When people talk about financial freedom, they're not just dreaming of being fabulously wealthy. At its core, it’s about having the power to choose. It means you’ve built up enough assets—investments, property, a business—that they generate enough income to cover all your living expenses.

The real prize? You’re no longer tied to a traditional paycheck just to survive. That’s the essence of financial independence, and it's a goal anyone can work toward.

In This Guide

- 1 What Financial Freedom Actually Looks Like

- 2 Calculating Your Financial Freedom Number

- 3 Choosing Your Wealth-Building Pathways

- 4 How Global Economics Can Impact Your Journey

- 5 Common Mistakes That Sabotage Financial Goals

- 6 Frequently Asked Questions About Financial Freedom

- 6.1 1. How long does it actually take to achieve financial freedom?

- 6.2 2. Is financial freedom possible on a low income?

- 6.3 3. What is the single biggest mistake people make?

- 6.4 4. How much cash should I keep in an emergency fund?

- 6.5 5. Should I pay off my mortgage early or invest extra money?

- 6.6 6. What’s the difference between financial freedom and early retirement?

- 6.7 7. How does inflation affect my "freedom number"?

- 6.8 8. What if the stock market crashes right after I retire?

- 6.9 9. Are cryptocurrencies a valid path to financial freedom?

- 6.10 10. How do I stay motivated on a long journey?

What Financial Freedom Actually Looks Like

It’s a common misconception to equate financial freedom with simply retiring early. The reality is much bigger and more personal than that. It’s about having the ability to design a life that truly revolves around your passions, not your bills.

You might decide to stop working altogether, sure. But you could also launch that dream business you’ve always talked about, travel the world for a year, or pour your time into a cause that matters to you—all without the nagging pressure of needing to earn a certain amount each month.

The path to get there isn't some hidden secret. It’s built on a foundation of solid, disciplined habits and smart financial moves. The biggest shift is moving from a consumer mindset to an owner's mindset, where you start seeing every dollar as a tool to build long-term security.

The Core Components

So, what does it take to actually get there? It really boils down to a few key pillars. These aren't complicated theories, but practical actions that, when you stick with them, compound over time to create real wealth.

Let's break them down into what I call the four pillars. This framework helps simplify the journey and keeps you focused on what truly moves the needle.

The Four Pillars of Financial Freedom

| Pillar | Description | Key Action |

|---|---|---|

| High Savings Rate | This is the engine of your wealth-building journey. It's the percentage of your income you consistently set aside to save and invest. | Aim to save at least 15-20% of your after-tax income, and increase it as your earnings grow. |

| Strategic Investing | Your money needs to do the heavy lifting. This means putting your capital into assets that outpace inflation and generate returns. | Build a diversified portfolio of assets like low-cost index funds, real estate, or a side business. |

| Debt Management | High-interest debt is a massive drag on your progress. Think of it as an anchor holding you back from your destination. | Aggressively pay down credit card debt and personal loans. Prioritize this before significant investing. |

| Income Growth | The more fuel you have for your financial engine, the faster you'll reach your goal. Increasing your earnings is a powerful accelerator. | Negotiate a raise, develop new skills, or start a side hustle to create additional income streams. |

Each of these pillars supports the others, creating a strong and stable foundation for your financial future.

The ultimate goal of building wealth is not to have more things, but to have more choices. Financial freedom provides the ultimate choice: the ability to control your own time.

This isn't about living a life of deprivation. It’s about being intentional—spending freely on what you genuinely value while cutting back ruthlessly on the things that don't bring you joy. Our guide on the financial freedom road goes much deeper into how to craft this kind of intentional lifestyle.

Getting a handle on these pillars is the critical first step. It helps you shift from just reacting to your finances to proactively controlling your own destiny.

Calculating Your Financial Freedom Number

So, what’s your number? I'm not talking about your phone number. I'm talking about the amount of money you need to be truly financially free. This isn't some pie-in-the-sky lottery figure; it's a real, tangible target that turns a vague dream into a concrete goal.

Getting to that number starts with a simple, if sometimes revealing, task: tracking your spending. For the next three months, I want you to watch where every single dollar goes. Don't judge yourself, just track it. From the big stuff like your mortgage down to that daily coffee. This is about gathering honest data.

Let's look at a real-life example. A couple I know, Alex and Jordan, did this exercise and found they were spending $60,000 a year to live comfortably. That covered everything—housing, food, transport, and a healthy budget for travel and fun. That $60,000 became the foundation for their entire plan.

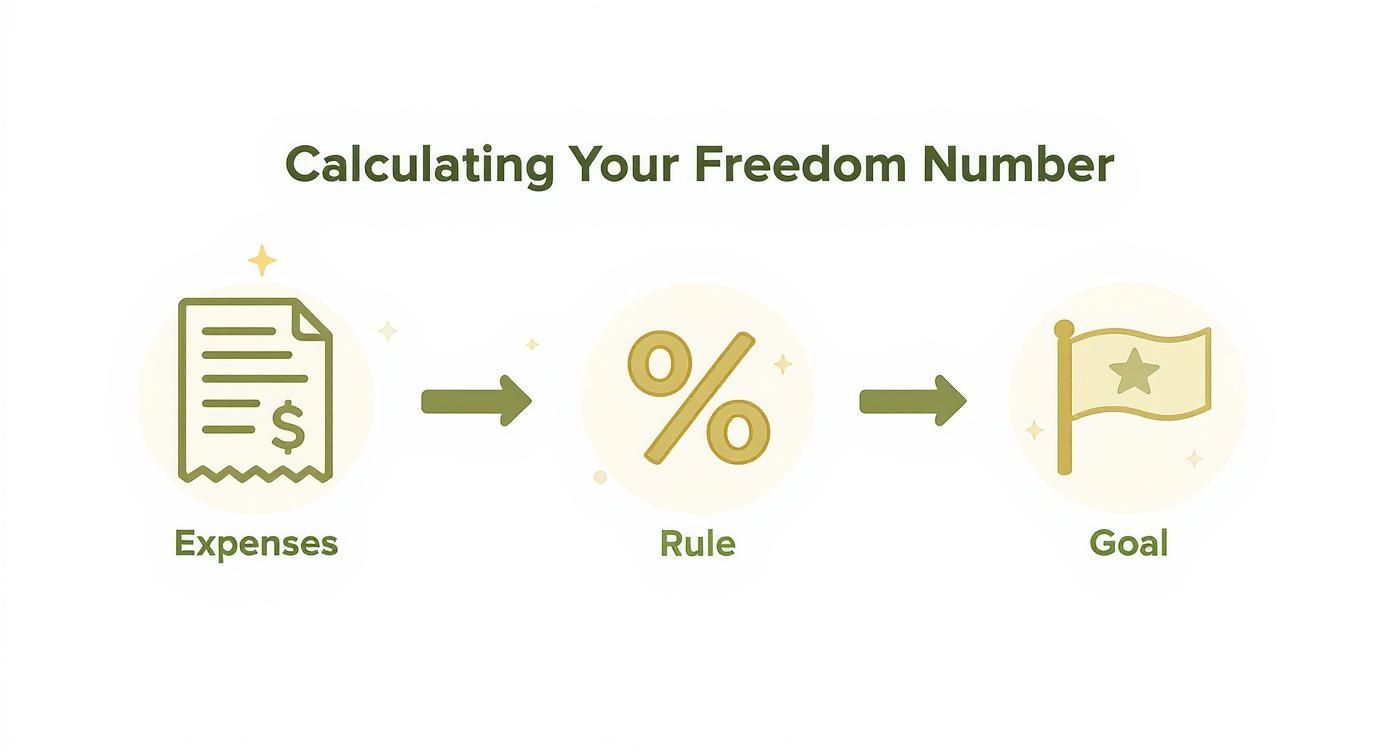

Applying The 4% Rule

Once you know your annual expenses, you can use a classic rule of thumb from the financial independence community: the 4% Rule. It's a surprisingly simple guideline that says you can safely withdraw 4% of your invested portfolio each year with a high likelihood that your money will last for at least 30 years, even with inflation.

The math is easy. Just multiply your annual expenses by 25.

For Alex and Jordan, it looked like this:

$60,000 (Annual Expenses) x 25 = $1,500,000

Their target, their financial freedom number, is $1.5 million. Once their investments hit that mark, they can pull out $60,000 a year (which is 4% of $1.5M) to live on. The idea is that their remaining portfolio will keep growing enough to beat inflation and replenish what they take out. The success of this hinges on your portfolio's growth rate, so it’s crucial to understand the average rate of return for different investments.

Key Takeaway: Financial freedom isn't about being "rich." It's about owning your time because your assets generate enough income to cover your life.

Modern Alternatives and Considerations

The 4% Rule is a brilliant starting point, but it’s not gospel. It was created using historical U.S. market data and is based on a typical 30-year retirement. If you're aiming for an early retirement, you might want to be a bit more conservative.

Here’s a quick comparison of how different withdrawal rates change your target number:

| Withdrawal Strategy | Annual Rate | Required Nest Egg (for $60k expenses) | Best For |

|---|---|---|---|

| The 4% Rule | 4.0% | $1,500,000 | The standard, well-tested approach for traditional retirements. |

| The 3.5% Rule | 3.5% | $1,714,285 | People planning a long retirement (40+ years) or who are risk-averse. |

| The 3.0% Rule | 3.0% | $2,000,000 | Ultra-conservative folks who want the highest certainty their money will last. |

Dropping your withdrawal rate to 3.5% or even 3% means you need a bigger nest egg, but it also gives you a much bigger cushion against bad market years or the possibility of living to 100. It all comes down to finding that sweet spot between how quickly you want to get there and how well you sleep at night.

This principle of freedom creating prosperity isn't just personal; it's global. According to the Economic Freedom of the World Report, nations in the top quartile for economic freedom have an average per-capita GDP of $66,434. Compare that to just $10,751 for countries in the bottom quartile. The data, which you can explore further in the global economic findings on cato.org, shows that a free environment—whether national or personal—is where wealth grows. Defining your number is the first, most powerful step you can take on your own path.

Choosing Your Wealth-Building Pathways

So, you've figured out your "magic number" for financial freedom. That's a huge step. But now comes the real question: how do you actually build an engine powerful enough to get you there? Saving alone won't cut it. You need a smart, strategic approach to investing.

The right path for you will hinge on your personality. Are you someone who wants to set it and forget it, or do you thrive on being hands-on? Your risk tolerance, how much time you can realistically commit, and your bigger life goals all play a major role.

There's no single "best" way to build wealth, but there are several well-worn paths that have consistently guided people to financial independence. Let's walk through the most common ones.

The infographic below gives a great high-level view of how to calculate that target number we just talked about.

It really boils down to three simple ideas: nail down your annual expenses, apply a safe withdrawal rate, and that's your goal.

The Passive Investor Path: Stock Market Investing

For most people, the most straightforward road to wealth is paved with stocks—specifically, low-cost index funds and ETFs. This is classic passive investing. You're not trying to be a Wall Street genius picking the next hot stock or timing the market's every move. Instead, you're just buying a small slice of the entire market and letting it grow.

Take an S&P 500 index fund. With one purchase, you're instantly invested in 500 of the biggest companies in the U.S. It's diversification made simple. This entire strategy is built on the simple fact that, over the long haul, the stock market goes up. Historically, that's been an average return of around 10% annually.

Let’s imagine Sarah, a 30-year-old software engineer who wants a hands-off approach to her money.

Real-Life Example: Sarah's Passive Strategy

- Action: She sets up an automatic investment of $1,500 every month into a total stock market index fund.

- Mindset: Her entire plan is to ignore the daily noise. Market up? Market down? She doesn't care. She just keeps investing.

- Goal: Her goal is to let the incredible power of compounding work its magic over the next 20 to 25 years.

The beauty of this method is its simplicity. You can get started with just a few dollars and a brokerage account.

The Active Entrepreneur Path: Real Estate

Another well-traveled road to financial freedom is real estate. But make no mistake, this is the polar opposite of passive stock investing. It’s an active, entrepreneurial venture. The classic playbook involves buying rental properties that provide you with monthly cash flow while the property (hopefully) appreciates in value.

Real estate brings some unique perks to the table, like using a mortgage (leverage) to control a big asset with a small amount of your own money, not to mention some pretty sweet tax benefits. But it's work. You're not just an investor; you're running a small business.

Now, let's meet Ben, a 35-year-old project manager who enjoys getting his hands dirty and wants to build wealth more proactively.

Real-Life Example: Ben's Active Strategy

- Action: He saves aggressively to get a 20% down payment for his first duplex.

- Mindset: He uses a strategy called "house hacking"—living in one unit and renting out the other. This move practically eliminates his own housing costs.

- Goal: He’s the one screening tenants, fixing leaky faucets, and managing the books, aiming to acquire a new property every few years.

Ben's path requires more sweat equity, no doubt. But if he plays his cards right, it can also rocket him toward his wealth goals much faster.

Comparison of Investment Strategies

Choosing between these paths—or maybe creating a hybrid of both—is a major decision. One isn't necessarily better than the other; they just fit different types of people. This table breaks down the core differences to help you see where you might fit in.

| Investment Vehicle | Typical Risk Level | Liquidity | Management Effort |

|---|---|---|---|

| Index Funds/ETFs | Medium | High (can sell shares any business day) | Low (set up automatic investments and rebalance annually) |

| Rental Properties | Medium to High | Low (selling a property can take months) | High (requires active management of tenants, maintenance) |

| REITs (Real Estate Investment Trusts) | Medium | High (traded like stocks) | Low (a passive way to invest in real estate) |

| Building a Business | Very High | Very Low (business equity is hard to sell) | Very High (requires full-time dedication and effort) |

Thinking it through is key. Your investment strategy has to fit your life, not the other way around.

Key Insight: Your ideal wealth-building strategy should align with your lifestyle. If the thought of a midnight call about a broken pipe fills you with dread, active real estate might not be for you, even if the potential returns are high.

Building Your Own Income Stream

There's a third path, which often works in tandem with the others: creating your own business or side hustle. This is easily the most demanding route, but it also has the highest ceiling. A profitable business can spit out the cash needed to dramatically accelerate your stock or real estate investments.

Whether it’s an Etsy shop, a consulting gig, or a popular YouTube channel, a successful business can be like pouring gasoline on your financial fire. Of course, it also carries the biggest risk. The Small Business Administration notes that about 20% of new businesses fail in their first year.

If this idea sparks your interest, start small. A side project lets you test the waters without quitting your day job. If it starts to take off, you can pour more time and energy into it. To dive deeper into various wealth-creation models, check out our guide on the best ways to build wealth.

At the end of the day, the journey to financial freedom is a marathon, not a sprint. Sarah’s slow-and-steady compounding and Ben’s hands-on hustle can both lead to the exact same destination. The most important thing is to pick a path, commit, and start moving.

How Global Economics Can Impact Your Journey

https://www.youtube.com/embed/IAqj30s4lH8

It’s easy to get tunnel vision when you’re chasing financial freedom. You focus on your savings rate, your investment portfolio, and your budget, but your personal strategy doesn’t exist in a vacuum. The larger economic and political world you're living in can either give you a powerful tailwind or act as a frustrating headwind on your journey.

Think about it like this: you can be the best driver in the world with the fastest car, but if the road ahead is full of potholes and unexpected detours, you’re not going to get very far, very fast. The economic "rules of the road" in your country play an enormous role in how easily you can build wealth.

These rules cover everything from the strength of property rights and the stability of your currency to tax policies and the amount of government red tape. In an environment where the government can seize assets, where regulations make it a nightmare to start a business, or where inflation is spiraling out of control, the path to financial freedom becomes incredibly steep.

The Link Between Economic and Financial Freedom

The big-picture idea of economic freedom is directly tied to your personal financial freedom. It’s a measure of how easy it is for people to work, produce, consume, and invest however they see fit. The more economic freedom a country has, the more opportunities its citizens generally have to prosper.

A stable, predictable economic framework is the bedrock of building personal wealth. It gives investors the confidence to make long-term plans without constantly looking over their shoulder, worried that the government will change the rules of the game overnight.

This isn't just a hunch; the data backs it up. The 2025 Index of Economic Freedom revealed that the global average economic freedom score is just 59.7, which is considered "mostly unfree." The index, which analyzes 184 countries, shows a powerful link between a nation's economic policies and the well-being of its people.

For instance, people in countries with higher economic freedom see drastically higher incomes. Those living in "mostly free" economies typically earn more than double what people in "moderately free" countries do. You can explore the full report and its findings on heritage.org to see exactly how different nations stack up.

Key Takeaway: The country you live in sets the stage for your financial journey. A system that protects property rights and encourages free enterprise makes building wealth a much more straightforward process.

Real-World Examples of Economic Impact

Let's look at a couple of scenarios to see how this plays out for real people.

| Scenario | Environment | Actions & Outcome |

|---|---|---|

| Maria in a 'Mostly Free' Economy | Strong property rights, stable currency, low business barriers. | Maria confidently invests in stocks and real estate, knowing her assets are secure. The tax code is predictable, allowing for long-term planning. Her path to financial independence is smoother as she can focus on strategy without systemic risk. |

| Carlos in a 'Repressed' Economy | High inflation, corruption, unpredictable government policies. | Carlos is hesitant to invest locally due to inflation and the risk of asset seizure. Starting a business is a bureaucratic nightmare. He is forced to consider complex, high-risk alternatives like foreign currencies just to preserve his capital. |

These examples really drive home why you have to pay attention to the macroeconomic landscape. Even the best personal finance habits can be completely undermined by a poor economic environment. It's the same reason international investors pay such close attention to the financial stability of nations, sometimes managed through massive portfolios like those discussed in our article about what sovereign wealth funds are and why they matter. Your financial plan has to account for the world outside your front door.

Common Mistakes That Sabotage Financial Goals

The road to financial freedom is less about a single stroke of genius and more about consistently sidestepping a few critical blunders. I've seen countless people with massive potential fall short, not from one catastrophic event, but from a slow drip of small, repeated errors that drain their wealth.

Recognizing these common pitfalls is the first, most important step. If you can spot these habits in your own life, you can make a change before they derail your entire future.

The Silent Killer: Lifestyle Inflation

One of the sneakiest traps out there is lifestyle inflation. It’s that all-too-human impulse to spend more money as you make more money. You land a raise and immediately start browsing for a newer car. A promotion hits, and suddenly your one-bedroom apartment feels cramped.

It feels like you’re just enjoying the fruits of your labor, but you're actually pushing the finish line further away. This is exactly why you hear about people earning six figures who still feel broke—their spending has kept pace with their income, leaving nothing left for building real wealth.

Take Maria, a graphic designer I know. Early in her career, she lived comfortably on $50,000 a year. Fast forward five years, and she was pulling in $100,000, but her savings rate had barely moved. Where did the money go? A new car payment, fancier vacations, and dining out a few more times a week. It all adds up.

Despite doubling her income, she was stuck on the same financial hamster wheel, just running twice as fast. The trick is to make a conscious choice to route most of any new income—bonuses, raises, side hustle cash—directly into your investments before you even get a chance to miss it.

The Paralysis of Over-Analysis

Another huge roadblock is something I call analysis paralysis. This is when you overthink a decision so much that you never actually make one. You spend weeks, even months, researching the "perfect" ETF or waiting for the "ideal" time to buy a rental property, but you never pull the trigger.

This hesitation usually comes from a fear of getting it wrong. But here’s the hard truth about investing: the cost of sitting on the sidelines is almost always higher than the risk of starting with a "good enough" option. While you’re waiting for perfection, you’re missing out on the most powerful force in your financial arsenal: compound growth.

The best time to start investing was yesterday. The second-best time is today. Don't let the search for the perfect strategy prevent you from starting with a good one.

A simple, diversified portfolio started today will almost always beat a "perfect" one you finally launch five years from now. Action beats perfection every single time.

The Danger of Chasing Hot Trends

Finally, let's talk about the quickest way to blow up your financial plan: chasing trends without a strategy. Whether it's the meme stock of the week or the latest obscure cryptocurrency, the promise of getting rich quick is a powerful temptation.

But that’s not investing; it's gambling. Real investing is a long game built on solid fundamentals and unwavering discipline. Jumping on every hot tip you hear on social media is a classic recipe for buying high and selling low—the exact opposite of what you want to do. For a closer look at this and other missteps, check out our guide on the common financial mistakes that cost you millions over time.

A solid financial plan is built on a proven, diversified strategy you can stick with, even when the market gets rocky. Learning to tune out the noise and resist the latest fad is what separates successful investors from everyone else.

Frequently Asked Questions About Financial Freedom

1. How long does it actually take to achieve financial freedom?

Your timeline depends almost entirely on your savings rate. Someone saving 50% of their income could potentially reach financial independence in as little as 15-17 years, while someone saving a more traditional 15% is likely on a 40+ year path. The higher your savings rate, the faster you get there.

2. Is financial freedom possible on a low income?

Yes, but it requires extreme discipline and a focus on income growth. The principles are the same: maximize the gap between what you earn and what you spend. This means living frugally while relentlessly pursuing new skills, better jobs, or scalable side hustles to increase your earnings.

3. What is the single biggest mistake people make?

The most common and destructive mistake is lifestyle inflation—letting your spending increase every time your income does. To accelerate your journey, you must consciously decide to invest the difference from raises and bonuses rather than absorbing it into your lifestyle.

4. How much cash should I keep in an emergency fund?

A standard emergency fund should cover 3 to 6 months of essential living expenses. This money should be kept in a liquid, high-yield savings account where it's safe and easily accessible but still earning some interest.

5. Should I pay off my mortgage early or invest extra money?

This is a personal decision. Mathematically, if your expected investment returns are higher than your mortgage interest rate, investing will build more wealth. However, the psychological security of owning your home outright is a powerful motivator for many. Choose the path that lets you sleep best at night.

6. What’s the difference between financial freedom and early retirement?

Financial freedom is the state of having your lifestyle funded by your assets. Early retirement is the choice to stop working for income. Freedom gives you the option to retire, but you could also choose to start a passion business, work part-time, or dedicate your time to philanthropy.

7. How does inflation affect my "freedom number"?

Inflation is a constant drag on your purchasing power. Your investment portfolio must generate returns that consistently and significantly outpace the rate of inflation for your wealth to grow in real terms. This is why simply saving cash is not a viable long-term strategy.

8. What if the stock market crashes right after I retire?

This is known as "sequence of returns risk," and it's a valid concern. To mitigate it, financial experts often recommend shifting to a more conservative asset allocation as you near your goal. Holding 1-2 years of living expenses in cash can also prevent you from needing to sell investments during a downturn.

9. Are cryptocurrencies a valid path to financial freedom?

Cryptocurrencies are highly speculative and volatile assets. While some have seen massive gains, they are not a reliable primary strategy for building foundational wealth. Most financial planners would suggest allocating only a very small percentage (1-5% maximum) of your portfolio to them, if any.

10. How do I stay motivated on a long journey?

Track your progress and celebrate milestones! Hitting your first $10k, $50k, or $100k in net worth are huge achievements worth acknowledging. Most importantly, keep your "why" front and center. Focusing on the life you are building—the freedom, the choices, the security—will provide the fuel to stay disciplined for the long haul.

At Top Wealth Guide, our mission is to provide you with the knowledge and strategies needed to build lasting wealth. The recent global push for financial inclusion, as noted by the World Bank, shows that more people than ever have access to the tools needed to save and invest. Explore our resources to deepen your understanding and secure your financial future.