Market volatility — yeah, it freaks people out. But should it really mess with your financial game plan? Nah. The answer is all about prepping — and sticking with strategies that get the job done, no matter what’s swirling in the markets.

Here at Top Wealth Guide, we’ve sifted through decades (yep, decades) of market data to figure out what really works when things get wild. These moves? They’ll help you keep your cool when the rest of the world loses it, and, even better, spot those hidden gems that chaos tends to uncover.

In This Guide

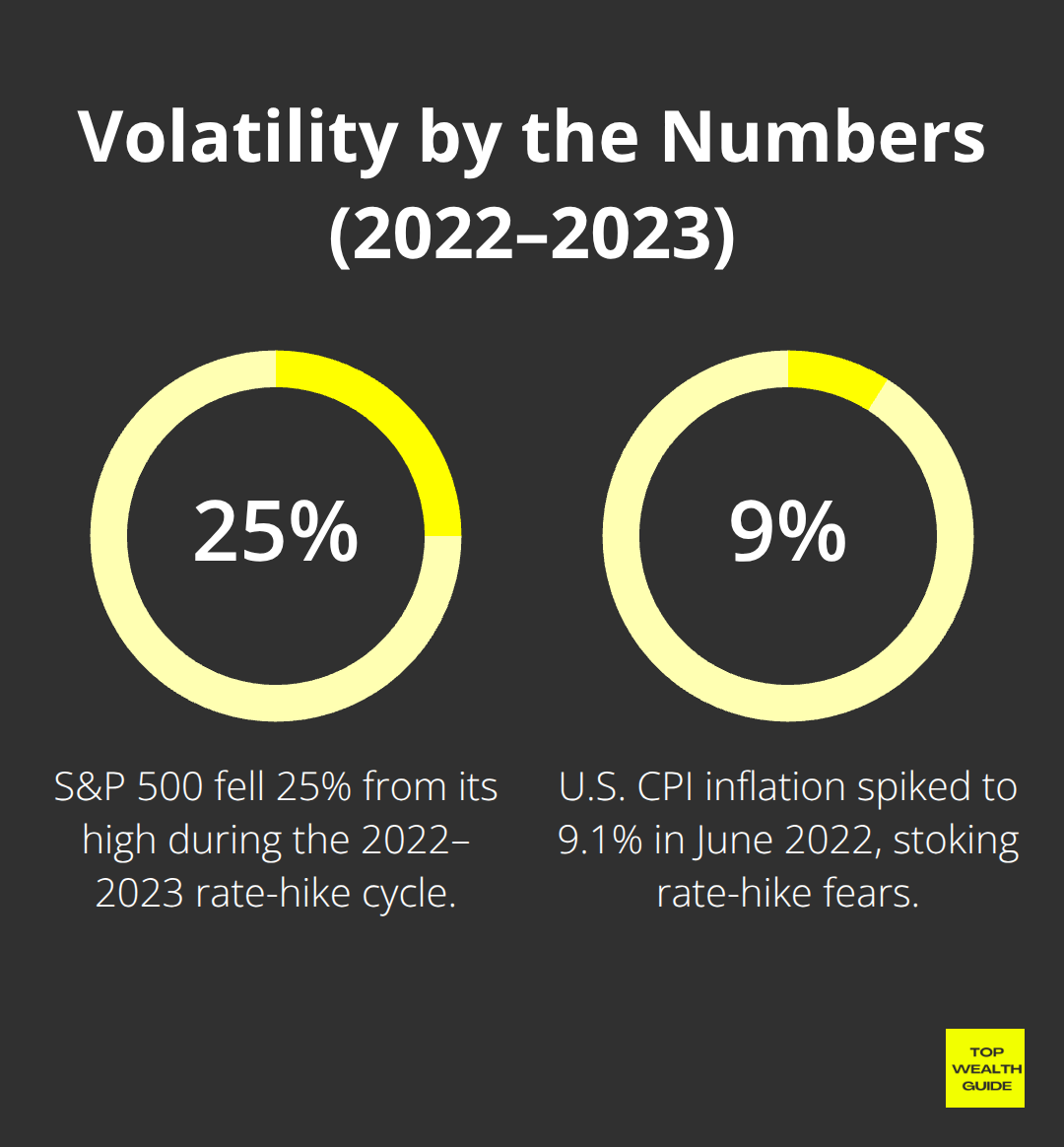

What Really Drives Market Volatility

Market volatility – it’s not just numbers on a screen; it’s a whirlwind driven by a triad of factors the wise folks watch like a hawk. Step one: Federal Reserve interest rate decisions. Yeah, the Fed – the heavyweight champ in the ring of market movers. When they bumped rates up by 525 basis points between March 2022 and July 2023, the S&P 500 went on a diet, shedding 25% from its all-time high. Now, let’s talk unemployment figures. These babies, courtesy of the Bureau of Labor Statistics’ monthly report, rip through markets because they mess with consumer spending and those bottom-line earnings. Then you’ve got inflation rates – the thorn in everyone’s side.

When the Consumer Price Index pointed to an inflation spike at 9.1% in June 2022, investors hit the panic button fearing the Fed would go full throttle on rate hikes.

Geopolitical Shocks That Move Money

Hold onto your hats, because wars and political shenanigans – they don’t just make headlines, they make markets jitterbug. Prime example: Russia’s foray into Ukraine in February 2022 sent oil prices skyrocketing 40% and caused European stocks to face plant. Trade battles – think Trump’s tariff antics in 2018 – crank up the market’s dance card, leading to daily seesaws of 2-3% in sectors caught in the crossfire. Elections, too, pack a punch. Case in point: Brexit 2016 – a decision that pulled a magic trick, disappearing 10% from UK markets overnight. Savvy investors? They keep their eyes peeled, not for who wins, but to nimbly adjust their portfolios when the dust settles and markets react like hyperactive toddlers.

The Psychology Behind Market Madness

Ah, investor behavior – the predictable lunacy that turns market moves into roller coasters you can’t hop off. Fear rules the roost during downturns. Check the VIX fear index, which went absolutely bonkers, climbing past 80 in March 2020’s pandemic freefall (compared to its 12-20 comfort zone). This panic-induced stampede results in investors offloading assets like they’re going out of style. Flip the coin, and it’s greed pulling the puppet strings. During the 2021 meme stock circus, GameStop’s stock skyrocketed 2,400% as retail investors tore up valuation rule books. Herd mentality? You betcha. When bullish sentiment hit 66.7% in January 2018, savvy investors raised eyebrows – markets hit the skids with a 10% drop mere weeks later. Seasoned pros? They see these emotional max-outs as flashing neon contrarian signals.

Market Timing vs. Market Preparation

Look, most investors are trying to play Nostradamus with volatility – spoiler alert: they usually flop. The real maestros? They prep, they don’t predict. They craft bulletproof portfolios ready to glide through turbulence like a hot knife through butter. This strategy? It’s all about being versatile – equipped to parry whatever curveball the market throws next.

How Do Seasoned Investors Actually Handle Volatility

The savviest money managers – they don’t chase shiny objects or play games with the market – they automate their victories with dollar-cost averaging. It’s a simple game: invest the same dough every month, rain or shine. Vanguard crunched the numbers and found that folks who just kept pouring in those monthly bucks during the 2008 financial rollercoaster saw a sweet 23% bump in returns compared to those who hit the brakes.

Look at Tesla stock – a wild ride that is. Invest $500 monthly between January 2020 and December 2022, and you’d end up with an average cost of $186 per share. Never mind it bounced between $85 and $414. The secret sauce? Automatic transfers that keep emotions out of it.

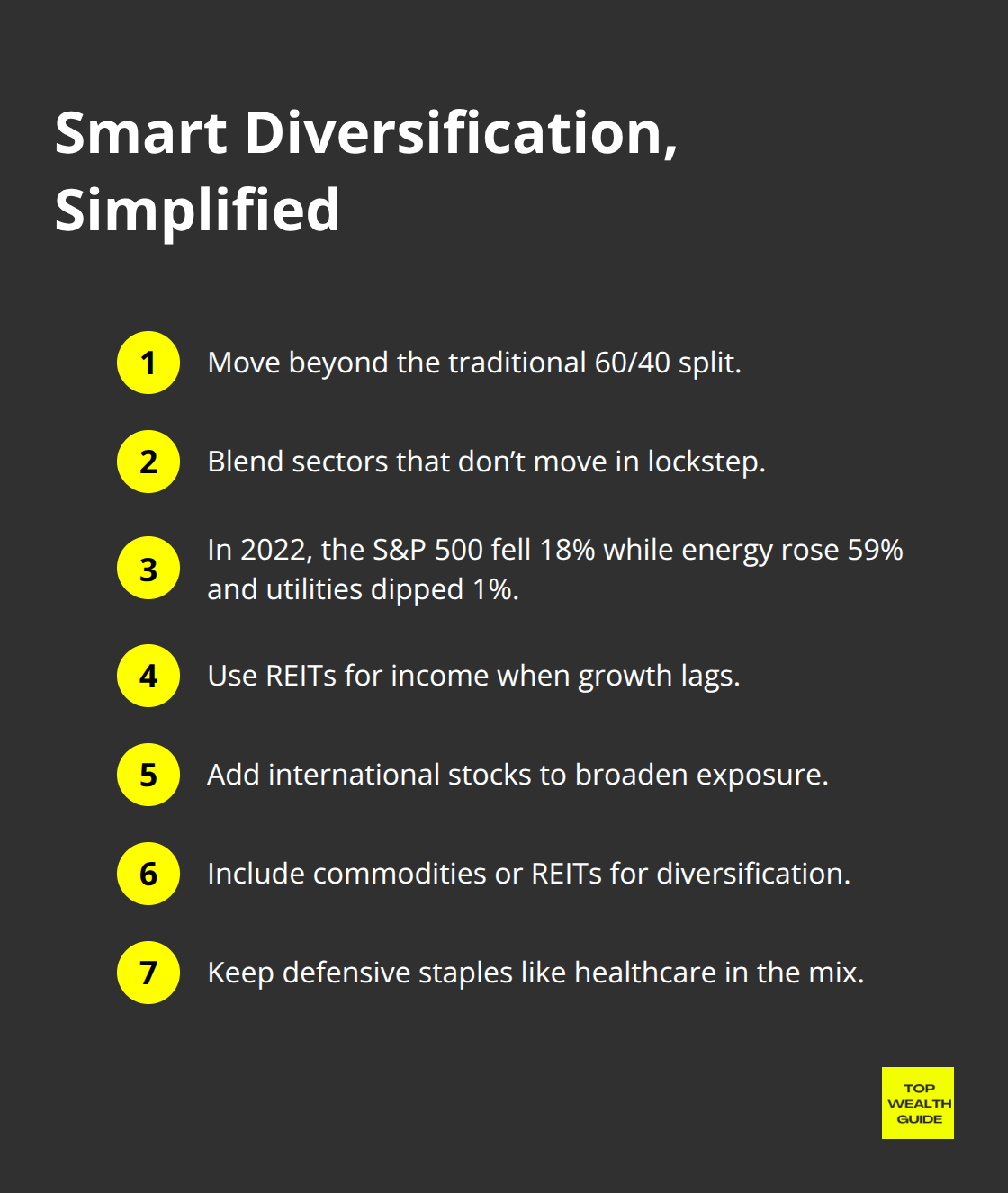

Smart Diversification Beyond Basic Asset Allocation

Chuck the dusty 60-40 stock-bond split out the window – modern diversification? It’s about spreading your chips across sectors that don’t dance to the same tune. Remember the tech massacre of 2022? The S&P 500 tanked 18%, yet energy stocks shot up 59% while utilities stayed cool with only a 1% dip.

Meanwhile, Real estate investment trusts were dishing out a 2.2% dividend yield when growth stocks were off brooding.

Global spin on things? That counts, too – when the U.S. market took a nosedive early 2022, European value stocks strutted ahead by 8%. The secret recipe? Toss in 25% international stocks, 15% commodities or REITs, and toss in defensive staples like healthcare – stuff folks need no matter what’s happening out there.

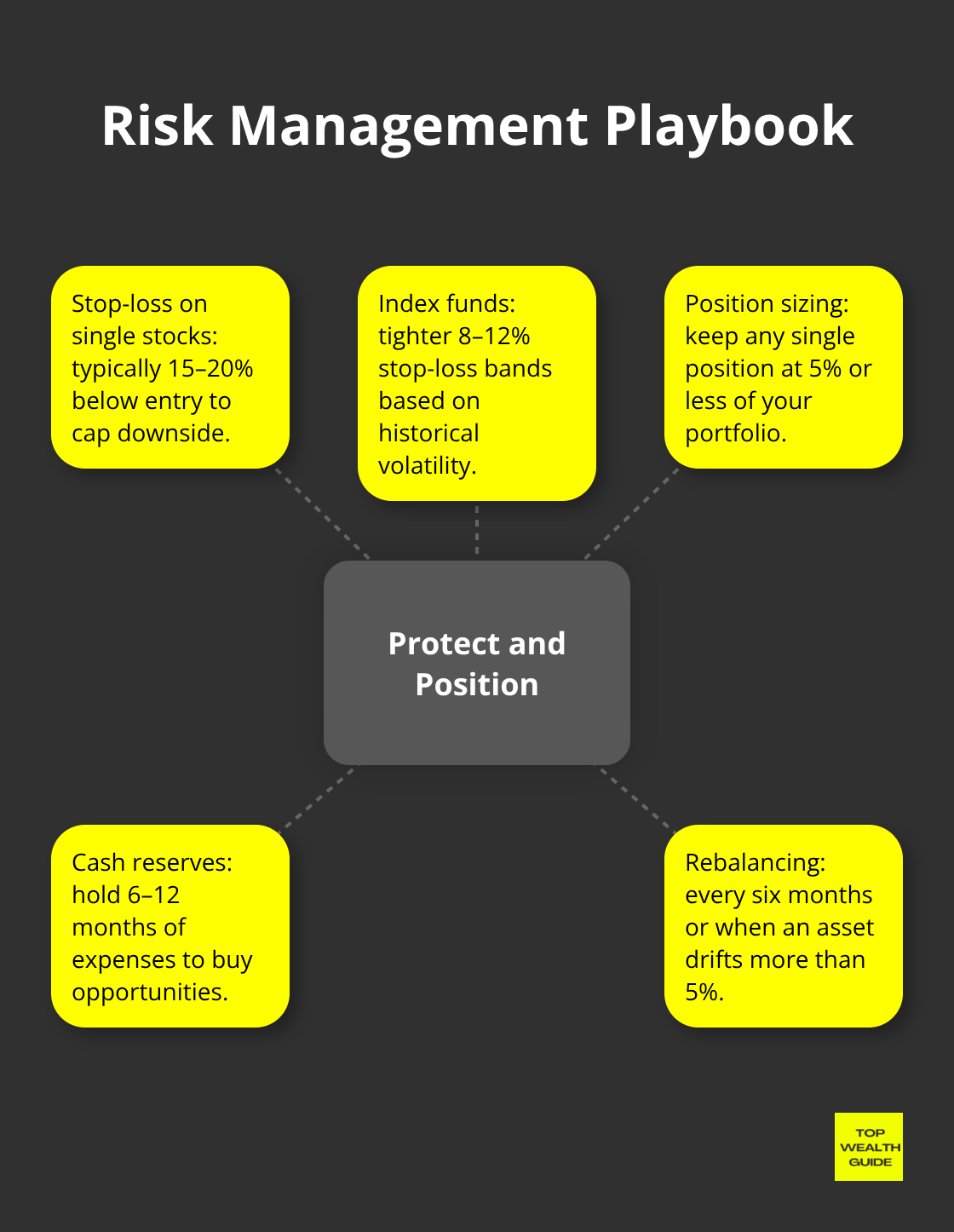

Risk Management Rules That Actually Work

Cue the stop-loss orders. This is your parachute, and where you pull the ripcord matters for both keeping your shirt and reaping rewards. The pros? They’ll slap a 15-20% stop-loss on single stocks, 8-12% on index funds, all based on historical ripples. But really – position sizing? It trumps stock picking any day – don’t bet more than 5% of your treasure on one investment.

The Oracle of Omaha – Buffett’s Berkshire Hathaway – lives by this creed.

Cash reserves – think of them as your secret weapon, enough to cover 6-12 months of spendings. Not for rainy days, but for those golden opportunities when quality stocks go on sale. Back in March 2020’s market dive, those with cash in hand snapped up Apple at $224 and watched it soar to $182 in two years. It’s these plays that separate the rookies from the ringers, but only if wrapped up in the right portfolio that’s built to grow wealth over the long haul.

What Makes a Portfolio Actually Bulletproof

Let’s grind through this: if you’ve got over 30 years until you ride into the retirement sunset, the numbers are clear – load up 80-90% on stocks. Why? Because U.S. equities, since roaring through 1926, have consistently trounced U.S. intermediate-term bonds over any 30-year stretch – bonds just clock a meager 5.8%. But for you folks staring down the retirement barrel within 5 years… flip it. You need 70% in bonds and defensive assets because short-term stock swings can blindside even the best-laid plans. What’s the magic mix for the nine-to-five workforce? That’d be a 70/30 bond-to-stock split – Vanguard’s playbook for conservative strategies nailed it.

The Defense-First Approach That Actually Works

The backbone of defense? Consumer staples and utilities. These stalwarts scoff at recessions – folks need toothpaste and power no matter the economic weather. Just look at Procter & Gamble… only dipped 7% during the 2008 financial whammy, while the S&P 500 was free-falling 37%. And those healthcare behemoths like Johnson & Johnson? Paying dues (ahem, dividends) for 61 unbroken years – talk about recession-proof DNA. Energy infrastructure, your next shield… Kinder Morgan’s pipelines still pumped cash like an oil-spiking Texan even when prices nosedived in 2020. Aim to stash 25-30% into these defensive plays.

Cash Reserves as Your Secret Weapon

Cash – the ace up your sleeve. Keep 15-20% of your portfolio liquid or in short-term Treasury bills, not for when it rains, but to pounce on market gold mines. Take a page from Warren Buffett’s big book – Berkshire’s omelette of $189 billion in cash awaits the right splash. When COVID-19 bulldozed markets in March 2020, those with cash reserves snatched up Microsoft at $132 – watched it bloom to $280 in a heartbeat (well, 18 months). With interest rates sweetening the pot, high-yield savings show 5.3% returns… cash isn’t just bench-warming. Smart movers build Treasury bill ladders at 3, 6, 12-month intervals – keeping liquidity while beating inflation.

Rebalancing Rules That Protect Your Gains

Every six months or when assets tip more than 5% – that’s your rebalancing cue. It’s automatic wisdom – buy low, sell high. Remember sub-2021’s tech fest? Savvy investors clipped their mushrooming tech slice, bagging bargains in undervalued stocks. Outcome? Gains secured and geared up for 2022’s twists. Set those date dots – January and July, the sweet spots to sidestep emotional rides during market crazies (hint: March meltdowns or December delirium).

Final Thoughts

Market volatility – it’s not the boogeyman; it’s the cover charge for building actual wealth. The numbers don’t lie: 94% of 10-year stretches in U.S. markets end up breathing green, which just goes to show-patience is undefeated against panic. Dollar-cost average your way through the noise, mix up your investments across sectors and borders to protect your portfolio when one part loses its footing, and keep cash in your back pocket to turn market crashes into golden chances.

Your game plan kicks off right now. Automate those monthly investments, hit reset every six months, and boost that emergency stash to 15-20% of your portfolio (we’re talking about straightforward moves here-proven tactics that distinguish the investors who make it big from the rest). Markets will see-saw again, economic roller coasters will test nerves, and political soap operas will spark selloffs.

With these tried-and-true strategies in your arsenal, you’ll ride out the storms like a pro. Market volatility-oh, it’ll be back-it’s not if, it’s when, and whether you’re prepped to cash in on it. We at Top Wealth Guide are confident these core principles can reshape your financial landscape when you stick with them.