Rising interest rates hit bond investors hard. When the Federal Reserve raised rates from near zero in 2022 to over 5% by 2023, bond prices fell sharply across the market.

At Top Wealth Guide, we show you how to protect your bond investing portfolio and actually profit from higher rates. This guide covers proven strategies that work when rates climb, plus the tools you need to adjust your holdings today.

In This Guide

How Bond Prices Fall When Interest Rates Rise

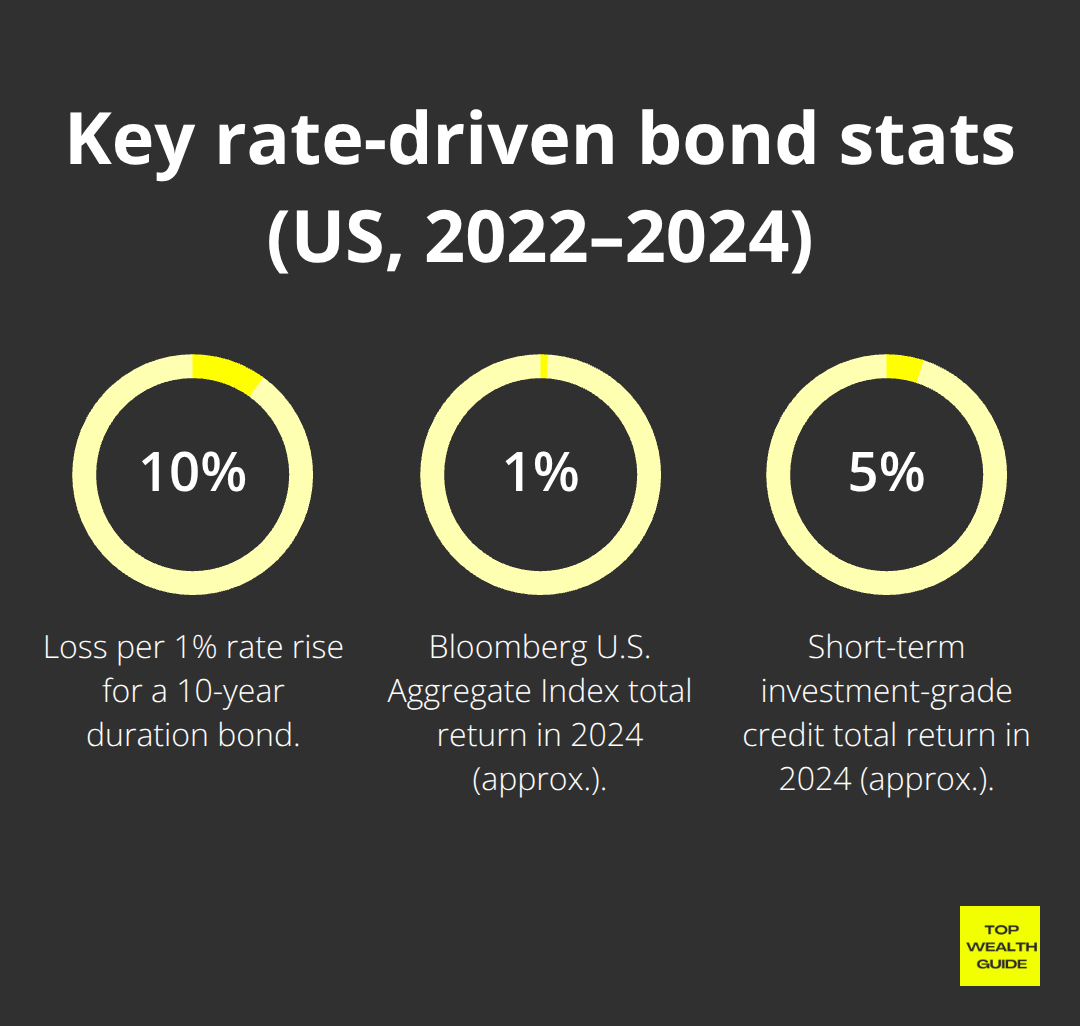

When the Federal Reserve raised rates from near zero in 2022 to over 5% by 2023, existing bond holders faced significant losses. Here’s what happened in real terms: a bond with a 10-year duration lost approximately 10% of its value for every 1% increase in interest rates. This inverse relationship between rates and bond prices is not theoretical-it’s how bond math works. When new bonds hit the market offering 5% yields, older bonds paying 2% become less attractive. Buyers will only purchase those lower-yielding bonds at a discount, which means their prices drop. According to J.P. Morgan Asset Management, the 10-year U.S. Treasury yield traded between 3.60% and 4.70% in 2024, ending the year up more than 70 basis points.

This volatility explains why many bond investors saw their portfolios decline sharply during this period.

Duration Determines Your Rate Risk

Duration is the metric that predicts how much your bond will lose if rates rise. A bond with 10 years of duration will lose roughly 10% if rates climb 1%, while a bond with 3 years of duration loses only about 3%. This is why shorter-duration bonds provide real protection in rising-rate environments. According to J.P. Morgan Asset Management, 1–5 year investment-grade credit yields around 4.9% with approximately 2.5 years of duration. If rates drop 100 basis points, that position could generate roughly 7% total return. Conversely, if rates rise 100 basis points, you’d see about 2% return. This asymmetry matters: shorter bonds protect your downside while still delivering meaningful income. In 2024, short-term investment-grade credit returned about 5%, demonstrating that you don’t sacrifice returns when you shorten duration.

Market Performance Proves Duration Matters

The Bloomberg U.S. Aggregate Index rose only about 1% in 2024, while short-term investment-grade credit returned approximately 5% and high-yield bonds delivered around 8%. This data from Bloomberg and J.P. Morgan Asset Management proves that positioning matters significantly. Duration risk isn’t just a number-it directly impacts your actual returns. When rates stabilize at higher levels, bonds that mature earlier allow you to reinvest at those elevated yields, compounding your income. The starting yield of the U.S. Aggregate Index near 5% provides a cushion against rate volatility and supports potential total returns going forward, according to J.P. Morgan Asset Management.

Why Reinvestment Rates Matter Now

Your bond portfolio’s performance depends entirely on how much duration risk you carry and whether you position yourself to benefit from higher reinvestment rates. When you hold shorter-duration bonds, maturing principal hits your account sooner, allowing you to lock in today’s elevated yields before rates potentially shift again. This timing advantage compounds over years. Adjusting your portfolio’s duration now rather than waiting for perfect conditions puts you ahead of investors who remain overexposed to rate risk. The strategies that work in rising-rate environments all share one characteristic: they reduce your exposure to duration risk while maintaining or increasing your income. Understanding this principle opens the door to the specific tactics that protect and grow your wealth.

Four Proven Strategies for Rising Rate Environments

Shorter-duration bonds cut your rate risk dramatically, but they represent only one piece of the puzzle. Multiple approaches work best when combined to maximize income while protecting principal. The most effective investors layer several strategies rather than relying on a single tactic.

Floating-Rate Bonds and Money Market Alternatives

Floating-rate bonds automatically adjust their coupons as rates rise, meaning your income increases when the Federal Reserve tightens policy. According to J.P. Morgan Asset Management, money market funds have grown toward nearly $7 trillion, reflecting demand for safety. Moving from money market funds into front-end bond exposure-those 1 to 5 year investment-grade bonds yielding around 4.9% with 2.5 years of duration-boosts your yield substantially with modest additional risk. This transition captures higher returns without exposing you to excessive duration risk.

High-Yield Bonds and Municipal Opportunities

High-yield corporate bonds and municipal bonds offer compelling alternatives when positioned correctly. Municipal bonds deliver tax-equivalent yields for investors in higher tax brackets. The key is selectivity: diversify across at least 10 issuers to reduce credit risk, and focus on bonds from companies or municipalities with stable fundamentals. This approach protects you from concentrated exposure while capturing the income these sectors provide.

Bank Loans and Tactical Positioning

Bank loans represent another tactical option, though they require careful evaluation. These securities feature floating coupons tied to benchmark rates like SOFR, which means your income rises with rate increases. However, bank loans typically settle in up to 20 days and may include call provisions that limit your upside potential. High-yield funds often exclude callable bonds to address this constraint, but you must review fund documentation before investing to understand what you’re actually holding.

Bond Laddering and Barbell Strategies

Bond laddering-purchasing individual bonds maturing at regular intervals across multiple years-separates itself as the most practical approach for hands-on investors. A ladder spanning 1 to 10 years with bonds from different quality levels lets you reinvest maturing principal at progressively higher rates as the Fed’s cycle advances. For example, buying five bonds maturing in years one through five means you receive principal back annually, giving you five opportunities to lock in current yields before rates potentially decline. Schwab offers a CD and Treasury Ladder Builder tool that simplifies this construction process.

If individual bond management feels overwhelming, consider a barbell strategy instead: combine very short-term bonds (maturing in 3 months to 3 years) with longer-term bonds (7 to 10 years), skipping intermediate maturities. This approach captures higher yields on longer bonds while maintaining liquidity and reinvestment flexibility through shorter positions. Active fixed-income managers can exceed benchmark yields through allocation across non-benchmark sectors to capture additional income while managing risk, according to J.P. Morgan Asset Management. For taxable accounts, mixing individual municipal bonds with taxable corporates creates tax efficiency while diversifying your income sources.

Taking Action in Today’s Rate Environment

The current environment-with the Fed expected to stabilize rates at higher levels in 2025-rewards investors who act now. Each strategy reduces your vulnerability to further rate increases while positioning you to benefit from the elevated yields available today. Your next step involves selecting which approach aligns with your time commitment and risk tolerance, then implementing the specific tactics that fit your situation.

Executing Your Bond Strategy With the Right Tools

Knowing which strategies work in rising-rate environments means nothing without the ability to measure them accurately and monitor your progress. The tools available today let you calculate duration impact before you invest, compare ETF performance in real time, and automate rebalancing decisions that would otherwise require constant attention.

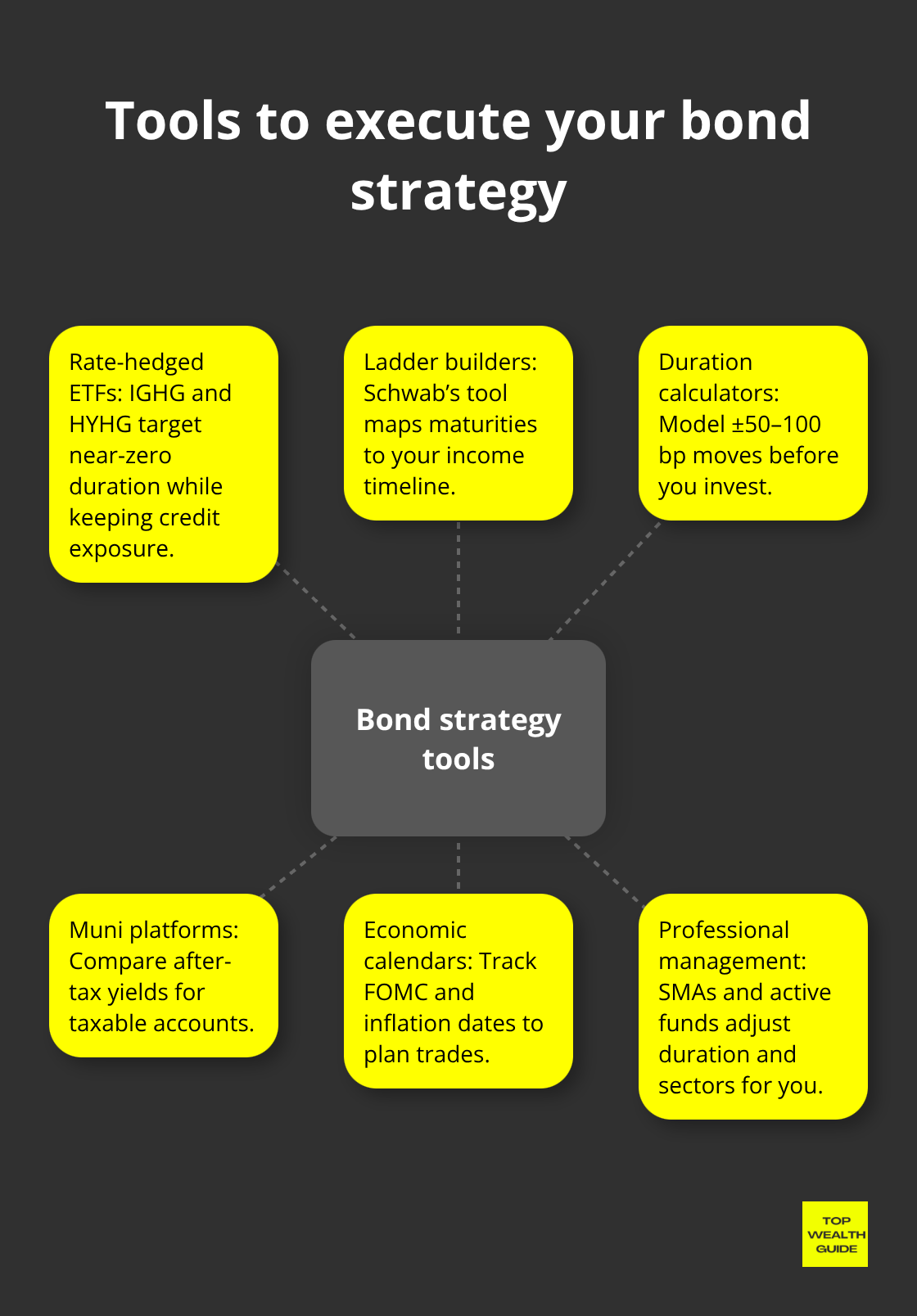

Rate-Hedged ETFs for Duration-Neutral Exposure

ProShares offers two rate-hedged bond ETFs worth examining: IGHG for investment-grade bonds and HYHG for high-yield exposure, both engineered to achieve near-zero duration using Treasury futures. These funds target a duration of virtually zero while maintaining credit exposure, meaning you capture spread income without suffering from rising rates. The FTSE High Yield (Treasury Rate-Hedged) Index and the FTSE Investment Grade (Treasury Rate-Hedged) Index underpin these vehicles, providing a transparent methodology you can evaluate independently. However, understand that no hedge is perfect-monthly resets mean outcomes vary with market moves, so review fund documentation carefully before committing capital.

Bond Ladder Construction Tools

For those building bond ladders manually, Schwab’s CD and Treasury Ladder Builder tool eliminates guesswork from maturity selection and reinvestment scheduling. The platform lets you specify your desired income timeline and shows exactly which maturities to purchase to align with your goals. Duration calculators from major brokers help you model what happens to your portfolio if rates move 50 or 100 basis points in either direction. This scenario analysis prevents surprises and forces you to confront your actual risk tolerance before deploying real money.

Municipal Bond Platforms and Tax Efficiency

Municipal bond platforms provide after-tax yield comparisons that matter tremendously for taxable accounts. These platforms show you exactly which securities deliver superior returns on an after-tax basis, eliminating the need for manual calculations. Comparing yields across taxable and tax-exempt options reveals opportunities that raw yield numbers alone would miss. Understanding investment accounts and their tax treatment helps you select the right structure for your bond holdings.

Interest Rate Forecasting and Economic Calendars

Interest rate forecast tracking through the Federal Reserve Bank of San Francisco and Bloomberg Terminal data helps you time ladder additions and understand where yields might head next. Most brokers offer free economic calendars flagging FOMC announcements and inflation reports that move rates, letting you anticipate volatility rather than react to it. These resources transform rate movements from surprises into predictable events you can prepare for in advance.

Professional Management for Complex Strategies

Active fixed-income managers and separately managed accounts implement these strategies under professional oversight, adjusting duration and sector allocation as conditions shift without requiring you to execute trades yourself. This approach suits investors who prefer hands-off management while still maintaining strategic control over their bond exposure and risk parameters.

Final Thoughts

Rising interest rates transform bond investing, but they don’t eliminate your opportunity to build wealth through fixed income. The strategies we’ve covered-shortening duration, laddering maturities, exploring floating-rate bonds, and using rate-hedged ETFs-all protect your principal while capturing the elevated yields available today. Start by assessing your current portfolio’s duration and calculate what happens if rates rise another 100 basis points or fall by the same amount (this scenario analysis reveals whether you carry excessive rate risk or position yourself appropriately for current conditions).

Next, select which strategy fits your situation. If you prefer hands-on management, construct a bond ladder with maturities spanning one to ten years across at least ten different issuers. If you want professional oversight, explore separately managed accounts or active fixed-income funds that adjust positioning as rates shift. For investors seeking simplicity, rate-hedged ETFs like IGHG and HYHG eliminate duration risk while preserving credit exposure, and the Fed’s expected stabilization of rates at higher levels throughout 2025 creates a window to lock in today’s yields before conditions change.

The tools to execute these strategies are readily available-Schwab’s ladder builder simplifies maturity selection, duration calculators model rate scenarios, and municipal bond platforms reveal tax-efficient opportunities. Visit Top Wealth Guide to explore additional resources on building and protecting your wealth across all asset classes. Your bond portfolio doesn’t need to suffer in rising-rate environments when you implement the right strategy today.