When you think of real estate, the first thing that probably comes to mind is buying a house. But commercial real estate (CRE) is a completely different world. It’s not about finding a place to live; it’s about acquiring property that works for you—an asset specifically designed to generate income.

Unlike a home, which is all about shelter, properties like office buildings, retail centers, or apartment complexes are pure business.

In This Guide

- 1 What Exactly Is Commercial Real Estate?

- 2 Exploring the Main Types of Commercial Properties

- 3 How to Analyze a Commercial Real Estate Deal

- 4 Reading the Economic Tea Leaves in Commercial Real Estate

- 5 Financing Your First Commercial Property

- 6 Taking Your First Steps into CRE Investing

- 7 Frequently Asked Questions for New CRE Investors

What Exactly Is Commercial Real Estate?

Let's use an analogy. Getting into residential real estate is like buying a personal sailboat. It’s manageable, relatively affordable, and you can learn the ropes on your own. Commercial real estate, on the other hand, is like owning a fleet of cargo ships.

These ships carry far more value, bring in a massive amount of revenue, and you absolutely need a professional crew to run them. The sailboat is a great start, but the cargo fleet is what builds generational wealth. This guide is your navigation chart for learning how to command that fleet.

Business vs. Shelter: The Core Difference

At its core, commercial real estate exists to support commerce. From the corner coffee shop to a massive distribution warehouse, every single property serves a business purpose. This fundamental distinction changes the entire investment game.

- How It's Valued: A house's price is determined by what similar homes in the area have sold for. A commercial property’s value is calculated based on how much income it produces. The more income, the more valuable the asset. Simple as that.

- The Leases: Residential leases are pretty straightforward, usually lasting a year. Commercial leases are complex, long-term contracts that can lock in tenants for five, ten, or even twenty years, creating a much more stable and predictable cash flow.

- Who the Tenants Are: You’re not renting to individuals; you’re renting to businesses. This dynamic usually means a more professional relationship—and far fewer calls at 2 AM about a clogged drain.

Who You Need on Your Team for a CRE Deal

Trying to navigate a commercial deal by yourself is a recipe for disaster. It’s like trying to sail that cargo ship solo—you’re going to hit an iceberg. Building a solid team of specialists is non-negotiable.

Key Takeaway: Your success in commercial real estate hinges on the quality of your expert team. Building this network is one of the most critical first steps for any new investor.

Here’s who you’ll need in your corner:

- Commercial Real Estate Broker: This isn't your neighborhood residential agent. A commercial broker is a specialist who lives and breathes a specific property type, like retail or multifamily, and knows the market data, lease terms, and deal flow inside and out.

- Real Estate Attorney: They handle the mountain of complex legal paperwork, from purchase agreements to title searches, that are unique to commercial deals.

- Commercial Lender: A banker or mortgage broker who specializes in financing business properties. The lending rules and qualification standards are completely different from a home mortgage.

- Accountant/CPA: Your numbers person. They'll advise on the tax implications of the deal, help structure it correctly, and vet the financial projections to make sure the investment is sound.

Grasping these fundamental differences is your first big step. To get a better sense of the bigger picture, our guide on if real estate is a good investment offers great background for anyone just starting out. With this foundation, you'll be ready for the deeper concepts we're about to dive into.

Exploring the Main Types of Commercial Properties

Diving into commercial real estate for the first time can feel like walking into a massive hardware store. You know you need tools to build wealth, but the sheer variety of options is overwhelming. Each property type is a different tool designed for a specific job, and each comes with its own set of risks and rewards.

Getting a handle on these core categories is your first real step toward building a successful portfolio. Commercial properties are usually grouped into four main categories—the "big four"—along with a few specialty niches. Which one is right for you will come down to your investment strategy, how much risk you're comfortable with, and the capital you have to work with.

The Big Four Core Asset Classes

Most commercial real estate deals you'll encounter will fall into one of these major buckets. Each one is a world of its own, driven by different economic forces and serving very different market needs.

-

Multifamily: This is probably the most familiar category. Think apartment buildings, duplexes, or any residential property with five or more units. The income is straightforward—tenants pay you rent to have a place to live. Because housing is a basic human need, multifamily is often seen as one of the more stable and recession-resistant investments you can make in CRE.

-

Office: This is where business happens. Office properties can be anything from a towering skyscraper in a major downtown core to a small, single-tenant building in a quiet suburban office park. The leases are typically long-term, which can provide a nice, steady income stream. However, this sector is very sensitive to economic shifts and emerging trends like remote work.

-

Retail: This bucket holds everything from your local strip mall and standalone fast-food joints to huge regional shopping centers. A retail property's success is tied directly to consumer spending and the financial health of its tenants. Leases here are often structured as "triple net" (NNN), meaning the tenant is responsible for paying taxes, insurance, and maintenance on top of their rent.

-

Industrial: This is the engine room of our modern e-commerce economy. Industrial properties include warehouses, distribution centers, manufacturing plants, and all sorts of logistics facilities. As online shopping continues to explode, the demand for well-located industrial space has gone through the roof, making it an incredibly popular sector for investors right now.

The infographic below really puts the scale of CRE into perspective, showing the massive jump from a single-family rental to a large commercial asset.

As you can see, commercial real estate operates on a completely different level. It's a team sport that requires more capital, deeper expertise, and a more sophisticated approach.

Comparison of Commercial Real Estate Property Types

To help you get a clearer sense of how these sectors stack up against each other, the table below provides a side-by-side comparison. It highlights the key differences that matter most to an investor, from where your money comes from to how much work is involved.

| Property Type | Primary Income Source | Typical Lease Length | Management Intensity | Economic Sensitivity | Beginner Friendliness |

|---|---|---|---|---|---|

| Multifamily | Tenant Rents | 1-2 Years | High (High Turnover) | Low to Moderate | High |

| Office | Tenant Rents | 5-10+ Years | Moderate (Longer Leases) | High (Job Market) | Moderate |

| Retail | Tenant Rents (% of Sales) | 3-10 Years | Moderate to High | High (Consumer Spending) | Moderate to Low |

| Industrial | Tenant Rents | 5-15+ Years | Low (Often NNN Leases) | Moderate (Supply Chain) | High |

This table is a great starting point for thinking about which property type aligns best with your financial goals and the amount of hands-on work you're willing to do.

Specialty Properties and Other Niches

Beyond the big four, the world of CRE is filled with specialty property types. These often require very specific knowledge and management skills but can offer fantastic returns if you know what you're doing.

Key Insight: While the big four offer broad opportunities, niche properties allow investors to focus on specific industries they understand well, potentially finding undervalued assets that others overlook.

A few examples of these niches include:

- Hotels and Hospitality

- Self-Storage Facilities

- Healthcare and Medical Offices

- Land and Development

Each of these is driven by its own unique market forces. For example, hotel performance is all about travel and tourism trends, while demand for medical offices is tied to local demographics and healthcare spending.

If you're not quite ready to buy an entire property, there are other ways to get in the game. You can check out our guide on Real Estate Investment Trusts to learn more about this popular alternative for beginners.

How to Analyze a Commercial Real Estate Deal

The secret to successful commercial real estate investing isn't about stumbling upon a "lucky" property. It's about disciplined, unemotional analysis. Before you even dream of making an offer, you have to learn how to evaluate a deal like a seasoned pro, stripping away the broker’s sales pitch to see the raw numbers underneath.

This means looking past the curb appeal and digging deep into the property's financial performance. Once you master a few key metrics, you'll be able to spot a potential winner—or a costly mistake—from a mile away, giving you the confidence to know when to walk and when to run.

The Three Pillars of Deal Analysis

For anyone new to commercial real estate, three core metrics will form the foundation of every deal you analyze. These numbers tell the true story of a property's health and its potential to make you money.

-

Net Operating Income (NOI): This is the single most important number in the business. NOI is the property's total income after you've paid all the operating expenses, but before you factor in your loan payments or income taxes. Think of it as the building's pure, unleveraged profit.

-

Capitalization (Cap) Rate: The Cap Rate is your yardstick for measuring a property's potential return. You calculate it by dividing the NOI by the purchase price. This simple percentage allows you to compare different properties on an apples-to-apples basis, no matter how an investor plans to finance them.

-

Cash-on-Cash Return: This is the metric that gets personal. It tells you the return on the actual cash you pulled out of your pocket. You find it by taking the annual pre-tax cash flow (NOI minus your total loan payments) and dividing it by your total cash investment (down payment plus closing costs). This is your "mailbox money" metric—it shows what you actually earn on your investment.

A Real-Life Example: Analyzing a Small Apartment Building

Let's walk through a real-world example to see these numbers come to life. Imagine you’re looking at a small, 10-unit multifamily property with a purchase price of $1,000,000. The seller claims it's a great deal, but you need to verify that with your own analysis.

Pro Tip: Never, ever trust the seller's initial numbers at face value. Always do your own homework by reviewing rent rolls, utility bills, and tax statements to build your own, more realistic financial picture of the property.

Here’s how you’d break down the deal.

Step 1: Calculate the Income

- Gross Potential Rent (10 units x $1,200/month x 12 months) = $144,000

- Vacancy Loss (assume a 5% market rate) = -$7,200

- Other Income (laundry, parking) = +$3,200

- Effective Gross Income (EGI) = $140,000

Step 2: Calculate the Expenses

- Property Taxes = $15,000

- Insurance = $6,000

- Utilities = $10,000

- Repairs & Maintenance = $8,000

- Property Management (8% of EGI) = $11,200

- Total Operating Expenses = $50,200

Step 3: Calculate the Key Metrics

With those numbers sorted, we can finally calculate our three pillar metrics.

| Metric | Formula | Calculation Example | Result | What It Tells You |

|---|---|---|---|---|

| NOI | EGI – Total Expenses | $140,000 – $50,200 | $89,800 | The property's raw annual profit before debt. |

| Cap Rate | NOI / Purchase Price | $89,800 / $1,000,000 | 8.98% | How the property's return compares to others in the market. |

| Cash-on-Cash | Annual Cash Flow / Total Cash | $35,800 / $280,000 | 12.78% | The actual return on your invested cash for the year. |

Note: The Cash-on-Cash calculation assumes a $250,000 down payment, $30,000 in closing costs, and a mortgage payment of $4,500/month.

Beyond the Numbers: Due Diligence

While the financial metrics are critical, your analysis doesn't stop with the spreadsheet. Due diligence is the investigative phase where you verify every assumption and hunt for any hidden problems.

This always involves:

- Physical Inspection: Hiring pros to inspect the roof, plumbing, electrical systems, and foundation. Don't skip this.

- Lease Audit: Reading every single lease to confirm rents, terms, and any unusual landlord obligations.

- Market Analysis: Researching local vacancy rates, what competing properties are charging for rent, and any future development plans for the area.

Running these calculations can get complex, especially when you're comparing multiple properties. To make it easier, you can use our real estate investment calculator to plug in your own numbers and analyze deals quickly. This framework—combining hard numbers with boots-on-the-ground investigation—is your best defense against making a bad investment.

Reading the Economic Tea Leaves in Commercial Real Estate

Think of the commercial real estate market like a sensitive ecosystem. It doesn't exist on its own; it's deeply connected to the broader economy. Things like interest rates, job growth, and even inflation act like the weather, either nourishing the landscape or creating stormy conditions. For anyone just starting out, learning to read these economic signs is the difference between a thriving investment and one that gets washed out.

Setting out without this knowledge is like trying to sail across the ocean without checking the forecast. Sure, you might get lucky with a stretch of calm weather, but you’ll be completely unprepared when the winds shift. A smart investor knows how to read the economic skies, spotting the patterns that signal both risk and incredible opportunity.

It's all about connecting the dots. When you hear that a big tech company is opening a new campus in town, don't just see it as a news headline. See it for what it is: a powerful signal of future job growth. Those new employees will need apartments to live in (a boost for multifamily) and places to shop and eat (a win for retail). On the flip side, when the news talks about rising interest rates, you know that borrowing money is about to get more expensive, which can put a chill on the market and make financing your next deal a bit tougher.

The Key Numbers Every Investor Should Watch

You don't need a degree in economics, but you do need to keep a few critical numbers on your radar. These are the vital signs of the economy that directly impact property values and your potential returns.

- Interest Rates: When the Federal Reserve hikes rates, the cost of borrowing goes up for everyone, investors included. This can slow down transaction volume and sometimes put downward pressure on property prices.

- Job Growth & Unemployment: A city with strong job growth is a city with a healthy, expanding economy. More jobs mean more people looking for apartments and more businesses needing office, industrial, or retail space. It’s a direct driver of demand.

- GDP Growth: Gross Domestic Product is the big-picture measure of the nation's economic health. A growing GDP generally means businesses are confident, consumers are spending, and the overall environment for CRE is positive.

- Inflation Rates: High inflation is a silent killer of profits. It drives up the cost of everything from new roofs and landscaping to property taxes and insurance. If you can't raise your rents enough to keep up, your cash flow will shrink.

What the Current Market is Telling Us

The 2025 commercial real estate market is a perfect real-world classroom for these principles. The entire landscape is being shaped by these big economic forces. Interest rates are probably the biggest story; we're seeing rates north of 5% for stable, high-quality properties, with riskier deals facing even steeper borrowing costs.

This environment has a direct impact, pushing capitalization rates up and asset values down. It's creating a real challenge for owners who have nearly $1 trillion in loans coming due soon. And while inflation has cooled off a bit, it’s still hovering around 2.7%, continuing to squeeze operating budgets. The silver lining? The U.S. economy is still showing steady growth of about 3%, which provides a solid foundation for rent growth in markets with strong demand. For new investors, the message is clear: focus on conservative financing and run a tight ship operationally. You can dive deeper into the current CRE market outlook on agorareal.com.

Where to Find Your Data (Without Getting Overwhelmed)

Staying in the loop is easier than you think. The goal isn't to become a full-time economist but to develop a habit of checking in with reliable sources who have already done the heavy lifting.

| Source Type | What to Look For | Real-World Example |

|---|---|---|

| Brokerage Reports | Quarterly market breakdowns from big firms like CBRE, JLL, or Cushman & Wakefield. | A report showing that office vacancy rates in a specific neighborhood you're targeting are finally starting to drop. |

| Government Data | Hard numbers from the Bureau of Labor Statistics (job growth) or the Census Bureau (population shifts). | Census data revealing that a Sun Belt city you're considering is one of the fastest-growing in the country. |

| Industry Publications | News and analysis from sites like The Real Deal or Commercial Observer. | An article detailing a spike in demand for industrial warehouses near major shipping ports. |

Key Takeaway: The most successful long-term investors are the ones who consistently analyze what's happening in the economy. They aren't just guessing. Make it a habit to read market reports, and you'll quickly pull ahead of the pack.

Financing Your First Commercial Property

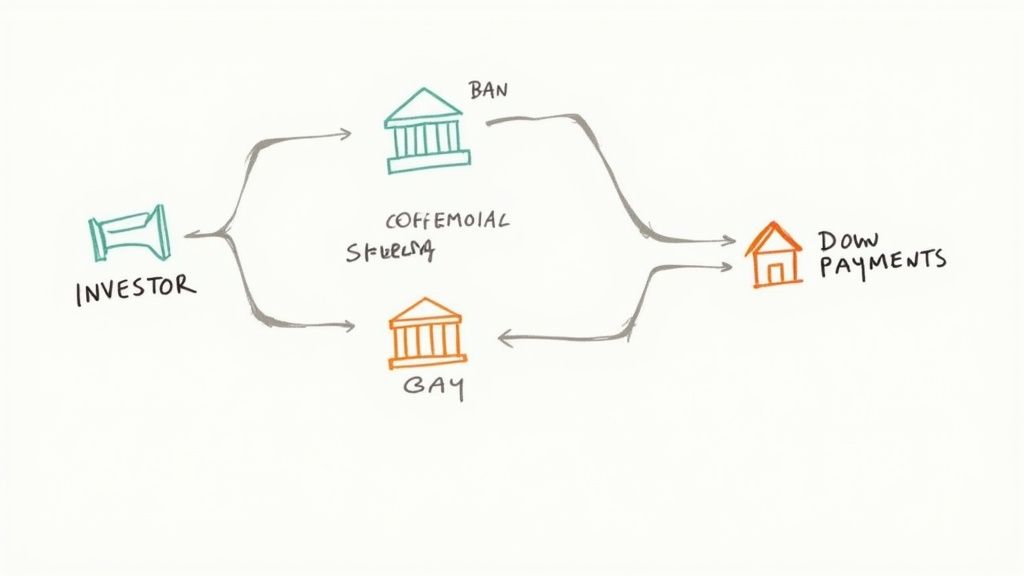

Let’s be honest: securing the money is often the most daunting part for anyone just starting in commercial real estate. If you’re used to home mortgages, you’re in for a surprise. Commercial lending isn't about your personal paycheck; it’s about the property's ability to pay for itself.

Think of it this way: for a home loan, the bank is betting on you. For a commercial loan, the bank is betting on the property as a self-sustaining business. Grasping this core difference is the first major step toward getting your deal funded.

Common Paths to Funding Your Deal

While the financing world is vast, most newcomers will travel down one of three main roads. Each one has its own quirks, rules, and best-case scenarios. Getting a handle on these will help you pair your specific deal with the right kind of capital.

-

Conventional Bank Loans: These are the bread and butter of commercial financing, offered by all sorts of banks. They generally have great rates, but the approval process is tough. Lenders will put your experience, net worth, and the property's financials under a microscope.

-

SBA Loans (504 & 7a): If you're a business owner looking to buy a building for your own company, this is where you should look first. The U.S. Small Business Administration backs a piece of the loan, which makes lenders more comfortable. That often translates into better terms for you, like a much smaller down payment.

-

Seller Financing: This is a creative solution where the seller essentially becomes your bank. You negotiate terms directly with them, making it a fantastic workaround if you can't quite qualify for a traditional loan. It’s all about finding a motivated seller and striking a deal that works for both of you.

Key Differences in Commercial Loans

Don't expect your standard 30-year fixed-rate mortgage here. Commercial loans are a different breed entirely. Down payments are much bigger, loan terms are shorter, and the entire approval process hinges on the property itself.

Key Takeaway: The single most important number for a commercial lender is the property's Net Operating Income (NOI). They use a metric called the Debt Service Coverage Ratio (DSCR) to make sure the property's income can easily cover the loan payments—usually by a margin of 1.25x or more.

Here’s a quick look at what you can expect:

| Loan Type | Typical Down Payment | Loan Term | Best For… |

|---|---|---|---|

| Conventional Loan | 25-35% | 5-10 years (with balloon) | Pure investment properties with a solid rental history. |

| SBA 504 Loan | As low as 10% | 20-25 years (fully amortizing) | Business owners buying a property they will occupy. |

| Seller Financing | Highly negotiable | Varies (often short-term) | Buyers who need flexible terms or have credit hurdles. |

Real-Life Example: Financing Two Different Deals

To see how this plays out, let's look at two different buyers with the same purchase price.

Scenario A: Sarah, The Entrepreneur

Sarah runs a successful online clothing store and needs a $750,000 warehouse to expand her operations. Since she’ll be using more than half of the space for her own business, she qualifies for an SBA 504 loan. This is a game-changer for her, as it allows her to put down just 10% ($75,000). Better yet, her loan is spread over 25 years with a fixed rate, so she avoids a massive balloon payment later on and has a predictable monthly cost.

Scenario B: Mark, The Investor

Mark is buying a $750,000 retail strip center purely for investment income. He heads to a local bank for a conventional loan. The bank, seeing this as a pure investment, requires a hefty 30% down payment ($225,000). His loan has a 10-year term, but the payments are calculated over a 25-year period. This means at the end of year 10, he’ll have a large balloon payment due. He’ll need to either sell the property before then, pay off the large remaining balance in cash, or refinance at whatever the prevailing interest rates are at that time.

As you start your own hunt for properties, it's wise to explore all the ways you might fund the purchase. To dive deeper, check out our complete guide on how to finance an investment property. Getting comfortable with these options is the first step in building a solid financial footing for your new venture.

Taking Your First Steps into CRE Investing

Reading and research are one thing, but building a real estate portfolio happens when you take action. You've got the concepts down, you understand the metrics, and you see how the market works. Now, let's put that knowledge to work with a clear, practical roadmap.

This is where you shift from theory to practice. It’s all about creating a disciplined framework for your search, starting with the single most important tool for any serious investor: your "buy box."

Define Your Personal Buy Box

Think of your buy box as a set of non-negotiable rules for any deal you'll consider. It’s your personal filter, designed to cut through the noise and keep you laser-focused on opportunities that actually fit your goals. Without it, you'll waste countless hours chasing the wrong properties.

Your criteria should be crystal clear. For example:

- Property Type: Are you hunting for small multifamily buildings? Or is a single-tenant retail space more your style? Get specific.

- Geographic Area: Pinpoint your target market. Don't just say "Phoenix"—narrow it down to the specific neighborhoods or submarkets you know inside and out.

- Deal Size: What’s your absolute maximum purchase price? This should be based on the capital you have and the financing you can get.

- Return Metrics: Decide on your minimum acceptable Cap Rate or Cash-on-Cash Return. If a deal doesn't hit your number, you walk away.

Start Building Your Essential Support Team

Let's be clear: commercial real estate is not a solo sport. Trying to do it all yourself is a recipe for disaster. Before you even start looking at deals, you need to begin assembling a team of trusted experts who will guide, protect, and help you get to the finish line.

Your core team should include these three professionals:

- A Commercial Real Estate Broker: Find someone who lives and breathes your chosen property type and geographic area. They aren't just salespeople; they are your source for market intelligence and deal flow.

- A Commercial Lender: Don't wait until you find a property to talk to a lender. Get pre-approved now. It shows sellers you're a serious, qualified buyer and gives you confidence in your budget.

- A Real Estate Attorney: A lawyer specializing in commercial transactions is non-negotiable. They'll review every contract and help you navigate the often-complex closing process.

Where to Find Potential Deals

With your buy box defined and your team in place, the hunt begins. You'll find deals online, but some of the best opportunities still come from old-fashioned networking.

The market is active. Recent data for 2025 shows that aggregate transaction volume hit $115 billion in the second quarter alone, a 3.8% increase from the previous year. The multifamily sector has been particularly hot, with activity jumping 39.5%. The takeaway? Even in a cautious market, great deals are out there if you know where to look. You can read more about the latest U.S. CRE transaction trends from Altus Group.

Kick off your search on platforms like LoopNet and Crexi, but don't stop there. The truly great opportunities are often off-market—deals that never get publicly listed. Our guide on how to find investment properties dives much deeper into this.

Build relationships with your broker, other local investors, and even property managers. This disciplined, team-based approach is your blueprint for getting started on the right foot.

Frequently Asked Questions for New CRE Investors

Jumping into commercial real estate can feel a bit like trying to read a map in a foreign language. Here are answers to the ten most common questions we hear from beginners.

1. How much cash do I really need to get started?

While CRE is capital-intensive, the entry point varies. For a direct purchase, you'll typically need a down payment of 25-35%. For a $500,000 property, that's $125,000 to $175,000 plus closing costs. However, options like SBA loans (for owner-occupied properties), partnerships, or investing in a Real Estate Investment Trust (REIT) can significantly lower the initial cash required.

2. What's the single biggest mistake new investors make?

The most common and costly mistake is skimping on due diligence. It's easy to get "deal fever" and rush the process. Failing to thoroughly inspect the property's physical condition, verify the financials, audit every lease, and understand the local market is the fastest way to turn a potential winner into a financial nightmare.

3. Gross lease vs. triple net (NNN) lease—what’s the difference?

It's all about who pays the operating expenses.

- Gross Lease: The tenant pays a single, flat rent. The landlord (you) pays for property taxes, insurance, and maintenance. This is common in office and some multifamily properties.

- Triple Net (NNN) Lease: The tenant pays a base rent plus their share of the property taxes, insurance, and maintenance. This creates a more predictable, passive income stream for the landlord and is common in retail and industrial properties.

4. Where do I actually find good commercial real estate deals?

The best deals often come from networking, not just online listings. While sites like LoopNet and Crexi are great starting points, build relationships with commercial brokers who specialize in your target asset type and location. Many of the best opportunities are off-market, meaning they are never publicly advertised and are found through professional connections.

5. Is commercial real estate riskier than residential?

It’s not necessarily riskier, but the risks are different. CRE is more sensitive to economic downturns, and vacancies can take longer to fill. However, it offers the stability of longer lease terms (often 5-10+ years), higher income potential, and tenants who are typically businesses, leading to more professional relationships.

6. What's the best type of property for a total beginner?

Many experts recommend starting with small multifamily properties (5-20 units) or single-tenant industrial buildings with NNN leases. Multifamily is relatable and driven by the consistent demand for housing. Small industrial properties are often low-maintenance and provide a very passive income stream, making them easier to manage from afar.

7. How long does it take to buy a commercial property?

It's a marathon, not a sprint. The process—from finding a property to analysis, due diligence, securing financing, and closing—typically takes 90 to 120 days, and sometimes even longer. The investigative and financing stages are far more complex than a residential purchase.

8. Do I need a special real estate agent?

Yes, absolutely. You need a commercial real estate broker. They possess specialized knowledge of market analysis, property valuation, lease negotiations, and deal structuring that residential agents do not have. Trying to use a residential agent for a commercial deal is a common beginner mistake.

9. What is a 'Cap Rate' and why is it so important?

The Capitalization Rate, or Cap Rate, is a key metric used to quickly compare the potential return of different properties. You calculate it by dividing the property's Net Operating Income (NOI) by its purchase price. A higher cap rate generally indicates a higher potential return but often comes with higher risk. It's a vital tool for comparing opportunities on an apples-to-apples basis.

10. Can I use my retirement account to invest in CRE?

Yes, you can use a self-directed IRA (SDIRA) to invest in alternative assets like real estate. However, the IRS has very strict rules about how you can use these funds (for example, you cannot personally manage a property owned by your IRA). It is critical to work with a specialized SDIRA custodian to ensure you remain compliant and avoid severe penalties.

At Top Wealth Guide, our mission is to provide the clear, expert guidance you need to build real, lasting wealth. Whether you're diving into real estate or navigating the stock market, we’re here to help you make smarter financial moves. To keep learning, explore more of our guides and strategies.