Penny stock trading attracts retail investors with promises of quick gains, but the reality is far harsher. Most traders lose money chasing these volatile, thinly traded stocks.

At Top Wealth Guide, we’ve seen firsthand how penny stocks can destroy portfolios faster than they build them. This guide shows you the real risks, proven strategies, and why most people should avoid them entirely.

In This Guide

Why Penny Stocks Have a Liquidity Problem That Kills Profits

The Bid-Ask Spread Trap

The moment you decide to sell a penny stock, reality hits hard. Penny stocks trade on OTC markets where bid-ask spreads often widen to 10-20% or more, meaning the price you see and the price you actually get differ dramatically. If a stock shows $2.50 on your screen but you need to sell immediately, you might only get $2.10. That gap erases gains before you pocket anything.

Liquidity dries up fastest during market downturns, exactly when you need to exit. A stock trading 5 million shares daily can suddenly see volume drop to 500,000 shares, trapping you in a position you wanted to abandon. The SEC defines penny stocks as having market caps under $250 million, and most trade so thinly that large position sizes create their own selling pressure-your exit actually pushes the price down further. A trader holding 50,000 shares of a stock with average daily volume of 100,000 faces a genuine problem: selling that position takes time and costs money through slippage.

Volatility and Price Manipulation

Volatility compounds the liquidity trap. Penny stocks swing 15-30% in a single trading session, and price manipulation thrives in this chaos. Pump-and-dump schemes remain prevalent because low market caps make prices easy to move with coordinated buying. Bad actors promote stocks through paid newsletters without disclosing their compensation, inflating prices artificially before dumping shares.

The Information Vacuum

Financial information disappears entirely on the Pink Sheets, where companies report to no one. Many penny stock issuers file no quarterly earnings, show no audited financials, and operate with zero transparency. You trade on rumors and hopes rather than facts. Organogenesis Holdings, trading around $2-3 historically, at least reports real revenue figures of $464.62 million annually, but most penny stocks don’t offer even that level of disclosure.

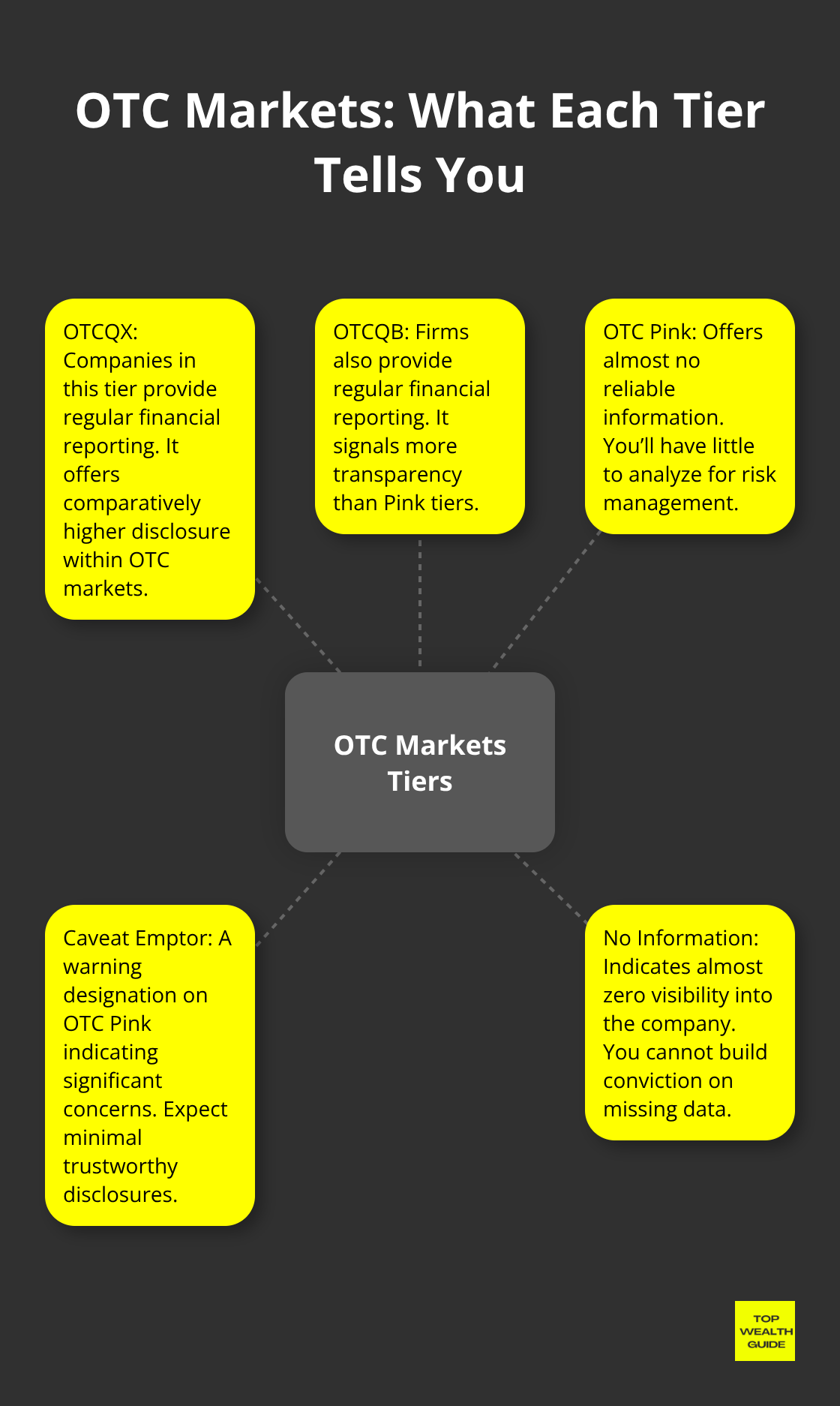

The OTC Markets tier system-OTCQX, OTCQB, and OTC Pink-reflects this information gap. OTC Pink stocks marked with Caveat Emptor or No Information designations give you almost nothing to analyze. You cannot build conviction on missing data, and you cannot manage risk without knowing a company’s debt levels or cash runway.

Why This Forces You Into Guesswork

This information vacuum forces you to gamble rather than invest. Gambling doesn’t belong in a wealth-building strategy, and the next section shows you exactly what responsible penny stock traders do to avoid these traps entirely.

How to Actually Protect Your Capital in Penny Stocks

Position Size Determines Your Survival Rate

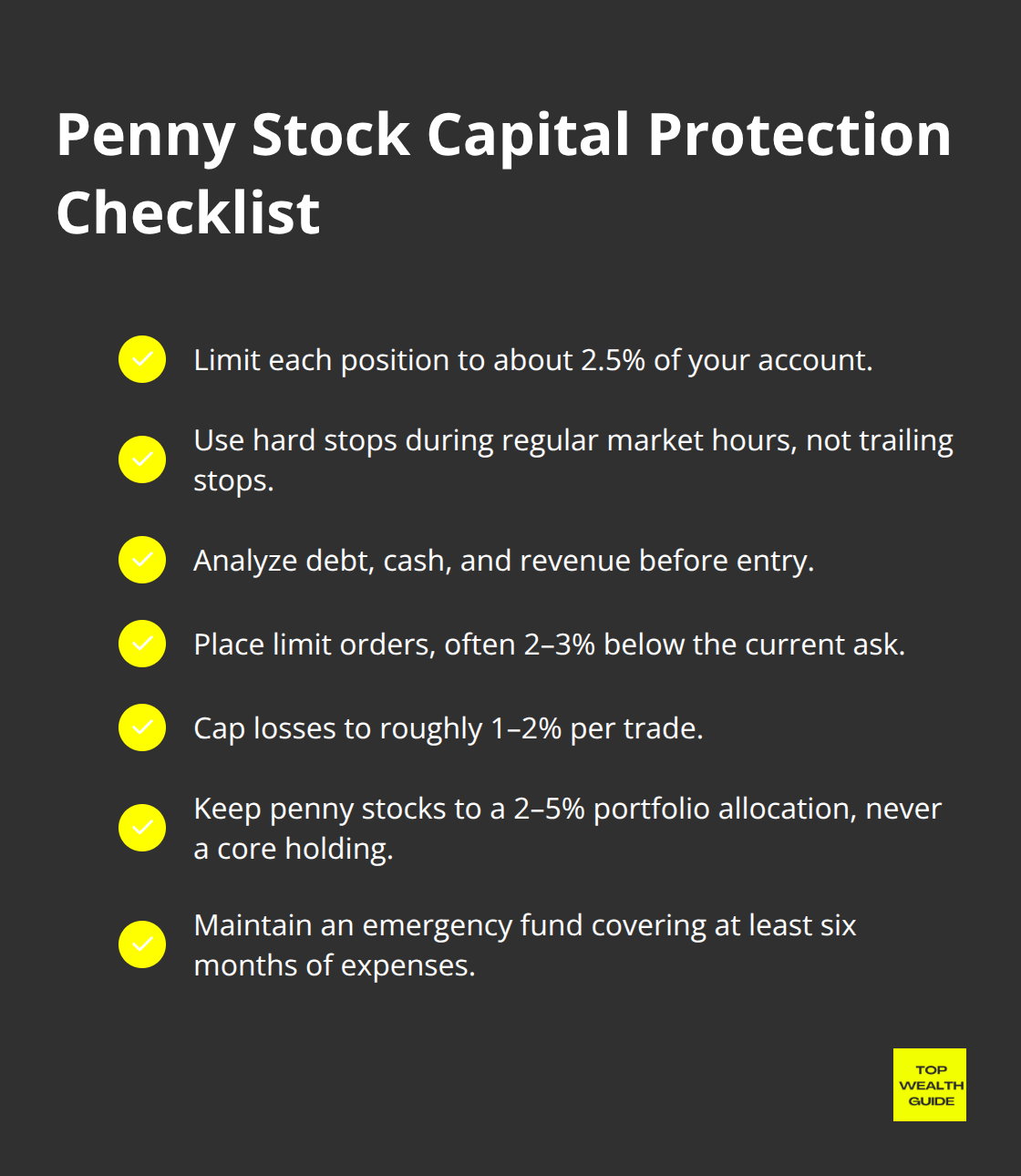

Penny stock traders who survive and occasionally profit follow one brutal rule: position size matters more than stock selection. A good starting point is 2.5% per trade, which limits your damage if the trade fails immediately. This sounds small until you realize most retail traders lose 5-10% on a single bad penny stock because they ignore sizing entirely. Organogenesis Holdings traders who held 10,000 shares at $3 and watched the stock crater to $1.50 lost $15,000 on a $30,000 initial investment-a 50% portfolio hit that takes years to recover from. That doesn’t happen if you cap position size properly and stop out at a defined level. The math is non-negotiable: if you trade a $100,000 account, one penny stock position should never exceed $2,500, and your maximum loss per trade should stay consistent with your sizing rule.

Hard Stops Beat Trailing Stops in Illiquid Markets

Trailing stops create a false sense of security in penny stocks because extended-hours trading and gap moves trigger stops at terrible prices before you see them coming. A hard stop executed during regular market hours protects you far better than hoping a trailing mechanism catches the right exit. You control the timing and the price, which matters enormously when liquidity vanishes.

Analyze the Balance Sheet Before You Buy

Research before buying means analyzing the balance sheet, not reading stocktwits forums or trading alerts. Check whether the company carries debt, how much cash it has on hand, and whether revenue actually exists. Zura Bio Limited trades under $5 but disclosed a Q3 net loss of $18.04 million against zero revenue-that’s a cash-burn story, not a growth story. Their cash runway exceeds two years, which matters, but the company is pre-revenue and bleeding money fast. Most traders skip this step and buy on hype. You need to know debt levels, cash position, and whether the business generates actual revenue before risking capital. OTC Markets’ tier classifications matter here: OTCQX and OTCQB tiers require regular financial reporting, while OTC Pink offers almost nothing. A company in the Current Information tier on OTC Pink at least files quarterly updates; one marked No Information gives you almost zero visibility.

Limit Orders Eliminate Emotional Entries

Limit orders are non-negotiable in penny stocks because market orders in illiquid stocks execute at whatever price someone is willing to accept, often 10-15% worse than the last traded price. If you place a market order to buy 5,000 shares and the bid-ask spread is $2.00 to $2.40, you might fill at $2.35 or $2.40 instead of the $2.00 you saw. On a $10,000 position, that spread costs you $200 instantly. Limit orders force discipline: you specify the exact price you’ll accept, and if the stock won’t trade there, you don’t buy. This eliminates FOMO-driven entries at terrible prices and keeps your entries mechanical and defensible. Try setting your limit order 2-3% below the current ask price and wait. If the stock doesn’t hit your price, it wasn’t a high-probability setup anyway.

The Real Test: Can You Execute These Rules?

Most traders understand these rules intellectually but abandon them the moment a stock moves 20% in their favor or against them. Discipline separates the traders who occasionally profit from those who consistently lose. Before you trade penny stocks, ensure you have a financial safety net in place-your emergency fund should cover at least six months of expenses so trading losses don’t derail your life. The next section shows you exactly what happens when traders ignore these protections-and what separates the rare winners from the rest.

What Actually Separates Penny Stock Winners From Everyone Else

Discipline Over Stock Selection

The rare traders who profit from penny stocks don’t win because they pick better stocks-they win because they follow mechanical rules that most traders abandon within weeks. Organogenesis Holdings illustrates this perfectly. The stock traded in the $2–$3 range historically, and traders who bought at $2.50, set a hard stop at $2.00 (limiting loss to 20%), and sold half their position at $3.75 locked in 50% gains on half their capital while letting the remainder run. That discipline separated them from traders who bought at $2.50, watched it spike to $4.00, got greedy holding for $5.00, then watched it crash back to $1.80 and held through the entire collapse hoping for recovery.

The difference wasn’t luck or stock selection-it was position sizing, defined stops, and mechanical exits.

Organogenesis raised 2025 earnings guidance despite prior losses, signaling improving profitability, yet even good fundamentals don’t protect traders who ignore risk rules. Most retail traders lose 5–10% annually on penny stocks because they violate three specific behaviors: they oversize positions on conviction plays, they move stops based on emotion, and they sell winners too early while holding losers hoping for rebounds. The math destroys them. A trader starting with a $50,000 account who loses 10% on three consecutive penny stock positions drops to $36,450-needing 37% gains just to break even. That recovery rarely happens in penny stocks because the same traders repeat the same mistakes.

How Corporate Actions Erase Gains

The patterns in failures repeat relentlessly across penny stocks. Zura Bio Limited trades under $5 with a Q3 net loss of $18.04 million against zero revenue, yet traders buy it anyway because an interim CEO appointment creates excitement and weekly volatility spikes 30–40%. Those spikes trap traders holding overnight positions after news, expecting continued momentum the next day, only to watch the stock gap down 15% at open when larger traders take profits.

Reverse splits consolidate existing shares into fewer, higher-priced shares without changing the company’s overall value, yet destroy positions faster than any price decline. Shares issued to fund operations or acquisitions water down existing shareholders, erasing 30–50% of gains in a single corporate action. A trader holding 10,000 shares worth $25,000 at $2.50 per share faces a 1-for-5 reverse split, suddenly owning 2,000 shares at $12.50 that nobody wants to buy because the stock now carries reverse-split stigma. That trader loses liquidity and momentum simultaneously.

What Winners Actually Research

Successful traders avoid these traps entirely by screening for debt levels, cash runway longer than two years, and actual revenue generation before risking a single dollar. Zura’s debt-free status and two-year cash runway matter, but pre-revenue means the company burns cash with no offsetting income-a losing position mathematically. Most penny stock traders skip this analysis and buy on technicals or alerts, which guarantees losses over time.

The traders who occasionally profit treat penny stocks as short-term tactical positions with defined time horizons-they enter on high-probability setups, exit when risk-reward windows close, and never hold overnight on news unless they’ve sized the position to survive a 30% gap down. That discipline requires treating penny stocks as 2–5% portfolio allocations maximum, never core holdings. The rare winners also diversify across three to five penny stocks instead of concentrating everything in one name, reducing single-stock disaster risk from 100% to 20–40% per position. This approach mirrors proven strategies that separate consistent performers from market noise.

Final Thoughts

Penny stock trading destroys more portfolios than it builds because most traders ignore the three rules that separate occasional winners from consistent losers: position sizing, mechanical stops, and fundamental analysis before entry. You cannot trade penny stocks successfully while violating these principles, and no amount of chart reading or alert-chasing changes that reality. A trader starting with $50,000 who loses 10% on three consecutive positions drops to $36,450 and needs 37% gains just to break even.

Penny stock trading works only when you treat it as a 2–5% portfolio allocation maximum, never as core holdings. You must cap losses at 1–2% per trade, diversify across three to five names instead of concentrating everything in one stock, and exit when the risk-reward window closes rather than holding overnight on news. Hard stops executed during regular market hours beat trailing stops in illiquid markets, limit orders eliminate emotional entries at terrible prices, and balance sheet analysis reveals whether a company burns cash or generates revenue.

Most people should avoid penny stocks entirely and focus instead on building wealth through diversified portfolios, consistent investing, and long-term fundamentals. At Top Wealth Guide, we help readers build sustainable wealth through practical strategies for long-term financial planning rather than speculative trades that destroy capital. The rare traders who profit from penny stocks follow discipline that most people abandon within weeks.

![Why Penny Stock Trading Can Make or Break Your Portfolio [2026] Why Penny Stock Trading Can Make or Break Your Portfolio [2025]](https://topwealthguide.com/wp-content/uploads/emplibot/penny-stock-trading-hero-1767892624-1024x585.jpeg)