The whole debate really boils down to one core concept: Term life is temporary, affordable protection, while whole life is permanent coverage that includes a savings and investment tool. The right choice for you hinges on a simple question: Do you just need a straightforward safety net for a specific period, or are you looking for a lifelong financial instrument to build and protect wealth?

In This Guide

- 1 Your Quick Answer to the Whole Life vs Term Life Debate

- 2 How Each Insurance Policy Actually Works

- 3 Comparing the True Cost of Premiums Over Time

- 4 The Cash Value Component: Is It a Good Asset?

- 5 Choosing the Right Policy for Your Life Stage

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. Can I convert a term policy to a whole life policy?

- 6.2 2. What is the "buy term and invest the difference" strategy?

- 6.3 3. Are whole life dividends guaranteed?

- 6.4 4. What happens if I can no longer afford my whole life premiums?

- 6.5 5. Is the death benefit from life insurance taxable?

- 6.6 6. How do I decide how much life insurance coverage I need?

- 6.7 7. Is it a good idea to own both policy types?

- 6.8 8. Are cash value loans better than bank loans?

- 6.9 9. What are the most important policy riders to consider?

- 6.10 10. How does my health affect premiums for each policy type?

Your Quick Answer to the Whole Life vs Term Life Debate

Deciding between whole and term life insurance is a cornerstone of any solid financial plan. This isn't just about what happens after you're gone; it's a decision that directly impacts your monthly budget, shapes your investment strategy, and can even define how you pass on wealth to the next generation.

Term life insurance is incredibly straightforward. You select a coverage period—usually 10, 20, or 30 years—and pay a fixed premium. If you pass away within that term, your beneficiaries get a tax-free payout. It's purpose-built to cover you during your most financially vulnerable years, like when you're paying off a mortgage or raising kids.

Whole life, on the other hand, is a different animal altogether. As a form of permanent life insurance, it’s designed to cover you for your entire life, provided you keep paying the premiums. A portion of every payment you make contributes to a cash value account that grows on a tax-deferred basis, creating an asset you can borrow against down the road.

Core Differences at a Glance: Term Life vs. Whole Life

To truly get a handle on the whole life vs term life conversation, it helps to see their key characteristics laid out clearly. This table strips away the noise and focuses on what really separates these two policies.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | For a specific term (e.g., 20 years). Protection is temporary. | Lifelong. Protection is permanent as long as premiums are paid. |

| Premiums | Significantly lower and typically fixed for the initial term. | Substantially higher but are guaranteed to remain level for life. |

| Primary Purpose | Income replacement and debt coverage during critical years (e.g., while raising a family). | Lifelong protection, estate planning, and tax-advantaged wealth accumulation. |

| Cash Value | No. It is a pure insurance product with no savings or investment component. | Yes. A portion of the premium builds a tax-deferred cash value that grows over time. |

| Complexity | Simple and straightforward to understand and purchase. | More complex, involving cash value growth, dividends, and loan provisions. |

Grasping these fundamental distinctions is your starting point. The right policy is rarely a one-size-fits-all answer; it depends entirely on your personal financial landscape, your long-term goals, and what helps you sleep at night.

Of course, the policy is only as good as the company behind it. Finding a great fit means exploring options from the best life insurance companies known for their financial stability and competitive products. This guide is here to give you the detailed analysis you need to make that choice with total confidence.

How Each Insurance Policy Actually Works

Before you can confidently decide between whole life vs term life, you really need to get under the hood of each one. They serve fundamentally different purposes. One is a pure, straightforward protection tool, while the other is a much more complex financial instrument designed to do two things at once.

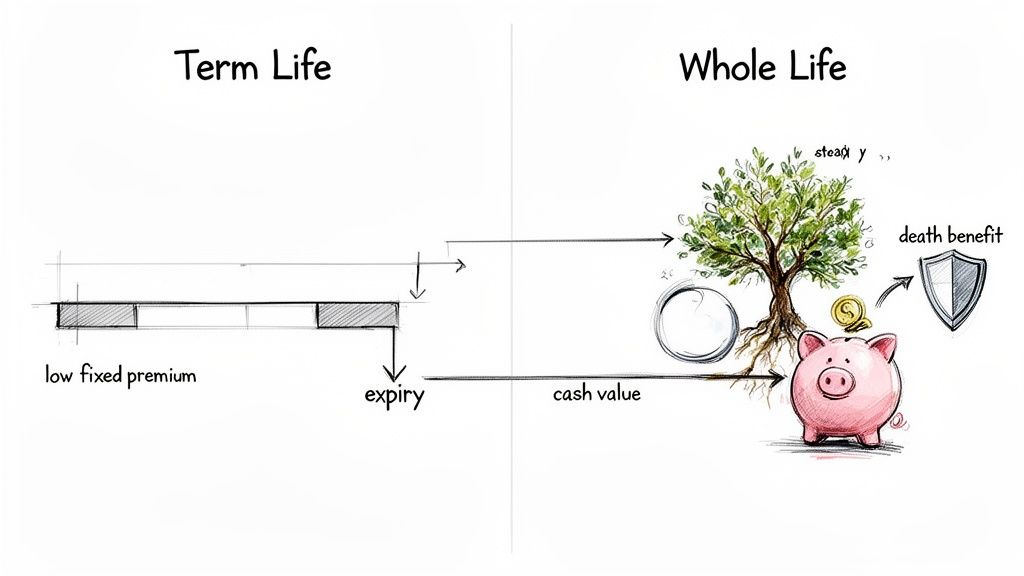

Term life insurance is built on a simple, transparent idea. You're paying for pure protection for a specific amount of time, which makes it an incredibly powerful and affordable safety net when your financial responsibilities are at their peak.

The Mechanics of Term Life Insurance

The easiest way to think about term life is to compare it to renting an apartment. You pay a fixed rent (your premium) for a set lease (the policy term, say, 20 years) to secure the apartment (your life insurance coverage). If you die during that lease, your family gets the full payout. Simple as that.

Most policies sold today are level term, which is great for budgeting because it means your premium and your death benefit are locked in for the entire period. No surprises.

But what happens when the term is up? You’ve got a few choices:

- Let it expire. If the kids are grown and the mortgage is paid off, you might not need the coverage anymore.

- Renew it. Most policies allow you to renew on an annual basis, but be warned—the premiums will jump significantly because you're older.

- Convert it. Many term policies have a built-in conversion feature, letting you switch to a whole life policy without needing to pass another medical exam.

The whole point is protection when you need it most. You can dive deeper into this no-frills approach in our guides to term life insurance.

Demystifying Whole Life Insurance

If term life is like renting, whole life is more like buying a house. Part of your payment (the premium) covers the insurance cost, but another part builds up equity (the cash value). It's a policy designed to cover you for your entire life, bundling insurance with a financial asset.

So, this policy is really doing two jobs at the same time:

- It provides a death benefit. This is a permanent, guaranteed death benefit that pays out to your beneficiaries whenever you pass away, as long as you've kept up with the premiums.

- It builds cash value. A portion of every premium you pay gets funneled into a cash value account. This money grows on a tax-deferred basis at a guaranteed minimum rate.

A key feature of "participating" whole life policies is the potential to earn dividends. While not guaranteed, these are paid out when the insurance company performs well. You can use them to buy more coverage, pay down your premiums, or simply take the cash.

This dual function explains why people choose one over the other. In the United States, which accounts for about 40% of all global life insurance premiums, the numbers are telling. Whole life policies made up 36% of new individual premiums, nearly double the 19% share held by term life.

This shows that, despite the higher cost, many people see real value in the wealth-building side of permanent insurance. It’s also why many savvy planners use both types of policies to build a more resilient financial strategy. You can see the full breakdown on how different households use these policies at insuranceandestates.com. This kind of hybrid approach can make a family significantly more prepared for unexpected financial shocks.

Comparing the True Cost of Premiums Over Time

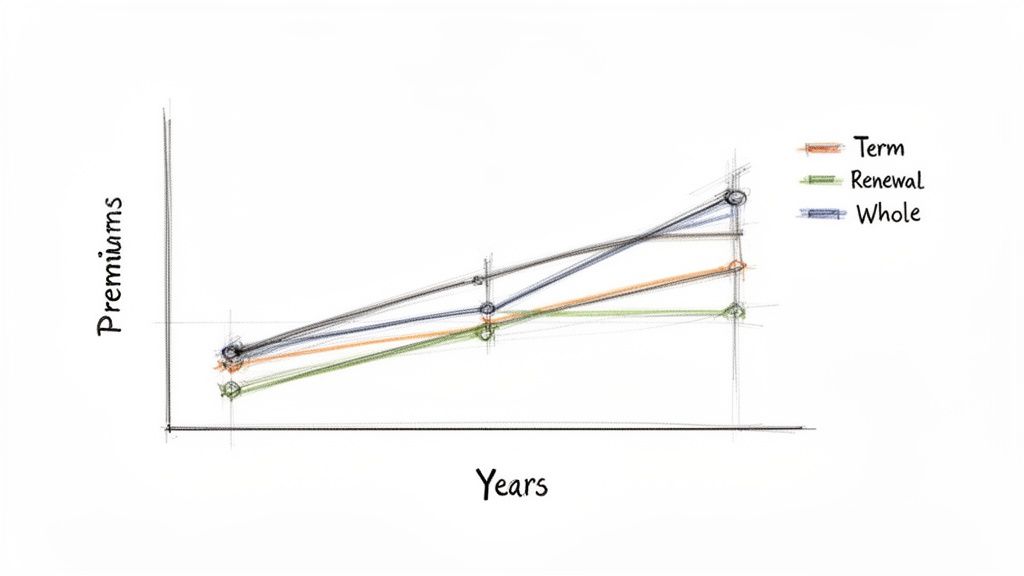

When you get right down to it, the single biggest difference between whole life and term life is the cost. It's not just a small gap—it’s a massive financial gulf that directly impacts how much money you have left over for other investments.

This premium difference is the central trade-off. For a healthy 30-year-old non-smoker who needs a $500,000 death benefit, the numbers are jarring. You're looking at around $21 per month for a 20-year term policy, but that number skyrockets to about $440 per month for a whole life policy with the same payout. That’s 21 times more.

This isn’t an anomaly; this pattern holds true across different ages and genders. The initial sticker shock is often the first major hurdle for anyone considering whole life.

The Term Life Premium Trajectory

Term life insurance is designed to be straightforward and affordable. You pick a term—usually 10, 20, or 30 years—and your premium is locked in for that entire period. This makes budgeting a breeze, especially for young families managing a new mortgage and other major expenses.

But here’s the catch: term life is temporary by design. Once your term is up, you'll face a choice. If you still need coverage, renewing your policy will be incredibly expensive because the new rate is based on your older age and any health issues you may have developed.

The strategy with term life is simple: cover yourself during your highest-earning years when your financial obligations are greatest. The goal is to become self-insured through savings and investments by the time the term runs out.

The Whole Life Premium Structure

Whole life works on a totally different principle. The premiums are much higher from the start, but they are guaranteed to never increase for as long as you live. You're essentially overpaying in the early years to fund the much higher cost of insurance when you're older.

This level premium gives you lifelong certainty. You’ll never be hit with a sudden rate hike or find that your coverage has become unaffordable. This stability is a key reason people use whole life as a permanent part of an estate plan or as a long-term financial tool. To dig deeper, you can explore more about life insurance rates and how they factor into your overall financial picture.

Sample Annual Premium Comparison ($500,000 Coverage)

To see how these costs play out in the real world, let's look at some sample annual premiums for a healthy non-smoker seeking $500,000 of coverage. The difference is stark and only widens with age.

| Age | 20-Year Term Life (Male) | Whole Life (Male) | 20-Year Term Life (Female) | Whole Life (Female) |

|---|---|---|---|---|

| 30 | $252 | $5,280 | $216 | $4,560 |

| 40 | $360 | $7,920 | $312 | $6,840 |

| 50 | $864 | $13,200 | $672 | $11,040 |

As the table shows, the upfront cost for term life is a fraction of what you'd pay for whole life. This is the financial firepower behind the popular "buy term and invest the difference" strategy.

A Real-World Cost Scenario

Let's make this tangible with an example. Imagine two 35-year-olds, Alex and Ben, who both need $500,000 of coverage.

- Alex chooses Term Life: He locks in a 20-year term policy for $30 per month. Over the next two decades, his total cost for pure protection will be $7,200.

- Ben chooses Whole Life: He goes with a whole life policy with a $470 per month premium. Over the same 20 years, Ben will have paid $112,800.

The difference in what they paid is a staggering $105,600. This is the core of the debate. While Ben is building a guaranteed cash value inside his policy, Alex has an extra $440 every single month to invest in stocks, real estate, or his business—assets with higher growth potential, though they also come with market risk. Your choice really boils down to whether you prioritize guarantees or growth potential.

The Cash Value Component: Is It a Good Asset?

The biggest difference between whole life and term life comes down to one feature: cash value. It’s the dividing line. Term life is straightforward protection. If you pass away during the term, your family gets a payout. Simple.

Whole life, on the other hand, is a different animal entirely. It’s part insurance, part savings account. A slice of every premium you pay gets funneled into a cash value account that grows over your lifetime. This dual nature is really the heart of the whole life vs. term debate.

This cash value doesn't just sit there, either. It’s designed to grow in a few specific ways. First, you get a guaranteed minimum interest rate from the insurer, which provides a stable floor. Second, that growth is tax-deferred, letting it compound without an annual tax bill dragging it down. And if you have a "participating" policy, you might also earn non-guaranteed dividends. The result is a predictable financial asset that’s insulated from the wild swings of the stock market.

How Cash Value Really Works for You

You can think of the cash value as a sort of supercharged savings account. Because the growth isn't taxed each year like the interest in a regular savings account, your money can compound much more effectively over decades.

But here’s the real kicker: that money is yours to use while you're still alive. This liquidity is what turns a whole life policy from a simple safety net into a flexible financial tool. It’s a game-changer for many people.

You generally have three ways to get your hands on that money:

- Policy Loans: You can borrow against your cash value. There’s no credit check, the interest rates are often reasonable, and best of all, the money you receive isn't considered taxable income. It’s a powerful way to fund big-ticket items.

- Withdrawals: You're allowed to pull out funds up to the amount you've paid in premiums (your "basis") without paying any taxes.

- Surrendering the Policy: If you no longer need the coverage, you can cancel the policy and walk away with the cash value. Just be aware that you'll owe income tax on any growth your money has seen.

The Trade-Off: Guarantees vs. Opportunity Cost

So, what's the catch? The safety and tax perks of cash value come at a price: a lower rate of return than you could likely get by investing in the stock market. The guaranteed growth is great for peace of mind, but it’s probably not going to keep pace with a solid index fund over 30 years.

This is exactly where the "buy term and invest the difference" argument comes from. Proponents of that strategy believe they can get far better returns by investing the money they save on cheaper term premiums, even with market risk. Whole life, in contrast, prioritizes slow, steady, tax-advantaged growth.

Let’s look at a quick example to see how this plays out in the real world.

Real-Life Example: Funding a Business Launch

Meet Sarah, a 40-year-old entrepreneur. She's owned a whole life policy for 15 years and has built up $75,000 in cash value. She needs $50,000 to get a new business off the ground, but she's not thrilled about the idea of jumping through hoops for a bank loan.

- Whole Life Path: Sarah simply takes out a $50,000 policy loan. The process is fast, nobody runs her credit, and the rate is locked in. While the loan is outstanding, her death benefit is reduced by that amount, but the policy stays in force and her remaining cash value keeps growing. She gets the capital she needs, tax-free and hassle-free.

- Term Life Alternative: If Sarah only had a term policy, that $75,000 asset wouldn't exist. To get the money, she'd have to apply for traditional financing or sell other investments, which could mean paying capital gains taxes and losing future growth potential.

This scenario really shows how cash value can act as your own private source of capital for whatever life throws at you. To see how this fits into a bigger financial picture, you can find more articles on whole life insurance and its many uses. In the end, deciding which path is right for you boils down to your own comfort level with risk and what you want your money to accomplish.

Choosing the Right Policy for Your Life Stage

The debate between whole life and term life isn’t about which one is universally “better.” It’s about matching the right tool to your specific circumstances at a particular point in your life. The best policy for a 28-year-old with a new baby looks completely different from what a 55-year-old business owner needs for their exit strategy.

This is where we get practical. Your age, income, net worth, and what you want your money to accomplish are the real drivers behind the decision. Let's walk through a few common scenarios to see how this plays out in the real world.

The Young Family on a Budget

For most young families, cash flow is king. You're juggling a new mortgage, childcare costs, maybe even student loan debt. The biggest financial risk you face is the unexpected loss of an earner, which could leave your partner struggling to keep everything afloat.

The goal here is simple: maximum protection for the lowest possible cost. This is exactly where term life insurance shines.

A 20 or 30-year term policy can provide a massive death benefit for a surprisingly manageable monthly premium. It protects your family during their most financially vulnerable years without draining the funds you need for daily living or other critical goals, like funding your retirement accounts.

The High-Net-Worth Individual

Once you move into high-net-worth territory, your concerns often shift from replacing lost income to preserving and transferring wealth. The primary challenge becomes managing estate taxes, which can take a significant bite out of your assets before they ever reach your heirs.

This is where whole life insurance becomes a powerful strategic tool. Its permanent death benefit is designed to pass to your beneficiaries income-tax-free, providing instant liquidity to cover estate taxes without forcing your family to sell off real estate or stock portfolios.

The cash value itself becomes a unique asset class within a diversified portfolio. It grows with guarantees, is insulated from market swings, and can be accessed tax-free through policy loans, making it a cornerstone of sophisticated estate planning.

The Established Business Owner

Business owners have their own unique set of financial puzzles to solve, like planning for succession, protecting against the loss of a key employee, or funding buy-sell agreements. A whole life policy is remarkably versatile for these complex needs.

- Succession Planning: The policy's cash value can serve as a ready source of capital to fund a buyout or provide a financial cushion during a leadership transition.

- Key Person Insurance: Taking out a policy on a crucial employee gives the business the funds it needs to recruit and train a replacement if that person passes away unexpectedly.

- Emergency Capital: An owner can take tax-free loans against the cash value to inject capital into the business during a downturn or to jump on a new opportunity—all without dealing with a bank.

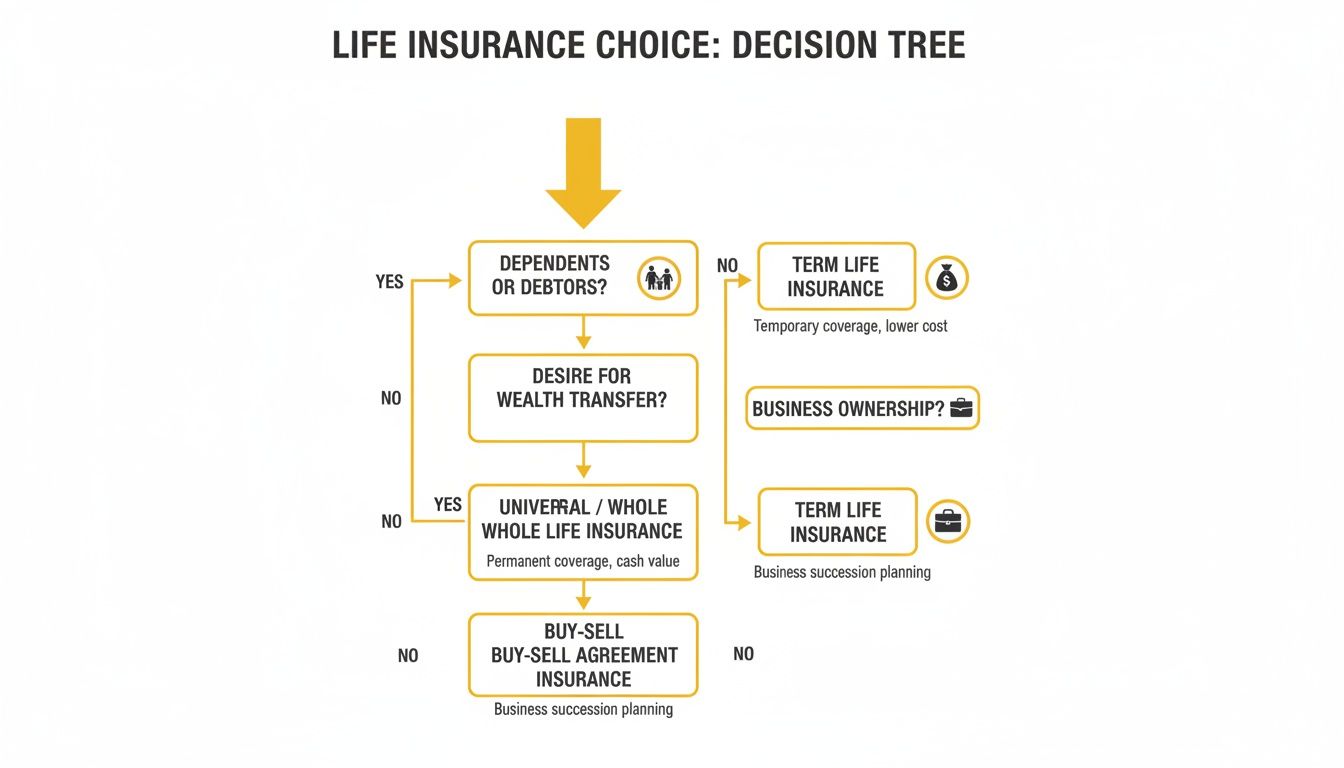

This decision tree infographic does a great job of visualizing how different life circumstances naturally lead you toward either term or whole life.

As you can see, term life is the go-to solution for temporary, high-need situations. Whole life, on the other hand, is built for permanent, wealth-focused objectives.

Making a Confident Decision

So, how do you make the final call? It really comes down to answering a few honest questions about your financial reality and your long-term goals. This table breaks it down based on your primary objective.

| If Your Primary Goal Is… | The Better Choice Is Likely… | Why It Fits |

|---|---|---|

| Protecting your family while paying off a mortgage. | Term Life | It provides the highest death benefit for the lowest cost during the specific period you have major debt. |

| Creating a tax-free inheritance for your heirs. | Whole Life | The permanent, tax-free death benefit is ideal for efficient wealth transfer and estate planning. |

| Supplementing your retirement with a stable asset. | Whole Life | The cash value provides a tax-advantaged source of income that is not correlated with the stock market. |

| Covering college costs for your children if you pass away. | Term Life | A term policy can be timed to expire once your children are grown and financially independent. |

Ultimately, your life insurance strategy has to fit seamlessly into your broader financial plan. Think about how it complements your other investments and savings. For more on that, check out our guide on the best asset allocation by age. By understanding these nuances, you can pick the policy that truly works for you.

Frequently Asked Questions (FAQ)

When you're trying to decide between whole life and term life insurance, a lot of practical questions pop up. Let's tackle the most common ones head-on, so you can move forward with confidence.

1. Can I convert a term policy to a whole life policy?

Yes, most term policies include a "conversion privilege." This allows you to convert your term policy into a whole life policy without needing a new medical exam, which is invaluable if your health changes. This option typically has a deadline, so be sure to check the details of your specific policy.

2. What is the "buy term and invest the difference" strategy?

This is a popular financial approach where you purchase less expensive term life insurance and invest the money you save (the "difference" in premiums compared to a whole life policy). The goal is to potentially achieve higher returns through investments in stocks, bonds, or real estate, though this strategy comes with market risk and requires disciplined investing.

3. Are whole life dividends guaranteed?

No, dividends are not guaranteed. They are paid by mutual insurance companies when their financial performance is better than anticipated. While many reputable insurers have a long history of paying consistent dividends, they are not contractually obligated to do so.

You have several options thanks to the policy's cash value. You can use dividends to pay premiums, take a policy loan, convert the policy to "reduced paid-up" status (a smaller, fully paid-for policy), or surrender the policy for its cash value (though you may owe taxes on the gains).

5. Is the death benefit from life insurance taxable?

In nearly all cases, the death benefit from both term and whole life insurance is paid to your beneficiaries completely free of income tax. This is a primary benefit of life insurance. The main exception involves very large estates that may be subject to federal or state estate taxes.

6. How do I decide how much life insurance coverage I need?

A common rule of thumb is 10-12 times your annual income, but for a more accurate figure, calculate your family's specific needs. Add up your mortgage balance, other debts, future college costs for children, and the amount of income your family would need to replace. This is often called the DIME method (Debt, Income, Mortgage, Education).

7. Is it a good idea to own both policy types?

Yes, for many people, a hybrid approach is ideal. You can use an affordable term policy to cover large, temporary needs like a mortgage and raising children, while a smaller whole life policy can cover permanent needs like final expenses and leaving a legacy.

8. Are cash value loans better than bank loans?

They offer different advantages. Policy loans are fast, private, require no credit check, and offer flexible repayment. However, the interest rate may be higher than a secured bank loan, like a home equity loan. Remember that an outstanding loan reduces your death benefit until it's repaid.

9. What are the most important policy riders to consider?

Three of the most valuable riders are the Waiver of Premium (pays your premiums if you become disabled), the Accelerated Death Benefit (allows access to funds if you're terminally ill), and the Conversion Rider (guarantees your ability to convert a term policy to a permanent one).

Your health status is a major factor for both policy types. Insurers use your health profile to assign a risk class, which determines your premium. Since whole life premiums start much higher, a poor health rating can make a whole life policy significantly more expensive than a term policy with the same rating.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build lasting wealth. Explore our articles on stocks, real estate, and more to start making smarter investment decisions today. Visit us at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.