Hedge funds, once the exclusive domain of institutional investors and the ultra-wealthy, utilize sophisticated methods to navigate complex markets. Understanding these approaches is no longer just for Wall Street insiders; it offers valuable insights for any serious investor looking to diversify and enhance their portfolio. These alternative investment vehicles are defined by their flexibility, employing a wide array of tools unavailable to traditional mutual funds, such as short selling, leverage, and derivatives, to pursue absolute returns regardless of market direction.

This comprehensive guide unpacks the most influential hedge fund investment strategies, moving beyond simple definitions to provide a clear view of their mechanics, risks, and potential rewards. We will explore everything from classic Long/Short Equity to opportunistic Event-Driven and quantitative-heavy Statistical Arbitrage. By examining how legendary investors built their fortunes, we can see how these complex strategies can inform a more robust wealth-building journey.

Whether you're an accredited investor considering a direct allocation to alternative assets or simply an ambitious individual seeking to deepen your financial knowledge, this roundup will equip you with a foundational understanding of the world of high-finance. You will learn the core principles behind each strategy, its typical risk-return profile, and potential ways to gain exposure. This article serves as a detailed map to the often-opaque universe of hedge funds, designed to make these advanced concepts accessible and actionable.

In This Guide

- 1 1. Long/Short Equity

- 2 2. Global Macro

- 3 3. Event-Driven (Merger Arbitrage)

- 4 4. Distressed Securities

- 5 5. Relative Value/Statistical Arbitrage

- 6 6. Credit/Fixed Income Arbitrage

- 7 7. Activist/Special Situations

- 8 8. Commodity Trading Advisors (CTA)

- 9 9. Multi-Strategy/Fund of Funds

- 10 10. Private Equity/Pre-IPO Investing

- 11 11. Cryptocurrency/Digital Assets

- 12 12. Insurance-Linked Securities (ILS)

- 13 12 Hedge Fund Strategies Compared

- 14 Integrating Hedge Fund Insights into Your Investment Framework

- 15 Frequently Asked Questions (FAQ)

- 15.1 1. What is the most common hedge fund strategy?

- 15.2 2. Can retail investors use hedge fund strategies?

- 15.3 3. Which hedge fund strategy is the riskiest?

- 15.4 4. What is a "market-neutral" strategy?

- 15.5 5. Why do hedge funds use short selling?

- 15.6 6. What does the "2 and 20" fee structure mean?

- 15.7 7. Are hedge fund strategies effective during a recession?

- 15.8 8. What is the difference between a hedge fund and a mutual fund?

- 15.9 9. What is "alpha" in the context of hedge funds?

- 15.10 10. How do I choose the right hedge fund strategy for my portfolio?

1. Long/Short Equity

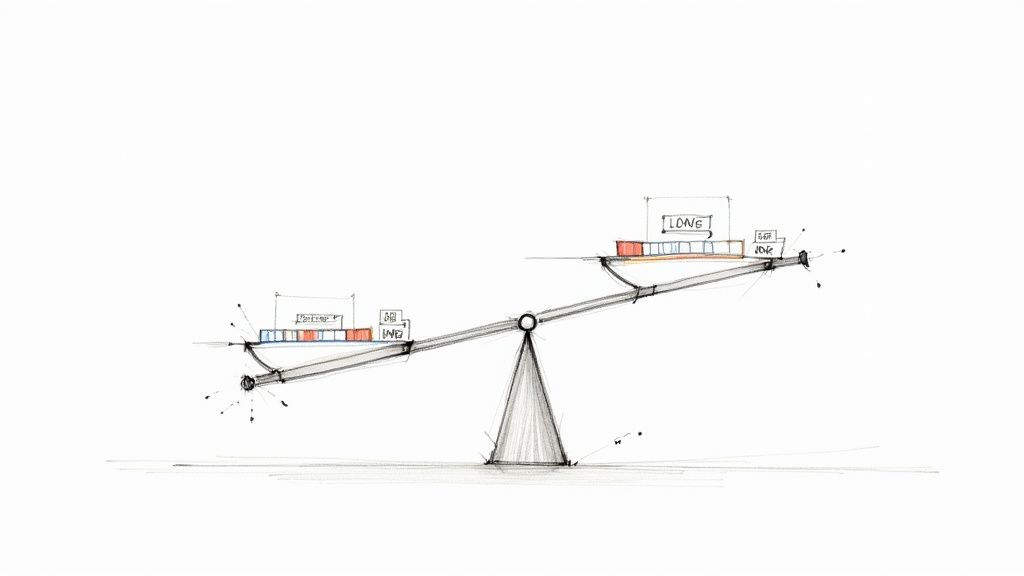

Long/short equity stands as one of the most foundational and widely practiced hedge fund investment strategies. This approach involves simultaneously taking long positions in stocks expected to appreciate in value and short positions in stocks expected to decline. The core objective is to generate returns from both accurate stock selection on the long and short sides, while also mitigating overall market risk. This dual-sided approach allows fund managers to capture alpha (excess returns) regardless of the broader market's direction.

This strategy is highly flexible. A manager can adjust the fund's net exposure (long positions minus short positions) to be net long, net short, or market neutral, depending on their market outlook. For instance, in a bull market, a fund might hold 100% long positions and 40% short positions, resulting in a 60% net long exposure. In contrast, a market-neutral fund might aim for a 0% net exposure to isolate returns purely from stock-picking skill.

How It Works in Practice

A classic example involves a pair trade within the same sector. A manager might identify two retail companies: one with strong e-commerce growth and another struggling with brick-and-mortar sales. The manager would go long on the outperformer and short the underperformer. This strategy, famously employed by managers like Ken Griffin at Citadel, can profit if the long position outperforms the short position, even if the entire retail sector declines. Mastering this requires deep fundamental analysis. If you want to learn more about how to identify top-performing stocks, this detailed guide can provide a solid foundation.

Key Implementation Tips

- Maintain Balanced Hedging: Actively manage your net and gross exposure to align with your risk tolerance and market view.

- Monitor Short Costs: Keep a close watch on the cost to borrow stocks for shorting, as high fees can erode profitability.

- Implement Stop-Losses: Use strict stop-loss orders for both long and short positions to manage downside risk from incorrect calls.

2. Global Macro

Global macro is a top-down hedge fund investment strategy that bases its trades on broad macroeconomic and geopolitical trends. Managers analyze factors like interest rate policies, inflation, political events, and international trade flows to make large, often leveraged, bets across global markets. This strategy is highly opportunistic and can involve trading currencies, commodities, sovereign bonds, and stock market indices, aiming to profit from major economic shifts.

Unlike strategies focused on individual securities, global macro is concerned with the big picture. A fund manager might forecast that a country's central bank will raise interest rates, leading them to long that nation's currency while shorting its government bonds. The flexibility to trade any asset class anywhere in the world gives these funds the potential for immense returns, but also exposes them to significant risk if their macroeconomic thesis proves incorrect.

How It Works in Practice

A legendary example is George Soros's 1992 bet against the British pound. Believing the UK government could not sustain the pound's high value within the European Exchange Rate Mechanism (ERM), Soros's Quantum Fund built a massive short position. When the UK was forced to withdraw from the ERM and devalue its currency, the fund reportedly made over $1 billion in profit. This trade highlights how a deep understanding of economic policy and market mechanics, similar to the operations of large entities like sovereign wealth funds, can lead to historic gains.

Key Implementation Tips

- Monitor Central Bank Policy: Closely track pronouncements and actions from major central banks like the Federal Reserve and ECB, as they are primary drivers of market movements.

- Track Geopolitical Developments: Stay informed on international relations, elections, and conflicts, as these events can create significant market volatility and opportunity.

- Develop Economic Models: Build and maintain robust frameworks for analyzing economic data to form a coherent, data-driven market thesis.

3. Event-Driven (Merger Arbitrage)

Event-driven is a prominent category of hedge fund investment strategies focused on capitalizing on specific corporate events. This approach involves taking positions in companies undergoing significant changes, such as mergers, acquisitions, bankruptcies, or spin-offs. The goal is to profit from the price movements that these "hard catalyst" events trigger, which are often independent of broader market trends. Managers analyze the probability and timing of an event's successful completion to capture the resulting value.

This strategy is highly specialized. A manager identifies a publicly announced deal, like an acquisition, and analyzes the "spread" between the current trading price of the target company's stock and the price offered by the acquirer. If the manager believes the deal will close successfully, they buy the target's stock, aiming to profit as its price converges toward the acquisition price. This focus on deal-specific outcomes provides a source of returns that is often uncorrelated with the overall stock market.

How It Works in Practice

A well-known example is when Microsoft announced its intention to acquire Activision Blizzard. An event-driven manager would have analyzed the deal's terms, regulatory hurdles (like antitrust reviews), and shareholder sentiment. Believing the deal would ultimately be approved, the fund would purchase Activision Blizzard's stock at a discount to the proposed acquisition price of $95 per share. The profit is the spread captured when the stock price rises to meet the offer price upon the deal's closure. Managers like Bill Ackman and Paul Singer have famously used this strategy to generate significant returns.

Key Implementation Tips

- Develop Regulatory Expertise: Understand the antitrust and regulatory approval processes in different jurisdictions, as they are often the biggest risk to a deal's completion.

- Monitor Deal Pipeline: Continuously analyze announced deals and potential M&A activity to identify attractive risk/reward opportunities.

- Assess Management Incentives: Evaluate the motivations of the management teams on both sides of a transaction to gauge their commitment to closing the deal.

4. Distressed Securities

Distressed securities investing is one of the more specialized hedge fund investment strategies, focusing on companies in financial turmoil. This approach involves purchasing the debt or equity of businesses that are in or near bankruptcy at deeply discounted prices. The central goal is to profit from a company's successful turnaround, restructuring, or liquidation, where the value of the acquired assets exceeds the purchase price. Managers like Howard Marks of Oaktree Capital have built legendary careers by navigating these complex, high-risk, high-reward situations.

This strategy requires a unique blend of legal, financial, and operational expertise. Unlike traditional equity analysis, success here often depends on understanding bankruptcy law, creditor rights, and the intricate process of corporate reorganization. A fund might purchase senior debt to gain control during a restructuring or buy junior debt and equity if they believe a recovery will be more robust than the market expects. This active, and often confrontational, approach allows managers to influence outcomes and unlock significant value.

How It Works in Practice

A classic example involves a fund buying a company's bonds for pennies on the dollar after it files for Chapter 11 bankruptcy. The fund's managers, such as those at Apollo Global Management, might then take an active role on the creditors' committee. They would negotiate the terms of the reorganization, potentially swapping their debt for a controlling equity stake in the newly restructured company. If the company successfully emerges from bankruptcy, the value of their new equity position could be multiples of their initial investment. This process is similar in principle to buying other distressed assets; you can learn more about how to find and acquire distressed properties for a parallel in the real estate world.

Key Implementation Tips

- Master Bankruptcy Law: A deep understanding of legal frameworks like Chapter 11 is non-negotiable for assessing risk and opportunity.

- Analyze Creditor Hierarchies: Determine the priority of claims (who gets paid first) to accurately value different securities within the capital structure.

- Maintain Liquidity: Restructurings can take years to play out, so ensure you have sufficient capital to withstand extended holding periods.

5. Relative Value/Statistical Arbitrage

Relative value, often executed through statistical arbitrage, is a quantitative hedge fund investment strategy that exploits temporary price discrepancies between related financial instruments. Instead of betting on the overall market direction, managers use sophisticated mathematical models to identify securities whose prices have deviated from their historical correlation. The core assumption is that these relationships will eventually revert to their mean, allowing the fund to profit from the convergence. This approach is highly systematic and technology-driven.

This strategy is celebrated for its market-neutral characteristics, as it aims to isolate alpha from pricing inefficiencies rather than broad market movements. Managers can apply this concept across various asset classes, including equities (pairs trading), convertible bonds (convertible arbitrage), and fixed-income securities. The goal is to generate consistent, low-volatility returns that are uncorrelated with the S&P 500 or other major indices.

How It Works in Practice

A classic example is pairs trading. A quantitative model might identify that the stock prices of two major competitors, like Coca-Cola and PepsiCo, have maintained a stable historical price ratio. If a temporary market event causes Coca-Cola's stock to drop significantly while PepsiCo's remains stable, the model would flag a statistical anomaly. A fund, such as those managed by pioneers like Jim Simons at Renaissance Technologies or Ken Griffin at Citadel, would go long on the undervalued Coca-Cola and short the relatively overvalued PepsiCo, profiting as their price relationship normalizes. If you're interested in the mechanics, our guide to algorithmic trading strategies offers deeper insights.

Key Implementation Tips

- Invest in Technology: A robust technology infrastructure is non-negotiable for data processing, model execution, and low-latency trading.

- Employ Rigorous Backtesting: Thoroughly backtest all models against historical data to validate their predictive power and understand their limitations.

- Monitor Model Performance: Continuously track key performance metrics and be prepared to recalibrate or retire models that exhibit decay or underperformance.

6. Credit/Fixed Income Arbitrage

Credit/Fixed income arbitrage is one of the more technical hedge fund investment strategies, focusing on exploiting pricing inefficiencies within credit and debt markets. This approach involves identifying and capitalizing on small pricing discrepancies between related fixed-income securities, such as government bonds, corporate bonds, and credit default swaps (CDS). The goal is to generate consistent, low-volatility returns by capturing relative value while hedging against broader interest rate and credit market movements.

This strategy is less about predicting the market's direction and more about identifying mispricings. Managers take offsetting long and short positions in instruments that are theoretically linked but temporarily trading at different prices. For example, a fund might buy an undervalued corporate bond while simultaneously shorting an overvalued, similar-maturity bond from the same issuer or a related credit default swap. This isolates the pricing inefficiency from general market risk.

How It Works in Practice

A classic example involves a convertible bond arbitrage trade. A manager might find a company's convertible bond is underpriced relative to its underlying stock. They would go long on the convertible bond and short a corresponding amount of the company's common stock. This position aims to be delta-neutral, meaning it's hedged against small movements in the stock price. The profit comes from the bond's yield and the eventual convergence of the bond's price to its theoretical value. Firms like Bracebridge Capital and Millennium Management are known for their sophisticated execution of these complex arbitrage strategies.

Key Implementation Tips

- Develop Strong Credit Analysis: Deeply analyze issuer creditworthiness, bond covenants, and capital structure to accurately identify mispricings.

- Monitor Yield Curve Dynamics: Actively track changes in the yield curve, as shifts can significantly impact the profitability of spread trades.

- Use CDS for Hedging: Employ credit default swaps not just for speculation but also to effectively hedge credit risk in your bond portfolio.

7. Activist/Special Situations

Activist or special situations is a high-stakes hedge fund investment strategy where managers acquire a significant equity stake in a publicly traded company. The goal is to influence corporate management and board decisions to unlock shareholder value. This is a confrontational and hands-on approach, far from passive investing, aimed at catalyzing change from within. Activists seek to correct what they perceive as mismanagement, poor capital allocation, or undervalued assets.

This strategy is not about simply picking stocks; it's about actively creating value. An activist fund might push for a sale of the company, the divestiture of non-core assets, share buybacks, or changes in executive leadership. Success hinges on the fund's ability to build a compelling case for its proposed changes and win support from other shareholders, often through public campaigns or proxy contests.

How It Works in Practice

A well-known example is Bill Ackman's Pershing Square Capital Management, which has engaged in numerous activist campaigns. In one notable case, Ackman took a large stake in Canadian Pacific Railway and successfully waged a proxy battle to replace its CEO and several board members. The subsequent operational and strategic overhaul led to a dramatic turnaround in the company's performance, causing its stock price to soar and generating substantial returns for Pershing Square. This demonstrates how activists can force meaningful change.

Key Implementation Tips

- Develop a Thorough Thesis: Your plan for value creation must be meticulously researched, data-driven, and presented with a clear 100-day plan.

- Engage Constructively: While confrontation is possible, initial attempts to work with management can often be more effective and less costly than a public battle.

- Build Shareholder Alliances: Gaining the support of other large institutional investors is crucial for winning proxy contests and pressuring the board.

8. Commodity Trading Advisors (CTA)

Commodity Trading Advisors (CTA), also known as managed futures, represent a systematic and often trend-following hedge fund investment strategy. CTAs trade in futures contracts across a wide array of asset classes, including commodities, currencies, stock indices, and interest rates. Their core objective is to generate returns by identifying and capitalizing on sustained price trends, or momentum, in global markets, making them uniquely positioned to profit in both rising and falling market environments.

This strategy relies heavily on quantitative and algorithmic models rather than fundamental analysis. By systematically analyzing historical price data, CTAs aim to capture market "beta" across different cycles. Because their returns are often uncorrelated with traditional stock and bond markets, they serve as powerful diversifiers within a broader investment portfolio, particularly during periods of market stress or high inflation when trends can be most pronounced.

How It Works in Practice

A classic CTA approach involves trend-following. For example, if a model identifies a strong upward trend in crude oil prices, the CTA will take a long position in oil futures. Conversely, if it detects a sustained downward trend in the Euro, it will go short. This strategy was famously taught by Richard Dennis through his "Turtle Traders" experiment, where he proved that systematic trading rules could be taught and successfully implemented. Modern CTAs like Man AHL and Winton Group apply sophisticated algorithms to hundreds of markets simultaneously.

Key Implementation Tips

- Robust Trend Identification: Develop or utilize a system that can reliably identify the start and end of trends across various market conditions.

- Careful Position Sizing: Use disciplined risk management to determine position sizes, ensuring no single trade can severely impact the portfolio.

- Monitor for Regime Changes: Markets can shift from trending to range-bound. Your models must adapt to these changes to avoid losses.

9. Multi-Strategy/Fund of Funds

A Multi-Strategy or Fund of Funds approach represents one of the most diversified hedge fund investment strategies. Instead of focusing on a single method, these funds either combine multiple strategies under one roof (Multi-Strategy) or invest in a portfolio of different, unaffiliated hedge funds (Fund of Funds). The primary goal is to generate consistent, risk-adjusted returns by blending various uncorrelated strategies, thereby reducing reliance on any single market condition, manager, or asset class.

This strategy offers built-in diversification. By allocating capital across different approaches like long/short equity, global macro, and event-driven, the fund can smooth out returns and lower overall portfolio volatility. This structure is particularly appealing to institutional investors, family offices, and high-net-worth individuals seeking broad hedge fund exposure without the burden of conducting due diligence on dozens of individual managers.

How It Works in Practice

A Multi-Strategy fund, like those managed by major firms such as Citadel or Millennium, operates with various internal portfolio management teams, each specializing in a different strategy. Capital is dynamically allocated between these teams based on market opportunities and risk management parameters. Similarly, a Fund of Funds manager, like those at Grosvenor Capital Management, will construct a portfolio by selecting external top-tier hedge fund managers. Their value lies in manager selection, portfolio construction, and ongoing monitoring, providing investors a single access point to a curated selection of elite funds.

Key Implementation Tips

- Assess the Fee Structure: Understand the double layer of fees (fees of the underlying funds plus the Fund of Funds' own fees) and how it impacts net returns.

- Evaluate Manager Selection: Scrutinize the fund's due diligence and manager selection process, as this is the primary driver of performance.

- Monitor Strategy Correlation: Ensure the underlying strategies are genuinely uncorrelated to achieve the desired diversification benefits.

10. Private Equity/Pre-IPO Investing

Private equity and pre-IPO investing is a strategy where a fund acquires significant, often controlling, stakes in private companies. Unlike public market strategies, this approach involves long-term commitments, with managers actively working alongside a company's leadership to drive operational improvements, scale growth, and increase its valuation before a liquidity event. The ultimate goal is to generate substantial returns through an eventual Initial Public Offering (IPO), strategic acquisition, or secondary market sale.

This strategy hinges on deep due diligence and a hands-on approach to value creation. Funds specializing in this area often develop sector-specific expertise, allowing them to identify promising ventures and provide strategic guidance. As one of the more illiquid hedge fund investment strategies, it offers the potential for outsized returns by capturing a company's most significant growth phase before it becomes accessible to the public market.

How It Works in Practice

A classic example is the role of venture capital firms like Sequoia Capital or Andreessen Horowitz (a16z). These firms identify early-stage technology companies with disruptive potential, such as Airbnb or Stripe. They provide not just capital but also invaluable mentorship, networking opportunities, and operational support to help these startups navigate challenges and scale rapidly. The fund realizes its gains years later when the company goes public or is acquired, turning a relatively small initial investment into a monumental return. This model, popularized by figures like Peter Thiel, requires patience and a strong belief in the long-term vision of the portfolio companies.

Key Implementation Tips

- Develop Deep Sector Expertise: Focus on a specific industry to better evaluate technology, market dynamics, and competitive advantages.

- Build Strong Founder Relationships: Success is often tied to the quality of the management team; foster trust and alignment from the start.

- Plan Exit Strategies Early: Understand the potential paths to liquidity (IPO, acquisition) and what milestones are needed to achieve them.

- Maintain Follow-On Capacity: Reserve capital to participate in subsequent funding rounds to avoid dilution and support a company's continued growth.

11. Cryptocurrency/Digital Assets

Cryptocurrency and digital assets represent one of the newest and most dynamic hedge fund investment strategies. This approach involves investing in a diverse range of digital assets, including major cryptocurrencies like Bitcoin and Ethereum, as well as emerging blockchain tokens and decentralized finance (DeFi) protocols. The goal is to generate high returns from the rapid growth and volatility inherent in this nascent asset class, leveraging deep technological and market understanding.

This strategy is highly multifaceted. Managers may employ simple long-only venture-style investing, actively trade spot markets and derivatives, or engage in complex activities like yield farming and staking directly on blockchain protocols. The extreme volatility of the asset class means risk management and security are paramount, distinguishing it from more traditional strategies.

How It Works in Practice

A crypto fund manager might identify a promising new blockchain protocol with superior transaction speeds and a strong developer community. The fund would take an early-stage equity or token position, similar to a venture capital investment. For example, Pantera Capital and Multicoin Capital are known for making early bets on foundational blockchain infrastructure projects that later saw exponential growth. Alternatively, a fund might use quantitative models to trade price discrepancies between different crypto exchanges, a form of arbitrage. Exploring a variety of approaches is key, and you can learn more about 9 proven cryptocurrency investment strategies for 2025 to understand the landscape better.

Key Implementation Tips

- Implement Robust Security: Use institutional-grade custody solutions and multi-signature wallets to protect assets from theft.

- Monitor On-Chain Metrics: Analyze network health, transaction volumes, and developer activity to inform investment decisions.

- Stay Updated on Regulation: The regulatory landscape is constantly evolving and can significantly impact asset prices.

- Manage Position Sizing: Given the high volatility, use careful position sizing to manage portfolio-level risk effectively.

12. Insurance-Linked Securities (ILS)

Insurance-Linked Securities (ILS) is a niche but powerful hedge fund investment strategy where funds invest in financial instruments whose value is driven by insurance loss events. These securities, most notably catastrophe bonds (or "cat bonds"), transfer specific risks, such as those from natural disasters like hurricanes or earthquakes, from insurance or reinsurance companies to capital market investors. The core objective is to earn attractive, non-correlated returns from the risk premiums paid by these insurers.

This strategy's main appeal is its low correlation to traditional financial markets. The performance of an ILS portfolio depends on the occurrence of specific catastrophic events, not on fluctuations in stock prices, interest rates, or economic growth. This provides a potent source of diversification for a broader portfolio, making it a unique component among hedge fund investment strategies. Managers in this space require deep expertise in actuarial science, meteorology, and catastrophe modeling.

How It Works in Practice

A fund manager, such as those at Nephila Capital, might purchase a catastrophe bond issued by a Florida-based insurer seeking protection against a major hurricane. Investors in the bond receive regular coupon payments (the premium). If no qualifying hurricane occurs before the bond's maturity, investors get their principal back plus the coupons. However, if a specified catastrophic event happens, the bond's principal is used to pay the insurer's claims, and investors may lose some or all of their investment. Success hinges on accurately modeling the probability of these events and diversifying across different perils and geographic regions.

Key Implementation Tips

- Develop Actuarial Expertise: A deep understanding of insurance risk and probability modeling is non-negotiable for success.

- Diversify Across Perils: Spread investments across different types of risks (e.g., hurricanes, earthquakes, mortality) and geographies to avoid concentrated losses from a single event.

- Monitor Reinsurance Cycles: Track the pricing cycles in the reinsurance market to identify opportunities when risk premiums are most attractive.

12 Hedge Fund Strategies Compared

To provide a clearer picture, this table compares the core characteristics of each strategy, offering a quick reference for understanding their distinct profiles.

| Strategy | Complexity & Key Skills | Risk Profile | Correlation to Equities | Ideal Market Condition | Real-World Example |

|---|---|---|---|---|---|

| Long/Short Equity | Medium: Deep stock analysis, hedging. | Moderate: Market risk is reduced but not eliminated. | Low to Medium | Any, but thrives on high stock dispersion. | A fund longs Apple (AAPL) due to strong iPhone sales and shorts a competitor with weak products. |

| Global Macro | High: Macroeconomics, geopolitics. | High: Dependent on major, often leveraged, directional bets. | Low to Variable | High volatility, changing economic regimes. | George Soros shorting the British Pound in 1992 based on flawed monetary policy. |

| Event-Driven | Medium: Legal, M&A deal analysis. | Low to Moderate: Risk is deal-specific (e.g., a merger failing). | Very Low | Active M&A and corporate restructuring. | Buying Activision Blizzard stock below Microsoft's acquisition price, betting the deal closes. |

| Distressed Securities | Very High: Bankruptcy law, credit analysis. | High: Binary outcomes (turnaround vs. liquidation). | Low | Economic downturns, recessions. | Investing in a bankrupt airline's debt, expecting a successful post-Chapter 11 recovery. |

| Statistical Arbitrage | Very High: Quantitative modeling, tech infrastructure. | Low: Model failure risk, market regime shifts. | Very Low | Stable, liquid markets with predictable correlations. | A quant fund simultaneously buys Coca-Cola and shorts PepsiCo when their price ratio deviates from the norm. |

| Credit Arbitrage | High: Fixed income, derivatives, credit analysis. | Low to Moderate: Credit spread and interest rate risk. | Low | Credit market dislocations or inefficiencies. | Buying a company's undervalued bond while shorting its overvalued stock (convertible arbitrage). |

| Activist Investing | High: Corporate governance, operational strategy. | High: Dependent on ability to influence management. | Medium to High | Companies with poor management or undervalued assets. | Bill Ackman's campaign to overhaul the board and strategy at Canadian Pacific Railway. |

| CTA / Managed Futures | Medium: Systematic trend-following models. | Moderate: Can suffer in choppy, non-trending markets. | Low to Negative | Strong, sustained market trends (up or down). | A CTA fund goes long on oil futures during a prolonged commodity bull market. |

| Private Equity | High: Deal sourcing, operational improvement. | High: Illiquid, long-term business risk. | Low (Private) | Growing economy, availability of credit. | A VC firm like a16z investing in an early-stage tech startup like Stripe. |

| Cryptocurrency | High: Tech, security, regulatory analysis. | Very High: Extreme volatility and asset-specific risk. | Low to Variable | High risk appetite, emerging technology adoption. | A fund like Pantera Capital investing in new blockchain protocols and DeFi projects. |

| Insurance-Linked Sec. | High: Actuarial science, catastrophe modeling. | Moderate: Event risk (e.g., major hurricane). | Very Low | Stable catastrophe cycles, high insurance premiums. | A fund buying a catastrophe bond that pays out only if a major California earthquake occurs. |

| Multi-Strategy | High: Manager selection, risk allocation. | Low to Moderate: Diversified across many strategies. | Low | All conditions, designed for consistency. | Citadel or Millennium dynamically allocating capital across dozens of internal trading teams. |

Integrating Hedge Fund Insights into Your Investment Framework

Navigating the complex world of hedge fund investment strategies can feel like learning a new language. From the opportunistic plays of Event-Driven funds to the systematic precision of Quantitative strategies, the core lesson is that there is no single path to generating returns. The true power lies not in blindly copying these tactics, which is often impossible for the average investor, but in understanding the underlying principles of risk management, diversification, and market analysis that drive their success. This guide has dissected a dozen distinct approaches, revealing that sophisticated investing is less about chasing "hot" assets and more about building a resilient, all-weather framework.

The primary takeaway is the concept of asymmetric returns and non-correlation. Hedge funds relentlessly seek opportunities where the potential upside significantly outweighs the downside risk. They also prioritize assets and strategies that do not move in lockstep with traditional stock and bond markets. By studying Global Macro, investors learn the importance of geopolitical awareness. By analyzing Distressed Securities, we grasp the power of deep value and patience. Even seemingly esoteric strategies like Insurance-Linked Securities teach a vital lesson about finding yield in unconventional places, completely disconnected from economic cycles.

Actionable Steps for the Modern Investor

So, how do you translate these institutional-grade insights into your personal portfolio? It begins with a shift in mindset from being a passive participant to an active architect of your financial future.

- Diversify Beyond Asset Classes: True diversification isn't just owning a mix of stocks and bonds. It's about diversifying your strategies. Consider adding an allocation to a liquid alternative ETF that mimics a managed futures (CTA) approach or a merger arbitrage fund to add a source of returns that is independent of broad market direction.

- Embrace Risk Management: Before making any investment, ask the key hedge fund question: "What is my downside?" Implement stop-loss orders, understand position sizing, and never allocate more capital to a speculative play than you are willing to lose. The discipline of Long/Short Equity managers, who constantly hedge their bets, is a principle every investor should adopt.

- Conduct Deeper Due Diligence: The success of Activist and Distressed Securities funds is built on exhaustive research. Apply this rigor to your own investments. Instead of just looking at a stock's price chart, read the company's annual report, understand its competitive landscape, and analyze its balance sheet. This depth of knowledge is your best defense against market volatility.

Building a More Sophisticated Portfolio

By integrating the logic behind these hedge fund investment strategies, you elevate your own investment process from simple asset accumulation to strategic wealth creation. You begin to see the market not as a monolithic entity but as a dynamic ecosystem of interconnected opportunities and risks. This perspective allows you to build a portfolio that is not only designed for growth but is also fortified against unforeseen shocks. The ultimate goal is to create a financial engine that works for you, regardless of whether the market is booming, busting, or moving sideways. Mastering these concepts is a journey, but it is one that pays dividends in the form of confidence, control, and long-term financial resilience.

Ready to move beyond the basics and apply these advanced principles to your own financial journey? The Top Wealth Guide provides the tools, in-depth analysis, and expert insights you need to build a truly sophisticated investment portfolio. Visit Top Wealth Guide to access our exclusive resources and start making smarter, more strategic financial decisions today.

Frequently Asked Questions (FAQ)

1. What is the most common hedge fund strategy?

Long/short equity is widely considered the oldest and most common hedge fund strategy. It offers a straightforward approach to generating alpha by picking winning stocks (long positions) and losing stocks (short positions) while managing overall market exposure.

2. Can retail investors use hedge fund strategies?

While direct investment in hedge funds is typically limited to accredited investors, retail investors can access similar strategies through liquid alternative mutual funds and ETFs. These products aim to replicate strategies like managed futures (CTA), merger arbitrage, and market-neutral investing in a regulated, daily-liquid format.

3. Which hedge fund strategy is the riskiest?

The riskiness of a strategy often depends on the leverage used and the nature of its bets. Global Macro can be extremely risky due to large, leveraged directional bets on currencies or interest rates. Distressed Securities and Activist Investing also carry high risk, as their success depends on binary outcomes like a successful company turnaround or a winning proxy fight.

4. What is a "market-neutral" strategy?

A market-neutral strategy is designed to have zero (or near-zero) net exposure to the overall market. The goal is to generate returns that are completely uncorrelated with market movements. Long/Short Equity and Statistical Arbitrage funds often operate market-neutral mandates, profiting solely from relative price differences between securities.

5. Why do hedge funds use short selling?

Short selling is a core tool for hedge funds for two main reasons: hedging and speculation. It allows them to hedge (or protect) their long positions against a market downturn. It also allows them to speculate and profit directly from a security's expected price decline, creating an additional source of alpha.

6. What does the "2 and 20" fee structure mean?

"2 and 20" is the classic hedge fund fee model. It consists of a 2% annual management fee charged on the total assets under management (AUM) and a 20% performance fee charged on any profits the fund generates. While this model is still common, fee structures have become more varied in recent years.

7. Are hedge fund strategies effective during a recession?

Certain hedge fund strategies are specifically designed to perform well during recessions or market downturns. Global Macro funds can profit from major economic shifts, Distressed Securities funds find opportunities in bankruptcies, and trend-following CTAs can profit from sustained downward trends. Market-neutral strategies aim to perform regardless of the economic cycle.

8. What is the difference between a hedge fund and a mutual fund?

The key differences lie in regulation, strategies, and investor eligibility. Mutual funds are heavily regulated, available to the general public, and typically restricted to long-only positions in stocks and bonds. Hedge funds are lightly regulated, open only to accredited investors, and can use a wide array of complex strategies, including leverage, short selling, and derivatives.

9. What is "alpha" in the context of hedge funds?

Alpha refers to the excess return a fund generates above a benchmark index (like the S&P 500). It is considered a measure of a manager's skill in generating returns that are independent of the broader market's movement. The primary goal of most hedge fund investment strategies is to generate consistent alpha.

10. How do I choose the right hedge fund strategy for my portfolio?

The right strategy depends on your risk tolerance, time horizon, and diversification goals. For diversification and low correlation, market-neutral or ILS strategies might be suitable. For potential crisis alpha, a Global Macro or CTA fund could be considered. For capturing value in corporate events, an Event-Driven strategy is appropriate. It is crucial to conduct thorough due diligence on any fund or strategy before investing.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.