Your retirement investing strategy—yeah, the strategy that’s gonna shape your golden years—it’s a big deal. Nail it this year and you’re looking at a potential windfall in your nest egg … like, we’re talking hundreds of thousands. Think about that.

So here’s the playbook. We, at Top Wealth Guide, have zeroed in on three key moves. First up, smart asset allocation—it’s the art of putting your eggs in the right baskets (and not having them all in one). Then there’s tax optimization … because why give the government any more of your hard-earned money than you have to? Last but not least, disciplined portfolio management—keep your cool no matter how crazy the market gets. These strategies? They’re bulletproof … no matter what’s happening out there.

In This Guide

What Asset Mix Maximizes Your Retirement Returns

The 50/50 stock-bond split financial advisors love to preach? It’s outdated garbage. Seriously, modern portfolio theory tells us strategic asset allocation drives 90% of your investment returns, not your fancy stock picks or trying to time the market like you’re some kind of investment ninja. Here’s the no-BS breakdown: go heavy on equities when you’re young and have time to recover from the bumps; ease back as you near those golden years. Bank of America’s research throws shade on going all conservative-inflation at 2.5% annually hacks $1 million at age 60 down to $539,391 by 85. Ouch.

Stock Market Positions That Pay

Growth stocks are your turbocharged ride to long-term wealth, but value investments? They’re your sturdy seatbelt when the market’s a rollercoaster. The S&P 500 has historically laid the smackdown on bonds and cash returns. Savvy investors? They put 70-80% in stocks in their 20s and 30s and ease back to 60% in their 50s. Within that stock magic, think 60% growth-oriented index funds and 40% value plays. This combo? Captures the fireworks of growth while providing a safety net during downturns.

Timeline-Based Risk Management

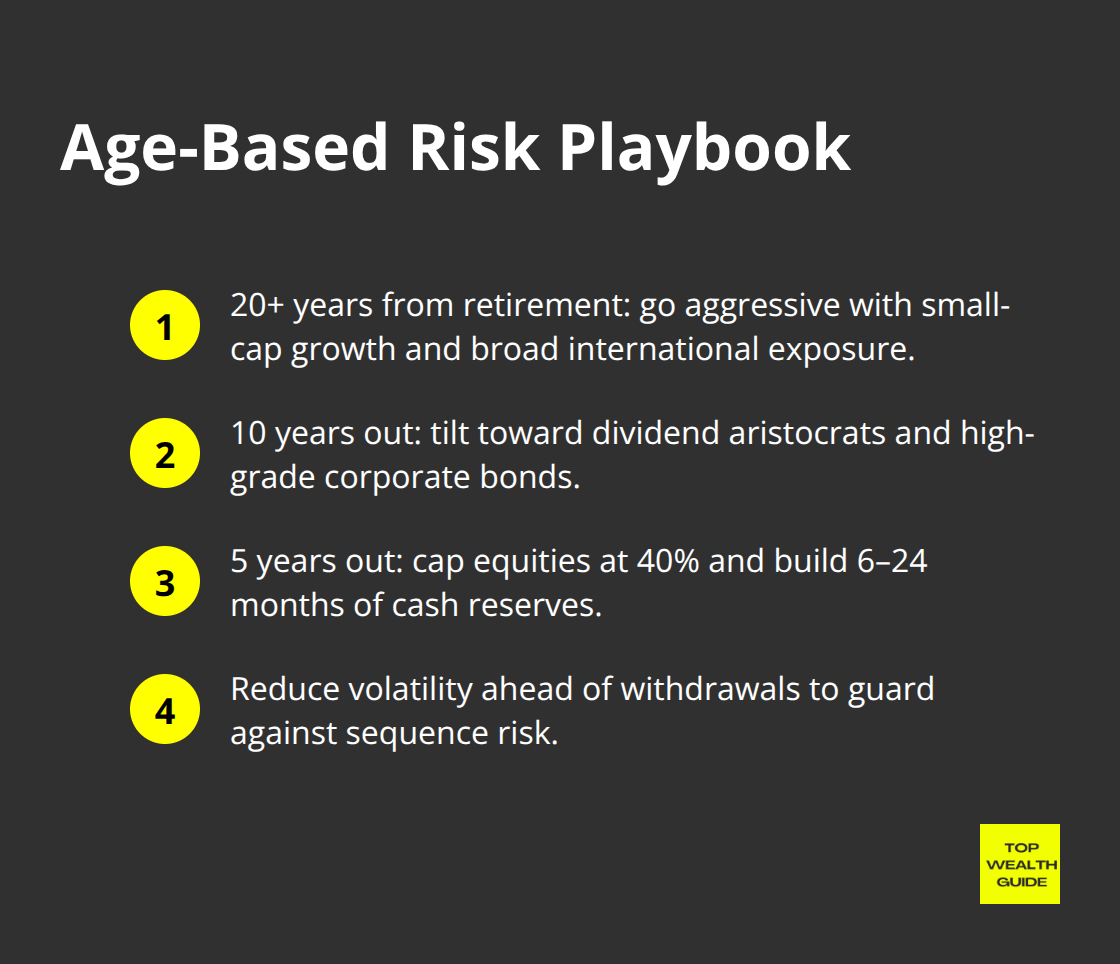

Your age? It’s the boss of risk tolerance, period. Twenty years from retirement? Time to unleash the aggression-small-cap growth funds and international exposure galore.

Ten years out, play defense with dividend aristocrats and high-grade corporate bonds. Five years from retirement? Go conservative, max 40% stocks, and stack up substantial cash reserves (think 6 months to 2 years of expenses). That brutal sequence risk in early retirement can do a serious number on your nest egg if you’re too volatility-happy when it’s time to start withdrawals.

International Diversification Strategy

Glued to domestic stocks? That’s not gonna cut it anymore. International markets are your ticket to growth that the U.S. might miss, especially in emerging economies. Aim for 20-30% of your equity slice to head abroad, splitting the love between developed markets (think Europe, Japan) and emerging powerhouses. This global spread takes you beyond U.S. economic cycles, hooking you into worldwide trends that most domestic investors are oblivious to.

Smart asset allocation is the blueprint, but tax optimization can tack on another 1-2% to your annual returns through some shrewd account management. It’s like finding money under the couch cushion, but for grown-ups.

How Much Can Tax Optimization Boost Your Returns

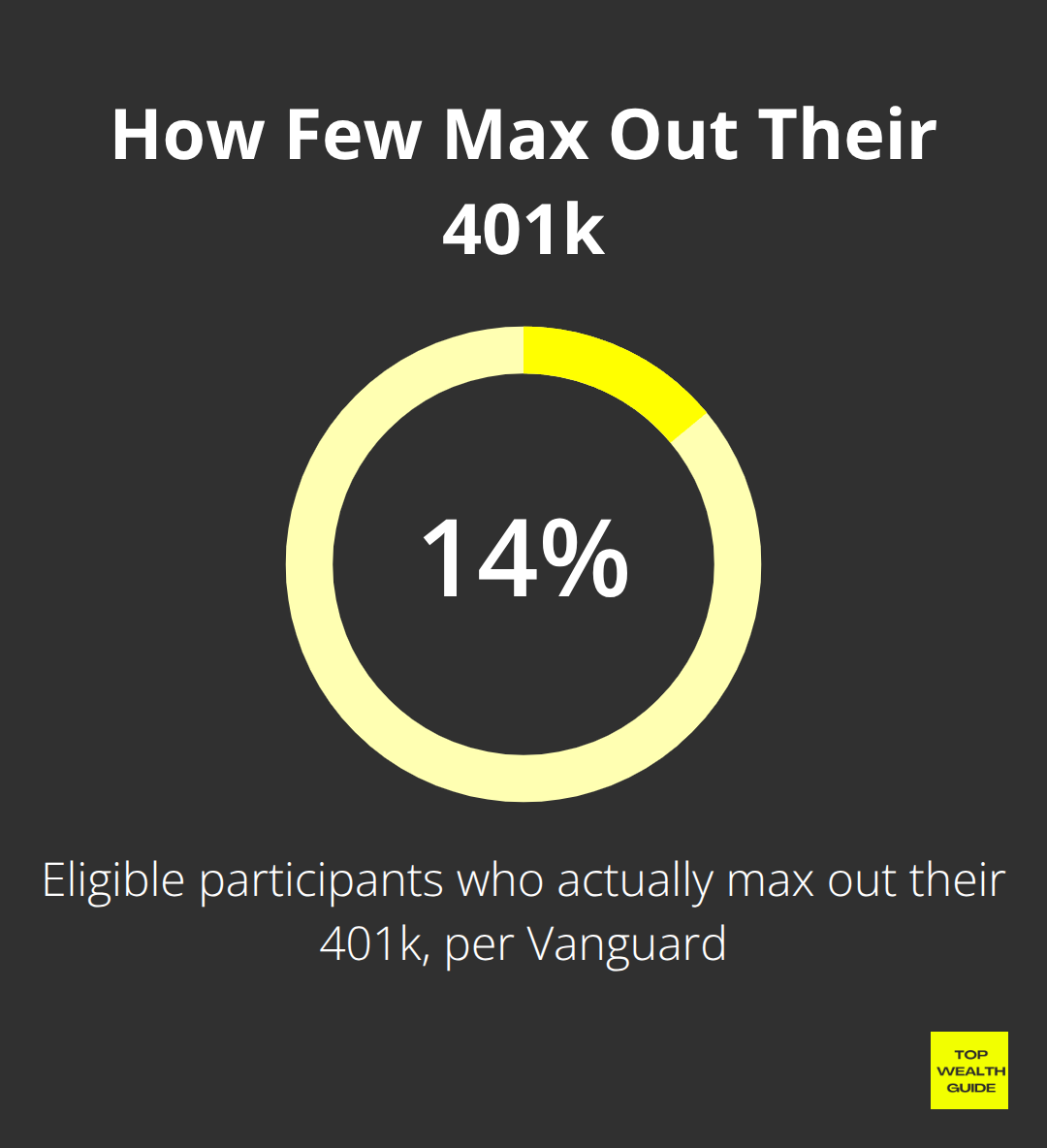

Here’s the deal-max out those retirement contributions this year or kiss thousands goodbye. The 2025 limits hit $23,500 for 401k plans and $7,000 for IRAs. Toss in those catch-up contributions if you’re 50-plus, and you’re looking at another $7,500 and $1,000. But you know what? Most folks barely make a dent-14% of the eligible herd actually max out their 401k according to Vanguard. And that employer match you’re ignoring? It’s like leaving a bag of cash on the street while you nitpick over latte prices.

Contribution Priority Framework

First things first-get that 401k match locked down, then swing over to IRAs. Why? Better investment options, lower fees. Health Savings Accounts-your stealth bomber of retirement savings-offer triple-tax advantages with $4,300 individual and $8,550 family limits for 2025. Contributions knock down your current taxes, growth is tax-free, and withdrawals? Totally untaxed if they fit the bill. Ignore HSAs and you’re just burning money.

Traditional vs Roth Decision Framework

Your tax bracket-it’s the magic eight-ball here. Earnings under $75,000? Roth contributions are your golden ticket ’cause you’re likely in the 12% bracket now and might hit 22% or higher when you retire. Making six figures? Going traditional is a no-brainer-cut down that tax bill now and enjoy lower rates later. The savvy move? Mix it up-traditional when your income goes Up, Roth when it dips.

Tax-Loss Harvesting Strategy

Here’s a move-tax-loss harvesting in taxable accounts boosts those post-tax returns, as Morningstar tells us. Dump investments going south to balance out gains, then dive back into similar assets when the 30-day wash sale rule chills out. Best with broad market index funds-you’ll find solid replacements easily. Tax savings snowball, especially when taxes are biting hard.

Account Location Strategy

Where you park those investments? It’s a big deal. Stock index funds? Slide them into taxable accounts because qualified dividends are tax-friendly. Bonds and REITs? Stuff ’em into tax-deferred accounts where ordinary income rates can’t sting. International funds belong in taxable accounts too-gotta love those foreign tax credits softening the blow. This ninja-level strategy can add 0.5% to 1.5% every year compared to mindless account placement.

Think about converting traditional IRA funds to Roth accounts during market slumps. Pay taxes on the dips and watch your money grow tax-free on the upswing. Smart portfolio management-it’s all about executing these tax strategies like a maestro. Disciplined execution turns a handful of tactics into a fortune factory.

Which Funds Actually Build Retirement Wealth

Expense ratios… the stealthy wealth vampires – sucking your portfolio dry faster than a Wall Street looter at bonus time. Yet, most folks just nod along, blissfully unaware. Take Vanguard’s Total Stock Market Index Fund. It hits you with a measly 0.03% annually, while its actively managed brethren boast an average of 0.67% (as per Morningstar). That 0.64% difference? It’s a $64,000 punch to the gut for every $100,000 invested over 30 years. Index funds tracking the S&P 500 have trounced 90% of actively managed funds over the past decade. It’s like choosing between a luxury yacht or a leaky dinghy for retirement voyages – no contest.

Index Fund Selection Strategy

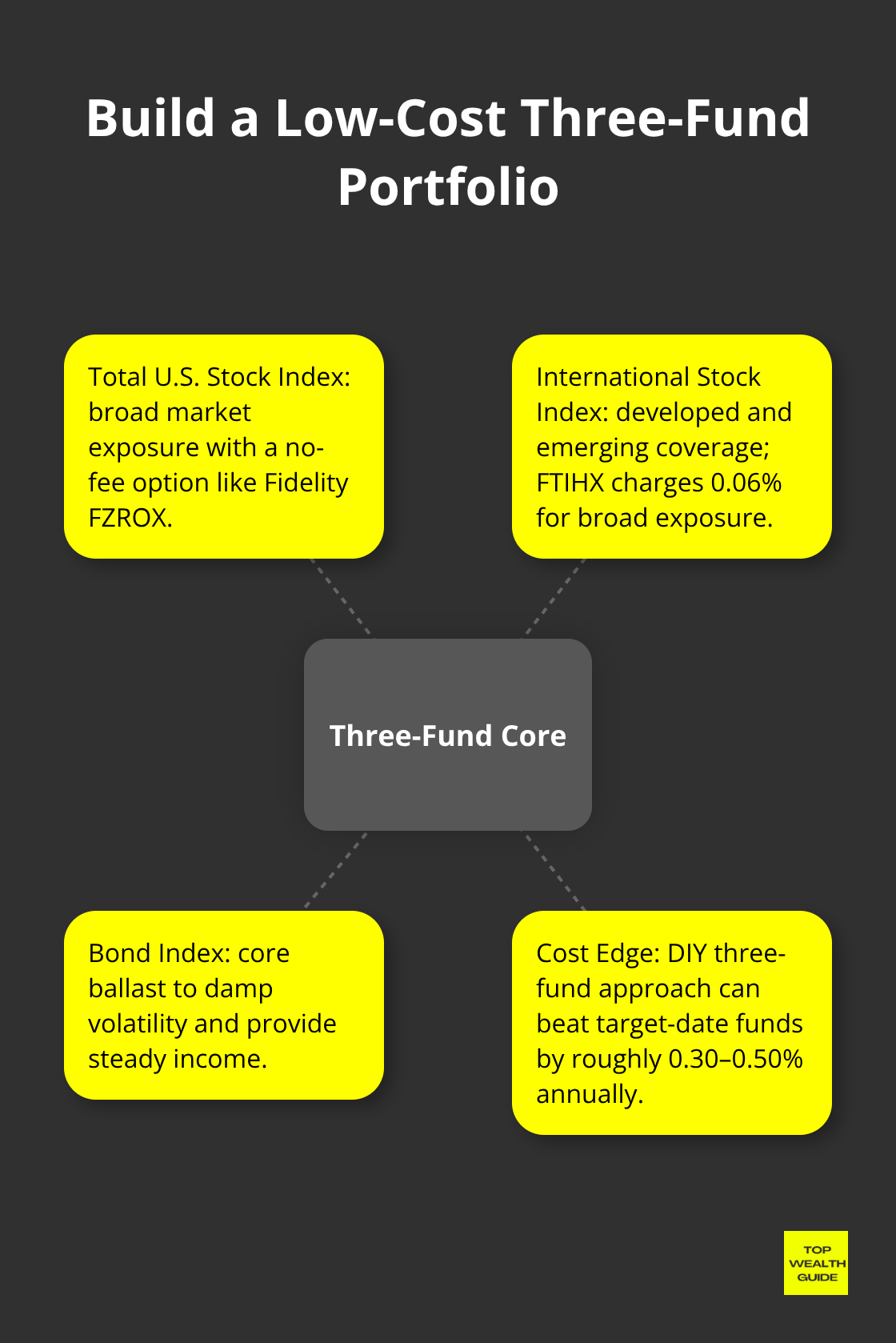

Target-date funds – they lure you in with convenience, but it’s a trap filled with high costs and one-size-fits-all mediocrity. Instead, roll up your sleeves and craft your own three-fund gladiator team: total stock market index, international stock index, and bond index. Fidelity’s FZROX says “no fees” for U.S. stocks, while FTIHX covers international waters at 0.06%. This lineup is like pitting a seasoned hedge fund manager against some overpriced target-date fund bots… and winning by 0.30-0.50% annually, all while you’re quarterbacking the asset allocation.

Schwab and Vanguard? They’re in the game too, with options so low-cost they’re practically paying you to invest.

Smart Rebalance Tactics

Quarterly rebalance versus annual – think Muhammad Ali versus a punching bag. Research from the CFA Institute backs it up. But go monthly? That’s a wealth shredder, tearing away your gains with transaction costs. Set those calendar pings for January, April, July, and October. When anything sways a 5% out of line, you’re back to baseline – selling high, buying low, draining emotion right out of the process.

Market Timing Traps

DALBAR research paints an ugly picture – average equity investors lagged the S&P 500 by 5.5% in 2023. That’s a canyon-sized gap – third largest ever. We’re talking six-figure wealth vanishings because of trading on gut feelings. Market timers, beware. They’re in the business of catching peaks and bottoms… only to find themselves upside down. Instead, set sail with automatic investments. Dollar-cost average your way into index funds, come bull or bear (you’ll have the last laugh over tactical allocation pretenders).

ETF vs Mutual Fund Choice

ETFs: the tax-smart younger sibling to mutual funds in your taxable arena – keeping Uncle Sam’s hands out of your pockets with fewer taxable events. Check this: Vanguard’s VTI and Fidelity’s ITOT – both track wide market indices and keep expenses under 0.05%. ETFs play the stock market game all day; mutual funds? They nap ‘till the closing bell before deciding value. In retirement accounts, the long game reigns supreme, but ETFs still edge out on cost slashing and tax finesse.

Final Thoughts

Alright, let’s break it down. Your retirement success-yeah, it all hinges on three big moves: going big with asset allocation when you’re young, harnessing tax magic to save thousands each year, and diving into low-cost index funds that build wealth like a snowball rolling downhill. If you skip these strategies, well, the financial picture ain’t pretty-six-figure losses by the time you hang up your working boots. So, what to do? Start now, max out that 401k at $23,500 and your IRA at $7,000.

If you’re under 40, why not throw 70-80% into stock index funds? But, hey, as you get older, ease up on that risk-makes sense, right? Oh, and don’t skip quarterly rebalancing; it keeps your portfolio cruising smoothly without those panic-button trades that gut your returns. Get tactical with tax-loss harvesting in taxable accounts and some savvy Roth conversions during market dips-they can tack on an extra 1-2% annually (yeah, those little percentages pack a punch over 20-30 years).

Here’s the deal: at Top Wealth Guide, we’ve seen way too many folks trip themselves up with high-fee funds and trying to time the market (spoiler: it rarely works). Stick to the plan-keep costs low, diversify like a champ, and stay the course. Your future self? They’ll be throwing a party to thank you for jumping on these wealth-building strategies today instead of kicking the can down the road another year.