Budgeting for financial freedom isn't some restrictive chore—it's your personal roadmap for aligning your spending with what you actually want out of life. It’s all about taking your income, your single most powerful wealth-building tool, and consciously pointing it toward a future where you call the shots. The goal here is to shift from a place of financial anxiety to one of genuine empowerment by creating a clear, actionable plan for every dollar you earn.

In This Guide

- 1 Why Your Budget Is the Blueprint for Financial Freedom

- 2 Defining Your Financial Freedom Number

- 3 Building Your Financial Fortress with an Emergency Fund

- 4 Choosing a Budgeting Method That Actually Sticks

- 5 Putting Your Savings to Work

- 6 Making Your Budget Something You'll Actually Stick With

- 7 Frequently Asked Questions About Budgeting for Financial Freedom

- 7.1 1. What is the fastest way to create a budget?

- 7.2 2. How do I budget with an irregular income?

- 7.3 3. Should I pay off debt or invest first?

- 7.4 4. How can I stay motivated on a long journey to financial freedom?

- 7.5 5. Is it ever okay to go over budget?

- 7.6 6. What's the difference between being rich and being financially free?

- 7.7 7. How often should I review and adjust my budget?

- 7.8 8. What are the best tools for budgeting?

- 7.9 9. How can I reduce my expenses without feeling deprived?

- 7.10 10. Can I still enjoy life while budgeting for financial freedom?

Why Your Budget Is the Blueprint for Financial Freedom

Let's clear up a huge misconception right away: a budget isn't about cutting out every last bit of fun. It’s about being intentional. Think of it as the architectural blueprint for the life you're trying to build. This process isn't about saying "no" to everything, but about making deliberate choices that serve your long-term vision. Without a plan, money just has a way of vanishing into small, mindless purchases that, let's be honest, don't really move the needle on your happiness.

A budget simply gives every dollar a job. This ensures your hard-earned money is actively working toward your real goals, whether that's wiping out debt, building a solid emergency fund, or investing for the future. Once you understand exactly where your money is going, you suddenly gain the power to redirect it from things you barely notice to the things that will actually get you to financial freedom faster.

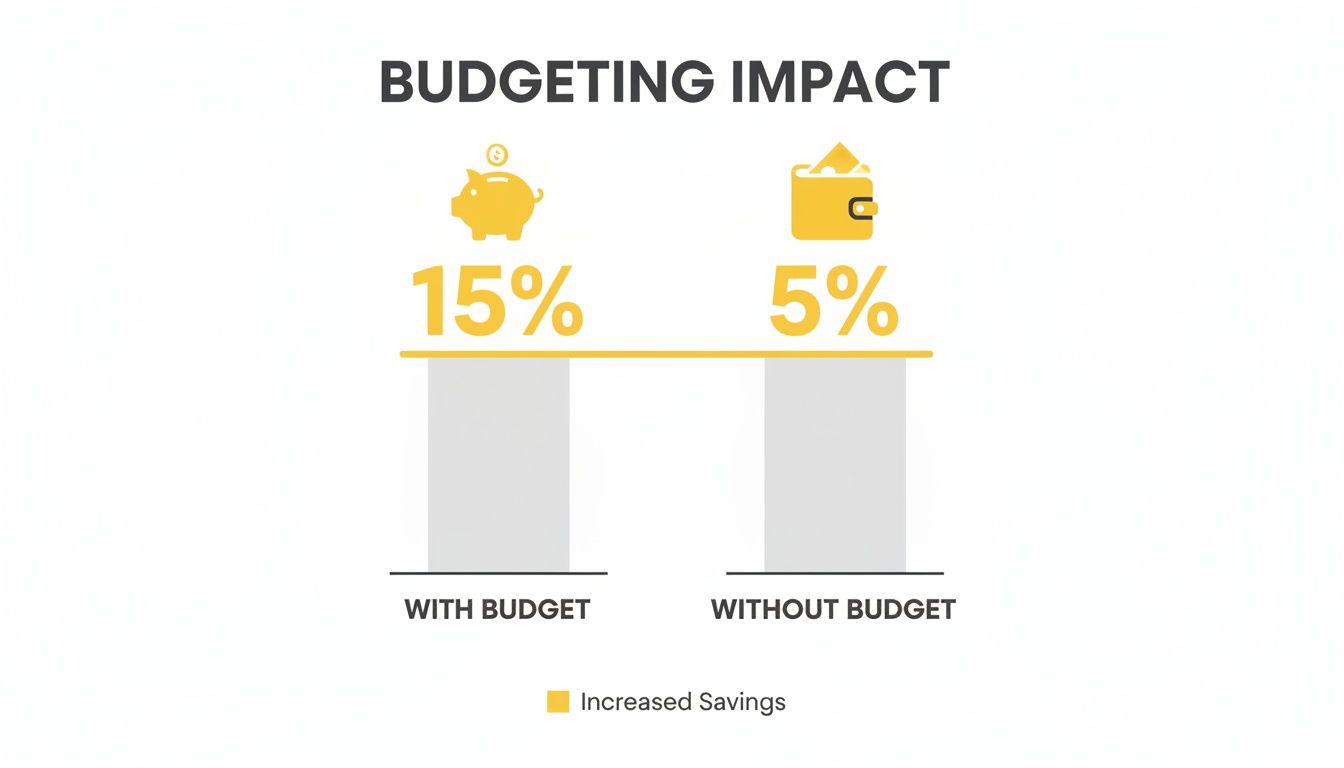

The Real-World Impact of a Budget

The difference between people who plan their money and those who don't is staggering. Research consistently shows that adults who follow a written budget save a median of 15–20% of their income. On the flip side, those without a budget typically save a meager 3–7%. That gap might seem small month-to-month, but it compounds into a massive difference over time, creating entirely different financial futures. You can dive deeper into the core principles of this journey in our complete guide to financial freedom.

Even the simple act of tracking your spending can make a huge impact. Studies have shown that people who just monitor their expenses on a weekly basis tend to cut their discretionary spending by about 10–25% within the first year. That’s a significant chunk of cash you can free up and put to work in investments, creating a powerful engine for building wealth. You can find more compelling statistics over at investingintheweb.com.

The whole point of budgeting isn't to limit your fun; it's to make sure you have money for the things that are truly important to you. It turns that abstract goal of 'financial freedom' into a series of concrete, daily actions.

From Anxiety to Empowerment

Ultimately, budgeting for financial freedom is a mindset shift. You stop reacting to bills and financial surprises and start proactively shaping your own financial destiny. When you create this blueprint, you're no longer just a passenger—you become the architect of your financial life.

See for yourself how a simple plan can dramatically alter your financial trajectory.

The Impact of Budgeting on Savings and Wealth

| Metric | With a Budget | Without a Budget |

|---|---|---|

| Typical Savings Rate | 15–20% of income | 3–7% of income |

| Financial Control | Proactive & Intentional | Reactive & Unpredictable |

| Goal Achievement | Clear path with milestones | Vague and often delayed |

| Long-Term Wealth | Accelerated growth potential | Slow, inconsistent progress |

The numbers don't lie. Putting a budget in place is one of the most effective steps you can take to accelerate your wealth-building and gain control over your financial future.

Defining Your Financial Freedom Number

Before you can build a budget that actually works, you need to know what you're building towards. Setting off on the path to financial freedom without a clear destination is like trying to drive across the country without a map. You need a specific, motivating target to aim for.

That target is your "Financial Freedom Number," often called your "FI Number." It's the magic number—the amount of money you need invested so that your assets can generate enough income to cover your living expenses, forever. You wouldn't have to work for money again unless you wanted to.

Calculating Your Core Number

So, how do you find this number? The most common and reliable way to estimate it is using the 25x Rule, which is just the inverse of the well-known 4% Rule from retirement planning. The 4% Rule suggests you can safely withdraw 4% from your investment portfolio each year without ever running out of money.

By flipping that logic, we get a beautifully simple formula for your target:

Your Financial Freedom Number = Your Desired Annual Expenses x 25

Let’s say you figure out you can live a happy, comfortable life on $60,000 a year. Your FI Number would be $1,500,000 (which is simply $60,000 multiplied by 25). Once you have that much invested, your portfolio should be able to spin off the $60,000 you need each year.

This is where your budget becomes your most powerful tool. It’s not about restriction; it's about acceleration. A good budget directly increases your savings rate, which is the fuel that gets you to your FI Number.

As you can see, people who intentionally budget often save three times as much as those who don't. That difference can shave decades off your timeline to financial freedom.

Different Paths to Financial Independence

Your FI Number is intensely personal. It’s not about what your neighbor needs or what you see on Instagram—it’s about the life you want to live. The great thing about financial independence is that it's not a one-size-fits-all concept. You can learn more about the different flavors of FI in our guide explaining what financial independence is.

Here’s a quick look at how different lifestyle goals dramatically change the target number.

| FI Lifestyle Type | Description | Estimated Annual Expenses | Your Financial Freedom Number |

|---|---|---|---|

| Lean FI | A minimalist life focused on essentials, often in a lower-cost area. | $40,000 | $1,000,000 |

| Standard FI | A comfortable, middle-class lifestyle with room for travel and hobbies. | $70,000 | $1,750,000 |

| Fat FI | A luxury lifestyle with significant spending on travel, dining, and other wants. | $120,000 | $3,000,000 |

This makes it crystal clear: the single biggest factor you control on this journey is your annual spending. That’s why your budget is everything. It’s the tool you use to design your future.

Your savings rate—the percentage of your income you save and invest—is the most powerful lever you have. It determines the speed of your journey more than anything else.

Breaking It Down into Milestones

Okay, I get it. Staring at a seven-figure number can feel completely paralyzing. Who wants to work toward a goal that feels 30 years away?

The secret is to break that massive goal into smaller, bite-sized milestones. This turns an overwhelming marathon into a series of achievable sprints, giving you wins to celebrate along the way.

Think about framing your progress like this:

- Your first $1,000 saved. This is your "get started" fund and a huge first step.

- Emergency fund fully funded. Now you have a safety net (3-6 months of expenses). You've bought yourself peace of mind.

- $25,000 invested. Your money is officially working for you around the clock.

- $100,000 invested. The first six figures is the hardest. This is a massive psychological and financial turning point.

- Hitting "Coast FI." This is when you've invested enough that, even if you never contributed another dime, your portfolio would grow to your full FI number by a traditional retirement age.

Each milestone you hit proves your budget is working and reinforces the positive habits you're building. By defining your ultimate number and then charting the course with smaller goals, you create a real, actionable roadmap to get there.

Building Your Financial Fortress with an Emergency Fund

Every solid financial plan starts with a strong defense. For you, that defense is your emergency fund—it’s the financial fortress that protects you from life's inevitable curveballs. Don't think of it as just cash sitting on the sidelines; see it as the one thing that prevents a single setback, like a job loss or a surprise medical bill, from completely derailing your journey to financial freedom.

Without this buffer, you're one bad day away from racking up high-interest debt or, even worse, cashing out your long-term investments at the absolute worst time. Your emergency fund is your financial moat. It gives you the security to weather storms without having to sacrifice your big-picture goals. This should be your first budgeting priority, period.

How Big Should Your Emergency Fund Be?

The classic rule of thumb is to have 3 to 6 months of essential living expenses tucked away. Pay close attention to the word "essential." This isn't three months of your total income or your typical monthly spending. It’s the bare-bones amount you'd need to keep the lights on if your income suddenly vanished.

To figure out your target number, add up the monthly cost for only the absolute necessities:

- Housing: Your rent or mortgage, plus property taxes and basic utilities.

- Food: Your non-negotiable grocery bill, not what you spend on takeout and restaurants.

- Transportation: Gas, insurance, and minimum car payments.

- Healthcare: Insurance premiums and unavoidable medical costs.

- Debt: The minimum payments on any loans you have.

So, if your essential monthly costs come out to $3,000, your goal is a fund between $9,000 (3 months) and $18,000 (6 months). If that feels daunting, just start with a small, achievable goal like $1,000 and build from there.

Don't underestimate how critical this is. A lack of emergency savings is one of the biggest reasons people get knocked off their wealth-building path. Cross-market surveys consistently show that around 50–57% of younger adults don't even have a three-month buffer. Research from institutions like the Bank of America's newsroom suggests having 3–6 months of expenses saved can reduce the chance of being forced to sell investments during a market downturn by an estimated 40–60%. That’s a massive advantage that keeps your compound growth working for you.

Where to Stash Your Emergency Cash

Your emergency fund has two critical jobs: it needs to be safe, and it needs to be easy to get to. This is not money for the stock market. You simply can't risk it losing value right when you need it most. The best place for it is an account that balances safety with a halfway decent return.

Here’s a quick breakdown of your best options:

| Account Type | Accessibility | Growth Potential | Best For |

|---|---|---|---|

| High-Yield Savings Account | High | Moderate | The best all-around choice for safety and returns. |

| Money Market Account | High | Moderate | Similar to an HYSA, sometimes with check-writing. |

| Traditional Savings Account | High | Very Low | Better than nothing, but just barely. |

A High-Yield Savings Account (HYSA) is the gold standard for your emergency fund. It keeps your money liquid and safe while earning an interest rate that actually helps fight back against inflation—something a standard savings or checking account just can't do.

Build Your Fortress Faster by Automating It

The most effective way to build this financial fortress is to put it on autopilot. Don't rely on willpower or remembering to move money over at the end of the month. Instead, set up an automatic transfer from your checking account to your high-yield savings account for the day after you get paid. For a detailed walkthrough, you might be interested in our guide on how to build an emergency fund.

By paying yourself first, you start treating your emergency savings like any other non-negotiable bill. This simple hack takes the emotion and friction out of the process, guaranteeing you make consistent progress without even thinking about it.

Choosing a Budgeting Method That Actually Sticks

Let's be honest. The most perfectly designed budget is useless if you can't stick with it. The best system isn't about having the fanciest spreadsheet; it's about finding a method that clicks with your personality and lifestyle.

Some people thrive on tracking every single penny, while others need a more hands-off, automated approach to stay on track. The key is to find a system that feels empowering, not punishing. Think of it as finding the right tool for the job of building wealth.

Comparison of Popular Budgeting Methods

So, where do you start? There are countless ways to organize your money, but most successful methods fall into a few key categories. We'll look at three of the most popular approaches. Each one works, but they cater to very different mindsets. See which one sounds the most like you.

| Budgeting Method | Best For | Pros | Cons |

|---|---|---|---|

| The 50/30/20 Rule | Beginners looking for a simple, flexible framework without tedious tracking. | Super easy to get started; provides a balanced guide for spending on needs, wants, and savings. | Can be too broad for complex finances; the percentages might not work for every income level or high cost-of-living area. |

| Zero-Based Budgeting | Detail-oriented people who want total control and to give every dollar a specific job. | Forces you to be intentional with all your money; extremely effective for plugging spending leaks and maximizing savings. | Requires time and effort each month to set up and track; can feel restrictive if you're not used to it. |

| The Envelope System | Anyone who struggles with overspending, particularly with the "invisible" nature of card payments. | Creates a powerful, physical stopgap against overspending; fantastic for building discipline in problem areas. | Using cash can be a hassle; doesn't work well for online shopping or automatic bill payments. |

After looking at the options, remember that you don't have to pick one and be stuck with it forever. The goal is to find what works for you right now. You can always adjust or even switch methods as your financial situation evolves.

A Real-World Example: Finding the "Big Wins"

It’s easy to get bogged down in the small stuff, like agonizing over a $5 coffee. But the real secret to moving the needle toward financial freedom is tackling your "big wins"—the largest line items in your budget.

Let's imagine a couple, Alex and Ben. They bring home a combined $6,000 a month after taxes. They felt like they were working hard but were only managing to save about $300, and the rest just seemed to vanish. To figure out where their money was going, they decided to try a Zero-Based Budget.

Here’s what their first month of tracking revealed:

- Housing (Rent + Utilities): $2,200

- Car Payments & Insurance: $650

- Groceries & Dining Out: $1,100

- Subscriptions & Gym: $150

- Student Loans: $400

- Miscellaneous Spending: $1,200

- Savings: $300

Instead of canceling their Netflix subscription, they went after the big fish. First, they shopped around for car insurance and found a new policy that immediately saved them $100 a month. Easy win.

Next, they tackled that massive food bill. They realized over $600 of it was from takeout and unplanned dinners out. They didn't want to stop eating out completely, so they created an intentional dining budget of $300 and started meal planning for their groceries. That simple change saved them another $300.

By making just two strategic changes, Alex and Ben freed up an extra $400 every single month. Their savings shot up from $300 to $700, more than doubling their savings rate without feeling deprived. That's the power of focusing on big wins.

So, Which Budgeting Style Is Right for You?

Ultimately, this comes down to self-awareness. Are you a hands-off person, or do you love getting into the weeds?

-

If you just want simple guidelines to get started, the 50/30/20 Rule is a great entry point. It provides a solid, balanced structure without the daily grind of tracking.

-

If you feel like your paycheck disappears into a black hole each month, give Zero-Based Budgeting a shot. It forces you to account for every dollar, leaving no room for mystery spending.

-

If you know your weakness is swiping a card for impulse buys, shopping, or food, try the Envelope System for just one month. The simple act of using physical cash can radically shift your perspective and habits.

The whole point of budgeting for financial freedom is to build a plan you can actually sustain for the long haul. Don't be afraid to test a method out, see how it feels, and even mix and match. You could use the 50/30/20 Rule for your overall plan but apply zero-based principles within your 30% "wants" category.

The perfect system is the one that gets you to save more and invest consistently, bringing you closer to your goals with every paycheck.

Putting Your Savings to Work

Carving out a gap between what you earn and what you spend is only half the battle. The second, and far more exciting, part is telling that extra cash exactly what to do to fast-track your journey to financial freedom. This is where you stop thinking of savings as idle money and start seeing it as the fuel for your wealth-building engine.

The single most powerful mindset shift you can make is to pay yourself first. Before a dollar goes to groceries, Netflix, or your morning coffee, a portion is set aside for your future. It’s that simple. Treating your financial goals like a non-negotiable bill is the secret sauce.

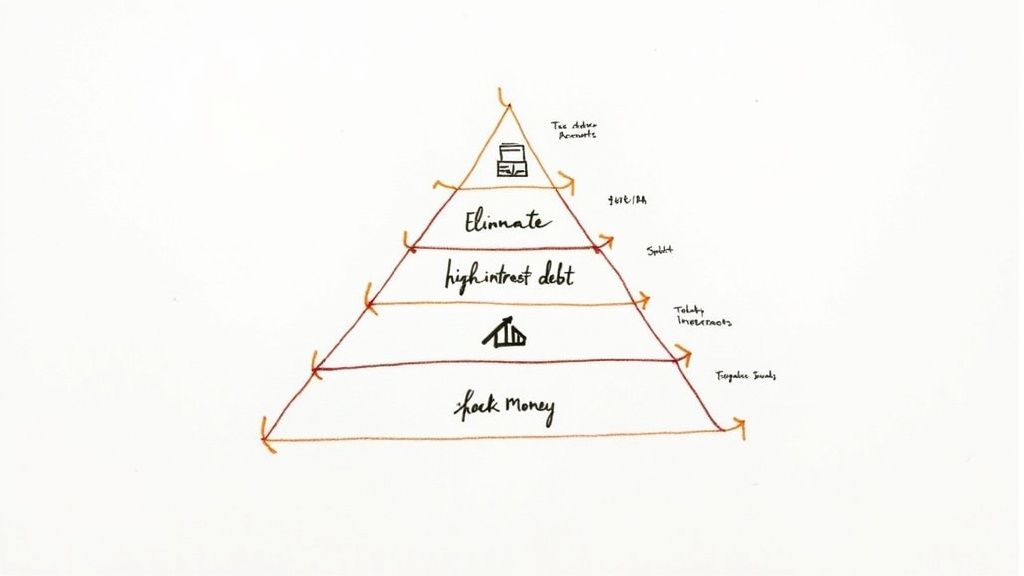

The Strategic Order of Operations

To get the most bang for your buck, your savings need a clear pecking order. Think of it as a strategic game plan that plugs financial leaks first and then puts your money to work in the most efficient way possible.

Here’s the playbook I’ve seen work time and time again:

- Annihilate High-Interest Debt: This is job number one, no exceptions. Credit card debt, with interest rates often north of 20%, is a financial emergency. Paying it off gives you a guaranteed, risk-free return on your money that you'll never find in the stock market.

- Load Up Tax-Advantaged Accounts: Once the toxic debt is gone, your focus shifts to accounts like a 401(k) or an IRA. These are game-changers because of their tax benefits—your money can grow tax-deferred or even be withdrawn tax-free in retirement. And if your employer offers a 401(k) match? That's not just a suggestion; it's free money you absolutely must capture.

- Open a Taxable Brokerage Account: After you've maxed out those tax-sheltered accounts, a standard brokerage account is your next stop. This is your workhorse for investing in assets like low-cost index funds to keep the wealth-building momentum going strong.

The Power of Consistent Investing

The "pay yourself first" rule isn't just a catchy phrase; it's a proven wealth accelerator. When you consistently funnel a percentage of your income into diversified investments, the long-term results are staggering.

Let's look at a real-world example. Based on conservative, historically plausible real returns of 4–5% per year, someone saving 10% of a $75,000 salary ($7,500 per year) would have about $141,000 after 15 years. Not bad. But by bumping that savings rate to 20% ($15,000 per year), their nest egg swells to roughly $282,000 in the same timeframe. That one change dramatically shortens the runway to financial freedom.

By prioritizing investing as a non-negotiable part of your budget, you shift from being a consumer to an owner. Each dollar invested is a small piece of a business working for you, 24/7.

Low-Cost Index Funds: The Smart Default

For most of us building a budgeting for financial freedom plan, the simplest and most effective tool is the low-cost index fund. Instead of trying to find a needle in a haystack by picking individual stocks, these funds buy a tiny piece of every company in a major market index (like the S&P 500). Instant diversification, zero guesswork.

It really boils down to two very different paths for a new investor:

| Investment Approach | Description | Risk Level | Cost | Management |

|---|---|---|---|---|

| Low-Cost Index Funds | Buys the entire market, providing broad diversification automatically. | Diversified (Lower) | Very Low (e.g., 0.04%) | Passive |

| Individual Stock Picking | Involves researching and buying shares of specific companies. | Concentrated (Higher) | Varies (Trading Fees) | Active |

By opting for index funds, you get off the high-stakes rollercoaster of trying to beat the market. Instead, you can focus on the two things you actually control: how much you save and how consistently you do it. If you're ready to take the next step, our guide on how to start investing money walks you through the entire process. This strategy is how you turn your budget's extra cash into a reliable, automated wealth-building machine.

Making Your Budget Something You'll Actually Stick With

Let's be honest: a budget you can't maintain is useless. It's not a one-and-done task you can frame and hang on the wall. Think of it more like a living, breathing financial plan that grows and changes right along with you.

The secret to making it last isn't about having superhuman discipline—it's about smart automation. When you make your financial plan run on autopilot, you remove the daily friction and the mental drain of making good choices. It just happens.

The single most effective thing you can do is set up automatic transfers. I'm talking about scheduling your savings and investment contributions to whisk away money the day after you get paid. Do the same for your big, recurring bills. This "pay yourself first" strategy ensures your most important goals are funded before you even have a chance to spend that money on something else.

Finding Your Rhythm for Quick Check-Ins

While automation does the heavy lifting, you still need to pop the hood every so often to make sure everything is running smoothly. This isn't about micromanaging every single coffee purchase. It’s about making sure your big-picture plan still fits your life. Finding that balance is key—it keeps you from either ignoring your budget completely or obsessing over it.

Here’s a simple schedule that I've found works for almost everyone:

- The Monthly 30-Minute Check-In: Once a month, grab a cup of coffee and just… review. Did you hit your savings goal? Did any surprise expenses pop up? This is your quick pit stop to make small adjustments for the next month. No big deal.

- The Quarterly 1-Hour Review: Every three months, it's time to zoom out a bit. How's your net worth looking? Are you still on track for your yearly goals? This is also the perfect time to glance at your investment performance and see if any major spending categories need a rethink.

Your Budget Needs to Bend, Not Break

Life happens. You get a promotion, you get married, you have kids. Your budget needs to be flexible enough to handle these shifts. If it’s too rigid, it will break. A budget that adapts to your life remains a powerful tool instead of just becoming an irrelevant old document.

For a deeper dive into building financial resilience, check out our guide on these powerful money habits that can transform your finances.

Think about how your financial plan would need to change during these common life moments:

| Life Event | Key Budget Adjustments to Consider |

|---|---|

| Getting a Pay Raise | This is a big one. Before you do anything else, bump up your automatic savings and investment transfers. I always tell people to aim to save at least 50% of the new money to fight off lifestyle creep. |

| Marriage or Partnership | Time for a money date. Sit down and get on the same page about your shared goals. You'll need to figure out your banking system (joint, separate, or a mix of both) and then build a new household budget together. |

| Having a Baby | From childcare and healthcare to diapers and formula, your expenses are about to change. You'll need to work these new costs into your budget, probably increase your emergency fund, and definitely review your life insurance. |

By combining smart automation with regular, low-stress check-ins, and a willingness to adapt, you turn your budget from a chore into a reliable system that will genuinely carry you toward financial freedom.

Frequently Asked Questions About Budgeting for Financial Freedom

1. What is the fastest way to create a budget?

The quickest method is the 50/30/20 rule. Allocate 50% of your after-tax income to "Needs" (housing, utilities, groceries), 30% to "Wants" (hobbies, dining out), and 20% to "Savings & Debt Repayment." It provides a simple framework without needing to track every single penny.

2. How do I budget with an irregular income?

Budget based on your lowest-earning month from the past year. Use this "baseline income" to cover all essential expenses. In months where you earn more, use the surplus to aggressively pay down debt, boost your emergency fund, or invest. This approach creates stability even when your income fluctuates.

3. Should I pay off debt or invest first?

Mathematically, you should prioritize high-interest debt (anything over 7-8%, like credit cards). The guaranteed return from paying off a 20% APR card is unbeatable. For low-interest debt (like a mortgage under 5%), it often makes more sense to invest, as historical market returns are higher. However, if being debt-free gives you peace of mind, it's okay to prioritize paying it all off.

4. How can I stay motivated on a long journey to financial freedom?

Break your large goal into smaller milestones and celebrate them. Key milestones could be: fully funding your emergency fund, paying off a credit card, reaching your first $25,000 invested, or hitting a $100,000 net worth. Celebrating these "wins" provides the positive reinforcement needed to stay engaged for the long haul.

5. Is it ever okay to go over budget?

Yes, life happens. The key is to have a plan for it. If an unexpected but necessary expense arises (like a car repair), your emergency fund should be the first line of defense. For discretionary overspending, acknowledge it, adjust your budget for the next month to compensate, and move on. A flexible budget is more sustainable than a rigid one.

6. What's the difference between being rich and being financially free?

Being "rich" is often tied to a high income or a large net worth. Financial freedom is different—it's about cash flow. You are financially free when your assets generate enough passive income to cover your living expenses without needing to work. This budget is your tool to build that reliable income stream.

7. How often should I review and adjust my budget?

A quick 15-30 minute check-in once a month is ideal to ensure you're on track and make minor adjustments. Plan for a more in-depth review once or twice a year, or after a major life event like a marriage, new job, or having a child.

8. What are the best tools for budgeting?

This depends on your personality. For simplicity, apps like Mint or YNAB (You Need A Budget) are excellent. For maximum control, a custom spreadsheet (using Google Sheets or Excel) is powerful. For those who struggle with overspending, the physical cash envelope system can be incredibly effective.

9. How can I reduce my expenses without feeling deprived?

Focus on the "big wins": housing, transportation, and food. Can you refinance your mortgage, shop for cheaper car insurance, or reduce food waste by meal planning? Cutting $200 from these categories is far more impactful and less painful than skipping every single coffee you enjoy.

10. Can I still enjoy life while budgeting for financial freedom?

Absolutely. A good budget is not about deprivation; it's about intentionality. It ensures you have money for the things you truly value, whether that's travel, hobbies, or dining out with friends. By cutting mindless spending on things you don't care about, you free up more resources for what brings you genuine joy.

At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. Whether you're navigating stocks, real estate, or crypto, our resources are designed to help you achieve your financial goals. Explore proven tactics to enhance your portfolio by visiting us at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.