Most people think building wealth requires luck or a high income — a lottery ticket or a unicorn paycheck. The truth is far simpler (and far less sexy): compound returns do the heavy lifting when you give them time… and stop tinkering.

At Top Wealth Guide, we’ve watched ordinary investors turn into millionaires by mastering one idea — small, consistent investments grow exponentially over decades. Sounds boring. Is boring. Works like a charm. This blog post walks through the exact math, the strategies that actually matter, and the mistakes that derail 90% of people (spoiler: impatience and trying to outsmart a long game).

If you Want to understand why these numbers grow so fast? this calculator shows the result

In This Guide

The Math Behind Compound Returns That Creates Millionaires

How Your Money Grows Faster Over Time

The math of compound returns is embarrassingly simple – and that’s why most people ignore it. Put $500 into the market every month and assume an 8% annual return. Ten years in, you’ve contributed $60,000 of your own money and you’re sitting on roughly $91,500.

Not magical. Not mysterious. Just math. Stretch that to 30 years and your $180,000 in contributions becomes about $1.2 million. The gap between what you put in and what you end up with is pure compound interest – your money makes money, then that money makes more money. Vanguard’s research is blunt about this: investors who stayed put through downturns saw portfolios recover and exceed prior highs in roughly 3–5 years. This isn’t luck. It’s math behaving exactly as advertised.

Time Becomes Your Actual Advantage

Here’s the uncomfortable truth – the biggest lever in compounding isn’t IQ or stock picking. It’s time. Start at 25 with $300 a month and you’ll beat the person who starts at 35 and drops in $1,000 a month until 65. Weird? Totally – but true. Time Becomes Your Actual Advantage because every year you delay compounds against you. A 20-year-old plunking down $5,000 a year for 45 years at a 7% average ends up near $1.9 million. A 30-year-old doing the same for 35 years ends up with roughly $840,000. That decade head start? It’s worth over a million dollars. Not hype – exponential math.

Real Millionaires Built This Way

The narratives get flashy – the hero investor, the hot tip. But the real story is boring and beautiful. Warren Buffett invested meaningful capital in his mid-20s and let compounding run for 70+ years, turning modest sums into a sum that reads like fiction. Jack Bogle started Vanguard in 1975 to democratize low-cost index investing and proved ordinary people could build extraordinary wealth by buying broad-market indexes and holding them for decades. Bogle didn’t win by swinging for the fences – he won by being boring, consistent, and cheap. These aren’t genetic outliers or people with secret feeds from Wall Street insiders – they started early and didn’t freak out during crashes.

What Separates Millionaires From Everyone Else

There isn’t a secret handshake. There isn’t a moonshot strategy. The wealthy get it because they do one thing better than most: stick. Small, consistent contributions turn into life-changing sums when time is on your side. Most people lose not because the plan is complex, but because they abandon the plan. Volatility triggers panic – and panic triggers selling. Impatience begets withdrawals. Fees and poor asset choices quietly eat returns like termites. The next section will call out the exact mistakes that sabotage compound growth – and how to avoid them.

How to Actually Build Wealth Through Compounding

Start Early-The Math Wins Every Time

The ugly truth: knowing compound returns work and actually capturing them are two different beasts. It boils down to three boring-but-crucial choices-when you start, what you buy, and what you do with the profits. Start at 25 instead of 35 and, assuming the same monthly contribution and return, the retirement pot is roughly double. Not inspiration-just arithmetic. Yet humans delay. Always waiting for the “right time” (a mythical creature), more money, or perfect conditions that never show up. People who funnel $200 a month into the market at 25 beat the person who waits and deposits $1,000 a month at 40. Why? Time turns pennies into engines. Move money into the market sooner-let compounding start pulling its weight.

At a 7% annual return, a 25-year-old ends up near $584,000; a 35-year-old? About $217,000. That ten-year head start? Worth north of $367,000. Stop waiting. Open a brokerage account this week.

Pick Low-Cost Assets That Actually Deliver

Asset choice matters-more than most assume, but not in the “pick-the-next-hot-stock” way. The real win is picking vehicles that deliver returns without devouring them via fees. Low-cost index funds tracking the S&P 500 or total market have averaged roughly 10% annually over decades (Vanguard’s history, not hype).

A 1% fee on a $500,000 portfolio is $5,000 a year-money that could compound. Over 30 years, that extra 0.97% (versus a 0.03% fund) robs the portfolio of hundreds of thousands. Actively managed funds rarely beat the market after fees-yet they charge 0.5% to 2%. Paying for underperformance is a tax on naiveté. Build a core of low-cost index funds-US stocks, international stocks, bonds-aligned to risk tolerance and time horizon. Simple, boring, effective.

Reinvest Everything Automatically

Reinvest dividends and capital gains-don’t take the cash. Dividend reinvestment turbocharges compounding because dividends buy more shares, and those shares pay dividends too. It’s the financial version of a snowball rolling downhill-gets bigger without dramatic effort.

Set up automatic dividend reinvestment-most brokerages offer it for free-and then forget it. This single move turns a static pile of assets into a self-feeding machine that compounds quietly, relentlessly.

The ways to sabotage compounding are simple and painfully common. Withdrawals too early. Chasing shiny, short-term gains. Letting fees bleed returns. That’s it-no clever hacks required to mess it up. The next section will call out exactly what kills compound growth-and how to avoid those traps.

What Kills Compound Growth and How to Stop It

Early Withdrawals Cost More Than You Think

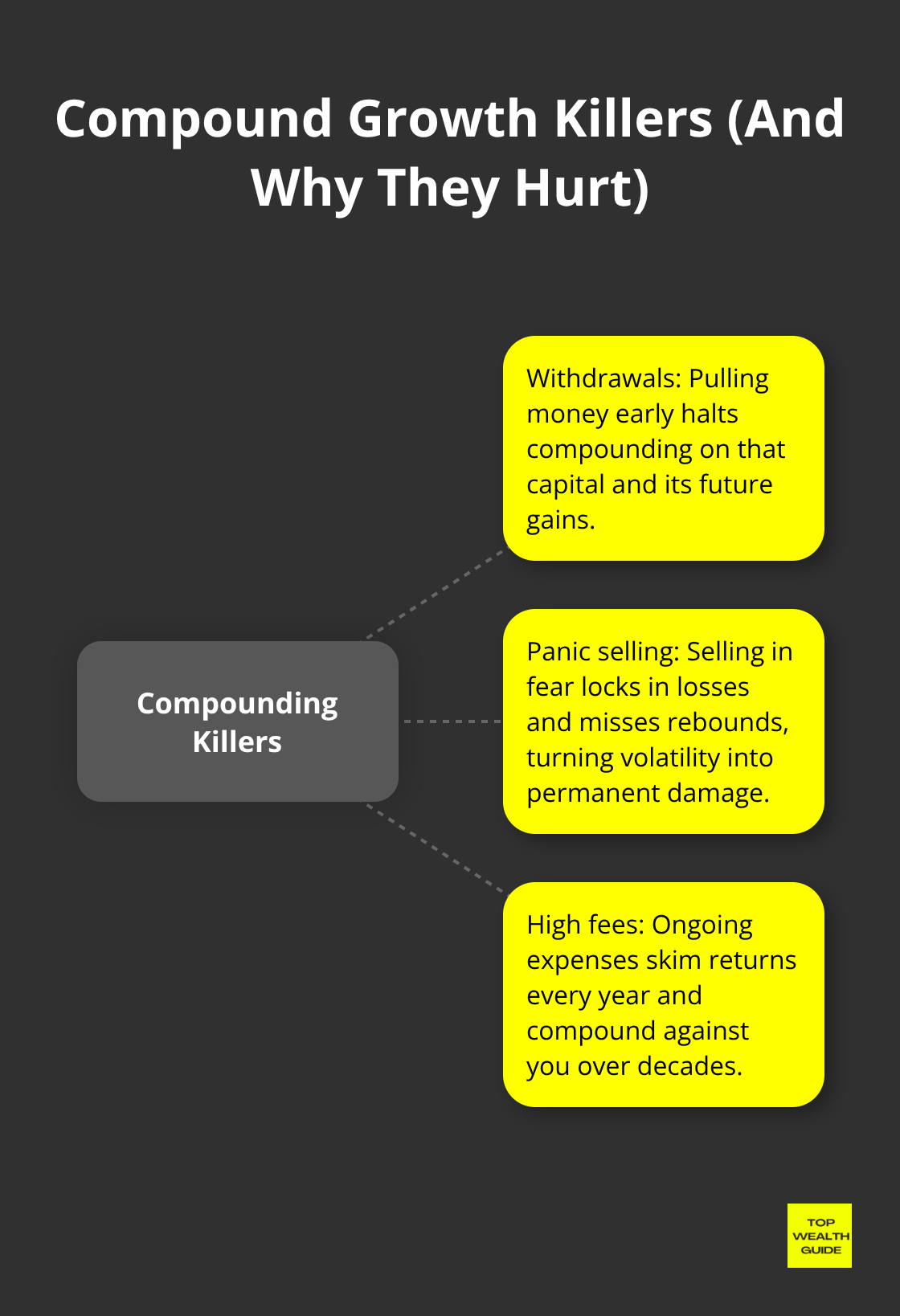

There are three killers of compound wealth – withdrawals, impatience, and fees – and they live squarely in your hands. Most people don’t blow portfolios because the market is cruel; they self-sabotage with tiny, repeatable decisions that compound in reverse. Leave money alone and math becomes your ally. Pull it out early, chase the next shiny stock, or siphon returns to fees and you’re fighting exponential growth instead of riding it.

Consider this – a 35-year-old who takes $50,000 out of a $200,000 portfolio doesn’t just lose $50,000. That withdrawal would have grown into roughly $150,000+ over 20 years at 7% (and yes, that single decision costs approximately $200,000 in future value). Early withdrawals are expensive in ways spreadsheets don’t make emotionally obvious.

Panic Selling Locks In Losses

The second trap is behavior – chasing quick gains and panicking on the way down. Research from Morningstar found that average investors underperform the market by roughly 2–3% a year because they buy into rallies and sell into fear. Over 30 years, that behavioral drag is literally hundreds of thousands of dollars.

Example: someone who bought the S&P 500 in January 2020 and held through the pandemic saw about 180% growth by 2024. Someone who panicked and sold in March 2020 locked in a 30% loss and missed the rebound. Fidelity data shows the odd truth – investors who “forgot” about their accounts did better than those who traded like they were day-trading adrenaline. The cure is boring and brilliant: stop checking your account.

Fees Silently Destroy Returns

The third killer is fees – invisible, steady, and devastating. A fund charging 1.5% versus 0.05% eats a meaningful chunk of your returns on a $500,000 portfolio over 30 years at 7%. A higher expense ratio means you’re paying each year for the privilege of underperforming – and over time that privilege compounds.

Build your core with index funds under 0.20% expense ratio. That one decision shields your returns from erosion that most investors never notice until decades vanish and they realize how much wealth they donated to fees.

How to Protect Your Compound Growth

Automate contributions (set it, forget it – and let friction beat your impulses) – https://www.mezzi.com/blog/how-ai-identifies-behavioral-triggers-in-rebalancing. Treat statements like a thermostat in winter: glance once, then move on. The people who win aren’t smarter or luckier – they remove themselves from the equation and let time do the work. Simple. Relentless. Unsexy – and it works.

Final Thoughts

The math punishes delay and rewards patience – brutally simple. Start at 25 with $300 a month and, at a 7% return, you end up with roughly $1.9 million by 65; start at 35 and triple the contribution and you land around $840,000. That ten-year gap costs you more than a million dollars – not because you lack discipline, but because compound returns run on time as their primary fuel. You can’t buy back the years you lose.

Millionaires get rich by doing three boring things really well: they put money into the market early, they buy cheap, boring assets, and they shut up and let it grow. They didn’t time the market or discover a secret algorithm – they consistently invested, picked index funds with fees under 0.20%, and ignored the circus when markets crashed. They didn’t panic-sell, they didn’t raid accounts for short-term wants, and they didn’t bleed returns to fees (each choice feels small in the moment – but over 30 years those small choices compound into hundreds of thousands of dollars lost).

Open a brokerage account this week and automate your contributions – even $200 a month is more powerful than you think when time is on your side. We at Top Wealth Guide have built practical resources and tools to help you move from understanding compound returns to actually capturing them. Patience and consistency beat market timing every single time.