Cash flowing out of your investments due to taxes? That’s money you could, and should, keep in your pocket. We’re talking about a 2-3% drag annually—an unnecessary donation to Uncle Sam. It’s time to rethink this.

Here at Top Wealth Guide, we’ve got the roadmap to put you in the driver’s seat of tax-efficient investing. We’re not only about staying ahead—it’s about hanging onto those hard-earned dollars. Whether it’s optimizing retirement accounts or diving into advanced tactics, we’ll help you crank up your returns (and quiet down the tax man). Because, let’s face it, keeping more of what you earn isn’t just smart… it’s essential.

In This Guide

Which Tax-Advantaged Accounts Build Wealth Fastest

Your employer’s 401(k) match is not just a perk… it’s free money in your pocket-plain and simple. Companies that match with 50% up to 6% of your salary are essentially handing you an instant 50% ROI. First order of business? Max out this match. Then crank up your 401(k) contributions to hit the 2025 ceiling of $23,500. If you’ve blown out 50 candles, you get the bonus round with an extra $7,500, hiking your total to $31,000. The math is elementary: every buck you toss in slices your current tax tab while piling up tax-deferred.

Traditional vs Roth IRA Decision Framework

The classic clash-traditional vs Roth IRAs-is all about tax brackets, not your gut feeling. Traditional IRAs are your friend if you rake in over $100k and foresee a lighter income come retirement. Roth IRAs roll out the welcome mat when you’re young, soaking in lower tax brackets, or if you reckon you’ll be swimming in cash in your golden years. For 2025, the IRA contribution cap hits $7,000, with an extra $1,000 for folks over 50. Roth IRAs have no mandatory withdrawal headaches, letting your cash compound like rabbits-indefinitely.

HSAs Beat Every Other Account

Health Savings Accounts are the unicorns of tax advantages, offering a triple tax advantage: deductible contributions, tax-free growth, and tax-free withdrawals for medical stuff. The 2025 limits hit $4,300 for singles and $8,550 for families. Once you’re 65, HSAs play the traditional IRA game for non-medical buys.

In the world of pricey healthcare-clocking in at $172,500 per retiree, courtesy of Fidelity-HSAs become a dual-purpose strategy. Invest your HSA loot in low-cost index funds instead of letting it lounge in cash accounts.

529 Plans for Education Expenses

Education expenses are the tax strategy battlegrounds. 529 plans let your dough grow and withdraw tax-free for qualified education expenses. These accounts are open to unlimited contributions, although gift tax rules kick in above $18,000 annually per kid. Plenty of states sweeten the deal with tax deductions for their 529 plans. You can shuffle beneficiaries within the same kin, giving you wiggle room for the brood.

Now that you’re squared away on accounts spouting tax advantages, time to zero in on specific tactics to trim taxes within these accounts and your taxable investments.

How to Cut Investment Taxes by 40% or More

Tax-loss harvesting-your new best friend. It turns market volatility into your shield against taxes. You take investments that are in the red, sell them to offset those pesky gains, and voilà, your tax bill shrinks by up to $3,000 a year against ordinary income. If you’ve got more losses? No problem-just roll them over to the next years like frequent flyer miles. But watch out for the wash sale rule; it makes you sit out 31 days before snapping up the same stock again. Smart (really smart) folks use this time to snag similar but not identical investments-swap one S&P 500 fund for another during this little hiatus.

And get this-Vanguard, those finance wizards, say tax-loss harvesting lifts your after-tax returns by 0.77% every year over 20 years. That’s not pocket change, that’s potentially tens of thousands beefing up your portfolio.

Asset Location Cuts Your Tax Bill in Half

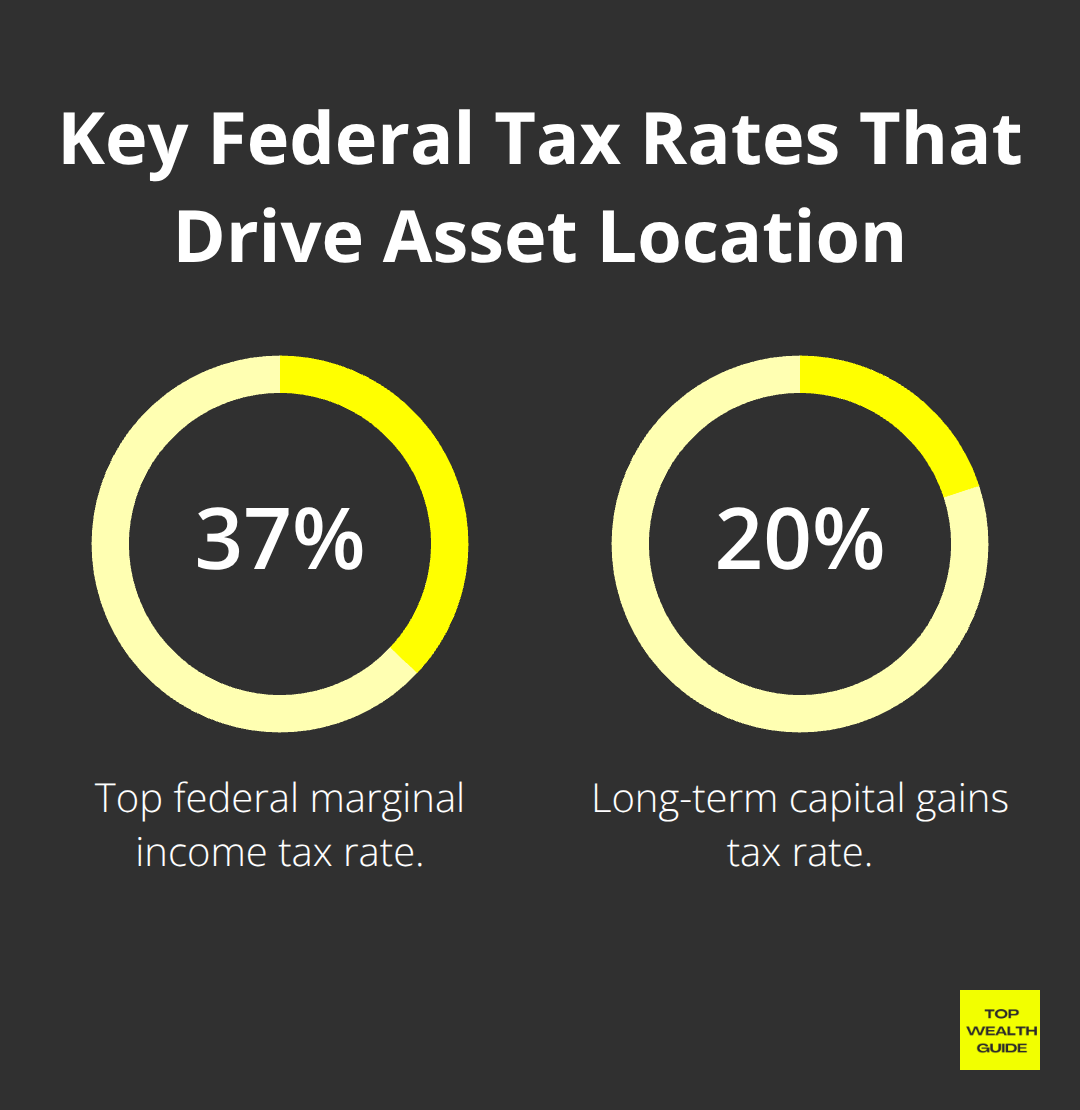

Put your investments in their sweet spots according to tax rules-asset location. Bond funds spitting out ordinary income? They go in tax-deferred accounts like 401(k)s, where you’d likely face a kinder, gentler tax rate in retirement-away from today’s 37% horror show top bracket. Growth stocks and index funds chill in your taxable accounts, giving you the power to decide when to cash in gains… and savor the sweet 20% long-term capital gains rate.

REITs? Stick ’em in IRAs because their dividends aren’t exactly treated like royalty. This single strategy slashes your yearly tax pain from 2-3% to under 1%-a tiny number, a huge impact when compounding gets involved.

Index Funds Demolish Actively Managed Fund Taxes

Actively managed funds-tax nightmares waiting to happen, generating taxable distributions even as you lose cash. Index funds, though? Much calmer waters. They don’t play musical chairs with trades; fewer trades mean fewer taxable events. Plus, their chill turnover rate allows you to keep more dough working for you instead of going to Uncle Sam.

Throw your money at broad market index funds in taxable accounts; they usually dish out less than 2% yearly, letting you call the shots on gains realization. This becomes your ace in the hole for tax optimization.

Municipal Bonds Shield High Earners From Taxes

If you’re a heavyweight income earner, welcome to a whole other tax league needing special strategies. Municipal bonds are like tax-free income machines; their interest is a secret weapon exempt from federal taxes-and often state taxes too. Isn’t that just beautiful?

What Advanced Strategies Cut Taxes for High Earners

High earners, here’s the deal: marginal tax rates hit 37% on the federal level, and once you toss in state taxes… hello, 50%+ in California and New York. Municipal bonds? Your new BFF. They pay interest free from federal taxes-and state taxes too if you’re investing in your home state.

Let’s talk return-grab a 4% municipal bond yield? That’s like snagging a 6.35% taxable yield for those stuck in the 37% tax bracket. Real cash in the pocket, not fattening Uncle Sam’s wallet.

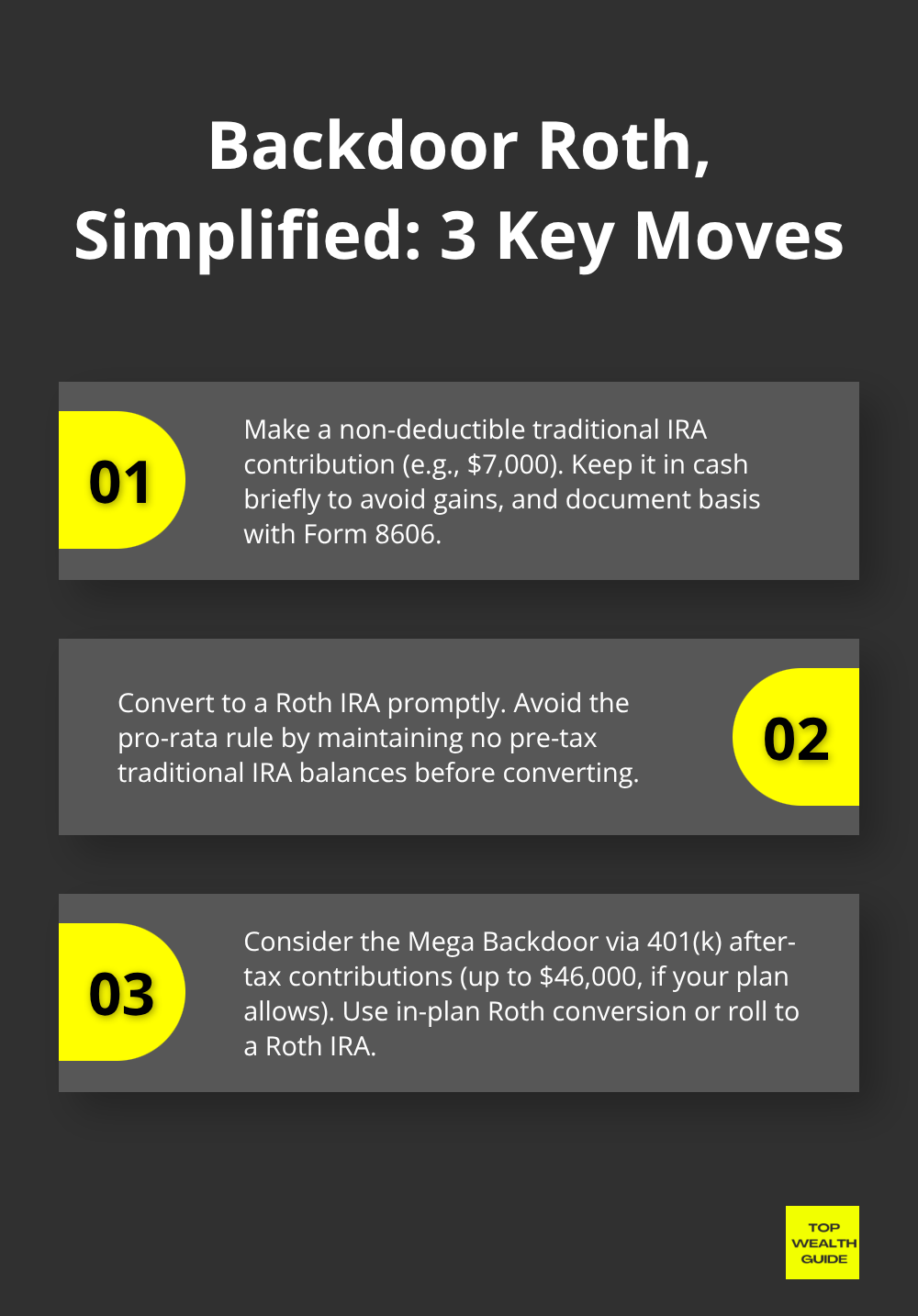

Backdoor Roth Conversions Beat Income Limits

The IRS loves its rules-like blocking direct Roth IRA contributions for big earners. But hey, the backdoor Roth conversion just sashays right past that red tape. You pop $7,000 into a non-deductible traditional IRA, then-bam-you convert it to a Roth.

No hurdles, no delays. Just watch out for taxes on any pre-tax traditional IRA balances-clear slates, folks, work best here.

Up for a Mega backdoor? 401(k) after-tax contributions could stash an extra $46,000 yearly into that sweet tax-free growth lane.

Turn tax code snarls into your playground.

1031 Exchanges Defer Real Estate Taxes Forever

Real estate? Welcome to tax deferral heaven. 1031 exchanges let you swap investment properties and hit pause on capital gains taxes-indefinitely. Flip a $500,000 rental for a $500,000 commercial place, and keep those taxes in limbo.

Trick is, you gotta pick your new digs within 45 days and close the deal within 180 days. Pros step in for the paperwork (it’s the law), but the tax breaks make every penny worth it.

REITs Create Paper Losses That Offset Income

Real Estate Investment Trusts? They’re your tax hack via depreciation deductions. Often, these exceed actual cash flow. Presto! Paper losses to offset income. A REIT dishing 5% dividends might drum up enough depreciation to shelter all its income.

Qualified Opportunity Zone investments? Defer those capital gains taxes until, oh, 2026, and kiss new taxes goodbye after a decade of ownership. Seriously, this isn’t theoretical-it’s the law rewarding you for betting on real estate.

Tax-Deferred Annuities Shield High-Income Portfolios

Variable annuities? They’re the limitless playground for high earners maxing out retirement accounts. Your cash grows tax-deferred, rocking it like traditional IRAs minus the contribution shackles. The catch-those fees and penalties if you bail early.

Fixed indexed annuities-these bad boys give you downside cover while still chasing market thrills. Perfect for those who love tax deferral minus the market rollercoaster.

Final Thoughts

Tax-efficient investing-it’s not brain surgery, but it’s about making the right moves that snowball over time. First things first, grab that employer’s 401(k) match. Then, go all in on tax-advantaged accounts like IRAs and HSAs. And hey, turn market slumps into tax wins with tax-loss harvesting. It’s about being strategic with where you stash your money.

If you’re on the lower end of the earning spectrum, think Roth accounts and index funds in taxable spaces. Those in the middle? They gotta juggle traditional and Roth contributions while playing the tax-loss harvesting game. And for the fat cats up top-yeah, they need municipal bonds, backdoor Roth maneuvers, and some slick real estate plays to dodge those hefty tax hits (looking at you, 50% tax levels).

The math is solid-doing tax right can tack on another 1-2% to your annual returns. Stretch that out over 30 years? You’re talking the difference between a cozy retirement and a flush one. Every tax dollar saved sticks around, working for you and not padding Uncle Sam’s budget. Looking to stack some serious dough? Top Wealth Guide delivers the real-deal strategies and insights to help you make savvy financial choices lined up with what you’re aiming for.