Ready for a reality check on cash flow from investments? Yeah, it’s not as boring as it sounds. Imagine your finances with those sweet, predictable income streams swooping in every month. Income investing? It’s the gift that keeps on giving—like a subscription box but with dividends, real estate gains, and fixed-income securities.

So, what’s the deal? The folks over at Top Wealth Guide—they’ve cracked the code. They’re slicing and dicing strategies that churn out monthly payments instead of the ol’ quarterly setup. It’s like hacking the system to build a portfolio that’s as sustainable as your grandma’s advice…steady through whatever the market throws your way.

In This Guide

High-Yield Dividend Stocks for Consistent Monthly Income

We’re talking monthly dividends – the holy grail of consistency in cash flow compared to those quarterly drip feeds. Enter Realty Income Corporation (ticker: O). Known as the monthly dividend company, it’s doling out yields around 5.8% – tick, tick, tick. They’ve been jacking up that dividend for 29 years in a row. So, yeah, pretty reliable. Then there’s Main Street Capital Corporation, delivering monthly distributions with a sweet spot yield of about 6.2%. They focus on middle-market lending – nice and steady, like grandma’s apple pie.

Top Monthly Dividend Payers Worth Your Attention

AGNC Investment Corp – it’s bringing in the big bucks with 12% yields – via monthly payments. But, hold your horses – mortgage-backed securities exposure makes it a bumpy ride. Then there’s the Canadian duo: Shaw Communications and Pembina Pipeline, both offering monthly dividends with yields hanging between 4% and 7%. Stateside, you’ve got Enterprise Products Partners (EPD) and Energy Transfer (ET) – they’re clocking in monthly payouts with yields over 8%, while keeping payout ratios efficient at around 50% of distributable cash flow. Solid stuff.

Dividend Aristocrats vs Growth Dividend Stocks

So we’ve got Dividend Aristocrats in one corner – think Coca-Cola and Johnson & Johnson, those members of the S&P 500 club. They’ve been upping their dividends for at least 25 years. But here’s the catch – they pay quarterly. These giants are all about stability when the economy’s throwing tantrums. On the flip side, you’ve got growth dividend stocks like Microsoft and Apple. Lower current yields – 2-3% range – but boy, do their payouts rise faster than a hot air balloon. It’s a classic showdown: immediate income versus prepping for the future.

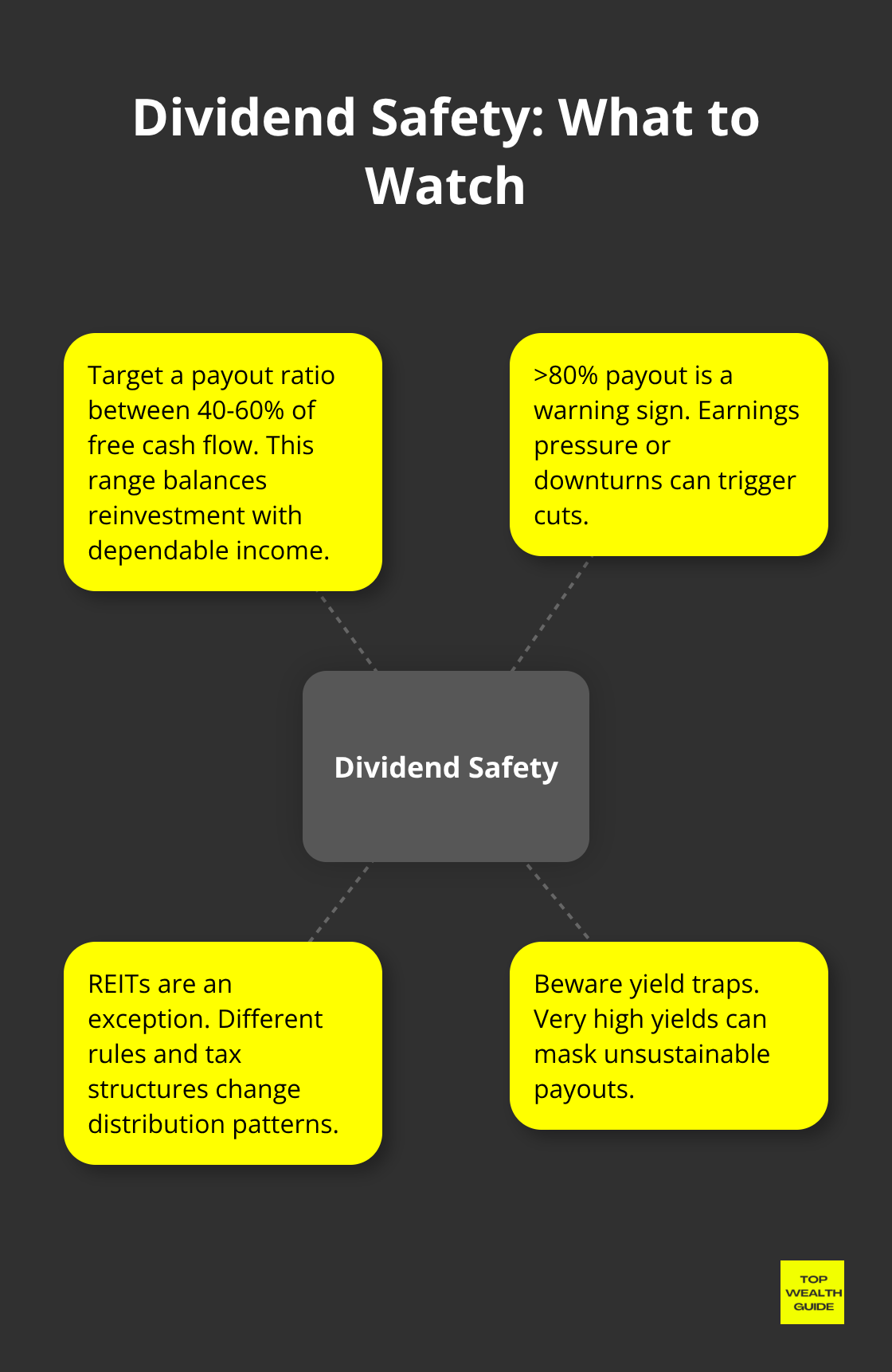

Evaluating Dividend Sustainability and Payout Ratios

Listen up, payout ratios – they matter more than just yield percentages when you’re assessing dividend safety. If companies are tossing back over 80% of their earnings as dividends, well, you might be looking at cuts when the economy gets grumpy. The sustainable spot? Between 40-60% of free cash flow. That balance leaves enough room for business reinvestment and some dividend growth. This is how you sort out the trusty income stocks from the yield traps that reel in investors with unsustainable high payouts.

Real estate investment trusts are the curveball – different rules, different tax structures. They play by their own game when it comes to distribution patterns and yields.

Real Estate Investment Trusts (REITs) for Passive Income

REITs play by a different set of rules compared to your typical dividend stocks – they’re legally bound to throw 90% of their taxable income your way. Most of them stick to the quarterly schedule, sure, but some, like Realty Income Corporation and STAG Industrial, have carved out their niche with steady monthly checks. Talk about keeping cash flows consistent.

Monthly REIT Distribution Leaders

Realty Income is floating at around $54 a share, giving out about $0.248 monthly per share, with a yield that’s flirting close to 5.5%. STAG Industrial is all about single-tenant industrial spaces and hands out roughly $0.122 monthly. These guys often come with a premium price tag – yeah, they’re pricier than the quarterly crowd – but the flow of predictable cash? It makes that price-to-funds-from-operations ratio feel like it makes sense.

Then there’s LTC Properties and Medical Properties Trust bringing monthly payouts to the healthcare REIT scene. LTC yields around 6.2% with $0.19 per month, while Medical Properties Trust is dangling yields in the 8.5% range, despite the curveballs thrown by the healthcare sector recently.

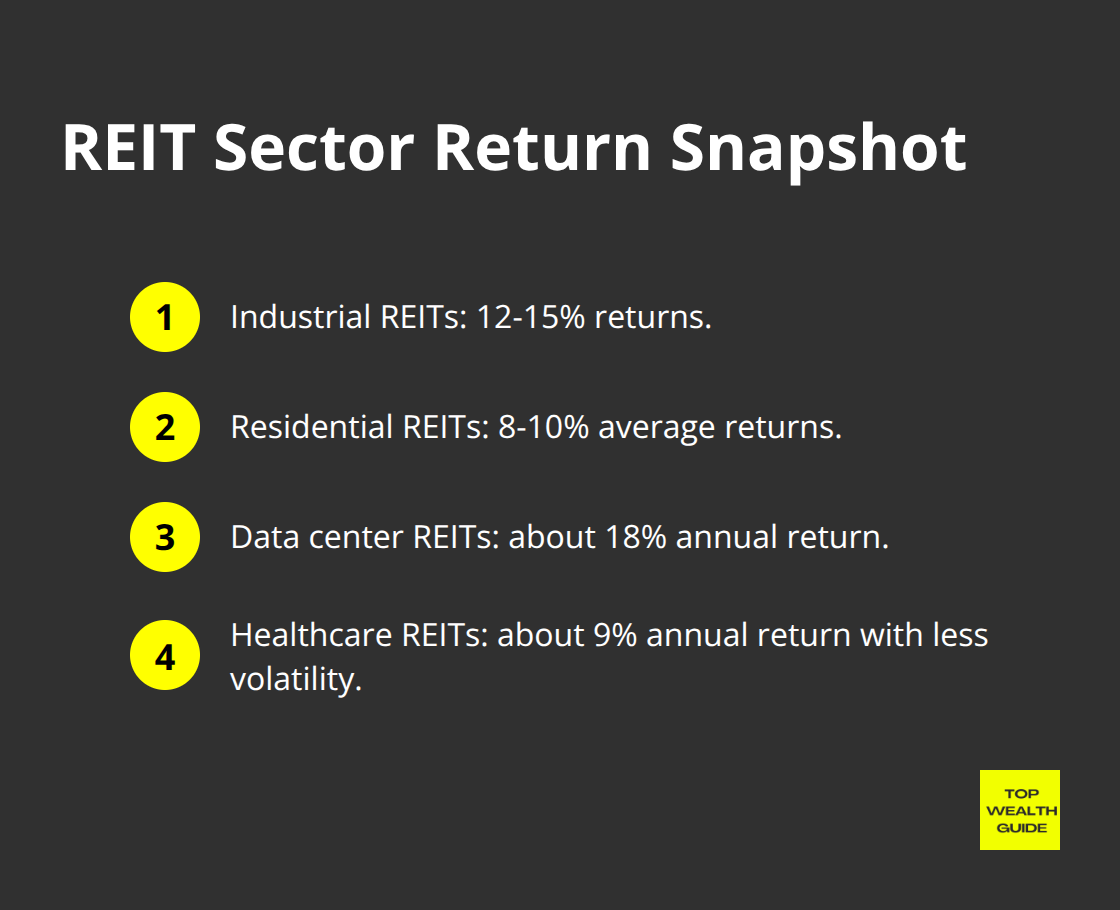

Commercial vs Residential REIT Performance

Per REIT data, the way property sectors perform is all over the map, with commercials and residentials dancing to different beats. Check out Industrial REITs like Prologis – they’ve been riding that e-commerce warehouse wave, churning out 12-15% returns.

Residential REITs like AvalonBay Communities have been a bit more clipped, posting average returns of 8-10%, thanks to the straitjacket of rent control policies in big cities. Specialty REITs? Now there’s your high-stakes casino – data center REITs like Digital Realty Trust are boasting an eye-popping 18% annual return, while healthcare REITs such as Welltower have settled into a smoother 9% with less volatility.

Picking your ride is part of the game.

REIT Tax Strategy and Portfolio Allocation

Now, about those REIT dividends – they’re taxing you like ordinary income, not the cushy qualified dividends, so your effective tax rate is a bit heftier than what you get from typical dividend stocks. Smart money moves? Park your REITs in tax-sheltered accounts like IRAs or 401ks, dodge that tax bullet.

In terms of portfolio dance moves, keeping REITs to 10-15% of your total assets is a good rule of thumb (more than that and you’re getting really cozy with interest rate fluctuations, since REITs have this tango with bond yields). Remember back in 2022, when Treasury rates took a rocket from 1.5% to 4.5%? Vanguard Real Estate ETF tanked by 26%, while the S&P 500 lost a mere 18%.

Fixed income securities? Another road to monthly cash flow, with bond ladders offering a structured approach to managing interest rates and ensuring those payments are as predictable as the sunrise.

Bond Ladders and Fixed Income Securities

So here’s the scoop on bond ladders – think of them as your trusty sidekick for getting that sweet, sweet monthly income. But there’s a catch: you gotta get the math. Picture this: you snag a bunch of bonds with different due dates – like buying 12 that wrap up each month for a year. Once one matures, roll it into a fresh 12-month gig. It’s like clockwork. Treasury bills? They’re the menu of maturity options. Meanwhile, big shots like Apple or Microsoft offer investment-grade bonds with juicy returns of 4.8-5.4%. And hey, if you’re into states like Texas or Florida, municipal bonds pay 3.8-4.2% tax-free. Uncle Sam approves.

Treasury Bills vs Corporate Bonds for Safety

Let’s talk safety. Treasury bills are the undefeated champs – backed by Uncle Sam himself. Now, even the crème de la crème like Johnson & Johnson have a tiny bit of risk, but let’s call it minimal. What’s the takeaway? Yields are the game-changer: a $100,000 bond ladder with Treasuries pays those monthly checks, while corporate bonds dangle higher yields. Municipal bonds-total winners for the high earners-why? They’re tax-free. If you’re shedding 32% or more in taxes, their tax-equivalent yield always comes out on top.

How to Build Your Monthly Bond Ladder System

Ready to jump in? Grab at least $60k to kickstart a 12-rung ladder – $5k a bond with monthly comebacks. TreasuryDirect.gov has your back for government bonds, and Fidelity or Schwab cover you for others. Here’s the kicker: when rates climb, your reinvestment rates party up. Rates drop? Lock those higher yields. The Fed’s rollercoaster from 0.25% to 5.25% in 2022-2023 showed what ladders are made of – fresh rungs with better rates and the oldies hold strong.

Interest Rate Risk Management Strategies

Interest rates – the arch-nemesis of bond investors. But bond ladders? The ultimate neutralizers – thanks to that reinvestment magic. Short-termers (under 2 years) barely flinch with rate changes, but long ones can dip 10-15% like a yo-yo. Duration measures how much they pout – a 5-year bond slumps 5% with a 1% rate hike. Craft that ladder wisely, keep average duration under 3 years, and your volatility stays chill while yields play nicely across the curve.

Final Thoughts

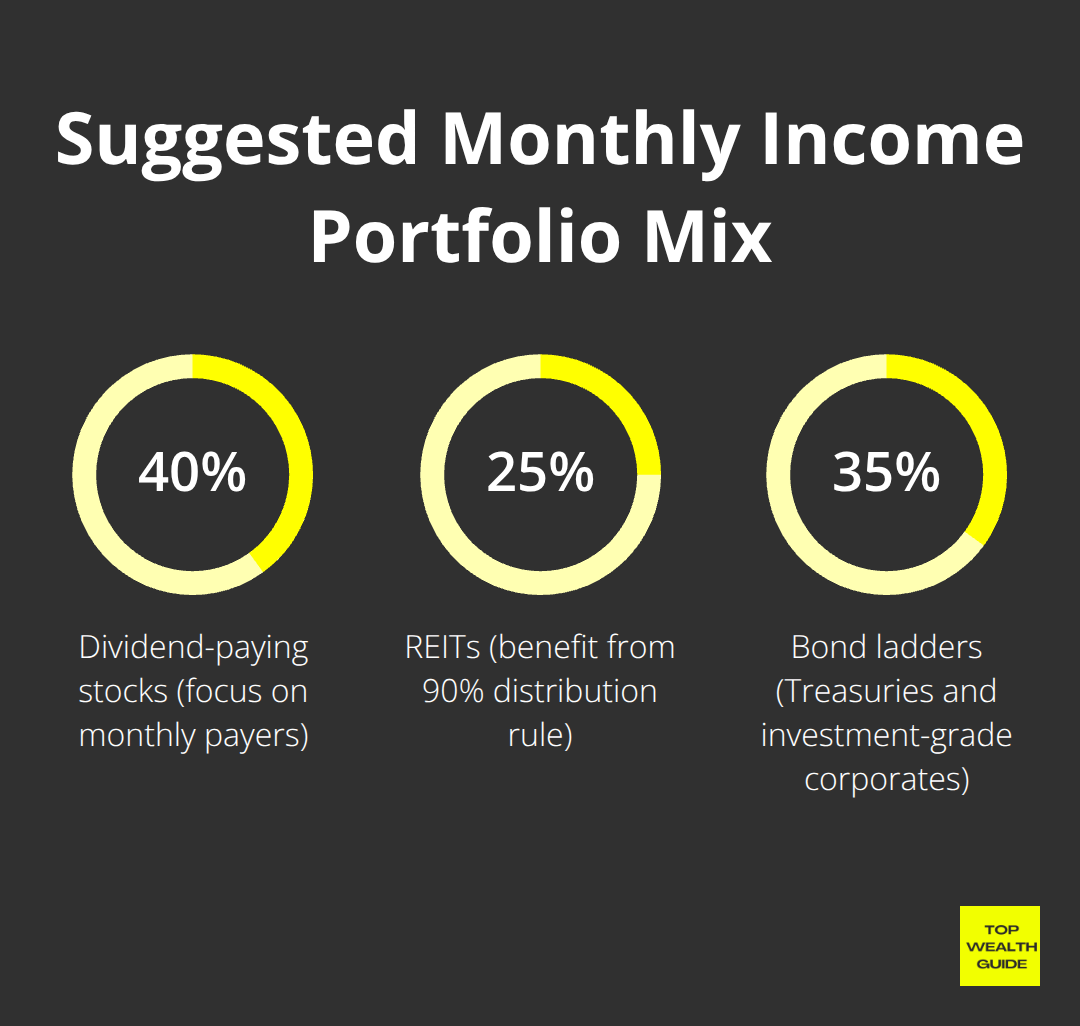

Let’s break this down-your monthly income portfolio is like a well-oiled machine that needs a harmony of dividend stocks, REITs, and bonds. Picture this: 40% of your portfolio in dividend-paying stocks. And we’re talking about those monthly payers, the rockstars like Realty Income and Main Street Capital. Then, toss 25% into REITs because of that 90% distribution requirement.

(And here’s the kicker: keep these in tax-sheltered accounts so Uncle Sam doesn’t eat up the returns with ordinary income tax rates.) The remaining 35%? Pour that into bond ladders with Treasury bills and some solid investment-grade corporates.

Now, risk management-think of it like steering a ship through choppy waters. You’ve got to diversify across sectors, keep those payout ratios under 60%, and be glued to the interest rate landscape. Remember when rates shot up from 1.5% to 4.5% in 2022? Ouch. REITs took a beating, plummeting 26%. But a diversified portfolio? It weathered the storm. And speaking of bonds, keep average durations under 3 years if you want to dodge the volatility bullet.

Here’s your starter kit: open a brokerage account, start with maybe $10,000 for a healthy spread, and set up automatic reinvestment. Now, here’s a pro tip: align those monthly cash flows with your expenses to fine-tune your allocation. The secret to income investing? It’s all about syncing your investment timelines with your cash flow needs.

And hey, if you need a hand, we at Top Wealth Guide are here with the tools and wisdom to help you build that sustainable wealth. Practical strategies that sync with your financial goals-it’s what we do.