Investment fraud costs Americans over $14 billion annually, according to the FBI’s Internet Crime Complaint Center. Scammers are getting smarter, using fake credentials and pressure tactics to steal your money.

At Top Wealth Guide, we’ve seen too many people lose their life savings to fraudsters. This guide shows you exactly what to watch for and how to protect yourself before it’s too late.

In This Guide

What Actually Signals a Fraudulent Investment

The Four Universal Red Flags

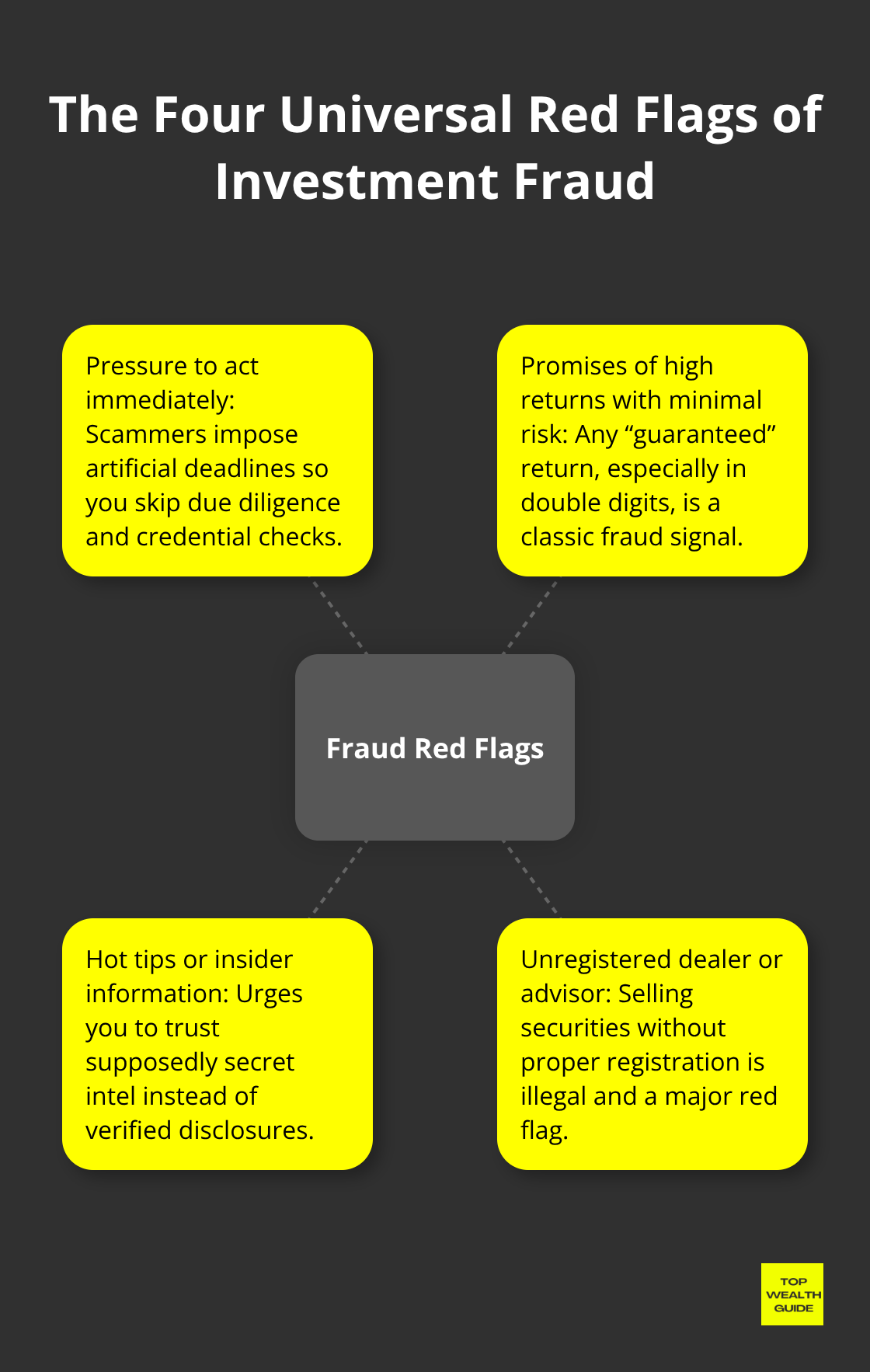

Fraudsters rely on a handful of psychological triggers to separate you from your money, and recognizing these patterns is your best defense. The Ontario Securities Commission reports that four universal warning signs appear across nearly all investment fraud cases: pressure to act immediately, promises of high returns with minimal risk, hot tips or insider information, and an unregistered investment dealer. These aren’t subtle-they’re deliberate tactics designed to bypass your rational thinking.

Unrealistic Return Promises

High-yield investment programs promise returns of 20%, 30%, or even 50% annually, and this should trigger immediate skepticism. Legitimate market returns typically hover between 7% and 10% for diversified portfolios over long periods. Anyone promising any return above 10% that’s “guaranteed safe” is trying to steal your money, as risk and reward are inversely correlated. The U.S. Securities and Exchange Commission warns that guarantees of profit or income mark hallmarks of fraud, and legitimate investments always involve documented risk disclosures.

Manufactured Urgency and Time Pressure

Time pressure is another critical red flag-phrases like “limited spots available,” “special pricing ends today,” or “exclusive access closes Friday” manufacture urgency designed to prevent you from asking questions or conducting research. Real investment opportunities don’t disappear if you take a week to verify credentials or consult a financial advisor. Scammers create artificial deadlines to stop you from thinking clearly.

Transparency Gaps and Unregistered Advisors

Legitimate investment platforms and professionals provide clear documentation about where your money goes, how returns are generated, and what fees you’ll pay. If a promoter refuses to provide a prospectus, avoids explaining the investment strategy in detail, or becomes defensive when you ask basic questions, walk away. Check an investment professional’s background, registration, and disciplinary history for free on Investor.gov. Unregistered advisors operating in your state commit a crime, yet many operate openly on social media or through unsolicited phone calls.

Affinity Fraud and Social Engineering

Affinity fraud specifically targets people who share your religion, ethnicity, professional background, or community membership, exploiting the trust built within these groups. A family friend or community leader recommending an investment carries psychological weight that fraudsters weaponize deliberately. The Ontario Securities Commission emphasizes researching the background of any investment professional regardless of personal connection and seeking a second opinion from an independent source.

Real estate investment scams frequently use aggressive seminars with fake testimonials promising quick wealth with minimal work, while cryptocurrency scams often begin with direct messages on social media showing fabricated growth reports before pressuring you to invest more. If the investment story sounds complex or requires you to move money through unusual channels (gift cards, wire transfers to personal accounts, or overseas payments), that’s not sophistication-it’s a deliberate attempt to make the fraud harder to trace and your money harder to recover.

These warning signs appear across different fraud types, which means understanding how scammers operate in specific schemes gives you another layer of protection.

How Scammers Execute Common Fraud Schemes

Ponzi and Pyramid Schemes: The Math That Always Fails

Ponzi schemes operate on a brutally simple mechanism: early investors receive returns funded entirely by money from new recruits, not from actual business earnings. The scheme collapses predictably when new investor money slows or stops flowing in. The U.S. Sentencing Commission reports that the median loss per securities and investment fraud offense reached approximately $1.95 million, with 20.2% of cases involving losses exceeding $9.5 million. Pyramid schemes work similarly but skip even the pretense of real investment activity-participants earn compensation primarily through recruiting others rather than selling legitimate products.

These structures always collapse because they require exponential growth that’s mathematically impossible.

Affinity Fraud: When Trust Becomes a Weapon

Affinity fraud weaponizes community trust by targeting people within religious congregations, ethnic communities, professional associations, or alumni networks. A trusted community member or leader recommends the investment, and that personal connection bypasses your normal skepticism. The Ontario Securities Commission specifically warns that affinity fraud often uses Ponzi or pyramid structures underneath, meaning the trust violation compounds the financial damage. Cryptocurrency scams frequently begin with direct messages on social media or dating apps, showing fabricated growth charts and testimonials before pressuring you to invest more-then the scammer vanishes with your funds.

Fake Platforms and Unlicensed Operators

Fake investment platforms and unlicensed advisors operate openly because many investors never verify credentials before sending money. Check whether the investment professional holds proper registration and licensing, which provides free searches of disciplinary history and background information. Boiler room operations use professional-looking websites and office setups to appear legitimate while operating under fake names and addresses. Real estate investment training scams promise risk-free profits requiring minimal work or your own capital, often with questionable testimonials that scammers fabricate.

Specialized Fraud Tactics Across Asset Classes

Precious metals dealers create artificial urgency and lie about credentials to pressure immediate payment, regardless of market conditions-the Commodity Futures Trading Commission specifically warns about this tactic. Advanced-fee schemes demand upfront payments supposedly to unlock access to larger profits, then vanish after collecting the fee. Recovery-room scams exploit prior fraud victims by promising to recover lost money for an upfront fee, compounding losses through false hope. If someone approaches you with an investment requiring payment through gift cards, wire transfers to personal accounts, or overseas channels, that payment method itself signals fraud. Legitimate investment professionals use standard banking and brokerage infrastructure, not workarounds designed to obscure transaction trails.

Understanding how these schemes operate gives you the foundation to spot them in action, but knowing the warning signs isn’t enough without concrete steps to verify legitimacy before your money moves.

Verify Before You Send Money

Check Registration Status First

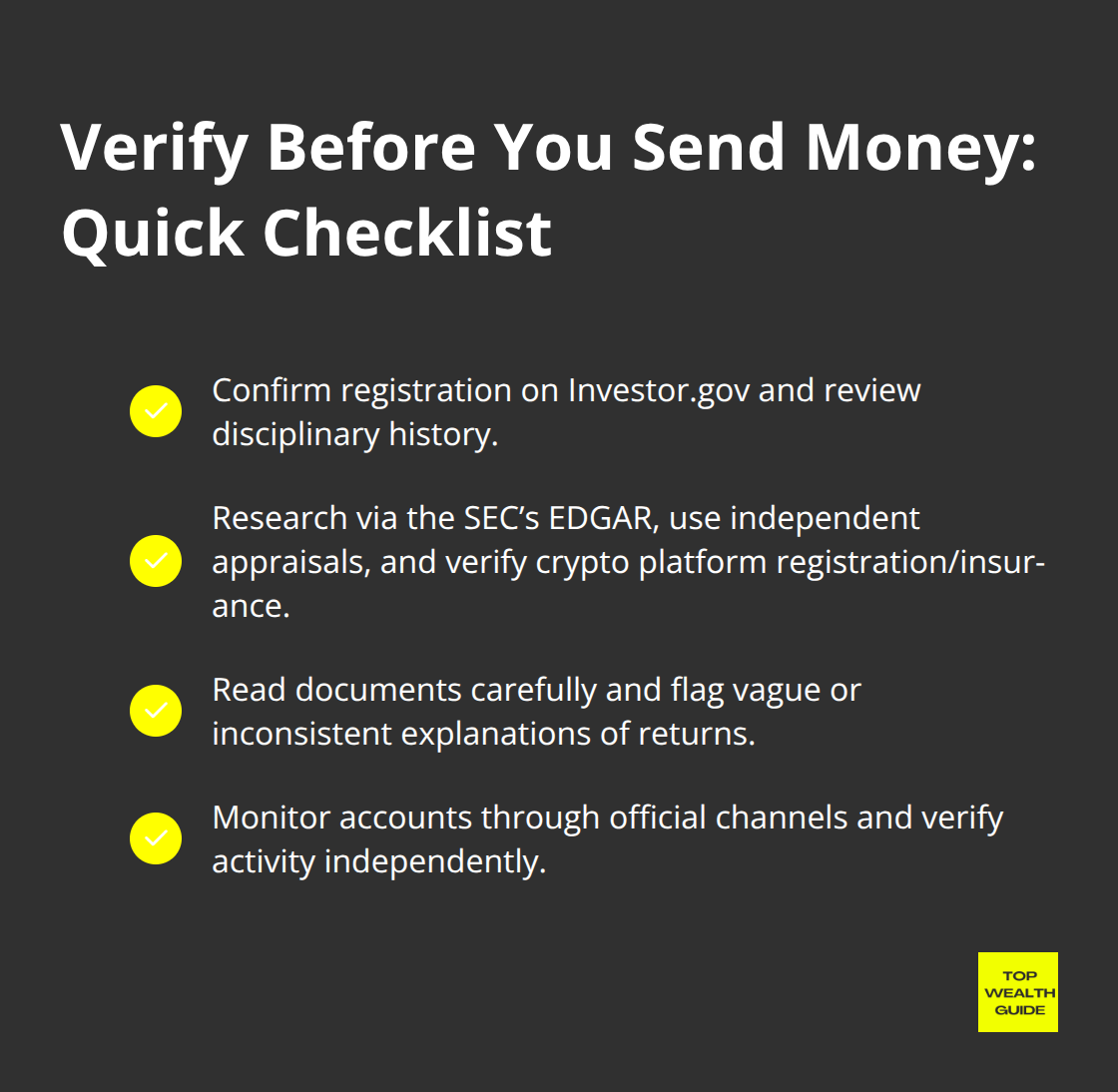

Start with the most critical step: confirm that the person or company selling you an investment holds proper licensing. Visit Investor.gov and search for the investment professional’s name and firm-this free tool shows registration status, disciplinary history, and whether they operate legally in your state. If the search returns no results or reveals disciplinary actions, that person cannot legally sell you investments. The Ontario Securities Commission provides CheckBeforeYouInvest.ca as an official verification tool for Canadian investors. Many fraudsters operate openly because most people skip this five-minute check entirely. Unlicensed advisors violate securities laws in every state, yet they operate through social media, unsolicited phone calls, and email because enforcement lags behind fraud creation.

If someone pressures you to invest before you verify their credentials, that pressure itself confirms fraud intent. Legitimate investment professionals welcome credential verification and provide their registration number without hesitation. Scammers either refuse, become defensive, or provide fake registration numbers that fail verification searches.

Research the Investment Opportunity Thoroughly

Research the actual investment opportunity with the same rigor you would apply to any major financial decision. For stocks and funds, use the SEC’s EDGAR database to review company filings and confirm basic corporate information before investing. For real estate deals, hire an independent appraiser rather than relying on valuations provided by the seller or promoter. For cryptocurrency investments, verify that the platform holds proper registration and insurance-many crypto scams operate through unregistered exchanges that disappear with customer funds.

Read investment documents carefully and look for missing information, vague language, or inconsistencies about how returns are generated. If the investment strategy remains unclear after reading all available materials, that’s not complexity-it’s intentional obfuscation designed to prevent questions.

Monitor Accounts Through Official Channels

Monitor your accounts regularly through official platforms, not through links provided by the investment promoter. Scammers create fake account statements or portals showing fictional gains to prevent victims from withdrawing money or asking questions. Verify account activity directly through your bank or brokerage by logging in independently and checking official statements. If your account shows activity you didn’t authorize or statements don’t match your records, contact your financial institution immediately rather than calling the investment promoter.

Final Thoughts

Spotting investment fraud before it costs you money requires three core actions: verify credentials through official databases, research thoroughly before committing funds, and trust your instinct when something feels off. The four universal warning signs-pressure to act immediately, promises of unrealistic returns, hot tips from unregistered advisors, and lack of transparency-appear across nearly every investment fraud scheme. If you encounter even one of these signals, pause and investigate further rather than moving forward.

The financial damage from investment fraud extends beyond lost money, as victims often experience delayed reporting because they feel embarrassed or ashamed, which gives scammers more time to target others. Report suspected fraud immediately to the Ontario Securities Commission at 1-877-785-1555, the SEC at sec.gov/tcr, or the FTC at ReportFraud.ftc.gov. These agencies track patterns that help identify larger fraud operations and protect future investors.

If your personal information was compromised during a fraud attempt, visit IdentityTheft.gov for personalized recovery steps and document everything-emails, transaction records, account statements, and communication with the fraudster-before reporting. This documentation strengthens investigations and increases the likelihood of recovering funds. Visit Top Wealth Guide to learn how to grow your wealth safely through legitimate strategies in stocks, real estate, and entrepreneurship.