Most people think options trading is only for experienced investors making risky bets. That’s simply not true.

At Top Wealth Guide, we’ve seen beginners generate steady monthly income using straightforward options strategies that don’t require complex analysis or constant monitoring. This guide shows you exactly how.

In This Guide

What Options Actually Are and How They Work

An option is a contract that gives you the right, but not the obligation, to buy or sell an asset at a specific price before a set date. That distinction matters more than most beginners realize. When you own a stock, you commit to holding it. When you own an option, you control whether to act on it.

Call options and put options Explained

A call option gives you the right to buy an asset at a predetermined price, called the strike price. A put option gives you the right to sell at that strike price. You pay an upfront cost called the premium to obtain this right. If the option expires without being used, you lose only the premium you paid, nothing more.

This is why options work for income strategies: you can sell options to other traders and pocket the premium they pay you, regardless of whether the option gets exercised. A call option gives its holder the right to buy 100 shares of the underlying security at the strike price, anytime before the option’s expiration date. This scaling matters when you calculate your real costs and potential income.

How Strike Price and Expiration Impact Your Returns

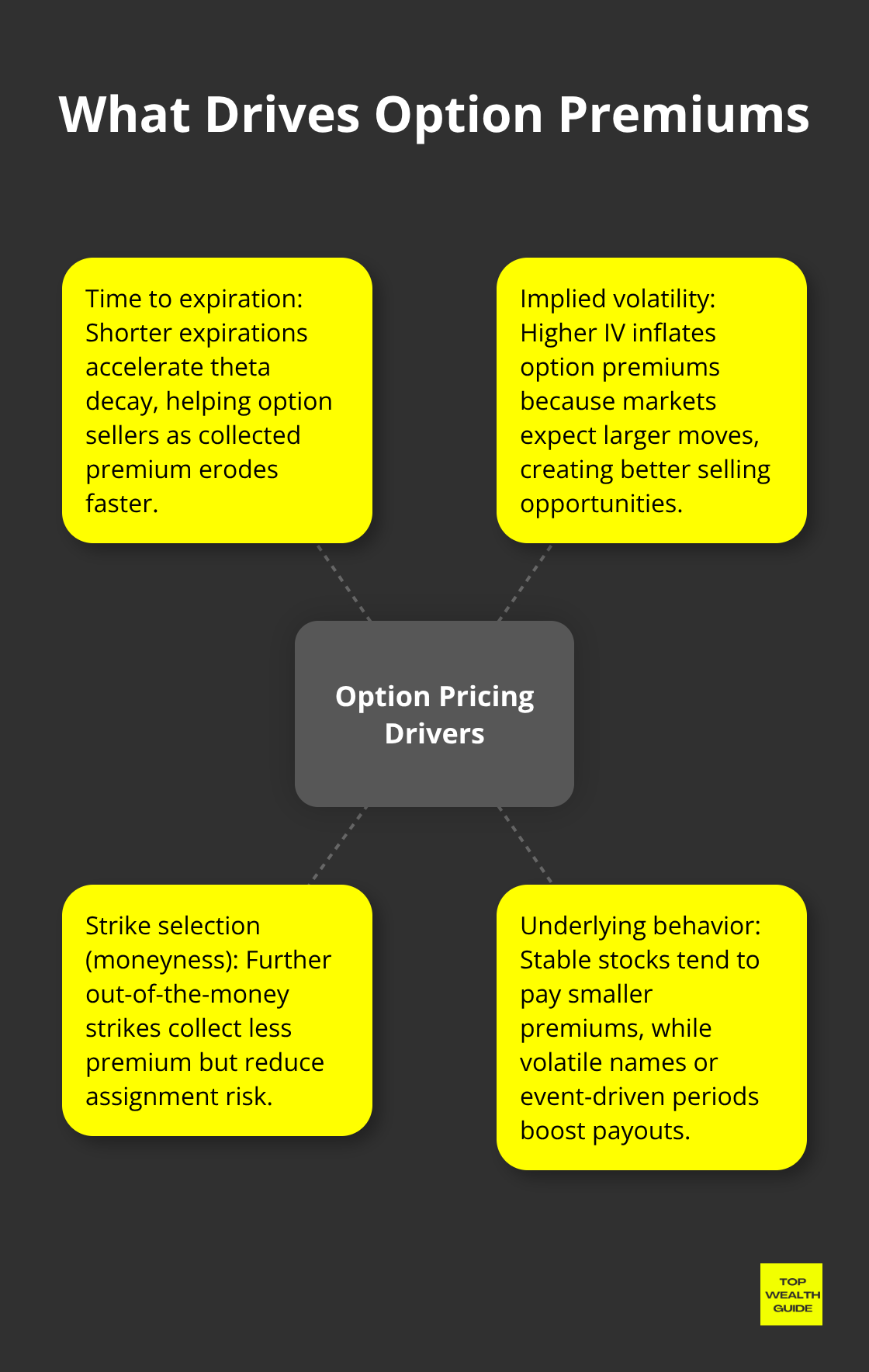

The strike price is the exact level at which you can buy or sell the underlying asset. Expiration dates range from days to months, and this timing directly impacts how much premium an option costs. An option that expires in 30 days costs far less than one that expires in 6 months because less time exists for the underlying price to move dramatically.

As expiration approaches, the option’s value decays faster, a phenomenon called theta decay. This decay works in your favor if you sell options for income: you collect premium upfront and watch it shrink as time passes, locking in profit. For beginners targeting steady income, shorter expirations like 30 to 45 days offer the best balance between premium collection and manageable risk.

Implied Volatility: The Hidden Pricing Factor

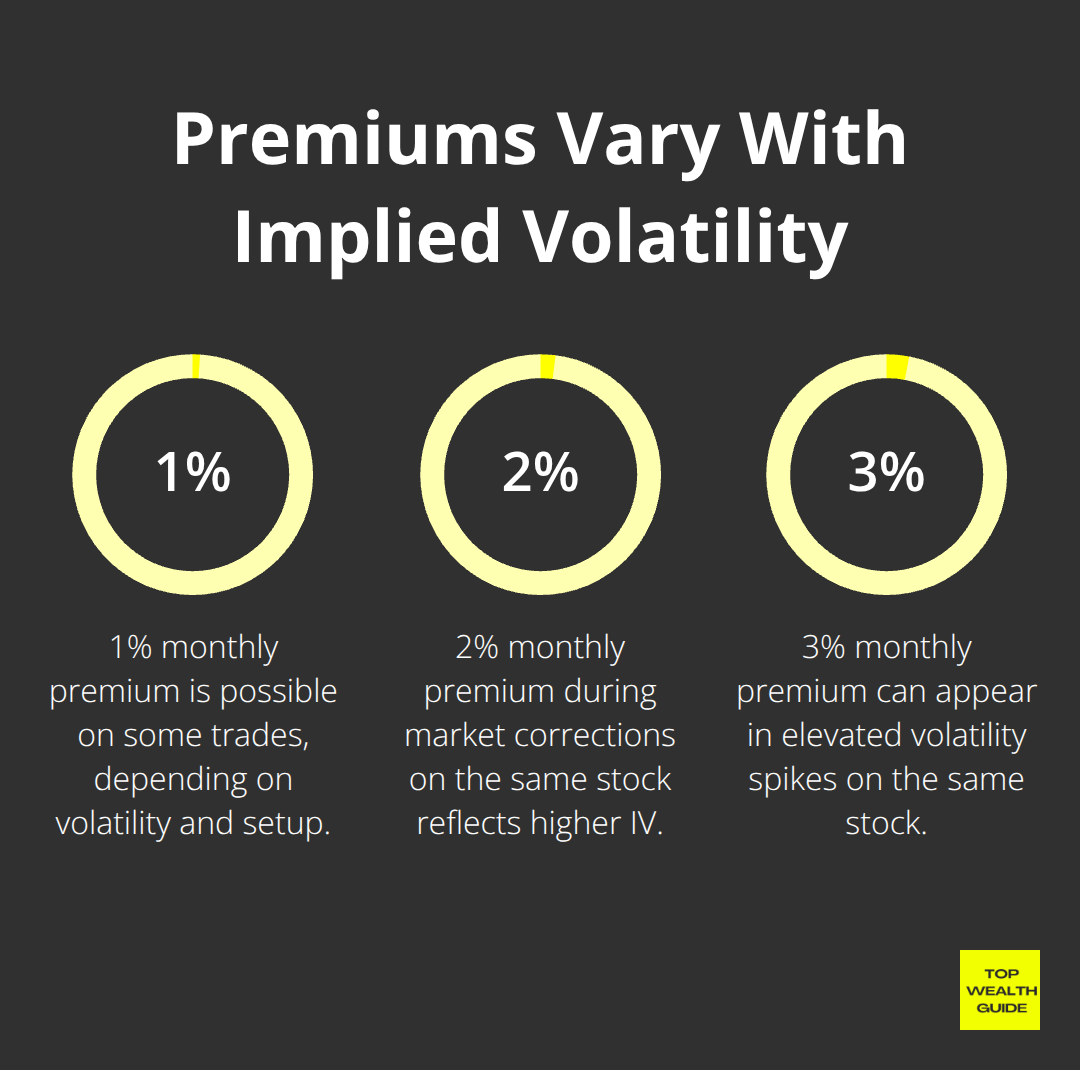

Implied volatility measures how much the market expects the asset to move, and it affects pricing significantly. When implied volatility is high, option premiums are expensive, creating better selling opportunities for income traders. When it’s low, premiums are cheap, making selling less attractive.

Comparing implied volatility to historical realized volatility tells you whether an option is overpriced or underpriced relative to actual movement. This comparison is essential because it reveals whether the market has priced in too much risk (or too little). Understanding this relationship helps you identify when to sell options and when to wait for better conditions.

Now that you understand how options work and what drives their prices, you’re ready to explore the specific income strategies that beginners can implement with confidence.

Three Income Strategies That Actually Work for Beginners

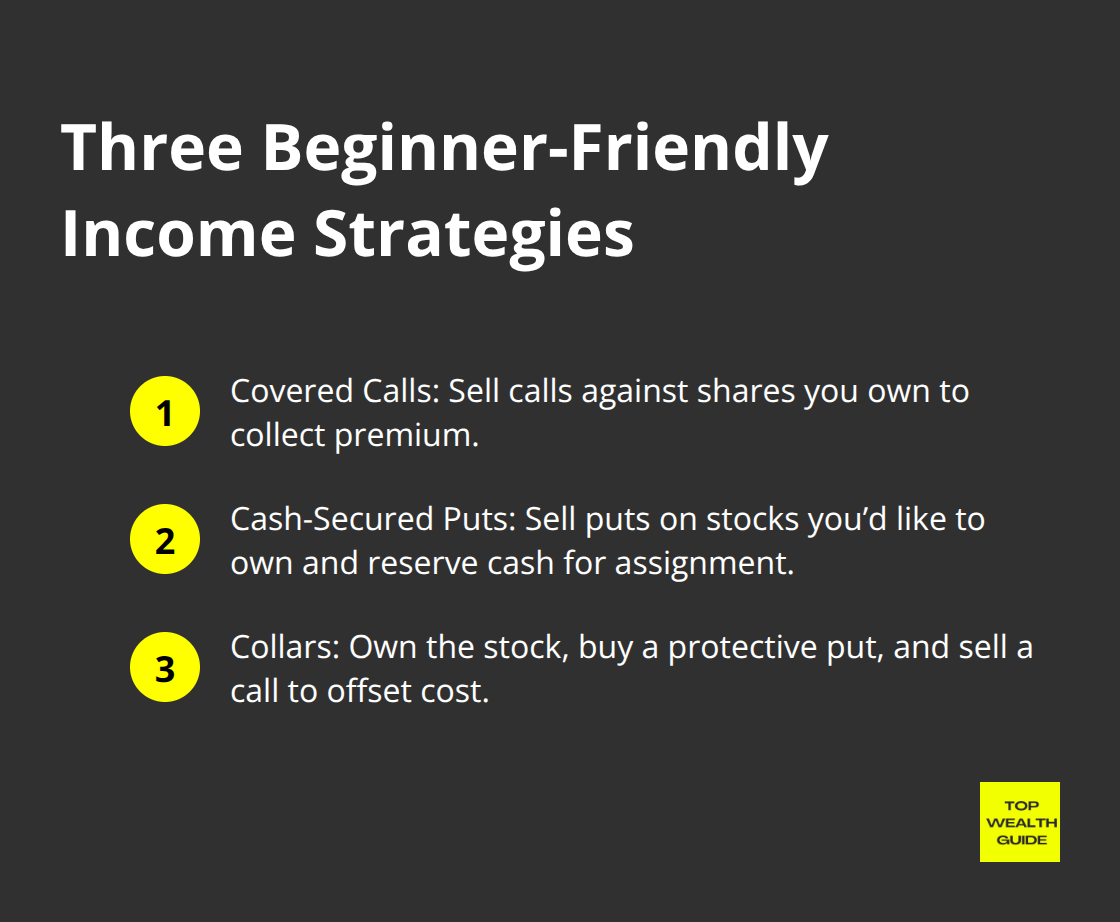

Covered Calls: Your First Income Stream

Covered call writing remains the simplest entry point for beginners seeking monthly income. You own shares of a stock you already hold, then sell call options against those shares. When you sell the call, you pocket the premium immediately. If the stock stays below the strike price at expiration, the option expires worthless and you keep both the shares and the premium. If the stock rises above the strike price, your shares get called away at that price, but you still keep the premium plus the gain from the stock appreciation.

On a $150,000 portfolio of stable stocks, selling monthly covered calls on 30 to 45 day expirations can generate $500 to $1,500 per month depending on volatility and strike selection. The downside is real: your upside becomes capped at the strike price you choose, so you trade unlimited gains for steady cash flow. This trade-off makes sense only if you’re comfortable holding the stock long-term anyway. Try selling calls at strikes 5-10% above the current price, giving yourself room to profit if the stock rises modestly while collecting meaningful premium.

Cash-Secured Puts: Income Without Ownership

Cash-secured puts work differently and suit beginners with cash sitting idle. You sell a put option on a stock you’d genuinely like to own at a lower price, then set aside enough cash to buy 100 shares if assigned. If the stock drops and you get assigned, you purchase those shares at your chosen strike price, which becomes your cost basis. If the stock stays above your strike, the put expires worthless and you pocket the premium without owning anything.

Cash-secured puts work best when implied volatility is elevated, typically during market corrections. Selling puts on quality stocks with 30 to 45 day expirations can yield 1-3% monthly premium on your cash, far better than money market rates. The trap most beginners fall into is selling puts on stocks they don’t want to own just to chase premium, which violates the core principle: only sell puts on companies you’d buy at that price.

Collar Strategies: Protecting Gains While Earning Income

Collar strategies protect existing gains while generating income, combining three legs into a single position. You own stock that has appreciated significantly, buy a protective put at a lower strike to cap losses, then sell a call at a higher strike to pay for the put. Done correctly, the put and call premiums nearly offset each other, costing you little to nothing.

Your maximum loss becomes fixed at the put strike, your maximum gain is capped at the call strike, and you pocket any remaining premium as income. This approach works exceptionally well after a stock has doubled or tripled and you want to lock in most of the gain while staying exposed to further upside within defined boundaries. The mechanics require a margin account and careful strike selection, but the payoff is peace of mind: you stop worrying about giving back your gains in a sudden correction.

Each of these three strategies operates on the same fundamental principle: you collect premium upfront and let time decay work in your favor. The choice between them depends on your current holdings and what you want to accomplish. Beginners often make critical mistakes when implementing these strategies, and understanding those pitfalls before you start trading separates consistent income generators from those who lose money quickly.

Where Beginners Lose Money in Options Trading

Trading Without a Written Plan

The gap between understanding how options work and actually profiting from them is where most beginners fail. Traders who implement covered calls, cash-secured puts, and collars without a structured framework consistently underperform those with written rules. The first mistake is trading without a documented plan that specifies exactly when you’ll enter a position, what strike price you’ll target, how many contracts you’ll sell, and most importantly, when you’ll exit if the trade moves against you.

A trader with $150,000 in capital who sells covered calls on five different stocks simultaneously without calculating maximum loss across all positions is essentially gambling. Write down your rules before you place a single trade: how much premium must an option offer relative to the underlying stock’s volatility, what’s your maximum loss tolerance per trade, how many contracts will you sell given your account size, and what happens if you get assigned. Traders who skip this step often panic when a stock drops sharply after they’ve sold puts, then sell the put position at a loss to stop the bleeding, crystallizing losses that would have recovered if they’d simply held until expiration.

Position Sizing Mistakes That Destroy Accounts

The second critical error is overusing leverage and selling far too many contracts relative to your account. A beginner with $30,000 in a margin account selling 10 put contracts on a single stock exposes themselves to a $100,000 maximum loss if assigned, far exceeding their account value. This violates basic position sizing: your maximum loss on any single trade should never exceed 1-3% of your total account.

If you’re selling cash-secured puts on a $50 stock with $30,000 available, selling just three contracts ties up $15,000 in buying power and limits your maximum loss to $3,000, which is 10% of your account. That’s still aggressive for a beginner. Most successful income traders cap their position size at 1-3% maximum loss per trade, which means fewer contracts but far better odds of surviving inevitable losing streaks.

Ignoring Implied Volatility Costs You Money

The third mistake is ignoring implied volatility entirely and selling options indiscriminately. When implied volatility is low, option premiums shrivel dramatically, but beginners often don’t notice because they’re focused only on the strike price and expiration. A covered call on a stable utility stock might offer only 0.5% premium per month when IV is depressed, while the same stock during a market correction might offer 2-3% premium.

The difference between selling at 0.5% and 2% compounds massively over a year. Check the IV rank or IV percentile before every trade: if it’s below the 30th percentile historically, the premium isn’t worth the risk. Your options broker likely offers this data directly in the platform. Discipline around these three areas separates traders generating consistent passive income from those who blow up their accounts or abandon options trading entirely after a few losing months.

Final Thoughts

Open an account with a broker that offers robust options tools and educational resources-Charles Schwab, TD Ameritrade, and Interactive Brokers all provide real-time implied volatility data, Greeks calculations, and screeners that help you identify high-premium opportunities. Your broker choice matters because poor tools lead to poor decisions. Paper trade for at least two weeks before risking real money, and most brokers offer free simulated accounts where you can practice selling covered calls, cash-secured puts, and collars without financial consequences.

Start small with a single strategy on a single stock and master covered calls on one holding before expanding to multiple positions or adding cash-secured puts to your playbook. Write your trading rules, stick to position sizing limits of 1-3% maximum loss per trade, and check implied volatility before every entry. These three habits separate traders who generate consistent monthly income from those who abandon options trading after losing money.

Options trading for beginners works best when you treat it as a systematic income source, not a speculation tool. Visit Top Wealth Guide for additional resources on building passive income streams and long-term wealth strategies that complement your options income approach. Your first month of steady premium collection will prove that options trading isn’t complicated or risky when executed with a plan.