Most folks are out there chasing quick bucks and then scratching their heads when wealth seems like a mirage. So what’s the real magic sauce between the average Joe and the billionaire down the block? Spoiler alert: It ain’t luck or being in the right place at the right time.

It’s all about that investment mindset. Over at Top Wealth Guide, we’ve put on our lab coats and peered into the noggins of those who know how to stack cash with a purpose.

Millionaires don’t have some secret society with a handshake and a map to hidden treasure. Nope, it’s their mental playbook—how they juggle money and risk—that draws the line in the sand.

In This Guide

What Mental Shifts Separate Millionaire Investors From Everyone Else

Here’s the scoop: wealthy folks think in decades, not days. While regular people are obsessed with the month-to-month grind, millionaires are all about that long game. Compound growth? It’s their magic trick. It’s why 401(k) millionaires shot up by 9.5% recently, according to the brainiacs at Fidelity Investments. These folks don’t sweat the daily portfolio status-they’re all about consistent contributions. Case in point? Warren Buffett-this guy’s held onto his Coca-Cola stock for over 30 years, and it’s paying off big time, way more than any flashy short-term play.

The 20-Year Rule Changes Everything

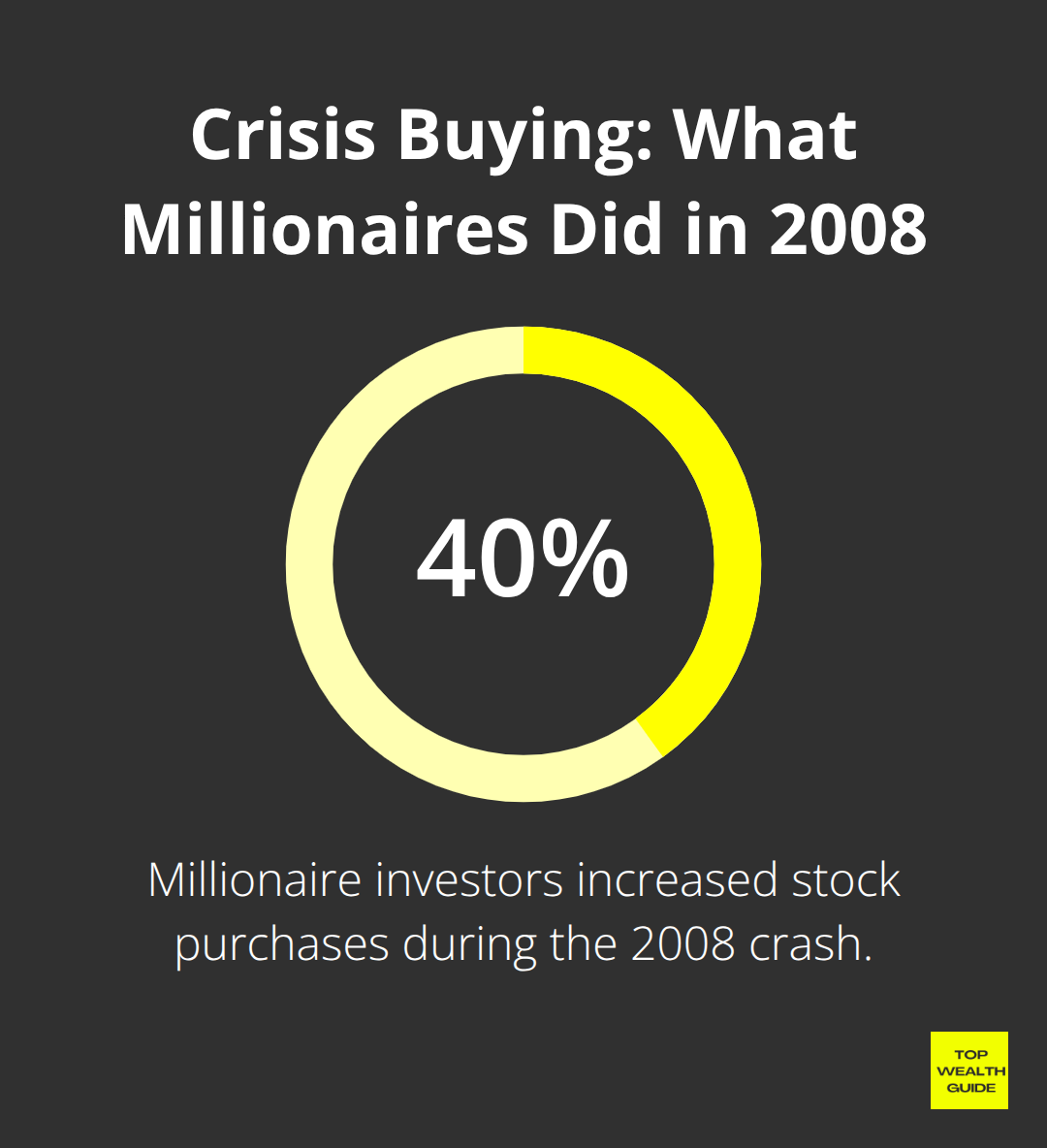

Say hello to the 20-year rule: your millionaire investor’s mantra. Every decision? It’s a two-decade plan. This way, they dodge knee-jerk reactions to market chaos and zero in on the solid stuff. The U.S. stock market, believe it or not, hasn’t dipped over any 20-year stretch. Yet, most folks hit the panic button during downturns and sell like their hair’s on fire. The wealthy? They see market crashes as epic shopping sprees. Back in the 2008 mess, they ramped up stock buying by 40% while everyone else was heading for the exit.

Smart Risk Takes Beat Risk Avoidance

Millionaires? They’ve got risk down to a science. They know dodging all risk is the riskiest move of all-thanks to inflation gobbling up purchasing power. Money chilling in savings? It’s losing 2-3% value a year to inflation. Meanwhile, the S&P 500 has been rocking an 8.55% annual return since 1928. So, they stow away 80-90% of their portfolio in growth machines like stocks and real estate (and keep a little cash-just 6-12 months’ worth of expenses-for those rainy days). They accept volatility as the cost of playing in the big leagues, knowing short-term wobbles don’t matter in a long-term game.

Compound Interest Becomes Their Best Friend

The wealthy get it: small change can snowball into serious wealth over time. Take a $500 monthly investment at 8-10% annually, and voila-you’ve got over $1.1 million after 30 years. That’s the millionaire’s game, folks: start early, stay steady. They automate investments to kick emotions to the curb and treat market blips as a chance to snag shares on sale. Most folks aren’t seeing the time-and-consistency magic, but millionaires? They’ve got compound interest working for them, not against them.

These mental rewires are the bedrock of wealth building. But hey, even the sharpest minds can’t dodge every investment pitfall that trips up financial progress.

Why Do Most Investors Sabotage Their Own Success

Here’s the brutal truth-and brace yourself for this-93% of Americans are missing the wealth-building habits that millionaires use, like, religiously. The big culprit? Emotional decisions. You see, when markets nosedive by 10%, your average Joe panics and sells at the absolute worst moment. The March 2020 crash? Retail investors dumped $326 billion right before the rocket back up. Meanwhile, savvy millionaire types scooped up the bargains. Fidelity says their best accounts? People who forgot they had them or were-get this-literally dead. So, what’s the takeaway? Your emotions… deserve a restraining order from your portfolio.

The Market Timing Trap That Destroys Returns

Trying to time the market is financial self-sabotage, yet guess what? Most investors do it anyway. Average equity investors underperformed the almighty S&P 500 by 848 basis points thanks to their own shenanigans. Missing out on the market’s top 10 days over the last 30 years? Yeah, it slices your returns in half. Even the pros-people with teams of analysts-can’t time markets consistently. So why would you even try? Stop peeking at your portfolio every single day. Set up automatic investments and then… forget. Wealthy folks automate to take emotions out of the picture.

Concentration Risk Kills More Millionaires Than Market Crashes

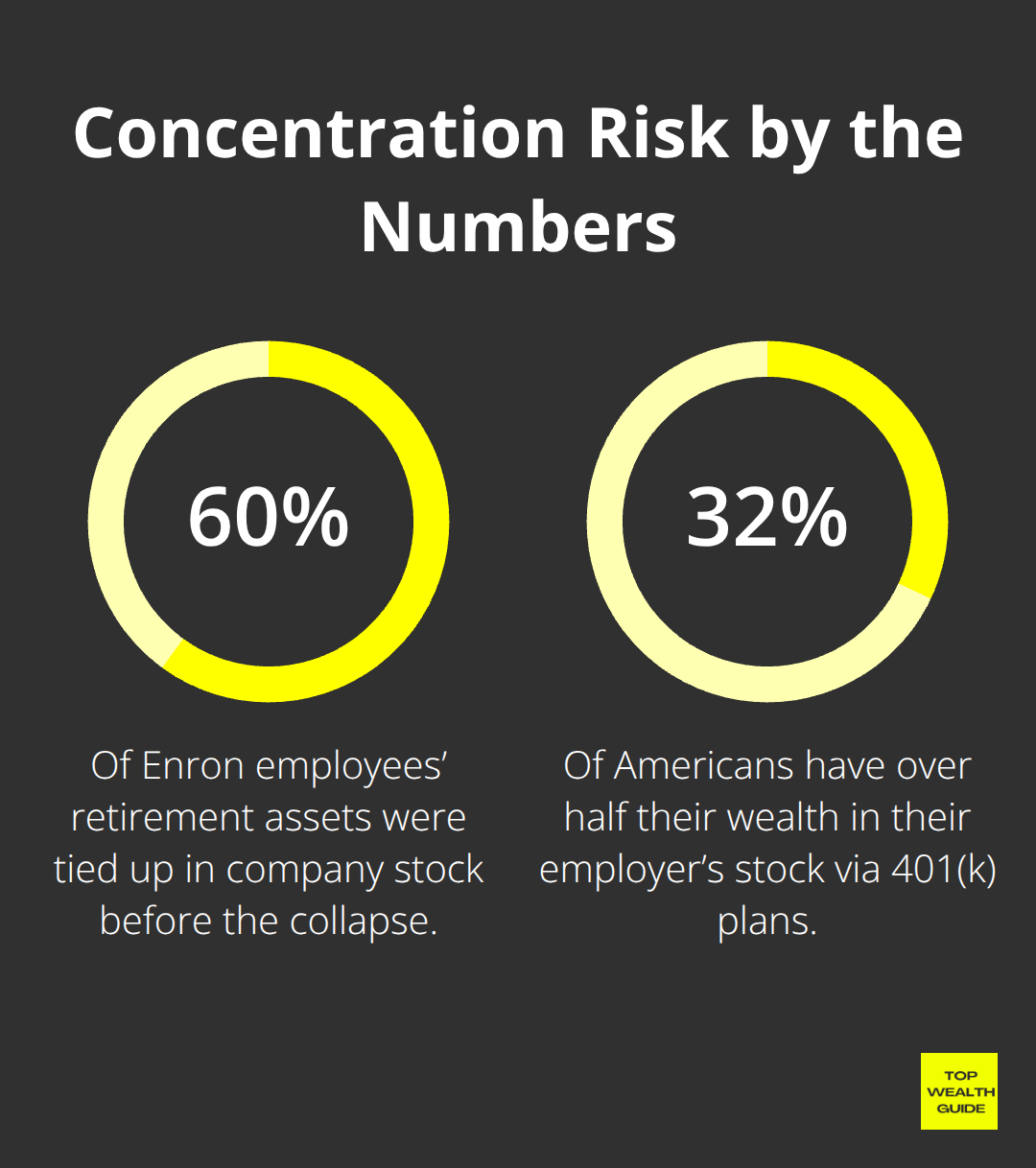

Putting your eggs in one basket-aka one stock, sector, or asset class? It’s like playing Russian roulette with your future. Remember Enron? Employees lost $1.3 billion in retirement ’cause 60% was tied up in company stock. Fast forward to today-32% of Americans have over half their wealth in their employer’s stock via 401(k) plans.

Smart money folks, though? They’re spreading the risk over 20-30 different investments… at least. Real millionaires? They’ve got index funds covering thousands of companies, real estate in different markets, and bonds for a little stability. Your portfolio? It should be snooze-worthy, not heart-racing.

The Procrastination Penalty That Costs Millions

Waiting to start investing? That’s more costly than any market crash. A 25-year-old investing $200 a month with 8% returns hits $525,000 by 65. Wait ’til you’re 35? You’re down to $245,000-less than half the wealth for the same effort. Most folks are just waiting for that “perfect moment” or think they need big bucks to start. Newsflash: Fractional shares let you hitch a ride with Amazon or Apple for just $10. The wealthy? They get it-time beats timing, every time.

These investment blunders? They’re what create the Grand Canyon between millionaires and everyone else. But here’s the scoop: millionaires follow some specific, approachable strategies that anyone can mimic to build serious wealth.

What Investment Methods Actually Build Millionaire Wealth

Alright, let’s break down how the smart money rolls in… Three investment strategies, tried and true-dollar-cost averaging with automated monthly contributions is where the magic begins. According to Fidelity data, investors automating their payments beat the manual crowd by 1.5% annually. Imagine this: set up a $500 monthly autopilot into an S&P 500 index fund, and voila, $1.37 million is what you’ll peek at after 30 years with 10% returns. No emotions, no stress-just robotic, consistent cash flow into your investments. Wealthy folks? Yeah, they let automation do the heavy lifting.

Index Funds Beat 90% of Professional Fund Managers

Here’s a secret the rich are in on: index funds obliterate those pricey actively managed funds. It’s not a rumor-92% of large-cap funds trail behind the S&P 500 according to S&P Dow Jones Indices over 15 years. So, what do savvy investors do? They dump 70-80% of their portfolios into low-cost index funds rocking expense ratios under 0.1%. Look at Vanguard’s Total Stock Market ETF with its tiny 0.03% fee compared to those active funds chomping 1-2% every year. That fee difference? It snowballs into hundreds of thousands eventually. Plus, they go global-20% in international funds and 10% catching waves in emerging markets. Global growth in their pockets, baby.

Real Estate Creates Multiple Wealth Streams Simultaneously

Stocks aren’t the whole play. Millionaires dive into real estate, owning rental properties that rain monthly cash while appreciating over time. Real estate investment trusts (REITs) consistently deliver competitive total returns-big dividends, steady appreciation. Try house hacking: snag a duplex, live in one unit, rent the other to cover that mortgage. Build equity, rinse and repeat the process. The wealthy utilize REITs for a slice of real estate pie without the property management headache. The ticket? Treating real estate as a business-keeping tabs on cap rates, returns, and debt coverage ratios. No falling for the charm of a cute porch.

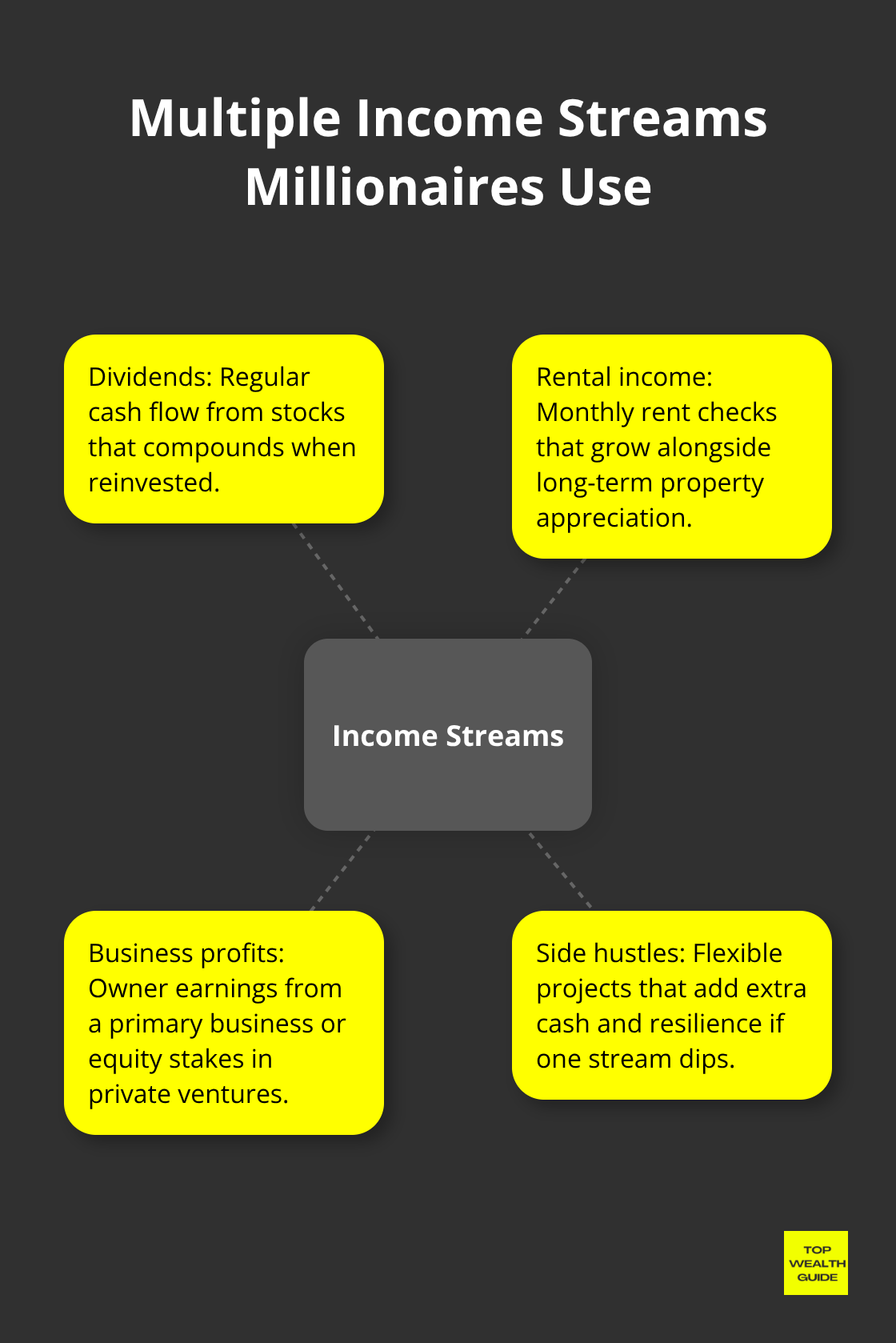

The Power of Multiple Income Streams

Millionaires? They’ve got 7 streams of income juggling at once. Mixing dividends, rental bucks, business profits, side hustles-they supercharge their wealth faster than any solo strategy could dream of. Picture a typical wealthy investor pulling $3,000 monthly from dividends, $2,500 from rentals, and $1,800 from a side gig wobbling in. This cavalcade of cash acts like a safety net if one income slime dips and jets up wealth accumulation through compounded growth across all assets.

Count ’em, baby-multiple streams, one big pool of financial freedom.

Final Thoughts

The secret sauce that minting millionaires boils down to rewiring your brain in three ways – think in decades, ignore the daily noise, and let the magic of compound interest roll on. Sounds fancy? It’s not. These are everyday habits, not Wall Street secrets. Anyone can do it. Step one: automate everything.

Set up monthly transfers to those low-cost index funds and automate that 401(k). Seriously, stop eye-balling your portfolio every day. The savvy know this: time in the market beats timing the market – every single time. Build those income streams with REITs, dividend stocks, rentals… and keep that 20-year lens (the not-so-secret that sets millionaires apart).

What’s the real divider between millionaires and the rest? Not genius, not luck – it’s discipline. Cut out the emotional trading, start early (even if it’s small), and spread your bets across different asset classes. Your road to financial independence kicks off by flipping the script on how you see money, risk, and time. Grab the wheel.