Dividend stocks—think about it—are like the best kind of money machine. They keep cranking out cash while you snooze. Pick the right ones and you’re not just chilling with a nice stream of income, but also padding out that long-term wealth.

So, over at Top Wealth Guide, we dove deep…sifting through hundreds of dividend stocks to sniff out the crème de la crème. Different sectors, different strengths—but we’ve got the top players nailed down. This guide? It’s your roadmap to the stocks that don’t just tease but truly pay—and how to craft a portfolio that’s your personal passive income generator.

In This Guide

Which Dividend Stocks Actually Pay

Track Record Matters Most

Let’s get this straight-companies with over 15 years of relentless dividend payments? That’s where the savvy money goes. Johnson & Johnson and Coca-Cola aren’t hitting 62 years of payouts because they stumbled onto some secret sauce. Nope, it’s more like a masterclass in how solid business models weather economic storms. Look for the ones that kept their promises during the chaos of ’08-’09 and 2020. That’s the real test-do they care more about you or some C-suite exec’s new yacht?

Cash Flow Beats Accounting Tricks

In the world of dividends, cash flow is king… and queens. You want free cash flow per share that’s at least 20% more than the dividends served up. Verizon? It pulls in $6.8 billion in free cash flow while shelling out $2.8 billion in dividends-that’s robust. AT&T learned the hard way; cash lagged, dividends axed. Always, always check those quarterly cash flow statements-not just the earnings games they play with depreciation and the infamous one-time charges. Cash flow tells the truth-the dollars that actually come through the door.

Payout Ratios Under 60% Win Long Term

Here’s a gem from Hartford Funds research-companies keeping payout ratios below 60%? That’s wiggle room to grow. Take Microsoft, with its 28% payout ratio while jacking up dividends by 11% annually since 2012. Compare that to those utility giants stuck at 70-80%-they’ve boxed themselves in. According to Morningstar, companies with payout ratios above 75% are twice as likely to slashing dividends compared to their under-50% peers. High ratios mean zero room for error when the going gets tough.

Dividend Aristocrats Lead the Pack

Then we have the elite club-S&P 500 Dividend Aristocrats. These 65 stellar companies as of 2024, who’ve pumped up their dividends for at least 25 years straight, outperform the rest by 1.8% annually over the last two decades. Procter & Gamble? Raised its dividends for 68 years unbroken, and 3M hung tight at 66 before recent bumps. The list isn’t static; entry and exit revolve around performance. This exclusivity? It forces management to keep their eye on the prize-financial discipline and that ever-critical shareholder focus.

Sector Stability Varies Dramatically

Consumer staples and utilities have held the reliable dividend crown, but don’t sleep on tech. Apple’s in the ring since 2012, and growing its dividends ever since. Healthcare titans like Pfizer and Merck-there’s stability, bolstered by future-ready pipelines. Energy firms dish out high yields, but with commodity prices as volatile as a rollercoaster, those payouts can be about as unpredictable as your average magic trick. And real estate investment trusts? They’ve got to spill 90% of their taxable income, crafting a different, unique risk landscape.

Which Sectors Pay the Most Reliable Dividends

Consumer Staples Lead Stability Rankings

Alright, so let’s chat about consumer staples-they’re the MVPs of stability, and the stats don’t lie. Consumer staples like Procter & Gamble-a cool 2.4% yield plus a mind-boggling 68 years of upping those dividends. Coca-Cola? They’ve been handing out 3.1% for 62 years like clockwork. Why so steady? People are buying toothpaste and downing soda whether the economy is booming or busting.

Then we have utilities playing second fiddle-NextEra Energy rolling with a 2.8% yield and 30 years of raising dividends. Thanks to regulated revenue streams that Uncle Sam’s agencies practically gift-wrap. But heads up-these guys get pummeled by interest rate spikes. Stock prices can wobble, but those dividend checks? They keep arriving, every time.

REITs Deliver the Highest Current Income

Now, real estate investment trusts are where it gets spicy, delivering some juicy yields. Since legally, they have to shell out 100 percent of their taxable loot. Take Realty Income-5.6% yield and they pony up monthly dividends (hence the moniker, The Monthly Dividend Company). Digital Realty Trust? Pulls in 3.4%, buoyed by demand for data centers thanks to our pals at Amazon and Microsoft.

Of course, there’s a trade-off-REITs get throttled when interest rates surge because debt gets pricey. But the stalwarts, like Simon Property Group, they weathered the storms of 2008 and 2020 without slashing dividends-showing that smart management trumps sector downsides every day.

Technology and Healthcare Offer Growth Potential

Now, shifting gears to tech and healthcare-these sectors are flexing growth potential. Microsoft transitioned from just another growth stock to a dividend dynamo with a 0.7% yield and amping payouts by 11% annually since 2012. Apple struts in with a 0.5% yield yet tossed back $15 billion in dividends during Q3 2024-on top of a cash fortress of $29 billion. Bulletproof, anyone?

And check out big healthcare players like Johnson & Johnson with a 3.2% yield, built on pharma pipelines spitting out cash flows like a broken ATM. Pfizer? Bags 5.8% yield post-dividend boost, riding on vaccine tailwinds and their beefy drug library. These arenas balance growth excitement with surging dividend streams-the dream team for long-haul wealth that consistently outpaces inflation.

There you have it-the inside scoop on sectors serving up dependable income. Your next mission? Crafting a portfolio strategy that milks these sector standouts while juggling risk like a pro across your whole investment lineup.

How Should You Structure Your Dividend Portfolio

Diversify Across Different Sectors

Okay, let’s break it down-spread your dividend bets across multiple sectors so a rogue wave in any single industry doesn’t sink your income ship. We’ve got eleven stock market sectors to play with. Cap any one at 15%, with consumer staples and utilities laying your foundation at 10-12% each. Then toss in healthcare at 8-10%, technology at 6-8%, and sprinkle REITs, financials, energy, and industrials at 5-7% per sector. Oh, and don’t forget about spreading your love globally-go 70% U.S. stocks, 20% into the mature markets like Europe and Japan, and 10% in the up-and-coming crowd (emerging markets). Spreading investments around lowers your portfolio’s ups and downs compared to betting the farm on a few stocks while keeping returns comfy.

Reinvest Dividends Instead of Taking Cash

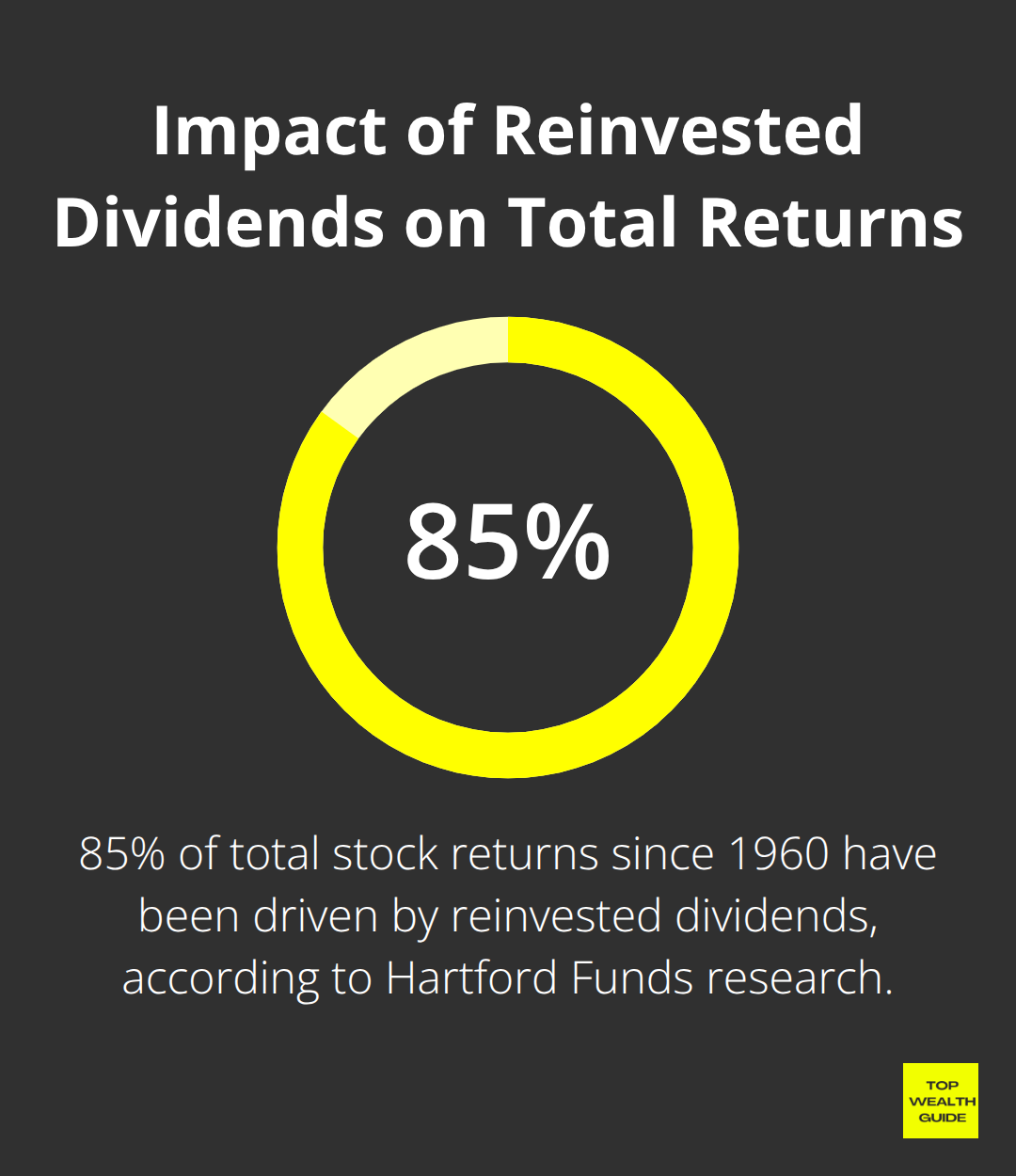

Here’s the skinny-let those dividends build your fortress of wealth. The math’s a no-brainer. Reinvested dividends have driven 85% of total returns since 1960. Get on board with auto-reinvestment through your broker-most do it free of charge. Put $10,000 in dividend aristocrats with a 3% yield. With reinvestment, it’s $43,219 after 20 years versus just $16,000 if you pocket the cash. Only flip the switch to cash out when you need it for expenses (usually after hitting the big 6-0).

Maximize Tax-Sheltered Accounts First

First stop-stuff your 401k and Roth IRA with dividend stocks because tax-free growth smokes taxable accounts hands down. In those taxable zones, qualified dividends hit you with 15-20% capital gains taxes, while ordinary ones take a bite out of your regular income tax, up to 37%. REITs hand out mostly ordinary dividends, so they’re your ticket for tax-sheltered accounts. Stash your dividend aristocrats and those payers of qualified dividends in taxable accounts to reap sweet tax benefits. Make sure your investment choices reflect your risk mood-this tactic can save you thousands a year since a $50,000 dividend portfolio lounging in the wrong account style costs you an extra $1,500-$3,000 in taxes annually.

Final Thoughts

Let’s talk wealth creation-through top dividend stocks. We’re talking discipline, folks, and some smart selection criteria. Here’s the play: zero in on companies that have been issuing consistent payments for 15-plus years, have free cash flow that exceeds dividends by 20%, and-get this-payout ratios below 60%. These numbers? They’re the gatekeepers… they separate the truly sustainable income generators from those pesky dividend traps that slash payments the minute trouble knocks on the door.

But let’s not forget-your portfolio construction is just as crucial as picking the right stocks. Rule of thumb: don’t let any individual sector hog more than 15% of your portfolio. Use tax-sheltered accounts for those REITs and high-yield stocks… and reinvest your dividends automatically to get that sweet, sweet compound return. Take it from the Hartford Funds data: 85% of stock returns since 1960 came from reinvested dividends. Yep, this strategy has legs… and it runs marathons.

Kick things off with three concrete steps: first, open a dividend-focused brokerage account. Second, put 60% into those dividend aristocrats for that rock-solid stability. Third, funnel 40% into higher-yield sectors like REITs and utilities. Make sure you’ve got automatic reinvestment in place, then sit back and review your holdings quarterly-not daily. Here at Top Wealth Guide, we’re all about those dividend strategies that have weathered multiple economic cycles and still come out rewarding shareholders.