Putting just $100 to work is one of the smartest money moves you can make. The secret is to keep it simple. You could grab a diversified S&P 500 ETF, buy a small piece of a company you already love, or let a robo-advisor handle everything for you.

Any of these paths will get you past the biggest hurdle—just getting started—and let the market begin to work its magic.

In This Guide

- 1 Your First Step Into Investing With Just $100

- 2 A Practical Breakdown of Your Investment Choices

- 3 The Real Secret to Growing Your Money: Compounding and Consistency

- 4 Your Action Plan for Making Your First Investment

- 5 Common Mistakes to Avoid on Your Investing Journey

- 6 Got Questions About Investing $100? We Have Answers.

- 6.1 1. Is It Even Worth Investing Just $100?

- 6.2 2. What's the Absolute Safest Way to Invest $100?

- 6.3 3. Realistically, Could I Lose All My Money?

- 6.4 4. Do I Have to Pay Taxes on My Profits?

- 6.5 5. What Are the Best Apps for a Beginner to Use?

- 6.6 6. Should I Put in the $100 All at Once or in Pieces?

- 6.7 7. How Long Should My $100 Stay Invested?

- 6.8 8. What's the Actual Difference Between a Stock and an ETF?

- 6.9 9. What Exactly Is a Robo-Advisor? Is It a Good Idea for Me?

- 6.10 10. Can I Get Into Real Estate or Crypto With Just $100?

- 7 What Comes After Your First $100?

Your First Step Into Investing With Just $100

Figuring out how to invest $100 can feel like a huge task, but it’s the single most important action you can take to build wealth over the long haul. The dollar amount isn't the point. It's the act of starting and building the habit that really counts.

This isn’t about a get-rich-quick scheme. It’s about a mental shift, moving from "I don't have enough to invest" to "I am an investor." That change in perspective pays dividends for life. For more tips on getting going, you can explore our detailed guide on how to invest with little money.

Why Starting Small Is a Big Deal

The real power behind investing is compounding—that incredible process where your earnings start generating their own earnings. When you're just starting out, time is your most valuable asset, making even a small initial investment incredibly powerful over the decades.

Let's look at a real-world example. Imagine Sarah, a recent college grad, decided to invest her first $100 bonus into an S&P 500 index fund on January 1, 2010. It felt like a small, almost insignificant move.

If she simply left it alone and reinvested the dividends, that $100 would have grown to approximately $530 by early 2024. That's over a 400% return, and her money worked for her through market ups and downs. This shows that even small amounts can grow substantially when given enough time.

Key Takeaway: Your goal isn't to time the market perfectly. It's to have time in the market. Consistency beats trying to find the perfect moment to invest.

Your Top 3 Investment Options for $100

To make your first move simple and effective, let's focus on three of the most accessible strategies for beginners. Each one offers a different mix of control, risk, and simplicity, so you can pick the one that feels right for you.

Here's a quick look at the best options for your first $100.

| Investment Option | Best For | Risk Level | Key Feature |

|---|---|---|---|

| S&P 500 ETF | The hands-off investor seeking instant diversification. | Medium | Spreads your $100 across 500 top U.S. companies in a single purchase. |

| Fractional Shares | The investor who wants to own a piece of familiar, high-priced companies. | High | Allows you to buy a slice of a stock like Apple or Amazon for as little as $1. |

| Robo-Advisor | The beginner who wants a professionally managed portfolio without the high cost. | Low to Medium | Uses algorithms to build and automatically rebalance a portfolio for you. |

Choosing any of these paths is a fantastic start and puts you ahead of the curve. In the next few sections, we'll break down exactly how to get started with each one, so you can confidently make your first investment today.

A Practical Breakdown of Your Investment Choices

That $100 in your pocket holds more potential than you might think. Let's move past the textbook definitions and get into the practical ways you can put that money to work. Each option strikes a different balance between risk, how much control you have, and the effort required, so you can find a path that fits your personality.

The great news is you don't need a fortune to own a piece of the world's most successful companies anymore. Modern investing platforms have torn down the old barriers, making it possible for anyone to start building wealth, even with a small amount.

Fractional shares are a total game-changer for new investors. Instead of needing thousands to buy a single share of a company like Nvidia, you can buy a small slice of it for as little as $1. This is huge because it lets you invest in companies you actually know and believe in without a huge upfront cost.

Real-Life Example: Let's say you're a big fan of Apple products and believe in the company's future. A single share of Apple (AAPL) is trading for over $200. With your $100, you could decide to invest it all in Apple and buy about half a share. You still get the benefits of the stock's growth and may even receive dividends, just scaled to your piece of the pie.

Platforms like Fidelity and Charles Schwab are my go-to recommendations here. They offer zero-commission trading on these fractional shares, which is critical to make sure fees don't just eat up your small investment. It gives you a real stake in a company's success.

ETFs: Instant Diversification in One Click

Think of Exchange-Traded Funds (ETFs) as investment bundles. One ETF can hold dozens, hundreds, or even thousands of different stocks or bonds, giving you instant diversification right out of the gate. This is probably one of the most powerful ways to lower your risk when you're just starting out.

It helps to know the two main flavors:

- Broad-Market ETFs: These are the workhorses. A fund like the Vanguard S&P 500 ETF (VOO) simply tracks a major index, in this case, the S&P 500. Buying one share of VOO is like owning a tiny piece of 500 of the largest U.S. companies all at once.

- Thematic ETFs: These get more specialized, focusing on a niche like robotics, clean energy, or cybersecurity. They can offer explosive growth, but they're also riskier because their fate is tied to just one sector.

When you're shopping for an ETF, the most important number to look at is the expense ratio. It's the small annual fee the fund manager charges. My advice? Hunt for funds with ultra-low expense ratios—think below 0.10%—to keep more of your money working for you, not paying fees.

Robo-Advisors: The "Set It and Forget It" Approach

If picking stocks and ETFs sounds like a headache you'd rather avoid, a robo-advisor might be your perfect match. Platforms like Betterment and Wealthfront use smart algorithms to build and manage a diversified portfolio for you.

You’ll start by answering some simple questions about your goals, timeline, and how you feel about risk. From there, the robo-advisor automatically invests your $100 into a suitable mix of low-cost ETFs. It even handles the complicated stuff, like rebalancing, to make sure your investments stay on track. For a deeper look at different investment styles, our guide on the best investments for beginners is a great resource.

Expert Insight: Robo-advisors have really leveled the playing field, making professional-grade money management accessible to everyone. They provide a disciplined, automated strategy that helps you avoid common emotional mistakes, like panic selling when the market gets choppy.

Comparing Beginner Investment Platforms and Methods

To help you visualize the best path for your $100, I've put together a simple table comparing the most popular methods. Each one has its own set of pros and cons, depending on how hands-on you want to be.

| Method | Typical Platform | Average Fees | Investor Control | Best For |

|---|---|---|---|---|

| Fractional Shares | Fidelity, Schwab | $0 commission | High (You pick the stocks) | The hands-on investor who wants to own specific companies. |

| ETFs | Vanguard, Fidelity | Low (Look for low expense ratios) | Medium (You pick the ETFs) | The DIY investor seeking easy, low-cost diversification. |

| Robo-Advisors | Betterment, Wealthfront | 0.25% – 0.40% annually | Low (Portfolio managed for you) | The beginner who wants a completely hands-off, automated experience. |

| High-Yield Savings | Ally, Marcus | $0 | N/A (It's a savings account) | The risk-averse person needing a safe place for short-term savings. |

Looking at them side-by-side really clarifies the tradeoffs between fees, control, and simplicity. There’s no single "best" option—only what's best for you.

Safer Harbors and Higher-Risk Plays

For those who are extremely cautious, a High-Yield Savings Account (HYSA) is a fantastic starting point. While it’s not technically an "investment," an HYSA offers an interest rate that trounces what you'd get at a traditional bank. This protects your money from being eaten away by inflation while keeping it completely safe and available anytime.

On the complete opposite end of the spectrum, you have cryptocurrency. You can easily buy $100 worth of Bitcoin or Ethereum, but please be warned: the crypto market is incredibly volatile. I would only suggest this path if you have a very high tolerance for risk and are fully prepared to lose your entire $100. For a beginner, sticking to more established, time-tested options is almost always the wiser move.

The Real Secret to Growing Your Money: Compounding and Consistency

When you're starting with just $100, it's easy to feel like it won't make a difference. But that first investment isn't just about the hundred bucks—it's about kicking off the single most powerful force in finance: compounding. Think of it as a snowball effect for your money. Your initial investment earns a return, and then those returns start earning their own returns.

It’s an engine that works 24/7, quietly building your wealth in the background. But for it to really work its magic, you need two things: time and consistency. The more time you give it, the bigger that snowball gets. That’s why you always hear experts say "time in the market beats timing the market." Getting started today with $100 is infinitely better than waiting years for the "perfect" time to jump in.

Just How Powerful Is It? A Look Back in Time

To see what long-term growth really looks like, let's pull a wild example from history. Imagine someone invested a single $100 bill into the S&P 500 way back at the beginning of 1970. If they just left it alone and reinvested all the dividends along the way, that tiny investment would have mushroomed into an incredible $20,450 by the end of 2023.

That’s a total return of over 20,000%, which breaks down to an average annual return of over 10%. This happened through recessions, oil crises, tech bubbles, and financial meltdowns. It’s a powerful testament to just how much patience and a long-term perspective can pay off.

Options like ETFs, fractional shares, and robo-advisors are fantastic starting points for beginners. They provide a simple on-ramp to get your money working and start benefiting from this kind of long-term growth.

The Smart Way to Stay Consistent: Dollar-Cost Averaging

Consistency is the other crucial piece of the puzzle. One of the best strategies for building an investing habit is Dollar-Cost Averaging (DCA). It sounds technical, but the idea is simple: you invest a set amount of money on a regular schedule, no matter what the market is doing.

So, you might invest your first $100 today, then set up an automatic transfer to invest $25 every single month.

- When the market dips, your $25 automatically buys more shares at a lower price.

- When the market is soaring, that same $25 buys fewer shares, but your existing ones are worth more.

This approach smooths out your average cost over time and, more importantly, it takes the emotion and guesswork out of investing. You're not trying to time the highs and lows; you're just consistently building your position. If you want to get into the nitty-gritty of how this growth works, our guide on what compound interest is breaks it all down.

Here’s what this looks like in the real world: Let's imagine you start with that $100 and then stick to contributing $25 a month. Assuming a conservative 8% average annual return (a common historical benchmark for the stock market), your small, steady habit starts to build serious momentum.

Check out how those small contributions could stack up over time:

| Time Horizon | Total You Invested | Potential Account Value |

|---|---|---|

| 10 Years | $3,100 | $4,845 |

| 20 Years | $6,100 | $15,190 |

| 30 Years | $9,100 | $38,200 |

This isn't about getting rich overnight. It’s about proving that you don’t need a fortune to start building one. All you really need is a plan, a little bit of consistency, and the decision to start today. That first $100 is your launchpad.

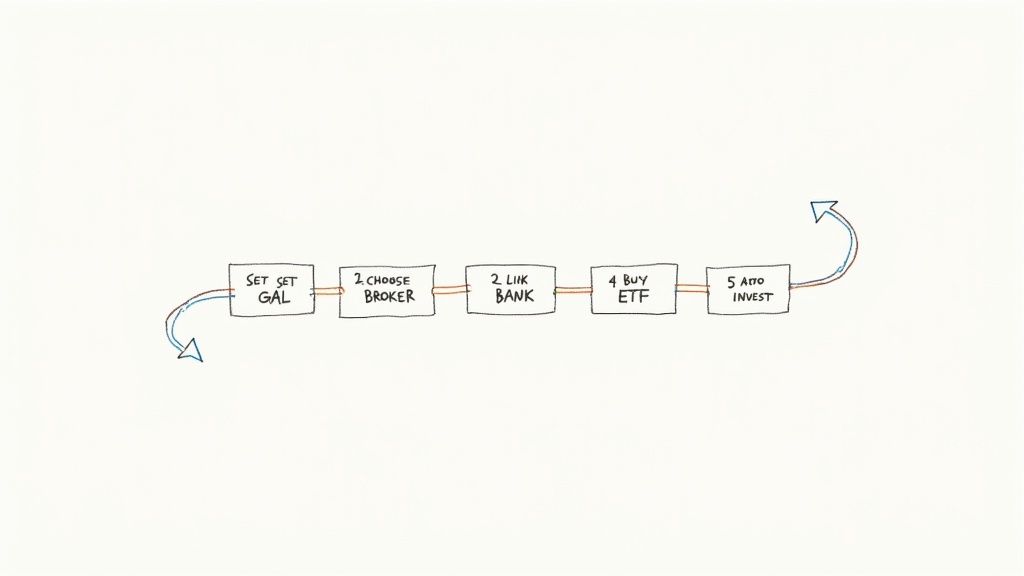

Your Action Plan for Making Your First Investment

Alright, theory is great, but taking action is what actually moves the needle and builds wealth. This is your hands-on guide to getting that first investment out of the way. We'll walk through it step-by-step to take the guesswork out of the equation so you can get started today.

The whole process is simpler than you think. You start by giving your money a job, pick the right platform for that job, and then—boom—you're officially an investor. Let's do this.

First, Give Your Money a Goal

Before you even think about where to put your money, you need to know why you're investing it. Seriously, take a minute and decide what this $100 is for. A clear purpose will guide every decision you make from here on out.

Are you kicking off a retirement fund that you won't touch for decades? Or are you saving for a down payment in five years? The answer completely changes your strategy.

- Long-Term Goals (10+ years): If retirement is the game, you have time on your side. This means you can generally take on more risk with things like an S&P 500 ETF, because you have decades to recover from any market dips.

- Short-Term Goals (Under 5 years): Need the cash for a vacation or a new car? Safety is your top priority. A high-yield savings account makes way more sense here. It protects your initial investment while still earning you a decent return.

Nailing down your timeframe is the single most important first step. It brings your entire strategy into focus.

Next, Pick Your Platform and Open an Account

Now for the fun part: choosing where to invest. Think back on the options we've covered and pick the brokerage that feels right for you and your goal. Thankfully, modern platforms have made signing up incredibly fast and easy.

For example, if you decided buying fractional shares of stocks or ETFs is your move, a powerhouse broker like Fidelity or Charles Schwab is a fantastic choice. If you’d rather set it and forget it, a robo-advisor like Betterment or Wealthfront is probably more your speed.

Want to weigh all your options? We break down the top contenders in our guide to the best investment apps for beginners.

Opening an account usually takes just a few minutes. You'll just need some basic info like your Social Security number to prove you are who you say you are.

Fund Your Account and Place That First Trade

Once you get that "you're approved!" email, it's time to connect your bank account and transfer the funds. This is a standard, secure process that lets you move your initial $100 into your shiny new investment account.

With money in the account, you're ready to pull the trigger.

Let's walk through a real-world example.

Scenario: Buying an S&P 500 ETF

- Find the Ticker: Log in to your brokerage app and use the search bar to look up a popular S&P 500 ETF. A common one is "VOO" (the Vanguard S&P 500 ETF).

- Hit "Trade" or "Buy": Once you're on the ETF's page, you'll see a big "Trade" or "Buy" button. Click it.

- Enter Your Dollar Amount: You're starting with $100, so look for the option to invest by dollar amount instead of by share. Just type in $100. The platform will do the math and figure out how many fractional shares that gets you.

- Review and Submit: Give the order one last look to make sure it's all correct, and then hit submit.

And that's it—you're an investor! The order will typically execute almost instantly during market hours. You now own a tiny slice of 500 of the biggest companies in America.

Finally, Put It on Autopilot

The last step is the one that separates dabblers from serious wealth-builders: make it automatic. Setting up recurring investments is the easiest way to stay consistent and put your Dollar-Cost Averaging strategy to work without even thinking about it.

Go into your brokerage's settings and look for "recurring transfers" or "automatic investments." You could set up a $25 transfer from your bank every month and have it automatically buy more of that same ETF.

This one simple move turns your $100 investment from a one-time event into a powerful, lifelong wealth-building habit.

Common Mistakes to Avoid on Your Investing Journey

Getting started is the most important step, but it’s also easy to get tripped up by a few classic beginner mistakes. Knowing what these traps look like ahead of time can save you from a lot of stress and money down the road.

The great part is, all of these are completely avoidable. Once you understand the psychology behind them, you can build smarter, more resilient investing habits from day one.

Trying to Time the Market

This is the big one. Almost every new investor is tempted to "time the market"—waiting for that perfect moment to buy at the absolute bottom or sell at the very peak. Here’s the hard truth: even the pros on Wall Street can't do this reliably. It's a fool's errand.

More often than not, this strategy just leads to analysis paralysis. You end up sitting on the sidelines, waiting for a dip that never comes, while the market keeps climbing without you.

Real-World Scenario: I have a friend who spent all of 2023 waiting for a big "crash" before he put his money to work. The market, of course, had other plans and rallied hard. He missed out on some serious gains because he was trying to be clever instead of just getting started. The mantra is time in the market, not timing the market.

Getting Caught in Hype and FOMO

It’s incredibly easy to get swept up in the buzz around a single "meme stock" or a cryptocurrency that’s suddenly all over social media. The fear of missing out (FOMO) is a powerful feeling, and it can push you to throw your entire $100 into one highly speculative bet.

This is the exact opposite of smart investing. It's gambling. For every viral story you see about someone getting rich overnight, there are thousands of others who lost everything. A solid strategy for how to invest $100 is about spreading your risk, not putting all your eggs in one lottery-ticket basket.

Ignoring the Impact of Fees

Fees are the silent killer of investment returns. They might look tiny on paper—a 1% management fee here, a small trading cost there—but their effect is devastating over time. Compounding is supposed to work for you, but high fees make it work against you.

This is exactly why choosing low-cost index funds and commission-free brokers is non-negotiable, especially when you're just starting. Always look for the expense ratio on any fund you consider. To really grasp the damage, it's worth seeing how investment fees are secretly destroying your wealth over the long haul.

Letting Emotions Drive Your Decisions

Honestly, the hardest part of investing isn't picking stocks; it's managing your own brain. The market goes up and down. That's what it does. You’ll feel a pit in your stomach when your balance drops and a rush of excitement when it soars.

Acting on those feelings is where people go wrong.

- Panic Selling: When you sell everything during a downturn, you're just locking in your losses. You miss the entire rebound that historically follows.

- Chasing Performance: Piling into a "hot" stock after it has already shot up usually means you're the one left holding the bag when it comes back down to earth.

Good investing is usually pretty boring. The goal is to make a simple, solid plan based on your long-term goals and then have the discipline to stick to it, tuning out all the daily noise.

Got Questions About Investing $100? We Have Answers.

Stepping into the world of investing for the first time can feel like learning a new language. You’ve probably got a dozen questions running through your mind, especially when you're starting with a smaller amount. That's not just normal—it's smart.

To help clear things up, I’ve put together answers to the 10 most common questions I hear from beginners who are ready to invest their first $100.

1. Is It Even Worth Investing Just $100?

Yes, one hundred percent. Investing your first $100 isn't about getting rich overnight. It's about two things that are far more valuable: starting a powerful habit and simply getting in the game.

Think of it as your first rep at the gym. It’s not about lifting the heaviest weight on day one; it's about learning the proper form. By investing $100, you learn the real-world process of opening an account, choosing an investment, and making a trade—all with very little at stake. This hands-on experience is invaluable and sets the foundation for your entire financial future.

2. What's the Absolute Safest Way to Invest $100?

When it comes to investing, "safe" usually means finding the right balance between protecting your money and giving it a chance to grow. For someone just starting out, the best blend of safety and real growth potential is a low-cost, diversified S&P 500 ETF.

Why? Because instead of betting on a single company, you're spreading your $100 across 500 of the biggest, most established companies in the U.S. This built-in diversification dramatically cushions you from the failure of any one business.

Want near-zero risk? A high-yield savings account is your best bet. Your money is protected and insured. The trade-off is that your returns will be modest and might not even keep up with inflation over time.

3. Realistically, Could I Lose All My Money?

It’s possible, but it’s highly unlikely if you're smart about it. Where you could get into trouble is by putting all your eggs in one very speculative basket—like throwing your entire $100 at a volatile "meme stock" or an unproven cryptocurrency. That's more like gambling than investing.

However, if you stick with a broadly diversified investment like an S&P 500 ETF, the odds of losing everything are practically zero. For that to happen, all 500 of America’s top corporations would have to go to zero simultaneously, which would mean a complete meltdown of the modern global economy.

4. Do I Have to Pay Taxes on My Profits?

Yes, any money you make from your investments is generally taxable. When you sell an investment for more than you paid, the profit is called a capital gain, and Uncle Sam will want his cut.

How much you pay depends on how long you held the investment:

- Long-Term Capital Gains: Held for more than one year. These profits are taxed at a much lower rate, which is a huge incentive to be a long-term investor.

- Short-Term Capital Gains: Held for one year or less. These are taxed at your regular income tax rate, which is almost always higher.

Keep in mind you might also owe taxes on dividends paid out by stocks or ETFs, even if you don’t sell your shares.

5. What Are the Best Apps for a Beginner to Use?

The best apps for someone investing their first $100 are the ones that don't charge you to trade and are easy to navigate. Here are my go-to recommendations, broken down by your preferred style:

- For the DIY Investor (You Pick): Major brokerages like Fidelity, Vanguard, and Charles Schwab are fantastic. They’ve eliminated trading fees and make buying fractional shares of stocks and ETFs incredibly simple.

- For the Hands-Off Investor (Done for You): Robo-advisors like Betterment and Wealthfront are perfect. You tell them your goals, and they automatically build and manage a diversified portfolio for you. It’s investing on autopilot.

6. Should I Put in the $100 All at Once or in Pieces?

For an amount like $100, just put it all in at once. This is called a lump-sum investment, and it gets your money working for you from day one.

The strategy of breaking up investments—known as dollar-cost averaging—is really more useful for larger sums of money or for when you’re making regular, ongoing contributions (like investing $100 every month). For your first $100, don't get bogged down in the timing. Getting invested is the goal.

7. How Long Should My $100 Stay Invested?

Any money you put in the stock market should be for the long haul. A good rule of thumb is to not touch it for at least five years, but honestly, the longer, the better.

The market can be a rollercoaster in the short term. But over decades, its trend has historically been consistently upward. Think of it this way: the stock market is a great place to build long-term wealth, not a place to park the cash you need for next year's vacation.

8. What's the Actual Difference Between a Stock and an ETF?

This is a great question, and the answer is key to understanding how to invest safely.

- A stock is a tiny piece of ownership in one single company. If you buy a share of Apple, your success rides entirely on how Apple performs.

- An ETF (Exchange-Traded Fund) is a big basket that holds hundreds or even thousands of stocks. Buying one share of an S&P 500 ETF, for example, instantly gives you a sliver of ownership in 500 different companies.

For most beginners, ETFs are the smarter, safer way to start because they provide instant diversification.

9. What Exactly Is a Robo-Advisor? Is It a Good Idea for Me?

A robo-advisor is an online platform that uses algorithms to build and manage an investment portfolio for you. You just answer some simple questions about your goals, timeline, and how you feel about risk. The "robo" then invests your money in a mix of low-cost ETFs and handles all the rebalancing for you.

They are an amazing choice for beginners. They take the guesswork and emotion out of investing and ensure you start with a sensible, diversified portfolio from the get-go.

10. Can I Get Into Real Estate or Crypto With Just $100?

You sure can, though it's important to know what you're getting into.

- Real Estate: Crowdfunding platforms like Fundrise let you buy into large portfolios of properties for as little as $10. It’s a simple way to get a piece of the real estate market without buying a whole building.

- Cryptocurrency: Exchanges like Coinbase make it easy to buy $100 worth of Bitcoin, Ethereum, or other digital currencies.

Just remember, both of these are typically higher-risk than a broad stock market ETF. For your very first investment, building a solid foundation with an S&P 500 ETF is usually the more prudent move.

What Comes After Your First $100?

Getting that first $100 invested is a massive win. Seriously, take a moment to appreciate it. You've officially crossed the line from thinking about investing to doing it. But the real magic happens next, and it’s all about building momentum.

So, what's the game plan now?

The single most powerful thing you can do is make investing a habit. You can set this up in just a few minutes. Go into your brokerage app and schedule a recurring transfer—even $25 a month is a fantastic start. Automating it means you’re building wealth without ever having to think about it.

Get creative with finding extra cash, too. Did you get a small bonus at work or some birthday money? Instead of letting it get absorbed into your daily spending, make a conscious choice to put it to work in your investment account.

The goal isn't just to make one investment. It's to become someone who invests consistently.

Small, regular contributions are what separate casual dabblers from people who successfully build wealth over the long haul. You've already taken the hardest step. Now, just keep the ball rolling.

Welcome to the club—you're an investor now.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.