Running out of money in retirement is a real fear for many people. The difference between a solid retirement withdrawal strategy and a poor one can mean tens of thousands of dollars over your lifetime.

At Top Wealth Guide, we’ve seen how the right approach to withdrawals transforms retirement from stressful to sustainable. This guide walks you through proven strategies that work in any market condition.

In This Guide

How Much Can You Really Withdraw Each Year

The 4% withdrawal strategy sounds simple: take 4% of your retirement portfolio in year one, then adjust that dollar amount upward for inflation annually. For a $1 million portfolio, that means $40,000 in year one, roughly $41,200 in year two (assuming 3% inflation), and so on. William Bengen introduced this framework in 1994 after analyzing historical market data, and it remains the most cited withdrawal benchmark today. The logic holds weight-historical data suggested a 50/50 stock-bond portfolio could sustain this withdrawal rate for 30 years with a high success rate. But here’s where most people go wrong: they treat the 4% rule as gospel rather than a starting point. The rule assumes you retire at 65, live exactly 30 years, pay minimal fees, and avoid major tax surprises. None of those assumptions hold for most retirees.

Charles Schwab’s 2025 research shows that if you have a 30-year horizon with a moderate allocation, your sustainable withdrawal rate actually reaches 4.2% to 4.8%-higher than the traditional 4%. However, that same research reveals that future returns may fall below historical averages, meaning the old 4% benchmark could be overly optimistic for someone retiring today. The real takeaway: safe withdrawal rates are personal. A $2 million portfolio with a 20-year horizon and a moderately conservative allocation can support a 5.8% to 6.3% initial withdrawal. A $500,000 portfolio with the same timeframe might justify only 4% to 4.5% because smaller portfolios have less room for error and less capacity to generate income from growth.

Three factors that determine your actual withdrawal rate

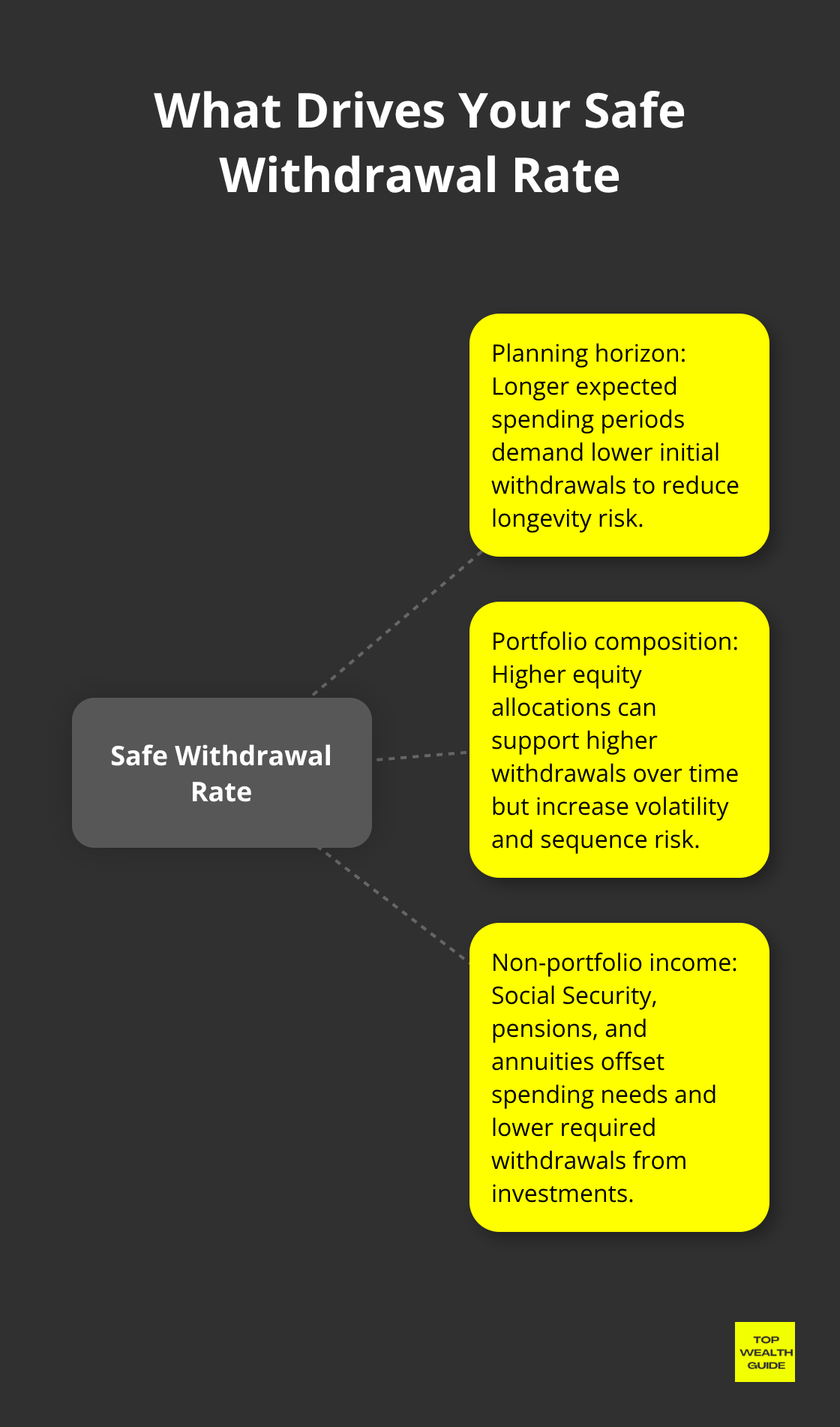

Your safe withdrawal rate depends on three concrete factors. First, your planning horizon-how long you expect to spend money in retirement. The Social Security Administration data shows the average remaining life expectancy for a 65-year-old is under 30 years, yet many people plan conservatively for 40 years. A longer horizon demands a lower withdrawal rate.

Second, your portfolio’s composition matters more than most realize. A portfolio weighted 70% stocks can theoretically support a higher withdrawal rate than a 40% stock portfolio because equities historically deliver better long-term returns. However, that higher equity allocation also means larger year-to-year swings in your account value, which creates sequence-of-returns risk-the fact that the order and timing of poor investment returns can have a big impact on how long your retirement savings last. A retiree who withdraws 5% in a down market faces a much steeper recovery challenge than someone withdrawing 3%. Third, your non-portfolio income (Social Security, pensions, annuities) directly reduces the amount you need to extract from investments. A retiree with $30,000 annual Social Security and a $500,000 portfolio only needs the portfolio to generate $20,000 annually to reach $50,000 total income, lowering the required withdrawal rate dramatically.

Why flexibility beats fixed formulas

The most dangerous mistake is treating your withdrawal rate as immutable. A 2023 retiree who rigidly followed 4% inflation adjustments would have withdrawn more during the 2024 market decline, accelerating portfolio depletion exactly when recovery mattered most. Dynamic withdrawal strategies support a higher initial safe withdrawal rate than the base case fixed real withdrawal method. This flexibility protects longevity without requiring you to cut spending permanently.

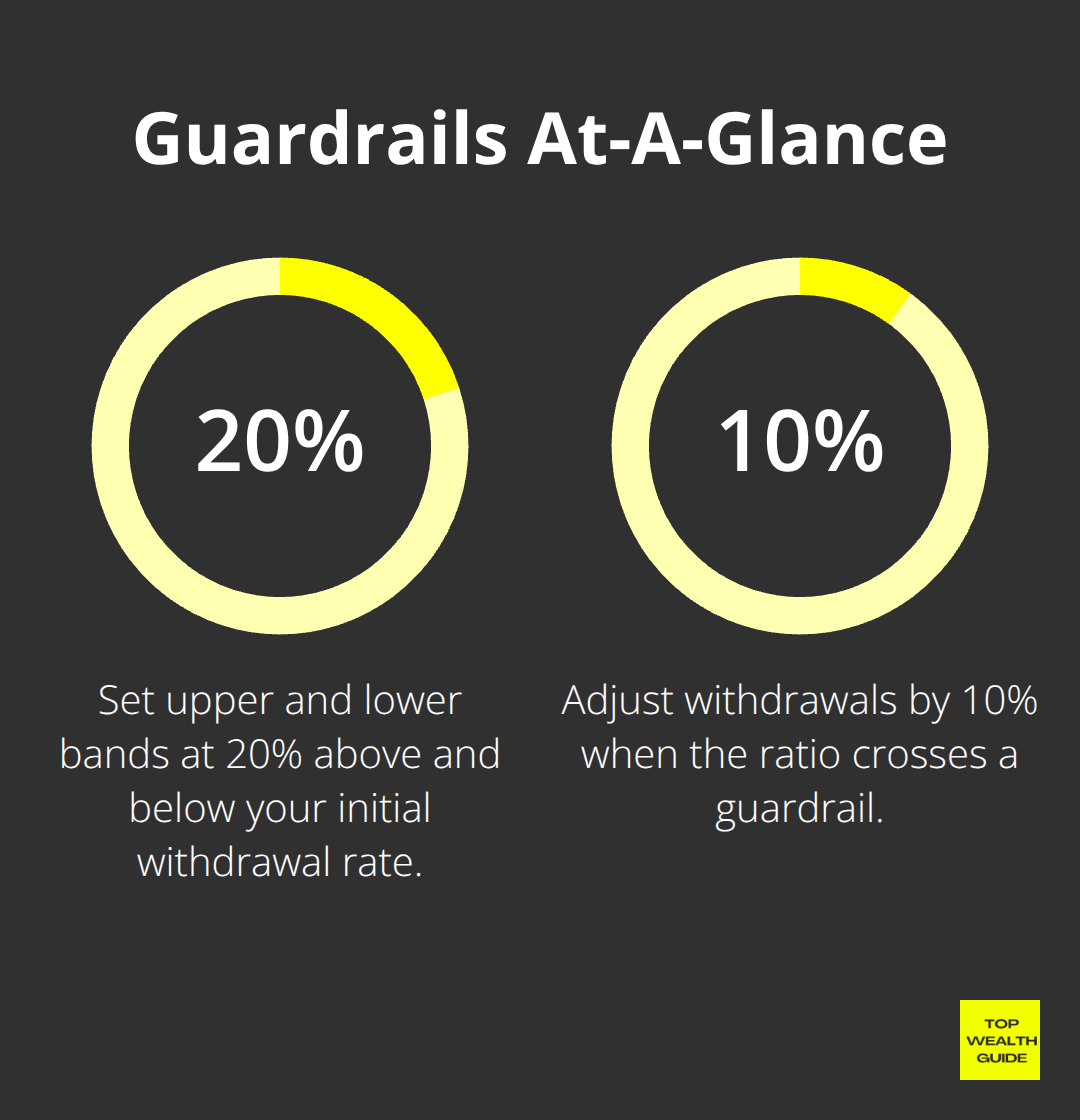

The guardrails approach offers a practical framework: set an initial withdrawal rate, then establish upper and lower bands at 20% above and below that rate. If your withdrawal drifts outside those guardrails, adjust by 10% in the opposite direction. For example, a $1.5 million portfolio with a 4.5% initial withdrawal ($67,500) has guardrails between 3.6% and 5.4%. If the portfolio grows to $2 million and you stick to the same dollar amount, you’ve fallen to 3.38%-below your lower guardrail-so you increase withdrawals by 10%. This approach prevents both overspending in good years and unnecessary deprivation in bad ones.

Moving from theory to your personal strategy

The 4% rule works best as a conversation starter with a financial advisor, not as a rigid rule. Your withdrawal strategy should reflect your actual spending needs, your portfolio size, your non-portfolio income, and your willingness to adjust when markets shift. These variables shift throughout retirement, which means your withdrawal approach must shift with them. The next section explores how to structure those withdrawals across different account types to minimize taxes and maximize what actually stays in your pocket.

Tax-Efficient Withdrawal Strategies

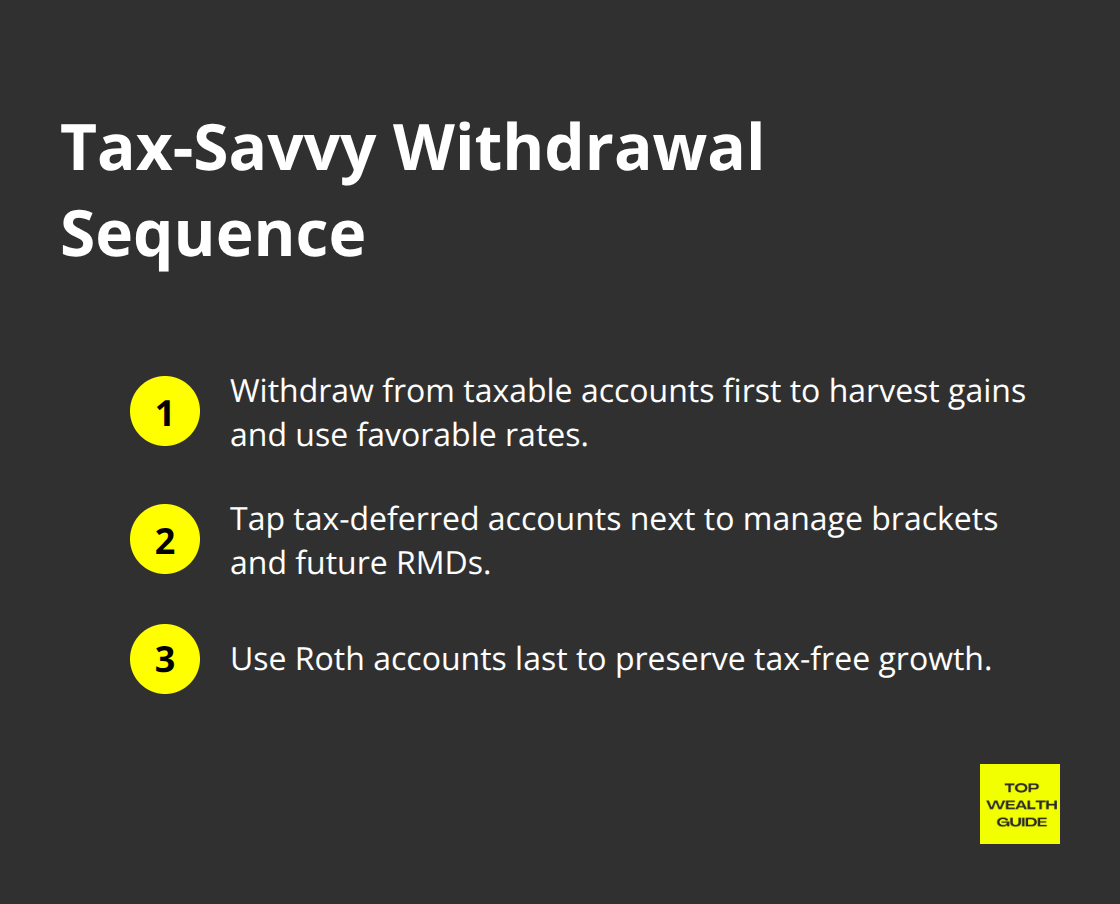

Withdrawal sequence determines how much of your money the government claims. Most retirees leave thousands on the table annually by pulling funds in the wrong order. The tax code gives you three account types to work with: taxable accounts (brokerage), tax-deferred accounts (traditional IRAs and 401(k)s), and tax-free accounts (Roth IRAs). Each generates different tax consequences when you withdraw, and the order matters enormously. A retiree with $500,000 across these three account types could pay $15,000 to $25,000 more in taxes over a decade through poor sequencing. The standard approach withdraws first from taxable accounts, then tax-deferred, and finally Roth accounts where withdrawals are tax free. This logic assumes you’ll spend decades in retirement and benefit from deferring Roth withdrawals. But this approach ignores capital gains management and tax brackets.

A smarter strategy sequences withdrawals to keep your taxable income within your current tax bracket, using qualified dividends and long-term capital gains that receive preferential treatment. If you’re in the 22% federal bracket with a $500,000 taxable portfolio generating $15,000 annually in long-term gains, you might withdraw $10,000 from those gains while staying in your bracket, then pull the remaining spending need from a traditional IRA. This keeps capital gains taxed at 15% instead of accelerating into a higher bracket where gains face 20%.

Managing High-Income Complications

High earners face additional complications. The 3.8% Net Investment Income Tax applies to modified adjusted gross income above $200,000 (single) or $250,000 (married filing jointly). A couple with $800,000 in taxable accounts and $300,000 in IRAs must carefully sequence withdrawals to avoid triggering this extra tax. Taking $50,000 from a taxable account with $30,000 in gains pushes them over the NIIT threshold, adding $1,140 in tax. Taking the same amount from the IRA avoids it entirely. Strategic withdrawal ordering prevents this penalty from eroding your retirement income unnecessarily.

Roth Conversions Reshape Your Tax Future

Roth conversions deserve far more attention than they receive. The strategy involves moving money from a traditional IRA into a Roth IRA, paying income tax on the conversion amount in that year, then letting the Roth grow tax-free forever. This sounds counterintuitive until you examine the math. A 62-year-old with $800,000 in a traditional IRA faces required minimum distributions starting at age 73. The RMD at age 73 will exceed $30,000 annually, pushing her into a higher tax bracket for the rest of her life. Converting $50,000 per year from age 62 to 72 allows her to pay tax at her current rate while in a lower bracket, then eliminates the future RMDs entirely. Over a 30-year retirement, this prevents $300,000 in additional RMD withdrawals that would have faced rates potentially 3 to 5 percentage points higher.

The conversion ladder technique extends this advantage. A 55-year-old who leaves their job can convert traditional IRA funds to a Roth, then use the IRS Rule 72(t) to access Roth contributions penalty-free after five years. This creates a bridge to Social Security without touching the taxable account, preserving it for later years when you have fewer other income sources. A concrete example: convert $40,000 annually from age 55 to 60. After age 60, withdraw the contributions (not earnings) from the Roth penalty-free, covering living expenses while the taxable portfolio grows undisturbed. This approach works only if you have the cash flow to pay conversion taxes from sources outside the IRA.

Strategic Account Positioning Prevents Bracket Creep

The worst outcome occurs when RMDs force you into a higher tax bracket, triggering Medicare premium increases and potentially subjecting more of your Social Security to taxation. This bracket creep is preventable. A 70-year-old with $1.2 million in a traditional IRA, $400,000 in a Roth, and $300,000 in taxable accounts should sequence withdrawals to stay in the 22% bracket. If her RMD is $45,000 and she needs $80,000 total, she takes the $45,000 RMD plus $20,000 from the taxable account (managing which securities to sell to minimize capital gains), then covers the final $15,000 from the Roth. This ordering keeps her taxable income at $65,000 instead of $80,000, potentially saving $2,250 in federal tax and preventing a $500 annual increase in Medicare Part B premiums.

The positioning works backward from your RMD date. At age 72, calculate what your RMD will be at 73, 75, and 80. Then work with a tax professional to determine how much to convert to Roth or withdraw from taxable accounts before RMDs begin. A strategic conversion at age 70 when your income is low prevents the forced withdrawals at 73 from devastating your tax situation. This requires planning three to five years in advance, not reacting when RMDs arrive. Once you establish this tax-efficient withdrawal sequence, the next step involves adjusting your approach as markets shift and your circumstances change.

Dynamic Withdrawal Approaches for Changing Markets

Adjusting Withdrawals Based on Portfolio Performance

Fixed withdrawal strategies fail spectacularly when markets collapse. A retiree who withdraws the same inflation-adjusted amount during a 30% market decline accelerates portfolio depletion at precisely the moment recovery matters most. Rigid adherence to the 4% rule during downturns destroys wealth. The guardrails approach solves this problem through automatic adjustment triggers based on portfolio performance.

Set your initial withdrawal rate, then establish upper and lower bands at 20% above and below that rate. If your withdrawal ratio drifts outside those bands, adjust by 10% in the opposite direction. A $1.5 million portfolio with a 4.5% initial withdrawal ($67,500) has guardrails between 3.6% and 5.4%.

When the portfolio declines to $1.2 million and you maintain the same dollar amount, your withdrawal ratio climbs to 5.63%-above your guardrail-so you cut withdrawals by 10% to $60,750. This prevents panic selling and protects the portfolio’s recovery capacity.

In strong markets, the same mechanism works in reverse. A portfolio that grows to $2 million with your unchanged $67,500 withdrawal falls to 3.38% of assets, triggering a 10% increase to $74,250. This framework prevents both deprivation during downturns and unnecessary portfolio drag during strong years.

The Bucket Strategy for Time-Based Spending

The bucket strategy complements guardrails through portfolio segmentation into time-based segments. Short-term buckets hold one to two years of spending needs in cash and short-term bonds, insulating you from forced sales during market declines. Medium-term buckets covering three to ten years sit in balanced allocations of 40% to 60% stocks. Long-term buckets invested entirely in equities fund spending after decade one.

This structure means a market crash does not force you to liquidate stocks at depressed prices. During 2024’s volatility, a retiree with a two-year cash bucket had already withdrawn their year-one spending, leaving a full year’s worth untouched-no selling required. Once markets stabilize, you refill the short-term bucket from the long-term allocation, restoring the structure.

A $1 million portfolio with 6% annual spending needs roughly $20,000 in the short-term bucket, $100,000 in medium-term, and $880,000 in long-term buckets. As markets shift and you withdraw funds, these proportions drift, necessitating occasional repositioning.

Rebalancing Discipline and Annual Maintenance

The bucket strategy requires annual rebalancing, typically in January or after significant market moves. Mechanical rebalancing discipline prevents emotional decisions and maintains long-term asset allocation targets without constant monitoring. The strategy works especially well for retirees between ages 65 and 80 who face sequence-of-returns risk most acutely. After age 80, spending patterns typically decline, reducing the urgency of this approach.

One practical consideration: the bucket strategy requires more cash than most retirees prefer, potentially dragging on returns during extended bull markets. Guardrails avoid this drag through full market exposure while using withdrawal adjustments as the control mechanism.

Combining Guardrails and Buckets for Optimal Results

The optimal approach combines both methods. Use guardrails to govern your annual withdrawal decision and buckets to structure how you access funds throughout the year. This ensures you never face forced sales during downturns while maintaining flexibility to spend more when markets perform well. Guardrails provide the decision framework; buckets provide the operational structure that prevents emotional reactions to market volatility.

Final Thoughts

Your retirement withdrawal strategy determines whether your money lasts 30 years or runs dry in 15. We at Top Wealth Guide have walked you through three proven approaches: the 4% rule as your baseline, tax-efficient sequencing to keep more money in your pocket, and dynamic adjustments that protect you when markets shift. The retirees who succeed combine all three into a personalized plan that reflects their actual spending needs, guaranteed income sources, and risk tolerance.

Start with honest numbers about your situation. Calculate your actual spending needs, add your guaranteed income from Social Security and pensions, then subtract that total from your annual requirement. The remaining gap tells you exactly what your portfolio must cover-a $1.5 million portfolio funding a $30,000 annual gap requires only a 2% withdrawal rate, far safer than the 4% rule suggests. Establish your guardrails before you need them by deciding in advance how much you’ll adjust withdrawals if your portfolio declines 20% or surges upward (write these rules down now, when emotions stay calm, so you follow your predetermined plan instead of panicking when markets shift).

Markets change, your health changes, and your spending changes throughout retirement. Schedule a conversation with a financial advisor each January to stress-test your withdrawal strategy against current conditions, and explore Top Wealth Guide’s resources on long-term financial planning for deeper guidance on building a comprehensive financial plan that adapts as your life unfolds.