This guide is your complete walkthrough for renters insurance—a simple, low-cost policy that works as a financial safety net for your belongings and protects you from liability claims. It's a must-have tool to shield you from the financial fallout of unexpected events like theft, fire, or accidents, making sure one bad day doesn't leave you with a massive bill.

In This Guide

- 1 Why Renters Insurance Is Your Financial Safety Net

- 2 What Does Renters Insurance Actually Cover?

- 3 What Determines Your Renters Insurance Premium

- 4 How To Choose And Purchase The Right Policy

- 5 Filing A Claim When Disaster Strikes

- 6 Smart Ways To Lower Your Insurance Costs

- 7 Your Top Renters Insurance Questions, Answered

- 7.1 1. Is Renters Insurance Legally Required?

- 7.2 2. What's the Difference Between My Landlord's Insurance and My Own?

- 7.3 3. Are My Roommates Covered By My Policy?

- 7.4 4. What If My Laptop Gets Stolen From My Car? Is That Covered?

- 7.5 5. How Much Liability Coverage Do I Really Need?

- 7.6 6. Are Floods and Earthquakes Covered?

- 7.7 7. Does My Policy Cover Damage Caused By My Pet?

- 7.8 8. What Exactly Is A "Rider" Or "Endorsement"?

- 7.9 9. What About Bed Bugs? Am I Covered?

- 7.10 10. What Happens If I Move?

Why Renters Insurance Is Your Financial Safety Net

Don't think of renters insurance as just another monthly bill. Think of it as a personal financial bodyguard for everything you own inside your apartment. It's a common mistake to assume your landlord’s insurance has you covered. The truth is, their policy only protects the building itself—the walls, the roof, the physical structure. Your stuff is entirely up to you.

That’s where renters insurance comes in. It’s a critical shield against life's curveballs.

It’s a lot like a fire extinguisher: you hope you never need it, but you'll be incredibly glad it's there if a fire ever breaks out. This small investment can stop a minor setback from spiraling into a full-blown financial crisis.

Protecting More Than Just Your Possessions

Renters insurance goes way beyond just covering your couch and TV. For any smart tenant, this coverage is non-negotiable.

Real-Life Example: Imagine your friend, Sarah, is visiting for dinner. She accidentally trips on a rug in your living room and fractures her wrist. The liability protection built into your policy can cover her medical bills and any legal fees if she sues, preventing a single accident from wrecking your financial future.

This is a big reason why more landlords are making it a requirement in their lease agreements—it protects them from liability stemming from their tenants.

The growing understanding of this vital protection is clear in market trends. According to a report by Allied Market Research, the global renters insurance market is projected to reach significant growth, showing a worldwide recognition of renters insurance as a basic part of renting responsibly.

A Foundation for Financial Peace of Mind

At the end of the day, renters insurance is a low-cost, high-value tool for protecting what you have and securing your future. For a surprisingly small monthly premium—often less than what you’d spend on a few coffees—you get genuine peace of mind.

This policy acts as a buffer, ensuring one unexpected disaster doesn't force you to drain your savings or put your financial goals on hold. In fact, having this protection goes hand-in-hand with other smart money habits, like learning how to build an emergency fund. By securing your assets, you’re building a much stronger financial foundation, freeing you up to focus on what really matters.

What Does Renters Insurance Actually Cover?

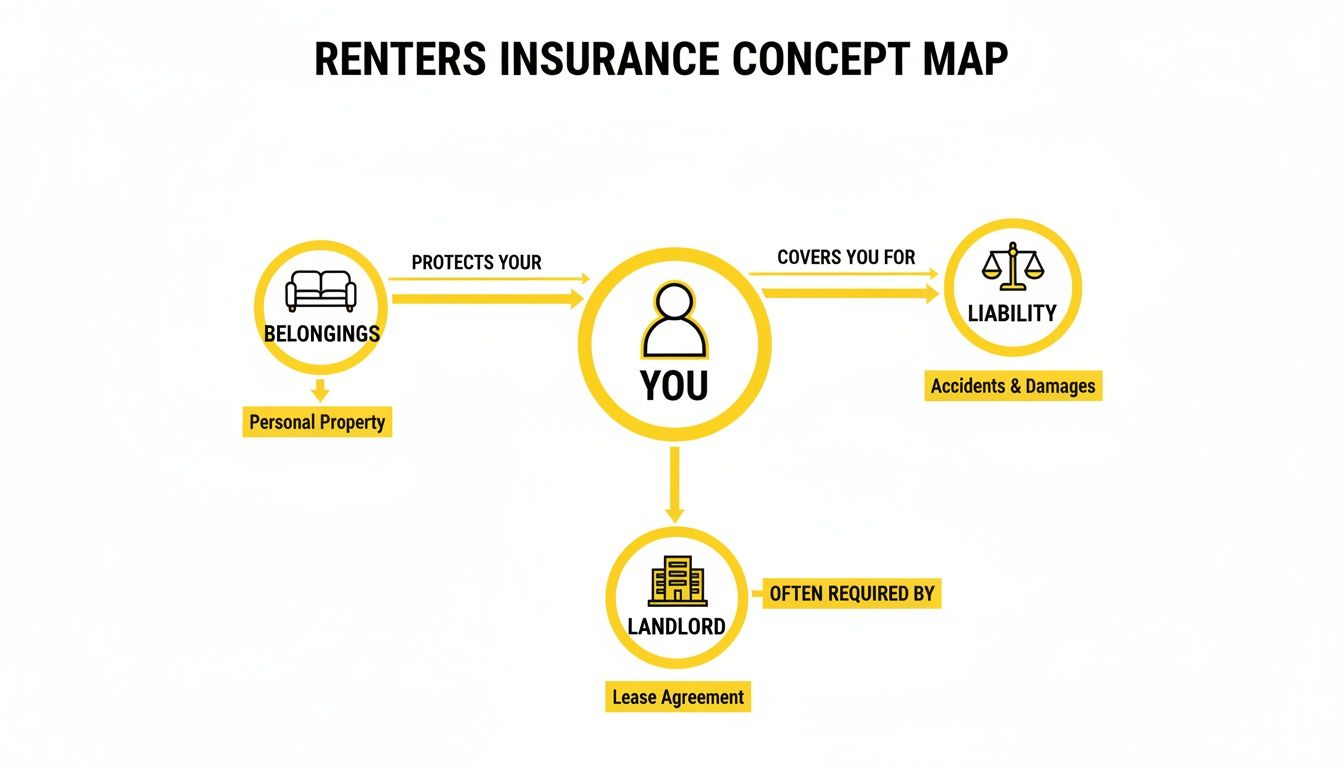

Think of renters insurance not as one giant shield, but as a bundle of three distinct protections, each designed to tackle a different kind of "what-if" scenario that every renter faces. Getting a handle on these three pillars—Personal Property, Liability, and Additional Living Expenses—is the key to seeing its real value and making sure you’re truly covered.

This visual map helps break it down, showing how a single policy connects your personal belongings, your financial security, and your landlord's requirements into one neat package.

As you can see, it’s a comprehensive safety net that puts you at the center.

Coverage For Your Stuff: Personal Property

This is the heart of any renters policy. Personal Property Coverage is what pays you back if your belongings are stolen or damaged by a covered event, like a fire, theft, or even a burst pipe. We’re talking about everything from your couch and TV to your clothes and laptop. It’s the part of the policy that helps you get back on your feet and rebuild if the unexpected happens.

When you're setting this up, you'll run into two critical terms: Actual Cash Value (ACV) and Replacement Cost Value (RCV). Understanding the difference is crucial for your financial recovery.

| Policy Type | How It Pays You Back | Example Payout for a 5-Year-Old Laptop |

|---|---|---|

| Actual Cash Value (ACV) | Pays for the item's current worth, accounting for depreciation. | You might get $200 because the laptop has lost value over time. |

| Replacement Cost Value (RCV) | Pays the full cost to buy a brand-new, similar item today. | You would get $1,200—enough to purchase a new, equivalent laptop. |

Simply put, RCV ensures you can replace your stolen TV with a new one, not just get a check for the value of an old, used model. Though it costs slightly more, RCV provides significantly better protection.

Coverage For Accidents: Personal Liability

Let’s say a friend comes over, slips on a wet spot on your kitchen floor, and ends up with a broken arm. This is exactly where Liability Coverage comes in. It protects your finances if you're held legally responsible for injuring someone or damaging their property.

Liability coverage can handle their medical bills, your legal defense costs if they decide to sue, and any settlement the court orders you to pay. A simple accident can escalate into a lawsuit that jeopardizes your savings and future income. This is your financial firewall, functioning much like other liability protections such as mortgage protection insurance, which shields a family from taking on mortgage debt.

Coverage For When You’re Displaced: Additional Living Expenses

Imagine a fire makes your apartment unlivable. Where would you go? How would you pay for it? That’s the problem that Additional Living Expenses (ALE) coverage solves. It’s also sometimes called "Loss of Use" coverage.

ALE kicks in to cover the extra costs you face when you're forced out of your home, including:

- Hotel bills or a short-term rental

- The cost of eating out if you don’t have a kitchen

- Laundry services, pet boarding, and other essentials

Real-Life Example: A pipe bursts in the unit above yours, causing severe water damage and mold. Your landlord says repairs will take three weeks. Your ALE coverage would pay for your hotel stay and the extra cost of dining out, ensuring you can maintain your normal life without draining your emergency fund.

To pull these concepts together, here’s a quick overview of how each coverage type works in the real world.

Renters Insurance Coverage At A Glance

| Coverage Type | What It Protects | Real-Life Scenario |

|---|---|---|

| Personal Property | Your personal items like furniture, electronics, and clothing from theft or damage. | A thief breaks into your apartment and steals your laptop and television. |

| Liability | Your assets from lawsuits if someone is injured in your home or you damage their property. | A guest trips over a rug in your living room, gets injured, and sues you for medical costs. |

| Additional Living Expenses (ALE) | Your costs for temporary housing and other essentials if your rental becomes unlivable. | A kitchen fire makes your apartment unsafe, forcing you to stay in a hotel for two weeks. |

With these three protections working together, a renters policy offers a powerful defense against some of life's most common and costly curveballs.

What Determines Your Renters Insurance Premium

Ever wonder how insurance companies come up with that monthly premium number? It’s not just pulled out of a hat. Your renters insurance rate is actually a custom-built price based on you, your apartment, and the coverage you decide on. Getting a handle on these factors is the key to finding a great policy that doesn't break the bank.

Think of it like a recipe: each ingredient changes the final result. For insurers, it's all about risk. The more risk they see, the higher your premium will be.

Location and Local Risk Factors

Where you live is a huge piece of the puzzle. Insurers look at your neighborhood's stats—everything from local crime rates to the likelihood of natural disasters like fires or severe storms. If you're renting in a city center with a high rate of break-ins, you'll almost certainly pay more than someone in a quiet suburb.

Coverage Amount and Deductible

This one is pretty straightforward: the more stuff you want to protect, the more it will cost. If you need to insure $50,000 worth of electronics, furniture, and clothes, your premium will naturally be higher than if you only needed $20,000 in coverage.

Then there’s your deductible. This is the amount you agree to pay yourself before the insurance company steps in to cover the rest. It's a trade-off.

- A higher deductible (say, $1,000) means you're taking on more of the initial financial hit. In return, the insurance company gives you a lower monthly premium.

- A lower deductible (like $250) means the insurer is on the hook for more, so they'll charge you a higher monthly premium.

Personal Information and Claims History

Your personal track record matters, too. If you've filed a bunch of claims in the past, an insurer might see you as a higher risk and charge you more. In most states, your credit history also plays a part through something called a credit-based insurance score. A solid financial history often translates to a lower premium because it suggests you're responsible.

Taking steps to improve your financial habits can pay off in more ways than one. For instance, see how a great credit score can benefit you in all sorts of situations.

Real-Life Example:

Alex rents an apartment downtown where theft is common and picks a policy with a low $250 deductible. Maria lives in a sleepy suburb and chooses a $1,000 deductible. Even if they insure the exact same amount of property, Alex’s premium will be significantly higher because of the combined risk of his location and his lower deductible.

How To Choose And Purchase The Right Policy

Alright, you understand what goes into the price, so now comes the fun part: finding the perfect policy for you. Picking the right renters insurance might seem like a chore, but it’s actually pretty straightforward. If you follow a few simple steps, you can lock in great coverage that fits your life and your wallet.

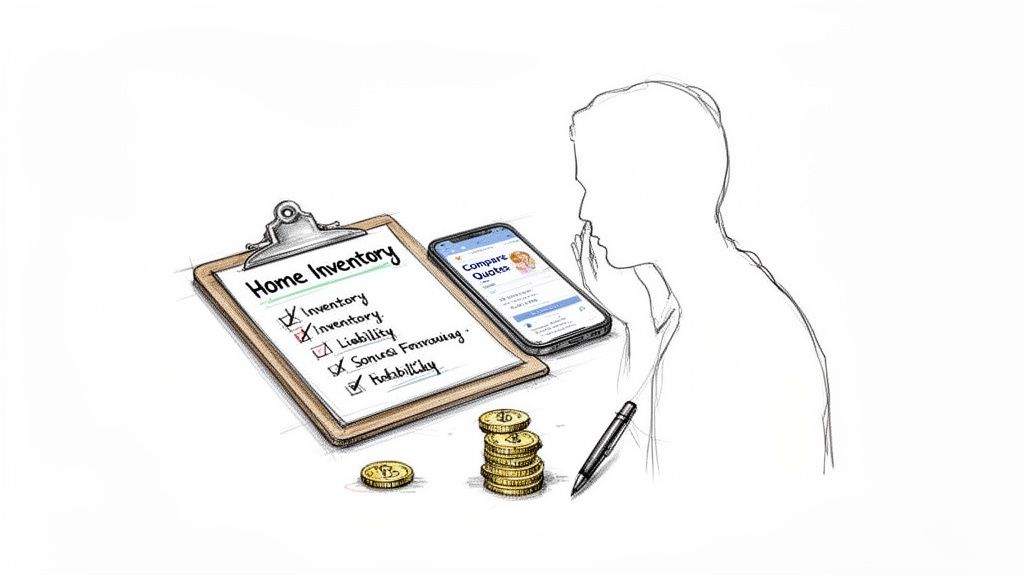

Step 1: Start With A Home Inventory

Before you even think about getting a quote, you need to know exactly what you’re protecting. This means taking a home inventory—a detailed list of all your belongings and what they're worth. I can't stress this enough: this is the most critical step in the whole process. It’s the only way to be sure you’re buying enough coverage to get back on your feet after a disaster.

Don't just pull a number out of thin air. You'd be shocked at how quickly the value of your books, clothes, electronics, and kitchen gadgets adds up.

Here are a few easy ways to tackle this:

- The Spreadsheet Method: Just open a spreadsheet and make columns for the item, its brand, when you bought it, and what it would cost to replace today.

- Use An App: There are tons of apps out there designed for home inventories. You can snap pictures of your stuff, upload receipts, and have it all organized on your phone.

- Shoot a Video: Simply walk through your apartment with your phone, recording a video. Talk through what you own and call out anything particularly valuable. Just be sure to save the video file somewhere safe, like a cloud storage service.

Step 2: Figure Out Your Coverage Needs

Once your inventory is done, you can confidently choose your coverage limits. The grand total from your inventory tells you how much personal property coverage you need. I always recommend rounding up to the nearest thousand dollars, just in case.

Next up is liability coverage. Most standard policies will start you off with $100,000, which is a solid baseline for many people. But if you have a dog, entertain guests often, or have built up some savings, it’s a smart move to bump that up to $300,000 or even $500,000. It costs very little to add a lot of extra protection.

Expert Tip: Pay close attention to high-value items like jewelry, art, or high-end electronics. Standard policies put caps on these categories, often around $1,500 for jewelry, for instance. If your engagement ring or camera collection is worth more than that, you’ll need to add a "rider" or "endorsement" to insure those items for their full, appraised value.

Step 3: Shop Around and Compare Quotes

This is the golden rule of insurance: never, ever take the first offer you get. The only way to find the best deal is to shop around and get quotes from at least three different companies.

A great place to start is with your current car insurance provider. Most companies give you a nice discount for bundling policies. The process of getting car insurance quotes online is a lot like this one and can save you a bundle.

When you start comparing, remember to look past the monthly price tag. The cheapest policy isn't a bargain if it's from a company with terrible customer service or a claims process that makes you want to pull your hair out. A simple checklist can help you evaluate each offer on its own merits.

Renters Insurance Policy Comparison Checklist

To make this easier, I've put together a table you can use to compare quotes from different providers side-by-side. Just fill in the blanks as you get your quotes.

| Feature To Compare | Provider A | Provider B | Provider C |

|---|---|---|---|

| Monthly Premium | (e.g., $18/mo) | (e.g., $15/mo) | (e.g., $22/mo) |

| Personal Property Limit | (e.g., $30,000) | (e.g., $30,000) | (e.g., $30,000) |

| Liability Limit | (e.g., $300,000) | (e.g., $100,000) | (e.g., $300,000) |

| Deductible | (e.g., $500) | (e.g., $1,000) | (e.g., $500) |

| Coverage Type | RCV | RCV | ACV |

| Available Discounts | (e.g., Bundle, Safety) | (e.g., Bundle) | (e.g., None) |

| Customer Service Rating | (e.g., 4.5/5 stars) | (e.g., 3.8/5 stars) | (e.g., 4.7/5 stars) |

Laying everything out like this makes it immediately obvious where the real differences are. You'll quickly see which company offers the best overall value, not just the rock-bottom price.

Filing A Claim When Disaster Strikes

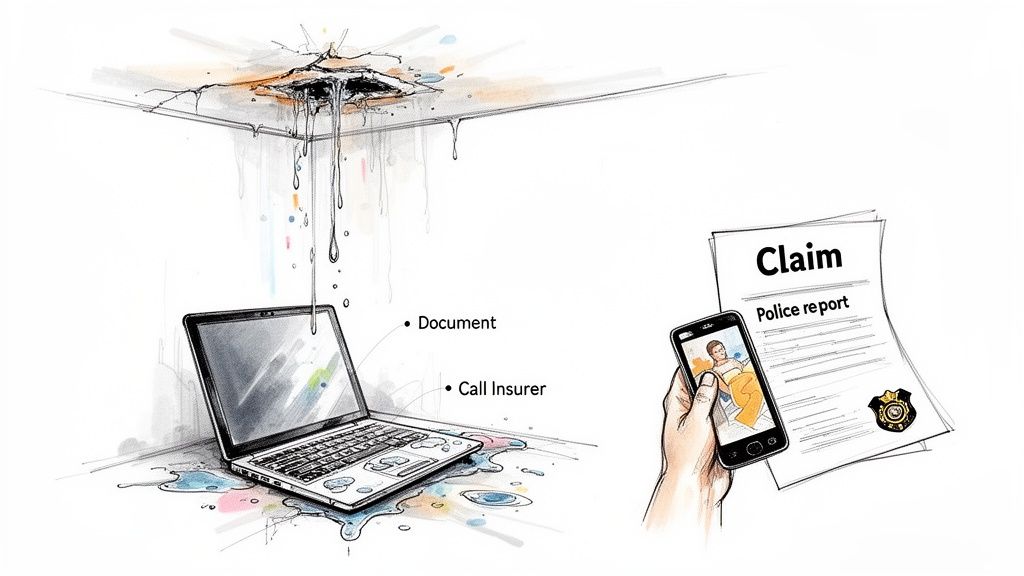

The last thing you want to deal with after a fire or theft is a mountain of complicated paperwork. Thankfully, filing a renters insurance claim is usually a pretty straightforward process, especially if you know what to expect. Think of it as a clear roadmap to getting your life back in order.

Immediate Steps After an Incident

What you do in the first few minutes and hours after something happens can make a huge difference in how smoothly your claim goes.

First things first: make sure you're safe. If there's a fire, get out. If you've been robbed, call the police and wait for them to arrive before you go inside. Your safety is always priority number one.

Once it's safe, your next job is to stop any further damage. If a pipe bursts and you can safely shut off the main water valve, do it. If a storm breaks a window, cover the opening with a tarp. Insurance policies actually expect you to take reasonable steps to prevent the problem from getting worse.

Document Everything Thoroughly

Remember that home inventory you made? This is where it becomes your best friend. But you also need to document the actual damage that just occurred. Pull out your smartphone and go to town.

Take tons of photos and videos of everything that was affected. Get shots from different angles and distances.

- Capture the cause: If you can see the leaky pipe or the broken door lock, get a clear picture of it.

- Show the scope: Take wide-angle photos of the entire room to give a sense of the full scale of the mess.

- Detail individual items: Get close-ups of your ruined laptop, soaked furniture, or any other damaged belongings.

This visual proof is powerful. It makes it much harder for anyone to downplay the severity of your loss.

Initiating Your Claim

Okay, the immediate crisis is over and you've documented the scene. Now it’s time to get in touch with your insurance company. Most insurers let you start a claim online, through their mobile app, or by calling a 24/7 claims hotline.

To make the call go smoothly, have this info handy:

- Your Policy Number: This lets them find your file in seconds.

- Date and Time of the Incident: Be as specific as you can.

- A Detailed Description: Explain exactly what happened, clearly and simply.

- Police or Fire Department Report Number: If you have one, this is gold. It adds a ton of credibility to your claim.

Once your claim is filed, the insurance company will assign a claims adjuster to your case. This person will be your main point of contact. They'll work with you to verify your losses and figure out your final payout. The key to a fast resolution is to be organized, get back to them quickly, and communicate clearly.

Smart Ways To Lower Your Insurance Costs

Getting your head around what your renters insurance covers is half the battle. The other half? Learning how to be a smart shopper to get the best possible price without skimping on crucial protection.

The good news is that insurers have plenty of straightforward discounts that can shave a surprising amount off your monthly premium. With a little proactive effort, you can keep your coverage solid and your costs down.

One of the quickest wins is to bundle your policies. If you already have car insurance, give your provider a call. Ask them what kind of deal they can offer for adding a renters policy to the mix. Insurance companies love loyal customers, and combining plans can easily save you 5% to 15% on both.

Proactive Steps for Lower Premiums

Insurers are all about risk. The less risky you appear, the lower your premium will be. This means that anything you do to make your rental safer can translate directly into savings.

You can often get a discount for installing basic safety features, such as:

- Smoke detectors and carbon monoxide alarms

- A fire extinguisher (especially in the kitchen)

- Deadbolt locks on your doors

- A monitored security system or burglar alarm

Think about it from their perspective: these simple devices make a fire or a break-in less likely, which means they’re less likely to have to pay out a claim. It’s a win-win.

Another powerful move is to choose a higher deductible. Your deductible is simply the amount you agree to pay out-of-pocket on a claim before the insurance company steps in. Bumping it up from, say, $250 to $1,000 can make a real dent in your premium. Just make sure you have enough in savings to comfortably cover that higher amount if something happens.

A higher deductible tells the insurance company you won't be filing small, nitpicky claims. It shows you're willing to handle the minor stuff yourself, which makes you a lower-risk (and more attractive) customer. You take on a little more potential cost upfront for a guaranteed discount every single month.

Maintain and Review Your Policy

Finally, don't forget about your financial habits and the importance of a regular check-up on your policy. A good credit score can actually lead to better insurance rates, as many companies use it as one of their rating factors.

It's also a great idea to review your coverage once a year. Life changes—you might have bought more stuff or gotten rid of things. You could be paying for too much coverage, or you might be eligible for new discounts you didn't know about. This kind of annual financial review is just one of many money-saving strategies for 2025 that can boost your overall financial well-being.

Your Top Renters Insurance Questions, Answered

Alright, even after covering the basics, a few specific questions always seem to pop up. Think of this as the "what if" section, where we tackle the common scenarios and clear up any lingering confusion. Let's dive into the questions we hear most often from renters just like you.

1. Is Renters Insurance Legally Required?

No, there are no state or federal laws that mandate you purchase renters insurance. However, many landlords and property management companies require it as a condition of the lease. They do this to protect their property from damage you might cause and to reduce their own liability.

2. What's the Difference Between My Landlord's Insurance and My Own?

This is the most critical distinction. Your landlord's policy covers the physical building—the structure, walls, and roof. Your renters insurance covers your personal belongings inside the apartment, protects you from liability claims if someone is injured, and pays for temporary living expenses if the unit becomes uninhabitable.

3. Are My Roommates Covered By My Policy?

Almost always, no. A standard policy covers you and resident relatives (like a spouse or child). A roommate is not considered a relative and needs their own separate policy to protect their belongings and cover their own liability. While some insurers may allow you to add a roommate, it can complicate claims, so separate policies are highly recommended.

4. What If My Laptop Gets Stolen From My Car? Is That Covered?

Yes, this is a great benefit of renters insurance. Your personal property coverage is "off-premises," meaning it travels with you. If your laptop is stolen from your car or a hotel room, your renters policy would cover the loss (minus your deductible). Your auto insurance would cover damage to the car itself, like a broken window.

5. How Much Liability Coverage Do I Really Need?

Most policies start with a standard limit of $100,000. For many renters, this is sufficient. However, if you have significant assets to protect, own a pet (especially certain dog breeds), or frequently host guests, it's wise to increase your limit to $300,000 or even $500,000. The cost to increase liability coverage is typically very small.

6. Are Floods and Earthquakes Covered?

No, standard renters insurance policies explicitly exclude damage from floods and earthquakes. These events require separate, specialized policies. If a pipe bursts and floods your apartment, that's covered. If a river overflows and floods your building, that is not.

7. Does My Policy Cover Damage Caused By My Pet?

It depends. The liability portion of your policy typically covers injuries your pet causes to another person (e.g., a dog bite). However, it will not cover damage your pet does to your own apartment, such as chewing carpets or scratching walls. Always be upfront about pets when getting a quote, as some dog breeds may be excluded by certain insurers.

8. What Exactly Is A "Rider" Or "Endorsement"?

A rider (or endorsement) is an add-on to your policy that provides extra coverage for specific high-value items. Standard policies have sub-limits for categories like jewelry, fine art, and electronics (often capped at $1,500). A rider allows you to insure a specific item, like an engagement ring, for its full appraised value.

9. What About Bed Bugs? Am I Covered?

Unfortunately, no. Renters insurance policies do not cover damage or removal costs associated with bed bugs, rodents, or other pest infestations. Insurers view pest control as a routine maintenance issue, not a sudden and accidental loss.

10. What Happens If I Move?

Your policy can move with you. Simply notify your insurance provider of your new address before you move. They will update your policy and adjust your premium based on the new location's risk factors—it may go up or down. This ensures you have continuous coverage without any gaps.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

At Top Wealth Guide, we're committed to giving you the knowledge to make smart financial decisions that protect your assets and build your future. Learn more about securing your wealth at https://topwealthguide.com.