Real estate depreciation is one of the most powerful—and often misunderstood—tools in an investor's tax-saving arsenal. It's a common misconception that this has anything to do with your property actually losing market value. In reality, it's a non-cash deduction the IRS allows you to take to account for the gradual wear and tear on your income-producing property.

This creates a "paper loss" that directly reduces your taxable income, letting you keep more of your hard-earned cash each year. For investors, mastering these rules is not just about compliance; it's about actively maximizing your investment's financial performance.

In This Guide

- 1 Why Depreciation Is a Real Estate Investor's Best Friend

- 2 How MACRS Works for Investment Properties

- 3 Getting Your Depreciable Basis Right

- 4 Boosting Deductions with Advanced Strategies

- 5 Understanding Depreciation Recapture When You Sell

- 6 Common Depreciation Mistakes and How to Avoid Them

- 7 Frequently Asked Questions About Real Estate Depreciation

- 7.1 1. Can I depreciate my personal residence?

- 7.2 2. What happens if I forget to claim depreciation for a few years?

- 7.3 3. How do I depreciate a major renovation, like a new kitchen?

- 7.4 4. Are state depreciation rules always the same as federal rules?

- 7.5 5. Why can't land be depreciated?

- 7.6 6. When can I start taking depreciation deductions?

- 7.7 7. What's the difference between a repair and an improvement?

- 7.8 8. Does refinancing affect my property's depreciable basis?

- 7.9 9. How does depreciation work after a 1031 exchange?

- 7.10 10. Is a cost segregation study worth the cost?

Why Depreciation Is a Real Estate Investor's Best Friend

Here's a simple way to think about it. Imagine you own a business that uses a delivery truck. That truck is a critical asset, but it gets worn down over time. You wouldn't write off the entire cost of the truck in the year you bought it. Instead, you'd deduct a piece of its cost each year over its "useful life." Real estate depreciation works the exact same way, but your "truck" is the building itself.

This annual deduction is a game-changer because it lowers your taxable rental income without you spending a single extra dollar. It’s a core reason why many successful investors consider real estate such a financially powerful asset. Understanding the depreciation rules is fundamental to maximizing your returns and building wealth, but it's important to first decide if real estate is a good investment for your portfolio.

Before we get into the nitty-gritty, let's nail down a few foundational concepts that every real estate investor must know.

Key Depreciation Concepts at a Glance

This table provides a quick overview of the essential terms and rules that form the foundation of real estate depreciation for investors.

| Concept | Brief Explanation | Why It's Important for Investors |

|---|---|---|

| Depreciable Basis | The value of the asset that can be depreciated. This is the building's value, not the land's. | This is the starting number for all your depreciation calculations. Getting it right is crucial. |

| Useful Life | The IRS-mandated period over which you can depreciate a property (27.5 or 39 years). | Determines how much you can deduct each year. A shorter life means larger annual deductions. |

| MACRS | The current tax depreciation system used in the U.S. (Modified Accelerated Cost Recovery System). | This is the official rulebook. You have to follow its methods and conventions. |

| Convention | Rules that determine when depreciation begins in the first year (e.g., Mid-Month). | Affects your first and last year's depreciation deduction, so it impacts your total tax savings. |

| Cost Segregation | An advanced strategy to separate property components into shorter depreciation periods. | Can significantly accelerate your deductions, providing a massive boost to cash flow early on. |

Understanding these terms is the first step toward using depreciation to your advantage. Now, let's dig into the most important rule of all.

The Golden Rule: Land vs. Building

There's one rule you absolutely must get right from the very beginning: you can only depreciate the building and its improvements, not the land.

From the IRS's perspective, land is an asset that never gets "used up" or wears out. It has an indefinite life, so it doesn't qualify for depreciation. This is a non-negotiable principle that underpins every depreciation calculation you'll ever make.

A huge part of setting up your investment correctly is allocating your property's purchase price between the land's value and the building's value. This is a critical step.

Key Takeaway: An incorrect allocation between land and the building is one of the most common—and costly—mistakes new investors make. Nail this from day one to ensure your deductions are accurate and can stand up to scrutiny.

How MACRS Works for Investment Properties

When it comes to real estate depreciation, the IRS has a specific playbook you need to follow called the Modified Accelerated Cost Recovery System (MACRS). The name sounds a lot more intimidating than it actually is. For real estate investors, the rules are surprisingly straightforward.

At its core, MACRS tells you the "useful life" of your property—the set number of years over which you can write off its cost. For buildings, the system uses a straight-line method. Just picture slicing a loaf of bread into perfectly even slices. You get to deduct the same amount of depreciation each full year your property is up and running.

The Two Magic Numbers: 27.5 and 39

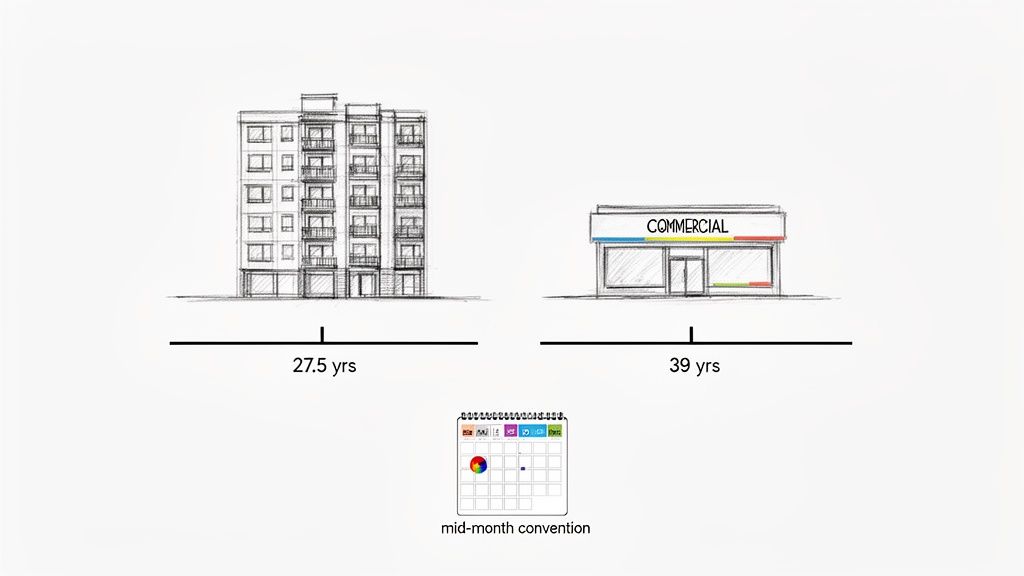

Under MACRS, every type of asset has a designated recovery period. For real estate investors, there are really only two numbers you need to burn into your memory.

- Residential Rental Property: This gets a 27.5-year recovery period. This bucket includes properties like apartment buildings, duplexes, and single-family rentals where at least 80% of the income comes from tenants living there.

- Commercial Property: This gets a much longer 39-year recovery period. Think office buildings, retail storefronts, warehouses, and industrial parks.

Getting this right is absolutely critical. Mixing up these two timelines is a common mistake that can throw off your deductions for years and attract unwanted attention from the IRS. The shorter recovery period for residential properties gives you a bigger annual deduction, making it a bit more powerful from a tax perspective. It's just one of the many crucial property investment tax deductions you should know about.

Real-Life Depreciation Examples

Let's walk through how this works in the real world with two common scenarios.

Example 1: A Residential Duplex

An investor, Sarah, buys a duplex for $400,000. Her local tax assessment values the land at 25% of the total property value. This means her building's value (her depreciable basis) is $300,000. Since it's a residential property, she uses the 27.5-year schedule.

- Calculation: $300,000 (Basis) ÷ 27.5 years = $10,909 per year

- Result: Sarah can deduct $10,909 from her rental income every single year, significantly reducing her tax bill and increasing her cash-on-cash return.

Example 2: A Small Commercial Office Building

Another investor, Tom, purchases a small office building. After accounting for land value and closing costs, his depreciable basis is $780,000. As a commercial property, it falls under the 39-year rules.

- Calculation: $780,000 (Basis) ÷ 39 years = $20,000 per year

- Result: Tom's annual depreciation deduction is a flat $20,000, a substantial paper loss that shields a large portion of his rental profit from taxes.

Property Type Depreciation Comparison

Here’s a quick side-by-side look at how the property type changes the math using our examples.

| Property Type | Depreciable Basis | MACRS Recovery Period | Annual Depreciation Deduction |

|---|---|---|---|

| Sarah's Residential Duplex | $300,000 | 27.5 Years | $10,909 |

| Tom's Commercial Office | $780,000 | 39 Years | $20,000 |

Understanding the Mid-Month Convention

There's one final wrinkle to MACRS you need to know: the mid-month convention. This rule simplifies things for the IRS by assuming you placed your property in service in the middle of the month, no matter if you closed on the 1st or the 31st.

The mid-month convention means you get a half-month's worth of depreciation for the month you acquire the property and a half-month for the month you sell it, no matter the actual date.

This stops investors from snatching up a property on December 31st and trying to claim a full month of depreciation. It means your first-year deduction will always be a partial one. For example, if you get your residential rental ready for tenants in October, you’ll get depreciation for 2.5 months (half of October, all of November, and all of December) in that first tax year.

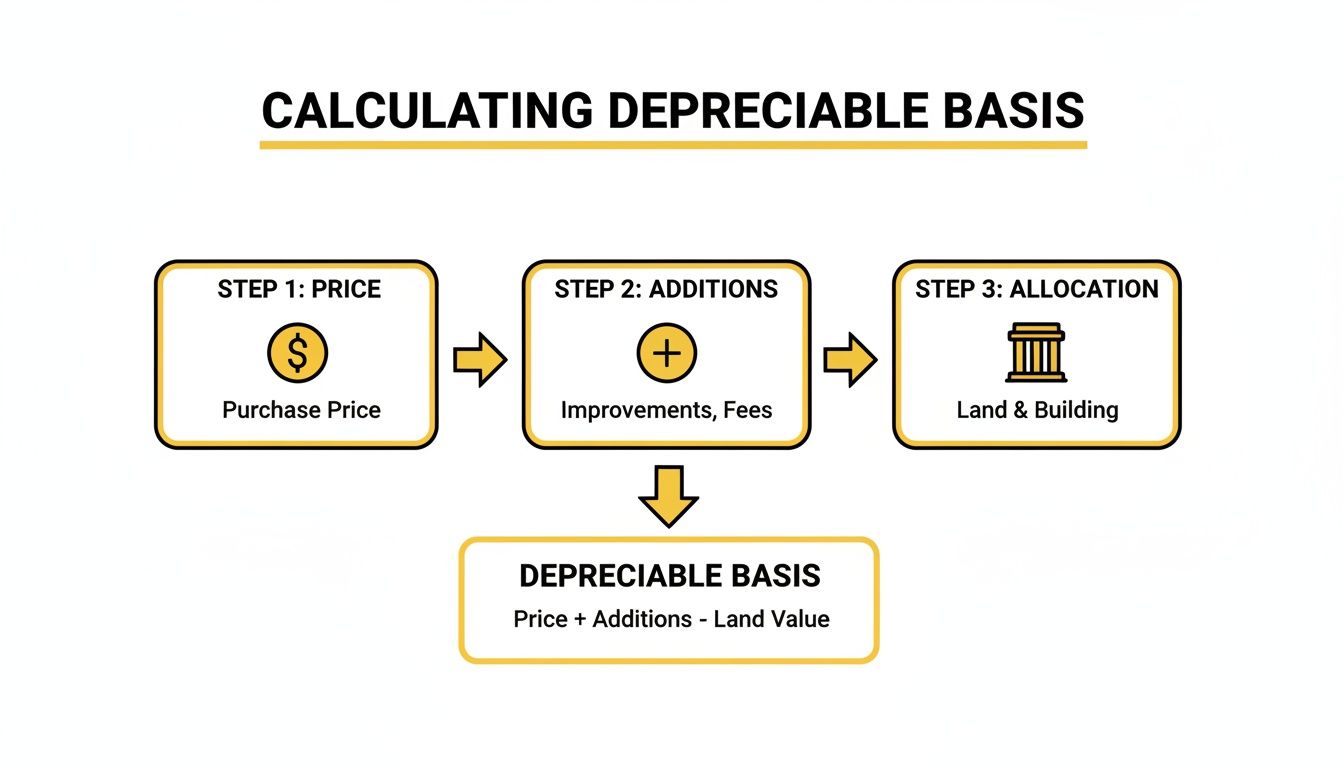

Getting Your Depreciable Basis Right

Everything we talk about with depreciation starts with one number: the depreciable basis. Nail this calculation, and you set yourself up for decades of accurate, maximized tax deductions. But if you get it wrong, that mistake will follow you year after year, costing you real money.

Think of your property's basis as its official starting value for tax purposes. It’s not just the price you paid. The real number includes the purchase price plus certain closing costs you paid to get the keys in your hand.

What Actually Goes Into Your Basis

To figure out your property's adjusted basis, you’ll start with the final contract price and then tack on specific settlement fees and other costs of acquisition. These are the necessary expenses that got the deal across the finish line.

Common costs you can add to your basis include:

- Legal and Recording Fees: The money you paid lawyers and the county to prepare and file the deed.

- Title Insurance: The one-time cost for the policy that protects your ownership rights.

- Property Surveys: Any fees for professional surveys required to close the deal.

- Transfer Taxes: Those pesky state or local taxes charged when a property changes hands.

Be careful not to confuse these with your annual operating expenses. Things like yearly property taxes or mortgage insurance premiums are deducted separately each year—they don't get added to your basis.

The Most Common Mistake: Separating Land from Building

Once you have your total adjusted basis, you’ve hit the most important—and most commonly botched—step. You absolutely must separate the value of the building from the value of the land it sits on.

Why? Because the IRS is crystal clear on this: land doesn't wear out, so you can't depreciate it. Only the structure itself, which deteriorates over time, qualifies for this incredible tax break.

Expert Insight: Pick a reasonable method for allocating the value between land and building, and then document it. The IRS wants to see a logical, consistent approach. If you ever face an audit, having that documentation in your files will be a lifesaver.

So how do you split the two? You have a few solid, IRS-accepted options:

- Property Tax Assessment: This is the easiest and most common way. Your local tax assessor’s statement almost always breaks down the property’s value into "land" and "improvements" (the building). Just use their ratio.

- A Professional Appraisal: If you got a loan, your lender ordered an appraisal. That report will contain a specific valuation for the land, giving you a very defensible number to use.

- Insurance Value: Sometimes, your property insurance policy will list a "replacement cost" for the structure. You can often use this figure to back into the building's value.

To really see how this plays out in your numbers, plug your figures into a good real estate investment calculator and watch how different allocations affect your cash flow and long-term returns.

An Allocation Example in Action

Let’s walk through a quick, real-world example. Imagine you just bought a small rental house.

Here’s what you paid:

| Item | Cost |

|---|---|

| Purchase Price | $350,000 |

| Title Fees | $1,500 |

| Recording Fees | $500 |

| Survey Fee | $1,000 |

| Total Adjusted Basis | $353,000 |

You pull out your latest property tax bill. It shows the county values the entire property at $300,000, with a breakdown of $60,000 (20%) for the land and $240,000 (80%) for the building. That 80/20 split is exactly what you need.

Now, you just apply that same ratio to your actual total cost:

- Land Value (Non-Depreciable): $353,000 x 20% = $70,600

- Building Value (Depreciable Basis): $353,000 x 80% = $282,400

And there it is. $282,400 is your magic number. That’s the depreciable basis you'll be writing off over the next 27.5 years. Taking the time to do this right from the start puts real money back in your pocket.

Boosting Deductions with Advanced Strategies

While the standard MACRS depreciation method is a reliable workhorse for steady, long-term tax benefits, savvy investors know there are ways to put their deductions into overdrive. If you want to maximize your tax savings in the early years of owning a property, you need to look beyond the basics.

These advanced strategies can dramatically increase your cash flow right out of the gate, giving you more capital to pay down debt, fund renovations, or snap up your next deal.

Unlocking Faster Write-Offs with Cost Segregation

The key to all of this is a powerful tax planning tool called cost segregation. Think of it as a detailed autopsy of your building, but for tax purposes.

Instead of lumping the entire property into one big asset that depreciates over 27.5 or 39 years, a cost segregation study surgically breaks it down. An engineering team identifies all the individual components of your property that wear out much faster than the building's structural shell.

A typical study will reclassify assets into much shorter depreciation schedules:

- 5-Year Property: This covers things that don't last long, like carpeting, certain appliances, and specialty lighting.

- 7-Year Property: Think office furniture and fixtures.

- 15-Year Property: This bucket is for land improvements—things like parking lots, landscaping, fencing, and sidewalks.

By shifting a significant chunk of the building's cost basis from the slow 27.5/39-year track to these much faster 5, 7, and 15-year tracks, you can claim enormous depreciation deductions in the first few years.

This flowchart shows the starting point—how you get to your initial basis before applying a powerful strategy like cost segregation.

This is just step one. The real magic happens when you pair this strategy with other tax code incentives.

Supercharging Deductions with Bonus Depreciation and Section 179

This is where the power of cost segregation really gets unleashed. When you reclassify assets into buckets with useful lives of 20 years or less (which includes all that 5, 7, and 15-year property), you suddenly make them eligible for a couple of the most potent tax breaks available.

Bonus Depreciation: This is a game-changer. It allows you to immediately write off a huge percentage of an asset's cost in the first year you put it to use. Depending on the tax laws for that year, this can be as high as 100%. It’s like getting a massive tax deduction on day one.

Section 179: This is another tool for expensing property right away. While it has annual limits and is mainly for tangible personal property, it works beautifully alongside bonus depreciation.

When you apply these rules to the assets identified in your cost segregation study, the result is often a massive "paper loss." This loss can wipe out your rental income for tax purposes and sometimes even offset your other income, leading to huge tax savings. It's a critical component to consider, especially when you think about your exit strategy; you can explore this further in our guide on how to minimize capital gains tax.

Comparing the Financial Impact

The difference this makes is not subtle. It's night and day. Let's take a look at a hypothetical $2 million commercial property to see just how dramatic the impact can be.

A cost segregation study can transform your first-year tax picture, as you'll see in the comparison below. We're looking at a standard, straight-line approach versus an aggressive strategy using cost segregation combined with 100% bonus depreciation (a common scenario under recent tax laws).

Standard Depreciation vs Cost Segregation Impact

| Asset Component | Cost Basis | Depreciation Method (Standard) | Year 1 Deduction (Standard) | Depreciation Method (Cost Seg) | Year 1 Deduction (Cost Seg) |

|---|---|---|---|---|---|

| Building Structure (39-Year) | $1,400,000 | 39-Year Straight-Line | $34,188 | 39-Year Straight-Line | $34,188 |

| Land Improvements (15-Year) | $300,000 | Part of 39-Year | $7,308 | 100% Bonus Depreciation | $300,000 |

| Personal Property (5-Year) | $300,000 | Part of 39-Year | $7,308 | 100% Bonus Depreciation | $300,000 |

| Total Deduction | $2,000,000 | $48,804 | $634,188 |

The numbers speak for themselves. In this example, the investor’s Year 1 deduction explodes from just $48,804 to a staggering $634,188.

That isn't just a paper gain. It's a real-world tax saving that injects a massive amount of cash back into your pocket during the most critical early phase of your investment.

Understanding Depreciation Recapture When You Sell

For years, you've been taking depreciation deductions on your rental property. It’s been a fantastic tax shield, lowering your taxable income each year and putting more cash in your pocket. But here's the catch: the IRS eventually wants its cut.

When you sell that property for a profit, the government "recaptures" the tax benefit you received. This is a critical concept for every investor to grasp, because it can lead to a surprisingly large tax bill if you aren't prepared for it. Think of it this way: all those depreciation deductions you’ve been enjoying aren't forgiven, they’re just deferred.

How Depreciation Recapture Is Taxed

Here’s where it gets interesting. Your profit on a sale isn't all taxed the same way. While your true long-term capital gains get those favorable 0%, 15%, or 20% rates, the portion of your gain that comes from depreciation is taxed differently.

This "recaptured" amount is taxed as ordinary income, but it's capped at a special maximum rate of 25%. The government essentially let you borrow those tax savings over the years, and the bill comes due when you sell.

A Real-Life Recapture Example

Let's walk through an example to see how this plays out in the real world.

An investor buys a residential rental property and holds it for 10 years.

- Total Purchase Price (with closing costs): $400,000

- Land Value (20%): $80,000

- Building's Depreciable Basis: $320,000

Each year, they claim depreciation deductions.

- Annual Depreciation: $320,000 / 27.5 years = $11,636

- Total Depreciation Claimed (10 years): $11,636 x 10 = $116,360

Claiming this depreciation reduces the property's adjusted basis to $283,640 (which is just the original $400,000 price minus the $116,360 in depreciation).

A decade later, they sell the property for $600,000. Here’s how the IRS looks at the profit:

| Calculation Step | Description | Amount |

|---|---|---|

| Total Gain | Sale Price ($600,000) – Adjusted Basis ($283,640) | $316,360 |

| Recapture Amount | The total depreciation claimed is taxed at up to 25%. | $116,360 |

| Capital Gain | The remaining profit is taxed at capital gains rates. | $200,000 |

See how that works? The total profit of $316,360 isn't taxed in one big chunk. Instead, it’s split into two pieces, each with its own tax rate.

Deferring Taxes with a 1031 Exchange

The good news is you don’t always have to write that check to the IRS right away. A 1031 exchange is one of the most powerful tools in an investor's toolbox for deferring both depreciation recapture and capital gains taxes.

By rolling the entire proceeds from the sale of one investment property into a new "like-kind" property, you can essentially hit the pause button on your tax bill. This strategy lets you keep your capital working for you, growing your portfolio without the drag of a massive tax payment. It's just one of several capital gains tax strategies that savvy investors use to build wealth.

Key Insight: A 1031 exchange doesn't erase your tax liability—it just kicks the can down the road. However, by continuously exchanging properties, many investors are able to defer these taxes indefinitely, building generational wealth.

Common Depreciation Mistakes and How to Avoid Them

Getting depreciation right is one of the most powerful wealth-building tools for a real estate investor. But it's also an area where a simple mistake can create a massive headache with the IRS. Think of it less like a set of rigid rules and more like a roadmap—if you follow it correctly, you'll get to your destination (maximum tax savings) safely.

Let's walk through the most common traps investors fall into and, more importantly, how you can steer clear of them.

Mistake 1: Depreciating Land

This is the classic rookie mistake, and it's a huge red flag for the IRS. The logic is simple: buildings get old, wear out, and lose value over time. Land, on the other hand, doesn't. You can't depreciate something that has an indefinite lifespan.

- How to Avoid It: Your property tax assessment is a great starting point, as it usually breaks down the value between land and improvements. For a more robust valuation, especially on larger properties, a professional appraisal will give you a defensible land-to-building ratio. Apply that ratio to your purchase price, and you'll have your true depreciable basis for the building.

Mistake 2: Using the Wrong Recovery Period

The IRS doesn't leave this one up for interpretation. They have set specific timelines, known as recovery periods, for different types of property. Using the wrong one will throw off your deduction calculation every single year.

- Residential Property: The magic number is 27.5 years. This applies to single-family homes, duplexes, and apartment buildings.

- Commercial Property: This bucket includes office buildings, retail centers, and warehouses, which must be depreciated over a longer period of 39 years.

Mixing these up—say, by depreciating a small office building over 27.5 years—will artificially inflate your deductions and could easily trigger an audit.

Mistake 3: Forgetting the Mid-Month Convention

Your depreciation clock doesn't start ticking the moment you sign the closing papers. Instead, the IRS simplifies things with the mid-month convention. This rule treats any property as being placed in service on the 15th of the month, no matter if you closed on the 1st or the 31st.

Key Takeaway: You'll always have a partial depreciation deduction in your first year. If you buy a rental and place it in service in October, you get credit for half of October plus all of November and December—a total of 2.5 months for that first tax year.

Mistake 4: Incorrectly Handling Capital Improvements

There's a big difference between a repair and a capital improvement, and the IRS cares a lot about it. Fixing a leaky faucet is a repair you can expense immediately. Installing a brand-new roof is a capital improvement because it adds significant value and extends the life of the property.

You can't just write off the full cost of that new roof in one year. Instead, that improvement gets its own, separate depreciation schedule. It's treated like a new asset, depreciated over the same recovery period as the building itself (27.5 or 39 years), starting from the month it was placed in service.

Finally, all of this activity—from the initial property depreciation to any new improvements—has to be meticulously reported on Form 4562, Depreciation and Amortization. This form is your official record, so keeping it accurate and attaching it to your tax return is non-negotiable for a solid, defensible tax strategy.

Frequently Asked Questions About Real Estate Depreciation

1. Can I depreciate my personal residence?

No, you cannot depreciate the home you live in. Depreciation is a tax deduction available only for properties used for business or income-producing purposes, such as rental properties. The only exception is for a qualifying home office, where you can depreciate the specific portion of your home used exclusively for business.

2. What happens if I forget to claim depreciation for a few years?

The IRS has an "allowed or allowable" rule, meaning they reduce your property's basis by the amount of depreciation you should have taken, even if you didn't. This can lead to a higher tax bill when you sell. To fix this, you can file IRS Form 3115, "Application for Change in Accounting Method," to claim the missed depreciation deductions from prior years all at once in the current year.

3. How do I depreciate a major renovation, like a new kitchen?

A major renovation that adds value or extends the life of the property is a capital improvement, not a repair. You must depreciate its cost separately from the building. The new kitchen would be treated as a new asset, depreciated over 27.5 years (for a residential property) starting from the month it was placed in service.

4. Are state depreciation rules always the same as federal rules?

Not necessarily. Many states do not conform to federal tax laws, especially regarding bonus depreciation. For example, states like California have their own set of depreciation rules. This may require you to calculate depreciation separately for your federal and state tax returns.

5. Why can't land be depreciated?

The IRS considers land to be an asset with an indefinite useful life. It does not wear out, become obsolete, or get used up like a building or equipment. Therefore, it is not eligible for depreciation deductions.

6. When can I start taking depreciation deductions?

Depreciation begins when the property is "placed in service," which means it is ready and available for its intended use (i.e., ready to be rented). You do not have to wait for a tenant to move in. As long as the property is actively being marketed for rent, you can start depreciating it.

7. What's the difference between a repair and an improvement?

A repair (like fixing a broken window) maintains the property's current condition and is expensed in the year it occurs. A capital improvement (like replacing all the windows) betters the property or extends its life and must be capitalized and depreciated over time.

8. Does refinancing affect my property's depreciable basis?

No, refinancing a property does not impact its depreciable basis. Your basis is determined by the original purchase price plus acquisition costs and subsequent capital improvements. A loan modification is a financial transaction and does not change the historical cost of the asset for tax purposes.

9. How does depreciation work after a 1031 exchange?

In a 1031 exchange, the basis of your old property carries over to the new property. You continue depreciating this carried-over basis on its original schedule. Any additional cash you invest to acquire the new property is treated as a new asset with its own depreciation schedule.

10. Is a cost segregation study worth the cost?

For properties valued at over $500,000, a cost segregation study is often highly beneficial. While there is an upfront cost, the study can identify components that qualify for shorter depreciation periods (5, 7, or 15 years), allowing for significantly larger deductions in the early years of ownership and substantially improving cash flow.

At Top Wealth Guide, we are dedicated to providing you with the knowledge to make smart financial decisions. Explore our resources to master investment strategies and secure your financial future. Learn more at Top Wealth Guide.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.