Your income level — let’s not kid ourselves — is a big deal when it comes to how fast you can kick the rat race to the curb and achieve financial independence. The math? Pretty simple: more money rolling in usually speeds up the wealth-building train. But — and it’s a big but — what you stash away matters even more than that shiny paycheck.

Here at Top Wealth Guide, we’ve crunched the numbers for different income brackets. Spoiler alert: with some savvy planning and a sprinkle of discipline, most folks can kiss financial dependence goodbye in 10-30 years.

In This Guide

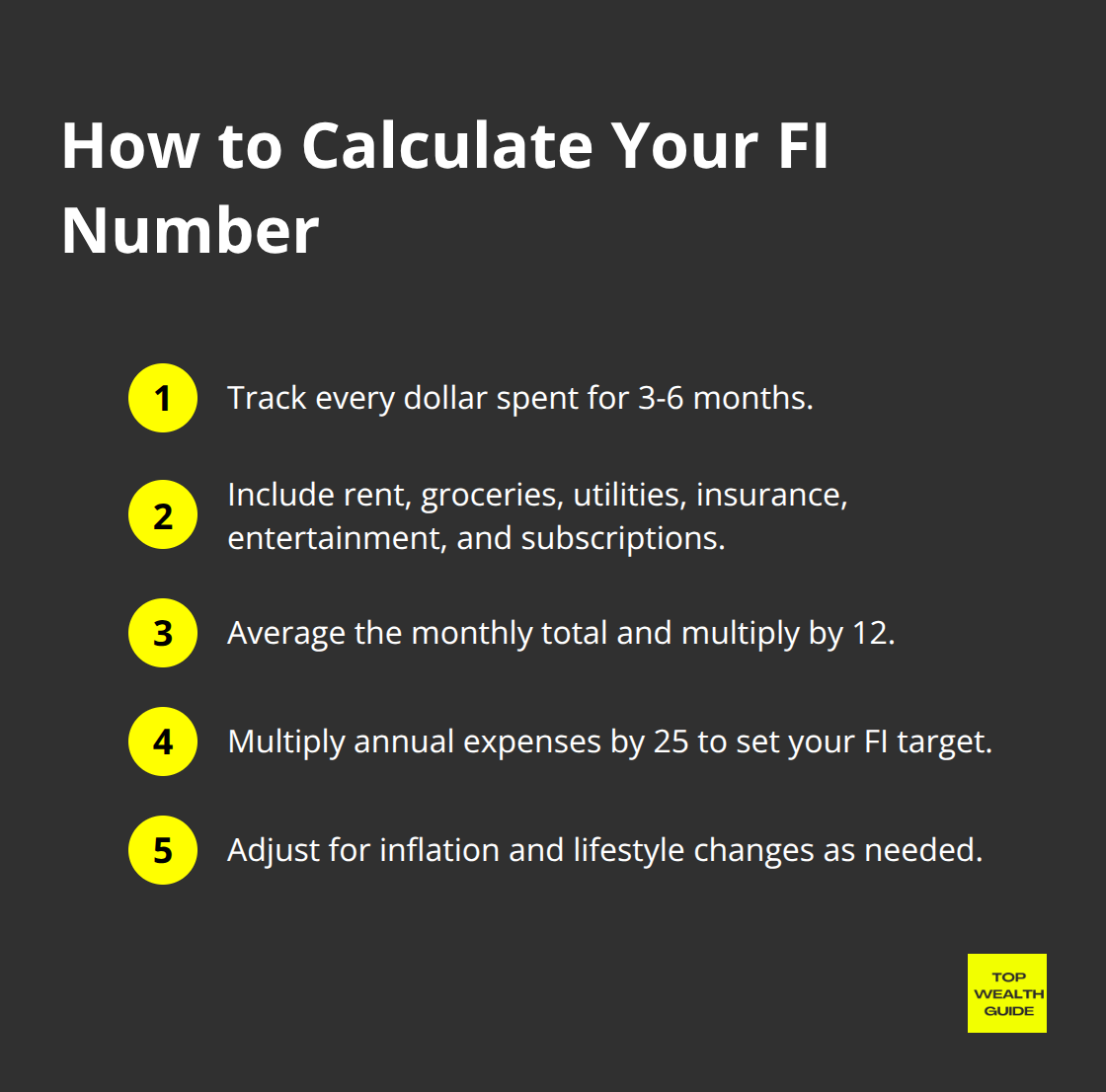

Understanding Your Financial Independence Number

Your financial independence number isn’t some mystical figure – it’s cold, hard math based on what you actually spend. Begin by tracking every dollar flowing out of your account for 3-6 months. Include the essentials: rent, groceries, utilities, insurance, entertainment, and those sneaky subscription services you forgot about.

Track Your Real Expenses First

Mint and YNAB make this tracking painless (bless ’em), but even a basic spreadsheet does the trick. Most folks lowball their real expenses by 20-30%… so be brutally honest with yourself. Once you’ve nailed down your monthly average, multiply by 12 for your annual living expenses. This baseline is the foundation for everything else.

Calculate Your Target Using the 25x Rule

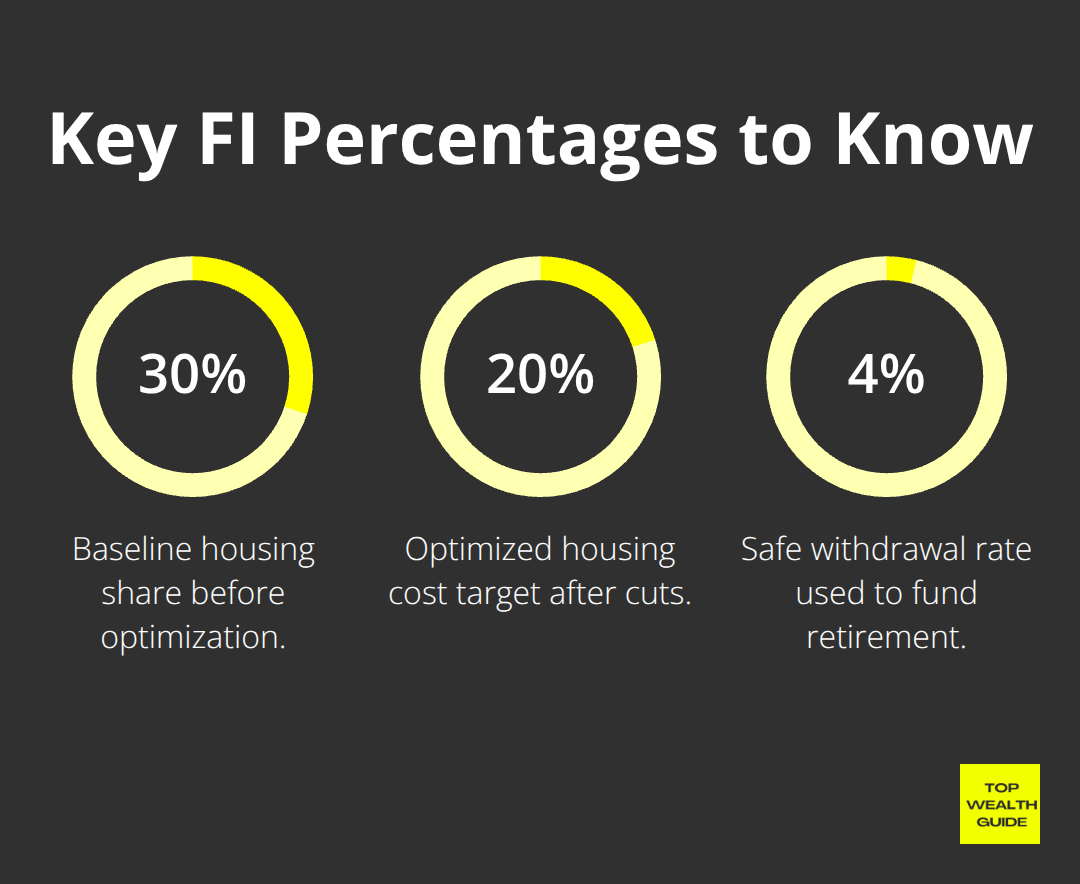

Take your annual expenses and multiply by 25 – that’s your FI number. Spend $60,000 per year? Boom, you need $1.5 million invested. This stems from the 4% withdrawal rule, backed by Trinity Study research, which says you can keep your lifestyle afloat by withdrawing 4% of your initial stash yearly. The math works out because you withdraw 4% annually while your investments crank out 7-10% returns, historically.

Some prefer the 33x multiplier for extra caution (think 3% withdrawal rate), but 25x remains the gold standard in most scenarios. Someone spending $48,000 yearly? They’ll need $1.2 million; if you’re at $80,000, then $2 million is your magic number.

Account for Inflation and Lifestyle Changes

Your $60,000 lifestyle today will set you back $81,000 in 15 years at 2% inflation. To beef up your FI number, tack on 20-30% to your target. Also, consider lifestyle inflation – promotions come with a side of increased expenses.

Calculate your Financial Freedom Number based on your dream retirement lifestyle, not just what you’re spending now. Planning for a mortgage-free retirement? Subtract housing costs. Craving world travel? Add 25-40% to your baseline expenses. These tweaks are crucial when eyeing different income levels and their timetables.

Timeline Scenarios by Income Level

Low Income ($30,000-$50,000): The 25-30 Year Reality

Alright, here’s the deal: making $30,000-$50,000 puts you on a snail-paced 25-30 year road to financial independence…unless you treat savings like your Netflix subscription-non-negotiable. Let’s say you pull in $40,000 a year, and sock away 20% of that. That’s $8,000 stashed away annually toward your FI dream. Assume a 7% return on investments, and bam! In 25 years, you’re sitting on $600,000, letting you live on $24,000 a year using the 4% withdrawal rule.

The bitter pill? You’re in for some serious belt-tightening. Housing should guzzle no more than 25% of your income (forget about the usual 30-35%). Get creative with house hacking-renting out rooms, or relocate to cheaper spots where your bucks go further.

The Side Hustle Imperative

At this income level, side hustles aren’t just a fancy add-on-they’re mission-critical. Uber driver, freelance writer, online seller…pick your gig poison to boost your savings from 20% to 30%. That one shift can lop 5-7 years off your timeline. Drive deliveries for an extra $500 a month, and presto, your FI journey shrinks from 28 years to 21.

Middle Income ($50,000-$100,000): The Sweet Spot

Okay, if you’re in the middle lane-earning $50,000-$100,000-you’re in the sweet spot. A steady mix of discipline and saving over 25%, and boom, you hit FI in 15-25 years. Take someone raking in $75,000 a year who puts away $25,000 annually. They’re looking at a cool $1.5 million after 20 years, supporting a $60,000 retirement lifestyle.

What gives you the edge here? You get to make expense cuts without living like a monk. Dine out occasionally, yet still max out your retirement accounts ($23,000 in 401k plus $7,000 in IRA for 2024).

High Income ($100,000+): The Golden Ticket

Big earners over $100,000-congrats, you snagged the Willy Wonka golden ticket to a 10-15 year FI timeline…unless lifestyle inflation nixes your plans. A software whiz making $150,000 who lives off $60,000 can sock away $90,000 every year, hitting $1.5 million in a swift 12 years.

The catch? Dodge the luxury trap that snags most high earners. Geographic arbitrage can do wonders-earn LA-level salaries while kicking it in Austin or Nashville, effectively doubling your savings rate. Master how to grow wealth with smart financial habits-it’s your secret weapon.

These timelines hinge on steady market returns and keeping spending in check. But-wanna speed things up even more?

Strategies to Accelerate Your FI Timeline

Cut Expenses Like Your FI Timeline Depends on It

Okay, here’s the deal-slash housing costs from 30% to 20% of income and you’re looking at chopping your FI timeline by 3-5 years. House hacking (think: Airbnb rentals) can bring in $800-1,500 each month while you… quite literally live there for free. Move from San Francisco to Austin, and bam!

Your $120,000 salary now supports a $45,000 lifestyle instead of $80,000. Magic!

Transportation? Yeah, it gulps down 15-20% of budgets-so maybe ditch the car. Opt for public transit or a bike. Meal prep-every influencer’s favorite-slashes that food bill from $600 to $300 a month. Ruthlessly cancel subscriptions; remember, two-thirds of consumers forgot about at least one recurring payment last year. Wipe out just a 5% increase in your savings rate and suddenly you’re shaving 6-8 years off that FI journey.

Boost Income Through Strategic Career Moves

Wanna know a secret? Career advancement blows penny-pinching out of the water for speeding up your FI timeline. Here’s why-software engineers who hop companies every 2-3 years snag at least 20% salary bumps. No brainer, right? Plus, snagging certifications like a PMP or CPA? That’s an extra $15,000-25,000 right there.

Don’t forget to max out those employer 401k matches-free money, folks. And if you’re in sales, commission-based roles (especially in tech or real estate) can double that sweet income. Those strategic career moves? They make your income boost compound faster than just expense slashing.

Launch High-Impact Side Hustles

Freelance gigs like writing, web design, or tutoring? They can add $1,000-3,000 monthly to that FI fund you’re building. Real estate agents working weekends rake in $30,000-60,000 annually on top of their day jobs. As for Uber drivers in big cities-$25-35 an hour during peak times… not too shabby.

So here’s the kicker-focus on scalable side hustles that don’t trap you in a cycle of trading time for money forever. Think digital products, rental income streams, or consulting services. These ventures? They crank out passive income that speeds up your FI timeline even after you hang up that working hat.

Optimize Investment Returns with Smart Asset Allocation

Wanna play it smart? Skip stock picking-smart asset allocation wins for stable wealth growth. Index funds like VTSAX deliver robust returns with tiny fees (looking at you, 0.03-0.05% expense ratios). Target-date funds? They rebalance for you-removing the whole guesswork headache from managing your portfolio.

Young investors? Go 80-90% into stocks for that juicy growth potential. Approach FI and start leaning toward bonds for a bit more stability. International diversification through funds like VTIAX-minimizes risk, keeps returns healthy. Need to drum up that FI Number? Multiply your expected annual expenses in retirement by 25. Simple math for financial freedom.

Final Thoughts

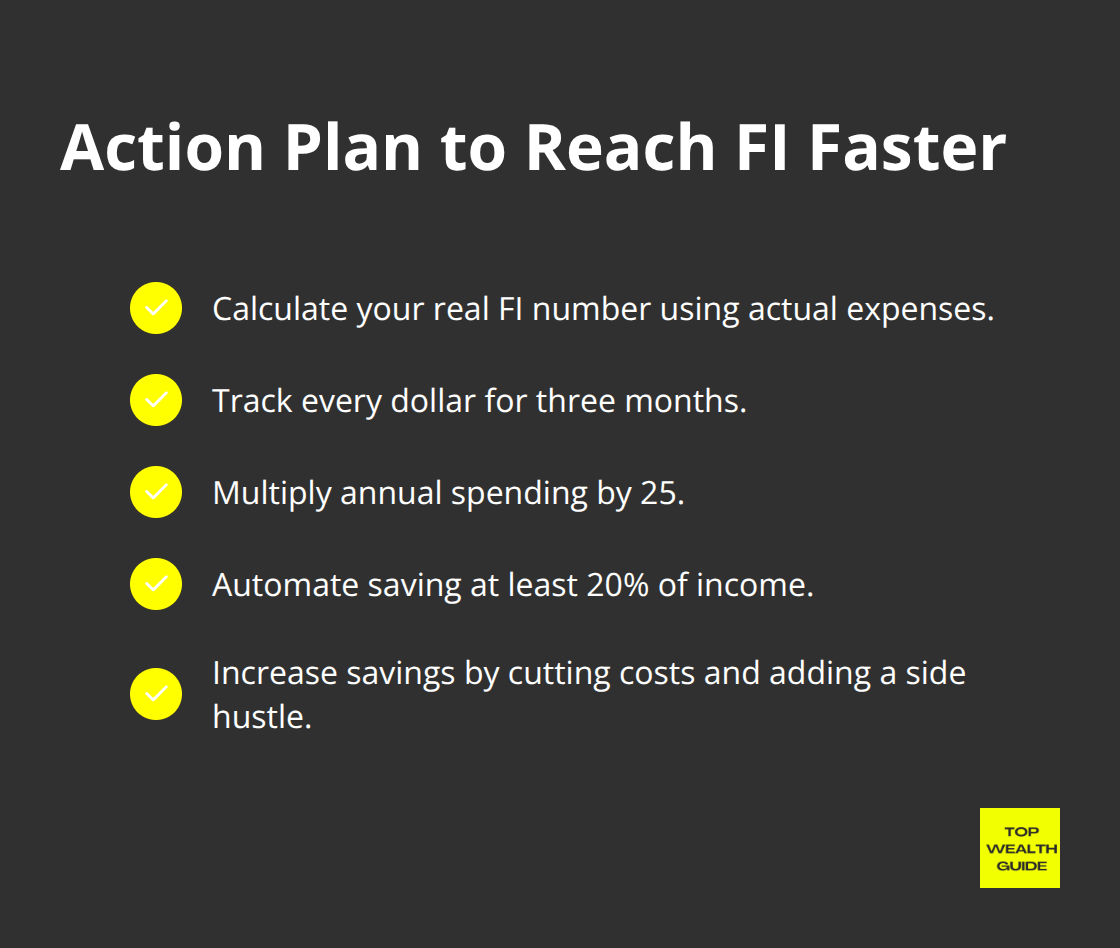

Let’s get real – your escape from the 9-to-5 grind isn’t just about that paycheck. Picture this: a $40,000 salary saver putting away 30% gets to financial independence way faster than a $100,000 earner who’s stashing only 10%. The secret sauce? Mashing together hefty savings with savvy investments and being strategic about upping that income.

Don’t delay – grab a piece of paper and work out your bona fide FI number using real expenses (not those optimistic guesstimates). Track where every buck goes for three months, then do the math: annual spending times 25. Now, set your savings on autopilot to snatch at least 20% of your income, then crank it up a notch-cut those expenses and hustle on the side.

Watch the magic unfold as even a tiny bump in your savings rate slashes years off your FI quest. Pivot from a 15% savings rate to 25%, and you’re axing 8-10 years off the timeline. Over at Top Wealth Guide, we’re in the business of nudging you along as you strategize and fine-tune your wealth-building game plan (no matter if you’re starting at $30,000 or pulling in $150,000-financial freedom is, indeed, on the table with the right mix of planning and sheer tenacity).