Economic ups and downs — they’re the rollercoaster nobody asked for but everyone’s on. So, preserving that hard-earned cash? It’s moved up to priority numero uno for investors big and small. Used to be, you could shove it all in a savings account and forget about it. But now? Savings accounts have the same stopping power as a water pistol in a wildfire when it comes to inflation and market slumps.

We at Top Wealth Guide are waving the banner for smart diversification (yep, that buzzword again) and strategic planning (because winging it isn’t a strategy). The magic bullet? Nope, but the right mix of stashed-away emergency funds, a diversified investment portfolio, and those inflation-proof assets can be your financial umbrella — raincoat and galoshes — against the stormy economic seas.

In This Guide

Emergency Fund Strategies for Wealth Protection

How Much Should Your Emergency Fund Actually Be?

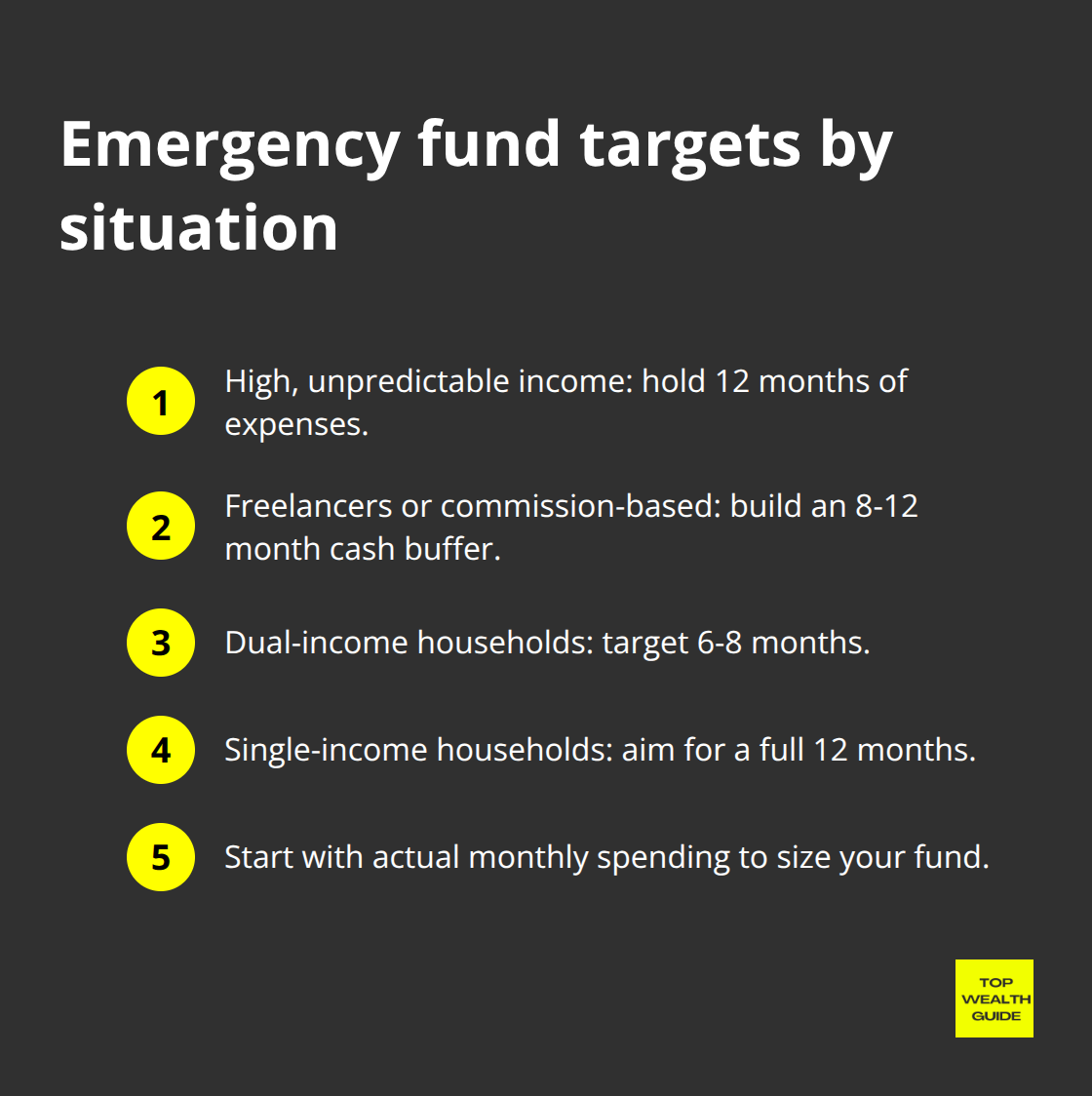

The three-to-six-month rule for emergency funds? It’s about as useful as a landline these days. You need an emergency fund that fits your life, not some general advice that’s as outdated as dial-up internet. For those who earn big but unpredictably-think high earners with incomes that flip-flop-you’re looking at 12 months of expenses. Meanwhile, the government gig folks might get away with just four. According to the Federal Reserve’s 2023 data, 63% of Americans say they’d pull from cash to handle a sudden $400 hit. Spoiler alert: they’re probably miscalculating big time.

The Real Numbers Game

Start your emergency fund planning with a cold, hard look at what you’re actually spending. Crunch those monthly numbers and factor in your risk lifestyle. If you’re freelancing or living on commission, 8-12 months is your cushion because your income’s shakier than a Jenga tower. Dual-income homes? They can think about 6-8 months since both folks losing jobs at once is rare.

But if you’re flying solo in the income game, shoot for a full 12 months-losing a paycheck means losing all income.

High-Yield Savings Beats Everything Else

Fancy titles like money market accounts might sound tempting, but high-yield savings accounts are where it’s at. They give you better returns and easier access. Marcus by Goldman Sachs and Ally Bank are offering up to 5.00%, versus money markets chilling around 3.8%. Do the math: that’s an extra $350 a year if you’ve got a $50,000 emergency fund. Ditch the complexity of money market minimums and jump through hoops (your emergency fund should be as predictable and accessible as an old favorite t-shirt).

Income-Based Liquidity Strategy

How you stockpile liquidity hinges on your paycheck style. For W-2 workers, stick 80% in those high-yield savings, and keep 20% handy in checking for quick grabs. Business owners and contractors should flip that script because when cash flow’s unpredictable, liquidity is king. Keep a month’s expenses in checking; let the rest earn its keep in savings. This beats leaving everything in low-yield checking accounts that basically pay zip.

Once your emergency fund is solid, it’s time to diversify across different asset classes to dodge market volatility and stay nimble during these roller-coaster economic times.

Diversification and Asset Allocation Methods

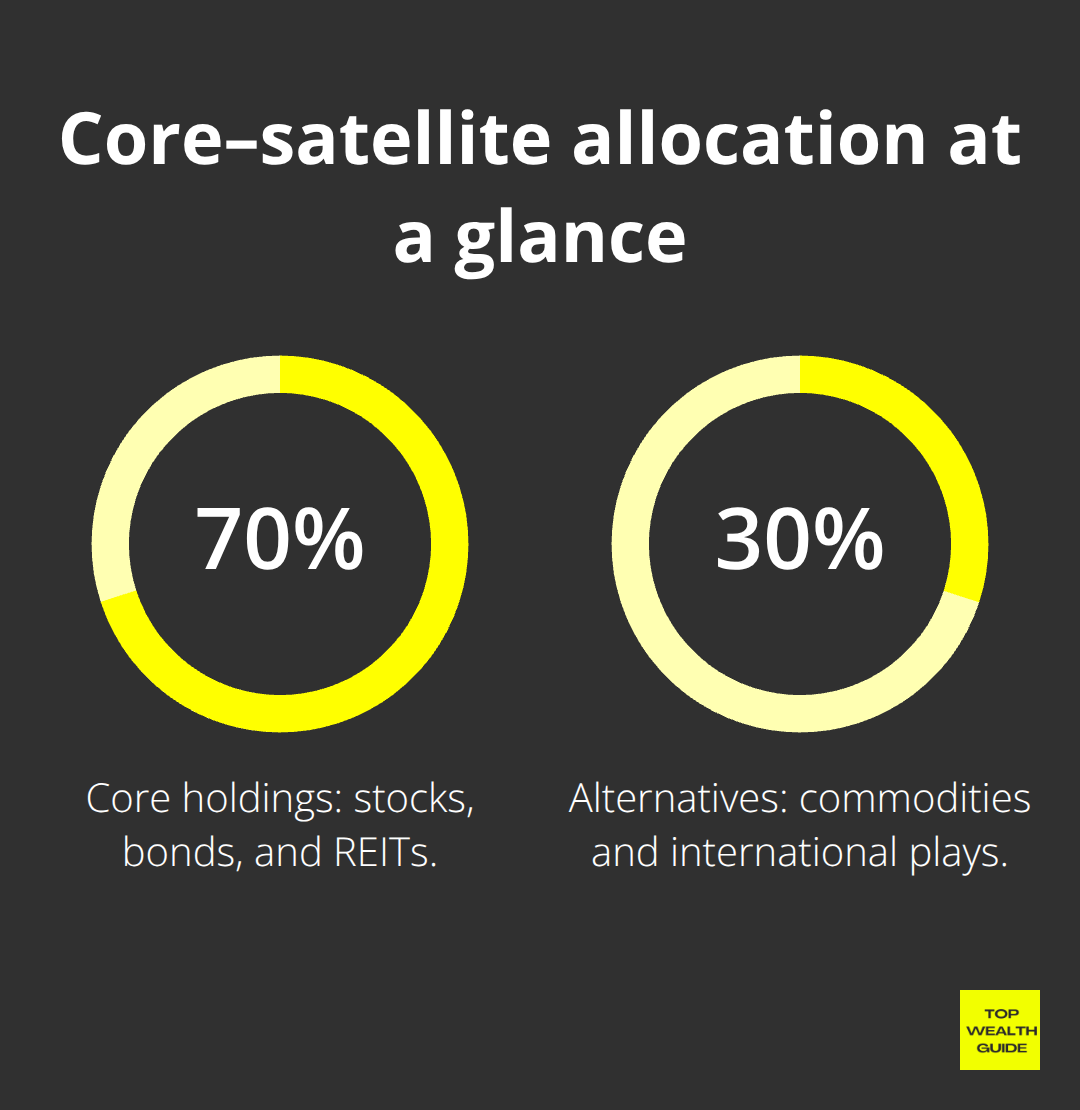

Asset allocation… it’s not about flinging darts at a dartboard and hoping Lady Luck is on your side. That classic 60/40 stock-bond mix that financial pros swore by for ages? Yeah, that’s ancient history. Vanguard’s 2024 study smacked us with the truth-traditional 60/40 portfolios gave us negative real returns during inflationary times from 2000-2022. Today’s savvy investor? They’re pivoting to something we like to call the core-satellite strategy: 70% in core holdings like stocks, bonds, and REITs, with 30% in the wild west of alternatives like commodities and international plays.

The New Asset Mix That Actually Works

Forget the old playbook (bring in the new era) with four foundational pillars: domestic equities at 35%, international stocks taking up 20%, fixed income at 25%, and alternatives rounding it out with 20%. This lineup? It toughed it out through the 2022 market storm way better than the old guard portfolios, as Morningstar tells us. For your slice of the equities pie, think large-cap growth, value stocks, and those juicy emerging markets. Your bond piece of the puzzle should be a cocktail of Treasury Inflation-Protected Securities, corporate bonds, and international flavors. Alternatives? We’re talking REITs, commodities, and infrastructure funds that dance to their own beat, away from traditional markets.

Why Geographic Spread Beats Home Bias

Americans have a thing for their backyard stocks, but this obsession costs them the big bucks. International players have outshone U.S. stocks in 7 of the last 15 years, but folks keep an 80% domestic stance. European markets strutted with 18.2% returns in 2023, while the S&P 500 logged 24.2%, and hey, emerging markets like India weren’t shy with a cool 28.7% gain. Spice things up-spread that investment dough across developed Europe, Asia-Pacific, and emerging markets to snag currency diversification and growth that’s not handcuffed to U.S. economic cycles.

Alternative Investments That Actually Hedge Risk

REITs, commodities, and infrastructure funds-they’re not just sprucing up your portfolio. Think of them as your safety net against the big bad market crashes. Gold has kept its mojo with average annual real returns of +0.6% since way back in 1792, while REITs give you that inflation shield through rental income tweaks. Commodities ETFs, those tracking oil, agricultural outputs, industrial metals-these guys do the tango in the opposite direction to stock markets during those stressful economic nights. Infrastructure bets in toll roads, utilities, and data centers keep cash flowing consistently, all without hitching their wagon to stock market antics (making them ideal wealth savers during uncertain times).

These diversification strategies hit their stride when they cozy up with investments that specifically take on inflation’s wealth-chomping effects, which we’re diving into next.

Inflation-Resistant Investment Approaches

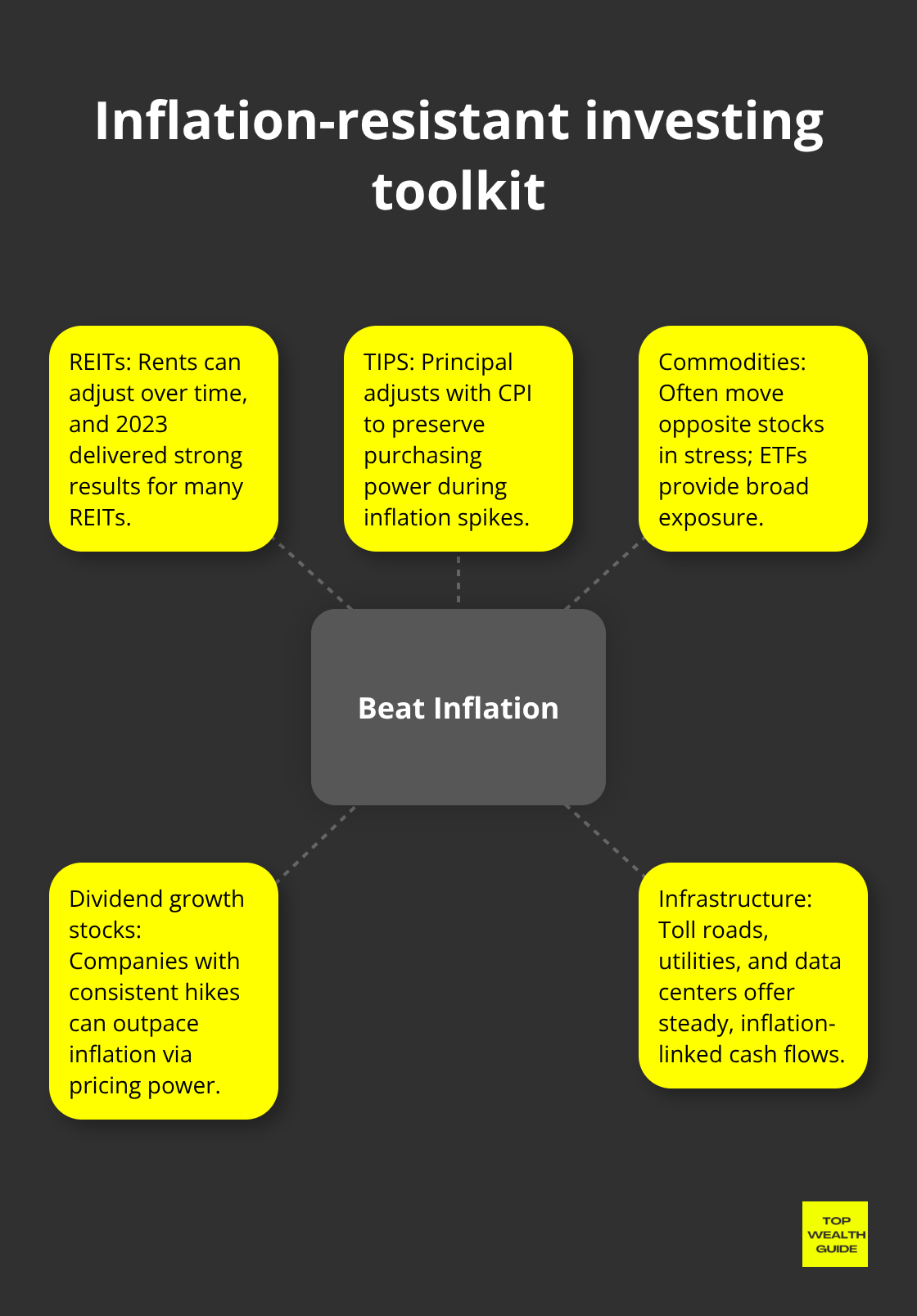

Inflation gobbled up 3.4% of your purchasing power in 2023 – thank you, Bureau of Labor Statistics. Meanwhile, traditional bonds? Face-planted. So, what’s the smart move? Dive into assets that outpace inflation spikes. Take real estate investment trusts – posting a juicy 13.9% return in 2023, right when inflation was flexing.

And good ol’ Treasury Inflation-Protected Securities? They adjust with the Consumer Price Index. Winners in this game are those ditching couch-cushion cash and going for assets that punch back at inflation.

Real Estate Dominates the Inflation Battle

Owning real estate directly? A heavyweight in inflation protection. But let’s face it, most people’s bank accounts aren’t exactly bulging for that kind of splurge. Enter REITs to save the day. They bring professional management and liquidity to the table, none of which your uncle’s rental property can boast. Look at Realty Income Corporation – 29 years straight of upping dividends. Public Storage? Hiked rents 6.8% each year during the 2021-2023 inflation rampage. Industrial REITs (like Prologis) are riding the e-commerce wave and up rental rates pronto. Residential REITs? They take a bit longer, but hey, they eventually catch up. Thanks to real estate investment apps, joining the party doesn’t require a fat wallet.

TIPS and Commodities Deliver Direct Protection

Treasury Inflation-Protected Securities are like a safety net, syncing their principal with the Consumer Price Index – meaning no losing the purchasing power game. Late 2024, a 10-year TIPS gave you a comfy 2.1% above inflation. Now, commodities? Real bench pressers. Invesco DB Commodity Index Fund scored a 16.2% gain during 2022’s inflation turmoil. While gold gleamed at $2,067 per ounce in 2023, agricultural commodities made it rain – corn up 28%, wheat up 31% amid supply chain hiccups.

Dividend Growth Stocks Compound Through Inflation

Companies boosting dividends each year are masters at outpacing inflation – all thanks to price prowess. Look at Johnson & Johnson – 61 years strong of upping dividends. Coca-Cola didn’t miss a beat with 60 consecutive increases. These dividend aristocrats from the S&P 500 have held the dividend-raising torch for at least 25 years. Utilities like NextEra Energy? They pair dividend growth with inflation-resilient models, passing rising costs right back to customers. Keep an eye on firms with snug payout ratios under 60% – giving them wiggle room to pump up dividends even when earnings crunch. Nailing down stock market cycles is key to picking the right entry point for these steady eddies.

Final Thoughts

Wealth preservation – a game of action, not just sitting there hoping the markets will “play nice.” You gotta have those emergency funds… the real deal that actually matches your risk profile. Think diversified portfolios that stretch across asset classes and continents, and throw in some inflation-resistant stuff to keep your purchasing power not just today, but over decades. These strategies? Yeah, they’re the bedrock when the economic seas get choppy.

Markets are funny like that – patience gets the gold star, while those waiting for perfect conditions just get a lesson in disappointment. Emergency fund? Priority numero uno (12 months if your income’s up and down, 6-8 months if there are two incomes in the mix), then comes diversification beyond the old-school 60/40 models – dive into core-satellite strategies and throw in 30% alternatives. And inflation? That beast needs taming with things like REITs, TIPS, and dividend aristocrats that have seen a cycle or seven.

Your wealth preservation strategy? It’s gotta move with you, step by step. But those core principles? Timeless. At Top Wealth Guide, we’re all about tossing out the practical strategies that stand their ground, no matter what the market throws. Check out Top Wealth Guide for more down-to-earth insights on keeping your wealth intact through every economic storm.