar lifts foreign profits when converted back to USD. A stronger dollar works against you. The solution isn’t avoidance-it’s hedging. Currency-hedged ETFs from providers like iShares and Vanguard eliminate this guesswork. You gain exposure to foreign markets without the FX volatility. Most investors don’t know these exist. They assume direct foreign investing requires mastering currency futures or forwards, which are genuinely complex. They’re wrong. A simple currency-hedged international ETF solves the problem in one click.

Emerging Markets Require Homework, Not Fear

China launched monetary easing with a 50 basis point reserve requirement ratio cut and a 20 basis point interest rate cut as part of a plan to reach about 5% growth. Taiwan produces more than half the world’s semiconductors and houses roughly 90% of advanced chip manufacturing capacity. India’s infrastructure and digital progress could lift growth substantially, with robust consumer spending supporting GDP expansion. These aren’t theoretical opportunities. They’re happening now. Emerging markets collectively account for about half of global GDP and roughly 90% of the world’s population according to MSCI and IMF data. Yet most Americans own zero emerging market exposure. The misconception is that EM investing is risky. It is riskier than U.S. stocks, but that risk comes with higher growth potential. EM earnings revisions have been trending upward, creating a persistent growth premium. The real risk is not investing. It’s watching your portfolio grow at 4% annually while emerging economies expand at 6-8%. Liquidity concerns deserve respect in thin-trading emerging markets, but major markets like China, India, and Taiwan have deep trading volumes and tight bid-ask spreads. Start there, not in frontier markets.

Where Most Americans Should Begin

You don’t need to open a foreign brokerage account or master complex derivatives to access international opportunities. American Depositary Receipts (ADRs) trade on U.S. exchanges in dollars, eliminating currency conversion headaches for your first trades. International ETFs from Vanguard, iShares, and State Street Global Advisors provide instant diversification across dozens of countries and sectors. U.S.-registered mutual funds offer region-specific or country-specific exposure with professional management built in. These three paths (ADRs, ETFs, and mutual funds) account for how most successful international investors start their foreign exposure.

They’re straightforward, low-cost, and available through any major U.S. broker. The next chapter walks you through the exact steps to open accounts and position your portfolio for global growth.

Where Global Growth Actually Happens

China’s nine-point reform guidelines now encourage firms to return cash to shareholders, making dividend payouts far more common than five years ago. Well-run Chinese companies increasingly distribute excess capital, creating catalysts for dividend yields while exporters and market-share gainers benefit from deglobalization trends. This shift matters because most American investors treat China as a single bet on growth rather than a source of income-generating assets. You gain exposure to both capital appreciation and steady dividend income by owning Chinese equities through ADRs or emerging market ETFs.

Taiwan’s Dominance in AI Infrastructure

Taiwan produces more than half of the world’s semiconductors and houses roughly 90% of advanced chip manufacturing capacity. The island also hosts key AI supply-chain players in testing, measurement, and substrates, offering back-door access to artificial intelligence infrastructure at valuations far cheaper than buying Nvidia directly. Most American investors focus on U.S. chipmakers and miss the Taiwanese companies that actually manufacture the hardware. A single position in a Taiwan-focused ETF or ADR gives you exposure to the companies powering the AI revolution without the premium valuations attached to household names.

India and South Korea’s Structural Advantages

India’s infrastructure improvements and bureaucracy reform lift growth substantially, with robust consumer spending supporting GDP expansion. The nation may become a global manufacturing hub as supply chains diversify away from China, and intercity travel efficiency improvements already boost business productivity. South Korea implemented a corporate value-up program specifically designed to lift stock prices through better disclosure, buybacks, and higher dividends. This signals a multiyear shift toward shareholder-friendly governance that could lift valuations in autos, financials, and industrials. These two markets alone account for trillions in equity value that most American portfolios completely ignore.

International Real Estate Beyond Stock Markets

Property in developed markets like Germany or the UK offers stable income with currency-hedged returns, while emerging market real estate in Mexico City or Bangkok provides appreciation potential paired with rising rents from expanding middle classes. Rather than purchasing foreign property directly, international REITs eliminate the complexity of foreign currency mortgages, local property taxes, and illiquid asset sales. Vanguard and iShares both offer global real estate ETFs that track diversified portfolios across multiple countries and property types. A single REIT position gives you exposure to international property markets without the operational headaches of direct ownership.

Accessing Global Equities at Discount Valuations

Alibaba’s 2014 NYSE listing raised about $25 billion, demonstrating how major foreign companies trade on American exchanges as ADRs. Beyond individual ADRs, broad international ETFs provide instant exposure to 50 or 100 companies across developed and emerging markets. A single position in an emerging markets ETF gives you exposure to China’s dividend reforms, Taiwan’s semiconductor dominance, India’s infrastructure boom, and South Korea’s governance improvements simultaneously. The forward price-to-earnings ratio for the MSCI All Country World ex USA index remains substantially lower than the S&P 500, meaning you purchase quality companies at genuine discounts rather than chase momentum. With these opportunities mapped out, the next chapter shows you the exact mechanics of opening accounts and positioning your portfolio to capture this global growth.

How to Actually Start Investing Abroad

Most Americans never start foreign investing because they overthink the mechanics. You don’t need a separate brokerage account in Singapore or a translator to buy Chinese stocks. Fidelity, E*TRADE, Charles Schwab, and Interactive Brokers all offer international access through your existing U.S. account. Log into any of these platforms and you’ll find sections for international stocks, ADRs, and global ETFs. The barrier to entry has collapsed. What remains is simply taking the first step.

ADRs Eliminate Currency Friction

Start with ADRs if you want individual company exposure. Alibaba, Spotify, and Vodafone all trade as ADRs on the NYSE in U.S. dollars. ADRs simplify investing in overseas entities by eliminating the need for direct dealings in foreign markets and currencies. A Hong Kong stock purchase costs roughly HK$299 in broker fees plus 0.138% in total fees per trade according to HKEX data, but an ADR purchase on the NYSE costs the same $0 to $10 commission most brokers charge for domestic stocks. That fee difference alone justifies starting with ADRs rather than direct foreign purchases. You save money and avoid the complexity of currency exchange in a single decision.

International ETFs Provide Instant Diversification

International ETFs from Vanguard, iShares, and State Street Global Advisors require no research into individual companies. An emerging markets ETF gives you instant exposure to Taiwan’s semiconductor dominance, China’s dividend reforms, and India’s infrastructure improvements in a single position. A broad international ETF costs between 0.08% and 0.20% annually in expense ratios, meaning you pay roughly $8 to $20 per year on a $10,000 investment for complete diversification across dozens of countries. This approach suits investors who prefer simplicity over stock-picking.

Tax Reporting Follows Straightforward Rules

Tax reporting appears intimidating but follows straightforward rules once you understand the basics. Foreign dividend income gets reported on Schedule B, and you may claim a foreign tax credit if the country withheld taxes on those dividends. Most brokers handle this automatically and provide tax documents each January. The IRS requires Form 8938 reporting if your foreign financial accounts exceed $200,000 at year-end, but this applies to direct foreign bank accounts and brokerage accounts abroad, not ADRs or ETFs purchased through U.S. brokers. FBAR reporting applies only if you hold accounts directly with foreign institutions, not investments held through U.S. brokerage platforms. Consult a tax professional if you plan to hold more than $200,000 in foreign investments, but for most investors starting with $5,000 to $50,000, the reporting burden amounts to a few extra lines on your annual tax return.

Geographic Diversification Protects Against Concentration Risk

Geographic diversification protects you from any single country’s political or economic collapse. Try allocating roughly 20% to developed international markets like Germany and the UK, 30% to emerging markets including China and Taiwan, 25% to India and South Korea, and 25% to real estate through international REITs. This allocation avoids overconcentration in any single region while capturing growth across multiple economies.

Rebalance annually to maintain these percentages, which forces you to sell winners and buy laggards-a discipline that improves long-term returns. Start with $5,000 to $10,000 across two or three positions rather than spreading tiny amounts across ten countries. Concentration builds conviction and makes monitoring manageable.

Final Thoughts

China’s dividend reforms, Taiwan’s semiconductor dominance, India’s infrastructure boom, and South Korea’s governance improvements represent real wealth-building catalysts that most American portfolios completely ignore. The valuation discount on international equities compared to U.S. stocks persists because home bias keeps capital concentrated domestically. That gap becomes your advantage when you act on foreign investing opportunities that sit overlooked while others chase the same mega-cap stocks.

Start with three practical steps. Open positions in currency-hedged international ETFs or individual ADRs through your existing U.S. brokerage account (Fidelity, E*TRADE, Charles Schwab, or Interactive Brokers all offer straightforward access). Allocate roughly 20-30% of new investment capital to international exposure rather than attempting a sudden portfolio overhaul. Monitor your positions annually and rebalance to maintain your target allocation across developed markets, emerging markets, and international real estate.

Log into your broker and search for emerging markets ETFs or individual ADRs in companies you recognize. Invest $5,000 to $10,000 as your initial position and track performance over the next year. We at Top Wealth Guide provide ongoing analysis of international opportunities and practical strategies for building globally diversified portfolios that capture growth most Americans miss.